Академический Документы

Профессиональный Документы

Культура Документы

Acin Ecc5 SD 0006

Загружено:

surendrasimhaОригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Acin Ecc5 SD 0006

Загружено:

surendrasimhaАвторское право:

Доступные форматы

WINLEN

4-1

SAP AG

SAP AG 2002

Sales with VAT

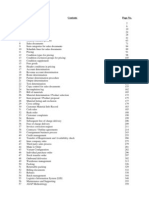

Contents:

VAT Implication on Sales Process

Business Place

SD Configuration

Master Data

Sales Scenarios

WINLEN

4-2

SAP AG

SAP AG 2002

VAT Implication in Sales Processes

SAP R/3

Purchasing

Invoice

Verification

Inventory

Valuation

Delivery

VAT

Accounting

Sales Order

Billing

Utilization &

Tax Payment

VAT

impact

The areas getting affected by VAT are the sales order in which the VAT taxes

appear and the billing document where the accounts get posted. We are not covering

the VAT utilisation.

WINLEN

4-3

SAP AG

SAP AG 2002

Business Place in R/3

BUSINESS PLACE A New

Organizational Unit in Logistics

Tax Reporting entity

Defined at Company Code

Level

A new Organizational entity - Business Place (BUPLA) has been brought in use in

Logistics.

Business Place represents a Tax Reporting entity for an Organization in a state or

Region.

Business Place in R/3 will be defined at the Company Code level and will be assigned

to Plant(s).

One Business Place can be assigned to more than one Plant in a Region, but one

Plant cannot be assigned to more than one Business Place.

Business Place is currently used by SAP customers in many countries for VAT related

Tax Reporting.

Note: In India Business Place field was in use in Finance for EWT before 1st April

2003, however, 1st April 2003 onwards this field was replaced with Section Code for

EWT. Now this field is in use for Logistics.

WINLEN

4-4

SAP AG

SAP AG 2002

Business Place Assignment

Business Place is assigned to Plants

WINLEN

4-5

SAP AG

SAP AG 2002

Business Place Applicability

Business Place used for VAT related Tax reporting in

Sales and Distribution

Materials Management

Before using in Logistics, Business Place was used in Finance till 1st April 2003.

WINLEN

4-6

SAP AG

SAP AG 2002

Business Place

Entity Business Place will primarily be used for -

Defining Vat Registration Number

Determining Official Number Range for :

All Billing Transactions in SD

All Credit Memo Transactions in MM

Consolidating data for Period End Processing requirements

Determining "Alternate G/L Accounts" for Taxes

WINLEN

4-7

SAP AG

SAP AG 2002

Business Place Scenario 1

Define Single Business Place for all the Plants in a state.

Define Single Business Place for all the Plants in a state.

PLANT 1

PLANT 2

PLANT 3

# Single VAT Registration

# Consolidation for all Plants

before utilization

# Single period end process

reports for all plants

COMPANY ABC

STATE : KARNATAKA

WINLEN

4-8

SAP AG

SAP AG 2002

Business Place Scenario 2

Define Separate Business Place for both Plants in the

state.

Define Separate Business Place for both Plants in the

state.

PLANT 1

PLANT 2

VAT Registration : XXX

COMPANY ABC

STATE : KARNATAKA

VAT Registration : YYY

Output is under deferral/

exemption scheme

An Organization has two plants in one state

Output of one plant is under deferral/ exemption scheme

State Law may require separate registration number for both the plants

WINLEN

4-9

SAP AG

SAP AG 2002

Business Place Scenario 3

State specific number range requirements may be specified

Solution: Business Place is

used to determine number

range objects.

Solution: Business Place is

used to determine number

range objects.

WINLEN

4-10

SAP AG

SAP AG 2002

Business Place Scenario 4

Need for maintaining separate VAT Credit and Debit accounts for different states

Solution: Separate G/L

Accounts are maintained at

state level. Business Place is

used to determine correct

G/L account at the time of

posting.

Solution: Separate G/L

Accounts are maintained at

state level. Business Place is

used to determine correct

G/L account at the time of

posting.

WINLEN

4-11

SAP AG

SAP AG 2002

Intra State Finished goods VAT applicable Sales pricing

and Tax procedure

Sales Order Pricing

Basic Rate Rs85X 10 pcs= Rs 850

Excise Duty @20 = Rs 170

Tax Base Amount Rs 1020

VAT Rs. 102

Total Rs.1122

Pricing procedure JFACT

Condition type UTXJ

Access sequence JIND

Access Country/ Plant Region / Region/ TaxCl1Cust/ Tax Cl.Mat

Tax Code S1

Plant details

Customer master

Material master

Tax procedure TAXINJ

JIN 6

10%

VAT

10% VAT rate used for ease of representation. Actual VAT rates as per law.

WINLEN

4-12

SAP AG

SAP AG 2002

SD Configuration

Define Condition Types

IMG PathSales and Distribution Basic Functions Pricing Pricing Control

Maintain Condition Types (Transaction V/06)

New SD tax conditions are introduced for the VAT:

JIN6: A/R VAT Payable

JIN7: A/R CST Payable under VAT

JIN8: A/R CST Surcharge Payable under VAT

The condition category of these and the existing condition types should be changed

to D

These new tax conditions would need to be added to the relevant pricing procedure

and the tax procedure

WINLEN

4-13

SAP AG

SAP AG 2002

SD Configuration

Change SD Pricing Procedure

IMG PathSales and Distribution Basic Functions Pricing Pricing Control

Define and Assign Pricing Procedure (Transaction V/08)

The control parameters for JIN6, JIN7 and JIN8 would remain same as JIN2, JIN4

and JIN5 respectively

WINLEN

4-14

SAP AG

SAP AG 2002

SD Configuration

Create New Condition Table

IMG Path Sales and Distribution Basic Functions Pricing Pricing Control

Define Condition Tables (Transaction V/04)

2 condition tables are required to determine UTXJ in domestic and export sales

document: Table 368 and Table 11

Table 368 (condition table for domestic pricing) to have following fields:

ALAND: Country

WKREG: Region of delivering plant

REGIO: Region of ship-to-party

TAXK1: Customer tax classification 1

TAXM1: Material tax classification 1

Table 11 (condition table for export pricing) to have the following fields:

ALAND: Country

LAND1: Destination country

TAXK1: Customer tax classification 1

TAXM1: Material tax classification 1

WINLEN

4-15

SAP AG

SAP AG 2002

SD Configuration

Change in Access Sequence

IMG PathSales and Distribution Basic Functions Pricing Pricing Control

Define Access Sequence (Transaction V/07)

Add the condition tables 11 and 368 in the access sequence JIND

Put condition table 11 before 368, so that the system checks first if the sale is an

export or domestic

The additional accesses are used in UTXJ to determine the Output Tax Code in SD

Documents

These accesses do not use jurisdiction code and would help users to determine the

tax code when Tax Jurisdiction code is switched off

In Export Pricing Procedure also UTXJ would determine the Output Tax Code

maintained for Export

WINLEN

4-16

SAP AG

SAP AG 2002

SD Configuration

Define Condition Types (TAXINN)

IMG PathSales and Distribution Basic Functions Pricing Pricing Control

Maintain Condition Types (Transaction V/06)

New SD tax conditions are introduced for the VAT:

JVAT: A/R VAT Payable

The condition category of these and the existing condition types should be changed to D

These new tax conditions would need to be added to the relevant pricing procedure

and the tax procedure

WINLEN

4-17

SAP AG

SAP AG 2002

SD Configuration

Settings for Tax Processing (TAXINN)

IMG PathFinancial Accounting Tax on Sales and Purchases Basic Setting

Check and Change setting for tax processing (Transaction OBCN)

WINLEN

4-18

SAP AG

SAP AG 2002

SD Configuration

Define Account Keys (TAXINN)

IMG PathSales and Distribution Basic FunctionAccount

Assignment/CostingRevenue Account Determination Define and Assign

Account Keys Define Account Keys

WINLEN

4-19

SAP AG

SAP AG 2002

SD Configuration

Change SD Pricing Procedure (TAXINN)

IMG PathSales and Distribution Basic Functions Pricing Pricing Control

Define and Assign Pricing Procedure (Transaction V/08)

Condition type JVAT added

WINLEN

4-20

SAP AG

SAP AG 2002

SD Configuration

Define Business Place

SM31 Table name: J_1BBRANCV

Define a new business place

Create business place for different controlling areas

Enter the country and region for which Business Place is created

WINLEN

4-21

SAP AG

SAP AG 2002

SD Configuration

Assign Business Place to Plant

SM31 Table name: J_1BT001WV

WINLEN

4-22

SAP AG

SAP AG 2002

Alternate G/L Accounts: Introduction

To determine alternate G/L accounts for Taxes

It is used for Sales Taxes and not meant for excise posting

Helpful in reporting

Useful in maintenance of Tax Codes (input & output)

The concept of alternate G/L Account is used for LST, CST etc and not applicable to

excise related duty

This feature will help to determine alternate G/L accounts for Taxes, which will in turn

help user for reporting and maintenance of Tax Code

This functionality is available for both types of taxes (Input and Output)

WINLEN

4-23

SAP AG

SAP AG 2002

Alternate G/L Accounts: Usage

Alternate G/L account can be used in the following business processes

Determination of Separate G/L Account for VAT and Non VAT

States

Determination of Separate G/L Account for Deferral & Non-

Deferral Plants by using Business Place

Determination of Separate G/L Account for Standard and Sub-

contracting Purchases

Any other Business requirements

WINLEN

4-24

SAP AG

SAP AG 2002

Alternate G/L Accounts: Maintenance

Alternate G/L account can be maintained based on:

Chart of accounts

Business Place

Transaction Key

Tax Code

It may be created for Alternate Debit as well as credit account.

WINLEN

4-25

SAP AG

SAP AG 2002

Alternate G/L Accounts: Configuration

Note 607907 to be applied

Transaction: SM30

Table name: J_1IT030K_V

WINLEN

4-26

SAP AG

SAP AG 2002

Master Data

Plant Region

WINLEN

4-27

SAP AG

SAP AG 2002

Master Data

Tax classification

Customer

WINLEN

4-28

SAP AG

SAP AG 2002

Master Data

Tax classification Material

WINLEN

4-29

SAP AG

SAP AG 2002

Master Data

Tax code determination

WINLEN

4-30

SAP AG

SAP AG 2002

Master Data

VAT rate 12.5%

WINLEN

4-31

SAP AG

SAP AG 2002

Official Document number Configuration

Define document Class

Assign the Document class to the Sales Area and Region

Define Document Numbering

Assign the Document numbering for the Business Place

Define the Document class through SM30 in view the V_DOCCLS. For example V for

VAT and B for BOS.

Assign the VAT/BOS document class for the Plant Region and Sales Area / Document

type in the view J_1IDCLSDET.

Create the Number group in the view V_1ANUMGR1.

Create the number range through the transaction J1AB.

Assign the Document Class / Number Group / number range for the company code and

Business place in the view V_OFNUM_TW_2.

Assign the accounting document type for the Billing type in transaction VOFA.

Assign the Routine 350 at the item level of the Copying control. The transaction code is

VTFL for Delivery related and VTFA for the Order related billing.

Assign any one of the document class for Example either V VAT or B- Bill of Sales for

the country IN in the view V_T003_B_I.

You may refer the OSS note 831870 for other information.

WINLEN

4-32

SAP AG

SAP AG 2002

Official document Number Process flow

Identify the country

of the customer.

IN Export -BOS

No

Check the

Tax code in

table

J_1iexcdef

Yes

Deemed

Export - BOS

Same Tax

Code

Check the

Tax code in

table

J_1iexmptco

de

Exempted

Sales - BOS

Exempted

Tax Code

Different

Tax Code

Check the VAT

Registration No

in the Customer

Master Tax code

Field

Normal

Tax Code

Un

Registered

customers

Sales - BOS

Unregistered

Customer

Registered

customers

Sales - VAT

Yes

All the Logic for Determining the VAT or BOS has been written in the Data transfer routine 350 assigned to

the item category.

The Tax code will be determined in UTXJ condition type.

The Deemed Export tax code should be maintained in the Excise default table J_1iexcdef table. If the

determined tax code is similar in the default table then it is a Deemed export sales and the Bill of Sales

document class will be used.

The Exempted tax code can be maintained in the view J_1iexmptcode. When the system find the

determined tax code in this table then this sales will be treated as Exempted sales and Bill Of Sales

Document class will be determined.

The VAT Registration number should be maintained in the Tax code 2 field of the customer master. Please

note that the VAT Registration number provided in the standard can not be used for CIN.

For some of the state for the Unregistered Customer also the VAT Invoice should be issued. To handled

this the User exit J_1I7_CHECK_CUSTOMER_VAT can be used to change the document class as VAT.

When the Customer country is in India and the tax code determined is not Deemed export Tax code and

the tax code is not Exempted sales and the customer is Registered then VAT Document class will be

determined.

All the VAT / BOS document class for the Plant Region and Document type of the Billing and Sales area

will be maintained in the view J_1IDCLSDET.

WINLEN

4-33

SAP AG

SAP AG 2002

Organization Structure

Chart of A/c INT

Plant 1 Mumbai IN10

Maharashtra

Plant 3 Chennai IN20

Sales Area (0001/ 01/ 01)

Company Code (EWT)

VAT Reg ID 1

VAT Reg ID 2

Shipping point 0001

Shipping point 0002

Ex gp E1, Series gp S1 Domestic, S2 Exports

Ex gp E2, Series gp S3

We are doing sales from Plant IN10 only which is at Mumbai state Maharashtra

WINLEN

4-34

SAP AG

SAP AG 2002

Master Data

Material Master

MBG01 - Professional Mountain Bike with Gears

MB01 - Professional Mountain Bike without Gears

Customer Master

INC01 Mumbai Dealer

INC02 Chennai Dealer

INC08 Depot Customer for VAT

INC09 - Depot Customer for CST

G/L Accounts

VAT Payable A/c - Used for paying VAT on all sales

VAT Alternate GL A/c - Used for paying VAT on all sales

WINLEN

4-35

SAP AG

SAP AG 2002

Sales Scenarios with VAT

Followings are the scenarios with VAT

Intra State

Finished goods (VAT applicable- general VAT rates)

Finished goods (VAT exempt)

Depot sales (VAT applicable)

Inter State

Finished goods

Exports

Finished goods

Deemed Exports Finished Goods

Stock Transfer

Inter State

Intra State

WINLEN

4-36

SAP AG

SAP AG 2002

Intra State Finished goods (VAT applicable general VAT

rates)

Sales Order Pricing

Basic Rate Rs85X 10 pcs= Rs 850

Excise Duty @20 = Rs 170

Tax Base Amount Rs 1020

VAT Rs. 102

Total Rs.1122

Pricing procedure JFACT

Condition type UTXJ

Access sequence JIND

Access Country/ Plant Region / Region/ TaxCl1Cust/ Tax Cl.Mat

Tax Code S1

Plant details

Customer master

Material master

Tax procedure TAXINJ

JIN 6

12.5%

VAT

Participants can try out Finished Goods (VAT applicable with alternate G/L Accounts)

WINLEN

4-37

SAP AG

SAP AG 2002

Intra State Finished goods (VAT exempt )

Accounting documents

Accounting documents

CENVAT suspense

ED payable

Sales revenue account

Customer account

CENVAT suspense

3

Bill of Sale

4

Excise invoice

Billing

2

Shipping

Shipping

Sales Order

1

5

Period end processing

NVAT-MAT1 VAT 0%

Intra-State Customer Cus_intra1

WINLEN

4-38

SAP AG

SAP AG 2002

Intra State - Depot Sales (VAT applicable)

Mumbai Plant IN10

(Factory)

Delivery

Excise Invoice

Mumbai Plant IN 30

(Depot)

Goods Receipt

Stock in Transit

Sales Order

Goods Issue

Billing

Purchase Order

VAT Register

Updation

VAT Register

Updation

Mumbai Plant IN 30

(Depot)

VAT Register

Updation

WINLEN

4-39

SAP AG

SAP AG 2002

Inter State -Finished goods

2

Shipping

Shipping

Sales Order

1

4

Excise invoice

3

Bill of Sale

Billing

5

Period end processing

Accounting documents

Dr.Customer a/c

Cr.Sales revenue a/c

Cr.CST payable

Cr. Cenvat Suspense

Dr.CENVAT suspense

Cr. ED payable

Inter State Customer (KAR) Cus_inter1

VAT- MAT1 (VAT rate 10%)

WINLEN

4-40

SAP AG

SAP AG 2002

Exports -Finished goods

2

Shipping

Shipping

Sales Order

1

4

Excise invoice

3

Bill of Sale

Billing

5

Period end processing

Foreign Customer (UK) Cust_exp1

MAT-EXP

WINLEN

4-41

SAP AG

SAP AG 2002

Deemed Exports -Finished goods

2

Shipping

Shipping

Sales Order

1

4

Excise invoice

3

Bill of Sale

Billing

5

Period end processing

Deemed Export Customer CUST_DEXP1

VAT- MAT1 (VAT rate 10%)

WINLEN

4-42

SAP AG

SAP AG 2002

Intra State Finished goods (VAT exempt) Sales pricing

and Tax procedure

Sales Order Pricing

Basic Rate Rs83X 10 pcs= Rs 830

Excise Duty @20 = Rs 166

Tax Base Amount Rs 996

VAT Rs. 0

Total Rs.996

Pricing procedure JFACT

Condition type UTXJ

Access sequence JIND

Access Country/ Plant Region / Region/ TaxCl1Cust/ Tax Cl.Mat

Tax Code S2

Tax procedure ZEXVAT

ZIN 1

0%

VAT

WINLEN

4-43

SAP AG

SAP AG 2002

I N 1 0

M u m b a i

E x c i s e I n v o i c e

S t o c k i n

T r a n s i t

C r I n v e n t o r y A / c P l a n t 1 = R s 1 0 0

D r I n v e n t o r y A / c P l a n t 2 = R s 1 0 0

N o A c c o u n t i n g E n t r i e s a n d

N o I n v o i c e v e r i f i c a t i o n

N o V A T c r e d i t s

S T O f r o m

P l a n t 2

Q t y 1 E A

R a t e 1 0 0

G o o d s I s s u e

M v t 6 4 1

C r E D P a y a b l e A / c = R s 1 6

D r E D C l e a r i n g A / c = R s 1 6

I N 2 0

C h e n n a i

C a p t u r e & P o s t

E x c i s e I n v o i c e

G o o d s R e c e i p t

M v t 1 0 1

D r R G 2 3 A / C A / c = R s 1 6

C r E D C l e a r i n g A / c = R s 1 6

M A H A R A S H T R A

V A T R e g I D 1

T A M I L N A D U

V A T R e g I D 2

P e r i o d E n d

P r o c e s s i n g

P e r i o d E n d

P r o c e s s i n g

Inter-State Stock Transfer via SD

WINLEN

4-44

SAP AG

SAP AG 2002

Intra-State Stock Transfer

M u m b a i

P l a n t 1

E x c i s e I n v o i c e

S t o c k i n

T r a n s i t

C r I n v e n t o r y A / c P l a n t 1 = R s 1 0 0

D r I n v e n t o r y A / c P l a n t 2 = R s 1 0 0

N o A c c o u n t i n g E n t r i e s a n d

N o I n v o i c e v e r i f i c a t i o n

N o V A T c r e d i t s

V A T R e g i s t e r

U p d a t i o n

( Q t y & V a l u e )

S T O f r o m

P l a n t 2

Q t y 1 E A

R a t e 1 0 0

V A T R e g i s t e r

U p d a t i o n

( Q t y & V a l u e )

G o o d s I s s u e

C r E D P a y a b l e A / c = R s 1 6

D r E D C l e a r i n g A / c = R s 1 6

M u m b a i

P l a n t 2

C a p t u r e & P o s t

E x c i s e I n v o i c e

G o o d s R e c e i p t

D r R G 2 3 A / C A / c = R s 1 6

C r E D C l e a r i n g A / c = R s 1 6

M A H A R A S H T R A

V A T R e g I D 1

WINLEN

4-45

SAP AG

SAP AG 2002

VAT Listing

Report RFUMSV00

Вам также может понравиться

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (120)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (266)

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (399)

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5794)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2259)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1090)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (895)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- Bus Ticket Invoice 1673864116Документ2 страницыBus Ticket Invoice 1673864116SP JamkarОценок пока нет

- True or False in Financial ManagementДокумент7 страницTrue or False in Financial ManagementDaniel HunksОценок пока нет

- SAP SD DeterminationsДокумент4 страницыSAP SD DeterminationssurendrasimhaОценок пока нет

- SAP SD Configuration GuideДокумент363 страницыSAP SD Configuration Guiderajendrakumarsahu94% (52)

- SheltaДокумент7 страницSheltaconfused597Оценок пока нет

- Process Costing LafargeДокумент23 страницыProcess Costing LafargeGbrnr Ia AndrntОценок пока нет

- Airbnb CaseДокумент2 страницыAirbnb CaseVân Anh Phan0% (1)

- Solar Light SystemsДокумент17 страницSolar Light Systemsswapnil2288Оценок пока нет

- Solar SystemsДокумент80 страницSolar SystemssurendrasimhaОценок пока нет

- Enterprise StructureДокумент3 страницыEnterprise StructuresurendrasimhaОценок пока нет

- 1) On Which Conditions We Can Determine Pricing Procdure and How Condition Types and Access Sequence Actully Work. Please Answer With Examples?Документ1 страница1) On Which Conditions We Can Determine Pricing Procdure and How Condition Types and Access Sequence Actully Work. Please Answer With Examples?surendrasimhaОценок пока нет

- SAP SD FAQ'sДокумент8 страницSAP SD FAQ'ssurendrasimhaОценок пока нет

- Acin Ecc5 SD 0008Документ27 страницAcin Ecc5 SD 0008surendrasimhaОценок пока нет

- Acin Ecc5 SD 0005Документ30 страницAcin Ecc5 SD 0005surendrasimhaОценок пока нет

- Acin Ecc5 SD 0007Документ18 страницAcin Ecc5 SD 0007surendrasimhaОценок пока нет

- Rebate Configuration in SAP SDДокумент31 страницаRebate Configuration in SAP SDVamsi SiripurapuОценок пока нет

- Project Appraisal Code568AДокумент2 страницыProject Appraisal Code568Amonubaisoya285Оценок пока нет

- Hotel Housekeeping - GuidelinesДокумент2 страницыHotel Housekeeping - GuidelinesNakhayo Juma100% (1)

- The Qmentary (더큐멘터리) - Seventeen (세븐틴) - Mansae (만세) (Eng-jpn-chn Sub) .SrtДокумент16 страницThe Qmentary (더큐멘터리) - Seventeen (세븐틴) - Mansae (만세) (Eng-jpn-chn Sub) .SrtArancha LucianaОценок пока нет

- DGDДокумент2 страницыDGDmarksahaОценок пока нет

- Financial Accounting Assignment - II: Ayush India Ltd. Revenue ModelsДокумент7 страницFinancial Accounting Assignment - II: Ayush India Ltd. Revenue ModelsnikunjОценок пока нет

- MASB7 Construction Contract1Документ2 страницыMASB7 Construction Contract1hyraldОценок пока нет

- QPMC Rate CardsДокумент9 страницQPMC Rate CardsTarek TarekОценок пока нет

- P&R Listsepoct09Документ16 страницP&R Listsepoct09307112402684Оценок пока нет

- Ch15 Questions 1Документ4 страницыCh15 Questions 1vietnam0711Оценок пока нет

- QMS 75B Master's Self Nav Audit Rev 6-Unprotected PDFДокумент5 страницQMS 75B Master's Self Nav Audit Rev 6-Unprotected PDFhoangminh2209Оценок пока нет

- Aptitude Sample PaperДокумент6 страницAptitude Sample PaperShriram Nagarajan100% (2)

- Business Environment PPT 2020 PDFДокумент50 страницBusiness Environment PPT 2020 PDFSatyam AgarwallaОценок пока нет

- Characteristics of Intermittent and Continuous ManufacturingДокумент3 страницыCharacteristics of Intermittent and Continuous ManufacturingSa RiTa100% (1)

- The IS - LM CurveДокумент28 страницThe IS - LM CurveVikku AgarwalОценок пока нет

- The Most Flattering Dress For Every Body TypeДокумент10 страницThe Most Flattering Dress For Every Body TypeObsessoryОценок пока нет

- Time Value of MoneyДокумент8 страницTime Value of MoneyMuhammad Bilal IsrarОценок пока нет

- Chapter 9 Making Capital Investment DecisionsДокумент32 страницыChapter 9 Making Capital Investment Decisionsiyun KNОценок пока нет

- Classwork10 06-Chasekinnel 15Документ4 страницыClasswork10 06-Chasekinnel 15api-310965037Оценок пока нет

- Contract Change Order No. 1 RedactedДокумент8 страницContract Change Order No. 1 RedactedL. A. PatersonОценок пока нет

- Magnit ValuationДокумент50 страницMagnit ValuationNikolay MalakhovОценок пока нет

- Universiti Teknologi Mara Cawangan Kelantan, Bukit Ilmu, 18500 Machang, Kelantan. Macroeconomics (Eco211) Group Project - (Report) - 10%Документ9 страницUniversiti Teknologi Mara Cawangan Kelantan, Bukit Ilmu, 18500 Machang, Kelantan. Macroeconomics (Eco211) Group Project - (Report) - 10%robertОценок пока нет

- Project Proposal IN Broiler Production: Maria Sofia B. Lopez Viii-Emerald Mrs. HongeriaДокумент3 страницыProject Proposal IN Broiler Production: Maria Sofia B. Lopez Viii-Emerald Mrs. HongeriaSofiaLopezОценок пока нет

- PZZ - © Aa VQ Gi Ms Kvab Gi Gi Ms KvabДокумент13 страницPZZ - © Aa VQ Gi Ms Kvab Gi Gi Ms KvabFarah DibaОценок пока нет

- Globalization in The Asia Pacific and South AsiaДокумент3 страницыGlobalization in The Asia Pacific and South AsiaKaren Aniñon BarcelonОценок пока нет

- Sample UploadДокумент14 страницSample Uploadparsley_ly100% (6)