Академический Документы

Профессиональный Документы

Культура Документы

Savings Maximiser

Загружено:

selenalaniИсходное описание:

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Savings Maximiser

Загружено:

selenalaniАвторское право:

Доступные форматы

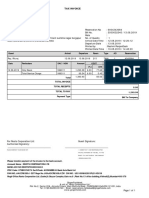

000 Client Number: 3009166

-00099 BSB Number: 923 100

Miss Selena-Lani Williams

Savings Maximiser Number: 11924099

1 Bligh St

KIRRIBILLI NSW 2061 Statement Number: 34

Statement From: 01/07/2009 to 30/09/2009

Introducing the everyday transaction account that pays you!

Sick of all the fees on your current transaction account? Now you have a real

alternative with Orange Everyday, our new transaction account that has no

monthly account keeping fee. It includes a Visa Debit Card which you can use

anywhere Visa is accepted worldwide or EFTPOS is available. If you withdraw

more than $200 at an Australian ATM we'll rebate the ATM owner fee, and

each time you withdraw $200 using EFTPOS, you'll receive a $0.50 bonus.

Apply online today at ingdirect.com.au.

$8,239.54 $0.00 $0.00 $8,312.46

ACCOUNT NAME: savings plan

Date Details Money Out $ Money In $ Balance $

31/07/2009 Interest Credit - Receipt 942316 24.49 8,264.03

31/08/2009 Interest Credit - Receipt 942316 24.57 8,288.60

30/09/2009 Interest Credit - Receipt 942364 23.84 8,312.44

30/09/2009 Credit Bonus Interest - Receipt 942364 0.02 8,312.46

Total Interest Financial Year to Date: $72.92

Total Interest for this statement: $72.92

Tax File Number / Exemption Provided: Yes

Statement Continued Over Page 1 of 2

Keeping me safe and secure

ING DIRECT takes the security of customers' transactions and information very seriously and are committed to protecting you

against online fraud. If you use our Interactive Service (online or phone banking), please remember these security guidelines:

1. Ensure that your Access Code, Security Code and PIN are not disclosed to anyone.

2. Choose an Access Code that is difficult to guess. It should not be your date of birth, a part of your name, or consist of

repeated, ascending or descending characters.

3. Avoid using computers that are shared with other unknown people for online banking, such as internet cafes and libraries.

4. ING DIRECT will never send you an email asking you to click on a link to access online banking, or to provide your Access

Code, Security Code or PIN.

5. Please check all transactions carefully. If you think there's been an error or unauthorised transaction, call us as soon as

possible on 133 464.

This summary does not set out the circumstances in which you may be responsible for unauthorised electronic transactions. Your

liability will be determined under the EFT Code of Conduct. For a full description of your responsibilities, please read your Terms

and Conditions.

Please check all transactions carefully. If you believe there is an error or unauthorised transaction, or if you have any queries, please call us

as soon as possible on 133 464.

Important Information

New customers (those who opened an account between 7 August 2009 and 30 September 2009) - A variable introductory rate applies

from 7 August 2009 until 31 January 2010 for balances up to $1 million. Please note, the variable introductory rate increased on

11 September 2009.

Existing customers - A variable promotional rate is applicable from 7 August 2009 until 31 January 2010 for all new deposits up to

$1 million made above your Savings Maximiser balance as at 11.59pm AEST on 3 August 2009. Please note, the variable promotional rate

increased on 11 September 2009.

From 1 February 2010 the rate that applies will be the Savings Maximiser standard variable rate.

Period Standard Bonus Variable Introductory / Applies to

Variable Rate Margin Promotional Rate

1 July 2009 - 6 August 2009 3.50% p.a. N/A N/A New Customers - N/A

Existing Customers -

Total Balance

7 August 2009 - 10 September 2009 3.50% p.a. 1.00% p.a. 4.50% p.a. New Customers -

Total Balance

Existing Customers -

Balance Increase

11 September 2009 - 30 September 2009 3.50% p.a. 1.25% p.a. 4.75% p.a. New Customers -

Total Balance

Existing Customers -

Balance Increase

Any advice in this statement does not take into account your objectives, financial situation or needs. Before making any decision in

relation to our savings products you should read the relevant Terms and Conditions booklet, available at ingdirect.com.au or by calling

133 464 and consider whether it and any information in this statement is appropriate for you given your situation. If you have a

complaint, please call 133 464 at any time, as we have procedures in place to help resolve any issues you may have. ING DIRECT's savings

products are issued by ING DIRECT, a division of ING Bank (Australia) Limited ABN 24 000 893 292.

Page 2 of 2

-00099

Вам также может понравиться

- Trading & Demat Account Opening Form and Power of Attorney: Application NoДокумент37 страницTrading & Demat Account Opening Form and Power of Attorney: Application NoMad AnshumanОценок пока нет

- Trading & Demat Account Opening Form and Power of Attorney: Application NoДокумент35 страницTrading & Demat Account Opening Form and Power of Attorney: Application NoMad AnshumanОценок пока нет

- ACCOUNT OPENING FORMДокумент15 страницACCOUNT OPENING FORMTuleshwar singh paikraОценок пока нет

- Individual Account Opening Form: (Demat + Trading)Документ29 страницIndividual Account Opening Form: (Demat + Trading)Paras SinghОценок пока нет

- Commodities Account Opening Form: Document Significance PAGE(s)Документ40 страницCommodities Account Opening Form: Document Significance PAGE(s)Krishna Kiran VyasОценок пока нет

- Demat and Trading Account Opening FormДокумент31 страницаDemat and Trading Account Opening Formzenith view filmsОценок пока нет

- Individual Account Opening Form: (Demat + Trading)Документ22 страницыIndividual Account Opening Form: (Demat + Trading)Shreevathsa NsОценок пока нет

- Individual Account Opening Form: (Demat + Trading)Документ22 страницыIndividual Account Opening Form: (Demat + Trading)Senthamizhan NandhakumarОценок пока нет

- Individual Account Opening Form: (Demat + Trading)Документ26 страницIndividual Account Opening Form: (Demat + Trading)Annu KashyapОценок пока нет

- Individual Account Opening Form: (Demat + Trading)Документ22 страницыIndividual Account Opening Form: (Demat + Trading)Ashneet KaurОценок пока нет

- BIR FORM 1600 TAXES WITHHELD LISTING FOR BARANGAY CASILI NORTEДокумент1 страницаBIR FORM 1600 TAXES WITHHELD LISTING FOR BARANGAY CASILI NORTEMelody Frac ZapateroОценок пока нет

- Business Studies - XII: Financial Markets ExplainedДокумент30 страницBusiness Studies - XII: Financial Markets ExplainedThe stuff unlimitedОценок пока нет

- Tax invoice for 100Mbps internet service renewalДокумент2 страницыTax invoice for 100Mbps internet service renewalSunil PatelОценок пока нет

- Individual Account Opening Form: (Demat + Trading)Документ21 страницаIndividual Account Opening Form: (Demat + Trading)Akshara KaraleОценок пока нет

- Account Statement From 1 Apr 2020 To 31 Mar 2021: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalanceДокумент9 страницAccount Statement From 1 Apr 2020 To 31 Mar 2021: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalanceRohit AgarwalОценок пока нет

- Individual Account Opening FormДокумент29 страницIndividual Account Opening FormPeer TahseenОценок пока нет

- Equity Trading and Demat Account Opening FormДокумент21 страницаEquity Trading and Demat Account Opening FormABHISHEK M JOGURОценок пока нет

- WHRBG 1224421 Payslip 02 2019 PDFДокумент1 страницаWHRBG 1224421 Payslip 02 2019 PDFAmit RamaniОценок пока нет

- Individual Account Opening Form: (Demat + Trading)Документ29 страницIndividual Account Opening Form: (Demat + Trading)AkshathОценок пока нет

- Individual Account Opening Form: (Demat + Trading)Документ23 страницыIndividual Account Opening Form: (Demat + Trading)anaparthi naveenОценок пока нет

- CSC Naseeb RazaДокумент3 страницыCSC Naseeb RazaMuhammad Naseeb RazaОценок пока нет

- Tax Invoice: OriginalДокумент12 страницTax Invoice: OriginalMuzammil SayedОценок пока нет

- Groww Stock Account Opening FormДокумент21 страницаGroww Stock Account Opening FormUmerОценок пока нет

- Valuation at A Glance: Acorns Securities, LLC - Member FINRA/SIPCДокумент12 страницValuation at A Glance: Acorns Securities, LLC - Member FINRA/SIPCinsert edgy username hereОценок пока нет

- Helpline 0141-3532000 7230044001, 7230044002: Bikaner Electricity Supply LimitedДокумент1 страницаHelpline 0141-3532000 7230044001, 7230044002: Bikaner Electricity Supply LimitedHimanshuОценок пока нет

- AY 2021-22 ITR3 Computation for Nagender GattuДокумент2 страницыAY 2021-22 ITR3 Computation for Nagender Gattuforty oneОценок пока нет

- Groww Stock Account Opening FormДокумент12 страницGroww Stock Account Opening FormAbdulla ThajilaОценок пока нет

- PDFДокумент2 страницыPDFbala kОценок пока нет

- Tata Unistore Seller Registration FormДокумент6 страницTata Unistore Seller Registration FormArbind Kumar BhagatОценок пока нет

- The Topic of Confluence With Fibonacci RetracementsДокумент6 страницThe Topic of Confluence With Fibonacci RetracementsVeljko KerčevićОценок пока нет

- Valuation at A Glance: Acorns Securities, LLC - Member FINRA/SIPCДокумент12 страницValuation at A Glance: Acorns Securities, LLC - Member FINRA/SIPCCecil PearsonОценок пока нет

- Nipro Medical India Private Limited: Payslip For The Month of April 2020Документ1 страницаNipro Medical India Private Limited: Payslip For The Month of April 2020ramuОценок пока нет

- SalarySlip Oct 2021Документ1 страницаSalarySlip Oct 2021shreyas kotiОценок пока нет

- 6094fb5b5272e87d5fbcde80 All SignДокумент27 страниц6094fb5b5272e87d5fbcde80 All SignDevhans GurjarОценок пока нет

- EДокумент13 страницESudipta Ghosh0% (1)

- Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceДокумент53 страницыDate Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceVishal BawaneОценок пока нет

- Mr. Kiran Kumar Midde's bank statement summaryДокумент4 страницыMr. Kiran Kumar Midde's bank statement summaryKiran KumarОценок пока нет

- Employee Details For RazorpayX PayrollДокумент8 страницEmployee Details For RazorpayX PayrollDeepak kumar M RОценок пока нет

- V K Sharma (5229)Документ1 страницаV K Sharma (5229)Vikas Kumar SharmaОценок пока нет

- Account StatementДокумент6 страницAccount StatementHussainОценок пока нет

- Transactions History: Statement of Account 027310100092293 For The Period of ToДокумент3 страницыTransactions History: Statement of Account 027310100092293 For The Period of ToSrikanthОценок пока нет

- Pfeda Synthetics PVT LTD: Payslip For The Month of January, 2020Документ3 страницыPfeda Synthetics PVT LTD: Payslip For The Month of January, 2020parvinderОценок пока нет

- 61ea0f0e2385d46bb5be627f All UPSTOX SIGNEDДокумент23 страницы61ea0f0e2385d46bb5be627f All UPSTOX SIGNEDgiri muthuОценок пока нет

- Tax Invoice for Placements ChargeДокумент2 страницыTax Invoice for Placements ChargeAnudeep MОценок пока нет

- Know Your Bank (Axis Bank)Документ47 страницKnow Your Bank (Axis Bank)amolОценок пока нет

- Account Statement From 1 Apr 2022 To 29 Aug 2022: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalanceДокумент2 страницыAccount Statement From 1 Apr 2022 To 29 Aug 2022: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalanceAbhay RajОценок пока нет

- Teamlease Services June 2019 Pay SlipДокумент2 страницыTeamlease Services June 2019 Pay SlipPravinThakurVlogsОценок пока нет

- Invoice SampleДокумент1 страницаInvoice SampleRituraj RayОценок пока нет

- Ifsc 2Документ1 443 страницыIfsc 2salboni0% (1)

- Proforma Invoice: Tera Software LimitedДокумент1 страницаProforma Invoice: Tera Software LimitedSigitek Software ServicesОценок пока нет

- Payslip July 2018-SushmitaДокумент1 страницаPayslip July 2018-SushmitaHR KansoftОценок пока нет

- Commodities Account Opening Form: Document Significance PAGE(s)Документ50 страницCommodities Account Opening Form: Document Significance PAGE(s)Priyanka KambleОценок пока нет

- Account Statement From 25 Nov 2021 To 8 Mar 2022: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalanceДокумент14 страницAccount Statement From 25 Nov 2021 To 8 Mar 2022: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalanceSumedha DeshmukhОценок пока нет

- Client Registration Form Completion GuideДокумент26 страницClient Registration Form Completion GuideAzhar ShaikhОценок пока нет

- HDFC Bank Balance Sheet - HDFC Bank LTD Balance Sheet, Financial StatementДокумент2 страницыHDFC Bank Balance Sheet - HDFC Bank LTD Balance Sheet, Financial StatementVikas Kumar PatroОценок пока нет

- Groww Stock Account Opening FormДокумент21 страницаGroww Stock Account Opening FormPranjal RanaОценок пока нет

- Payment Advices Detail ReportДокумент1 страницаPayment Advices Detail Reportrowena dela cruzОценок пока нет

- 1565195920000Документ4 страницы1565195920000Sandeep TeotiaОценок пока нет

- NW Business Reserve Info Sheet 190521Документ2 страницыNW Business Reserve Info Sheet 190521true.exeОценок пока нет

- Valuation of Contributions of PartnersДокумент3 страницыValuation of Contributions of Partnersfinn mertensОценок пока нет

- International BankingДокумент10 страницInternational BankingVinod AroraОценок пока нет

- Contract of Loan With Real Estate MortgageДокумент2 страницыContract of Loan With Real Estate MortgageKatrine ManaoОценок пока нет

- Personal LoanДокумент49 страницPersonal Loantodkarvijay50% (6)

- Case 5Документ4 страницыCase 5ad1gamer100% (1)

- FABM2121 Fundamentals of Accountancy Q2 Performance Task 1Документ3 страницыFABM2121 Fundamentals of Accountancy Q2 Performance Task 1Christian TeroОценок пока нет

- Almandine - The Trust Company PDFДокумент1 страницаAlmandine - The Trust Company PDFAnonymous MoQ28DEBPОценок пока нет

- Internship Report of BOPДокумент52 страницыInternship Report of BOPRani Bakhtawer100% (1)

- 68th Capping Ceremony Uniform Ordering GuideДокумент3 страницы68th Capping Ceremony Uniform Ordering GuideIra AcostaОценок пока нет

- History of Banking in India GK Notes in PDF 2Документ6 страницHistory of Banking in India GK Notes in PDF 2Yogesh LondheОценок пока нет

- DW Data 2014 q4Документ15 страницDW Data 2014 q4helpdotunОценок пока нет

- Catering Invoice TemplateДокумент2 страницыCatering Invoice TemplateEscapayd EОценок пока нет

- Cu Profile 68241Документ10 страницCu Profile 68241Odel KabristanteОценок пока нет

- Ba Credit Card Funding, LLC Bank of America, National AssociationДокумент30 страницBa Credit Card Funding, LLC Bank of America, National AssociationishfaqqqОценок пока нет

- LBBH - m2 - 1 EgySzámla - Keretszerz Déses 2017.03.14-EnДокумент6 страницLBBH - m2 - 1 EgySzámla - Keretszerz Déses 2017.03.14-EnRaviОценок пока нет

- TXN Date Value Date Description Ref No./Cheque No. Branch Code Debit Credit BalanceДокумент8 страницTXN Date Value Date Description Ref No./Cheque No. Branch Code Debit Credit BalanceRaju RoyОценок пока нет

- Investor Presentation in Q2FY22Документ45 страницInvestor Presentation in Q2FY22alnoor manjiyaniОценок пока нет

- 31-Jan-2024 31-Jan-2024 31-Jan-2024Документ1 страница31-Jan-2024 31-Jan-2024 31-Jan-2024Atta Urehman100% (1)

- Project Report Abhay PDFДокумент20 страницProject Report Abhay PDFNikita KotianОценок пока нет

- IU045849Документ1 страницаIU045849Luka UrushadzeОценок пока нет

- T N e M e T A T S R e M o T S U CДокумент2 страницыT N e M e T A T S R e M o T S U Czubair ahmad100% (1)

- Mathematics: Interest Rates and FinanceДокумент55 страницMathematics: Interest Rates and FinanceAmr Tarek100% (1)

- 1st Long Exam (Summer 2022) WITHOUT ANSWERДокумент10 страниц1st Long Exam (Summer 2022) WITHOUT ANSWERDaphnie Kitch CatotalОценок пока нет

- 8.0money Demand & Money MKT EquilibriumДокумент16 страниц8.0money Demand & Money MKT EquilibriumJacquelyn ChungОценок пока нет

- FSSP: Financial Sector Support ProjectДокумент6 страницFSSP: Financial Sector Support ProjectRaihanul KabirОценок пока нет

- Lucknow Circle and BranchesДокумент23 страницыLucknow Circle and BranchesShashank Dohrey60% (5)

- Foreign Exchange ManagementДокумент21 страницаForeign Exchange ManagementSreekanth GhilliОценок пока нет

- Basic Instructions For A Bank Reconciliation StatementДокумент4 страницыBasic Instructions For A Bank Reconciliation StatementMary100% (14)

- Questions For Financial Functions in ExcelДокумент20 страницQuestions For Financial Functions in ExcelTarunSainiОценок пока нет

- Axis Bank MIS Report on Management Information SystemДокумент13 страницAxis Bank MIS Report on Management Information SystemAnurag RanaОценок пока нет