Академический Документы

Профессиональный Документы

Культура Документы

Modelul Altman LR

Загружено:

claudia_claudia1111Исходное описание:

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Modelul Altman LR

Загружено:

claudia_claudia1111Авторское право:

Доступные форматы

International Journal of Business and Management Vol. 5, No.

4; April 2010

133

Predicting Bankruptcy: Evidence from Israel

Shilo Lifschutz

Academic Center of Law and Business

26 Ben-Gurion St., Ramat Gan, Israel

Tel: 972-2-5869-341 E-mail: shilo@clb.ac.il

Arie Jacobi

Department of Software Engineering, Sami Shamoon Academic College of Engineering

Beer Sheva, 84100, Israel

Tel: 972-2-5827-639 E-mail: ariej@mscc.huji.ac.il

Abstract

In this study, we conducted an empirical investigation of whether it is possible to rely on two versions of the

Altman Model (1968) to predict financial failure of publicly traded companies in Israel between 2000 and 2007.

The findings of the study indicated that given the sample and the study term, the preferable model for predicting

financial failure of Israeli companies is the Ingbar version of the Altman Model with a critical value of 1 and

with the addition of the gray area. In particular, a survival index above 1 predicts a high likelihood of survival,

while a lower index predicts low likelihood of survival. According to our study, the model is able to predict

bankruptcy of companies with a 95% accuracy rate one year prior to bankruptcy and with an 85% accuracy rate

two years prior to bankruptcy.

Keywords: Altman model, Bankruptcy prediction, Corporate failures, Financial ratios, Israel

1. Introduction

The ability to predict bankruptcy is critical for many users of financial statements. Such users include banks,

investors, credit rating agencies, underwriters, auditors and regulators .During a period of financial and

economic crisis, the importance of using a model to predict bankruptcy and flag warning signs as early as

possible becomes increasingly important. Thus, for example, it is important for institutional investors who are

buying corporate bonds to know the risk of bankruptcy inherent in said bonds, both prior and subsequent to their

purchase.

One of the prominent models for forecasting bankruptcy is Edward Altman's Survival Model. Altman's studies

(e.g., Altman, 1968; Altman, 1983) showed that poor management of a firm (as reflected in the financial ratios)

and not necessarily fierce competition and economic recession is the main cause of bankruptcy. Using the model,

it is possible to predict early warning signs of potential collapse. Altman compared two groups of firms:

bankrupt and non-bankrupt firms. The model examined a large number of financial ratios to forecast the

company's risk of financial failure, and the five best were selected to predict bankruptcy. Each ratio received a

different weight based on its relative contribution to assessing the stability of the company. In 1968, the accuracy

of the Altman Model in predicting bankrupt firms was estimated at 95% one year prior to bankruptcy and 72%

two years prior to bankruptcy.

Yair Ingbar (1994) "converted" the Altman Index to publicly traded companies in Israel by using coefficients

Altman found (1983) for private companies and determining different critical values. In his study, based on data

from the 1980s, he achieved 93% accuracy in forecasting bankruptcy one year prior to collapse and 73% two

years prior to it. These rates are very similar to the aforementioned rates of the Altman Index.

The research question in this study is: Is it possible to rely on the various versions of the Altman Model to

predict financial failure of publicly traded companies in Israel today?

Previous studies in the Israeli context were based on data from the 1980s. It is important to reexamine this issue

in recent years, in light of the major changes that have taken place both in the economy (particularly following

the financial crisis that let many companies to experience liquidity problems) and in firm activity (in technology

and financial terms).

International Journal of Business and Management www.ccsenet.org/ijbm

134

This study contributes to a growing body of literature on the relationship between financial ratios and risk of

bankruptcy in various countries. Most studies that have examined the predictive ability of the Altman Model

were performed in developed countries such the US and UK. In contrast, our study focuses on a developing

country, Israel, which like other developing countries is marked by a centralized capital market and significant

government intervention. These characteristics may impact the way firms are managed (e.g. the financial

strategy of said companies) which, in turn, may influence the financial ratios of said firms and their importance.

Additionally, in light of the globalization and integration process in the capital markets, many foreign investors

invest in the Israeli capital market, and thus, of 25 Israeli companies listed on the TA-25 Index, 6 of them were

dual listed. As a reflection of this reality, foreign investor interest in the Israel capital market has increased in

recent years, as has the analysis of the condition of publicly traded companies. For these reasons, it is critical to

examine the predictive ability of the Altman Model in Israel today.

The structure of the article is as follows: Section 2 provides a review of some of the relevant literature and

presents various versions of the Altman Index (different models). Section 3 sets out the hypotheses and describes

the methodology and sample. As part of the study, the companies will be analyzed using two versions (models)

of the Altman Index: (1) The original model proposed by Altman (1968) for public companies with a critical

value of 2.675 - referred to hereafter as the original Altman Model, (2) The Ingbar Model and use of coefficients

Altman (1983) found for private companies with a critical value of 1 and the addition of the gray area

hereinafter, the Ingbar Model. Section 4 contains an analysis of the findings, and Section 5 a conclusion.

2. Literature Review with Emphasis on the Altman Model

Altman was the first to use multi-variable models to predict bankruptcy. In his influential 1968 research, he

analyzed financial ratios of bankrupt and stable firms. He used a combination of financial ratios to predict

bankruptcy. The inherent advantage of his model is a combination of the typical attributes of the relevant firm,

while examining the common impacts of the variables, in contrast to Beaver's Model (Beaver, 1966), which

examined each ratio separately.

Altman examined the various financial ratios related to liquidity, profitability, financial leverage, activity and

solvency. He used a discriminate ratio model, where the dependent variable is classified in one of two groups -

bankrupt firms and non-bankrupt firms, and the model provides coefficients for the explanatory variables,

according to the discriminating ability of the variables. Of the numerous financial ratios examined, five (X

1

through X

5

) that significantly contributed to forecasting. Each ratio is assigned a coefficient (weight) based on its

relative contribution. The index - the Z-score - comprises the multiplication of each of the ratios by the

appropriate coefficient and addition of the results. The model, which has become standard, showed high

predictive power regarding which companies could face financial distress. The following is a listing of the ratios

and coefficients:

Original Altman Model (Altman, 1968):

Z = 1.2(X

1

) + 1.4(X

2

) + 3.3(X

3

) + 0.6(X

4

) +0.99(X

5

)

Where: X

1

=

working capital/total assets; X

2

= retained earnings/total assets; X

3

= earnings before interest and

taxes/total assets; X4

=

market value equity/ total debt; X5

=

annual sales /total assets.

The Z-Score, which as aforementioned is a survival indicator, classifies companies based on their solvency. The

higher the value is, the lower the risk of bankruptcy. A low or negative Z-Score indicates high likelihood of

bankruptcy. Altman set critical values between companies based on the survivability indicator. He defined

companies with a Z-Score lower than 1.81 as companies where bankruptcy is likely, companies with a Z-Score

greater than 2.99 as stable companies where bankruptcy is unlikely to occur. Companies that have a score

between 1.81 and 2.99 are in the gray area, meaning that bankruptcy is not easily predicted one way or the other.

Furthermore, he found that the value Z=2.675 maximizes the critical value between bankrupt companies and

non-bankrupt companies.

In 1983, Altman revised his original 1968 model and established different coefficients to forecast bankruptcy in

private companies (the capital in variable X

4

is measured according to book value).

The Altman Model for Private Companies (Altman, 1983):

Z = 0.717(X

1

) +0.847(X

2

) +3.107(X

3

) +0.420(X

4

) +0.998(X

5

)

The following are the critical values of Z in private companies:

International Journal of Business and Management Vol. 5, No. 4; April 2010

135

If the score is lower than 1.23, the likelihood of bankruptcy is high.

If the score is between 1.23 and 2.9, the company is in the gray area.

A score higher than 2.9 indicates its a high likelihood of survival.

Over the past decade, the Z-score models were used as a proxy for bankruptcy risks in such areas as strategic

planning (Calandro, 2007), investment decisions (Sudarsanam and Lai, 2001; Lawson, 2008), asset pricing

(Griffin and Lemmon, 2002; Ferguson and Shockley, 2003), capital structure (Allayannis et al., 2003; Molina,

2005), credit risk pricing (Kao, 2000; Jayadev, 2006), distressed securities (Altman, 2002: ch. 22; Marchesini et

al., 2004) and going-concern research (Citron and Taffler, 2004; Taffler et al., 2004).

As mentioned, Altman used Multivariate Discriminant Analysis (MDA) to predict corporate failures. Additional

studies that use this approach include Blum (1974), Deakin (1977) and in more recent years: Beynon and Peel

(2001), Neophytou et al. (2001) and Chung et al. (2008). Other researchers used logit regression techniques

(Ohlson, 1980), recursive partitioning analysis (Frydman et al., 1985) and artificial neural network models

(Trippi and Turban, 1996). According to Perez (2006), MDA is still one of the most popular approaches used for

bankruptcy prediction. The traditional Z-Score method is still very accepted in financial statement analysis. It is

described in the standard literature on the subject in detail, and its practical use is widespread among financial

statement users (Agarwal and Taffler, 2007).

Begley et al. (1996) used the original Altman Model of 1968, while revising the coefficients. The study showed

that revising the coefficients negatively impacted on the forecasting ability compared to the original model.

Aziz and Dar (2006) reviewed 89 studies on prediction of bankruptcy between 1968-2003. They found that the

multi-variable models (Z-Score) and logit were the most popular in the 89 studies. Chung et al. (2008) examined

the insolvency predictive ability of different financial ratios for ten failed finance companies during 2006-2007

in New Zealand. They found that four of the five Altman (1968) ratios, one year prior to failure, were superior to

other financial ratios for predicting corporate insolvency.

In 1994, in Israel, Ingbar conducted a study on the financial statements of 40 publicly traded Israeli companies,

some profit and stable and others not profitable or undergoing recovery processes in 1982-1990. The results of

the study, published in his book Analysis of Financial Statements, indicated that application of the Altman

Model yields good results both for stable and bankrupt companies. In terms of the bankrupt companies, warning

signs could be identified two and even three years prior to the onset of the crisis at the company.

Ingbar found that companies in Israel operate with less working capital and higher financial leverage than

American companies, explaining why he made the criteria more flexible. He changed the limits of the critical

values of Z for public companies in Israel:

A Z value greater than 2.50 indicates a stable and healthy company.

When the Z value is lower than 1.00, it indicates a weak company where bankruptcy is likely.

When the Z value is between 1.00 and 2.50, the company is in the gray area and bankruptcy is not easily

predicted one way or another. Ingbar calculated equity according to its book value.

In his book, Ingbar also compares 15 companies that went bankrupt and 15 stable companies, selected randomly

from the list of companies that were traded on the Tel Aviv Stock Exchange during the period in which the

bankruptcies of the first 15 companies occurred. All the ratios were calculated using the Altman Model for

private companies. It proves that in virtually all the bankrupt companies, the crisis could be predicted three years

earlier. Using Altman's survival indicators, only with respect to three of the 15 companies was it impossible to

predict bankruptcy three years earlier, and only with respect to one of the 15 companies did the model fail to

predict bankruptcy one year prior to collapse. Ingbar notes that these success rates are in line with the accuracy

level of the Altman indicators, at 90%-95%.

Studies conducted following Ingbar's also indicate the applicability of Altman indicators and their importance in

predicting bankruptcy, both in the Altman Model for private companies and Altman's original model for public

companies. Thus, for example, Ben-Horin (1996) demonstrates this with Adacom, which collapsed in 1994,

based on the quarterly data of the indicator for 1992-1994. A later study conducted by Eden and Meir (2007)

demonstrates this on Shamir Salads, which collapsed in 2005, according to data for 2003 and 2004. Both studies

prove that the Altman indicators clearly show that the companies are in financial distress.

International Journal of Business and Management www.ccsenet.org/ijbm

136

3. Research Hypotheses, Methodology and Sample

3.1 Research hypotheses

Based on the findings in the international and domestic literature, we will set out seven hypotheses below. The

hypotheses relate to the question of whether in recent years in Israel it has been possible to predict bankruptcy of

companies using the accepted Altman models.

In the two first hypotheses, we propose that the ability to predict bankruptcy with the Altman Model for

publicly traded companies in Israel in recent years will be good, as proven in studies that included samples of

companies about 20 or more years ago.

Hypothesis 1: The Altman Model will predict bankruptcy in companies that actually went bankrupt with at least

80% accuracy.

Hypothesis 2: The Altman Model will predict stability in stable companies with at least 80% accuracy.

The third hypothesis assumes that the models predictive ability increases the closer the date of bankruptcy.

Hypothesis 3: The closer the date of bankruptcy, the higher the accuracy of predicting bankruptcy according to

the Altman Model.

The fourth, fifth and sixth hypotheses refer to the Ingbar Model (1994), and the definition of two critical

values, while adding the gray area (Z greater than 1) to the upper range. The hypotheses examine whether the

Ingbar model, adjusted for Israeli companies, improves the predictive ability, compared to the results in the

examination of Hypothesis 1 through 3 (above).

Hypothesis 4: The Ingbar Model improves the predictive ability for bankrupt companies.

Hypothesis 5: The Ingbar Model improves the predictive ability for stable companies.

Hypothesis 6: The closer the date of bankruptcy, the better the accuracy of predicting bankruptcy according to

the Ingbar Model.

Hypothesis 7 assumes that the Ingbar Model has an advantage over the Altman Model and is based on the good

results of Ingbar's study on Israeli companies in the 1980s.

Hypothesis 7: The Ingbar Model improved the overall predictive ability compared to the Altman Model.

3.2 Methodology

The results of the study will be examined according to the original model developed by Altman in 1968 and

according to the Ingbar Model.

Examination of the hypotheses will be done by calculating the Z-Score.

Examination of Hypotheses 1 and 2 will be done by rating Z for both critical values: The first category -

Z-Scores greater than 2.675, second category - Z-Scores below 2.675. Altman (1968) found that this value

discriminates best between bankrupt and non-bankrupt companies. Companies in the first category will be

classified as stable, while companies in the second category will be classified as being at risk for bankruptcy.

Then, the percentage of companies correctly classified and the percentage of companies incorrectly classified

will be calculated. The percentage of correctly classified companies will reflect the predictive accuracy of the

Altman Model.

Examination of Hypothesis 3 will be done by comparing the percentage of correctly classified

companies (classified according to the critical values determined by Altman in his original 1968 model) over

three years.

Examination of Hypotheses 4 and 5 will be conducted according to the Ingbar Model, similar to the

examination of Hypotheses 1 and 2 with two critical values: The first category - Z-Scores greater than 1.00,

second category - Z-Scores below 1.00.

Examination of Hypotheses 6 and 7 will be done by comparing the percentage of companies classified

correctly (classified according to the Ingbar Model) over three years.

3.3 Sample and data

The sample includes 40 companies publicly traded on the Tel-Aviv Stock Exchange between 2000 and 2007, 20

companies that were in suspension, liquidation or receivership (failed companies) and 20 matched stable

(non-failed) companies.

International Journal of Business and Management Vol. 5, No. 4; April 2010

137

The failed group, including all failed public companies with full financial data, resulted in 20 companies which

include the vast majority of bankrupt public companies during the aforementioned period.

The control group includes 20 stable companies that were matched with the failed companies in the sample for

asset size and industry. For the sake of comparison, only stable companies not lacking data over the years

examined were included.

As in similar studies conducted in Israel in the past (Ingbar, 1994), let us note that the small number of publicly

traded bankrupt companies in Israel is a limitation in the study. Therefore, to address part of this problem, firms

from different sectors were included in the sample.

Financial data of the companies was taken from the MAYA site and Yifat Hon Database.

4. Results

Hypotheses 1-3: Table 1 in the Appendix and the corresponding diagram display the companies classified

correctly and incorrectly within the ranges of the original Altman Model, with a critical value of 2.675. If we

examine the overall predictive ability - both of stable companies and bankrupt companies, we will find that the

accuracy rate of prediction for the overall Altman Model ranges between 63% and 68%. In contrast, with respect

to bankrupt companies, the accuracy rate of prediction of the Altman Model in the two years prior to the date of

bankruptcy is 100%. In other words, the model clearly identifies bankrupt companies. In contrast, the model

indicates that a stable company is a bankrupt company in most cases.

Hypotheses 4 - 7: Table 2 in the Appendix and the following diagram present the prediction accuracy according

to the Ingbar Model, when the critical value is 1.00 and with the addition of the gray area.

The important finding from Table 2 is improved accuracy of prediction of stable companies compared to

previous examinations. That said, compared to the previous analysis, when dealing with bankrupt companies, the

accuracy of the Ingbar model is lower. Additionally, it can also be seen that the overall accuracy of prediction

improved compared to the previous analysis and ranges between 73% and 80%.

The following is a more detailed examination of the individual hypotheses:

Hypothesis 1 was verified: The original Altman Model for public companies predicted bankruptcy with over

80% accuracy. Three years prior to bankruptcy, the accuracy rate is 95% and two years and one year prior to

bankruptcy, the predictive ability reaches 100%.

Hypothesis 2 was not verified: The original Altman Model did not forecast stability in stable companies with an

accuracy rate of 80% or higher. The highest accuracy rate achieved was only 35%. In other words, the Altman

Model does not identify most of the companies as stable and has a high type I error rate, or gives many "false

alarms".

Hypothesis 3 was verified: The closer the date of bankruptcy, the higher the predictive accuracy of the original

Altman Model. As mentioned above, three years prior to bankruptcy, the predictive accuracy was 95%, and two

years prior to bankruptcy, accuracy increased to 100%.

Hypothesis 4 was not verified: The Ingbar Model had poorer results than the Altman Model with respect to

bankrupt companies. However, the Ingbar Model's ability to predict bankruptcy is very high and reached 85%

two years prior to bankruptcy and 95% one year prior to bankruptcy.

Hypothesis 5 was verified: The Ingbar Model predicted stable companies with greater accuracy. According to

the Altman Model, the highest level of accuracy reached 35%; under the Ingbar Model, the highest accuracy rate

is 70%.

Hypothesis 6 was verified: The Ingbar Model demonstrated greater accuracy in predicting companies facing

financial distress the closer the date of bankruptcy.

Hypothesis 7 was verified: The better predictive ability of the Ingbar Method for stable companies has an impact

on the overall predictive ability and on the preference for the Ingbar Method in the sample of Israeli companies.

5. Summary and Conclusions

In this study, which includes a sample of 40 publicly traded companies in Israel, we examined the applicability

of the Altman Model and the Ingbar Model for forecasting bankruptcies between 2000 - 2007. Previous studies

published in Israel were conducted on a single company or in a different economic environment, and therefore

we felt it was important to re-examine the issue on a sample of companies and during a later period.

International Journal of Business and Management www.ccsenet.org/ijbm

138

Our study shows that the predictive ability of the original Altman Model for publicly traded companies is very

high with respect to bankrupt companies. However, the model is less efficient in predicting stable companies and

gives many "false alarms". Use of the Ingbar Model improves the predictive ability for stable companies and, as

a result, the overall predictive ability of the model.

In light of our study, and considering the sample and period of the study, the recommended model for predicting

bankruptcy in Israel (between the two examined) is the Ingbar Model, with a critical value of 1.00 and the

addition of the gray area to the upper range A score higher than 1.00 indicates that bankruptcy is unlikely to

occur, and a score below 1.00 predicts that bankruptcy is likely. Between the two models examined, this model

achieves the best results when predicting stable companies (a rate of 65%-70%). According to our study, the

Ingbar Model is able to predict bankrupt companies with an accuracy rate of 95% one year prior to bankruptcy,

while two years prior to bankruptcy it has an accuracy rate of 85%.

We should note that the Altman Model (all versions) is only a single tool in evaluating the risk of bankruptcy for

companies and therefore other information, both qualitative and quantitative, must be used to evaluate the

solvency of companies. This is done in the banking industry as part of managing and controlling credit risks.

That said, the results of the study are encouraging because even today the Inbar Model can be used to predict

financial failure of companies in Israel, even two years prior to bankruptcy. This issue has been very important

over the past year, following the liquidity distress many Israeli and global companies have faced.

The most important advantage of the model compared to more advanced ones is its simplicity and the low cost of

its application. Using an objective, quantitative indicator represented by a single number, the credit risk can be

estimated. We believe the issue to be of great importance now, in light of the significant growth in recent years

in the amount of information companies include in financial statements. The model allows users to focus

attention on a single number in an era when we are "flooded" with financial information, when we cannot see

the forest for the trees."

It is important to note two limitations of the study. First, given the small number of publicly traded companies in

Israel that have gone bankrupt compared to the United States, our sample is limited (similar to other samples

taken in Israel). This constitutes a certain limitation and therefore the relatively good results of the study must be

looked at with a critical eye, and which are sensitive to the sample and to the period reviewed. Second, as part of

the study, we examined publicly traded companies in various industries, and therefore we cannot rush to draw

conclusions regarding private companies. Therefore, there is certainly room for a future study that will include a

wider sample of companies (following the financial crisis) and, if possible, the study would also examine private

companies separately. In the future, as financial reporting is established under IFRS and the transition to fair

value accounting, there will also be room to re-examine the models.

Acknowledgement

We thank Anna Basov for computational assistance.

References

Agarwal, V., & Taffler. R. J. (2007). Twenty-five years of the Taffler z-score model: Does it really have

predictive ability? Accounting and Business Research, 37 (4), 285-300.

Allayannis, G., Brown, G. W., & Klapper, L. F. (2003). Capital structure and financial risk: Evidence from

foreign debt use in East Asia. Journal of Finance, 58(6), 26672709.

Altman, E. I. (1968). Financial ratios, discriminant analysis and the prediction of corporate bankruptcy. Journal

of Finance, 23 (4), 589-609.

Altman, E. I. (1983). Corporate financial distress: A complete guide to predicting, avoiding, and dealing with

bankruptcy. New York: John Wiley & Sons.

Altman, E. I. (2002). Bankruptcy, credit risk, and high yield junk bonds: a compendium of writings. Oxford:

Blackwell Publishing.

Aziz, M. A., & Dar, H. A. (2006). Predicting corporate bankruptcy: Where we stand? Corporate Governance, 6

(1), 18-33.

Beaver, W. H. (1966). Financial ratios as predictors of failure. Journal of Accounting Research, 4, Empirical

Research in Accounting: Selected Studies, (Supplement), 71 111.

Begley, J., Mining, J., & Watts, S. (1996). Bankruptcy classification errors in the 1980s: An empirical analysis

of Altman's and Ohlson's models. Review of Accounting Studies, 1 (4), 267-284.

International Journal of Business and Management Vol. 5, No. 4; April 2010

139

Ben-Horin, M. (1996). Securities and the capital market, Tcherikover, 305-307. [in Hebrew]

Beynon, M. J., & Peel, M. J. (2001). Variable precision rough set theory and data discretisation: An application

to corporate failure prediction. Omega, 29, 561-576.

Blum, M. P. (1974). Failing company discriminant analysis. Journal of Accounting Research, 12 (1), 1-25.

Calandro, J. (2007). Considering the utility of Altman's Z-score as strategic assessment and performance

management tool. Strategic & Leadership, 35(5), 37-43.

Chung, K. C., Tan, S. S., & Holdsworth, D. K. (2008). Insolvency prediction model using multivariate

discriminant analysis and artificial neural network for the finance industry in New Zealand. International

Journal of Business and Management, 3(1), 19-29.

Citron, D. B., & Taffler, R. J. (2004). The comparative impact of an audit report standard and an audit

going-concern standard on going-concern disclosure rates. Auditing: A Journal of Practice and Theory, 23(2),

119130.

Deakin, E. B. (1977). Business failure prediction: An empirical analysis. In E. Altman, & A. Sametz (Eds.),

Financial crises: Institutions and markets in a fragile environment. New York: John Wiley.

Eden, I., & Meir, Y. (2007). Between Edward Altman and Boaz Yona. Roeh Haheshbon, 5 (October), 100-101.

[In Hebrew]

Ferguson, M. F., & Shockley, R. L. (2003). Equilibrium anomalies. Journal of Finance, 58(6), 2549-2580.

Frydman, H. E., Altman E. I., & Kao, D.G. (1985). Introducing recursive partitioning for financial classification:

The case of financial distress. Journal of Finance, 40 (1), 269-291.

Griffin, J., & Lemmon, L. (2002). Book-to-market equity, distress risk, and stock returns. Journal of Finance,

57(5), 23172336.

Ingbar, Y. (1994). Analysis of financial statements. Israel Institute of Productivity. (Chapter 13). [in Hebrew]

Jayadev, M. (2006). Predictive power of financial risk factors: An empirical analysis of default companies. The

Journal for Decision Makers, 31(3), 45-56.

Kao, D. L. (2000). Estimating and pricing credit risk: An overview. Financial Analysts Journal, 56(4), 5066.

Lawson, R. (2008). Measuring company quality. Journal of Investing, 17(4), 38-55.

Marchesini, R., Perdue, G., & Bryan, V. (2004). Applying bankruptcy prediction models to distressed high yield

bond issues. Journal of Fixed Income, 13(4), 5056.

Molina, C. A. (2005). Are firms underleveraged? An examination of the effect of leverage on default

probabilities. Journal of Finance, 60(3), 14271459.

Neophytou, E., Charitou, A., & Charalambous, C. (2001), Predicting corporate failure: Empirical evidence for

the UK. Discussion Paper No. 01-173, March, School of Management, University of Southampton,

Southampton.

Ohlson, J. (1980). Financial ratios and probabilistic prediction of bankruptcy. Journal of Accounting Research,

18 (1), 109-131.

Perez, M. (2006). Artificial neural networks and bankruptcy forecasting: a state of the art. Neural Computer &

Application, 15, 154163.

Sudarsanam. S., & Lai, J. (2001). Corporate financial distress and turnaround strategies: An empirical analysis.

British Journal of Management, 12(3), 183-199.

Taffler, R. J., Lu, J., & Kausar, A. (2004). In denial? Stock market under reaction to going-concern audit report

disclosures. Journal of Accounting & Economics, 38(13), 263296.

Trippi, R., & Turban E (Eds). (1996). Neural networks in finance and investing: using artificial intelligence to

improve real-world performance (pp. 367-394). London: IRWIN Professional Publishing.

International Journal of Business and Management www.ccsenet.org/ijbm

140

Appendix

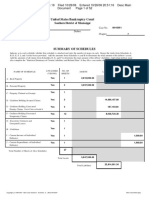

Table 1. The Predictive Ability of the Altman model

% error correct N1/N2

Company

Type

Year

%

number

0% 100% 20 20 Bankrupt

One year

before

bankruptcy

75% 25% 5 20 Stable

37.5% 62.5% 25 40 Total

0% 100% 20 20 Bankrupt

Two years

before

bankruptcy

65% 35% 7 20 Stable

32.5% 67.5% 27 40 Total

5% 95% 19 20 Bankrupt

Three years

before

bankruptcy

70% 30% 6 20 Stable

37.5% 62.5% 25 40 Total

Table 2. The Predictive Ability of the Ingbar Model

% error

correct

N1/N2

Company

Type

Year

% number

5% 95% 19 20 Bankrupt

One year before

bankruptcy

35% 65% 13 20 Stable

20% 80% 32 40 Total

15% 85% 17 20 Bankrupt Two years

before

bankruptcy

35% 65% 13 20 Stable

25% 75% 30 40 Total

25% 75% 15 20 Bankrupt Three years

before

bankruptcy

30% 70% 14 20 Stable

27.5% 72.5% 29 40 Total

International Journal of Business and Management Vol. 5, No. 4; April 2010

141

ALTMAN Z-SCORE

0%

20%

40%

60%

80%

100%

1 2 3

Bankrupt

Total

Stabl e

Diagram 1. The Predictive Ability of the Altman model

INGBAR SCORE

0%

20%

40%

60%

80%

100%

1 2 3

Bankrupt

Total

Stabl e

Diagram 2. The Predictive Ability of the Ingbar Model

Reproducedwith permission of thecopyright owner. Further reproductionprohibited without permission.

Вам также может понравиться

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5794)

- 1 s2.0 S1042443114000584 MainДокумент17 страниц1 s2.0 S1042443114000584 Mainclaudia_claudia1111Оценок пока нет

- Modelul AnghelДокумент7 страницModelul Anghelclaudia_claudia1111Оценок пока нет

- International Journal of Commerce & Management 2007 17, 4 Proquest CentralДокумент17 страницInternational Journal of Commerce & Management 2007 17, 4 Proquest Centralclaudia_claudia1111Оценок пока нет

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- PDFДокумент16 страницPDFclaudia_claudia1111Оценок пока нет

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (895)

- PDFДокумент16 страницPDFclaudia_claudia1111Оценок пока нет

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (344)

- America'S Community Banker Nov 1997 6, 11 Proquest CentralДокумент1 страницаAmerica'S Community Banker Nov 1997 6, 11 Proquest Centralclaudia_claudia1111Оценок пока нет

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (399)

- Model Insolventa de TradusДокумент28 страницModel Insolventa de Tradusclaudia_claudia1111Оценок пока нет

- Insolvency Evolution in The European UnionДокумент19 страницInsolvency Evolution in The European Unionclaudia_claudia1111Оценок пока нет

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- Economic and Business Review For Central and South - Eastern Europe Feb 2008 10, 1Документ17 страницEconomic and Business Review For Central and South - Eastern Europe Feb 2008 10, 1claudia_claudia1111Оценок пока нет

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (266)

- OptiuneVA+reorganizare+falim AustraliaДокумент27 страницOptiuneVA+reorganizare+falim Australiaclaudia_claudia1111Оценок пока нет

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- Global FinancialДокумент20 страницGlobal Financialclaudia_claudia1111Оценок пока нет

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- 1 s2.0 S0197397511000221 MainДокумент9 страниц1 s2.0 S0197397511000221 Mainclaudia_claudia1111Оценок пока нет

- Credit & Financial Management Review First Quarter 2005 11, 1 Proquest CentralДокумент16 страницCredit & Financial Management Review First Quarter 2005 11, 1 Proquest Centralclaudia_claudia1111Оценок пока нет

- Bilant SC 1212 XML v100 140213Документ1 страницаBilant SC 1212 XML v100 140213claudia_claudia1111Оценок пока нет

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- 1 s2.0 S0197397511000221 MainДокумент9 страниц1 s2.0 S0197397511000221 Mainclaudia_claudia1111Оценок пока нет

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- Failure ProcessesДокумент21 страницаFailure Processesclaudia_claudia1111Оценок пока нет

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2259)

- Global FinancialДокумент20 страницGlobal Financialclaudia_claudia1111Оценок пока нет

- Panorama Company Insolvencies - Spring 2013Документ11 страницPanorama Company Insolvencies - Spring 2013claudia_claudia1111Оценок пока нет

- Coface CEE Insolvencies Booklet 2013Документ26 страницCoface CEE Insolvencies Booklet 2013claudia_claudia1111Оценок пока нет

- Accounting Is An InstrumentДокумент21 страницаAccounting Is An Instrumentclaudia_claudia1111Оценок пока нет

- Of LegitimateДокумент19 страницOf Legitimateclaudia_claudia1111Оценок пока нет

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- Modele - En.ivonciu ManecutaДокумент12 страницModele - En.ivonciu Manecutaclaudia_claudia1111Оценок пока нет

- OptiuneVA+reorganizare+falim AustraliaДокумент27 страницOptiuneVA+reorganizare+falim Australiaclaudia_claudia1111Оценок пока нет

- Pedagogic Metaphors and The Nature of Accounting SignificationДокумент33 страницыPedagogic Metaphors and The Nature of Accounting Significationclaudia_claudia1111Оценок пока нет

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1090)

- Definire Insolventa Pe TariДокумент16 страницDefinire Insolventa Pe Tariclaudia_claudia1111Оценок пока нет

- PDFДокумент44 страницыPDFclaudia_claudia1111Оценок пока нет

- Bankruptcy Prediction Model For Listed Companies in Romania: Vintilă Georgeta and Toroapă Maria GeorgiaДокумент11 страницBankruptcy Prediction Model For Listed Companies in Romania: Vintilă Georgeta and Toroapă Maria Georgiaclaudia_claudia1111Оценок пока нет

- Business Credit Feb 2010 112, 2 Proquest CentralДокумент2 страницыBusiness Credit Feb 2010 112, 2 Proquest Centralclaudia_claudia1111Оценок пока нет

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (120)

- PDFДокумент12 страницPDFclaudia_claudia1111Оценок пока нет

- PDFДокумент9 страницPDFclaudia_claudia1111Оценок пока нет

- Notice Concerning Fiduciary RelationshipДокумент4 страницыNotice Concerning Fiduciary Relationshipjoe100% (3)

- D 1 DD 7 Ee 9 A 142Документ14 страницD 1 DD 7 Ee 9 A 142Koustubh MohantyОценок пока нет

- Business Law Syllabus BA081IUДокумент10 страницBusiness Law Syllabus BA081IUJacky HoОценок пока нет

- FH HRTFДокумент29 страницFH HRTFJess Guiang CasamorinОценок пока нет

- Research EssayДокумент13 страницResearch Essayapi-584024170Оценок пока нет

- DBMP chapter 11 - Joint Motion Official Committee of Asbestos Personal Injury Claimants and the Future Claimants Representatives Conditional Motion to Establish a Two-step Protocol for Estimating the Debtors Asbestos LiabilitiesДокумент14 страницDBMP chapter 11 - Joint Motion Official Committee of Asbestos Personal Injury Claimants and the Future Claimants Representatives Conditional Motion to Establish a Two-step Protocol for Estimating the Debtors Asbestos LiabilitiesKirk HartleyОценок пока нет

- United States Court of Appeals, Second CircuitДокумент7 страницUnited States Court of Appeals, Second CircuitScribd Government DocsОценок пока нет

- GGP Reorganization 072010Документ14 страницGGP Reorganization 072010Chris AllevaОценок пока нет

- Beach SettlementДокумент9 страницBeach Settlementkc wildmoon100% (1)

- In Re: M.P. Construction Company, Inc., 9th Cir. BAP (2013)Документ17 страницIn Re: M.P. Construction Company, Inc., 9th Cir. BAP (2013)Scribd Government DocsОценок пока нет

- T21-G4-T1Q1 - Full AnswerДокумент3 страницыT21-G4-T1Q1 - Full AnswerAndy HuangОценок пока нет

- Oria V McMicking GR 7003 Jan 18 1912 PDFДокумент6 страницOria V McMicking GR 7003 Jan 18 1912 PDFChami YashaОценок пока нет

- MMJS - English Version - Oman VAT LawДокумент28 страницMMJS - English Version - Oman VAT LawJay DusejaОценок пока нет

- Devaynes V Noble Baring V Noble (1831) 39 ER 482Документ5 страницDevaynes V Noble Baring V Noble (1831) 39 ER 482akhil SrinadhuОценок пока нет

- English Law Week 2017: The Law - A Noble Profession or Just Business?Документ32 страницыEnglish Law Week 2017: The Law - A Noble Profession or Just Business?Zviagin & CoОценок пока нет

- 2nd Amended ComplaintДокумент23 страницы2nd Amended ComplainthuffpostjonxОценок пока нет

- GIPC Course Brochure 202324 V2 (10 Jul 2023)Документ25 страницGIPC Course Brochure 202324 V2 (10 Jul 2023)Justin AlexanderОценок пока нет

- IBC Case LawДокумент3 страницыIBC Case LawPrashant SinghОценок пока нет

- Odyssey ContractДокумент76 страницOdyssey ContractGazetteonlineОценок пока нет

- Gary L. Reinert, Sr. V., 3rd Cir. (2015)Документ7 страницGary L. Reinert, Sr. V., 3rd Cir. (2015)Scribd Government DocsОценок пока нет

- Frazier Claiborne BK ScheduleДокумент52 страницыFrazier Claiborne BK Schedulethe kingfishОценок пока нет

- Shaji Purushottaman v. Union Bank of IndiaДокумент4 страницыShaji Purushottaman v. Union Bank of IndiaMohit JainОценок пока нет

- Young Conaway Fee App - ImerysДокумент60 страницYoung Conaway Fee App - ImerysKirk HartleyОценок пока нет

- Oblicon - Extinguishment of ObligationДокумент9 страницOblicon - Extinguishment of ObligationBeejay BenitezОценок пока нет

- RKG-NCLT Case Analysis On IBCДокумент34 страницыRKG-NCLT Case Analysis On IBCranjusanjuОценок пока нет

- Vivifi India Finance PVT LTDДокумент11 страницVivifi India Finance PVT LTDMohd lrfanОценок пока нет

- Distribution AgreementДокумент11 страницDistribution Agreementtwells3120100% (1)

- Real Estate Service Act (Resa Law) Republic Act 9646Документ18 страницReal Estate Service Act (Resa Law) Republic Act 9646Mike Angelow EsperaОценок пока нет

- Topic 2-Proceedings in Company Liquidation - PPTX LatestДокумент72 страницыTopic 2-Proceedings in Company Liquidation - PPTX Latestredz00Оценок пока нет

- 2012 Corporate InsolvencyДокумент96 страниц2012 Corporate Insolvencygreenemerald36Оценок пока нет

- Finance Basics (HBR 20-Minute Manager Series)От EverandFinance Basics (HBR 20-Minute Manager Series)Рейтинг: 4.5 из 5 звезд4.5/5 (32)

- I Will Teach You to Be Rich: No Guilt. No Excuses. No B.S. Just a 6-Week Program That Works (Second Edition)От EverandI Will Teach You to Be Rich: No Guilt. No Excuses. No B.S. Just a 6-Week Program That Works (Second Edition)Рейтинг: 4.5 из 5 звезд4.5/5 (13)

- How to Start a Business: Mastering Small Business, What You Need to Know to Build and Grow It, from Scratch to Launch and How to Deal With LLC Taxes and Accounting (2 in 1)От EverandHow to Start a Business: Mastering Small Business, What You Need to Know to Build and Grow It, from Scratch to Launch and How to Deal With LLC Taxes and Accounting (2 in 1)Рейтинг: 4.5 из 5 звезд4.5/5 (5)

- The One-Page Financial Plan: A Simple Way to Be Smart About Your MoneyОт EverandThe One-Page Financial Plan: A Simple Way to Be Smart About Your MoneyРейтинг: 4.5 из 5 звезд4.5/5 (37)

- The Science of Prosperity: How to Attract Wealth, Health, and Happiness Through the Power of Your MindОт EverandThe Science of Prosperity: How to Attract Wealth, Health, and Happiness Through the Power of Your MindРейтинг: 5 из 5 звезд5/5 (231)

- Ledger Legends: A Bookkeeper's Handbook for Financial Success: Navigating the World of Business Finances with ConfidenceОт EverandLedger Legends: A Bookkeeper's Handbook for Financial Success: Navigating the World of Business Finances with ConfidenceОценок пока нет

- Love Your Life Not Theirs: 7 Money Habits for Living the Life You WantОт EverandLove Your Life Not Theirs: 7 Money Habits for Living the Life You WantРейтинг: 4.5 из 5 звезд4.5/5 (146)

- Getting to Yes: How to Negotiate Agreement Without Giving InОт EverandGetting to Yes: How to Negotiate Agreement Without Giving InРейтинг: 4 из 5 звезд4/5 (652)