Академический Документы

Профессиональный Документы

Культура Документы

Script

Загружено:

shahidsarkИсходное описание:

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Script

Загружено:

shahidsarkАвторское право:

Доступные форматы

Before discussing the analysis of NBP, lets have a brief overview of banking industry in 2013.

The profitability of the Pakistani banking sector remained muted as the banks absorbed the

impact of reduction in the net interest margins. So, in order to off-set the impact of reduction in

yield the banks used the volume growth approach. During this period, however, the balance

sheet size of the banking industry grew, but the sector remained exposed to credit risk.

Basel

As we know that all the banks have to comply with the rules and regulations of the SBP, these

rules and regulations are mentioned in the Basel framework.

Basel framework is based on three pillars

1. Minimum Capital Requirement (MCR): is the nominal amount of capital banks/ DFIs are

required to hold. Currently the MCR for banks and DFIs is PRs. 10 billion as prescribed by

SBP.

ii. Capital Adequacy Ratio:

The Capital Adequacy Ratio (CAR) assesses the capital requirement based on the risks faced by

the banks/ DFIs. Currently the required CAR for banks is 10%.

2. Risk Management

This pillar is to ensure that risks are taken into account by the banks. These include

Credit Risk

Operational Risk

Market and Liquidity risk (etc)

All of these will be discussed later in the presentation in relation to NBP

3. Market exposure

Profitability

The major contributor in the NBPs profitability is the Commercial & Retail Banking Group which

handles both liabilities and assets products. On liability side, the group manages procurement

of deposits under different schemes/products. The group offers various financing products

which include commercial, SME, agriculture, consumer & commodity financing. Under

consumer financing the bank offers NBP Advance Salary, NBP Saibaan and Cash & Gold

products.

The profitability of NBP has declined over the years. This decline in profitability is mainly

because of a decline in NIM. The NIM has declined because the SBP has reduced the discount

rate which impacted the yield on assets. In addition to this, the deposit rate was increased

(profit and loss sharing accounts) from 6% to 7% increasing the expenses of the bank.

Also there was a change in calculation of profit from minimum balance to average balance

which further contributed to lower NIM.

Likewise the ROE i.e., the rate of return to the shareholders also declined due to reduced Net

income and increase in equity. The bank has continued to make impressive capital gains in both

money and capital markets which has led to an increase in equity.

Similarly, Non NIM is negative because the non-interest expenses are more than the non-

interest revenues. Although both revenues and expenses are increasing but the increase in

expenses are more than the revenues resulting in the negative non NIM.

Earning spread of NBP is also declining over the years which is also due to lower return on loans

and increased deposit rate.

Вам также может понравиться

- Empty Feasible Region Maximize Z 8x-3y SubjectДокумент4 страницыEmpty Feasible Region Maximize Z 8x-3y SubjectshahidsarkОценок пока нет

- Pepsi ChangДокумент2 страницыPepsi ChangshahidsarkОценок пока нет

- The Simplex Method1Документ4 страницыThe Simplex Method1shahidsarkОценок пока нет

- B. If The Objective Is To Maximize The Discount Show That The LP Model IsДокумент5 страницB. If The Objective Is To Maximize The Discount Show That The LP Model IsshahidsarkОценок пока нет

- ScriptДокумент2 страницыScriptshahidsarkОценок пока нет

- Graphical Solutions of Linear InequalitiesДокумент6 страницGraphical Solutions of Linear InequalitiesshahidsarkОценок пока нет

- GroupsДокумент1 страницаGroupsshahidsarkОценок пока нет

- Banco RealДокумент17 страницBanco Realshahidsark100% (1)

- IntroductionДокумент10 страницIntroductionshahidsarkОценок пока нет

- Guidelines For Synopsis Thesis PHD Degree Punjab UniversityДокумент5 страницGuidelines For Synopsis Thesis PHD Degree Punjab Universityfarooqsami4uОценок пока нет

- MEMBERS AREA IndexДокумент13 страницMEMBERS AREA IndexshahidsarkОценок пока нет

- Job Detail of HR OfficersДокумент1 страницаJob Detail of HR OfficersshahidsarkОценок пока нет

- Economic Problems of Pakistan: UnemploymentДокумент7 страницEconomic Problems of Pakistan: UnemploymentshahidsarkОценок пока нет

- Service Sector of PakistanДокумент2 страницыService Sector of Pakistanshahidsark100% (1)

- A Tale of Two DepressionsДокумент8 страницA Tale of Two DepressionsshahidsarkОценок пока нет

- 8 Roles Assessment - SchoolДокумент12 страниц8 Roles Assessment - SchoolJoy BalisiОценок пока нет

- 881 FTPДокумент16 страниц881 FTPshahidsarkОценок пока нет

- Seminar Habits LetterДокумент5 страницSeminar Habits LetterMuhammad ShahidОценок пока нет

- CanonApple PDFДокумент17 страницCanonApple PDFFlorin LazaroiuОценок пока нет

- Stress andДокумент15 страницStress andshahidsarkОценок пока нет

- FundraisingДокумент3 страницыFundraisingTomato13Оценок пока нет

- 05 StrategicChangeHealthcareABCДокумент17 страниц05 StrategicChangeHealthcareABCshahidsarkОценок пока нет

- Java BookДокумент35 страницJava BookBalaguru PalanivelОценок пока нет

- The Global Economic Crisis and Developing CountriesДокумент25 страницThe Global Economic Crisis and Developing CountriesshahidsarkОценок пока нет

- A Project Report On Targeting and Positioning Strategy of Reliance MoneyДокумент68 страницA Project Report On Targeting and Positioning Strategy of Reliance MoneySamir Anand100% (106)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5794)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (895)

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (344)

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (399)

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (266)

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (121)

- A Study On Labour Absenteeism in Ammarun Foundries Coimbatore-QuestionnaireДокумент4 страницыA Study On Labour Absenteeism in Ammarun Foundries Coimbatore-QuestionnaireSUKUMAR75% (8)

- Lexis® Gift VouchersДокумент1 страницаLexis® Gift VouchersNURUL IZZA HUSINОценок пока нет

- Virata V Wee To DigestДокумент29 страницVirata V Wee To Digestanime loveОценок пока нет

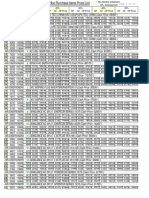

- PriceListHirePurchase Normal6thNov2019Документ56 страницPriceListHirePurchase Normal6thNov2019Jamil AhmedОценок пока нет

- LG Market AnalysisДокумент6 страницLG Market AnalysisPrantor ChakravartyОценок пока нет

- A Reaction PaperДокумент6 страницA Reaction PaperRedelyn Guingab Balisong100% (2)

- 10 Steps To Starting A Business in Ho Chi Minh CityДокумент5 страниц10 Steps To Starting A Business in Ho Chi Minh CityRahul PatilОценок пока нет

- Combination Resume SampleДокумент2 страницыCombination Resume SampleDavid SavelaОценок пока нет

- Personal Selling in Pharma Marketing: Shilpa GargДокумент17 страницPersonal Selling in Pharma Marketing: Shilpa GargNikhil MahajanОценок пока нет

- Project ManagementДокумент2 страницыProject ManagementJohanChvzОценок пока нет

- Investor PDFДокумент3 страницыInvestor PDFHAFEZ ALIОценок пока нет

- Ready To Eat Food DM20204Документ18 страницReady To Eat Food DM20204Akai GargОценок пока нет

- Top Multinational Medical Devices CompaniesДокумент3 страницыTop Multinational Medical Devices CompaniesakashОценок пока нет

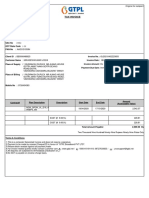

- Tax Invoice: U64204GJ2008PTC054111 24AADCG1959N1ZA 9984 GJДокумент1 страницаTax Invoice: U64204GJ2008PTC054111 24AADCG1959N1ZA 9984 GJMrugesh Joshi50% (2)

- Agency TheoryДокумент2 страницыAgency TheoryAmeh SundayОценок пока нет

- The Swot of Taco BellДокумент2 страницыThe Swot of Taco BellJennyfer PaizОценок пока нет

- Assignment 1.3Документ3 страницыAssignment 1.3ZeusОценок пока нет

- NOTICE: This Order Was Filed Under Supreme Court Rule 23 and May Not Be Cited As PrecedentДокумент20 страницNOTICE: This Order Was Filed Under Supreme Court Rule 23 and May Not Be Cited As PrecedentmikekvolpeОценок пока нет

- AspenTech's Solutions For Engineering Design and ConstructionДокумент13 страницAspenTech's Solutions For Engineering Design and Constructionluthfi.kОценок пока нет

- 1LPS 3 BoQ TemplateДокумент369 страниц1LPS 3 BoQ TemplateAbdulrahman AlkilaniОценок пока нет

- Design Failure Mode and Effects Analysis: Design Information DFMEA InformationДокумент11 страницDesign Failure Mode and Effects Analysis: Design Information DFMEA InformationMani Rathinam Rajamani0% (1)

- Commonwealth Bank 2012 Annual ReportДокумент346 страницCommonwealth Bank 2012 Annual ReportfebriaaaaОценок пока нет

- President Uhuru Kenyatta's Madaraka Day SpeechДокумент8 страницPresident Uhuru Kenyatta's Madaraka Day SpeechState House Kenya100% (1)

- Final QARSHI REPORTДокумент31 страницаFinal QARSHI REPORTUzma Khan100% (2)

- أثر السياسة النقدية على سوق الأوراق المالية في الجزائرДокумент21 страницаأثر السياسة النقدية على سوق الأوراق المالية في الجزائرTedjani Ahmed DzaitОценок пока нет

- Notes On b2b BusinessДокумент7 страницNotes On b2b Businesssneha pathakОценок пока нет

- New ISO 29990 2010 As Value Added To Non-Formal Education Organization in The FutureДокумент13 страницNew ISO 29990 2010 As Value Added To Non-Formal Education Organization in The Futuremohamed lashinОценок пока нет

- Pledge, REM, Antichresis DigestsДокумент43 страницыPledge, REM, Antichresis DigestsAnonymous fnlSh4KHIgОценок пока нет

- Chapter 4 The Market Forces of Supply and DemandДокумент76 страницChapter 4 The Market Forces of Supply and DemandGiang NguyễnОценок пока нет

- Persona Based Identity and Access ManagementДокумент39 страницPersona Based Identity and Access Managementsneha sureshbabuОценок пока нет