Академический Документы

Профессиональный Документы

Культура Документы

Certificate in International Payment Systems Bangalore

Загружено:

Makarand Lonkar0 оценок0% нашли этот документ полезным (0 голосов)

102 просмотров4 страницыA globally acclaimed certification

Авторское право

© © All Rights Reserved

Доступные форматы

PDF, TXT или читайте онлайн в Scribd

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документA globally acclaimed certification

Авторское право:

© All Rights Reserved

Доступные форматы

Скачайте в формате PDF, TXT или читайте онлайн в Scribd

0 оценок0% нашли этот документ полезным (0 голосов)

102 просмотров4 страницыCertificate in International Payment Systems Bangalore

Загружено:

Makarand LonkarA globally acclaimed certification

Авторское право:

© All Rights Reserved

Доступные форматы

Скачайте в формате PDF, TXT или читайте онлайн в Scribd

Вы находитесь на странице: 1из 4

Certified International Payment

Systems Professional (CIPSP)

TM

CIPSP certification will help you in enhancing

your skills in International Payment Systems.

Get certified to stay ahead

of the competition.

All our training programs

are also available in-

house. To arrange an in-

house program please

contact us on :

+91-20-25466154

or

+91-9764835350

or email

info@mvlco.com

MVLCO offers a four full days comprehensive

CIPSP certification program extensively focused on

International Payment Systems. The course covers

important payments systems in countries i.e. USA,

Europe (SEPA), Canada, Hong Kong, China and

India with detailed understanding of each of the

payment systems including RTGS, Hybrid Systems

and Card/Mobile Payment Systems.

The CIPSP program emphasizes on active participa-

tion from delegates and includes exercises and case

studies.

When you complete CIPSP, you will have complete

understanding of :

What are payment and settlement systems ?

What are the risks in payment systems ?

How paper based payment systems operate ?

How electronic payment systems operate ?

How mobile and card payments are made ?

How international payments are made ?

SWIFT and other messaging systems for payments

Location: Bangalore, India

BFSI Academy is the

training division of MVL

Consulting Private

Limited.

Visit MVLCO at

www.mvlco.com

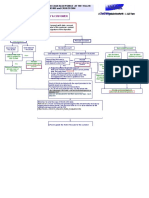

Certified International Payment Systems Professional (CIPSP)

Coursecontents

Introduction

Broad objectives of Payment system and components of payment system

Three key elements : Message, Clearing/Netting and Settlement

Paper to electronic payments check truncation/conversion, Check 21,

Remote deposit capture

Payment processing

Paper to paper

Paper to electronic

Electronic to electronic

Electronic to paper Cheque Processing service

Card and mobile payments

Mobile payments

Why does a bank make payments

Own account transactions including position maintenance and cover

operations

Customer transactions

Risks in Payment Systems :

Herstatt risk, Credit Risk,

Liquidity Risk,

Systemic Risk

Operational Risk.

Risk mitigation techniques

Carefully chosen members

Novation, Central counterparty system

Loss sharing arrangements,

Collateral

Other mitigation techniques

Relationship structures

Correspondent banking

Bilateral clearing arrangements

Network managed banking

Payment types

Book payments

Local payments

Domestic payments

Cross border payments,

Payments systems

Real Time Gross Settlement (RTGS),

Real Time Net Settlement (Canadian LVTS)

Net Settlement,

Hybrid settlement,

Continuous Linked Settlement (CLS)

Why should you attend:

International and domestic

payments are one of the

most happening domain

areas in banking and

finance. Large opportuni-

ties exist for Payment Pro-

fessionals in banks and

IT/Software industry.

After this certification you

would have a cutting edge

over others !

Duration:

4 full days. 15th August,

2014 to 18th August, 2014. Four

full days in continuation.

Fees:

Indian Participants

INR 15000 +12.36% tax

International Participants

US$ 750 +12.36% tax

Certification Fees include

all the tuition, full course

documentation, lunches

and refreshments for the

duration of the program but

does not include accommo-

dation facility and transport

costs.

Full course fees is payable

in advance in favor of

MVL Consulting

Private Ltd.

Remittance information

is provided at the time of

registration.

www.mvlco.com

Coursecontents(Connued)

Regional payments systems

USA payment systems : Fedwire, CHIPS, NSS, ACH

SEPA payment systems : TARGET2, EURO1, STEP1, STEP 2 (SCT/SDD)

UK payment systems : CHAPS, Faster Payments, BACS

China payment system : China Domestic Foreign Currency Payment System

Hong Kong payment system : CHATS

Canadian payment system : LVTS

Indian payment systems : RTGS, NEFT

SWIFT messaging : MT and MX messages

Role of SWIFT in payment systems

SWIFTnet Fin, Fileact, Interact, Browse

SWIFT payment message processing MT 1XX, MT 2XX, MT 9XX, MX PAIN/PACS

SWIFT Payment Messages examples

SWIFT for corporates

Straight through processing

Codes IBAN, BBAN, BIC, BEI, UID, UPIC, ABA routing codes etc.

Single and bulk payment instruction processing

Processing by payment engines

Card and mobile payments

Card products types viz. credit, debit, charge etc.

Players in card system Issuer, Acquirer, Interconnect, Processors, Partner networks

Services provided by interconnect (including STIP)

Functions of EFT, HSM and other devices

Card present/card not present transactions

Introduction to ISO 8583 message formats

Authentication, Authorisation and Accounting

CVV, VbV/Securecode, OTP. AVS

Switch operations and card transaction process

Interconnect transactions and settlement process

Presentment, re-presentment and chargebacks

Foreign exchange transactions

Cash, TOM, Spot, Forwards

Interbank transactions

Merchant transactions

Exchange rate determination and rate computation : Card rates, standard rates, fine rates

Cash management products

Concept of float

Cash concentration and notional pooling

Sweep

Virtual account management (VAM)

Controlled disbursements, positivepay, reverse positivepay

ACH filter/ACH block

Lockboxes

Impact of regulation

Basel Committee on Systemically Important Payment and Settlement Systems

FATF/OFAC compliance

Wolfsberg Group compliances

Dodd Frank Requirements in USA

FATCA compliance

AML compliance

www.mvlco.com

Certified International Payment Systems Professional (CIPSP)

Course modules

Module 1 : Basics of payment systems

Module 2 : Risks in payment systems

Module 3 : Introduction to RTGS /Hybrid payment systems

Module 4 : Introduction to SWIFT MT and MX messages

Module 5 : Fedwire RTGS in USA

Module 6 : CHIPS in USA

Module 7 : ACH and NSS operations in USA

Module 8 : Introduction to SEPA and TARGET2

Module 9 : EURO1 and STEP1 in SEPA

Module 10 : SEPA SCT and SEPA SDD

Module 11 : China FCDPS and HKMA CHATS

Module 12 : Large Value Transfer System, Canada

Module 13 : Continuous Linked Settlement System

Module 14 : Card payment systems

Module 15 : Mobile payments

Module 16 : Cash management products

Module 17 : Antimoney laundering and other regulation

www.mvlco.com

Certified International Payment Systems Professional (CIPSP)

MVL Consulting Private Limited

#17, Laxman Villa Condominium, Near Jog Hospital, Paud Road, Pune 411038 India

Telefax: +91-20-25466154, +91-20-25422874 Mobile: +91-9764835350

Вам также может понравиться

- The Positive Case For A CBDCДокумент20 страницThe Positive Case For A CBDCForkLogОценок пока нет

- GN On Audit of Internal Financial Controls PDFДокумент218 страницGN On Audit of Internal Financial Controls PDFPavan RaikarОценок пока нет

- ML and TF in The Securities SectorДокумент86 страницML and TF in The Securities SectorYan YanОценок пока нет

- Lukoil A-Vertically Integrated Oil CompanyДокумент20 страницLukoil A-Vertically Integrated Oil CompanyhuccennОценок пока нет

- Amla Irr PDFДокумент94 страницыAmla Irr PDFClauds GadzzОценок пока нет

- Measuring and Managing Operational Risk Under Basel IIДокумент34 страницыMeasuring and Managing Operational Risk Under Basel IITammie HendersonОценок пока нет

- Wolfsberg Guidance On PEPs May 2017Документ12 страницWolfsberg Guidance On PEPs May 2017jawed travelОценок пока нет

- Real Property Evaluations GuideДокумент6 страницReal Property Evaluations GuideIchi MendozaОценок пока нет

- Understanding FX LiquidityДокумент49 страницUnderstanding FX Liquiditymuhamadirfani100% (1)

- Lecture 33 Credit+Analysis+-+Corporate+Credit+Analysis+ (Ratios)Документ33 страницыLecture 33 Credit+Analysis+-+Corporate+Credit+Analysis+ (Ratios)Taan100% (1)

- Business Process ProjectДокумент8 страницBusiness Process ProjectKhwaja ArshadОценок пока нет

- IBM Banking: Our Payments Framework Solution For Financial Services Helps Simplify Payments OperationsДокумент4 страницыIBM Banking: Our Payments Framework Solution For Financial Services Helps Simplify Payments OperationsIBMBankingОценок пока нет

- Project On SebiДокумент15 страницProject On SebiVrushti Parmar86% (14)

- VisaДокумент16 страницVisaMasud RanaОценок пока нет

- Oracle FLEXCUBE Core Banking Helps Banks Overcome ChallengesДокумент3 страницыOracle FLEXCUBE Core Banking Helps Banks Overcome ChallengesashishbansaОценок пока нет

- BNY MellonДокумент3 страницыBNY MellonRajat SharmaОценок пока нет

- Payment Systems in India: Reserve Bank of IndiaДокумент16 страницPayment Systems in India: Reserve Bank of IndiaRahul BadaniОценок пока нет

- Contestable Markets and the Rise of CompetitionДокумент8 страницContestable Markets and the Rise of Competitionman downОценок пока нет

- Risk ManagementДокумент10 страницRisk ManagementJ Sunil ChowdaryОценок пока нет

- E-Payment System Trends and TechnologiesДокумент43 страницыE-Payment System Trends and TechnologiesDeepu MssОценок пока нет

- Future Aml EditДокумент25 страницFuture Aml EditSharukhAnsariОценок пока нет

- 2017 McKinsey Payments Report PDFДокумент16 страниц2017 McKinsey Payments Report PDFnihar shethОценок пока нет

- Risk Model Presentation For Risk and DDДокумент15 страницRisk Model Presentation For Risk and DDjohn9727100% (1)

- A Comprehensive Method For Assessment of Operational Risk in E-BankingДокумент7 страницA Comprehensive Method For Assessment of Operational Risk in E-BankingMohamed Mahdi MouhliОценок пока нет

- Global ATM Market Report: 2013 Edition - Koncept AnalyticsДокумент11 страницGlobal ATM Market Report: 2013 Edition - Koncept AnalyticsKoncept AnalyticsОценок пока нет

- Tickmill LTD Seychelles Privacy PolicyДокумент11 страницTickmill LTD Seychelles Privacy PolicyJalil MochlasОценок пока нет

- Financial Development and Economic Growth Views and Agenda - Ross LevineДокумент49 страницFinancial Development and Economic Growth Views and Agenda - Ross Levinedaniel100% (1)

- Functions and Roles of the Financial SystemДокумент33 страницыFunctions and Roles of the Financial SystemtanzirkhanОценок пока нет

- IMF (FinTech Notes) Blockchain Consensus Mechanisms - A Primer For SupervisorsДокумент18 страницIMF (FinTech Notes) Blockchain Consensus Mechanisms - A Primer For SupervisorsMuning AnОценок пока нет

- C-Kyc Frequently Asked Questions (Faq) : Section A: General FaqsДокумент9 страницC-Kyc Frequently Asked Questions (Faq) : Section A: General FaqsAnuj KumarОценок пока нет

- Clustering Approaches For Financial Data Analysis PDFДокумент7 страницClustering Approaches For Financial Data Analysis PDFNewton LinchenОценок пока нет

- Transaction ProcessingДокумент2 страницыTransaction ProcessingNidhi BharatiyaОценок пока нет

- PwC Vietnam IT Auditor JobДокумент2 страницыPwC Vietnam IT Auditor JobHoàng MinhОценок пока нет

- IoT For CITIES Hackathon V5Документ2 страницыIoT For CITIES Hackathon V5Sachin HubballiОценок пока нет

- Optimizing Anti-Money Laundering Transaction Monitoring Systems Using SAS® Analytical ToolsДокумент10 страницOptimizing Anti-Money Laundering Transaction Monitoring Systems Using SAS® Analytical ToolsShanKumarОценок пока нет

- ATM Cash Forecasting by Neural NetworkДокумент6 страницATM Cash Forecasting by Neural NetworkPradeep MotwaniОценок пока нет

- AML AML Suite BrochureДокумент2 страницыAML AML Suite BrochureMariem Ben ZouitineОценок пока нет

- FisДокумент27 страницFisForeclosure Fraud100% (1)

- 2.5 CC Trade ReceivablesДокумент36 страниц2.5 CC Trade ReceivablesDaefnate KhanОценок пока нет

- Vijay Shinde: Planning Skills For Managing Business Operations & Meeting Top / Bottom-Line ObjectivesДокумент3 страницыVijay Shinde: Planning Skills For Managing Business Operations & Meeting Top / Bottom-Line Objectivesvijay shindeОценок пока нет

- Single Euro Payments Area: 15th Updated EditionДокумент50 страницSingle Euro Payments Area: 15th Updated EditionJoaquinОценок пока нет

- Customers Digital Onboarding FrameworkДокумент13 страницCustomers Digital Onboarding FrameworkzardarwaseemОценок пока нет

- KYC Policy-Internet Version-Updated Upto 10.05.2021-CompressedДокумент73 страницыKYC Policy-Internet Version-Updated Upto 10.05.2021-CompressedAmaanОценок пока нет

- Pssbooklet PDFДокумент142 страницыPssbooklet PDFForkLogОценок пока нет

- Wealth Management ReportДокумент41 страницаWealth Management Reportagrawal.ace9114Оценок пока нет

- Payment System Oversight FrameworkДокумент16 страницPayment System Oversight FrameworkNarayanPrajapatiОценок пока нет

- Trade Surveillance QAДокумент2 страницыTrade Surveillance QAManoj GuptaОценок пока нет

- EMVCo White Paper On Payment Account Reference v2.1.1 FinalДокумент25 страницEMVCo White Paper On Payment Account Reference v2.1.1 FinalPriyanka PalОценок пока нет

- Bank Lending Policies and ProceduresДокумент6 страницBank Lending Policies and ProceduresDeepak SinghОценок пока нет

- Caiib PDFДокумент14 страницCaiib PDFAbhishek KaushikОценок пока нет

- Process of Cash AcceptanceДокумент5 страницProcess of Cash AcceptanceJayakrishnaraj AJDОценок пока нет

- ATM White Label ATM PDFДокумент2 страницыATM White Label ATM PDFSURENDRA SAHUОценок пока нет

- Mal Module10Документ42 страницыMal Module10sjmpakОценок пока нет

- Branch Banking PDFДокумент4 страницыBranch Banking PDFAbdul BasitОценок пока нет

- Equity Risk Management PolicyДокумент4 страницыEquity Risk Management PolicymkjailaniОценок пока нет

- Bank Portfolio ManagementДокумент6 страницBank Portfolio ManagementAbhay VelayudhanОценок пока нет

- Commercial Lending System with STP, Syndicated Loans, and SaaS OptionsДокумент1 страницаCommercial Lending System with STP, Syndicated Loans, and SaaS OptionsJJ100% (1)

- Week - 11 AML BasicsДокумент26 страницWeek - 11 AML BasicsEmiraslan MhrrovОценок пока нет

- Collections 12 0Документ76 страницCollections 12 0Pearl AsiamahОценок пока нет

- Akanksha Gupta - XML Interface For NEFTДокумент17 страницAkanksha Gupta - XML Interface For NEFTatularvin23184Оценок пока нет

- OmarДокумент350 страницOmarTroden MukwasiОценок пока нет

- Interview Question Answer For KYC AML Profile 1677153332Документ13 страницInterview Question Answer For KYC AML Profile 1677153332shivali guptaОценок пока нет

- Slide-19B-Capital Adequacy Framework For Banks & BASEl I, II & III Capital AccordДокумент64 страницыSlide-19B-Capital Adequacy Framework For Banks & BASEl I, II & III Capital AccordRahul ParateОценок пока нет

- ICRRS Guidelines - BB - Version 2.0Документ25 страницICRRS Guidelines - BB - Version 2.0Optimistic EyeОценок пока нет

- Mortgage Lending Principles and Practices (4th Edition) Quiz Answers Module 1: Lending OverviewДокумент1 страницаMortgage Lending Principles and Practices (4th Edition) Quiz Answers Module 1: Lending OverviewMakarand LonkarОценок пока нет

- Freddie Mac Condominium Unit Mortgages: Topic RequirementsДокумент8 страницFreddie Mac Condominium Unit Mortgages: Topic RequirementsMakarand LonkarОценок пока нет

- Freddie Mac Condominium Unit Mortgages: Topic RequirementsДокумент8 страницFreddie Mac Condominium Unit Mortgages: Topic RequirementsMakarand LonkarОценок пока нет

- Processing FHA TOTAL and VA MortgagesДокумент38 страницProcessing FHA TOTAL and VA MortgagesMakarand LonkarОценок пока нет

- लंदन ठुमकदा London Thumakda Hindi Lyrics - QueenДокумент1 страницаलंदन ठुमकदा London Thumakda Hindi Lyrics - QueenMakarand LonkarОценок пока нет

- Credit DerivativesДокумент23 страницыCredit DerivativesMakarand LonkarОценок пока нет

- RBI Master Circular on Risk Management and Inter-Bank DealingsДокумент53 страницыRBI Master Circular on Risk Management and Inter-Bank DealingsMakarand LonkarОценок пока нет

- Forward Rate Agreements and Interest Rate Swaps - GuidelinesДокумент9 страницForward Rate Agreements and Interest Rate Swaps - GuidelinesMakarand LonkarОценок пока нет

- Capital FundsДокумент43 страницыCapital FundsMakarand LonkarОценок пока нет

- Best Practices For Anti Money Laundering (AML) : System Selection and ImplementationДокумент20 страницBest Practices For Anti Money Laundering (AML) : System Selection and ImplementationMakarand LonkarОценок пока нет

- Credit DerivativesДокумент23 страницыCredit DerivativesMakarand LonkarОценок пока нет

- RBI Report Recommends Physically Settled Interest Rate FuturesДокумент52 страницыRBI Report Recommends Physically Settled Interest Rate FuturesMakarand LonkarОценок пока нет

- RBI Circulars Update Investments, PD Business, FCNR RatesДокумент3 страницыRBI Circulars Update Investments, PD Business, FCNR RatesMakarand LonkarОценок пока нет

- CAG Approves Quality FrameworkДокумент24 страницыCAG Approves Quality FrameworkMakarand LonkarОценок пока нет

- I. General State of Preparedness: Survey On State of Preparedness of Commercial Banks in Respect To Basel IIДокумент4 страницыI. General State of Preparedness: Survey On State of Preparedness of Commercial Banks in Respect To Basel IIMakarand LonkarОценок пока нет

- PG ProcurementДокумент25 страницPG ProcurementMakarand LonkarОценок пока нет

- Asn 1Документ2 страницыAsn 1medamineОценок пока нет

- RBI Report Recommends Physically Settled Interest Rate FuturesДокумент52 страницыRBI Report Recommends Physically Settled Interest Rate FuturesMakarand LonkarОценок пока нет

- The SAS Intelligent Value Chain2Документ16 страницThe SAS Intelligent Value Chain2Makarand LonkarОценок пока нет

- Delivering Value in Business IntelligenceДокумент12 страницDelivering Value in Business IntelligenceaОценок пока нет

- Basel II Capital Disclosure Q4 2009/10Документ3 страницыBasel II Capital Disclosure Q4 2009/10aОценок пока нет

- CIPSP May2016 PDFДокумент6 страницCIPSP May2016 PDFMakarand Lonkar0% (1)

- EPC020-08 Book 3 - Data Elements - SCS Volume v7.1Документ104 страницыEPC020-08 Book 3 - Data Elements - SCS Volume v7.1Makarand LonkarОценок пока нет

- Inventories: Indian Accounting Standard (Ind AS) 2Документ10 страницInventories: Indian Accounting Standard (Ind AS) 2Bathina Srinivasa RaoОценок пока нет

- Agricultural Development Bank Limited: Unaudited Financial Results (Quarterly) ProvisionalДокумент3 страницыAgricultural Development Bank Limited: Unaudited Financial Results (Quarterly) ProvisionalaОценок пока нет

- t24 Brochure OptДокумент24 страницыt24 Brochure OptngvsonОценок пока нет

- Treasury Operations 2016Документ4 страницыTreasury Operations 2016Makarand Lonkar0% (1)

- 1Документ56 страниц1Ankur DuttaОценок пока нет

- SWIFT Error Codes Ufec2014Документ199 страницSWIFT Error Codes Ufec2014Makarand LonkarОценок пока нет

- Marketing Digest PDFДокумент26 страницMarketing Digest PDFRia SinghОценок пока нет

- NISM Currency Derivatives Mock TestДокумент12 страницNISM Currency Derivatives Mock Testsimplypaisa67% (3)

- Micro Ch14 PresentationДокумент36 страницMicro Ch14 PresentationGayle AbayaОценок пока нет

- Atlantic Computer: A Bundle of Pricing Options Group 4Документ16 страницAtlantic Computer: A Bundle of Pricing Options Group 4Rohan Aggarwal100% (1)

- Syllabus Mba4Документ7 страницSyllabus Mba4Vishal SoodОценок пока нет

- Definition of Distributation ChannelДокумент11 страницDefinition of Distributation ChannelrituparnaОценок пока нет

- Developing A Marketing StrategyДокумент10 страницDeveloping A Marketing Strategyash_007283Оценок пока нет

- Introduction To IMCДокумент86 страницIntroduction To IMCVishakha PawarОценок пока нет

- Imc in Bank SectorДокумент5 страницImc in Bank SectorNathalie Harris100% (1)

- Final Nasir GlassДокумент57 страницFinal Nasir GlassShuvo Taufiq Ahmed100% (2)

- CRM Module 1: Comprehensive CRM StrategyДокумент17 страницCRM Module 1: Comprehensive CRM StrategyrumarakeshОценок пока нет

- Nica's ReportДокумент6 страницNica's ReportAaron Dela Cruz ÜОценок пока нет

- Principles and Theories of Management Final PaperДокумент11 страницPrinciples and Theories of Management Final PaperAnthony RoyupaОценок пока нет

- Capital Market in IndiaДокумент3 страницыCapital Market in IndiasadathnooriОценок пока нет

- C A S E 9 Dell Inc.: Changing The Business ModelДокумент6 страницC A S E 9 Dell Inc.: Changing The Business ModelMasud Rana100% (3)

- Relationship between spot and forward currency ratesДокумент11 страницRelationship between spot and forward currency ratesKajal ChaudharyОценок пока нет

- Market Study PUP TaguigДокумент50 страницMarket Study PUP TaguigJhely De CastroОценок пока нет

- KeefeДокумент5 страницKeefeRochester Democrat and ChronicleОценок пока нет

- Chapter 7 Pricing StrategiesДокумент30 страницChapter 7 Pricing StrategiestafakharhasnainОценок пока нет

- Project On Capital Market ReformsДокумент99 страницProject On Capital Market Reformsthorat82100% (3)

- L'oreal B.V. NederlandДокумент12 страницL'oreal B.V. NederlandAli Raza100% (1)

- The State of The Penny Stock Union: Tom Mccarthy Pre Promotion StocksДокумент46 страницThe State of The Penny Stock Union: Tom Mccarthy Pre Promotion StocksTom McCarthyОценок пока нет

- Govt. Securities Market - 1Документ46 страницGovt. Securities Market - 1Bipul Mishra100% (1)

- Bai IstijrarДокумент10 страницBai IstijrarInsyirah WafiyyahОценок пока нет

- Investment Banking - Session 1Документ28 страницInvestment Banking - Session 1Grishma Rupera100% (1)