Академический Документы

Профессиональный Документы

Культура Документы

Multiple Choice Questions

Загружено:

Jawad HassanАвторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Multiple Choice Questions

Загружено:

Jawad HassanАвторское право:

Доступные форматы

6/11/2014 Multiple Choice Questions

http://wps.prenhall.com/ca_ph_horngren_accounting_7/60/15481/3963328.cw/content/index.html 1/5

Home Chapter 18 Multiple Choice Questions

Multiple Choice Questions

This activity contains 15 questions.

Evaluating financial statement information can be divided into broad categories

including

vertical analysis (shows the relationship between numbers on a financial

statement for one year)

horizontal analysis (compares financial statement amounts to amounts from

previous years in terms of the percentage of change)

ratio analysis (expresses the relationship of one number to another number)

all of the above

Use the following information and horizontal analysis to compute the

percentage increase in sales: 2007 sales were $200,000 and 2008 sales were

$250,000.

sales increased by 125%

sales increased by 25%

sales increased by 80%

sales increased by 20%

2006 sales were $200,000, 2007 sales were $220,000, 2008 sales were

$240,000, and 2009 sales were $300,000. 2006 is the base year. Using the

previous information and your knowledge of trend analysis, select the

statement that is false.

The trend analysis % for 2009 is 125%.

Trend analysis is a type of horizontal analysis.

The trend analysis % for 2006 is 100%.

Amounts are always compared to, or divided by, the base year amount.

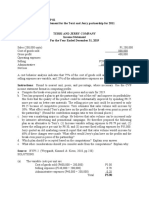

2007 net sales $200,000; 2007 Cost of Goods Sold $130,000; 2001 operating

expenses $50,000; and 2007 net income $20,000. Use this information and

your knowledge of vertical analysis to select the statement that is false.

On the income statement, all amounts are usually compared to, or divided by, net

sales.

On the balance sheet, all amounts are compared to, or divided by, total liabilities.

6/11/2014 Multiple Choice Questions

http://wps.prenhall.com/ca_ph_horngren_accounting_7/60/15481/3963328.cw/content/index.html 2/5

The vertical analysis % for Cost of Goods Sold is 65%.

Vertical analysis shows the relative importance of each income statement item.

2007 current assets $100,000; 2007 long-term assets $300,000; 2007 total

liabilities $150,000; and 2007 total shareholders' equity $250,000. Using the

previous information and your knowledge of common-sized statements, select

the statement that is false.

Common-size statements allow companies of different sizes to be more easily

compared.

The common-size % for total liabilities is 37.5%.

Common-size statements are a type of vertical analysis.

The common-size % for current assets is 33.3%.

All of the following are true regarding benchmarking except

benchmarking includes comparing one company with a key competitor

if the industry average for cost of goods sold (COGS) is 50% and your company

average is 60%, this would be considered favourable

if the industry average for gross profit is 35% and your company average is 40%,

this would be considered favourable

benchmarking includes comparing one company with the industry average

Ratio analysis expresses the relationship of one number to another number. To

add meaning to a ratio it can be compared to

industry averages

ratios of prior years or accounting periods

budgeted ratios

all of the above

All of the following statements are true regarding ratios that measure a

company's ability to pay current liabilities except

in most industries, a current ratio of 2.0 is considered adequate

a higher current ratio is always preferred to a lower current ratio

6/11/2014 Multiple Choice Questions

http://wps.prenhall.com/ca_ph_horngren_accounting_7/60/15481/3963328.cw/content/index.html 3/5

working capital = current assets - current liabilities

inventory and prepaid expense are included in the numerator of the current ratio,

but not in the numerator of the acid-test ratio

All of the following statements are true regarding ratios that measure a

company's ability to sell inventory and collect receivables except

an increased accounts receivable turnover ratio indicates an increased ability to

collect cash from credit customers

the formula for the inventory turnover ratio is sales/average inventory

an increased inventory turnover ratio indicates a company is selling merchandise

more quickly than in previous accounting periods; in general, this translates into

more merchandise being sold and higher profitability

a decreased days' sales in receivables ratio indicates the company is collecting

cash from credit customers more quickly. In general, this results in greater cash

inflows

All of the following statements are true regarding ratios that measure a

company's ability to pay short-term and long-term debt except

a debt ratio of 60% indicates 60% of assets are financed with debt

a debt ratio of 90% indicates lower financial risk than a debt ratio of 60%; in

general, lower financial risk results in lower interest rates

a high times-interest-earned ratio indicates a company can pay interest expense

with relative ease

the average debt ratio is between 0.57 and 0.67 according to Robert Morris

Associates

All of the following statements are true regarding ratios that measure a

company's profitability except

return on assets includes interest expense plus net income in the numerator

because these are the returns to the two groups that have financed company

assets

companies strive for a high return on sales

earnings per share is the only ratio that must appear on the face of the income

statement

return on assets (ROA) is usually greater than return on equity (ROE) because

creditors demand a higher return than shareholders

All of the following statements are true regarding ratios that analyze a stock

investment except

in general, an increased price/earnings ratio indicates increased investor

6/11/2014 Multiple Choice Questions

http://wps.prenhall.com/ca_ph_horngren_accounting_7/60/15481/3963328.cw/content/index.html 4/5

confidence in the future of the company

many experts argue that book value is the most useful ratio for investment

analysis

two ways for shareholders to earn a return on a share investment are receiving

dividends and selling the stock investment at a gain

shareholders who invest primarily to receive dividends pay special attention to the

dividend yield ratio

Given the following information: Cash 29,000, Accounts Receivable $114,000,

Inventory $113,000, Prepaid Expenses $6,000, Total capital assets $525,000,

Total current liabilities $142,000, Long-term debt $289,000, Total shareholders'

equity $356,000' Net sales $858,000, Cost of goods sold $513,000, Gross

Margin $345,000, Net income $48,000. The acid test ratio is:

55%

1.85

75%

1.01

Given the following information: Cash 29,000, Accounts Receivable $114,000,

Inventory $113,000, Prepaid Expenses $6,000, Total capital assets $525,000,

Total current liabilities $142,000, Long-term debt $289,000, Total shareholders'

equity $356,000' Net sales $858,000, Cost of goods sold $513,000, Gross

Margin $345,000, Net income $48,000. The debt ratio is:

101%

185%

75%

55%

Given the following information: Cash 29,000, Accounts Receivable $114,000,

Inventory $113,000, Prepaid Expenses $6,000, Total capital assets $525,000,

Total current liabilities $142,000, Long-term debt $289,000, Total shareholders'

equity $356,000' Net sales $858,000, Cost of goods sold $513,000, Gross

Margin $345,000, Net income $48,000. The inventory turnover ratio is:

5.56

4.54

8.62

7.52

6/11/2014 Multiple Choice Questions

http://wps.prenhall.com/ca_ph_horngren_accounting_7/60/15481/3963328.cw/content/index.html 5/5

Some questions in this exercise may have more than one correct answer. To answer such questions

correctly, you must select all the correct answers. Also note that answer choices in this exercise appear in a

different order each time the page is loaded.

Copyri ght 1995 - 2010 Pearson Education . Al l ri ghts reserved.

Legal Notice | Privacy Policy | Permissions

Вам также может понравиться

- Toaz - Info Chapter 11 PRДокумент46 страницToaz - Info Chapter 11 PRPrincess BilogОценок пока нет

- The Controller of The Ijiri Company Wants You To Estimate A Cost Function From The Following Two Observations in A General Ledger Account Called MaintenanceДокумент3 страницыThe Controller of The Ijiri Company Wants You To Estimate A Cost Function From The Following Two Observations in A General Ledger Account Called MaintenanceElliot RichardОценок пока нет

- Chap 18 WileyДокумент13 страницChap 18 WileyPratik Patel100% (1)

- Working 3Документ6 страницWorking 3Hà Lê DuyОценок пока нет

- CPMДокумент3 страницыCPMAnonymous pUfzYuXHaОценок пока нет

- Wiley - Chapter 9: Inventories: Additional Valuation IssuesДокумент20 страницWiley - Chapter 9: Inventories: Additional Valuation IssuesIvan BliminseОценок пока нет

- Dumandan, Kenneth R BSA 302-A Financial Markets P15-1Документ8 страницDumandan, Kenneth R BSA 302-A Financial Markets P15-1Lorielyn AgoncilloОценок пока нет

- TB Ch12Документ36 страницTB Ch12AhmadYaseenОценок пока нет

- Chapter 20 - Inventory Management, Just in Time & Back Flush CostingДокумент3 страницыChapter 20 - Inventory Management, Just in Time & Back Flush Costingaprina.sОценок пока нет

- Tugas Audit Chpter9 Risk PrintДокумент11 страницTugas Audit Chpter9 Risk PrintKazuyano DoniОценок пока нет

- Managerial Accounting 8th Edition: Chapter 11 SolutionsДокумент25 страницManagerial Accounting 8th Edition: Chapter 11 SolutionsMarielle Tamayo100% (1)

- BUSI 354 - CHДокумент4 страницыBUSI 354 - CHBarbara SlavovОценок пока нет

- Question and Answer - 60Документ31 страницаQuestion and Answer - 60acc-expertОценок пока нет

- Appendix11A Transfer Pricing Quality Costs and Service Department Cost AllocationДокумент29 страницAppendix11A Transfer Pricing Quality Costs and Service Department Cost AllocationLSОценок пока нет

- Assignment 2 - Financial Statement AnalysisДокумент6 страницAssignment 2 - Financial Statement AnalysisGennia Mae MartinezОценок пока нет

- CVP AnalysisДокумент5 страницCVP AnalysisAnne BacolodОценок пока нет

- Activity Based CostingДокумент16 страницActivity Based CostingCharmine de la CruzОценок пока нет

- MGT 2281 Fall 2019 Assignment Solution Outline: Page 1 of 13Документ13 страницMGT 2281 Fall 2019 Assignment Solution Outline: Page 1 of 13BessieDuОценок пока нет

- (Solved) Chapter 14, Problem 14-9 - Fundamentals of Financial Management (15th Edition) - AДокумент2 страницы(Solved) Chapter 14, Problem 14-9 - Fundamentals of Financial Management (15th Edition) - AAli Hussain Al SalmawiОценок пока нет

- Chapter 1: The Role of Managerial Finance: ProblemsДокумент1 страницаChapter 1: The Role of Managerial Finance: ProblemsFatima FahdaОценок пока нет

- Case Study-Short SolutionДокумент6 страницCase Study-Short SolutionMhmd KaramОценок пока нет

- Chapter 1: Flexible Budgeting and The Management of Overhead and Support Activity Costs Answer KeyДокумент33 страницыChapter 1: Flexible Budgeting and The Management of Overhead and Support Activity Costs Answer KeyRafaelDelaCruz50% (2)

- Chap 010Документ147 страницChap 010Khang HuynhОценок пока нет

- Recovery Year Property Class 3-Year 5-Year 7-Year 10-Year 1 2 3 4 5 6 7 8 9 10 11 TotalsДокумент2 страницыRecovery Year Property Class 3-Year 5-Year 7-Year 10-Year 1 2 3 4 5 6 7 8 9 10 11 Totalssneha sm0% (1)

- Tutorial Chapter 11 SolДокумент7 страницTutorial Chapter 11 SolMadina SuleimenovaОценок пока нет

- DocДокумент13 страницDocIbnu Bang BangОценок пока нет

- Distributions To Shareholders Dividends and RepurchasesДокумент34 страницыDistributions To Shareholders Dividends and RepurchasesSiwar Hakim0% (1)

- Mund Manufacturing Inc Started Operations at The Beginning of TheДокумент1 страницаMund Manufacturing Inc Started Operations at The Beginning of TheLet's Talk With HassanОценок пока нет

- Ma Bep01Документ4 страницыMa Bep01Grace SimonОценок пока нет

- Exercise Stock ValuationДокумент2 страницыExercise Stock ValuationUmair ShekhaniОценок пока нет

- Finance Chapter 18Документ35 страницFinance Chapter 18courtdubs100% (1)

- Review Questions: Solutions Manual To Accompany Dunn, Enterprise Information Systems: A Pattern Based Approach, 3eДокумент17 страницReview Questions: Solutions Manual To Accompany Dunn, Enterprise Information Systems: A Pattern Based Approach, 3eOpirisky ApriliantyОценок пока нет

- Module 4 Exercises - JFCДокумент10 страницModule 4 Exercises - JFCJARED DARREN ONGОценок пока нет

- Mini CaseДокумент9 страницMini CaseJOBIN VARGHESEОценок пока нет

- MUH - SYUKUR - A031191077) AKUNTANSI MANAJEMEN-PROBLEM 11-18 Return On Investment (ROI) and Residual IncomeДокумент3 страницыMUH - SYUKUR - A031191077) AKUNTANSI MANAJEMEN-PROBLEM 11-18 Return On Investment (ROI) and Residual IncomeRismayantiОценок пока нет

- Problem 18 - 18 18 - 31 and 18 - 32Документ5 страницProblem 18 - 18 18 - 31 and 18 - 32anon_459698449Оценок пока нет

- BMGT 321 Chapter 13 HomeworkДокумент11 страницBMGT 321 Chapter 13 Homeworkarnitaetsitty100% (1)

- Accounting For Derivatives and Hedging Activities: Answers To QuestionsДокумент22 страницыAccounting For Derivatives and Hedging Activities: Answers To QuestionsGabyVionidyaОценок пока нет

- Industrial Restructuring and Enterpreneurship - H. J. HEINZ Company CaseДокумент5 страницIndustrial Restructuring and Enterpreneurship - H. J. HEINZ Company CaseFagbola Oluwatobi OmolajaОценок пока нет

- Managerial Accounting ExamДокумент10 страницManagerial Accounting ExamJeremy Linn100% (1)

- Soal Chapter 7 Penilaian ObligasiДокумент3 страницыSoal Chapter 7 Penilaian ObligasiAnonymous yMOMM9bsОценок пока нет

- Fundamentals of Cost Management: True / False QuestionsДокумент238 страницFundamentals of Cost Management: True / False QuestionsElaine GimarinoОценок пока нет

- Soal Job Costing 14 Maret 2021Документ5 страницSoal Job Costing 14 Maret 2021Sugata SОценок пока нет

- Chapter 10 - Standard CostingДокумент20 страницChapter 10 - Standard CostingEnrique Miguel Gonzalez Collado100% (1)

- CH 14Документ40 страницCH 14franchesca1230% (1)

- Auditing & Accounting Chapter 17 TBДокумент61 страницаAuditing & Accounting Chapter 17 TBgilli1tr100% (2)

- Problems Chapter 7Документ9 страницProblems Chapter 7Trang Le0% (1)

- Chapter 13 Relevant Costs For Decision Making: True/False QuestionsДокумент140 страницChapter 13 Relevant Costs For Decision Making: True/False QuestionsexgayssОценок пока нет

- Overhead Variances SolutionДокумент2 страницыOverhead Variances Solutionyacapinburgos50% (2)

- In 2008 Keenan Company Paid Dividends Totaling 3 600 000 On NeДокумент1 страницаIn 2008 Keenan Company Paid Dividends Totaling 3 600 000 On NeAmit PandeyОценок пока нет

- Solution C03ProcessCostingДокумент68 страницSolution C03ProcessCostingbk201heitrucle86% (7)

- Role of Financial Management in OrganizationДокумент8 страницRole of Financial Management in OrganizationTasbeha SalehjeeОценок пока нет

- Chapter 16 (Dilutive and Earning Per Share)Документ2 страницыChapter 16 (Dilutive and Earning Per Share)dinar100% (1)

- Expenditure Cycle Case - GARCIAДокумент2 страницыExpenditure Cycle Case - GARCIAARLENE GARCIAОценок пока нет

- ReceivablesДокумент17 страницReceivablesJaspreet GillОценок пока нет

- Group Assignment 1Документ5 страницGroup Assignment 1pushmbaОценок пока нет

- 1determine A FirmДокумент50 страниц1determine A FirmCHATURIKA priyadarshaniОценок пока нет

- The Business Owner's Guide to Reading and Understanding Financial Statements: How to Budget, Forecast, and Monitor Cash Flow for Better Decision MakingОт EverandThe Business Owner's Guide to Reading and Understanding Financial Statements: How to Budget, Forecast, and Monitor Cash Flow for Better Decision MakingРейтинг: 4 из 5 звезд4/5 (4)

- Financial Ratio AnalysisДокумент4 страницыFinancial Ratio AnalysisFSLACCTОценок пока нет

- Customers (Form) (AX 2012)Документ25 страницCustomers (Form) (AX 2012)Jawad HassanОценок пока нет

- Microsoft Dynamics Ax 2009 Cost Management White PaperДокумент97 страницMicrosoft Dynamics Ax 2009 Cost Management White PaperJawad HassanОценок пока нет

- Pakistan General Knowledge Online Test 2 Mcqs Practice QuestionsДокумент6 страницPakistan General Knowledge Online Test 2 Mcqs Practice QuestionsJawad Hassan100% (1)

- Commodity Trading GuideДокумент6 страницCommodity Trading GuideJawad HassanОценок пока нет

- NBFCДокумент47 страницNBFCRevathi VadakkedamОценок пока нет

- Managerial Economics AssignmentДокумент2 страницыManagerial Economics Assignmentharshit2010pmbОценок пока нет

- Popicorn - ProfileДокумент13 страницPopicorn - ProfileNawab's Nawab's KitchenОценок пока нет

- Principles of AccountingДокумент60 страницPrinciples of AccountingAtits75% (4)

- Accounting Based KPIДокумент48 страницAccounting Based KPIAlan ChengОценок пока нет

- TP Methods and Their ApplicationДокумент55 страницTP Methods and Their ApplicationYogendra MishraОценок пока нет

- Marginal CostingДокумент10 страницMarginal CostingNishant ModiОценок пока нет

- Lecture 6Документ34 страницыLecture 6Tiffany TsangОценок пока нет

- Unilever Global Business StrategyДокумент31 страницаUnilever Global Business StrategyRameesha IshtiaqОценок пока нет

- 8STM Chap1 Introduction 20120926 v4 HC-accpДокумент23 страницы8STM Chap1 Introduction 20120926 v4 HC-accpTaufiq AdiyantoОценок пока нет

- Chapter 1-5Документ6 страницChapter 1-5Bien BibasОценок пока нет

- IE54500 - Problem Set 4: 1. Pure and Mixed Nash EquilibriaДокумент5 страницIE54500 - Problem Set 4: 1. Pure and Mixed Nash EquilibriaM100% (1)

- Finacc 3Документ6 страницFinacc 3Tong WilsonОценок пока нет

- Tata Chemicals FinalДокумент38 страницTata Chemicals FinalAshutosh Kumar100% (1)

- Mem Chapter 6 - Rational InsanityДокумент18 страницMem Chapter 6 - Rational InsanityHarleen queenzelОценок пока нет

- Global Links NotesДокумент8 страницGlobal Links NotesVictoria YanОценок пока нет

- Quantitative Analysis For Business Midterm - SolutionДокумент6 страницQuantitative Analysis For Business Midterm - SolutionYiPingHungОценок пока нет

- Descending Broadening WedgeДокумент2 страницыDescending Broadening WedgeHammad SaeediОценок пока нет

- Strategic MarketingДокумент251 страницаStrategic Marketingindrajeet_sahani100% (1)

- InvoiceДокумент1 страницаInvoiceNabeel Shaikh0% (1)

- Zoomlion Heavy Industry Science and Technology Co.,Ltd.: PCS/ NoДокумент1 страницаZoomlion Heavy Industry Science and Technology Co.,Ltd.: PCS/ NofaruqОценок пока нет

- Dissertation On Idr and AdrДокумент112 страницDissertation On Idr and AdrAbhay KumarОценок пока нет

- SchindlerДокумент7 страницSchindlerShaina DewanОценок пока нет

- Name of Work: Town Municipal CouncilДокумент38 страницName of Work: Town Municipal CouncilmaniannanОценок пока нет

- PrtogualДокумент689 страницPrtogualFilipa Monteiro da Silva100% (1)

- Joel Greenblatt The Little Book That Beats The Market Talks at Google Chinese TranslationДокумент28 страницJoel Greenblatt The Little Book That Beats The Market Talks at Google Chinese TranslationSun ZhishengОценок пока нет

- Sri Lanka Banking Sector Report - 02 01 2015 PDFДокумент26 страницSri Lanka Banking Sector Report - 02 01 2015 PDFRandora LkОценок пока нет

- New Microsoft Office Word DocumentДокумент4 страницыNew Microsoft Office Word DocumentRajni KumariОценок пока нет

- Ch. 3 Displaying and Describing Quantitative Data PDFДокумент32 страницыCh. 3 Displaying and Describing Quantitative Data PDFSanjay NairОценок пока нет

- Libya Since 1969 - Qadhafis Revolution Revisited - Dirk Vandewalle 2008 PDFДокумент268 страницLibya Since 1969 - Qadhafis Revolution Revisited - Dirk Vandewalle 2008 PDFAbid ChaudhryОценок пока нет