Академический Документы

Профессиональный Документы

Культура Документы

Hospitalcash Brochure

Загружено:

Kumud GandhiАвторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Hospitalcash Brochure

Загружено:

Kumud GandhiАвторское право:

Доступные форматы

Hospital Cash

Daily Allowance

Complete Health protection

for you and family

Bajaj Allianz

Contact Details

Bajaj Allianz General Insurance Company Limited,

G.E. Plaza, Airport Road, Yerawada, Pune - 411 006.

Tel: (020) 6602 6666. Fax: (020) 6602 6667.

www.bajajallianz.com

Email: info@bajajallianz.co.in

For any queries please contact:

BSNL/MTNL

(Toll Free)

1800 22 5858

Other

(Chargeble)

<Prefix City Code> 3030 5858

Any Mobile & Landline

(Toll Free)

1800 209 5858

Insurance is the subject matter of the solicitation

Hospital Cash Daily Allowance/V002/w.e.f.01st October 2013

UIN: IRDA/NL-HLT/BAGI/P-H/V.I/146/13-14

Revision/ Modification of the policy:

There is a possibility of revision/ modification of terms,

conditions, coverages and/or premiums of this product at any

time infuture, withappropriate approval from IRDA. Insuchan

event of revision/modification of the product, intimation shall

be set out to all the existing insured members at least 3

months prior to the date of such revision/modification comes

into the effect.

Portability Conditions

As per the Portability Guidelines issued by IRDA, If you are

insuredunder any other healthinsurance policy of Nonlife

insurer you can transfer to Hospital Daily Allowance policy

with all your accrued benefits after due allowances for

waiting periods and enjoy all the available benefits of

Hospital DailyAllowance.

The pre-policy medical examination requirements and

provisions for such cases shall remain similar to non

-portable cases

Withdrawal of Policy

There is possibility of withdrawal of this product at any time in

future withappropriate approval from IRDA, as We reserve Our

right to do so with a intimation of 3 months to all the existing

insured members. In such an event of withdrawal of this

product, at the time of Your seeking renewal of this Policy, You

can choose, among Our available similar and closely similar

Health insurance products. Upon Your so choosing Our new

product, You will be charged the Premium as per Our

Underwriting Policyfor suchchosennew product, as approved

byIRDA.

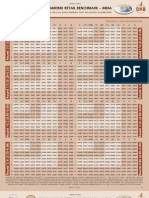

Annual Premiumchart:

Family discount: 5%

*Premiumare exclusive of service tax

Premiumfor 30 days cover

Option

Sum

Insured

90 days-

25 yrs

A 1200

B 1800

C 3600

D 4600

500/-

1000/-

2000/-

. 2500/-

250

300

600

800

400

600

850

1,100

650

900

1700

2600

900

1300

2800

3500

26-

40 yrs

41

50 yrs

51

55 yrs

56 yrs

& above

Premiumfor 60 days cover

Option

Sum

Insured

90 days-

25 yrs

A 1600

B 3000

C 4800

D 5800

500

1000

2000

2500

300

500

1000

1350

525

825

1500

1800

850

1800

3600

4200

1200

2400

4400

5000

26-

40 yrs

41-

50 yrs

51-

55 yrs

56 yrs

& above

*Premiumare exclusive of service tax

Under normal circumstances, lifetime renewal benefit is

availableunder thepolicy except on thegrounds of fraud,

misrepresentationormoral hazard.

In case of our own renewal a grace period of 30 days is

permissible and the Policy will be considered as continuous

for the purpose of 30 days and one year waiting period Any

medical expenses incurred as a result of disease condition/

Accident contracted during the break period will not be

admissibleunderthepolicy.

For renewals received after completion of 30 days grace

period, a fresh application of health insurance should be

submittedtoUs, it wouldbeprocessedasper anewbusiness

proposal.

After the completion of maximum renewal age of

dependant children, the policy would be renewed for

lifetime. However a separate proposal form should be

submitted to us at the time of renewal with the insured

member as proposer. Suitable credit of continuity/waiting

periodsforall thepreviouspolicyyearswouldbeextendedin

the new policy, provided the policy has been maintained

without abreak.

Premium payable on renewal and on subsequent

continuation of cover are subject to change with prior

approval fromIRDA.

We may cancel this insurance by giving You at least 15 days

writtennotice, andif noclaimhas beenmade thenWe shall

refund a pro-rata premiumfor the unexpired Policy Period.

Under normal circumstances, policy will not be cancelled

except for reasons of non-disclosure while proposing for

insuranceand/orlodginganyfraudulent claim.

You may cancel this insurance by giving Us at least 15 days

written notice, and if no claimhas been made then the We

shall refundpremiumonshort termrates for the unexpired

PolicyPeriodaspertheratesdetailedbelow.

Renewal & Cancellation

Get yourself and your family

covered by Hospital Cash Daily

Allowance today and sleep easy.

Disclaimer: The above information is only indicative in nature. For details of the

coverage & exclusions please contact our nearest office.

To know more visit our website, Website: www.bajajallianz.com or get in touch with

Email: wellness.HAT@bajajallianz.co.in ;24*7 helpline number: 1800-103-2529

(toll free) / 020-30305858

Network Hospital & Value Added service Provider list is provisional & subject to

change based on the review of the providers

Wealsooffer following Insurancepolicies:

Disclaimer The above terms & conditions are indicative innature, for details

please get intouchwiththe nearest office.

% of Annual Premium Refunded

Upto 1 month 75.00%

Exceeding 1 month and upto 3 months 50.00%

Exceeding 3 months and upto 6 mon ths 25.00%

Exceeding 6 months Nil

Period of Risk

HOSPITAL CASH

DAILY ALLOWANCE

SILVER HEALTH

HEALTH ENSURE

HEALTH GUARD

PERSONAL GUARD

CRITICAL ILLNESS

STAR PACKAGE

TRAVEL

TAX GAIN

HEALTH GUARD

FAMILY FLOATER OPTION

EXTRA CARE SANKAT MOCHAN

BJAZ-B-0097/7-Oct-13

Bajaj Allianz

Bajaj Allianz General Insurance Company Limited is a joint

venture between Bajaj Finserv Limited and Allianz SE. Both

enjoy a reputation of expertise, stability and strength. This

joint venture company incorporates global expertise with

local experience. The comprehensive, innovative solutions

combine the technical expertise and experience of the 110

year old Allianz SE, and in-depth market knowledge and good

will of Bajaj brand in India. Competitive pricing and quick

honest response have earned the company the customer's

trust andmarket leadership inaveryshort time.

What is a Hospital Cash Daily Allowance Policy?

Hospital Cash Daily Allowance Policy guards you and your

family against the trauma that you face because of increased

financial burdenduring hospitalization.

This policy pays a daily benefit amount to take care of the

incidental expenses during hospitalisationperiod.

Who can be covered under the policy?

Hospital Cash Daily Allowance offers complete health

protectionfor you, your spouse as well as children.

Under normal circumstances, lifetime renewal benefit is

available under the policy except on the grounds of fraud,

misrepresentationor moral hazard.

What is renewal age?

Sum Insuredoptions available are

! Rs 500 per day

! Rs 1000 per day

! Rs 2000 per day

! Rs 2500 per day

Cover is available for 30 days and60 days per policyperiod.

What are the SumInsured Options available?

! This is anannual policy

What is the policy period?

What are the exclusions under the policy?

The policy can be taken along with any other health insurance

schemes, ESIS, CGHSetc.

Thebenefitspayableareforeachdayofhospitalization

Thebenefitisdoubledincaseof ICUadmission(formaximum

7 days)

Photocopy of discharge card, along with copies of reports,

bills and prescriptions corresponding required for claims

processing.

IncomeTaxbenefitonthepremiumpaidaspersection 80Dof

the IncomeTax Act

5%familydiscountapplicableif 2ormorefamilymembersare

covered under the same policy.The family discount will be

offeredforbothnewpoliciesaswell asforrenewal policies

Key Features:

If you are not satisfied with policy coverage, terms and

conditions, You have the option of canceling the policy within

15 days of receipt of the policy documents, provided there has

beenno claim.

Free Look Period

1. Pre-existing disease: Any medical condition or

complication arising from it which existed before the

commencement of the PolicyPeriod, or for whichcare,

treatment or advice was sought, recommended by or

received from a Physician or for which a claim has or

couldhave beenmade under anyearlier policy.

2. Any treatment not performed by a Physician or any

treatment of apurelyexperimental nature.

3. Any and all variants of the condition commonly

referred to as Cancer, except in case of invasive

malignant melanoma.

4. Any routine or prescribed medical check up or

examination. Medical Expenses relating to any

hospitalisation for diagnostic, X-ray or laboratory

examinations not consistent with or incidental to the

diagnosis and treatment of the positive existence or

presence of any Illness or accidental Bodily Injury for

whichhospitalisationis required.

5. Any Sickness that has been classified as an Epidemic by

the Central or State Government.

6. Sickness requiring Hospitalisation within the first 30

days from the commencement date of the Policy

Period unless the Policy is renewed without

interruptionandwiththe Company.

7. Without prejudice to Exclusion 1 above, the

treatment of cataracts, benignprostatic hypertrophy,

hysterectomy, menorrhagia, fibromyoma, D&C,

endometriosis, herniaof all types, hydrocele, fistulae,

haemorrhoids, fissure inano, stones inthe urinary and

biliary systems, surgery on ears, tonsils or sinuses,

skin and all internal tumours/cysts/nodules/polyps of

any kind including breast lumps, gastric or duodenal

ulcer, backache, prolapsed intervertebral disc during

the first year of a series of Daily Hospital Allowance

Policies renewedwiththe Company

without interruption.

8. Circumcision, cosmeticor aesthetictreatments of any

description change of life surgery or treatment, plastic

surgery(unless necessaryfor the treatment of Illness or

accidental

BodilyInjuryas adirect result of the insuredevent and

performedwithin6 months of the same).

9. Dental treatment or surgery of any kind unless

necessitated by Accidental Bodily injury. 10.

Convalescence, general debility, nervous or other

breakdown, rest cure, congenital diseases or defect or

anomaly, sterility, sterilization or infertility (diagnosis

and treatment), any sanatoriums, spa or rest cures

or long term care or hospitalisation undertaken as a

preventive or recuperative measure.

11. Self afflictedinjuries or conditions (attemptedsuicide),

and/or the use or misuse of anydrugs or alcohol.

12. Any sexually transmitted diseases or any condition

directly or indirectly caused to or associated with

Human T-Cell Lymphotropic Virus type or any

Syndrome or conditionof a

similar kindcommonlyreferredto as AIDS.

13. Anydiagnosis or treatment arising from or traceable to

pregnancy (whether uterine or extra uterine),

childbirth including caesarean section, medical

termination of pregnancy and/or any treatment

related to pre and post natal care of the mother or the

new born.

14. Hospitalisation for the sole purpose of traction,

physiotherapy or any ailment for which hospitalisation

is not warranted due to advancement in medical

technology

15. War, invasion, act of foreign enemy, hostilities

(whether war be declaredor not), civil war, rebellion,

revolution, insurrection military or usurped power of

civil commotion or loot or pillage in connection

herewith.

16. Naval or military operations of the armed forces or air

force andparticipationinoperations requiring the use

of arms or whichare orderedby military authorities for

combating terrorists, rebels andthe like.

17. Anynatural peril including but not limitedto avalanche,

Simple

hassle free

claim

procedure

earthquake, volcanic eruptions or any kind of natural

hazard.

18. Participationinanyhazardous activity.

19. Radioactive contamination.

20. Non-allopathictreatment.

21. Consequential losses of any kind, be they by way of loss

of profit, loss of opportunity, loss of gain, business

interruption, market loss or otherwise, or any claims

arising out of loss of a pure financial nature such as

loss of goodwill or any legal liability of any kind

whatsoever.

When can I enhance my suminsured?

Sum Insuredenhancement canbe done at renewals.

For enhancement of sum insured, fresh proposal form

along withthe renewal notice shouldbe submitted

The Bajaj Allianz Advantage

Global expertise

Innovative packages to matchindividual needs

Quickdisbursement of claims

Premium paid is exempt under IT section 80D 80D

HAT: In-house Claim Administration

Grace period

In case of our own renewal a grace period of 30 days is

permissible and the Policy will be considered as

continuous for the purpose of one year waiting period.

Any medical expenses incurred as a result of disease

condition/ Accident contracted during the break period

will not be admissible under the policy.

What is the entry age?

Entry age for proposer, spouse is from 18 yrs - 65 yrs

Entry age for dependent childrenis 3 months to 21 yrs.

Вам также может понравиться

- Basel II To Basel IIIДокумент24 страницыBasel II To Basel IIIKumud GandhiОценок пока нет

- Premium Personel GuardДокумент2 страницыPremium Personel GuardKumud GandhiОценок пока нет

- Premium Personel GuardДокумент2 страницыPremium Personel GuardKumud GandhiОценок пока нет

- Silver Health: Get Yourself and Your Family Covered by Silver Health Today and Sleep EasyДокумент2 страницыSilver Health: Get Yourself and Your Family Covered by Silver Health Today and Sleep EasyKumud GandhiОценок пока нет

- Portability FaqsДокумент7 страницPortability FaqsKumud GandhiОценок пока нет

- HeathGuard BrochureДокумент2 страницыHeathGuard BrochureKumud GandhiОценок пока нет

- Star PackageДокумент2 страницыStar PackageKumud GandhiОценок пока нет

- Health Ensure: Get Yourself and Your Family Covered by Health Ensure Today and Sleep EasyДокумент2 страницыHealth Ensure: Get Yourself and Your Family Covered by Health Ensure Today and Sleep EasyKumud GandhiОценок пока нет

- Health Guard Customer Information Sheet: Bajaj Allianz General Insurance Company LimitedДокумент3 страницыHealth Guard Customer Information Sheet: Bajaj Allianz General Insurance Company LimitedKumud GandhiОценок пока нет

- Extra Care Brochure FinalДокумент2 страницыExtra Care Brochure FinalParth KunderОценок пока нет

- Family Floater Health Guard v4Документ2 страницыFamily Floater Health Guard v4Viplav DasОценок пока нет

- Commissioner of Income-Tax Vs Associated Cables P. Ltd. On 7 August, 2006Документ1 страницаCommissioner of Income-Tax Vs Associated Cables P. Ltd. On 7 August, 2006Kumud GandhiОценок пока нет

- KPMG Retention MoneyДокумент4 страницыKPMG Retention MoneyKumud GandhiОценок пока нет

- Indian Medical Devices Sector ReportДокумент33 страницыIndian Medical Devices Sector ReportPradip SinghiОценок пока нет

- Design To Value in Medical Devices1Документ11 страницDesign To Value in Medical Devices1Kumud GandhiОценок пока нет

- GMDN EDMA CodesДокумент108 страницGMDN EDMA CodesKumud Gandhi75% (4)

- SadriДокумент38 страницSadriKumud GandhiОценок пока нет

- GmdnkullaniciengДокумент49 страницGmdnkullaniciengKumud GandhiОценок пока нет

- Medical Devices and Equipment Sector ProfileДокумент3 страницыMedical Devices and Equipment Sector ProfileArvind MehtaОценок пока нет

- Medical Devices and Equipment Sector ProfileДокумент3 страницыMedical Devices and Equipment Sector ProfileArvind MehtaОценок пока нет

- DRB India June11 RoundДокумент2 страницыDRB India June11 RoundKumud GandhiОценок пока нет

- Medical Devices and Equipment Sector ProfileДокумент3 страницыMedical Devices and Equipment Sector ProfileArvind MehtaОценок пока нет

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (400)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (895)

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (266)

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1090)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (344)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (121)

- Chest Tube DrainageДокумент4 страницыChest Tube DrainageJoshua Andre PepitoОценок пока нет

- An Exploratory BriefДокумент11 страницAn Exploratory BriefElizabeth Roxan Lizaso GonzálezОценок пока нет

- Inborn Errors or MetabolismДокумент25 страницInborn Errors or MetabolismSamdiSutantoОценок пока нет

- FDA Medical RecordДокумент4 страницыFDA Medical RecordSanty Dara KrisnawatiОценок пока нет

- Finalpaper SchnakeДокумент6 страницFinalpaper Schnakeapi-315989347Оценок пока нет

- Borderline Personality DisorderДокумент25 страницBorderline Personality DisordersindhurajОценок пока нет

- MC Namara Analysis / Orthodontic Courses by Indian Dental AcademyДокумент69 страницMC Namara Analysis / Orthodontic Courses by Indian Dental Academyindian dental academyОценок пока нет

- Art Therapy and Dialectical Behavioral Therapy - A WorkbookДокумент35 страницArt Therapy and Dialectical Behavioral Therapy - A WorkbookZainab BorjiОценок пока нет

- Ericksonian Hypnosis Techniques PDFДокумент2 страницыEricksonian Hypnosis Techniques PDFJakara25% (4)

- Management Flabby RidgeДокумент4 страницыManagement Flabby RidgeNidya Patricia Sembiring100% (1)

- Home Care RN Skills ChecklistДокумент2 страницыHome Care RN Skills ChecklistGloryJaneОценок пока нет

- Dexmedetomidine Vs Propofol - RCT - Merry Andriany 406162043Документ7 страницDexmedetomidine Vs Propofol - RCT - Merry Andriany 406162043Merry AndrianyОценок пока нет

- Electric Shock: Presented By: Jignasha PatelДокумент22 страницыElectric Shock: Presented By: Jignasha PatelBhargavОценок пока нет

- Hamberger-Hastings1988 Article SkillsTrainingForTreatmentOfSpДокумент10 страницHamberger-Hastings1988 Article SkillsTrainingForTreatmentOfSpFer MuaОценок пока нет

- Ear DisordersДокумент10 страницEar DisordersPatzie MolinaОценок пока нет

- Combined Cellulitis - FinalДокумент78 страницCombined Cellulitis - Finalsaru_patel0% (1)

- Jaclyn Wanie Resume PDFДокумент2 страницыJaclyn Wanie Resume PDFapi-631931479Оценок пока нет

- Dimension of WellnessДокумент43 страницыDimension of WellnessInaОценок пока нет

- T-Spine MT 1 Review GoodДокумент12 страницT-Spine MT 1 Review GoodRaymondОценок пока нет

- A 10-Point Plan For Avoiding Hyaluronic Acid Dermal Filler-Related Complications During Facial Aesthetic Procedures and Algorithms For ManagementДокумент9 страницA 10-Point Plan For Avoiding Hyaluronic Acid Dermal Filler-Related Complications During Facial Aesthetic Procedures and Algorithms For Managementleenatalia93100% (1)

- AmblyopiaДокумент26 страницAmblyopiaTaiba RafiqОценок пока нет

- Night FeverДокумент5 страницNight FeverdewioktaОценок пока нет

- Surgery: Epithelial FormationДокумент12 страницSurgery: Epithelial FormationReuben AntiОценок пока нет

- DR Kumar Ponnusamy Biochemistry Genetics USMLE Preparatory Course BIOGEN Reusable On Line Resources For Large Group Teaching Learning in Relatively SHДокумент2 страницыDR Kumar Ponnusamy Biochemistry Genetics USMLE Preparatory Course BIOGEN Reusable On Line Resources For Large Group Teaching Learning in Relatively SHPonnusamy KumarОценок пока нет

- ONLY WATCH 6th Edition 2015Документ126 страницONLY WATCH 6th Edition 2015Thimios KoukОценок пока нет

- Intrathecal Injection (LP) ENGДокумент1 страницаIntrathecal Injection (LP) ENGAlina RadescuОценок пока нет

- Spasmophilia Comorbidity in Fibromyalgia SyndromeДокумент6 страницSpasmophilia Comorbidity in Fibromyalgia SyndromenovywardanaОценок пока нет

- PMLS Lesson 4Документ3 страницыPMLS Lesson 4Void MelromarcОценок пока нет

- Koe V Noggle Injunction OrderДокумент83 страницыKoe V Noggle Injunction OrderLindsey BasyeОценок пока нет

- Dutch COPD Physiotherapy Guidelines PDFДокумент64 страницыDutch COPD Physiotherapy Guidelines PDFyohanОценок пока нет