Академический Документы

Профессиональный Документы

Культура Документы

BJ Sum06 3 dddHowToSucceedAtValue

Загружено:

saif_shakeel0 оценок0% нашли этот документ полезным (0 голосов)

15 просмотров4 страницыdd

Авторское право

© © All Rights Reserved

Доступные форматы

PDF, TXT или читайте онлайн в Scribd

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документdd

Авторское право:

© All Rights Reserved

Доступные форматы

Скачайте в формате PDF, TXT или читайте онлайн в Scribd

0 оценок0% нашли этот документ полезным (0 голосов)

15 просмотров4 страницыBJ Sum06 3 dddHowToSucceedAtValue

Загружено:

saif_shakeeldd

Авторское право:

© All Rights Reserved

Доступные форматы

Скачайте в формате PDF, TXT или читайте онлайн в Scribd

Вы находитесь на странице: 1из 4

SUMMER 2006 | 15

VALUE STOCKS HAVE PERFORMED REMARKABLY

well since stock markets peaked in March 2000,

with the Morgan Stanley Capital International

(MSCI) World Value Index returning a cumulative

29.9 percentage points more than the MSCI World

Index through February 2006 (Display 1). But it

doesnt automatically follow that value stocks will

now suffer a large reversal. Indeed, history suggests

they may go on winning, albeit by less than before.

And if a value investor exploits other clues in the

market, apart from classic value measures like low

price/earnings ratios, the odds of success can be

further enhanced.

Few Obvious Mispricings to Exploit

Life is certainly getting harder for the value inves-

tor. Value investing is, of course, all about buying

stocks that are trading below their intrinsic worth

based on realistic estimates of company earning

power. Typically, investors overreact to near-term

problems within a given company or industry and

overly discount the prospects for recovery.

It was easy to fnd undervalued stocks at the peak of

the Internet bubble, when the enormously extended

valuations of high-tech, media, and telecom (TMT)

stocksand the very low prices in much of the rest

of the marketcreated huge opportunities. Today,

price differences between industries are much

smaller, as the new-economy stocks have come

down to earth and other industries have recovered

or fallen by much less. As a result, bargains in the

stock market are harder to fnd.

Our own internal gauge of the value opportunity

in the market at largewhat we call the discount

to fair value, or the amount by which the cheapest

stocks in the global large-cap market are under-

priced compared with the average stockconfrms

this seemingly spartan outlook. Our discount to

fair value measure is currently at the bottom of its

historical range, reinforcing the impression that

there are few pricing discrepancies left to exploit

(Display 2, following page).

When we review past levels of discount to fair

value, we see that extremes in either direction have

tended to be pivotal moments for value investing.

The very small valuation differences that prevailed

in 1997 marked the start of growth stocks unprec-

edented bull run and a very diffcult time for value

investors. At the other extreme, the massive differ-

ences in March 2000 marked the end of growth

stocks outperformance and the tremendous revival

of value stocks.

How to Succeed at Value Investing

By Really, Really Trying

Six years after the bursting of the Internet bubble, some people think that value stocks cant

outperform much longer. But there are ways to keep winning with value stocks even when

theyre not in favor.

Display 1

Has value run its course?

Cumulative Returns (U.S. Dollars)

Mar 2000Feb 2006

MSCI World Value

MSCI World

(Index)

Value Outperformance

29.9%

40

60

80

100

120

140

06 05 04 03 02 01 00

Past performance does not guarantee future results.

Index = 100 as of March 2000

Source: MSCI

16 | BERNSTEIN JOURNAL: PERSPECTIVES ON INVESTING AND WEALTH MANAGEMENT

Small valuation differenceshard times for value;

big differencesgood times. Little wonder, then,

with the valuation gap small again, that value

investors are nervous.

Change in the Wings

To gain insight into what may happen next, we

examined the causes of todays narrow spreads,

compared todays situation with previous simi-

lar periods, and weighed the implications for our

value-based portfolios. We discovered two factors

at play that seem to be causative.

First, investors are far less confdent today about

long-term company earnings than they are about

more immediate earnings, so that theyre unwill-

ing to pay up for expected future earnings. This is

understandable: Earnings growth has been so fast

in recent years that investors are cautious about

expecting more. So the best growth stocks are not

selling at exorbitant valuations.

Second, at this moment no industries or sectors

face problems so huge as to cause stocks in that

industry to become really cheap.

Both these factors were also observable in past

instances of very small valuation spreads. And in

all cases, once they hit an extreme, the differences

in stock valuations increased again. In fact, over the

past 34 years, extremely large and extremely small

stock-valuation differences have tended to move

toward normal within the following two years

(Display 3).

Spreads Reect Real Economic Trends

Evidence is surfacing that the same scenario is

starting to unfold now. One clue is the change in

corporate behavior as refected in capital spending.

Before the Internet bubble, investment in additional

production capacity was about the same in the new-

economy telecom and old-economy paper industries

(Display 4). Both were investing in capacity at

a faster rate than their assets were depreciating.

In other words, they were expanding their abil-

ity to produce, which was not surprising given the

strength of the economy at the time.

But as people became ever-more enthusiastic about

new-economy industries, investment spending in

telecommunications simply soared. Meanwhile, the

rise of information delivery via electronic media like

the Internet, along with general pessimism about

old-economy industries, caused paper companies to

Display 3

The value opportunity is mean reverting

Mean Reversion of Global Discount to Fair Value*

Year 2 Year 1 Year 0

Widest Quintile

25

30

35

40%

Narrowest Quintile

Long-Term Average

* Monthly observations of discount to fair value of stocks in MSCI All Country

World Index from 1971 to March 31, 2005, ranked into quintiles; discount to

fair value of highest to lowest quintile is plotted 12 and 24 months after initial

observation.

Source: MSCI and Bernstein

Display 2

The value opportunity is at an all-time low

Discount to Fair Value

Global Equities

Japan Asset Bubble

Internet Euphoria

Oil Shock

10

20

30

40

50%

06 03 99 95 91 87 83 79 75 71

Through March 31, 2006

These data represent the amount by which the most attractively priced large-cap

stocks within each market sell below overall market valuations. The proportion

of Bernstein investments in stocks from this group will vary over time but will

typically be high. Bernsteins estimates of the fair value of these stocks may not

be realized for a variety of reasons.

Source: Compustat, Datastream, DRI, FactSet, MSCI, and Bernstein

SUMMER 2006 | 17

cut back on expansion. And so, at the peak of the

Internet bubble in early 2000, investments in new

capacity in telecom and paper were miles apart.

As we now know, the level of capital spending in

telecom turned out to be excessive. It fell dramati-

cally when the Internet bubble burst and whatever

cash still existed at telecom companies was needed

to repay debt and rebuild balance sheets. Capital

spending in telecom and paper thus gradually

converged. And just as telecom stocks had become

much more expensive than paper stocks during the

expansion period, now the valuations of the two

industries similarly converged.

The lesson is that large differences in stock valu-

ations hold the seeds of their own demise. But

interestingly, this doesnt seem to happen to the

same extent at the other end of the spectrum

when stock-valuation differences are extremely

small. At such times the economy is generally

placid; nothing big is going on. Its possible that

something could happen to cause valuations to

radically diverge, like a sudden slowdown in GDP

growth, or a bout of irrational investor exuberance

over a particular sector. But neither scenario seems

likely at the moment.

Todays Low-Risk Environment Is Deceptive

Given all this, what should value investors be doing

in the current small-spread environment? One

widely touted view argues that when you fnd an

especially undervalued stock you should load up on

it. Yes, spreads will probably widen before they fall

again, but these investors think the risk is smaller

than the opportunity.

Were not so sure about that. In fact, our analysis

suggests that risk for value stocks as a group is

starting to increase. The hard fact is that theres

simply not as much extra return potential in classic

value stocks at the moment as usual. As a result,

very large investments in any particular value

stock, or group of value stocks, are not warranted.

To the contrary, our Strategic Value accounts are

more broadly diversifed at the moment than usual.

But rest assured that when stock mispricings pick

up again, well take on enough risk to be able to try

to capture the returns those opportunities should

provide, focusing on the industries that hold the

most promise.

Exploiting a Diverse Tool-Set

Does this mean weve given up on outperform-

ing the market for the time being? Absolutely not.

For one thing, our intense company and industry

research is still enabling us to uncover instances

where price/earnings, price/book value, and price/

cash earnings ratios are notably below average. And

were going beyond classic value measures in this

environment, paying special attention to factors like

stock-price momentum and company proftability.

Our research has found that when coupled with low

stock prices, these additional measures can further

pinpoint stocks with the high potential to outper-

form. Other factors like exchange-rate movements,

interest rates, and balance-sheet accruals also color

our view of a stocks attractiveness more than usual

in this environment. When all these signs point in

the right direction, an active value-based manager

Display 4

Wide value spreads are self-correcting

00 99 98 97 01 02

Widening Spreads Narrowing Spreads

03

50

100

150

200%

Paper

Telecom

Capital Spending

Just Equals Depreciation

04

Capital Spending vs. Depreciation

Based on U.S. company data

Source: Citigroup, MSCI, Worldscope, and Bernstein

18 | BERNSTEIN JOURNAL: PERSPECTIVES ON INVESTING AND WEALTH MANAGEMENT

can earn substantial extra return even in a low-

spread environment (Display 5). Although the stars

wont always align perfectly, a focus on all of these

factors can really help identify winning stocks.

The upshot is that history provides several useful

lessons for today. It tells us that value investing

can succeed even when valuation spreads are very

small, if not on the grand scale possible in more

unsettled markets. And that success can be magni-

fed by capitalizing on clues other than the classic

value measuresclues we call value-plus factors,

which, when combined with a low stock price, can

help tilt a value managers odds of winning in a

favorable direction. n

Display 5

The value-plus approach

Value Factors

Company

Success Factors

Other Factors

Return on

Equity

Stock Price

Momentum

Interest Rates

Balance-Sheet Accruals

Currency Momentum

Purchasing-Power

Parity

Price/Earnings

Price/Book

Price/Cash

Earnings

Source: Bernstein

Вам также может понравиться

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (121)

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (400)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (266)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2259)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (345)

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (895)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- SemiДокумент252 страницыSemiGОценок пока нет

- Stocks Have Rallied and Will Now Return Less. Hip Hip Hooray! But Now What?Документ5 страницStocks Have Rallied and Will Now Return Less. Hip Hip Hooray! But Now What?saif_shakeelОценок пока нет

- Preventing OOS DeficienciesДокумент65 страницPreventing OOS Deficienciesnsk79in@gmail.comОценок пока нет

- 9.admin Rosal Vs ComelecДокумент4 страницы9.admin Rosal Vs Comelecmichelle zatarainОценок пока нет

- Position DDДокумент1 страницаPosition DDsaif_shakeelОценок пока нет

- ACT-II Story BookДокумент4 страницыACT-II Story Booksaif_shakeelОценок пока нет

- Recruiting 10 6 2011Документ25 страницRecruiting 10 6 2011saif_shakeelОценок пока нет

- Equip Yourself Well For Interviews: Before The InterviewДокумент4 страницыEquip Yourself Well For Interviews: Before The Interviewsaif_shakeelОценок пока нет

- Nat Law 2 - CasesДокумент12 страницNat Law 2 - CasesLylo BesaresОценок пока нет

- Mpi Model QuestionsДокумент4 страницыMpi Model QuestionshemanthnagОценок пока нет

- Design & Construction of New River Bridge On Mula RiverДокумент133 страницыDesign & Construction of New River Bridge On Mula RiverJalal TamboliОценок пока нет

- Nisha Rough DraftДокумент50 страницNisha Rough DraftbharthanОценок пока нет

- 88 - 02 Exhaust Manifold Gasket Service BulletinДокумент3 страницы88 - 02 Exhaust Manifold Gasket Service BulletinGerrit DekkerОценок пока нет

- Health, Safety & Environment: Refer NumberДокумент2 страницыHealth, Safety & Environment: Refer NumbergilОценок пока нет

- Te 1569 Web PDFДокумент272 страницыTe 1569 Web PDFdavid19890109Оценок пока нет

- Numerical Transformer Differential RelayДокумент2 страницыNumerical Transformer Differential RelayTariq Mohammed OmarОценок пока нет

- Codex Standard EnglishДокумент4 страницыCodex Standard EnglishTriyaniОценок пока нет

- Lexington School District Two Return To School GuideДокумент20 страницLexington School District Two Return To School GuideWLTXОценок пока нет

- HP Sustainability Impact Report 2018Документ147 страницHP Sustainability Impact Report 2018Rinaldo loboОценок пока нет

- Floor Paln ModelДокумент15 страницFloor Paln ModelSaurav RanjanОценок пока нет

- Class 11 Accountancy NCERT Textbook Chapter 4 Recording of Transactions-IIДокумент66 страницClass 11 Accountancy NCERT Textbook Chapter 4 Recording of Transactions-IIPathan KausarОценок пока нет

- Lec # 26 NustДокумент18 страницLec # 26 NustFor CheggОценок пока нет

- Majalah Remaja Islam Drise #09 by Majalah Drise - Issuu PDFДокумент1 страницаMajalah Remaja Islam Drise #09 by Majalah Drise - Issuu PDFBalqis Ar-Rubayyi' Binti HasanОценок пока нет

- Elliot WaveДокумент11 страницElliot WavevikramОценок пока нет

- Fr-E700 Instruction Manual (Basic)Документ155 страницFr-E700 Instruction Manual (Basic)DeTiEnamoradoОценок пока нет

- Icom IC F5021 F6021 ManualДокумент24 страницыIcom IC F5021 F6021 ManualAyam ZebossОценок пока нет

- Dr. Najeebuddin Ahmed: 969 Canterbury Road, Lakemba, Sydney, NSW, Australia, 2195Документ2 страницыDr. Najeebuddin Ahmed: 969 Canterbury Road, Lakemba, Sydney, NSW, Australia, 2195Najeebuddin AhmedОценок пока нет

- Residential BuildingДокумент5 страницResidential Buildingkamaldeep singhОценок пока нет

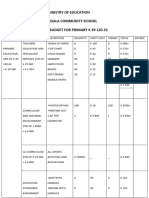

- Ministry of Education Musala SCHДокумент5 страницMinistry of Education Musala SCHlaonimosesОценок пока нет

- SettingsДокумент3 страницыSettingsrusil.vershОценок пока нет

- Document 3Документ3 страницыDocument 3AdeleОценок пока нет

- The Finley ReportДокумент46 страницThe Finley ReportToronto StarОценок пока нет

- Kicks: This Brochure Reflects The Product Information For The 2020 Kicks. 2021 Kicks Brochure Coming SoonДокумент8 страницKicks: This Brochure Reflects The Product Information For The 2020 Kicks. 2021 Kicks Brochure Coming SoonYudyChenОценок пока нет

- Pthread TutorialДокумент26 страницPthread Tutorialapi-3754827Оценок пока нет

- A Winning Formula: Debrief For The Asda Case (Chapter 14, Shaping Implementation Strategies) The Asda CaseДокумент6 страницA Winning Formula: Debrief For The Asda Case (Chapter 14, Shaping Implementation Strategies) The Asda CaseSpend ThriftОценок пока нет