Академический Документы

Профессиональный Документы

Культура Документы

Fundamentals of Risk Management

Загружено:

Rakib HossainОригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Fundamentals of Risk Management

Загружено:

Rakib HossainАвторское право:

Доступные форматы

FUNDAMENTALS OF RISK MANAGEMENT

1. Pure risks are risks that offer only the prospect of a loss. Examples include

the risk that a plant will be destroyed by fire or that a product liability suit will

result in a large judgment against the firm.

2. Speculative risks are situations that offer the chance of a gain but might

result in a loss. Thus, investments in new projects and marketable securities

involve speculative risks.

. Demand risks are associated with the demand for a firm!s products or

services. "ecause sales are essential to all businesses, demand risk is one of

the most significant risk that firms face.

#. Input risks are risks associated with input costs, including both labour and

materials. Thus, a company that uses copper as a row material in its

manufacturing process faces the risk that the cost of copper will increase and

that it will not be able to pass this increase on to its customers.

$. Financial risks are risks that result from financial transactions. %f a firm plans

to issue new bonds, it faces the risk that interest rates will rise before the

bonds can be brought to market. &imilarly, if the firm enters into contracts with

foreign customers or suppliers, it faces the risk that fluctuations in exchange

rates will result in unanticipated losses.

'. Property risks are associated with destruction of productive assets. Thus, the

threat of fire, floods, and riots imposes property risks on a firm

(. Personnel risks are risks that result from employees! actions. Examples

include the risks associated with employee fraud or embe))lement, or suits

based on charges of age of sex discrimination.

International Commodity Trading and Risk Management

December 1-2, 2008

1

*. Environmental risks include risks associated with pollution he environment.

+ublic awareness in recent years, coupled with the huge costs of

environmental cleanup, has increased the importance of this risk.

,. Liability risks are associated with product, service, or employee actions.

Examples include the very large judgments assessed against asbestos

manufacturers and some health care providers, as well as costs incurred as a

result of improper actions of employees, such as driving corporate vehicles in

a reckless manner.

1-. Insurable risks are risks that can be covered by insurance. %n general ,

property, personnel, environmental, and liability risks can be transferred to

insurance companies. .ote, though, that the ability to insure a risk does not

necessarily mean that the risk should be insured. %ndeed, a major function of

risk management involves evaluating all alternatives for managing a particular

risk, including self/insurance, and them choosing the optimal alternative.

RISK MANAGEMENT AND AVOIDANCE

4 WAYS TO DEAL WITH RISK

There are four ways of dealing with or managing each risk that you have

identified. 0ou can1

Accept it

Transer it

Red!ce it

"liminate it

International Commodity Trading and Risk Management

December 1-2, 2008

2

MICROSOFTS GOAL : MANAGE EVERY RISKS

Twenty years ago, risk management meant buying insurance against fire, theft,

and liability losses. Today, though, due to globalisation, volatile markets, and

a host of lawyers looking for someone to sue, a multitude of risks can

adversely affect companies. 2icrosoft addressed these risks by creating a

virtual consulting practice, called 2icrosoft 3isk 4o. to help manage the risks

faced by its sales, operations, and product groups.

&cott 5ange, head of 2icrosoft 3isk, in an article identified these 12 major

sources of risk1

1. Business partners 6interdependency, confidentiality, cultural conflict,

contractual risks7

2. Competition 6market share, price wars, industrial espionage, antitrust

allegations etc.7

. Customers 6product liability, credit risk, poor market timing, inade8uate

customer support7.

#. Distribution systems 6transportation, service availability, cost, dependence

on distributors7

$. Financial 6foreign exchange, portfolio, cash, interest rate, stock market7.

'. Operations 6facilities, contractual risks, natural ha)ards, internal processes

and control7.

(. People 6employees, independent contractors training staffing inade8uacy7

International Commodity Trading and Risk Management

December 1-2, 2008

#

*. Political 6civil unrest, war, terrorism, enforcement of intellectual property

rights, change in leadership, revised economic policies7.

,. Regulatory and legislative 6antitrust export licensing, jurisdiction, reporting

and compliance, environmental7.

1-. Reputations 6corporate image, brands, reputations of key employees7.

11. Strategic 6mergers and ac8uisitions, joint ventures and alliances, resource

allocation and planning, organi)ational agility7.

12. ec!nological 6complexity, obsolescence, the year 2--- problem, workforce

skill sets7.

AN APPROACH TO RISK MANAGEMENT

1. %dentify the risks faced by the firm.

2. 2easure the potential effect of each risk.

. 9ecide how each relevant risk should be handled.

:. Transfer the risk to an insurance company.

". Transfer the function that produces the risk to a third party.

4. +urchase derivative contracts to reduce risk.

9. 3educe the probability of occurrence of an adverse event.

E. 3educe the magnitude of the loss associated with an adverse event.

;. Totally avoid the activity that gives rise to the risk.

International Commodity Trading and Risk Management

December 1-2, 2008

$

Вам также может понравиться

- 99 Names of Allah in Arabic and EnglishДокумент3 страницы99 Names of Allah in Arabic and EnglishAbdul Ahad Khan100% (2)

- The International-Dependence RevolutionДокумент2 страницыThe International-Dependence RevolutionRakib Hossain100% (14)

- Sales SUALOGДокумент21 страницаSales SUALOGEynab Perez100% (1)

- Assignment Agreement1Документ1 страницаAssignment Agreement1Joshua Schofield100% (2)

- Strategic Risk Management: The New Competitive EdgeДокумент11 страницStrategic Risk Management: The New Competitive EdgesammirtoОценок пока нет

- Corrección Miro - Zrepmir7Документ19 страницCorrección Miro - Zrepmir7miguelruzОценок пока нет

- Timesheets and Laytime CalculationДокумент14 страницTimesheets and Laytime CalculationJuan Alfaro100% (1)

- 6learning Outcome 6Документ19 страниц6learning Outcome 6Indu MathyОценок пока нет

- Introduction and Risk MGT 3Документ21 страницаIntroduction and Risk MGT 3Mridul SethОценок пока нет

- Risk MG T HandoutsДокумент9 страницRisk MG T HandoutsHelarie RoaringОценок пока нет

- Risk Management Full NotesДокумент40 страницRisk Management Full NotesKelvin Namaona NgondoОценок пока нет

- Key Trends in Risk Management Further ReadingДокумент6 страницKey Trends in Risk Management Further ReadingSiddhantpsinghОценок пока нет

- Risk Management: Alternative Risk Transfer: StructureДокумент21 страницаRisk Management: Alternative Risk Transfer: StructureRADHIKAFULPAGARОценок пока нет

- Effect of Uncertainty On Objectives) Followed by Coordinated and Economical Application of Resources ToДокумент6 страницEffect of Uncertainty On Objectives) Followed by Coordinated and Economical Application of Resources ToKatrina Vianca DecapiaОценок пока нет

- Risk Management in IndustryДокумент6 страницRisk Management in Industrykasa1981100% (6)

- 1-The Big PictureДокумент20 страниц1-The Big PictureAdistya 송 EkkyОценок пока нет

- Risk Management - ITCДокумент65 страницRisk Management - ITCVenugopal VutukuruОценок пока нет

- Article 2Документ18 страницArticle 2aravind sharenОценок пока нет

- Financial Risk ManagementДокумент18 страницFinancial Risk Managementdwimukh360Оценок пока нет

- RISK MGMT Chap III 2020 Sem IIДокумент18 страницRISK MGMT Chap III 2020 Sem IIobedОценок пока нет

- Derivatives - MergedДокумент65 страницDerivatives - MergedAdithyaОценок пока нет

- Research Project AssignmentДокумент27 страницResearch Project AssignmentSam CleonОценок пока нет

- Lloyd's Case StudyДокумент2 страницыLloyd's Case StudySiddharth ChyОценок пока нет

- Managing Risk in BusinessДокумент3 страницыManaging Risk in BusinesstkurasaОценок пока нет

- Enterprise Risk ManagementДокумент12 страницEnterprise Risk ManagementDesna IkhsandraОценок пока нет

- Unit IДокумент27 страницUnit Isinghishita1504Оценок пока нет

- IRM 5-6 Risk Mgt.Документ9 страницIRM 5-6 Risk Mgt.surya kumarОценок пока нет

- Risk Management FIN 404/BBAДокумент8 страницRisk Management FIN 404/BBANomanОценок пока нет

- Risk and Insurance Module - 1Документ11 страницRisk and Insurance Module - 11CG20MBA08 Kushal Kumar PОценок пока нет

- Ins CTДокумент8 страницIns CTtahsinahmed9462Оценок пока нет

- Effects of Risk Management Practices On The Performance of Insurance Firms in Kenya: A Case of AIG Insurance Company LTDДокумент5 страницEffects of Risk Management Practices On The Performance of Insurance Firms in Kenya: A Case of AIG Insurance Company LTDIjsrnet EditorialОценок пока нет

- Dickinson EnterpriseRiskManagement 2001Документ8 страницDickinson EnterpriseRiskManagement 2001Iis IstianahОценок пока нет

- Compliance, Political and Strategic RiskДокумент26 страницCompliance, Political and Strategic RiskManny HermosaОценок пока нет

- RISK - Insurers & ReinsurersДокумент40 страницRISK - Insurers & ReinsurersMarcus AureliusОценок пока нет

- Financial Markets & Risk ManagementДокумент48 страницFinancial Markets & Risk ManagementGabriel Alva AnkrahОценок пока нет

- Concept of Risk and Risk ManagementДокумент30 страницConcept of Risk and Risk ManagementCck CckweiОценок пока нет

- Fianl Hard Copy of RMДокумент26 страницFianl Hard Copy of RMKinjal Rupani100% (1)

- P3 - Summary Notes - Ultimate AccessДокумент128 страницP3 - Summary Notes - Ultimate AccessRecruit guideОценок пока нет

- Risk CH 2 PDFДокумент23 страницыRisk CH 2 PDFWonde Biru50% (2)

- Lesson 8. Managing Small Business Risk: Iloilo Science and Technology University Leon CampusДокумент7 страницLesson 8. Managing Small Business Risk: Iloilo Science and Technology University Leon CampusLEON CAMPUSОценок пока нет

- 2023 Handout 6 Risk Management, Goal Setting, Time ManagementДокумент68 страниц2023 Handout 6 Risk Management, Goal Setting, Time Managementeddiemasiga3100% (1)

- Corp Gov Chapter 3 New UpdatedДокумент10 страницCorp Gov Chapter 3 New UpdatedDarlyn Dalida San PedroОценок пока нет

- 5Документ4 страницы5shitalzeleОценок пока нет

- Future of Risk AnalyticsДокумент17 страницFuture of Risk AnalyticsIshitaОценок пока нет

- LFSL LWL - CH 1 CH 7 Risks of Financial InstitutionsДокумент22 страницыLFSL LWL - CH 1 CH 7 Risks of Financial InstitutionsHelen JohnОценок пока нет

- Enterprise Risk Management Thesis TopicsДокумент5 страницEnterprise Risk Management Thesis Topicsnaogmlvcf100% (2)

- Complete ProjectДокумент99 страницComplete ProjectDANJUMA ADAMUОценок пока нет

- Chapter - I Enterprise Risk Management: An IntroductionДокумент37 страницChapter - I Enterprise Risk Management: An IntroductionkshitijsaxenaОценок пока нет

- Basel NormsДокумент66 страницBasel NormsShanmathiОценок пока нет

- Tech 638 Homework 1 F14 SolutionsДокумент2 страницыTech 638 Homework 1 F14 SolutionsShafiMohd100% (1)

- Compiled Notes CH 11 15Документ26 страницCompiled Notes CH 11 15Miks EnriquezОценок пока нет

- Untitled 1Документ4 страницыUntitled 1Marry Shane BetonioОценок пока нет

- RM-MTP N22Документ11 страницRM-MTP N22Mani ganesanОценок пока нет

- What Is Risk Management?: Dr. Zainal ArifinДокумент28 страницWhat Is Risk Management?: Dr. Zainal ArifinLinda FitriОценок пока нет

- Energy Industry - Evolving Risk - MarshДокумент28 страницEnergy Industry - Evolving Risk - MarshbxbeautyОценок пока нет

- Chapter 1 Introduction To RiskДокумент17 страницChapter 1 Introduction To RiskBrenden KapoОценок пока нет

- Business Risk HND-1Документ10 страницBusiness Risk HND-1josephfaith711100% (1)

- FM 11-9 Gbs For Week 02 03 PDFДокумент11 страницFM 11-9 Gbs For Week 02 03 PDFShugi YenОценок пока нет

- EWS ReportДокумент21 страницаEWS ReportppayonggОценок пока нет

- 8 CorporateRiskMngmt TheoryPracticeДокумент11 страниц8 CorporateRiskMngmt TheoryPracticeAl fikri Al ahmadОценок пока нет

- Title: The Negative Effect of Poor Risk Management On BusinessДокумент18 страницTitle: The Negative Effect of Poor Risk Management On BusinessqwertyОценок пока нет

- Treasury RisksДокумент24 страницыTreasury RisksAngelie Dela CruzОценок пока нет

- Sigma4 2014 enДокумент36 страницSigma4 2014 enHarry CerqueiraОценок пока нет

- Insurance and Risk ManagementДокумент17 страницInsurance and Risk ManagementFardus Mahmud92% (24)

- Managing It-Related Operational Risks: Ana SavićДокумент22 страницыManaging It-Related Operational Risks: Ana SavićasifsubhanОценок пока нет

- Research and Design IДокумент16 страницResearch and Design ISoumyadeep MaityОценок пока нет

- Juvenile Delinquency - A Recent Trend of Child CrimeДокумент4 страницыJuvenile Delinquency - A Recent Trend of Child CrimeRakib HossainОценок пока нет

- History + ChipsДокумент8 страницHistory + Chipscs_danielОценок пока нет

- The Final Version of Emotional Abuse Article - Doc 11 Sep 2013Документ24 страницыThe Final Version of Emotional Abuse Article - Doc 11 Sep 2013Rakib HossainОценок пока нет

- InstructionsДокумент9 страницInstructionsRakib HossainОценок пока нет

- The Special Powers Act 1947Документ1 страницаThe Special Powers Act 1947Rakib HossainОценок пока нет

- Democracy in BangladeshДокумент20 страницDemocracy in BangladeshRakib HossainОценок пока нет

- Responses To Information Requests (Rirs) : Search About Rirs HelpДокумент4 страницыResponses To Information Requests (Rirs) : Search About Rirs HelpRakib HossainОценок пока нет

- Alg RulesДокумент2 страницыAlg RulesangrybkittenОценок пока нет

- BD Court System BanglaДокумент11 страницBD Court System BanglaRakib HossainОценок пока нет

- Dialogue For The Importance of Tree PlantationДокумент2 страницыDialogue For The Importance of Tree PlantationRakib HossainОценок пока нет

- Picture Perception Cha5 FormatedДокумент11 страницPicture Perception Cha5 FormatedRakib HossainОценок пока нет

- Economist Contribution On CrimeДокумент64 страницыEconomist Contribution On CrimeRakib HossainОценок пока нет

- MT Activity Sheets CompleteДокумент12 страницMT Activity Sheets CompleteRakib HossainОценок пока нет

- Regional Development & CrimeДокумент6 страницRegional Development & CrimeRakib HossainОценок пока нет

- Eve TeasingДокумент23 страницыEve TeasingRakib HossainОценок пока нет

- Police System of BangladeshДокумент14 страницPolice System of BangladeshShahriar ShaonОценок пока нет

- 24 Ii ViДокумент7 страниц24 Ii ViRakib HossainОценок пока нет

- Analytical Tools ThesisДокумент16 страницAnalytical Tools ThesisRakib HossainОценок пока нет

- Lecture 7 GDPДокумент61 страницаLecture 7 GDPRakib HossainОценок пока нет

- Human Development IndexДокумент2 страницыHuman Development IndexAshley MorganОценок пока нет

- Overview of UK Courts and Tribunals SystemДокумент3 страницыOverview of UK Courts and Tribunals SystemRakib HossainОценок пока нет

- Footwear: Edited by Subrata BanarjeeДокумент11 страницFootwear: Edited by Subrata BanarjeeRakib HossainОценок пока нет

- Overview of UK Courts and Tribunals SystemДокумент3 страницыOverview of UK Courts and Tribunals SystemRakib HossainОценок пока нет

- Reverse Speech & MicroexpressionsДокумент7 страницReverse Speech & MicroexpressionsRakib Hossain100% (1)

- Letter For SSC ExamДокумент10 страницLetter For SSC ExamRakib HossainОценок пока нет

- Metropolitan PoliceДокумент20 страницMetropolitan PoliceRakib HossainОценок пока нет

- Evidence Act DefinitionДокумент2 страницыEvidence Act DefinitionRakib HossainОценок пока нет

- MARK977 Research For Marketing Decisions Autumn Semester, 2017 Week 8Документ54 страницыMARK977 Research For Marketing Decisions Autumn Semester, 2017 Week 8Soumia HandouОценок пока нет

- Chocolate Industry Final Case AnalysisДокумент10 страницChocolate Industry Final Case AnalysisSadia SaeedОценок пока нет

- Sample Statement of Purpose.42120706Документ8 страницSample Statement of Purpose.42120706Ata Ullah Mukhlis0% (2)

- Project ManagementДокумент2 страницыProject ManagementJohanChvzОценок пока нет

- Project On Rewards Recognition Schemes Staff Officers HLLДокумент56 страницProject On Rewards Recognition Schemes Staff Officers HLLRoyal Projects100% (4)

- Industrial Relation of LawДокумент3 страницыIndustrial Relation of LawArunОценок пока нет

- Credit Card ConfigurationДокумент5 страницCredit Card ConfigurationdaeyongОценок пока нет

- Uber Final PPT - Targeting and Positioning MissingДокумент14 страницUber Final PPT - Targeting and Positioning MissingAquarius Anum0% (1)

- Break Even Point (Bep) Analysis of Tomato Farming Business in Taraitak I Village, Langowan District, Minahasa DistrictДокумент8 страницBreak Even Point (Bep) Analysis of Tomato Farming Business in Taraitak I Village, Langowan District, Minahasa Districtrenita lishandiОценок пока нет

- Bahan Presentasi - Kelompok 3 - Supply ChainДокумент46 страницBahan Presentasi - Kelompok 3 - Supply ChainpuutОценок пока нет

- Lexis® Gift VouchersДокумент1 страницаLexis® Gift VouchersNURUL IZZA HUSINОценок пока нет

- A Study On Customer Preference Towards Heavy Commercial Vehicle-3145 PDFДокумент6 страницA Study On Customer Preference Towards Heavy Commercial Vehicle-3145 PDFAkash DasОценок пока нет

- AspenTech's Solutions For Engineering Design and ConstructionДокумент13 страницAspenTech's Solutions For Engineering Design and Constructionluthfi.kОценок пока нет

- FOLMxnXUJJ nkJs-KiNbsgДокумент1 страницаFOLMxnXUJJ nkJs-KiNbsgAbhishek KunduОценок пока нет

- Ias 2Документ29 страницIas 2MK RKОценок пока нет

- HPM 207Документ7 страницHPM 207Navnit Kumar KUSHWAHAОценок пока нет

- Sample Club BudgetsДокумент8 страницSample Club BudgetsDona KaitemОценок пока нет

- Menu EngineeringДокумент9 страницMenu Engineeringfirstman31Оценок пока нет

- Solutions ArtLog Edition9Документ15 страницSolutions ArtLog Edition9scottstellОценок пока нет

- HULДокумент27 страницHULAshwini SalianОценок пока нет

- ASB-Company ProfileДокумент10 страницASB-Company ProfileJie LionsОценок пока нет

- RDL1 - Activity 1.2Документ1 страницаRDL1 - Activity 1.2EL FuentesОценок пока нет

- Pizza Choice: Submitted By: Submitted ToДокумент11 страницPizza Choice: Submitted By: Submitted ToNeha SharmaОценок пока нет

- Khushboo Kukreja Front PageДокумент4 страницыKhushboo Kukreja Front Pagejassi7nishadОценок пока нет

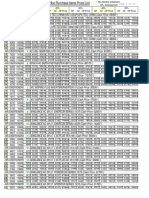

- PriceListHirePurchase Normal6thNov2019Документ56 страницPriceListHirePurchase Normal6thNov2019Jamil AhmedОценок пока нет

- Canada Post Amended Statement of Claim Against Geolytica and Geocoder - CaДокумент12 страницCanada Post Amended Statement of Claim Against Geolytica and Geocoder - CaWilliam Wolfe-WylieОценок пока нет