Академический Документы

Профессиональный Документы

Культура Документы

Non Parametrical Estimation of The Regression Used in Economic Analyses

Загружено:

Loredana GheorgheОригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Non Parametrical Estimation of The Regression Used in Economic Analyses

Загружено:

Loredana GheorgheАвторское право:

Доступные форматы

Revista Romn de Statistic Trim.

I/2013 - Supliment 38

Non-parametrical Estimation of the Regression used

in Economic Analyses

Prof. Constantin ANGHELACHE PhD

Artifex University of Bucharest

Academy of Economic Studies, Bucharest

Prof. Gabriela Victoria ANGHELACHE PhD

Academy of Economic Studies, Bucharest

Prof. Liviu BEGU PhD

Academy of Economic Studies, Bucharest

Georgeta BARDAU PhD Student

Academy of Economic Studies, Bucharest

Abstract

Non-parametric methods are useful, but raises some problems. In

practice, they require a large number of observations and are used for a

relatively small number of explanatory variables. Moreover, the result is

sensitive to the choice of the smoothing parameter and to a lesser extent in

the nucleus. They pose a problem for the presentation of results that can not

be contained in a compact formula but can only be described by graphs. A

non-parametric analysis does not allow extrapolation outside the range of

observation, but econometric is an advantage.

Key words: non-parametric methods, variables, regression

function, appraisal

JEL Classification: C01, C51

General aspects

Contrary to the other domains, the economic theory is rarely mentioning

functional forms but, usually, it specifies only a list of the relevant variables in

order to explain a phenomenon. The specification of the relation form is resulting,

to a great extent, out of an empirical study containing a good model which

works well. A first level of analysis consists of writing a model (linear, logarithm

linear, non-linear etc.) and performing the estimation without taking into account

its approximate nature. A second approach consists of specifying a parametrical

model which incorrect specification is explicit. This is leading, for instance, to the

correction of the expression for variations or to the selection of the models for the

erroneous specification.

Revista Romn de Statistic Trim I/2013- Supliment 39

Practically, we have to get all the specified conditions by adopting a non-

parametrical approach when estimating the regression, in which the data

themselves are selecting the form of the function to be built up.

Various methods (models) for estimating the non-parametrical regression

have been drawn up which are presently commonly used. We consider likewise the

nucleus method, which is a simple one and, in certain situations, dominated by

other approaches.

The non-parametrical methods are useful but they are raising certain

problems. In practice, they are requiring a large number of observations and are to

apply to a relatively small number of explanatory variables. Moreover, the outcome

is sensitive to the selection of the equalizing parameter and, to a smaller extent to

the nucleus. They are raising a problem as to submitting the outcomes which

cannot be covered by a compact formula but can be described by means of

diagrams. A non-parametrical analysis does not allow an extrapolation outside the

observation domain but, from the econometric point of view, this is an advantage.

In order to redeem some of these difficulties, semi-parametrical methods have been

developed which purpose is to estimate only certain characteristics of the

regression or to constrain the regression function to satisfy certain conditions. The

dimension of the issue is thus reduced and the obtaining of the outcomes

facilitated. Meantime, it is possible to insert also structural conditionings to the

model.

For the beginning, we take into consideration the standard estimation of the

regression nucleus and then, we discuss certain problems of the estimation for

specific characteristics of the regression or the estimation under compulsion.

The band lengths for the variables

The previous expression is transformed in the following mode. In the

dispersion terms,

q

n

h becomes

=

q

j

jn

h

1

.

In addition, the same argument as the one applied to the density can be

utilized in order to set up the width of the band and nucleus. We can use the

expression of the squared mean asymptotic integrated error in order to derive the

best width of the band at z fix.

This calculation implies that g and f are known. We can go on with

estimating the f and g, first with a couple of initial values of the band width and,

then, by using these estimations in order to improve the band width.

This procedure is merely a delicate one because it requires the estimation

of the differentials, which are converging slowly (and need a large sample) and the

conditioned dispersion. This method of connecting has been also extended to the

selection of a specific band width for each explanatory variable.

After replacing the band width by its optimum value, we can look after an

optimum nucleus, which is the Epanechnikov nucleus, as in the case of the density

estimation.

Revista Romn de Statistic Trim. I/2013 - Supliment 40

An alternative approach for selecting the optimum width consists of the so-

called crossed validation method.

The expression does not depend on

n

h

and can be numerically minimized

by observing

n

h for a given interval.

The AMISE calculation is based on two conditions, respectively: the fact

that

dar

and on the double difference of the observation density. The distance between g

and g

n

, measured by AMISE can be reduced by assuming a differentiation at a

higher order or by selecting K so that:

for j < r

In this case, the smallest r in this formula is called the order of the nucleus

K. To note that when K is a density of measurement of the probability (K non

negative), then r equals to 2.

The term of the systematic error is then equal, up to a multiplicative

constant, with

) , min( 2 r s

n

h , where s is the order of the differentiation and r is the

order of the nucleus.

The disadvantage of the nucleuses of high order, of order higher then 2,, is

that there are no more densities and the estimated densities can be negative, at least

on small samples.

When Lf h

n

equals to the optimum choice, the convergence rate

q

n

nh

becomes:

This is the convergence non-parametrical optimum rate with the measure q

which can be compared with the usual parametrical rate, namely n . We are

checking the fact that indeed the interval between the two rates increases along

with the increase of q .

In order to utilize this outcome in practice, we must estimate the density

and the conditional dispersion. The density is estimated by the nucleus and,

similarly, the conditional dispersion.

The estimation of the regression function transformation

Instead of the estimation of the regression function, we can analyze a

transformation of this function. The option for this transformation is grounded by

Revista Romn de Statistic Trim I/2013- Supliment 41

the economic analysis which defines the parameters of interest. Obviously , there

are many transformations which can be considered but we shall focus on a specific

class characterized by the relation:

In this formula , ( ) ( ) z z y E z g = =

~

|

~

, and w(z) is a weight function which is

either scalar, or vectorial and satisfies w(z)=0 if ( ) 0

arg

= z f

m

, which is natural

since g(z) is defined only if ( ) 0

arg

> z f

m

. The parameter of interest

is scalar

or vectorial. This class of transformation is justified by the properties of the

resulting estimator

and, meantime, by its relevance as regards many issues of

applied econometrics, which are special situations of these analyses.

Before entering into details, we notice the fact that this transformation does

not insert the over-determination of the conditions on the variables distribution.

We shall estimate the mean of the regression differentials. We have seen

that the parametrical estimation of a regression erroneously specified does not

allow us to consistently estimate the differentials of this function in a certain point.

In many econometrical issues, the differentials are parameters of interest. The

estimation is possible but its rate of convergence is very slow and, consequently,

requires a large sample. Nevertheless, in many applications it is enough to estimate

the mean of the regression differentials, namely:

where is a multiple index of the derivation and

is the derivation defined by

this multiple index. The function v(z) is a density on the explanatory variable

which can be equal to ( ) z f

m

, the density of the actual explanatory variable being

studied. We shall analyze the under-additively test. In order to illustrate this

situation, lets assume that the function C is the function cost which associates an

expected cost with the quantities of the different products z. The economic theory

is interested in the under-additively C, namely it is:

Which means that, the cost of a company producing

=

p

j

j

z

1

, is lower than the cost

of several companies each producing

j

z . The above property must be true for

each p and each sequence ) ,..., (

1 p

z z . It is easy to show that this property is

equivalent to the property which will be explicitly shown by the content. If is

Revista Romn de Statistic Trim. I/2013 - Supliment 42

the density ) ,..., (

1 p

z z ,

~

the density of the sum

p

z z + + ...

1

and

j

the density

j

z , than, it is equivalent with the fact that for each , we have:

The reciprocal is resulting by taking into account the distribution on

) ,..., (

1 p

z z focused in one point. Now, we shall approach the under-additively test.

The previous relation suggests that there is a defined, namely:

the sign of this parameter having to be tested.

The estimation of defined can be made in two modes.

The first variant consists of the estimation of g followed by the calculation.

The second approach avoids the estimation g and is based on the

particularity given by the utilized (final) function:

This condition is seldom satisfied. We can replace

arg m

f with a

parametrical or non-parametrical estimation.

Implicitly, we assume that w is given. In practice, iv can be partially or

totally unknown (since it is, for instance, a function of

arg m

f ) and thus w must be

replaced by an estimation.

A procedure of adjustment is inserted sometimes, consisting of the

elimination of the data placed at the limit of the support of the explanatory

variables distribution. The adjustment can be inserted in the function w as the form

of a function with multiplying indicator.

The main asymptotic result is the convergence rate

n

at . Indeed, we

know:

in the frame regularity conditionings and under the condition that the bands width

have an adequate asymptotic behavior. In order to limit the problems of

dimensioning or to impose certain restrictions originating in the economic theory,

we often assume that the conditioned probability g(z), which is a function of the

variables q, depends in fact on the functions of a reduced number of variables and,

possibly, on certain parameters. In fact, there are two points of view being

expressed: either we assume that g is actually restricted to this specific form or we

Revista Romn de Statistic Trim I/2013- Supliment 43

are searching for the best approximation g through an element satisfying the

considered restrictions.

References

Anghelache, C. (coord., 2012) Modele statistico econometrice de analiz

economic utilizarea modelelor n studiul economiei Romniei, Revista

Romn de Statistic, Supliment Noiembrie 2012

Bardsen, G., Nymagen, R., Jansen, E. (2005) The Econometrics of

Macroeconomic Modelling, Oxford University Press

Benjamin, C., Herrard A., Hanee-Bigot, M., Tavere, C. (2010) Forecasting with

an Econometric Model, Springer

Dougherty, C. (2008) Introduction to econometrics. Fourth edition, Oxford

University Press

Jesus Fernandez-Villaverde & Juan Rubio-Ramirez (2009) Two Books on the

New Macroeconometrics, Taylor and Francis Journals, Econometric Reviews

Mitru, C. (2008) Basic econometrics for business administration, Editura

ASE, Bucureti

Voineagu, V., ian, E. i colectiv (2007) Teorie i practic econometric,

Editura Meteor Press

Вам также может понравиться

- Trade Barriers and Export PotentialДокумент49 страницTrade Barriers and Export PotentialLoredana GheorgheОценок пока нет

- Political Culture, Values and - 204-1447-3-PBДокумент17 страницPolitical Culture, Values and - 204-1447-3-PBLoredana GheorgheОценок пока нет

- Europe 2020 Competitiveness Report 2012Документ44 страницыEurope 2020 Competitiveness Report 2012Mary BeachОценок пока нет

- Business Diplomacy and TradeДокумент40 страницBusiness Diplomacy and TradeLaura RamonaОценок пока нет

- Agriculture Versus Fish - Norway in WTOДокумент24 страницыAgriculture Versus Fish - Norway in WTOLoredana GheorgheОценок пока нет

- Business Diplomacy PDFДокумент81 страницаBusiness Diplomacy PDFLoredana GheorgheОценок пока нет

- Commercial Diplomacy and International BusinessДокумент42 страницыCommercial Diplomacy and International BusinessLoredana GheorgheОценок пока нет

- Business Diplomacy PDFДокумент81 страницаBusiness Diplomacy PDFLoredana GheorgheОценок пока нет

- Higher Algebra - Hall & KnightДокумент593 страницыHigher Algebra - Hall & KnightRam Gollamudi100% (2)

- Overview of ShoppingДокумент14 страницOverview of ShoppingLoredana GheorgheОценок пока нет

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5794)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (890)

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (399)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (344)

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (265)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1090)

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2219)

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (119)

- 5994 17003 1 PBДокумент10 страниц5994 17003 1 PBPutra MeranaОценок пока нет

- Project Plan - Kel 5 PDFДокумент5 страницProject Plan - Kel 5 PDFKarisa ArdeliaОценок пока нет

- 2018 Revised Hutech - Thesis GuidelinesДокумент33 страницы2018 Revised Hutech - Thesis GuidelinesNhàn Nguyễn100% (1)

- Nature of Management Control SystemsДокумент2 страницыNature of Management Control SystemsKimОценок пока нет

- ECN 202: Introductory Macroeconomics: Module 1: Introduction To MacroeconomicsДокумент18 страницECN 202: Introductory Macroeconomics: Module 1: Introduction To MacroeconomicsBielan Fabian GrayОценок пока нет

- FM - Hanuman Industri (Inventory)Документ92 страницыFM - Hanuman Industri (Inventory)jagrutisolanki01Оценок пока нет

- Defining CurriculumДокумент7 страницDefining CurriculumRoxane RiveraОценок пока нет

- VOLTASДокумент109 страницVOLTASMishra AmitОценок пока нет

- The Art of Measurement Calibration GuideДокумент16 страницThe Art of Measurement Calibration GuideSarah ClarkОценок пока нет

- Treatment Resistant Perpetrators of Intimate Partner ViolenceResearch AdvancesДокумент4 страницыTreatment Resistant Perpetrators of Intimate Partner ViolenceResearch AdvancesAbigail MJОценок пока нет

- Impact of Human Resource Management Practices On Organizational Performance (A Case of Nepal) Gopal Man PradhanДокумент18 страницImpact of Human Resource Management Practices On Organizational Performance (A Case of Nepal) Gopal Man PradhanAdil AdilОценок пока нет

- Net Promoter Score: A Conceptual Analysis: Pratap Chandra MandalДокумент11 страницNet Promoter Score: A Conceptual Analysis: Pratap Chandra MandalcamillaОценок пока нет

- Rhetorical Summaries WebsiteДокумент5 страницRhetorical Summaries Websiteapi-437376338Оценок пока нет

- Re Positioning at DaburДокумент50 страницRe Positioning at Daburtariquewali11Оценок пока нет

- All Weeks 1 8 Inquiries, Investigations,&ImmersionДокумент53 страницыAll Weeks 1 8 Inquiries, Investigations,&ImmersionKorona Quarantina100% (2)

- Operations Research: Assignment 1Документ7 страницOperations Research: Assignment 1Shashank JainОценок пока нет

- Chao, Forlin & HoImproving Teaching Self Efficacy For Teachers in Inclusive Classrooms in Hong Kong PDFДокумент14 страницChao, Forlin & HoImproving Teaching Self Efficacy For Teachers in Inclusive Classrooms in Hong Kong PDFJeanYanОценок пока нет

- Statistics Exercise No. 1Документ8 страницStatistics Exercise No. 1Romeo Madrona Jr100% (1)

- Exactica Book EditingДокумент11 страницExactica Book EditingTinashe MashoyoyaОценок пока нет

- Module 5 3is No ActivityДокумент7 страницModule 5 3is No Activitygirlie jimenezОценок пока нет

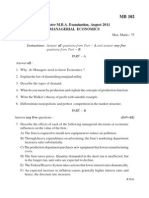

- Managerial Economics: MB102 I Semester M.B.A. ExaminationДокумент2 страницыManagerial Economics: MB102 I Semester M.B.A. ExaminationsuryavamshirakeshОценок пока нет

- Experiential Learning Theory: A Dynamic, Holistic Approach To Management Learning, Education and DevelopmentДокумент59 страницExperiential Learning Theory: A Dynamic, Holistic Approach To Management Learning, Education and DevelopmentamiОценок пока нет

- Charpy Impact TestДокумент3 страницыCharpy Impact TestKajal KhanОценок пока нет

- The Purposes of AssessmentДокумент5 страницThe Purposes of AssessmentMichael Prants91% (11)

- Final Questions For Last ClassДокумент5 страницFinal Questions For Last ClassNitish KumarОценок пока нет

- Data Science Master60 Englisch Studienablaufplan MyStudies NEU 1Документ1 страницаData Science Master60 Englisch Studienablaufplan MyStudies NEU 1Kyaw Si ThuОценок пока нет

- Mce Training NotesДокумент135 страницMce Training NotesJay PeterОценок пока нет

- Fees CounsellingДокумент25 страницFees CounsellingmanhattanОценок пока нет

- Large Fog Collectors New Strategies For Collection Efficiency and Structural Response To Wind Pressure 2015 Atmospheric ResearchДокумент14 страницLarge Fog Collectors New Strategies For Collection Efficiency and Structural Response To Wind Pressure 2015 Atmospheric ResearchChristianОценок пока нет

- Female sanitation workers' experience during CovidДокумент89 страницFemale sanitation workers' experience during CovidDevyani KaleОценок пока нет