Академический Документы

Профессиональный Документы

Культура Документы

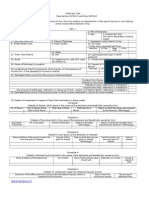

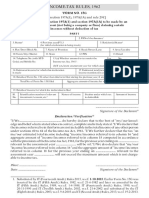

"Form No. 15H: Area Code Range Code AO No. AO Type

Загружено:

pkw0070 оценок0% нашли этот документ полезным (0 голосов)

19 просмотров2 страницыThis document appears to be Form 15H, which is used in India to declare certain income without deduction of tax if the individual is over 60 years of age. The form includes several schedules to provide details of:

- Shares held by the declarant (Schedule I)

- Sums given by the declarant on interest (Schedule II)

- Mutual fund units held by the declarant (Schedule III)

- Withdrawals from savings schemes (Schedule IV)

The form collects information like the declarant's name, address, PAN, income sources and amounts. It requires declarations from the individual and verification from the person paying the income.

Исходное описание:

Form15H

Оригинальное название

Form15H

Авторское право

© © All Rights Reserved

Доступные форматы

PDF, TXT или читайте онлайн в Scribd

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документThis document appears to be Form 15H, which is used in India to declare certain income without deduction of tax if the individual is over 60 years of age. The form includes several schedules to provide details of:

- Shares held by the declarant (Schedule I)

- Sums given by the declarant on interest (Schedule II)

- Mutual fund units held by the declarant (Schedule III)

- Withdrawals from savings schemes (Schedule IV)

The form collects information like the declarant's name, address, PAN, income sources and amounts. It requires declarations from the individual and verification from the person paying the income.

Авторское право:

© All Rights Reserved

Доступные форматы

Скачайте в формате PDF, TXT или читайте онлайн в Scribd

0 оценок0% нашли этот документ полезным (0 голосов)

19 просмотров2 страницы"Form No. 15H: Area Code Range Code AO No. AO Type

Загружено:

pkw007This document appears to be Form 15H, which is used in India to declare certain income without deduction of tax if the individual is over 60 years of age. The form includes several schedules to provide details of:

- Shares held by the declarant (Schedule I)

- Sums given by the declarant on interest (Schedule II)

- Mutual fund units held by the declarant (Schedule III)

- Withdrawals from savings schemes (Schedule IV)

The form collects information like the declarant's name, address, PAN, income sources and amounts. It requires declarations from the individual and verification from the person paying the income.

Авторское право:

© All Rights Reserved

Доступные форматы

Скачайте в формате PDF, TXT или читайте онлайн в Scribd

Вы находитесь на странице: 1из 2

7.

Assessed in which Ward/Circle

No. of

shares

Total value

of shares

Amount of

Amount of

sums given

on interest

Rate of

interest

Number of

units

(Details of the withdrawal made from Savings Scheme)

Range Code

8. Road/Street/Lane

13. PIN

Interest on sums referred to in Schedule III

9. Area/Locality

14. Last Assessment Year in which assessed

17. Present Ward/Circle

12. State

3. Age 4. Assessment Year

(for which is being made)

1. Name of Assessee (Declarant)

10. AO Code(under whom assessed last

Area Code

AO No.

19. Present AO Code (if not same as above)

AO Type

"FORM NO. 15H

[See 197A(1C) and rule 29C(1A)]

PART-I

under 197A(1C) of the Income-tax Act, 1961 to be made by an individual who is of the age of sixty years or more claiming certain receipts

without of tax.

5. Flat/Door/Block No. 6. Name of Premises

2. PAN of the Assessee

18. Name of

15. Email 16. Telephone No. (with STD Code) and Mobile No.

20. Chief Commissioner of Income-tax or Commissioner of Income-tax(if not assessed

to Income-tax earlier)

11. Town/City/District

Range Code AO No.

Income from units referred to in Schedule IV

AO Type

Area Code

21. total income from the sources below

Dividend from shares referred to in Schedule I

Interest on referred to in Schedule II

(Please the relevant box)

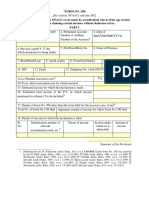

SCHEDULE-V

Name and address of the

person to whom the sums are

given on interest

SCHEDULE-II

of the Post Oce where the account under the

Savings Scheme is maintained and the account number

Date on which the account was

opened(dd/mm/yyyy)

The amount of

withdrawal from the

account

Name and address of the

mutual fund

SCHEDULE-III

(Details of the sums given by the declarant on interest)

SCHEDULE-IV

(Details of the mutual fund units held in the name of declarant and benecially owned by him)

The amount of withdrawal referred to in clause (a) of sub- 2 of 80CCA referred to in Schedule V

22. total income of the previous year in which income in Column 21 is to be included

(Details of shares, which stand in the name of the declarant and benecially owned by him)

23.Details of investments in respect of which the is being made:

Number of

of

SCHEDULE-I

Date(s) of

(dd/mm/yyyy)

Date(s) on which the were acquired by the

declarant(dd/mm/yyyy)

Class of shares &

face value of each

share

numbers of

the shares

Date(s) on which the shares were acquired by the

declarant(dd/mm/yyyy)

Class of units and face

value of each unit

number of units

Income in respect of

units

Period for which such sums were

given on interest

Date on which the sums were

given on interest(dd/mm/yyyy)

(Details of the held in the name of declarant and benecially owned by him)

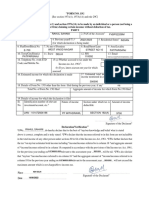

Declaraton/Vericaton

.

Signature of the Declarant

Place:

Date:

Place:

Date:

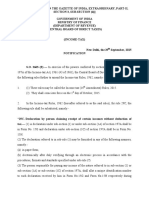

Notes:

1.

2.

3.

i)

ii)

4.

Before signing the vericaton , the declarant should satsfy himself hat he informaton furnished in the declaraton is true, correct and complete in all

respects. Any person making a false statementn the declaraton shall be liable to prosecuton under 277 of he Income-tax Act, 1961 and on convicton be

punishable-

[For use by the person to whom the declaraton is furnished]

*Delete whichever is not applicable.

The person responsible for paying the income referred to in column 21 of Part I shall not accept he declaraton where the amount o ncome of he nature

referred to in secton 197A(1C) or the aggregate of he amounts of such income credited or paid or likely to be credited or paid during the previous year in

which such income is to be included exceeds the maximum amount which is not chargeable to tax and deducton(s) under Chapter VI-A, if any, for which the

declarant is eligible.";

In a case where tax sought o be evaded exceeds twenty-ve lakh rupees, with rigorous imprisonment which shall not be less than 6 months but

which may extend to seven years and with ne;

In any other case, with rigorous imprisonment which shall not be less than 3 months but which may extend to two years and with ne.

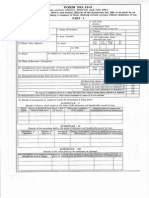

PART II

2. PAN of the person indicated in Column 1 of Part II

4. TAN of the person indicated in Column 1 of Part II

Forwarded to the Chief Commissioner or Commissioner of Income-tax

..

5. Email

The declaraton should be furnished in duplicate.

6. Telephone No. (with STD Code) and Mobile No.

7. Status

Signature of the Declarant

..

..

.

Signature of he person responsible for

paying the income referred to in Column

21 of Part I

.

.

3. Complete Address

I.do hereby declare that I am resident n India within the meaning of secton 6 of he Income-tax Act, 1961. I also, hereby declare that o

the best of my knowledge and belief what s stated above is correct, complete and is truly stated and that he incomes referred to in this form are not

includible in the total income of any other person u/s 60 to 64 of he Income-tax Act, 1961. I further, declare that he tax on my estmated total income,

including *income/incomes referred to in column 21 computed in accordance with the provisions of he Income-tax Act, 1961, for the previous year ending on

.................... relevant to the assessment year ..................will be nil.

12. Date of declaraton, distributon or payment of

dividend/withdrawal under the Natonal Savings

Scheme(dd/mm/yyyy)

13. Account number of Natonal Savings Scheme from which withdrawal has been made

8. Date on which declaraton is furnished

(dd/mm/yyyy)

9. Period in respect of which the dividend has been

declared or the income has been paid/credited

10. Amount of income paid 11. Date on which the

income has been paid /

credited(dd/mm/yyyy)

1. Name of the person responsible for paying the income referred to in Column 21 of Part I

Вам также может понравиться

- 15G FormДокумент2 страницы15G Formgrover.jatinОценок пока нет

- New Form 15H For Fixed Deposits Editable in PDFДокумент2 страницыNew Form 15H For Fixed Deposits Editable in PDFMutual Funds Advisor ANANDARAMAN 944-529-6519Оценок пока нет

- Form No 15HДокумент3 страницыForm No 15HsaymtrОценок пока нет

- "Form No. 15H (See Section 197A (1C) and Rule 29C (1A) ) Declaration Under Section 197A (1C) of The Income of Sixty Years or More Claiming Certain Receipts Without Deduction of TaxДокумент3 страницы"Form No. 15H (See Section 197A (1C) and Rule 29C (1A) ) Declaration Under Section 197A (1C) of The Income of Sixty Years or More Claiming Certain Receipts Without Deduction of TaxRajanОценок пока нет

- "Form No. 15H (See Section 197A (1C) and Rule 29C (1A) ) Declaration Under Section 197A (1C) of The Income of Sixty Years or More Claiming Certain Receipts Without Deduction of TaxДокумент3 страницы"Form No. 15H (See Section 197A (1C) and Rule 29C (1A) ) Declaration Under Section 197A (1C) of The Income of Sixty Years or More Claiming Certain Receipts Without Deduction of TaxRajanОценок пока нет

- OBC Bank Form - 15H PDFДокумент2 страницыOBC Bank Form - 15H PDFKrishnan Vaidyanathan100% (1)

- Form 15g TaxguruДокумент3 страницыForm 15g Taxguruulhas_nakasheОценок пока нет

- PDFДокумент4 страницыPDFushapadminivadivelswamyОценок пока нет

- Form No. 15H: Part - IДокумент2 страницыForm No. 15H: Part - Itoton33Оценок пока нет

- "Form No. 15G: AO No. AO Type Range Code Area CodeДокумент2 страницы"Form No. 15G: AO No. AO Type Range Code Area CodePruthvish ShuklaОценок пока нет

- Bonds Form 15gДокумент3 страницыBonds Form 15gRishi TОценок пока нет

- PAN No.Документ5 страницPAN No.haldharkОценок пока нет

- Form 15 HДокумент2 страницыForm 15 Hsingh ramanpreetОценок пока нет

- PDF 4Документ3 страницыPDF 47ola007Оценок пока нет

- 15h Form (1) - CompressedДокумент4 страницы15h Form (1) - Compressedrekha safarirОценок пока нет

- New Form 15G PDFДокумент2 страницыNew Form 15G PDFSoma Sundar50% (2)

- Tax Form 15H PDFДокумент4 страницыTax Form 15H PDFraviОценок пока нет

- Form 15H Format 1Документ4 страницыForm 15H Format 1ASHISH KINIОценок пока нет

- 15G FormДокумент2 страницы15G Formsurendar147Оценок пока нет

- Form No. 15H: (IT Dept. Copy)Документ9 страницForm No. 15H: (IT Dept. Copy)jpsmu09Оценок пока нет

- New Form 15G Form 15H PDFДокумент6 страницNew Form 15G Form 15H PDFdevender143Оценок пока нет

- BLANK IOCL Form 15GДокумент3 страницыBLANK IOCL Form 15Gsaiboyshostel37Оценок пока нет

- Form No.15gДокумент2 страницыForm No.15gPrakash GowdaОценок пока нет

- Form 15g NewДокумент4 страницыForm 15g NewnazirsayyedОценок пока нет

- Form 15GДокумент2 страницыForm 15GSrinivasa RaghavanОценок пока нет

- 103120000000007845Документ3 страницы103120000000007845arjunv_14100% (1)

- Form 15 GДокумент2 страницыForm 15 GRahul SahaniОценок пока нет

- TAX SAVING Form 15g Revised1 SBTДокумент2 страницыTAX SAVING Form 15g Revised1 SBTrkssОценок пока нет

- Srnoin Form 15G Srnoin Form 15H Particulars (Required Details)Документ6 страницSrnoin Form 15G Srnoin Form 15H Particulars (Required Details)priyaradhiОценок пока нет

- Income-Tax Rules, 1962: (See Section 197A (1), 197A (1A) and Rule 29C)Документ4 страницыIncome-Tax Rules, 1962: (See Section 197A (1), 197A (1A) and Rule 29C)utuavn evОценок пока нет

- Form No. 15GДокумент9 страницForm No. 15Gjpsmu09Оценок пока нет

- Income Tax DepartmentДокумент6 страницIncome Tax DepartmentRajasekar SivaguruvelОценок пока нет

- PDF Editor: Form No. 15GДокумент2 страницыPDF Editor: Form No. 15GImissYouОценок пока нет

- FORM-15G: (Please Tick The Relevant Box)Документ4 страницыFORM-15G: (Please Tick The Relevant Box)Kayam BalajiОценок пока нет

- Form 15GДокумент3 страницыForm 15Gsriramdutta9Оценок пока нет

- New Form No 15GДокумент4 страницыNew Form No 15GDevang PatelОценок пока нет

- 15 G Form (Pre-Filled)Документ2 страницы15 G Form (Pre-Filled)Palaniappan Meyyappan83% (6)

- 15 G Form (Pre-Filled)Документ8 страниц15 G Form (Pre-Filled)pankaj_electricalОценок пока нет

- 15 G Form (Pre-Filled)Документ2 страницы15 G Form (Pre-Filled)Pawan Yadav0% (2)

- Form 15gДокумент4 страницыForm 15gcontactus kannanОценок пока нет

- "Form No. 15GДокумент2 страницы"Form No. 15GJayvin ShiluОценок пока нет

- Form 15h Revised1Документ2 страницыForm 15h Revised1rajprince26460Оценок пока нет

- Form 15 H - 2020-21Документ2 страницыForm 15 H - 2020-21Lavesh DixitОценок пока нет

- FD - Form 15 - G - Oct 2015Документ6 страницFD - Form 15 - G - Oct 2015mohantamilОценок пока нет

- New FORM 15H Applicable PY 2016-17Документ2 страницыNew FORM 15H Applicable PY 2016-17addsingh100% (1)

- Form 15GДокумент4 страницыForm 15GRavi SainiОценок пока нет

- Form15h GH01389401 PDFДокумент3 страницыForm15h GH01389401 PDFNamme KyarakhahaiОценок пока нет

- Bar Review Companion: Taxation: Anvil Law Books Series, #4От EverandBar Review Companion: Taxation: Anvil Law Books Series, #4Оценок пока нет

- Simple Guide for Drafting of Civil Suits in IndiaОт EverandSimple Guide for Drafting of Civil Suits in IndiaРейтинг: 4.5 из 5 звезд4.5/5 (4)

- Introduction to Negotiable Instruments: As per Indian LawsОт EverandIntroduction to Negotiable Instruments: As per Indian LawsРейтинг: 5 из 5 звезд5/5 (1)

- 1040 Exam Prep: Module II - Basic Tax ConceptsОт Everand1040 Exam Prep: Module II - Basic Tax ConceptsРейтинг: 1.5 из 5 звезд1.5/5 (2)

- J.K. Lasser's Your Income Tax 2019: For Preparing Your 2018 Tax ReturnОт EverandJ.K. Lasser's Your Income Tax 2019: For Preparing Your 2018 Tax ReturnОценок пока нет

- Reply Brief in Support of Apple's Motion To VacateДокумент33 страницыReply Brief in Support of Apple's Motion To VacateKif Leswing0% (1)

- Case CommentДокумент9 страницCase CommentNishantОценок пока нет

- No Inquiry Before FIRДокумент2 страницыNo Inquiry Before FIRpriyaОценок пока нет

- Definition Usul FiqhДокумент3 страницыDefinition Usul FiqhMohd FekhriОценок пока нет

- Caloocan City Ordinance No. 0386-04 PDFДокумент83 страницыCaloocan City Ordinance No. 0386-04 PDFnathalie velasquez0% (1)

- Inspection Report 008PE2018 EndetoДокумент2 страницыInspection Report 008PE2018 Endetorcpretorius0% (1)

- Tax 2 - Unit 2. Chapter 2.Документ7 страницTax 2 - Unit 2. Chapter 2.Rujean Salar AltejarОценок пока нет

- MASN Notice of AppealДокумент36 страницMASN Notice of Appealngrow9Оценок пока нет

- De Ocampo vs. Florenciano 107 Phil 35Документ9 страницDe Ocampo vs. Florenciano 107 Phil 35Bfp Siniloan FS LagunaОценок пока нет

- Law of Torts Defence of Consent I Volenti Non Fit InjuriaДокумент23 страницыLaw of Torts Defence of Consent I Volenti Non Fit InjuriaAyushi RajputОценок пока нет

- The Attorney General V Gammon (CACC001033-1982)Документ13 страницThe Attorney General V Gammon (CACC001033-1982)William TongОценок пока нет

- Criminal Law Book 1 ReviewerДокумент13 страницCriminal Law Book 1 ReviewerBelinda Viernes91% (11)

- Section 12Документ6 страницSection 12vvishaljaswaОценок пока нет

- Directive Principles of State PolicyДокумент27 страницDirective Principles of State PolicyAiswarya a Sunil100% (1)

- SPL Special Penal LawsДокумент12 страницSPL Special Penal LawsCarla January OngОценок пока нет

- Reconstruction Finance Corp. v. Kaplan in Re Waltham Watch Co, 185 F.2d 791, 1st Cir. (1951)Документ11 страницReconstruction Finance Corp. v. Kaplan in Re Waltham Watch Co, 185 F.2d 791, 1st Cir. (1951)Scribd Government DocsОценок пока нет

- Role, Cost and Mangement of Hospitality FacilitiesДокумент40 страницRole, Cost and Mangement of Hospitality FacilitiesjessieОценок пока нет

- Fingerprint InstructionsДокумент4 страницыFingerprint InstructionsDaniel OngОценок пока нет

- Short Duration Discussions (Rule-193) Further Discussion On Need ... On 7 May, 2010Документ10 страницShort Duration Discussions (Rule-193) Further Discussion On Need ... On 7 May, 2010sreevarshaОценок пока нет

- Your Straw ManДокумент8 страницYour Straw ManJonah OrangeОценок пока нет

- Sentència D'estrasburgДокумент5 страницSentència D'estrasburgModerador Noticies WebОценок пока нет

- Feds Probe Fulton Bank and 3 Other Subsidiary Banks of Fulton Financial With Stan J. Caterbone Civil Actions and Mind Control Research of Monday November 9, 2016Документ946 страницFeds Probe Fulton Bank and 3 Other Subsidiary Banks of Fulton Financial With Stan J. Caterbone Civil Actions and Mind Control Research of Monday November 9, 2016Stan J. CaterboneОценок пока нет

- 187854Документ9 страниц187854The Supreme Court Public Information OfficeОценок пока нет

- Hill V VelosoДокумент3 страницыHill V VelosoChaii CalaОценок пока нет

- Grand Boulevard Hotel v. Genuine Labor OrganizationДокумент2 страницыGrand Boulevard Hotel v. Genuine Labor OrganizationAnonymous 5MiN6I78I0100% (1)

- Bosnia V SerbiaДокумент2 страницыBosnia V Serbiacarl dianneОценок пока нет

- Pakistan The Factories Act, 1934: CHAPTER I - PreliminaryДокумент56 страницPakistan The Factories Act, 1934: CHAPTER I - Preliminarydanni1Оценок пока нет

- Powell County Growth PolicyДокумент119 страницPowell County Growth PolicyDeerlodge Valley Conservation DistrictОценок пока нет

- Deed of Absolute SaleДокумент6 страницDeed of Absolute SaleEvita Faith LeongОценок пока нет

- Uniform Plumbing Code Uniform Plumbing Code Standards 2009 EditionДокумент104 страницыUniform Plumbing Code Uniform Plumbing Code Standards 2009 EditionVijaya Raghavan100% (1)