Академический Документы

Профессиональный Документы

Культура Документы

Form No 15H

Загружено:

Prajesh SrivastavaИсходное описание:

Оригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Form No 15H

Загружено:

Prajesh SrivastavaАвторское право:

Доступные форматы

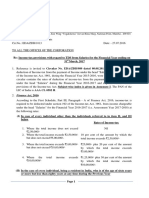

FORM NO.

15H

[See Section 197A(1C) and Rule 29C(1A)]

Declaration under section 197A(1C) of the Income Tax Act, 1961 to be made by an indiidual !ho is of the a"e of sixty #ear or more claimin" certain recei$ts !ithout deduction of

tax%

&art ' I

()% Details of Inbestment in res$ect of !hich the Declaration is bein" made*

+chedule I

(Details of +hares, !hich stand in the name of the declarant and beneficially o!ned by him)

,o% of +hares Class of +hares - .ace /alue of

0ach +hares

Total /alue of +hare Distinctie ,o of +hares Date(s) on !hich the shares !ere ac1uired by the

declarant (dd2mm2yyyy)

+chedule II

(Details of +ecurities held in the name of the declarant and beneficially o!ned by him)

Descri$tion of

+ecurities

,o% of +ecurities Amount of +ecurities Date(s) of +ecurities

(dd2mm2yyyy)

Date(s) on !hich the securities !ere ac1uired by the

declarant (dd2mm2yyyy)

+chedule III

(Details of sum "ien by the declarant on interest)

,ame - Address of the $erson to !hom the sums are "ien

on interest

Amount of +um "ien

on interest

Date on !hich the sum !as "ien

on interest (dd2mm2yyyy)

&eriod for !hich such sum

!ere "ien on interest

3ate of Interest

+chedule I/

(Details of 4utual .und 5nits held in the name of the declarant and beneficially o!ned by him)

,ame - Address of the 4utual .und ,o% of 5nits Class of 5nit and .ace alue of

each unit

Distinctie no% of 5nits Income in

res$ect of units

+chedule /

(Details of !ithdra!al made from ,ational +ain"s +ceme)

&articulars of &ost 6ffice !here the account under the ,ational +ain"s scheme is maintained and Account ,o% Date on !hich the account

!as o$ened (dd2mm2yyyy)

The amount of !ithdra!al

from account

+i"nature of the Declarant

Declaration2 /erification

1% ,ame of Assessee (Declarant)* (% &A, of Assessee *

)% A"e * 7% Assessment #ear *

(.or !hich declaration is bein" made)

8% .lat2 Door2 9loc: ,o%* 6% ,ame of &remises* 7% Assessed in !hich ;ard 2 Circle *

<% 3oad2 +treet2 =ane* 9% Area2 =ocality* 1>% A6 Code*

( 5nder !hom assessed last time)

Area Code A6 Ty$e 3an"e Code A6 ,o%

11% To!n2 City2 District*

1(% +tate*

1)% &I,* 17% =ast Assessment year in !hich assessed*

18% 0mail 16% Tele$hone ,o% (!ith +TD code) and

4obile ,o%*

17% &resent ;ard2 Circle

1<% ,ame of 9usiness2 6ccu$ation * 19% &resent A6 Code ( if not same as aboe)

(>% ?urisdictional Chief Commissioner of Income tax or Commissioner of Income Tax ( if not

assessed to Income Tax earlier*

Area Code A6 Ty$e 3an"e Code A6 ,o%

(1% 0stimated Total Income from the sources mentioned belo!

) &lease Tic: the 3eleant 9ox (

Diidend from +hares referred to in +chedule I

Interest on +ecurities referred to in schedule II

Interest on sums referred to in schedule III

Income from 5nits referred to in schedule I/

The amount of !ithdra!al referred to in Clause (a) of +ub ' section ( of +ection <>CCA referred to in schedule /

((% 0stimated total income of the $reious year in !hich income mentioned in column (1 to be included

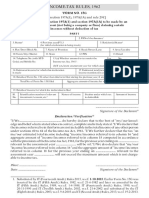

I @@@@@@@@@@@@@@@@@ do hereby declare that I am resident in India !ithin the meanin" of section 6 of the Income Tax Act, 1961% I also,

hereby declare that to the best of my :no!led"e and belief !hat is stated aboe is correct, com$lete and is truly stated and the incomes

referred to in this form are not includible in the total income of any other $erson u2s 6> to 67 of the Income Tax Act, 1961% I further, declare

that the tax on my estimated total income, includin" Aincome2 incomes referred to in column (1 com$uted in accordance !ith the $roisions

of the Income Tax Act, 1961, for a $reious year endin" on )1

st

4arch BBBBBBB releant to the Assessment

yearBBBBBBBB !ill be nil%

&lace*

Date*

+i"nature of the Declarant

&A3T II

C.or use by the $erson to !hom the declaration is furnishedD

1% ,ame of the $erson res$onsible for $ayin" the income referred to in column (1 of &art I* (% &A, of the $erson indicated in column 1 of

&art II*

)% Com$lete Address* 7% TA, of the $erson indicated in column 1 of

&art II*

8% 0mail 6% Tele$hone ,o% (!ith +TD code) and 4obile

,o%*

7% +tatus*

<% Date on !hich declaration is furnished

(dd2mm2yyyy)

9% &eriod in res$ect of !hich the diidend has

been declared or the income has been $aid2

credited*

1>% Amount of Income

&aid*

11% Date on !hich the

income has been $aid2

Credited

(dd2mm2yyyy)

1(% Date of declaration, distribution or $ayment of diidend 2 !ithdra!al under

the ,ational +ain"s +cheme

(dd2mm2yyyy)

1)% Account no% of ,ational +ain"s +cheme from !hich !ithdra!al has

been made*

.or!arded to Chief Commissioner or Commissioner of Income TaxBBBBBBBBBBBBBBBBBBB%%

&lace*

Date*

+i"nature of the $erson res$onsible for $ayin" the

income referred to in column (1 of &art I

,otes*

1% The declaration should be furnished in du$licate%

(% A Delete !hicheer is not a$$licable%

)% 9efore si"nin" the erification, the declarant should satisfy himself that the information furnished in the declaration is true, correct and com$lete in all res$ects%

Any $erson ma:in" a false statement in the declaration shall be liable to $rosecution under section (77 of the Income Tax Act, 1961 and on coniction be $unishable '

(i) In a case !here tax sou"ht to be eaded exceeds t!enty fie la:h ru$ees, !ith ri"orous im$risonment !ich shall not be less than six months but

!hich may extend to seen years and !ith fine E

(ii) In any other case, !ith ri"orous im$risonment !hich shall not be less than three months but !hich may extend to t!o years and !ith fine%

7% The $erson res$onsible for $ayin" the income referred to in column (1 of &art I shall not acce$t the declaration !here the amount of income of the nature referred to in

section 197A(1C) or the a""re"ate of the amounts of such income credited or $aid or li:ely to be credited or $aid durin" the $reious year in !hich such income is to be

included exceeds the maximum amount !hich is not char"eable to tax and deduction(s) under Cha$ter /I A, if any , for !hich the declarant is eli"ible%

Вам также может понравиться

- PCL Chap 4 en CaДокумент70 страницPCL Chap 4 en CaRenso Ramirez100% (1)

- HRD 2401-Hps 2112-Entrepreneurship Skills Notes-Juja May 2015Документ46 страницHRD 2401-Hps 2112-Entrepreneurship Skills Notes-Juja May 2015Jackson100% (13)

- Formula, Rates and Due Dates REAДокумент21 страницаFormula, Rates and Due Dates REAKaren Balisacan Segundo Ruiz100% (2)

- Worksheet PalaganasДокумент38 страницWorksheet PalaganasMomo HiraiОценок пока нет

- Form 15g Blank1Документ2 страницыForm 15g Blank1Rasesh ShahОценок пока нет

- 201455200239Amendments-F.a. 2013 - For UplaodingДокумент7 страниц201455200239Amendments-F.a. 2013 - For UplaodingvishalniОценок пока нет

- Taxation System in IndiaДокумент13 страницTaxation System in IndiaTahsin SanjidaОценок пока нет

- Form No.16: Part AДокумент5 страницForm No.16: Part APradeep KumarОценок пока нет

- IT Return IndividualДокумент42 страницыIT Return IndividualAllanОценок пока нет

- Pan NoДокумент3 страницыPan NokpsmilraviОценок пока нет

- 15G FormДокумент2 страницы15G Formgrover.jatinОценок пока нет

- Dimaampao Tax NotesДокумент63 страницыDimaampao Tax NotesMaruSalvatierra100% (1)

- New Form 15G Form 15H PDFДокумент6 страницNew Form 15G Form 15H PDFdevender143Оценок пока нет

- Form 3CD NewДокумент16 страницForm 3CD NewRikta KariaОценок пока нет

- Income Tax 2017 Edazdb1013Документ50 страницIncome Tax 2017 Edazdb1013Pradeep PatilОценок пока нет

- Notf.36 2000 CeДокумент2 страницыNotf.36 2000 Cepatelpratik1972Оценок пока нет

- Form No. 16: Finotax 1 of 3Документ3 страницыForm No. 16: Finotax 1 of 3dugdugdugdugiОценок пока нет

- Financial Condition Report (FCR) For General Insurance CompaniesДокумент28 страницFinancial Condition Report (FCR) For General Insurance Companiesraheja_ashishОценок пока нет

- Advance Payment of TaxДокумент11 страницAdvance Payment of TaxParul Bhardwaj VaidyaОценок пока нет

- Tax Credit Statement (: Instructions For Filling FORM ITR-2Документ6 страницTax Credit Statement (: Instructions For Filling FORM ITR-2ajey_p1270Оценок пока нет

- Commissioner of Internal Revenue vs. Fortune Tobacco Corporation (July 21, 2008 and September 28, 2011)Документ7 страницCommissioner of Internal Revenue vs. Fortune Tobacco Corporation (July 21, 2008 and September 28, 2011)Vince LeidoОценок пока нет

- Memorandum of Agreement TOV 29072014Документ5 страницMemorandum of Agreement TOV 29072014BobbyConchasОценок пока нет

- Tax Credit Statement (: Instructions For Filling FORM ITR-2Документ7 страницTax Credit Statement (: Instructions For Filling FORM ITR-2Manyam JainiОценок пока нет

- Form No. 15G: Area Code AO Type Range Code Ao NoДокумент2 страницыForm No. 15G: Area Code AO Type Range Code Ao NoRanjan ManoОценок пока нет

- Notes in VATДокумент6 страницNotes in VATJuris GempisОценок пока нет

- 16 Deductions Under Chapter ViaДокумент89 страниц16 Deductions Under Chapter ViabinoygnairОценок пока нет

- Notes On Exempted IncomeДокумент4 страницыNotes On Exempted Incomevaibs8900Оценок пока нет

- Guide For Preparation of Income Tax Return-ITR1 (SARAL-II) For AY 2010-11Документ6 страницGuide For Preparation of Income Tax Return-ITR1 (SARAL-II) For AY 2010-11amitbabuОценок пока нет

- 15 G Form (Pre-Filled)Документ2 страницы15 G Form (Pre-Filled)Pawan Yadav0% (2)

- CIR Vs PhilamlifeДокумент2 страницыCIR Vs PhilamlifeBreAmberОценок пока нет

- You're Nearly There! To Ensure That Your Payment Is Received by Your Institution Without Any Delays, Please Follow The Instructions BelowДокумент6 страницYou're Nearly There! To Ensure That Your Payment Is Received by Your Institution Without Any Delays, Please Follow The Instructions BelowJosin JoseОценок пока нет

- Revenue RegulationsДокумент13 страницRevenue RegulationsErika AvedilloОценок пока нет

- Chapter Xxi.cДокумент12 страницChapter Xxi.cdakshbajajОценок пока нет

- T1 - Introduction To Malaysian Tax & Resident Status (A)Документ7 страницT1 - Introduction To Malaysian Tax & Resident Status (A)Vincent ChenОценок пока нет

- Be It Enacted by The Senate and House of Representatives of The Philippine Congress AssembledДокумент6 страницBe It Enacted by The Senate and House of Representatives of The Philippine Congress AssembledAdeline HoodhemwinfordОценок пока нет

- Income TaxДокумент10 страницIncome TaxSanda ZahariaОценок пока нет

- Instructions For Filling Out FORM ITR-2Документ8 страницInstructions For Filling Out FORM ITR-2Ganesh KumarОценок пока нет

- Know More About Income TaxДокумент5 страницKnow More About Income TaxcanarayananОценок пока нет

- Flat/Door/Block No. 7 7. Name of Premises 8.Rond/Street/Lane os9.Area/Locality Vaidn Hna QovДокумент3 страницыFlat/Door/Block No. 7 7. Name of Premises 8.Rond/Street/Lane os9.Area/Locality Vaidn Hna QovVishwini ViswanathanОценок пока нет

- Instructions For Filling Out FORM ITR-2Документ7 страницInstructions For Filling Out FORM ITR-2Harminder Singh DhamОценок пока нет

- See Section 194C and Rule 37Документ5 страницSee Section 194C and Rule 37Trans TradesОценок пока нет

- FAQsДокумент10 страницFAQsrajdeeppawarОценок пока нет

- Minimum Corporate Income Tax: A Bane or A Boon? by Rosalino G. Fontanosa, Cpa, MbaДокумент14 страницMinimum Corporate Income Tax: A Bane or A Boon? by Rosalino G. Fontanosa, Cpa, MbaanggandakonohОценок пока нет

- E-TDS Return Preparation SoftwareДокумент37 страницE-TDS Return Preparation Softwareshabs4uroseОценок пока нет

- Form 15GДокумент3 страницыForm 15GRahul DattoОценок пока нет

- Tax Form 15H PDFДокумент4 страницыTax Form 15H PDFraviОценок пока нет

- 103120000000007845Документ3 страницы103120000000007845arjunv_14100% (1)

- Domondon NotesДокумент15 страницDomondon NotesShiela ValdezОценок пока нет

- Events After The Reporting Period: Myanmar Accounting Standard 10Документ5 страницEvents After The Reporting Period: Myanmar Accounting Standard 10Kyaw Htin WinОценок пока нет

- By CA Rajeev Kumar Ranjan Mob. No. 8100052661: Management's Responsibility For The Financial StatementsДокумент3 страницыBy CA Rajeev Kumar Ranjan Mob. No. 8100052661: Management's Responsibility For The Financial Statementspathan1990Оценок пока нет

- Tax RatesДокумент3 страницыTax RatesAhmed RazaОценок пока нет

- Taxation of Salaried EmployeesДокумент39 страницTaxation of Salaried Employeessailolla30Оценок пока нет

- Tax Send Up Aug 2011Документ3 страницыTax Send Up Aug 2011Minhaj SikanderОценок пока нет

- Milton Form16Документ4 страницыMilton Form16sundar1111Оценок пока нет

- Chapter 8 Income Taxes: Learning ObjectivesДокумент40 страницChapter 8 Income Taxes: Learning Objectivessamuel_dwumfourОценок пока нет

- Auditors, Advocates, Taxation & Company Law AdvisorsДокумент3 страницыAuditors, Advocates, Taxation & Company Law AdvisorsHussain MehmoodОценок пока нет

- Rental-Property Profits: A Financial Tool Kit for LandlordsОт EverandRental-Property Profits: A Financial Tool Kit for LandlordsОценок пока нет

- Unloved Bull Markets: Getting Rich the Easy Way by Riding Bull MarketsОт EverandUnloved Bull Markets: Getting Rich the Easy Way by Riding Bull MarketsОценок пока нет

- A Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionОт EverandA Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionОценок пока нет

- BRAUДокумент3 страницыBRAUKrisОценок пока нет

- Acctg 123 Merchandising Operations WorksheetДокумент18 страницAcctg 123 Merchandising Operations WorksheetCyruz Jared RamosОценок пока нет

- Lecture2020 SSP 9757Документ30 страницLecture2020 SSP 9757Sebastian ZhangОценок пока нет

- Lecture Week 8Документ51 страницаLecture Week 8Muhammad HusseinОценок пока нет

- Chapter 2Документ21 страницаChapter 2TENGKU NURUL ALISYA TENGKU AHMADОценок пока нет

- Economics and International BusinessДокумент23 страницыEconomics and International BusinessEthelyn Cailly R. ChenОценок пока нет

- Chapter Five: The Financial Statements of Banks and Their Principal CompetitorsДокумент39 страницChapter Five: The Financial Statements of Banks and Their Principal CompetitorsThu ThaoОценок пока нет

- Financial Statements: Viet Nam - Aeg Joint Stock CompanyДокумент3 страницыFinancial Statements: Viet Nam - Aeg Joint Stock CompanyHung NguyenОценок пока нет

- Chapter 5 Accounting For Merchandising Operations PDFДокумент36 страницChapter 5 Accounting For Merchandising Operations PDFJed Riel BalatanОценок пока нет

- Quiz #2 - BSA 23 Absorp Variable CostingДокумент6 страницQuiz #2 - BSA 23 Absorp Variable CostingShiela Mae Pon AnОценок пока нет

- Tax Assignment 3Документ2 страницыTax Assignment 3Monis KhanОценок пока нет

- S6 ENTREPRENUERSHIP Needed Notes To The EndДокумент84 страницыS6 ENTREPRENUERSHIP Needed Notes To The EndRAMZ RA WILZОценок пока нет

- Statistical Appendix in English PDFДокумент175 страницStatistical Appendix in English PDFMADHAVОценок пока нет

- Unit 3 KeynoteДокумент12 страницUnit 3 KeynoteTrung HiếuОценок пока нет

- SS 07 Quiz 2 - AnswersДокумент130 страницSS 07 Quiz 2 - AnswersVan Le Ha100% (1)

- MCQ in - Basics of EconomicsДокумент27 страницMCQ in - Basics of Economicshearthacker_30288% (8)

- Current Affair Questions On Lagos StateДокумент43 страницыCurrent Affair Questions On Lagos Statealphatrade500Оценок пока нет

- Controlling Case StudyДокумент3 страницыControlling Case StudyJulius Torres SilvaОценок пока нет

- Advanced Accounting - 2015 (Chapter 17) Multiple Choice Solution (Part I)Документ1 страницаAdvanced Accounting - 2015 (Chapter 17) Multiple Choice Solution (Part I)John Carlos DoringoОценок пока нет

- Viray, Nhicole S. Asynchronous Quiz 1 - Accounting Changes and ErrorsДокумент6 страницViray, Nhicole S. Asynchronous Quiz 1 - Accounting Changes and ErrorsZeeОценок пока нет

- Managerial Acct 32 PDFДокумент41 страницаManagerial Acct 32 PDFemraan KhanОценок пока нет

- 1차 문제은행 국제재무기초 이상휘Документ50 страниц1차 문제은행 국제재무기초 이상휘JunОценок пока нет

- Mathematics: Standardised Competence-Oriented Written School-Leaving ExaminationДокумент12 страницMathematics: Standardised Competence-Oriented Written School-Leaving ExaminationbestgamerОценок пока нет

- Master Switchwords For Creating WealthДокумент5 страницMaster Switchwords For Creating WealthDennis ClintОценок пока нет

- ACW366 - Tutorial Exercises 5 PDFДокумент5 страницACW366 - Tutorial Exercises 5 PDFMERINAОценок пока нет

- Chapter 15Документ15 страницChapter 15franchesca123Оценок пока нет

- Income From House PropertyДокумент27 страницIncome From House PropertyJames Anderson0% (1)