Академический Документы

Профессиональный Документы

Культура Документы

Course of Business, or (Ii) in The Process of Production For Such Sale, or (Iii) For Consumption in The Production of Goods or Services For Sale

Загружено:

Aashray RjИсходное описание:

Оригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Course of Business, or (Ii) in The Process of Production For Such Sale, or (Iii) For Consumption in The Production of Goods or Services For Sale

Загружено:

Aashray RjАвторское право:

Доступные форматы

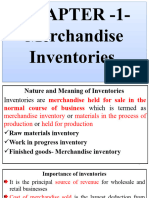

INVENTORIES

Inventories Defined

According to Accounting Standard 2 on Valuation of Inventories, issued by the

Institute of Chartered Accountants of India, Para 1,

Inventories are tangible property held (i) for sale in the ordinary

course of business, or (ii) in the process of production for such

sale, or (iii) for consumption in the production of goods or services

for sale.

Components of Inventory

For a manufacturing firm, raw materials, semi-finished goods and finished goods.

For merchandising firm, only the finished goods

INVENTORY VALUATION METHODS

The following are the methods of inventory valuation. There are mainly four

commonly used methods in the valuation of inventory. Accountants generally accept all these

four methods, but each of these is based on a different cost flow assumption.

To illustrate the four methods, the following data will be assumed for an accounting

period:

Units Unit Cost ( Rs.) Total Cost (Rs.)

Jan. 1 Beginning Inventory 100 2 200

Mar. 27 Purchase 100 3 300

June 12 Purchase 100 4 400

Sept. 19 Purchase 100 5 500

Nov. 30 Purchase 100 6 600

Available for sale 500 2,000

Sold 350

Dec. 31 Ending Inventory 150

1. Specific Identification Method

This method assigns specific costs to each unit sold and each unit on hand. This

method may be used if the units the ending inventory can be identified as coming from

specific purchases. The specific identification method is particularly suited to inventories of

high-value, low-volume items such as jewellery. Each unit in inventory must be identified

with an identification tag.

To illustrate, assume that December 31 inventory consisted of 60 units from March 27

purchase, 70 units from the June 12 purchase, and 20 units from the September 19 purchase.

The cost of ending inventory is then computed as follows:

60 units from the purchase of March 27 at Rs.3 Rs.180

70 units from the purchase of June 12 at Rs.4 280

20 units from the purchase of September 19 at Rs.5 100

________

Ending Inventory 560

________

The cost of goods sold is computed by subtracting the ending inventory from the cost of

goods available for sale, as shown below:

Cost of goods available for sale Rs.2,000

Less Ending inventory 560

________

Cost of goods sold 1,440

________

2. First-in, First-out (FIFO) Method

This method assumes that the first units acquired are the first units sold. Therefore

the cost of the units in the ending inventory is that of the most recent purchases. Although

the FIFO method is a cost flow assumption, physical flow often follows the first-in first-out

rule.

In the previous illustration the cost of the 150 units in the ending inventory would be

Rs.850, computed as follows:

50 units from the purchase of September 19 at Rs.5 Rs.250

100 units from the purchase of November 30 at Rs.6 600

Ending Inventory 850

Under FIFO method, the cost of goods sold is Rs.1,150 which is computed as follows:

Cost of goods available for sale Rs.2,000

Less Ending Inventory 850

Cost of goods sold 1,150

3. Last-in, First-out (FIFO) Method

The last in first out method assumes that the last units acquired are the first units sold.

Therefore the cost of the units in the ending inventory is that of the earliest purchases.

Under the LIFO method, the cost of 150 units in the ending inventory would be

Rs.350, computed as follows:

100 units from the purchase of January at Rs.2 Rs.200

50 units from the purchase of March 27 at Rs.3 150

Ending inventory 350

The cost of goods sold is Rs.1,650, computed as follows:

Cost of goods available for sale Rs.2,000

Less Ending Inventory 350

Cost of goods sold 1,650

4. Weighted-Average Cost Method

This method assumes that the goods available for sale are homogenous. Average cost

is computed by dividing the cost of goods available for sale, which comprise the cost

of the beginning inventory and all the purchases, by the number of units available for

sale. The weighted-average unit cost that results from this computation is applied to

the units in the ending inventory.

In the previous illustration, the unit cost under this method would be Rs.4, computed

as under:

Cost of goods available for sale Rs.2,000

Number of units available for sale 500

Weighted-average unit cost Rs. 4

Ending Inventory: 150 units @ Rs.4/- Rs. 600

The cost of goods sold is Rs.1,400, computed as follows:

Cost of goods available for sale Rs.2,000

Less Ending Inventory 600

Cost of goods sold 1,400

Вам также может понравиться

- Inventory ValuationДокумент12 страницInventory Valuationcooldude690Оценок пока нет

- Inv ValДокумент9 страницInv ValNishanth PrabhakarОценок пока нет

- 1.1. Inventory Costing Methods Under A Periodic SystemДокумент6 страниц1.1. Inventory Costing Methods Under A Periodic Systembeth elОценок пока нет

- Module 4 Valuation of InventoryДокумент6 страницModule 4 Valuation of Inventorykaushalrajsinhjanvar427Оценок пока нет

- Inventory ValuationДокумент23 страницыInventory Valuationvkvivekkm163Оценок пока нет

- One of The Largest Current Assets InventoryДокумент15 страницOne of The Largest Current Assets InventorySaadat ShaikhОценок пока нет

- Principle of Accounting 2 - Unit 2Документ17 страницPrinciple of Accounting 2 - Unit 2Denekew asmareОценок пока нет

- Chazpter One Accounting For InventoriesДокумент11 страницChazpter One Accounting For InventoriesyebegashetОценок пока нет

- Valuation of InventoryДокумент12 страницValuation of InventoryChandan SenapatiОценок пока нет

- Presentation 1Документ12 страницPresentation 1Chandan SenapatiОценок пока нет

- Methods of Inventory ValuationДокумент13 страницMethods of Inventory Valuationhajeer98ssОценок пока нет

- Chapter 1 InventoryДокумент12 страницChapter 1 InventoryDaniel AssefsОценок пока нет

- FIFO Method For Inventory Valuation May Increase Income Tax Due As Well As Showing True Financial Position of A BusinessДокумент2 страницыFIFO Method For Inventory Valuation May Increase Income Tax Due As Well As Showing True Financial Position of A BusinessRashid Rathor100% (1)

- Accounting For InventoriesДокумент29 страницAccounting For InventoriesLakachew GetasewОценок пока нет

- Inventory Valuation (Ias 2)Документ30 страницInventory Valuation (Ias 2)Patric CletusОценок пока нет

- Inventories Chapter Summary: Inventory Costing Under A Periodic Inventory SystemДокумент3 страницыInventories Chapter Summary: Inventory Costing Under A Periodic Inventory SystemAsem AmerОценок пока нет

- P2 - New Ch2Документ10 страницP2 - New Ch2mulugetaОценок пока нет

- Valuation & Accounting of InventoryДокумент21 страницаValuation & Accounting of InventoryPrasad BhanageОценок пока нет

- Fundamentals of Acc II Chapter 1 - InventoryДокумент11 страницFundamentals of Acc II Chapter 1 - Inventoryceerbe tubeОценок пока нет

- InventoryДокумент12 страницInventoryMesele AdemeОценок пока нет

- Chapter 4 Inventorie Ifa 4Документ38 страницChapter 4 Inventorie Ifa 4Nigussie BerhanuОценок пока нет

- Bridget Dindi Method of Stock EvaluationДокумент3 страницыBridget Dindi Method of Stock EvaluationBridget DindiОценок пока нет

- Accounting For Managerial Decision MakingДокумент35 страницAccounting For Managerial Decision MakingThakur Prakhar SinghОценок пока нет

- Inventary ManagementДокумент11 страницInventary ManagementDinesh GannerllaОценок пока нет

- Financial and Managerial Acct-5Документ75 страницFinancial and Managerial Acct-5Neway AlemОценок пока нет

- Chapter - 1 Inventories Definition: - Inventory Is Used To DesignateДокумент14 страницChapter - 1 Inventories Definition: - Inventory Is Used To DesignateMulugeta TsegaОценок пока нет

- Libby Financial Accounting Chapter7Документ10 страницLibby Financial Accounting Chapter7Jie Bo Ti0% (2)

- Inventory Valuation Methods IntroductionДокумент1 страницаInventory Valuation Methods Introductionwaiting4yОценок пока нет

- Inventories Valuation A Cost Basis ApproachДокумент19 страницInventories Valuation A Cost Basis Approachabshir haybeОценок пока нет

- Inventory AccountingДокумент4 страницыInventory AccountingIndra ThamilarasanОценок пока нет

- Module 1 Inventories(7)没看完Документ43 страницыModule 1 Inventories(7)没看完curly030125Оценок пока нет

- Chapter 5Документ61 страницаChapter 5FAIZATUL AMLA BT ABDUL HAMID (PUO)Оценок пока нет

- Methods of Inventory ValuationДокумент1 страницаMethods of Inventory Valuationwaiting4y0% (1)

- Determining The Monetary Amount of Inventory at Any Given Point in TimeДокумент44 страницыDetermining The Monetary Amount of Inventory at Any Given Point in TimeParth R. ShahОценок пока нет

- Chapter 6 - Inventories Classifying Inventory?: Accounting Principle - Grade 1 - FCASU - 2 TermДокумент6 страницChapter 6 - Inventories Classifying Inventory?: Accounting Principle - Grade 1 - FCASU - 2 TermFintech GroupОценок пока нет

- Funamentals of Acct - II - Chapter 1 InventoriesДокумент47 страницFunamentals of Acct - II - Chapter 1 InventoriesibsaashekaОценок пока нет

- Fundamentals of Acc II CH 1 - InventoryДокумент12 страницFundamentals of Acc II CH 1 - InventorySisay Belong To JesusОценок пока нет

- Inventory - Practice ProblemДокумент9 страницInventory - Practice ProblemAustin Grace WeeОценок пока нет

- Perpetual InventoryДокумент19 страницPerpetual InventoryKarl MangligotОценок пока нет

- 06 InventoriesДокумент3 страницы06 InventoriesCy MiolataОценок пока нет

- CH 1 Funamentals of Acct - II - InventoriesДокумент35 страницCH 1 Funamentals of Acct - II - InventoriesNatnael AsfawОценок пока нет

- InventoriesДокумент4 страницыInventoriesCyril DE LA VEGAОценок пока нет

- PPAcct II InventoryДокумент9 страницPPAcct II InventoryNigussie BerhanuОценок пока нет

- AccountingДокумент6 страницAccountingVanessa Plata Jumao-asОценок пока нет

- Chapter - 1-Accounting For InventoriesДокумент40 страницChapter - 1-Accounting For InventoriesWonde BiruОценок пока нет

- Inventory ValuationДокумент2 страницыInventory ValuationJonathan WilderОценок пока нет

- Ifa CH 4Документ20 страницIfa CH 4Nigussie BerhanuОценок пока нет

- Inventory Valuation Methods: Treatment in Financial StatementДокумент10 страницInventory Valuation Methods: Treatment in Financial Statementneten_dkjОценок пока нет

- Inventory CostiДокумент8 страницInventory CostiChowsky123Оценок пока нет

- Financial Reports Analysis: Faculty of Commerce "English Section" - Level IV - Course Code: ACC 401Документ44 страницыFinancial Reports Analysis: Faculty of Commerce "English Section" - Level IV - Course Code: ACC 401AHMED ALAWADYОценок пока нет

- Welcome Back: Accounting For Business Decisions AДокумент65 страницWelcome Back: Accounting For Business Decisions ALeah StonesОценок пока нет

- Chapter 6 InventoryДокумент59 страницChapter 6 InventoryAbdullah Al AminОценок пока нет

- Accounting Principles 7Th Canadian Edition Volume 1 by Jerry J. Weygandt, Test BankДокумент95 страницAccounting Principles 7Th Canadian Edition Volume 1 by Jerry J. Weygandt, Test BankakasagillОценок пока нет

- INVENTORYДокумент21 страницаINVENTORYFiruzaОценок пока нет

- Inventory Practice ProblemsДокумент14 страницInventory Practice ProblemsmikeОценок пока нет

- Inventory ValuationДокумент18 страницInventory ValuationHimanshu Upadhyay AIOA, NoidaОценок пока нет

- Accounting For InventoriesДокумент16 страницAccounting For InventoriesLemma Deme ResearcherОценок пока нет

- Inventory - Lecture ExamplesДокумент6 страницInventory - Lecture ExamplesAyandiswa NdebeleОценок пока нет

- Chapter 14 - InventoriesДокумент5 страницChapter 14 - InventoriesFerb CruzadaОценок пока нет

- Exam 1 - QuestionsДокумент89 страницExam 1 - QuestionsTSZ YING CHAUОценок пока нет

- Effectiveness of iNVENTORY CONTROL MEASURESДокумент67 страницEffectiveness of iNVENTORY CONTROL MEASURESUtkarsh Srivastava0% (1)

- Cost Accounting and Financial ManagementДокумент38 страницCost Accounting and Financial ManagementHappy RenuОценок пока нет

- Assessing The Impact of Inventory Management and Control On The Profitability of An OrganizationДокумент60 страницAssessing The Impact of Inventory Management and Control On The Profitability of An OrganizationDaniel ObasiОценок пока нет

- DM Notes Mim Jbims 12 13Документ56 страницDM Notes Mim Jbims 12 13abigail.godinhoОценок пока нет

- Lesson 8 Process CostingДокумент15 страницLesson 8 Process CostingRohanne Garcia AbrigoОценок пока нет

- Exercise Chap 8Документ6 страницExercise Chap 8hangbg2k3Оценок пока нет

- PDF 3Документ35 страницPDF 3Mannu GargОценок пока нет

- LIFO or FIFO? That's The Question Case Summary and ISSUESДокумент4 страницыLIFO or FIFO? That's The Question Case Summary and ISSUESBinodini SenОценок пока нет

- Zenith Steel Fabricators LTD All Products 2023 June Small 24 PagesДокумент24 страницыZenith Steel Fabricators LTD All Products 2023 June Small 24 PagesTony muneneОценок пока нет

- Chapter 8 - Valuation of Inventories - A Cost-Basis ApproachДокумент16 страницChapter 8 - Valuation of Inventories - A Cost-Basis ApproachheryadiОценок пока нет

- Adv - Accounting-M - Test - Question - 01 10 2020Документ7 страницAdv - Accounting-M - Test - Question - 01 10 2020RADHIKAОценок пока нет

- Level Four Code 2 Project One: Process PayrollДокумент3 страницыLevel Four Code 2 Project One: Process PayrollbiniamОценок пока нет

- Intermediate Accounting Ifrs 3rd Edition Kieso Solutions ManualДокумент38 страницIntermediate Accounting Ifrs 3rd Edition Kieso Solutions Manualrococosoggy74yw6m100% (17)

- Unit 4 - PMMДокумент27 страницUnit 4 - PMMAsh RoyОценок пока нет

- Chapter 06 v0Документ43 страницыChapter 06 v0Diệp Diệu ĐồngОценок пока нет

- Reviewer in Intermediate Accounting (Midterm)Документ9 страницReviewer in Intermediate Accounting (Midterm)Czarhiena SantiagoОценок пока нет

- Ch1 Mini Case IntroДокумент3 страницыCh1 Mini Case IntroRuany Lisbeth0% (1)

- Cost Accounting and CostManagementДокумент35 страницCost Accounting and CostManagementLiza Magat MatadlingОценок пока нет

- Practice Midterm #2Документ10 страницPractice Midterm #2Bree JiangОценок пока нет

- Chapter 26 - Inventory Cost Flow: Question 26-1Документ11 страницChapter 26 - Inventory Cost Flow: Question 26-1Cyrus IsanaОценок пока нет

- International Financial Reporting Standard IAS2Документ21 страницаInternational Financial Reporting Standard IAS2ThanhTam NguyenОценок пока нет

- Inventory Management and JIT Group AssignmentДокумент24 страницыInventory Management and JIT Group AssignmenthuleОценок пока нет

- Cat/fia (Ma2)Документ12 страницCat/fia (Ma2)theizzatirosli50% (2)

- P2 Process CostingДокумент9 страницP2 Process CostingGanessa RolandОценок пока нет

- Chapter Reconciliation 4Документ17 страницChapter Reconciliation 4bhagyashripande321Оценок пока нет

- SCM Mod3Документ25 страницSCM Mod3Amir RajaОценок пока нет

- Accounts FinnalДокумент21 страницаAccounts FinnalAyusha MakenОценок пока нет

- Sample Supplier Audit ChecklistДокумент1 страницаSample Supplier Audit ChecklistMuhammad Hafizuddin Abu SamahОценок пока нет

- Financial Merchandise Management: Retail Management: A Strategic ApproachДокумент31 страницаFinancial Merchandise Management: Retail Management: A Strategic ApproachJohnny LewisОценок пока нет

- The Accounting Game: Learn the Basics of Financial Accounting - As Easy as Running a Lemonade Stand (Basics for Entrepreneurs and Small Business Owners)От EverandThe Accounting Game: Learn the Basics of Financial Accounting - As Easy as Running a Lemonade Stand (Basics for Entrepreneurs and Small Business Owners)Рейтинг: 4 из 5 звезд4/5 (33)

- Purchasing, Inventory, and Cash Disbursements: Common Frauds and Internal ControlsОт EverandPurchasing, Inventory, and Cash Disbursements: Common Frauds and Internal ControlsРейтинг: 5 из 5 звезд5/5 (1)

- Getting to Yes: How to Negotiate Agreement Without Giving InОт EverandGetting to Yes: How to Negotiate Agreement Without Giving InРейтинг: 4 из 5 звезд4/5 (652)

- I Will Teach You to Be Rich: No Guilt. No Excuses. No B.S. Just a 6-Week Program That Works (Second Edition)От EverandI Will Teach You to Be Rich: No Guilt. No Excuses. No B.S. Just a 6-Week Program That Works (Second Edition)Рейтинг: 4.5 из 5 звезд4.5/5 (13)

- The Science of Prosperity: How to Attract Wealth, Health, and Happiness Through the Power of Your MindОт EverandThe Science of Prosperity: How to Attract Wealth, Health, and Happiness Through the Power of Your MindРейтинг: 5 из 5 звезд5/5 (231)

- A Beginners Guide to QuickBooks Online 2023: A Step-by-Step Guide and Quick Reference for Small Business Owners, Churches, & Nonprofits to Track their Finances and Master QuickBooks OnlineОт EverandA Beginners Guide to QuickBooks Online 2023: A Step-by-Step Guide and Quick Reference for Small Business Owners, Churches, & Nonprofits to Track their Finances and Master QuickBooks OnlineОценок пока нет

- The E-Myth Chief Financial Officer: Why Most Small Businesses Run Out of Money and What to Do About ItОт EverandThe E-Myth Chief Financial Officer: Why Most Small Businesses Run Out of Money and What to Do About ItРейтинг: 5 из 5 звезд5/5 (13)

- The ZERO Percent: Secrets of the United States, the Power of Trust, Nationality, Banking and ZERO TAXES!От EverandThe ZERO Percent: Secrets of the United States, the Power of Trust, Nationality, Banking and ZERO TAXES!Рейтинг: 4.5 из 5 звезд4.5/5 (14)

- Finance Basics (HBR 20-Minute Manager Series)От EverandFinance Basics (HBR 20-Minute Manager Series)Рейтинг: 4.5 из 5 звезд4.5/5 (32)

- Accounting 101: From Calculating Revenues and Profits to Determining Assets and Liabilities, an Essential Guide to Accounting BasicsОт EverandAccounting 101: From Calculating Revenues and Profits to Determining Assets and Liabilities, an Essential Guide to Accounting BasicsРейтинг: 4 из 5 звезд4/5 (7)

- How to Measure Anything: Finding the Value of "Intangibles" in BusinessОт EverandHow to Measure Anything: Finding the Value of "Intangibles" in BusinessРейтинг: 4.5 из 5 звезд4.5/5 (28)

- Start, Study and Pass The CPA Exam FAST - Proven 8 Step CPA Exam Study PlaybookОт EverandStart, Study and Pass The CPA Exam FAST - Proven 8 Step CPA Exam Study PlaybookРейтинг: 5 из 5 звезд5/5 (4)

- How to Start a Business: Mastering Small Business, What You Need to Know to Build and Grow It, from Scratch to Launch and How to Deal With LLC Taxes and Accounting (2 in 1)От EverandHow to Start a Business: Mastering Small Business, What You Need to Know to Build and Grow It, from Scratch to Launch and How to Deal With LLC Taxes and Accounting (2 in 1)Рейтинг: 4.5 из 5 звезд4.5/5 (5)

- Overcoming Underearning(TM): A Simple Guide to a Richer LifeОт EverandOvercoming Underearning(TM): A Simple Guide to a Richer LifeРейтинг: 4 из 5 звезд4/5 (21)

- Accounting For Small Businesses QuickStart Guide: Understanding Accounting For Your Sole Proprietorship, Startup, & LLCОт EverandAccounting For Small Businesses QuickStart Guide: Understanding Accounting For Your Sole Proprietorship, Startup, & LLCРейтинг: 5 из 5 звезд5/5 (1)

- Tax-Free Wealth: How to Build Massive Wealth by Permanently Lowering Your TaxesОт EverandTax-Free Wealth: How to Build Massive Wealth by Permanently Lowering Your TaxesОценок пока нет

- Excel for Beginners 2023: A Step-by-Step and Quick Reference Guide to Master the Fundamentals, Formulas, Functions, & Charts in Excel with Practical Examples | A Complete Excel Shortcuts Cheat SheetОт EverandExcel for Beginners 2023: A Step-by-Step and Quick Reference Guide to Master the Fundamentals, Formulas, Functions, & Charts in Excel with Practical Examples | A Complete Excel Shortcuts Cheat SheetОценок пока нет

- The One-Page Financial Plan: A Simple Way to Be Smart About Your MoneyОт EverandThe One-Page Financial Plan: A Simple Way to Be Smart About Your MoneyРейтинг: 4.5 из 5 звезд4.5/5 (37)

- Love Your Life Not Theirs: 7 Money Habits for Living the Life You WantОт EverandLove Your Life Not Theirs: 7 Money Habits for Living the Life You WantРейтинг: 4.5 из 5 звезд4.5/5 (146)

- The Intelligent Investor, Rev. Ed: The Definitive Book on Value InvestingОт EverandThe Intelligent Investor, Rev. Ed: The Definitive Book on Value InvestingРейтинг: 4.5 из 5 звезд4.5/5 (760)

- The Credit Formula: The Guide To Building and Rebuilding Lendable CreditОт EverandThe Credit Formula: The Guide To Building and Rebuilding Lendable CreditРейтинг: 5 из 5 звезд5/5 (1)