Академический Документы

Профессиональный Документы

Культура Документы

Common Banking Terms

Загружено:

Gangadhara RaoИсходное описание:

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Common Banking Terms

Загружено:

Gangadhara RaoАвторское право:

Доступные форматы

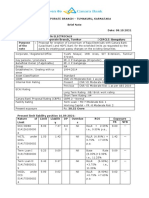

Common Banking Terms / Important Rates

Bank Rate: Normally RBI lends to commercial banks through its discount window to help the banks meet

depositors demands and reserve requirements. The interest rate the RBI charges the banks for this purpose

is called bank rate. The current bank rate is 9%.

Cash Reserve Ratio: All commercial bank have to keep certain minimum cash reserves with RBI to the

needs of securing the monetary stability in the country. The Reserve Bank could prescribe CRR for

scheduled banks between 3% and 20% as per the demand. The current rate is 4%.

Statutory Liquidity Ratio (SLR): Apart from the CRR, banks are required to maintain liquid assets in the

form of gold, cash and approved securities. Higher liquidity ratio forces commercial banks to maintain a

larger proportion of their resources in liquid form and thus reduces their capacity to grant loans and

advances, thus it is an anti-inflationary impact. The current rate is 23%.

Repo Rate or Repurchase Rate: Repo Rate is the rate at which the RBI lends shot-term money to the

banks against securities. When the repo rate increases borrowing from RBI becomes more expensive.

Therefore, we can say that in case, RBI wants to make it more expensive for the banks to borrow money, it

increases the repo rate; similarly, if it wants to make it cheaper for banks to borrow money, it reduces the

repo rate. The current rate is 8%.

Reverse Repo Rate: Reverse Repo Rate is the rate at which banks park their short-term excess liquidity

with the RBI. The banks use this tool when they feel that they are stuck with excess funds and are not able to

invest anywhere for reasonable returns. An increase in the reverse repo rate means that the RBI is ready to

borrow money from the banks at a higher rate of interest. As a result, banks would prefer to keep more and

more surplus funds with RBI. The current rate is 7%.

Indian Settlement Systems: India has two main electronic funds settlement systems for one to one

transactions: the real time gross settlement (RTGS) and the national electronic fund transfer (NEFT)

systems.

Real Time Gross Settlement: The term RTGS stands for real time gross settlement, and Reserve Bank of

India maintains this payment network. RTGS system is a funds transfer mechanism where transfer of money

takes place from one bank to another on a real time and on gross basis. This is the fastest possible money

transfer system through the banking channel.

National Electronic Fund Transfer: The national electronic fund transfer (NEFT) system is a nationwide

system that facilitates individuals, firms and corporate to electronically transfer funds from any bank branch

to any individual, firm or corporate having an account with any other bank branch in the country. IFSC or

Indian financial system code is required to perform a transaction using NEFT or RTGS and can be found out

on RBI website.

Automated Teller Machine or Automatic Teller Machine (ATM), is a computerized device that provides

customers of a financial institution with access to financial transactions in a public space without the need

for a cashier, clerk or bank teller.

Demat Account: An account required for trading in listed stocks or debentures in electronic form rather

than paper, as required for investors by the Securities and Exchange Board of India (SEBI).

Foreign Exchange Market: The foreign exchange market (forex/ currency market) is a form of exchange

for the global decentralized trading of international currencies. Financial centers around the world function

as anchors of trading between a wide range of different types of buyers and sellers around the clock, with the

exception of weekends.

Cash Credit: Cash credit is an arrangement whereby the bank allows the borrower to draw amount up to a

specified limit. The amount is credited to the account of the customer. Interest is charged on the amount

actually withdrawn. Cash Credit is granted as per terms and conditions agreed with the customers.

Overdraft: Overdraft is also a credit facility granted by bank to the customer who has a current account

with the bank is allowed to withdraw more than the amount of credit balance in his account. It is a

temporary arrangement.

Discounting of Bills: Banks provide short-term finance by discounting bill, that is, making payment of the

amount before the due date of the bills after deducting a certain rate of discount. The party gets the funds

without waiting for the date of maturity of the bills. In case any bill is dishonoured on the due date, the bank

can recover the amount from the customer.

Net Banking or Online Banking: With the extensive use of computer and Internet, banks have now started

transactions over Internet. The customer having an account in the bank can log into the banks website and

access his bank account. He can make payments for bills; give instructions for money transfers, fixed

deposits and collection of bill, etc.

Phone Banking: In case of phone banking, a customer of the bank having an account can get information of

his account; make banking transactions like, fixed deposits, money transfers, demand draft, collection and

payment of bills, etc. by using telephone.

Acceleration: A standard clause in a mortgage instrument permitting the lender to demand full payment of

principal from the borrower upon default of the obligation.

Bill: A Bill in the banking parlance means a bill of exchange drawn by a seller on the buyer whenever he

sells goods or services on payment later basis. Such a transaction is also referred to as a credit transaction.

The bill is routed through the bank for collection of amount from the buyer.

Letter of Credit: One of the terms of supply is that buyer will establish a letter of credit in favour of the

seller through his bank. The seller should furnish proof of dispatch of goods or services and submit all the

documents required under the L/C. Then, the buyers bank will pay the amount of bill drawn by the seller on

the buyer under this agreement. International letter of credit is by and large, irrevocable.

Remittance: A facility, by which its customers at one place makes funds available to the bank and the bank

in exchange, makes the funds available to the customer or any other specified party at the required place,

within the same country or abroad. Remittance can be in the form of Demand Draft (DD), Mail Transfer

(MT), Telegraphic Transfer (TT), Electronic Mail transfer (EMT) through computer networking (or satellite

channel), International Money Order (IMO) etc.

MICR: Magnetic Ink Character Recognition is a 9 digit number printed on banking instruments such as a

cheque or a demand draft using a special type of ink made of magnetic material. The first 3 digits denote the

city, the 4th to 6th digits denote the bank, while the last 3 digits denote the branch number. The code can be

read by a machine, minimising the chances of error in clearing of cheques, thereby making funds transfer

faster.

Payable At Par or MCC: Multi City Cheques (MCC) or Payable at Par (PAP) can be encashed anywhere

in India irrespective of the city they were issued in. They are treated as local clearing cheques across India,

the amount is credited in the account the same day and there is no inter-city collection charges associated

with a normal cheques being encashed in another city.

Fixed Deposits: FDs are deposits that are repayable on fixed maturity date along with the principal and

agreed interest rate for the period. Banks pay higher interest rates on FDs than the savings bank account.

Recurring Deposits: These are also called cumulative deposits and in recurring deposit accounts, a certain

amounts of savings are required to be compulsorily deposited at specific intervals for a specified period.

Credit Rating: It is the rating which an individual (or company) gets from the credit industry depending on

the individuals credit history. The details of which are available from specialist organisations like CRISIL

in India.

Bill of Exchange: An order written by the seller of goods instructing the purchaser to pay the seller (or

bearer of the bill) a specified amount on a specified future date.

Dividends: Company earnings that may be paid out to shareholders according to the number of shares or

stocks they hold. Dividends can be earned on stocks as also units of mutual funds.

Inflation: A percentage rate of change in the price level.

Non Performing Assets (NPA): When due payments in credit facilities remain overdue above specified

period, then such credit facilities are classified as NPA.

Reconciliation: Checking all bank account papers to make sure that the banks records and customers

records ar in sync.

Cash Flow: The cash flow is often defined as the liquid balance of cash as well as the bank balance that is

available with an organization or a corporation. In some cases, the cash flow is also defined as the net

amount of cash that is generated by the net income that has been generated by an organization or corporation

in a particular time period.

Endorsement: Endorsement is basically the handing over of rights of a financial/legal document or a

negotiable instrument to another person. The person who hands over his/her rights is known as the endorser,

and the person to whom the rights have been transferred is known as the endorsee.

Government Bonds: A government bond, which is also known as a government security, is basically any

security that is held with the government and has the highest possible rate of interest.

Lock-in Period: A guarantee given by the lender that there will be no change in the quoted mortgage rates

for a specified period of time, which is called the lock-in period.

Mortgage: A mortgage is a legal agreement between the lender and borrower where real estate property is

used as collateral for the loan, in order to secure the payment of the debt. According to the mortgage

agreement, the lender of the loan is authorized to confiscate the property, the moment the borrower stops

paying the installments.

Вам также может понравиться

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5794)

- MS Assignment QuestionsДокумент1 страницаMS Assignment QuestionsGangadhara RaoОценок пока нет

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- Management Science PrefaceДокумент1 страницаManagement Science PrefaceGangadhara RaoОценок пока нет

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- Pre-Ph.D Required DocumentsДокумент1 страницаPre-Ph.D Required DocumentsGangadhara RaoОценок пока нет

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (895)

- Objectives of The SubjectДокумент1 страницаObjectives of The SubjectGangadhara RaoОценок пока нет

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (400)

- MS Internal Exam Question PaperДокумент1 страницаMS Internal Exam Question PaperGangadhara RaoОценок пока нет

- Objectives of The SubjectДокумент1 страницаObjectives of The SubjectGangadhara RaoОценок пока нет

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- Unit-1: Conceptual Lesson Plan For Management ScienceДокумент6 страницUnit-1: Conceptual Lesson Plan For Management ScienceGangadhara RaoОценок пока нет

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- SM 11st UnitДокумент13 страницSM 11st UnitGangadhara RaoОценок пока нет

- Mir Ghrm-I Assignment TopicsДокумент1 страницаMir Ghrm-I Assignment TopicsGangadhara RaoОценок пока нет

- SM 11st UnitДокумент13 страницSM 11st UnitGangadhara RaoОценок пока нет

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- Service Marketing Environment and Other Factors Affecting Marketing EnvironmentДокумент31 страницаService Marketing Environment and Other Factors Affecting Marketing EnvironmentDilshaad Shaikh83% (6)

- Hedging ProblemДокумент1 страницаHedging ProblemGangadhara RaoОценок пока нет

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- MS Question BankДокумент4 страницыMS Question BankGangadhara RaoОценок пока нет

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (266)

- LSCM Unit-VДокумент28 страницLSCM Unit-VGangadhara RaoОценок пока нет

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (344)

- Unit-Iv: The Sourcing DecisionsДокумент31 страницаUnit-Iv: The Sourcing DecisionsGangadhara Rao100% (1)

- SM 2nd UnitДокумент8 страницSM 2nd UnitGangadhara RaoОценок пока нет

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2259)

- SM 3rd UnitДокумент6 страницSM 3rd UnitGangadhara RaoОценок пока нет

- LSCM Unit-VДокумент28 страницLSCM Unit-VGangadhara RaoОценок пока нет

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1090)

- SM 11st UnitДокумент13 страницSM 11st UnitGangadhara RaoОценок пока нет

- 02.01.2019 - 13.01.2019 Welding Master TrainingДокумент2 страницы02.01.2019 - 13.01.2019 Welding Master TrainingGangadhara RaoОценок пока нет

- LSCM Unit-IiДокумент21 страницаLSCM Unit-IiGangadhara RaoОценок пока нет

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- LSCM Unit-VДокумент28 страницLSCM Unit-VGangadhara RaoОценок пока нет

- MissingДокумент2 страницыMissingGangadhara RaoОценок пока нет

- RM WT - 2Документ1 страницаRM WT - 2Gangadhara RaoОценок пока нет

- Andhra Loyola Institute of Engineering and TechnologyДокумент1 страницаAndhra Loyola Institute of Engineering and TechnologyGangadhara RaoОценок пока нет

- Role of BanksДокумент4 страницыRole of BanksGangadhara RaoОценок пока нет

- Glimpses of A 30 Day Work Shop On Start and Improve Your BusinessДокумент4 страницыGlimpses of A 30 Day Work Shop On Start and Improve Your BusinessGangadhara RaoОценок пока нет

- WT - 1Документ1 страницаWT - 1Gangadhara RaoОценок пока нет

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (121)

- BRM On 11-3-2019Документ2 страницыBRM On 11-3-2019Gangadhara RaoОценок пока нет

- Competency MappingДокумент5 страницCompetency MappingGangadhara RaoОценок пока нет

- Spouses Panlilio V Citibank G.R. No. 156335Документ27 страницSpouses Panlilio V Citibank G.R. No. 156335Gen GrajoОценок пока нет

- Articles of Association of Southern Ispat and Energy LimitedДокумент58 страницArticles of Association of Southern Ispat and Energy LimitedleovenuОценок пока нет

- Your Strawman (Legal Fiction)Документ31 страницаYour Strawman (Legal Fiction)Karl_23100% (4)

- Debt RestructuringДокумент2 страницыDebt RestructuringVicong PogiОценок пока нет

- Co-Operative Banks Preservation of Records RulesДокумент4 страницыCo-Operative Banks Preservation of Records Rulessherry j thomasОценок пока нет

- Overall Banking Activities OF Everest Bank Limited: An Internship ReportДокумент37 страницOverall Banking Activities OF Everest Bank Limited: An Internship ReportPEmaa LMОценок пока нет

- Accounting Notes For EE SubjectДокумент32 страницыAccounting Notes For EE SubjectSanjay YadavОценок пока нет

- Profitiability Analysis of Nabil Bank Limited: A Project Work ReportДокумент39 страницProfitiability Analysis of Nabil Bank Limited: A Project Work Reportaakash shresthaОценок пока нет

- Buenaventura Vs MetrobankДокумент8 страницBuenaventura Vs MetrobankI'm a Smart CatОценок пока нет

- GOVERNMENT SERVICE INSURANCE SYSTEM vs. COURT OF APPEALS & MR. AND MRS. ISABELO R. RACHOДокумент2 страницыGOVERNMENT SERVICE INSURANCE SYSTEM vs. COURT OF APPEALS & MR. AND MRS. ISABELO R. RACHOTrudgeOnОценок пока нет

- Time Value of MoneyДокумент10 страницTime Value of MoneyanjaliОценок пока нет

- Assignment 2b QuestionsДокумент2 страницыAssignment 2b Questionsshar winОценок пока нет

- Gurus On Business Strategy by Tony Grundy (2003)Документ235 страницGurus On Business Strategy by Tony Grundy (2003)arif420_9990% (1)

- Cacayorin v. AfpmbaДокумент2 страницыCacayorin v. AfpmbaWorstWitch TalaОценок пока нет

- 0452 s14 QP 22Документ20 страниц0452 s14 QP 22simplesaiedОценок пока нет

- C 03Документ52 страницыC 03Lạc LốiОценок пока нет

- Corporate Distributions, Windings-Up, and Sales: Solutions To Chapter 15 Assignment ProblemsДокумент21 страницаCorporate Distributions, Windings-Up, and Sales: Solutions To Chapter 15 Assignment ProblemsKiều Thảo AnhОценок пока нет

- Raja Electricals Consortium Brief Note 08 10 2021Документ3 страницыRaja Electricals Consortium Brief Note 08 10 2021MSME SULABH TUMAKURUОценок пока нет

- Lee V Bangkok BankДокумент43 страницыLee V Bangkok Bankgerald scottОценок пока нет

- Chapter 30 - Working Capital ManagementДокумент61 страницаChapter 30 - Working Capital ManagementNguyễn T.Thanh HươngОценок пока нет

- HousingДокумент11 страницHousingMark Joseph Caadiang NaralОценок пока нет

- Southern Motors v. BarbosaДокумент2 страницыSouthern Motors v. BarbosaJewelОценок пока нет

- If RegisterДокумент13 страницIf RegisterAshok PrasathОценок пока нет

- Economics Nov 2009 Eng MemoДокумент30 страницEconomics Nov 2009 Eng Memokubayik7402Оценок пока нет

- Bond Lodgement Form NZДокумент2 страницыBond Lodgement Form NZJordyCarterОценок пока нет

- Banking - My Big Fat Wonderfully Wealthy Life PDFДокумент150 страницBanking - My Big Fat Wonderfully Wealthy Life PDFAnonymous umFqhh100% (3)

- Paper Code MB0035Документ8 страницPaper Code MB0035Hossam M.shareifОценок пока нет

- Case No. 16-Cv-4014 CATERBONE v. The United States of America, Et - Al., COMPLAINT UPDATED December 12, 2016 Ver 2.0Документ107 страницCase No. 16-Cv-4014 CATERBONE v. The United States of America, Et - Al., COMPLAINT UPDATED December 12, 2016 Ver 2.0Stan J. Caterbone0% (1)

- Farmers SuicideДокумент16 страницFarmers SuicideSANJIVAN CHAKRABORTYОценок пока нет

- 004 Sarmiento Eulogio v. BellДокумент3 страницы004 Sarmiento Eulogio v. BelltheresebernadetteОценок пока нет

- These are the Plunderers: How Private Equity Runs—and Wrecks—AmericaОт EverandThese are the Plunderers: How Private Equity Runs—and Wrecks—AmericaРейтинг: 4.5 из 5 звезд4.5/5 (14)

- University of Berkshire Hathaway: 30 Years of Lessons Learned from Warren Buffett & Charlie Munger at the Annual Shareholders MeetingОт EverandUniversity of Berkshire Hathaway: 30 Years of Lessons Learned from Warren Buffett & Charlie Munger at the Annual Shareholders MeetingРейтинг: 4.5 из 5 звезд4.5/5 (97)

- Summary of The Black Swan: by Nassim Nicholas Taleb | Includes AnalysisОт EverandSummary of The Black Swan: by Nassim Nicholas Taleb | Includes AnalysisРейтинг: 5 из 5 звезд5/5 (6)