Академический Документы

Профессиональный Документы

Культура Документы

FRM Course 2012

Загружено:

Khurram ShahzadАвторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

FRM Course 2012

Загружено:

Khurram ShahzadАвторское право:

Доступные форматы

1

Beirut, Lebanon

Proudly Offers

Financial Risk Manager

FRM

Preparatory Courses

2

IFA Profile

IFA, The institute for Financial Analysts is a firm specialized in offering preparatory courses

and seminars for professional designations such as the Chartered Financial Analyst (CFA),

Certified Valuation Advisor (CVA), Islamic Finance Qualification (IFQ) and the Financial Risk

Manager (FRM) programs.

The multitude of review courses are offered by IFA in Kuwait, Saudi Arabia, United Arab

Emirates, Qatar, Bahrain, Jordan and Egypt and have been expanding at an impressive rate.

IFA faculty holds the CFA charter, FRM certification, CVA designation or Ph.D. in Finance with

years of teaching experience. The success of our candidates is unsurpassed in Lebanon and

this is what got us the reputation of being the undisputed leader in CFA review courses in

Lebanon, with more than double the pass rate of the competition.

IFA is also the regional distributor of Schweser study material in the Middle East.

FRM Certification

The Financial Risk Manager (FRM) is the certification recognized among financial risk

professionals worldwide, with 17,673 FRM holders in 90 countries across the globe.

Financial risk management is one of the hottest skill sets to have in the financial services

industry today that offers excellent visibility and outstanding earnings potential. The

profession has seen considerable growth over the past 15 years fueled by the complexity of

financial products, increased regulation and recent notable failures.

Like other careers in finance, having an advanced degree and certification helps to increase

your career potential in financial risk management. FRM holders occupy positions such as

Chief Risk Officer, Senior Risk Analyst, Head of Operational Risk, and Director, Investment

Risk Management, to name a few. If you are in financial risk management, or considering a

career in it, then earning your FRM is the next natural step.

Certificate Requirements

In order to be certified as a Financial Risk Manager (FRM

) and be able to use the FRM

acronym after your name, the following is required:

A passing score on the FRM Examination (on each of the two levels of the certificate).

Active membership in the Global Association of Risk Professionals.

A minimum of two years experience in the area of financial risk management or

another related field including, but not limited to, trading, portfolio management,

academic or industry research, economics, auditing, risk consulting, and/ or risk

technology.

3

Earning the right to use 'FRM' after your name, demonstrates professionalism and dedication

to the profession.

FRM Topics and Exam Weights

FRM PART I:

Quantitative Analysis ----------------------------------------- 20%

Foundations of Risk Management -------------------------- 20%

Financial Markets and Products ---------------------------- 30%

Valuation and Risk Models ----------------------------------- 30%

FRM PART II

Market Risk Measurement and Management ------------ 25%

Credit Risk Measurement and Management-------------- 25%

Operational and Integrated Risk Management----------- 25%

Risk Management and Investment Management -------- 15%

Current Issues in Financial Markets ------------------------ 10%

IFA Study Plan: Why Engage IFA?

Candidates joining IFAs FRM study programs will be offered a complete package of study

sessions and assistance that shall help them in ensuring a successful completion of the

examination, provided a sufficient level of study and preparation effort from their part.

IFA thus offers its candidates:

Full and rigorous live study classes grouped in 4 modules (60 hours) taught by our top-

notch faculty that would collectively cover all the topics of the level.

A complete package of study material including outlines of the readings and solutions

The original SCHWESER Review material and preparation notes that comprehensively

cover all study sessions of the program

Self assessment exams

Mock exam (full day to simulate the big day)

Benefits of FRM Certification

You will be recognized across the globe as a leader in financial risk management.

You will be more desirable to executive recruiters and hiring managers since they are

now seeking FRM holders for senior risk management jobs more than ever before.

The FRM professional certification differentiates you from your peers.

Studying the broad concepts underlying risk management in today's dynamic market

environment will give you a holistic view and appreciation for the role risk

management plays in an enterprise.

4

Provides you with the feeling of personal achievement and the satisfaction of

conquering an exam developed by the best risk management practitioners in the

world.

Objectively benchmarks your knowledge of the major strategic disciplines of financial

risk management:

Market Risk

Credit Risk

Operational Risk

Risk Management in Investment Management

Allows you to join an elite group of 17,673 FRMs across the globe with the only risk

management certification recognized worldwide.

Expands your personal and professional opportunities within the world of finance.

Provides you with the ability to network with some of the world's leading financial

risk management professionals.

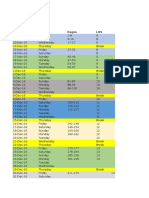

Exam Deadlines

-- 19-May-12 17-Nov-12

Early Dec. 1, 2011 - Jan 31, 2012 Dec. 1, 2011 - July 31, 2012

Standard Feb. 1 - Feb 28, 2012 Aug. 1 - Aug. 31, 2012

Late March 1 - April 15, 2012 Sept. 1 - Oct. 15, 2012

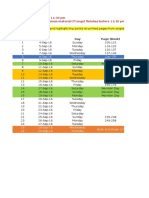

Exam Fees

2011 FRM Exam Part I Early Standard Late

Enrollment Fee $300 $300 $300

Exam Registration Fee $350 $475 $650

Total $650 $775 $950

5

Faculty

Our knowledgeable and highly qualified faculty, are specialists in their fields. They have had

extensive teaching experience or are active investment professionals. They have consistently

demonstrated an ability to convey complex material in an informative and effective manner

and have all earned Ph.D., FRM or CFA

charter.

Dr. Assem Safieddine is the Managing Director of IFA, The Institute for Financial Analysts

and the chairperson of the Finance, Accounting and Managerial Economics Track, the director

of the Corporate Governance Program at The American University of Beirut- AUB. He is the

founding president of the Lebanese CFA Society and the regional director of the Global

Association of Risk Professionals (GARP) and the president of the Lebanese Risk Management

Society. He has served as an advisor notably on corporate governance for several

multinational companies and organizations including IFC, Al Badie Group, Aramco and others.

Dr. Safieddine holds a Ph.D. in finance from Boston College, and has held faculty appointment

at Michigan State University for five years and visiting faculty appointment at Harvard

University Summer School for more than four years. His research has been published in

leading finance journals like the Journal of Finance, Journal of Financial Economics, and the

Journal of Financial and Quantitative Analysis, and his work has been profiled in the Business

Week, Harvard Business Review, CFA Digest and the National Bureau of Economic Research

along with others.

Mr. Khaled Abdel Samad is a Financial Risk Manager (FRM). He holds an MBA with

Distinction from the Lebanese American University. For the past year, he has been serving as

the Head of the Credit Risk Department and Basel II Project Manager at Lebanon and Gulf

Bank.

Mr. Ghazi Homsi has a BS in Economics from the Lebanese University, he holds an MBA

(emphasis Finance) from the Lebanese American University and he is currently a CFA

Candidate for Level III. Mr. Homsi has worked for 6 years as Deputy Manager at the Center for

Banking Studies, founded by the Association of Banks in Lebanon and Saint Joseph University,

and he is currently a member of IFA faculty. Mr. Homsi also teaches at the Lebanese American

University and the American University in Beirut.

Mr. Marwan Chbaklo is a Chartered Financial Analyst (CFA), he has a BE in Electrical

engineering from AUB in 1996. He holds an MBA from the Lebanese American University; he

also worked as a Finance Manager. After receiving the CFA designation in 2003, Mr. Chbaklo

worked as managing partner in a biomedical engineering firm, heading the marketing and

finance departments. Mr. Chbaklo also worked as a part time instructor at AUB and LAU in

2006. Starting 2007, he started working for the IFA as a lecturer covering CFA subjects and

financial modeling.

Mr. Haytham Moussa holds a Bachelor degree in Banking and Finance as well as an MBA

with Distinction from the Lebanese American University. He has been teaching at the

Lebanese American University Continuing Education Program (CEP) and is currently a faculty

member at IFA.

6

Contact Information

For more information about the designation, please visit FRM website:

www.garp.com

For more information about the training program or for registration for our FRM review

course, please contact:

Institute for Financial Analysts- IFA at:

P.O. Box 113-5245

Beirut, Lebanon

Telephone: +961 1 366 535

Mobile: +961 3 647 350

Facsimile: +961 1 366 535

Email: instffa@instffa.com

Website: www.instffa.com

Вам также может понравиться

- Doctor PrescriptionДокумент2 страницыDoctor PrescriptionKhurram ShahzadОценок пока нет

- Rasmala Bank Clients With Similar Shariah Structure: Started Using Structure in 2018Документ7 страницRasmala Bank Clients With Similar Shariah Structure: Started Using Structure in 2018Khurram ShahzadОценок пока нет

- ADB - Winning Consultant Contracts PDFДокумент40 страницADB - Winning Consultant Contracts PDFRudransh AehamОценок пока нет

- Book 2Документ2 страницыBook 2Khurram ShahzadОценок пока нет

- Basel III - Extract PageДокумент1 страницаBasel III - Extract PageKhurram ShahzadОценок пока нет

- No. Date Day Page (Book) : Revise Previous Material If Target Finishes Before 11:30 PM - No Mobile in 3 HoursДокумент3 страницыNo. Date Day Page (Book) : Revise Previous Material If Target Finishes Before 11:30 PM - No Mobile in 3 HoursKhurram ShahzadОценок пока нет

- JDДокумент1 страницаJDKhurram ShahzadОценок пока нет

- Guide To PE Due DiligenceДокумент23 страницыGuide To PE Due DiligenceKhurram ShahzadОценок пока нет

- Name Type Parameters Probability Mass/density Function Cum. Dist. PGF MGF Mean VarianceДокумент2 страницыName Type Parameters Probability Mass/density Function Cum. Dist. PGF MGF Mean VarianceKhurram ShahzadОценок пока нет

- JDДокумент1 страницаJDKhurram ShahzadОценок пока нет

- Naidech PrivateEquityFundFormation Nov11Документ20 страницNaidech PrivateEquityFundFormation Nov11Vipul DesaiОценок пока нет

- Smith Harmon Best Practices For Apology EmailsДокумент13 страницSmith Harmon Best Practices For Apology Emailsraghav_catty2009Оценок пока нет

- Core Technical Subjects ListДокумент1 страницаCore Technical Subjects ListKhurram ShahzadОценок пока нет

- Guide To PE Due DiligenceДокумент23 страницыGuide To PE Due DiligenceKhurram ShahzadОценок пока нет

- Name Type Parameters Probability Mass/density Function Cum. Dist. PGF MGF Mean VarianceДокумент2 страницыName Type Parameters Probability Mass/density Function Cum. Dist. PGF MGF Mean VarianceKhurram ShahzadОценок пока нет

- Distribution Name Parameters and Domains Important FactsДокумент4 страницыDistribution Name Parameters and Domains Important FactsKhurram ShahzadОценок пока нет

- Exam Fees 2013Документ2 страницыExam Fees 2013dmglaОценок пока нет

- Econ BFG 17feb13 SaudiJapan Business CouncilДокумент19 страницEcon BFG 17feb13 SaudiJapan Business CouncilKhurram ShahzadОценок пока нет

- Actuarial AdvantEDGE (Sample Manual)Документ33 страницыActuarial AdvantEDGE (Sample Manual)Zaheer AhmadОценок пока нет

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5794)

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (895)

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (400)

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (344)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1090)

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (121)

- Actron Vismin ReportДокумент19 страницActron Vismin ReportSirhc OyagОценок пока нет

- Previews 1633186 PreДокумент11 страницPreviews 1633186 PreDavid MorenoОценок пока нет

- ABBindustrialdrives Modules en RevBДокумент2 страницыABBindustrialdrives Modules en RevBMaitry ShahОценок пока нет

- Vendor Registration FormДокумент4 страницыVendor Registration FormhiringОценок пока нет

- DL Manual - Com Vs Controller Gs Driver p100 Operating ManualДокумент124 страницыDL Manual - Com Vs Controller Gs Driver p100 Operating ManualThiago Teixeira PiresОценок пока нет

- Bichelle HarrisonДокумент2 страницыBichelle HarrisonShahbaz KhanОценок пока нет

- Department of Education: Raiseplus Weekly Plan For Blended LearningДокумент3 страницыDepartment of Education: Raiseplus Weekly Plan For Blended LearningMARILYN CONSIGNAОценок пока нет

- 5 Ways To Foster A Global Mindset in Your CompanyДокумент5 страниц5 Ways To Foster A Global Mindset in Your CompanyGurmeet Singh KapoorОценок пока нет

- Chapter 5 - Principle of Marketing UpdateДокумент58 страницChapter 5 - Principle of Marketing UpdateKhaing HtooОценок пока нет

- The Anti-PaladinДокумент9 страницThe Anti-PaladinBobbyОценок пока нет

- Polyether Polyol Production AssignmentДокумент9 страницPolyether Polyol Production AssignmentanurdiaОценок пока нет

- Index: © Christopher Pitt 2018 C. Pitt, The Definitive Guide To AdonisjsДокумент5 страницIndex: © Christopher Pitt 2018 C. Pitt, The Definitive Guide To AdonisjsZidi BoyОценок пока нет

- PRESENTACIÒN EN POWER POINT Futuro SimpleДокумент5 страницPRESENTACIÒN EN POWER POINT Futuro SimpleDiego BenítezОценок пока нет

- HKUST 4Y Curriculum Diagram CIVLДокумент4 страницыHKUST 4Y Curriculum Diagram CIVLfrevОценок пока нет

- HR Practices in Public Sector Organisations: (A Study On APDDCF LTD.)Документ28 страницHR Practices in Public Sector Organisations: (A Study On APDDCF LTD.)praffulОценок пока нет

- Tata NanoДокумент25 страницTata Nanop01p100% (1)

- Physiol Toric Calculator: With Abulafia-Koch Regression FormulaДокумент1 страницаPhysiol Toric Calculator: With Abulafia-Koch Regression FormuladeliОценок пока нет

- SCIENCE 11 WEEK 6c - Endogenic ProcessДокумент57 страницSCIENCE 11 WEEK 6c - Endogenic ProcessChristine CayosaОценок пока нет

- This Is A Short Presentation To Explain The Character of Uncle Sam, Made by Ivo BogoevskiДокумент7 страницThis Is A Short Presentation To Explain The Character of Uncle Sam, Made by Ivo BogoevskiIvo BogoevskiОценок пока нет

- Properties of WaterДокумент23 страницыProperties of WaterNiken Rumani100% (1)

- Aharonov-Bohm Effect WebДокумент5 страницAharonov-Bohm Effect Webatactoulis1308Оценок пока нет

- Intro To MavenДокумент18 страницIntro To MavenDaniel ReckerthОценок пока нет

- An Analysis of Students' Error in Using Possesive Adjective in Their Online Writing TasksДокумент19 страницAn Analysis of Students' Error in Using Possesive Adjective in Their Online Writing TasksKartika Dwi NurandaniОценок пока нет

- Outlook of PonДокумент12 страницOutlook of Ponty nguyenОценок пока нет

- SPFL Monitoring ToolДокумент3 страницыSPFL Monitoring ToolAnalyn EnriquezОценок пока нет

- Dist - Propor.danfoss PVG32Документ136 страницDist - Propor.danfoss PVG32Michal BujaraОценок пока нет

- Unit 1 Bearer PlantsДокумент2 страницыUnit 1 Bearer PlantsEmzОценок пока нет

- Method Statement FINALДокумент61 страницаMethod Statement FINALshareyhou67% (3)

- E Voting PPT - 1Документ11 страницE Voting PPT - 1madhu100% (2)

- Gobekli TepeДокумент2 страницыGobekli TepeCarl Feagans100% (1)