Академический Документы

Профессиональный Документы

Культура Документы

SANCHITA BASU DAS (2014) TPP - An Agreement To Bridge The United States With ASEAN and Asia

Загружено:

Khath Bunthorn0 оценок0% нашли этот документ полезным (0 голосов)

159 просмотров2 страницыSANCHITA BASU DAS (2014) TPP- An Agreement to Bridge the United States With ASEAN and Asia

Оригинальное название

SANCHITA BASU DAS (2014) TPP- An Agreement to Bridge the United States With ASEAN and Asia

Авторское право

© © All Rights Reserved

Доступные форматы

PDF, TXT или читайте онлайн в Scribd

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документSANCHITA BASU DAS (2014) TPP- An Agreement to Bridge the United States With ASEAN and Asia

Авторское право:

© All Rights Reserved

Доступные форматы

Скачайте в формате PDF, TXT или читайте онлайн в Scribd

0 оценок0% нашли этот документ полезным (0 голосов)

159 просмотров2 страницыSANCHITA BASU DAS (2014) TPP - An Agreement To Bridge The United States With ASEAN and Asia

Загружено:

Khath BunthornSANCHITA BASU DAS (2014) TPP- An Agreement to Bridge the United States With ASEAN and Asia

Авторское право:

© All Rights Reserved

Доступные форматы

Скачайте в формате PDF, TXT или читайте онлайн в Scribd

Вы находитесь на странице: 1из 2

EastWestCenter.

org/APB Number 268 | June 12, 2014

Asia Pacic Bulletin

TPP: An Agreement to Bridge the United States

with ASEAN and Asia

BY SANCHITA BASU DAS

Afer already missing the deadline twice to conclude the Trans-Pacic Partnership (TPP)

negotatons, the trade ministers of the twelve member negotatng economies met once

again in Singapore in May 2014, pledging to intensify engagement and conrming a

series of meetngs in the months ahead to resolve outstanding issues. One is for the US

administraton to secure the Trade Promoton Authority (TPA), a fast track procedure

that pre-commits the US Congress to vote upon legislaton without amendment and within

a specied tme frame. Partner countries in the TTP negotatons are worried that absent

TPA authority any nalized TPP agreement could face numerous roadblocks from

Congress, especially on issues like intellectual property rights, and labor and

environmental standards. A case in point is the US-Korea free trade agreement (FTA)

known as KORUS, which had to be renegotated to satsfy demands from Congress.

It should be noted however that for the United States TPP is a key foreign policy tool for

future engagement with the Associaton of Southeast Asian Natons (ASEAN), the central

hub for many FTAs in Asia. Although seven ASEAN economies and the United States

already extend preferental treatment to each other through Asia Pacic Economic Council

(APEC), that forum remains non-binding in nature, and having 21 member economies

makes it difcult to atain consensus on contentous issues. In contrast, TPP is structured to

be a binding agreement that will benet the United States in both trade and foreign policy

maters. This concerns not only those ASEAN member countries currently partaking in the

negotatons, but also with ASEAN as a whole.

Indeed, the four economies of ASEAN that are currently negotatng the TPP agreement are

at diferent stages of economic development. Vietnam, for example, is predicted to double

its middle class to more than 30 million by 2020, and per capita income is expected to

increase from almost $1,800 in 2012 to $3,000 by 2020. The country has been growing at

an average annual rate of 7 percent since the early 1990s and complied with the rules of

the world trading system afer gaining membership to the World Trade Organizaton

(WTO) in 2007. This has caught the atenton of many investors, including American

franchises Kentucky Fried Chicken, Coca Cola, Starbucks, Pizza Hut, Burger King,

McDonalds, Procter & Gamble, Unocal, Conoco and Intel. All now have a presence in

Vietnam, either directly or through their afliates.

Likewise, Malaysia contnues with its ambiton of ataining developed-naton status by

2020. Its target of hitng $15,000 per capita gross natonal income is calculated to be

achievable through atractng over $440 billion in overseas investment. The government is

aiming not only to create 3.3 million new jobs but also increase private spending in

healthcare, transportaton, educaton, housing, consumer and luxury goods, and

infrastructure.

Sanchita Basu Das, Lead

Researcher for Economic Affairs

at the ASEAN Studies Center,

ISEAS, Singapore, explains that

Without a TPP agreement, it is

highly unlikely that US trade

accords with major partners in

Asia can be successfully

concluded and enacted upon

anytime soon.

The East-West Center promotes better

relations and understanding among the

people and nations of the United States,

Asia, and the Pacific through cooperative

study, research, and dialogue. Established

by the US Congress in 1960, the Center

serves as a resource for information and

analysis on critical issues of common

concern, bringing people together to

exchange views, build expertise, and

develop policy options.

Asia Pacic Bulletin Asia Pacic Bulletin

Finally, one cannot ignore the smaller, but wealthier, economies of Singapore and Brunei.

Both have rst world per capita GDPs at more than $40,000. Brunei is the third-largest oil

producer in Southeast Asia, with output averaging 180,000 barrels per day and it is also

the fourth-largest producer of liqueed natural gas in the world. Major US banks,

including Bank of America and Citgroup, have had substantal and lucratve operatons in

Brunei for more than three decades.

Singapore has established itself as the preferred destnaton for global businesses to

headquarter their Asian operatons. The city-state has a network of avoidance of double

taxaton treates with more than 70 countries and is strategically located at the

crossroads of the main trade and shipping routes of the world, including the major sea

route between China and India. With rst world infrastructure, travel to any ASEAN

economy is only a short fight away. The country also has a sound intellectual property

protecton regime and trusted legal system. As a result, US-based rms are increasingly

keen about investng in Singapore in a number of varied sectors, ranging from

manufacturing to services industries, and the nancial services sector.

The United States, in bringing together these four Southeast Asian economies under TPP,

is well placed to strengthen its linkages with ASEAN. These four have the potental to

become a gateway into ASEAN for US companies. Encompassing ten member states,

ASEAN is one of the most diverse and rapidly growing regions in the world. It has a

consumer base of 626 million with a combined GDP of almost $2.5 trillion, and is also the

third largest economy in Asia, and the seventh largest in the world. According to

McKinsey, ASEAN is on track to be the fourth largest economy in the world by 2050. Its

current 67 million middle class households are expected to increase to 125 million by

2025. Although intra-regional trade in ASEAN is half that of North America under NAFTA,

it is likely to deepen signicantly once the ASEAN Economic Community is in place to

deliver on free movement of goods, services, investment, labor and capital.

ASEAN hosts 227 global companies which have more than $1 billion in revenue creaton or

three percent of worlds total revenue. As highlighted in the East-West Centers ASEAN

Maters for America/America Maters for ASEAN publicaton, ASEAN countries, taken

together, rank fourth afer Canada, Mexico and China as a goods export market for the

United States and America is the third largest trading partner for ASEAN. The total value

of US-ASEAN bilateral trade has increased 71 percent since 2001from $137 billionto

$234 billion in 2012.

Indeed, the United States has high stakes in the TPP agreement. For the past ten years,

while America was occupied with wars in Iraq and Afghanistan, there have been

signicant developments in Asia: China and Indias economics have been contnuing to

grow, the smaller countries of ASEAN have been emerging as important economic hubs,

countries have been easing trade and investment restrictons to support the regional

producton network, and China has been enlarging its military power. In encouraging

politcal and economic actvites in Asia, the TPP is denitely a key component in the US

pivot or rebalancing strategy towards Asia. The US presence in the region through TPP

is reassuring for ASEAN natons, and also a potental platorm for economic integraton

across the Asia-Pacic region. This last factor of economic integraton across the Asia-

Pacic is in turn expected to increase US exports and investment in the region, which are

critcal for the creaton and retenton of jobs in the United States.

Despite the TPP being a potental win-win scenario for all, only tme will tell how the US

Congress will vote on this mater. Without a TPP agreement though, it is highly unlikely

that US trade accords with major partners in Asia can be successfully concluded and

enacted upon anytme soon.

Asia Pacific Bulletin | June 12, 2014

This last factor of economic

integration across the Asia-

Pacific is in turn expected to

increase US exports and

investment in the region,

which are critical for the

creation and retention of

jobs in the United States.

The Asia Pacific Bulletin (APB) series is

produced by the East-West Center in

Washington.

APB Series Editor: Dr. Satu Limaye

APB Series Coordinator: Damien

Tomkins

The views expressed in this

publication are those of the author

and do not necessarily reflect the

policy or position of the East-West

Center or any organization with which

the author is affiliated.

Sanchita Basu Das is an ISEAS Fellow and Lead Researcher for Economic Affairs at the

ASEAN Studies Center, ISEAS, Singapore. She can be contacted via email at

sanchita@iseas.edu.sg.

Вам также может понравиться

- Artículo EuropeaДокумент16 страницArtículo EuropeaBeatriz Diaz LopezОценок пока нет

- ASEAN and Its Affect On Southeast Asian: Executive SummaryДокумент11 страницASEAN and Its Affect On Southeast Asian: Executive Summaryjahidul islamОценок пока нет

- China-Asean Free Trade AgreementДокумент20 страницChina-Asean Free Trade AgreementBeatriz Diaz LopezОценок пока нет

- ASEANДокумент2 страницыASEANTerompah LiyanaОценок пока нет

- Economic Relationship among SAARC NationsДокумент17 страницEconomic Relationship among SAARC NationschelsseyОценок пока нет

- China's Silk Road StrategyДокумент1 страницаChina's Silk Road StrategyRAJESH GANESANОценок пока нет

- Australian Trade Minister Simon Birmingham's Speech To Center For China and GlobalizationДокумент8 страницAustralian Trade Minister Simon Birmingham's Speech To Center For China and GlobalizationLatika M BourkeОценок пока нет

- House Hearing, 114TH Congress - The Trans-Pacific Partnership: Prospects For Greater U.S. TradeДокумент88 страницHouse Hearing, 114TH Congress - The Trans-Pacific Partnership: Prospects For Greater U.S. TradeScribd Government DocsОценок пока нет

- U.S. & Global Administrative LawДокумент8 страницU.S. & Global Administrative LawSteve SchearОценок пока нет

- Apcac ReportДокумент16 страницApcac ReportAmChamSingaporeОценок пока нет

- Gale Researcher Guide for: Rivalry in Asia-Pacific Regions: APEC and ASEANОт EverandGale Researcher Guide for: Rivalry in Asia-Pacific Regions: APEC and ASEANОценок пока нет

- PAD 380 – CURRENT AFFAIRS IN SOUTH EAST ASIA ASSIGNMENT 2 (INDIVIDUALДокумент18 страницPAD 380 – CURRENT AFFAIRS IN SOUTH EAST ASIA ASSIGNMENT 2 (INDIVIDUALbillykhairi100% (1)

- Ja Ko 202129159604207Документ40 страницJa Ko 202129159604207latif_y.Оценок пока нет

- China's Policies on Asia-Pacific Security CooperationОт EverandChina's Policies on Asia-Pacific Security CooperationОценок пока нет

- Promoting Shared Interests: Policy Recommendations On Africa For The Second Term of The Obama AdministrationДокумент64 страницыPromoting Shared Interests: Policy Recommendations On Africa For The Second Term of The Obama AdministrationKDDcommОценок пока нет

- Regional Economic Integration in East AsiaДокумент24 страницыRegional Economic Integration in East AsiaArthur SkyОценок пока нет

- Chirathivat-Langhammer2020_Article_ASEANAndTheEUChallengedByDividДокумент12 страницChirathivat-Langhammer2020_Article_ASEANAndTheEUChallengedByDividhenrythomas2016Оценок пока нет

- Hnsam, Dnam, Naxa: About The AuthorДокумент17 страницHnsam, Dnam, Naxa: About The AuthorAvinash MishraОценок пока нет

- An Evaluation On The Regional Comprehensive Economic Partnership AgreementДокумент2 страницыAn Evaluation On The Regional Comprehensive Economic Partnership AgreementOmirbek HanayiОценок пока нет

- Lynne Rienner Publishers Asian Perspective: This Content Downloaded From 111.68.97.182 On Mon, 26 Feb 2018 10:09:01 UTCДокумент31 страницаLynne Rienner Publishers Asian Perspective: This Content Downloaded From 111.68.97.182 On Mon, 26 Feb 2018 10:09:01 UTCwajeeharizwan14Оценок пока нет

- ConclusionДокумент4 страницыConclusionpathanfor786Оценок пока нет

- ASEAN Discussion PaperДокумент4 страницыASEAN Discussion PaperEarly Joy BorjaОценок пока нет

- Midterm AssignmentДокумент3 страницыMidterm AssignmentXCXY C.Оценок пока нет

- The Role of Asean in South East AsiaДокумент12 страницThe Role of Asean in South East Asiahusna madihahОценок пока нет

- Understanding Asian Regionalism and Its Role in Southeast AsiaДокумент2 страницыUnderstanding Asian Regionalism and Its Role in Southeast AsiaAngelica AbajaОценок пока нет

- Investing in ASEAN 2011 2012Документ116 страницInvesting in ASEAN 2011 2012ASEAN100% (1)

- US Exit From TPP To Impact Security Architecture in Asia-PacificДокумент2 страницыUS Exit From TPP To Impact Security Architecture in Asia-PacificRitesh KumarОценок пока нет

- Contemporary WorldДокумент3 страницыContemporary WorldAnn Dela CruzОценок пока нет

- The Impact of Trade War Between The United States and China On ASEAN and Huawei Technologies Reviewed by Trade, Investment, and Competition LawДокумент12 страницThe Impact of Trade War Between The United States and China On ASEAN and Huawei Technologies Reviewed by Trade, Investment, and Competition LawMonica VaniaОценок пока нет

- Apec 01 PDFДокумент17 страницApec 01 PDFtzengyenОценок пока нет

- Hum1024 Da 19BLC1024Документ7 страницHum1024 Da 19BLC1024rm8001680Оценок пока нет

- Asean ConclusionДокумент2 страницыAsean Conclusionkeshni_sritharanОценок пока нет

- MEGA REGIONALS AND DEVELOPing COUNTRIESДокумент13 страницMEGA REGIONALS AND DEVELOPing COUNTRIESStuti SinhaОценок пока нет

- ASEAN2015Документ142 страницыASEAN2015Rudejane TanОценок пока нет

- Trans-Pacific Partnership: HearingДокумент101 страницаTrans-Pacific Partnership: HearingScribd Government DocsОценок пока нет

- Asian Integration Will Not Drive GrowthДокумент3 страницыAsian Integration Will Not Drive GrowthlawrenceОценок пока нет

- Pad 381 ChallengesДокумент6 страницPad 381 ChallengesAlia NdhirhОценок пока нет

- Presentation-RCEP and CAFTAДокумент18 страницPresentation-RCEP and CAFTAPutri RakhmadhaniОценок пока нет

- Critical issues raised by US trade agreementsДокумент4 страницыCritical issues raised by US trade agreementsMink gyoОценок пока нет

- Research Paper On Regional IntegrationДокумент4 страницыResearch Paper On Regional Integrationgzzjhsv9100% (1)

- Hillary Clinton-America's Pacific CenturyДокумент11 страницHillary Clinton-America's Pacific CenturyAntonio ScaliaОценок пока нет

- In Retrospect: Assessing Obama's Asia Rebalancing Strategy: by Uriel N. GalaceДокумент3 страницыIn Retrospect: Assessing Obama's Asia Rebalancing Strategy: by Uriel N. GalaceSaadiОценок пока нет

- UCNfC95l1Z8Km1qU PNNbJZBr9 3Yyic4-Essential Reading 7Документ11 страницUCNfC95l1Z8Km1qU PNNbJZBr9 3Yyic4-Essential Reading 7Aldo JimenezОценок пока нет

- Human Relations & ASEAN IntegrationДокумент11 страницHuman Relations & ASEAN IntegrationNarte, Angelo C.Оценок пока нет

- US Int'l Business Essay - Govt Policies, Trade Theories & T-TIPДокумент4 страницыUS Int'l Business Essay - Govt Policies, Trade Theories & T-TIPSoumyadeep BoseОценок пока нет

- Understanding The 'New East Asian Regionalism'Документ6 страницUnderstanding The 'New East Asian Regionalism'Alkhemist Alief MuhammadОценок пока нет

- MERCOSUR and NAFTA - The Need For ConvergenceДокумент8 страницMERCOSUR and NAFTA - The Need For Convergencetranvanhieupy40Оценок пока нет

- Chiang-China ASEAN Economic Relations After Establishment of Free Trade AreaДокумент25 страницChiang-China ASEAN Economic Relations After Establishment of Free Trade AreaRalph Romulus FrondozaОценок пока нет

- 10 0000@muse Jhu Edu@chapter@1195264Документ30 страниц10 0000@muse Jhu Edu@chapter@1195264Stefan SchweizerОценок пока нет

- Asean Should Become One CountryДокумент3 страницыAsean Should Become One Countryjust1394Оценок пока нет

- Asian Regionalism 2Документ17 страницAsian Regionalism 2aljon jayОценок пока нет

- ASEANДокумент21 страницаASEANShashank Shekhar SinghОценок пока нет

- 01 China's Strategy For FTAДокумент18 страниц01 China's Strategy For FTADimas Wahyu SatriaОценок пока нет

- AseanДокумент7 страницAseanSiddhant KumarОценок пока нет

- AseanДокумент7 страницAseanSiddhant KumarОценок пока нет

- Effect of The Currently Negotiated Trans-Pacific Partnership If United States Would Adopt It and If The Philippines Would First Adopt It Through American Influence?Документ7 страницEffect of The Currently Negotiated Trans-Pacific Partnership If United States Would Adopt It and If The Philippines Would First Adopt It Through American Influence?Chin MartinzОценок пока нет

- Political History NotesДокумент3 страницыPolitical History NotesMuhammad QureshОценок пока нет

- The Trans Pacific Partnership Can The United States Lead The Way in Asia Pacific IntegrationДокумент23 страницыThe Trans Pacific Partnership Can The United States Lead The Way in Asia Pacific IntegrationGabrielaОценок пока нет

- 2002, Cambodia - Defense Strategic ReviewДокумент28 страниц2002, Cambodia - Defense Strategic ReviewKhath BunthornОценок пока нет

- Buddhism and EnvironmentДокумент2 страницыBuddhism and EnvironmentKhath BunthornОценок пока нет

- Cambodian Libraries & Documentation Centers - CKS - Center For Khmer StudiesДокумент4 страницыCambodian Libraries & Documentation Centers - CKS - Center For Khmer StudiesKhath BunthornОценок пока нет

- Unit: %Документ21 страницаUnit: %Khath BunthornОценок пока нет

- Priyanka Parvathi (2015) Adoption and Impact of Black Pepper Certification in IndiaДокумент29 страницPriyanka Parvathi (2015) Adoption and Impact of Black Pepper Certification in IndiaKhath BunthornОценок пока нет

- 010616, How The U.S. Senate Is Supposed To WorkДокумент2 страницы010616, How The U.S. Senate Is Supposed To WorkKhath BunthornОценок пока нет

- 2002 Declaration On The Conduct of Parties in The South China SeaДокумент4 страницы2002 Declaration On The Conduct of Parties in The South China SeaKhath BunthornОценок пока нет

- 2000, Security and DevelopmentДокумент70 страниц2000, Security and DevelopmentKhath BunthornОценок пока нет

- 2017, Asean Economic Integration BriefДокумент8 страниц2017, Asean Economic Integration BriefKhath BunthornОценок пока нет

- 010616, Chinese Students Brainwashed by Western Theories', Say Scholars PDFДокумент1 страница010616, Chinese Students Brainwashed by Western Theories', Say Scholars PDFKhath BunthornОценок пока нет

- 1996 29th AMMJCДокумент11 страниц1996 29th AMMJCKhath BunthornОценок пока нет

- Angkor Involved - Angkor Temple GuideДокумент9 страницAngkor Involved - Angkor Temple GuideKhath BunthornОценок пока нет

- 1996, Policy Recommendation of The AEM-MITI's Working Group On Economic Cooperation in Cambodia, Laos and MyanmarДокумент5 страниц1996, Policy Recommendation of The AEM-MITI's Working Group On Economic Cooperation in Cambodia, Laos and MyanmarKhath BunthornОценок пока нет

- Sub Decree To Establish Preah Sihamoni Raja Buddhist University, Phnom PenhДокумент3 страницыSub Decree To Establish Preah Sihamoni Raja Buddhist University, Phnom PenhKhath BunthornОценок пока нет

- Islam and Society in Southeast AsiaДокумент20 страницIslam and Society in Southeast AsiaKhath BunthornОценок пока нет

- Ven. Walpola Sri Rahula (1982) One Vehicle For PeaceДокумент5 страницVen. Walpola Sri Rahula (1982) One Vehicle For PeaceKhath BunthornОценок пока нет

- Cambodia Charges Six As MP 'Sex Scandal' DeepensДокумент2 страницыCambodia Charges Six As MP 'Sex Scandal' DeepensKhath BunthornОценок пока нет

- WBSC Constitution SummaryДокумент3 страницыWBSC Constitution SummaryKhath BunthornОценок пока нет

- ADB (2012) Aid For TradeДокумент105 страницADB (2012) Aid For TradeKhath BunthornОценок пока нет

- A Comparative Study of Thai & Khmer BuddhismДокумент139 страницA Comparative Study of Thai & Khmer BuddhismArthur Antonovitch100% (3)

- Cambodia's Political Prisoners - LICADHOДокумент6 страницCambodia's Political Prisoners - LICADHOKhath BunthornОценок пока нет

- Indonesia - PancasilaДокумент2 страницыIndonesia - PancasilaKhath BunthornОценок пока нет

- A Countrys Size Culture Matter in Its Approach To International Law Opinion NДокумент8 страницA Countrys Size Culture Matter in Its Approach To International Law Opinion NKhath BunthornОценок пока нет

- US HR Resolution Concerning The Crisis in Cambodia July 1997Документ5 страницUS HR Resolution Concerning The Crisis in Cambodia July 1997Khath BunthornОценок пока нет

- Cambodia Socio-Economic Survey 2013 ReportДокумент87 страницCambodia Socio-Economic Survey 2013 ReportKhath BunthornОценок пока нет

- Guidebook2013 English ALLДокумент189 страницGuidebook2013 English ALLKhath BunthornОценок пока нет

- Holocaust Genocide Studies 1998 Kiernan 213 4Документ2 страницыHolocaust Genocide Studies 1998 Kiernan 213 4Khath BunthornОценок пока нет

- Mears Heimer 2001Документ4 страницыMears Heimer 2001AxelОценок пока нет

- Book Chapters-Journal ArticlesДокумент9 страницBook Chapters-Journal ArticlesKhath BunthornОценок пока нет

- v32n1 C LibreДокумент27 страницv32n1 C LibreKhath BunthornОценок пока нет

- Daniels08 pp-1Документ33 страницыDaniels08 pp-1Rayan Al-ShayaОценок пока нет

- Incoterms 2010 rules guide international tradeДокумент4 страницыIncoterms 2010 rules guide international tradeJunctionTОценок пока нет

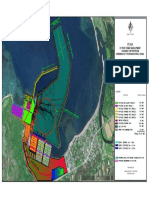

- Proposed Plan (Ceza)Документ1 страницаProposed Plan (Ceza)Crissa Mae Haduca MaritoriaОценок пока нет

- Supply Chain Management OverviewДокумент15 страницSupply Chain Management Overviewalice.9Оценок пока нет

- Inventory Management I: Click To Edit Master Subtitle StyleДокумент42 страницыInventory Management I: Click To Edit Master Subtitle StylewaragainstloveОценок пока нет

- ETY161Документ5 страницETY161coffeepathОценок пока нет

- Supply Chain Management: Session 1: Part 1Документ8 страницSupply Chain Management: Session 1: Part 1Safijo AlphonsОценок пока нет

- Instruments or Tools of Commercial PolicyДокумент2 страницыInstruments or Tools of Commercial PolicySamad SamОценок пока нет

- Incoterms 2010 Poster V5Документ1 страницаIncoterms 2010 Poster V5trafico7387Оценок пока нет

- GATT: General Agreement on Tariffs and TradeДокумент29 страницGATT: General Agreement on Tariffs and TradeAmol PhadaleОценок пока нет

- Big Four Accounting Firms - WikipediaДокумент4 страницыBig Four Accounting Firms - WikipediaNguyen Vu DoanОценок пока нет

- Trends in India's Foreign TradeДокумент35 страницTrends in India's Foreign Tradedimple100% (1)

- Chapter 6 Accounting For MaterialДокумент4 страницыChapter 6 Accounting For MaterialIbrahim SameerОценок пока нет

- Aligned documentation system presentation transcriptДокумент6 страницAligned documentation system presentation transcriptAvinash ShuklaОценок пока нет

- 310 CH 1Документ3 страницы310 CH 1MuhdAfiq100% (1)

- Harmonized System and Procedure of Importation & ExportationДокумент22 страницыHarmonized System and Procedure of Importation & ExportationMuhammad Adli Bin Ja'affarОценок пока нет

- BSCM01Документ34 страницыBSCM01Serina TsengОценок пока нет

- Unit-3 (Industrial Management)Документ48 страницUnit-3 (Industrial Management)Ankur Agrawal0% (1)

- Preserving and Protecting The Environment of The World So As To Benefit All The Nations of The WorldДокумент2 страницыPreserving and Protecting The Environment of The World So As To Benefit All The Nations of The WorldSK LashariОценок пока нет

- Books RequiredДокумент2 страницыBooks RequiredImissyouLove CombakОценок пока нет

- Internship ReportДокумент10 страницInternship ReportAjai008Оценок пока нет

- Ballou 09Документ105 страницBallou 09Andrew RhoОценок пока нет

- Port of Tacoma: Directory of Third-Party Logistic Service ProvidersДокумент4 страницыPort of Tacoma: Directory of Third-Party Logistic Service ProvidersPort of TacomaОценок пока нет

- Just-In-time Manufacturing - Wikipedia, The Free EncyclopediaДокумент6 страницJust-In-time Manufacturing - Wikipedia, The Free Encyclopediasyafiq badrishahОценок пока нет

- OTM Domain Knowledge - NaveenДокумент38 страницOTM Domain Knowledge - NaveenImpactianRajenderОценок пока нет

- Transfer Pricing and Tax HavensДокумент83 страницыTransfer Pricing and Tax HavensMartin TørnqvistОценок пока нет

- Panama Papers - Empresas de ArgentinosДокумент17 страницPanama Papers - Empresas de ArgentinosEl Destape100% (3)

- Types of Trade BarriersДокумент4 страницыTypes of Trade BarrierssumitdangОценок пока нет

- Uruguay RoundДокумент13 страницUruguay RoundRavi VermaОценок пока нет

- Practical Guide To INCOTERMS 2010Документ22 страницыPractical Guide To INCOTERMS 2010Global Negotiator100% (13)