Академический Документы

Профессиональный Документы

Культура Документы

Cmt2 Reading Spr12

Загружено:

ng_viet_cuong_group0 оценок0% нашли этот документ полезным (0 голосов)

64 просмотров4 страницыFinacial Book

Авторское право

© © All Rights Reserved

Доступные форматы

PDF, TXT или читайте онлайн в Scribd

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документFinacial Book

Авторское право:

© All Rights Reserved

Доступные форматы

Скачайте в формате PDF, TXT или читайте онлайн в Scribd

0 оценок0% нашли этот документ полезным (0 голосов)

64 просмотров4 страницыCmt2 Reading Spr12

Загружено:

ng_viet_cuong_groupFinacial Book

Авторское право:

© All Rights Reserved

Доступные форматы

Скачайте в формате PDF, TXT или читайте онлайн в Scribd

Вы находитесь на странице: 1из 4

Chartered Market Technician (CMT) Program Level 2

Spring 2012 Reading Assignments

CMT Level 2 candidates are responsible for the theory and application of concepts and techniques covered by the

assigned readings. CMT Level 2 candidates must expand his/her understanding of technical analysis to apply various

technical indicators and techniques in the analysis of the overall market or an individual security.

The CMT Level 2 Exam requires the candidate to demonstrate a greater depth of competency and proficiency by

applying more advanced analytical techniques.

Exam time length: 4 hours

Exam format: Multiple Choice

Immediate scoring will be available on this exam.

Listed below and on the following page are the reading assignments for the Level 2 Exam. The CMT candidate is

responsible for knowing and understanding the entire list of reading assignments. All candidates are encouraged to also

review the reading materials for the Level 1 Exam.

***********************************************************************************

CMT Level 2 Exam Reading Assignments

1) MTA Code of Ethics (attached at the end of this document)

2) Edwards, Robert D. and Magee, John, Technical Analysis of Stock Trends, 9th Edition, CRC Press, Taylor & Francis Group, Boca

Raton, Florida, c2007, ISBN 0-8493-3772-0

Chapters:

17. A Summary and Some Concluding Comments

17.1. Technical Analysis and Technology in the 21st Century

17.2. Advancements in Investment Technology

23. Choosing and Managing High-Risk Stocks

24. Probable Moves of Your Stocks

27. Stop Orders

28. What is a bottom? What is a top?

42. Portfolio Risk Management

Appendix A The Probable Moves of Your Stocks

3) Frost, A.J. and Prechter, Robert R., Elliott Wave Principle, Tenth Edition, New Classics Library, Gainesville, GA c. 1978-2005, ISBN

0-932750-75-3

Chapters:

1. The Broad Concept

2. Guidelines of Wave Formation

3. Historical and Mathematical Background

4. Ratio Analysis and Fibonacci Time Sequences

4) Kaufman, Perry J., New Trading Systems and Methods, 4th Edition, John Wiley & Sons, Inc., c.1998, ISBN 0-471-26847-X

Chapters:

1. Introduction

2. Basic Concepts

3. Charting

4. Charting Systems and Techniques

6. Regression Analysis

7. Time-Based Trend Calculations

8. Time Based Trend Systems

9. Momentum and Oscillators

10. Seasonality

11. Cycle Analysis

12. Volume, Open Interest and Breadth

13. Spreads and Arbitrage

14. Behavioral Techniques

20. Advanced Techniques

21. System Testing

23. Risk Control

24. Diversification and Portfolio Allocation

5) Kirkpatrick, Charles D. and Dahlquist, Julie R.: Technical Analysis The Complete Resource for Financial Market Technicians,

Pearson Education, Inc., Upper Saddle River, New Jersey 07458, c. 2006, ISBN 10:0-13-153113-1

Chapters:

7. Sentiment

10. Flow of Funds

13. Breakouts, Stops, and Retracements

14. Moving Averages

15. Bar Chart Patterns

17. Short-Term Patterns

18. Confirmation

19. Cycles

20. Elliott, Fibonacci, and Gann

21. Selection of Market and Issues: Trading and Investing

23. Money and Risk Management

Appendix A Basic Statistics

6) Nison, Steve, Japanese Candlestick Charting Techniques, 2nd Edition, New York Institute of Finance, c.2001, ISBN 0-7352-0181-1

Chapters:

1. Introduction

2. A Historical Background

3. Constructing the Candlestick

4. Reversal Patterns

5. Stars

6. More Reversal Patterns

7. Continuation Patterns

9. Putting It All Together

7) Pring, Martin J., Investment Psychology Explained, John Wiley & Sons, Inc., c.1993, ISBN 0-471-13300-0

Chapters:

All Chapters

8) Pring, Martin J.: Technical Analysis Explained, 4th Edition, McGraw Hill Book Company, New York, NY, c.2001, ISBN 0-07-1381937

Chapters:

16. The Concept of Relative Strength

19. Price: Group Rotation

21. Practical Identification of Cycles

25. Why Interest Rates Affect the Stock Market

28. Checkpoints for Identifying Primary Stock Market Peaks and Troughs

29. Automated Trading Systems

9) Excerpt from: Wilkinson, Chris: Technically Speaking, Courtesy of Traders Press Inc.

The required reading excerpt from this book can be found here: http://tinyurl.com/cmtlevel2

10) Aronson, David R.: Evidence-Based Technical Analysis, John Wiley & Sons, Inc., Hoboken, New Jersey, c. 2007 by David R.

Aronson. ISBN-13: 978-0-470-00874-4 (cloth), ISBN-10: 0-470-00874-1 (cloth)

Chapters:

4. Statistical Analysis

5. Hypothesis Tests and Confidence Intervals

6. Data-Mining Bias: the Fools Gold and Objective TA

7. Theories of Nonrandom Price Motion

11) Jeremy du Plessis, The Definitive Guide to Point and Figure, Harriman House LTD, 2009, ISBN 1-897-59763-0. Click on the

following link to buy it at an MTA members special discount: www.updata.co.uk/shop/mtabookoffer.asp

Chapters:

5. Analyzing Point and Figure Charts

6. Point and Figure Charts of Indicators

7. Optimization of Point and Figure Charts

8. Point and Figures Contribution to Market Breadth

9. Advanced Point and Figure Techniques

Revised November 2011

Market Technicians Association

CODE OF ETHICS

Amended December 2004

The Market Technicians Association has established ethical standards of professional conduct which every Member and Affiliate shall maintain. The

Ethical Standards set forth in 1 through 9 serve as a guide of professional responsibility and as a benchmark for ethical judgment.

1. Members and Affiliates shall maintain at all times the highest standards of professional competence, integrity and judgment. Said standards

should be maintained, and members and affiliates should act with dignity and in an ethical manner when dealing with the public, clients, prospects,

employees, fellow Members and Affiliates and business associates.

This ethical standard requires strict compliance with the applicable laws and regulations of any government, governmental agency and regulatory

organization which has jurisdiction over the professional activities of Members and Affiliates.

This same ethical standard requires that Members and Affiliates abide by the Constitution and By-Laws of the Association, and all rules

promulgated by its Board of Directors. Members and Affiliates shall not unduly exploit their relationship with the Association for commercial

purposes, nor use, or permit others to use, Association mailing lists for other than Association purposes.

2. Members and Affiliates shall not publish or make statements which they know or have reason to believe are inaccurate or misleading. Members

and Affiliates shall avoid leading others to believe that their technically-derived views of future security price behavior reflect foreknowledge rather

than estimates and projections subject to reexamination and, as events may dictate, to change.

3. Members and Affiliates shall not publish or make statements concerning the technical position of a security, a market or any of its components

or aspects unless such statements are reasonable and consistent in light of the available evidence and of the accumulated knowledge in the field of

financial technical analysis. New methods of technical analysis and modifications of existing concepts and techniques shall be fully documented as

to procedure and rationale. Proprietary methods shall not be infringed, but this standard shall be a guide in the creation of proprietary products.

4. Members and Affiliates shall not publish or make statements which indefensibly disparage and discredit the analytical work of others.

5. Members and Affiliates shall not seek, disseminate or act on the basis of material, non-public (inside) information, if to do so would violate the

laws and regulations of any government, governmental agency or regulatory organization relating to the use of inside information.

6. Members and Affiliates shall keep in confidence knowledge concerning the lawful private affairs of both past and present clients, employers, and

employers clients.

7. When a Member or Affiliate recommends that a security ought to be bought, sold or held, adequate opportunity to act on such a

recommendation shall be given to the Members or Affiliates clients, employer, and the employers clients before acting on behalf of either the

Members or Affiliates own account or the accounts of immediate family members.

8. Members and Affiliates shall not copy or deliberately use substantially the same language or analysis contained in reports, studies or writings

prepared by any author unless permission to do so is received, in advance, from the author. In the event the original author is deceased, or is

otherwise unavailable to grant such permission, Members and Affiliates must ensure that the original author receives prominent and adequate

credit for the original work.

9. Members who have earned the CMT designation shall use CMT after their name whenever and wherever appropriate.

Вам также может понравиться

- 2014may cmt3Документ3 страницы2014may cmt3Pisut OncharoenОценок пока нет

- Chartered Market Technician (CMT) Program: Level 1 - Spring 2010Документ4 страницыChartered Market Technician (CMT) Program: Level 1 - Spring 2010Foru FormeОценок пока нет

- Chartered Market Technician (CMT) Program Level 3 - Spring 2010Документ3 страницыChartered Market Technician (CMT) Program Level 3 - Spring 2010Foru FormeОценок пока нет

- MTA Symposium - My Notes (Vipul H. Ramaiya)Документ12 страницMTA Symposium - My Notes (Vipul H. Ramaiya)vipulramaiya100% (2)

- Building A Trading PlanДокумент2 страницыBuilding A Trading PlanGeorge KangasОценок пока нет

- CTA Program DetailsДокумент3 страницыCTA Program DetailsJennylyn BОценок пока нет

- Order Execution Policy PDFДокумент18 страницOrder Execution Policy PDFRory BrownОценок пока нет

- Project CharterДокумент11 страницProject ChartermmeindlОценок пока нет

- CMT1Документ8 страницCMT1pmlopez22220000Оценок пока нет

- Study of Fluctuations in Stock MarketДокумент34 страницыStudy of Fluctuations in Stock MarketHeena GuptaОценок пока нет

- Pin Bars AdvancedДокумент9 страницPin Bars AdvancedTrendzchaser SrdОценок пока нет

- CMTДокумент3 страницыCMTRohit TiwariОценок пока нет

- Development and Analysis of A Trading Algorithm Using Candlestick PatternsДокумент21 страницаDevelopment and Analysis of A Trading Algorithm Using Candlestick PatternsManziniLeeОценок пока нет

- CMTProgram BrochureДокумент12 страницCMTProgram BrochureAbe-ScribdОценок пока нет

- Asia Charts Super Rally (SR) Trading CourseДокумент5 страницAsia Charts Super Rally (SR) Trading Coursejancok asuОценок пока нет

- Share Market Courses BroucherДокумент9 страницShare Market Courses BroucherRaj DubeyОценок пока нет

- Assignment 1 SolutionДокумент31 страницаAssignment 1 SolutionGuangjun Ou100% (1)

- Guppy Multiple Moving AverageДокумент6 страницGuppy Multiple Moving AverageJaime GuerreroОценок пока нет

- OTA PatentДокумент21 страницаOTA Patentmkpai-1Оценок пока нет

- NAL Algorithmic Trading and Computational Finance Using Python Brochure 30 PDFДокумент5 страницNAL Algorithmic Trading and Computational Finance Using Python Brochure 30 PDFnimitjain10Оценок пока нет

- 13-How Good Is Your DataДокумент6 страниц13-How Good Is Your DataAnonymous rOv67RОценок пока нет

- GFF - Using Price Action To Identify TrendsДокумент14 страницGFF - Using Price Action To Identify Trendslilli-pilli100% (1)

- New Student Action ItemsДокумент3 страницыNew Student Action Itemso1100% (1)

- BrochureДокумент12 страницBrochurePhogat AshishОценок пока нет

- Capital Markets Dealers ModuleДокумент186 страницCapital Markets Dealers ModulePriyanka SasmalОценок пока нет

- VIX IndexДокумент2 страницыVIX Indexthomas_matheusОценок пока нет

- K Means PseudocodeДокумент1 страницаK Means PseudocodeMusa Milli100% (1)

- NIFM Training Proposal For School & CollegeДокумент22 страницыNIFM Training Proposal For School & CollegeshailendranifmОценок пока нет

- Chartbook For Level 3.13170409Документ65 страницChartbook For Level 3.13170409calibertraderОценок пока нет

- Journal of Financial Economics: Amy Kwan, Ronald Masulis, Thomas H. McinishДокумент19 страницJournal of Financial Economics: Amy Kwan, Ronald Masulis, Thomas H. McinishJackCardosoОценок пока нет

- StrategyQuant Help.3.6.1 PDFДокумент130 страницStrategyQuant Help.3.6.1 PDFenghoss77Оценок пока нет

- Rithmic Manual Digital - EnglishДокумент16 страницRithmic Manual Digital - EnglishThe Trading PitОценок пока нет

- CTF Lecture NotesДокумент105 страницCTF Lecture NotesMartin Martin MartinОценок пока нет

- Nancy New - Petition To Enter Guilty PleaДокумент10 страницNancy New - Petition To Enter Guilty PleaWLBT NewsОценок пока нет

- What Are Episodic Pivots and How To Find Them: Home Members Only MM Stockbee 50 VideosДокумент6 страницWhat Are Episodic Pivots and How To Find Them: Home Members Only MM Stockbee 50 VideosXoodmaОценок пока нет

- Impicit NonlinearДокумент608 страницImpicit Nonlinearmaxbr03Оценок пока нет

- The Scavenger Hunt NieДокумент47 страницThe Scavenger Hunt NieSubathara PindayaОценок пока нет

- Catalogo Mineria SMC UsaДокумент12 страницCatalogo Mineria SMC UsaLela S CamposОценок пока нет

- Forecasting Bitcoin Price Using Deep Learning AlgorithmДокумент7 страницForecasting Bitcoin Price Using Deep Learning AlgorithmIJRASETPublicationsОценок пока нет

- Bringing Health Care To Your Fingertips Ahead of The Curve SeriesДокумент30 страницBringing Health Care To Your Fingertips Ahead of The Curve SeriespowerforwardОценок пока нет

- Canada Emplyoment AgenciesДокумент11 страницCanada Emplyoment AgenciesDanish ShaikhОценок пока нет

- SERIES 24 EXAM STUDY GUIDE 2021 + TEST BANKОт EverandSERIES 24 EXAM STUDY GUIDE 2021 + TEST BANKОценок пока нет

- Ultimate Swing Trader Manual: Read/DownloadДокумент3 страницыUltimate Swing Trader Manual: Read/DownloadAalon SheikhОценок пока нет

- Piyush PPT of ZRAMДокумент16 страницPiyush PPT of ZRAMPiyush SharmaОценок пока нет

- FoundationBook2016e VersionДокумент241 страницаFoundationBook2016e VersionMohamed El Minawi100% (1)

- Setting SL & TP in Harmonic TradingДокумент1 страницаSetting SL & TP in Harmonic TradingBiantoroKunarto0% (1)

- Meta Stock User ManualДокумент808 страницMeta Stock User ManualAndre YosuaОценок пока нет

- Session 21 - Action Plan For Daily Income Trader (Template)Документ4 страницыSession 21 - Action Plan For Daily Income Trader (Template)Sri Chowdary0% (1)

- Global Variable DescriptionДокумент2 страницыGlobal Variable DescriptionelgpakОценок пока нет

- Abandon The Indicators Trade Like The Big Shots Institutional Traders Underground Shocking Secrets To Set and Forget Trading and Instant Fo A2jye PDFДокумент2 страницыAbandon The Indicators Trade Like The Big Shots Institutional Traders Underground Shocking Secrets To Set and Forget Trading and Instant Fo A2jye PDFnathaniel ekaikoОценок пока нет

- 14 - Intro To Automated Trading and End of Semester ReviewДокумент5 страниц14 - Intro To Automated Trading and End of Semester ReviewcollegetradingexchangeОценок пока нет

- TM ManualДокумент15 страницTM Manualboatran8Оценок пока нет

- How To Trade Wyckoff For Beginners A-ZДокумент3 страницыHow To Trade Wyckoff For Beginners A-ZCaser TOtОценок пока нет

- Chartered Market Technician (CMT) Program Level 2: May 2013 Reading AssignmentsДокумент4 страницыChartered Market Technician (CMT) Program Level 2: May 2013 Reading Assignmentsανατολή και πετύχετεОценок пока нет

- 2014may cmt2Документ4 страницы2014may cmt2Pisut OncharoenОценок пока нет

- Chartered Market Technician (CMT) Program Level 2 - Spring 2010Документ4 страницыChartered Market Technician (CMT) Program Level 2 - Spring 2010Foru FormeОценок пока нет

- CMT Level 1 - 2013 Practice ExamДокумент5 страницCMT Level 1 - 2013 Practice Examdev2700100% (1)

- Chartered Market Technician (CMT) Program Level 3: May 2013 Reading AssignmentsДокумент3 страницыChartered Market Technician (CMT) Program Level 3: May 2013 Reading AssignmentsGheorghe GigeluОценок пока нет

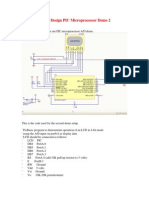

- Project 10: Frequency Measurement Using Input CaptureДокумент18 страницProject 10: Frequency Measurement Using Input Captureng_viet_cuong_groupОценок пока нет

- Junior Design PIC Microprocessor Demo 2Документ2 страницыJunior Design PIC Microprocessor Demo 2ng_viet_cuong_groupОценок пока нет

- Servo ConnectДокумент1 страницаServo Connectng_viet_cuong_groupОценок пока нет

- Special Purpose Basic SwitchДокумент5 страницSpecial Purpose Basic Switchng_viet_cuong_groupОценок пока нет

- PLC Solution BookДокумент49 страницPLC Solution BookJagadeesh Rajamanickam71% (14)

- MCP3909 3-Phase Energy Meter Reference DesignДокумент88 страницMCP3909 3-Phase Energy Meter Reference Designng_viet_cuong_groupОценок пока нет

- cmt1 Sampleques BookbДокумент25 страницcmt1 Sampleques Bookbng_viet_cuong_groupОценок пока нет

- De 1 211Документ6 страницDe 1 211ng_viet_cuong_groupОценок пока нет

- OrCad TutorialДокумент62 страницыOrCad Tutorialng_viet_cuong_groupОценок пока нет

- 70 Test B 8955Документ503 страницы70 Test B 8955ng_viet_cuong_groupОценок пока нет

- CS9803GPДокумент2 страницыCS9803GPng_viet_cuong_groupОценок пока нет

- International Business EnvironmentДокумент29 страницInternational Business EnvironmentNardsdel RiveraОценок пока нет

- PRNCaseStudiesBook PDFДокумент21 страницаPRNCaseStudiesBook PDFDiana Teodora ȘtefanoviciОценок пока нет

- AR29Документ405 страницAR29HarveyОценок пока нет

- Insider Trading RegulationsДокумент22 страницыInsider Trading Regulationspreeti211Оценок пока нет

- Chapter - 4 Intermediate Term FinancingДокумент17 страницChapter - 4 Intermediate Term FinancingMuhammad D. Hossain Mak33% (3)

- 2130 Ds Machinery HealthAnaДокумент14 страниц2130 Ds Machinery HealthAnajose rubenОценок пока нет

- Ias 41 AgricultureДокумент23 страницыIas 41 AgricultureSunshine KhuletzОценок пока нет

- Motivation - Case StudyДокумент4 страницыMotivation - Case Studysunnysopal100% (1)

- Delta One: What Does It Do?Документ1 страницаDelta One: What Does It Do?Jasvinder JosenОценок пока нет

- Profit and Lossl PDFДокумент18 страницProfit and Lossl PDFsangili2005Оценок пока нет

- Solution Manual Chapter 5Документ6 страницSolution Manual Chapter 5sshahar2Оценок пока нет

- Q & A - Test 1 Acc106 - 114Документ8 страницQ & A - Test 1 Acc106 - 114Jamilah EdwardОценок пока нет

- Corporation Law ReviewerДокумент216 страницCorporation Law ReviewerJobi BryantОценок пока нет

- Problem - Trader For A Day - Restrictions - Tora Internship Test - April 2019 - INGIniousДокумент7 страницProblem - Trader For A Day - Restrictions - Tora Internship Test - April 2019 - INGIniousPaul GabrielОценок пока нет

- HDFC ValuationДокумент23 страницыHDFC ValuationUdit UpretiОценок пока нет

- Public Economics: Budget & Its TypesДокумент24 страницыPublic Economics: Budget & Its TypesMahesh Rasal0% (1)

- Case Study - BamboocraftДокумент6 страницCase Study - BamboocraftNicah AcojonОценок пока нет

- The Future Outlook of Desalination in The GulfДокумент63 страницыThe Future Outlook of Desalination in The GulfChristian D. OrbeОценок пока нет

- Oil and Gas Reservoirs Management PrinciplesДокумент13 страницOil and Gas Reservoirs Management PrinciplesTim ClarkeОценок пока нет

- The Role of Sustainability in Brand Equity Value in The Financial SectorДокумент19 страницThe Role of Sustainability in Brand Equity Value in The Financial SectorPrasiddha PradhanОценок пока нет

- ch13 PDFДокумент5 страницch13 PDFNoSepasi FebriyaniОценок пока нет

- GMAT Practice Set 13 - VerbalДокумент73 страницыGMAT Practice Set 13 - VerbalKaplanGMATОценок пока нет

- MSCI World Index (USD) : Cumulative Index Performance - Net Returns (Usd) (AUG 2006 - AUG 2021) Annual Performance (%)Документ3 страницыMSCI World Index (USD) : Cumulative Index Performance - Net Returns (Usd) (AUG 2006 - AUG 2021) Annual Performance (%)Krishna MoorthiОценок пока нет

- Year Ahead 2022Документ72 страницыYear Ahead 2022Dan CraneОценок пока нет

- Rent, Profit and InterestДокумент15 страницRent, Profit and InterestVeena SangeethОценок пока нет

- Working Capitral of HDFC BANK Final ProjectДокумент110 страницWorking Capitral of HDFC BANK Final ProjectyashОценок пока нет

- Difference Between Direct and Indierect TaxesДокумент3 страницыDifference Between Direct and Indierect TaxesZeus JhonОценок пока нет

- Ic Exam Review: VariableДокумент122 страницыIc Exam Review: VariableJL RangelОценок пока нет

- STCQCAA Class Reps Assembly 2018Документ42 страницыSTCQCAA Class Reps Assembly 2018STCQC Alumnae AssociationОценок пока нет

- Foreign Direct InvestmentДокумент8 страницForeign Direct InvestmentHarshita BhallaОценок пока нет