Академический Документы

Профессиональный Документы

Культура Документы

Synopsis Final

Загружено:

Gautam Kumar0 оценок0% нашли этот документ полезным (0 голосов)

15 просмотров5 страницsynopsis on risk and return

Авторское право

© © All Rights Reserved

Доступные форматы

DOCX, PDF, TXT или читайте онлайн в Scribd

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документsynopsis on risk and return

Авторское право:

© All Rights Reserved

Доступные форматы

Скачайте в формате DOCX, PDF, TXT или читайте онлайн в Scribd

0 оценок0% нашли этот документ полезным (0 голосов)

15 просмотров5 страницSynopsis Final

Загружено:

Gautam Kumarsynopsis on risk and return

Авторское право:

© All Rights Reserved

Доступные форматы

Скачайте в формате DOCX, PDF, TXT или читайте онлайн в Scribd

Вы находитесь на странице: 1из 5

A STUDY ON SECURITY MARKET RISK AND RETURN

FROM INVESTORS PERSPECTIVE

Synopsis submitted in partial fulfillment of requirement for the award of the

Degree of

MASTER OF BUSINESS ADMINISTRATION

Of

BANGALORE UNIVERSITY

By

GAUTAM KUMAR

12KXCMA016

Under the guidance of

Prof. PRASHANTH P.B

Assistant Professor

SURANA COLLEGE

CENTRE FOR POST GRADUATE STUDIES

#17 KENGERI SATELLITE TOWN, BANGALORE 560060

Bangalore University

2013-2014

INTRODUCTION:

Securities market a place or places where securities are bought and sold, the facilities and people

engaged in such transactions, the demand for and availability of securities to be traded, and the

willingness of buyers and sellers to reach agreement on sales. Securities markets include over-

the-counter markets, the New York Stock Exchange, the Bombay stock exchange.

Risk is a complex topic. There are many types of risk, and many ways to evaluate and measure

risk. In the theory and practice of investing, a widely used definition of risk is:

Risk is the uncertainty that an investment will earn its expected rate of return.

Typically, individual investors think of risk as the possibility that their investments could lose

money. They are likely to be quite happy with an investment return that is greater than expected -

a positive surprise. However, since risky assets generate negative surprises as well as positive

ones, defining risk as the uncertainty of the rate of return is reasonable. Greater uncertainty

results in greater likelihood that the investment will generate larger gains, as well as greater

likelihood that the investment will generate larger losses (in the short term) and in higher or

lower accumulated value (in the long term.)

LITERATURE REVIEW:

Grewal S.S and Navjot Grewall (1984) revealed some basic investment rules and rules for selling

shares. They warned the investors not to buy unlisted shares, as Stock Exchanges do not permit

trading in unlisted shares.

Jack Clark Francis (1986) revealed the importance of the rate of return in investments and

reviewed the possibility of default and bankruptcy risk. He opined that in an uncertain world,

investors cannot predict exactly what rate of return an investment will yield.

Preethi Singh(1986) disclosed the basic rules for selecting the company to invest in. She opined

that understanding and measuring return and risk is fundamental to the investment process.

According to her, most investors are 'risk averse'. To have a higher return the investor has to face

greater risks.

David.L.Scott and William Edward4 (1990) reviewed the important risks of owning common

stocks and the ways to minimize these risks. They commented that the severity of financial risk

depends on how heavily a business relies on debt. Financial risk is relatively easy to minimize if

an investor sticks to the common stocks of companies that employ small amounts of debt.

Nabhi Kumar Jain (1992) specified certain tips for buying shares for holding and also for selling

shares. He advised the investors to buy shares of a growing company of a growing industry. Buy

shares by diversifying in a number of growth companies operating in a different but equally fast

growing sector of the economy.

NEED FOR STUDY:

To know investors satisfaction with return from security market.

To know what are the main risk factors in security market.

OBJECTIVES:

To know what are the main risk factors in secondary market.

To determine the necessary rate of return on the amount of money you will be investing

to reach your goals.

To understand the depth about different investment avenues available in market.

To find out the factors that investor consider before investment.

HYPOTHESIS:

H0: An increase in alternative target allocation will not reduce the portfolios risk.

H1: An increase in alternative target allocation will reduce the portfolios risk.

SCOPE OF THE STUDY:

Selections of companies are restricted to nifty index and nifty junior index only. The companies

are chosen and analyzed based on their performance in the past three years. No other factor other

than the share price movements, index movement, rate of return on government securities and

beta values for the securities for the past three years are taken for analysis.

METHODOLOGY:

Research is an organized enquiry designed and carried to provide its information to solve the

problem. The project includes findings of primary and secondary data. The research is done with

the aid of the annual reports, the company data base text books. The study is conducted based on

exploratory research because the problem has not been clearly defined as yet.

DATA COLLECTION:

PRIMARY DATA:

Companys finance manager.

Books

SECONDARY DATA:

Journals,

Magazines and

NSE website.

TOOLS AND TECHNIQUES USED FOR ANALYSIS:

There are three important methods to analyze the data. They are

1. Capital Asset Pricing Model(CAPM)

2. Beta coefficient

3. Arbitrage pricing Theory

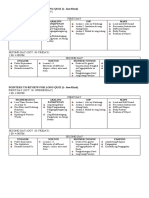

CHAPTER SCHEME:

- CHAPTER ONE : INTRODUCTION

- CHAPTER TWO : PROFILE OF THE GENESIS FINANCIAL SOLUTIONS.

- CHAPTER THREE : RESEARCH DESIGN

- CHAPTER FOUR : DATA ANALYSIS AND INTERPRETATION

- CHAPTER FIVE : SUMMARY OF FINDINGS, CONCLUSION AND

SUGGESTIONS

- BIBLIOGRAPHY

- APPENDICES, ANNEXURE

BIBLIOGRAPHY

- Grewal S.S and Navjot Grewall (1984), Study on security market risk and return from

investors prospective,International Journal of innovative research & studies,

ISSN 2319-9725 Vol-2 Issue4, April (2013)

- Francis, J. C. (1993). Management of investments (Ed.). McGraw-Hill Book Co.

- Rachna Bajaj, Investor's perception towards the capital market International

Multidisciplinary Research Journal, ISSN No : 2230-7850, Vol 4 Issue 2 March 2014.

- Srivastava, Rajendra K., Tasadduq A. Shervani, and Liam Fahey (1998), Market-Based

Assets and Shareholder Value: A Framework for Analysis, Journal of Marketing, 62

(January), 218.

- John Y. Campbell, Understanding Risk and Return, , The Journal of Political Economy,

Vol. 104, No. 2. (Apr., 1996), pp. 298-345.

- HUI GUO and ROBERT F. WHITELAW, Uncovering the RiskReturn Relation in the

Stock, THE JOURNAL OF FINANCE VOL. LXI, NO. 3 JUNE 2006.

WEB SITES:

Responsible investment, accessed on 05/06/2014

http://www.bseindia.com/static/about/responsible_investment.aspx?expandable=4

Companies by market capitalization, viewed on 05/06/2014

http://www.bseindia.com/markets/equity/eqreports/topmarketcapitalization.aspx?expandable=3

Securities Information, viewed on 05/06/2014

http://www.nseindia.com/corporates/content/securities_info.htm

Risk Management, viewed on 02/06/2014

http://www.nseindia.com/int_invest/content/risk_management.htm

Financial Results, accessed on 29/05/2014

http://www.bseindia.com/static/about/financials.aspx?expandable=2

Security Lending and Borrowing Scheme (SLBS), viewed on 04/06/2014

http://www.nseindia.com/products/content/equities/slbs/slbs.htm

Вам также может понравиться

- A Study On Effectiveness of Supply Chain Management With Special Reference To Bisleri International PVT LTDДокумент113 страницA Study On Effectiveness of Supply Chain Management With Special Reference To Bisleri International PVT LTDGautam Kumar100% (1)

- CNX Nifty01 28 June 2014Документ30 страницCNX Nifty01 28 June 2014Gautam KumarОценок пока нет

- Year ACC Return (SR-SM) (RM-RM) (SR-SM) (RM-RM)Документ9 страницYear ACC Return (SR-SM) (RM-RM) (SR-SM) (RM-RM)Gautam KumarОценок пока нет

- Question AreДокумент9 страницQuestion AreGautam KumarОценок пока нет

- Question AreДокумент9 страницQuestion AreGautam KumarОценок пока нет

- Question AreДокумент9 страницQuestion AreGautam KumarОценок пока нет

- Market Based InvestmentДокумент4 страницыMarket Based InvestmentGautam KumarОценок пока нет

- Executive SummaryДокумент3 страницыExecutive SummaryGautam KumarОценок пока нет

- E Hrmguide PDFДокумент33 страницыE Hrmguide PDFsonuОценок пока нет

- Introduction To Sales ManagementДокумент70 страницIntroduction To Sales ManagementGautam KumarОценок пока нет

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5794)

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (895)

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (400)

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (344)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1090)

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (121)

- Managing Human Resources 17Th Edition by Scott A Snell Full ChapterДокумент35 страницManaging Human Resources 17Th Edition by Scott A Snell Full Chapterhenry.pralle792100% (25)

- Tafseer: Surah NasrДокумент9 страницTafseer: Surah NasrIsraMubeenОценок пока нет

- Internal Assignment Applicable For June 2017 Examination: Course: Cost and Management AccountingДокумент2 страницыInternal Assignment Applicable For June 2017 Examination: Course: Cost and Management Accountingnbala.iyerОценок пока нет

- ArggsДокумент5 страницArggsDaniel BrancoОценок пока нет

- KTQTE2Документ172 страницыKTQTE2Ly Võ KhánhОценок пока нет

- The IS - LM CurveДокумент28 страницThe IS - LM CurveVikku AgarwalОценок пока нет

- Concrete Calculator Steel Calculator Brick Calculator: Atish Kumar EmailДокумент12 страницConcrete Calculator Steel Calculator Brick Calculator: Atish Kumar EmailAnil sainiОценок пока нет

- Pointers To Review For Long QuizДокумент1 страницаPointers To Review For Long QuizJoice Ann PolinarОценок пока нет

- Annual Agreement Final CSL 522Документ3 страницыAnnual Agreement Final CSL 522api-270423618Оценок пока нет

- Kaatyaayanaaya VidmaheДокумент12 страницKaatyaayanaaya VidmaheGobu Muniandy100% (1)

- T Proc Notices Notices 035 K Notice Doc 30556 921021241Документ14 страницT Proc Notices Notices 035 K Notice Doc 30556 921021241Bwanika MarkОценок пока нет

- Koalatext 4Документ8 страницKoalatext 4YolandaOrduñaОценок пока нет

- SES 4 at 22. °W: Advertisements AdvertisementsДокумент6 страницSES 4 at 22. °W: Advertisements Advertisementsemmanuel danra10Оценок пока нет

- Formation Burgos RefozarДокумент10 страницFormation Burgos RefozarJasmine ActaОценок пока нет

- A Research Paper Submited To Department of Management For Partalfulfilment of The Requirement in Ba Degree in ManagementДокумент44 страницыA Research Paper Submited To Department of Management For Partalfulfilment of The Requirement in Ba Degree in ManagementEng-Mukhtaar CatooshОценок пока нет

- OJT Research Bam!Документ14 страницOJT Research Bam!mrmakuleetОценок пока нет

- Marketing Case - Cowgirl ChocolatesДокумент14 страницMarketing Case - Cowgirl Chocolatessarah_alexandra2100% (4)

- Bernini, and The Urban SettingДокумент21 страницаBernini, and The Urban Settingweareyoung5833Оценок пока нет

- Steinmann 2016Документ22 страницыSteinmann 2016sofyanОценок пока нет

- Invoice 141Документ1 страницаInvoice 141United KingdomОценок пока нет

- Senate Bill No. 982Документ3 страницыSenate Bill No. 982Rappler100% (1)

- Ocus Complaint RERAДокумент113 страницOcus Complaint RERAMilind Modi100% (1)

- Freemason's MonitorДокумент143 страницыFreemason's Monitorpopecahbet100% (1)

- Atip Bin Ali V Josephine Doris Nunis & AnorДокумент7 страницAtip Bin Ali V Josephine Doris Nunis & Anorahmad fawwaz100% (1)

- Asian Marketing Management: Biti's Marketing Strategy in VietnamДокумент33 страницыAsian Marketing Management: Biti's Marketing Strategy in VietnamPhương TrangОценок пока нет

- Vera vs. AvelinoДокумент136 страницVera vs. AvelinoPJ SLSRОценок пока нет

- Under The Crescent Moon: Rebellion in Mindanao By: Marites Danguilan Vitug and Glenda M. GloriaДокумент2 страницыUnder The Crescent Moon: Rebellion in Mindanao By: Marites Danguilan Vitug and Glenda M. Gloriaapperdapper100% (2)

- Siswa AheДокумент7 страницSiswa AheNurMita FitriyaniОценок пока нет

- Unit Test 7A: 1 Choose The Correct Form of The VerbДокумент4 страницыUnit Test 7A: 1 Choose The Correct Form of The VerbAmy PuenteОценок пока нет

- Toll BridgesДокумент9 страницToll Bridgesapi-255693024Оценок пока нет