Академический Документы

Профессиональный Документы

Культура Документы

Cat Ear Pattern

Загружено:

Bill Hunter0 оценок0% нашли этот документ полезным (0 голосов)

131 просмотров1 страницаTrading pattern

Авторское право

© © All Rights Reserved

Доступные форматы

DOCX, PDF, TXT или читайте онлайн в Scribd

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документTrading pattern

Авторское право:

© All Rights Reserved

Доступные форматы

Скачайте в формате DOCX, PDF, TXT или читайте онлайн в Scribd

0 оценок0% нашли этот документ полезным (0 голосов)

131 просмотров1 страницаCat Ear Pattern

Загружено:

Bill HunterTrading pattern

Авторское право:

© All Rights Reserved

Доступные форматы

Скачайте в формате DOCX, PDF, TXT или читайте онлайн в Scribd

Вы находитесь на странице: 1из 1

The Cat's Ears Pattern

Eavesdropping The Bear

Heres a rare but reliable bearish formation: the cats ears. A visual hybrid of double-top and failed-cup formations, the cats ears

formation occurs during downtrends, predicting further price decline with a price target.

Many technical analysts believe the most profitable patterns are the continuation ones. This is because the market has

already established a trend and the odds favor its continuation after a short pause. Flags, pennants, rectangles, wedges,

and head & shoulders are the widely known bearish continuation patterns. Some time ago, I discovered one more

continuation pattern that occurs during downtrends, which I named cats ears (CE) due to its distinctive appearance. The

CE is rare but reliable and offers a well-defined price target.

THE MODEL

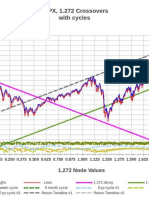

In Figure 1 you can see the textbook model of the CE pattern. The CE takes place in the middle of a six-phase context:

Phase 1: The price is in a severe downtrend

Phase 2: The price pauses for a while and oscillates

Phase 3: The price bumps up then quickly recedes, creating the cats left ear

Phase 4: The price oscillates again, creating the scalp of the cat

Phase 5: The price makes a second bump up but again recedes, creating the cats right ear

Phase 6: The price breaks the scalp line (the support line defined by the lows in the cats scalp) and resumes its previous

downtrend.

FIGURE 1: THE TYPICAL CATS EARS PATTERN. The typical cats ears pattern takes place in a context of six phases. The price declines

(phase 1), pauses for a while (phase 2), bumps up abruptly, and quickly falls back, creating the cats left ear (phase 3). In the sequence, it

oscillates in a relatively narrow range, giving shape to the cats scalp (phase 4) and again bumps up and recedes, creating the cats right ear

(phase 5). As soon as the price breaks the support line defined by the cats scalp (scalp line), it falls further down.

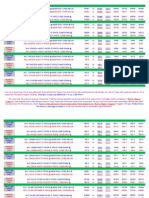

USUAL VARIANTS

Figure 2 summarizes the usual variants of the pattern. The left and right ears may not be exactly the same height and the

scalp line may be slightly above or below the low level of phase 2. While the cats ears usually develops in a context of six

phases, there are cases where the second phase is absent. There are also cases where phase 2 is long and volatile, so the

price appears as if it forms a bottom, but the emergence of the cats ears pattern is the last attempt of the price to recover

before it dips again.

Вам также может понравиться

- FINANCIAL MARKET TECHNICAL ANALYSIS by D-Illustrader PDFДокумент41 страницаFINANCIAL MARKET TECHNICAL ANALYSIS by D-Illustrader PDFNd Reyes100% (1)

- II Charting Candlestick ChartsДокумент4 страницыII Charting Candlestick ChartsdrkwngОценок пока нет

- Richard's Candlestick Cheat SheetДокумент5 страницRichard's Candlestick Cheat SheetsumitdalalОценок пока нет

- Technical Analysis: Concepts: The Basic Concepts Underlying Charting Techniques / Chart Analysis AreДокумент19 страницTechnical Analysis: Concepts: The Basic Concepts Underlying Charting Techniques / Chart Analysis AremaddyvickyОценок пока нет

- The 30-Minute Breakout Strategy: © Trading Concepts, IncДокумент20 страницThe 30-Minute Breakout Strategy: © Trading Concepts, IncsumitdalalОценок пока нет

- Lecture 9, Part 1 Graphical Patterns AnalysisДокумент10 страницLecture 9, Part 1 Graphical Patterns AnalysisHilmi AbdullahОценок пока нет

- Amount of Fish CaughtДокумент1 страницаAmount of Fish CaughtAnonymous sMqylHОценок пока нет

- Nifty Wave CountДокумент8 страницNifty Wave Countrajendraa1981Оценок пока нет

- PinoyInvestor Academy - Technical Analysis Part 3Документ18 страницPinoyInvestor Academy - Technical Analysis Part 3Art JamesОценок пока нет

- Fib Markets Introduction To Fibonacci Trading TechniquesДокумент7 страницFib Markets Introduction To Fibonacci Trading TechniquesAlex Farah DrazdaОценок пока нет

- Investools Candlesticks 1Документ44 страницыInvestools Candlesticks 1PICKLAROОценок пока нет

- Daily Trading Stance - 2009-06-22Документ2 страницыDaily Trading Stance - 2009-06-22Trading FloorОценок пока нет

- 3 Chart Patterns Cheat SheetДокумент7 страниц3 Chart Patterns Cheat SheetKing of pumpОценок пока нет

- Candlestick Patterns: Abandoned Baby Bottom Is A Bullish ReversalДокумент27 страницCandlestick Patterns: Abandoned Baby Bottom Is A Bullish ReversalRajesh LullaОценок пока нет

- Power of OptionsДокумент11 страницPower of OptionsNilayОценок пока нет

- Toshimoku's Trading Tips & Tricks - #SatoshiMoku - CarpeNoctom - Medium PDFДокумент54 страницыToshimoku's Trading Tips & Tricks - #SatoshiMoku - CarpeNoctom - Medium PDFSyed Asad TirmazieОценок пока нет

- The Psychology of A "Near Miss" in 4D LotteryДокумент6 страницThe Psychology of A "Near Miss" in 4D Lotterycrumpiteer0% (1)

- Rules & Guidelines of Elliott WaveДокумент12 страницRules & Guidelines of Elliott WaveNd Reyes100% (2)

- Price Breaks ThroughДокумент34 страницыPrice Breaks Throughpb41Оценок пока нет

- ReversalCandlestickVietnam Updated PDFДокумент7 страницReversalCandlestickVietnam Updated PDFdanielОценок пока нет

- ElliottWaveManual v2+G P@FBДокумент71 страницаElliottWaveManual v2+G P@FBPranshu guptaОценок пока нет

- Candlesticker by AmericanbullsДокумент2 страницыCandlesticker by Americanbullskahfie100% (1)

- Full Guide On Support and Resistance: by Crypto VIP SignalДокумент11 страницFull Guide On Support and Resistance: by Crypto VIP SignalSaroj PaudelОценок пока нет

- Respondents Currently Investing Money in Share Market?Документ16 страницRespondents Currently Investing Money in Share Market?Ajay RaiОценок пока нет

- Edition 23 - Chartered 2nd February 2011Документ8 страницEdition 23 - Chartered 2nd February 2011Joel HewishОценок пока нет

- Multiple Time Frames - Bruce Babcock: Sensitivity TestДокумент8 страницMultiple Time Frames - Bruce Babcock: Sensitivity TestOxford Capital Strategies LtdОценок пока нет

- Basic Trendline ChartДокумент2 550 страницBasic Trendline ChartMark LytleОценок пока нет

- Chart Technical AnalysisДокумент56 страницChart Technical Analysiscool_air1584956Оценок пока нет

- Pivot Point CalculatorДокумент2 страницыPivot Point Calculatorfanni serehОценок пока нет

- Trade CyclesДокумент10 страницTrade CyclessushmasomannaОценок пока нет

- Allen Gale 04allen Gale 2004Документ39 страницAllen Gale 04allen Gale 2004hectorgm77Оценок пока нет

- Trendline BasicsДокумент2 страницыTrendline BasicsAngelo NunesОценок пока нет

- Bigot Es Wabe Guide 01Документ3 страницыBigot Es Wabe Guide 01Jms JmsОценок пока нет

- PSE Academy: 2012 Stock Market Seminars (January - March)Документ5 страницPSE Academy: 2012 Stock Market Seminars (January - March)hill_valley_2015Оценок пока нет

- Cory Janssen Chad Langager Casey Murphy: Fundamental Analysis Technical AnalysisДокумент43 страницыCory Janssen Chad Langager Casey Murphy: Fundamental Analysis Technical AnalysisRahul ChaudharyОценок пока нет

- James16 Part BДокумент46 страницJames16 Part BAnonymous JrCVpuОценок пока нет

- Finance 21 QuestionsДокумент10 страницFinance 21 QuestionsAmol Bagul100% (1)

- Edition 26 - Chartered 17th March 2011Документ7 страницEdition 26 - Chartered 17th March 2011Joel HewishОценок пока нет

- Divergence Cheat Sheet: Type Bias Price Oscillator Description ExampleДокумент2 страницыDivergence Cheat Sheet: Type Bias Price Oscillator Description Exampletawhid anam100% (2)

- Example: Crude CMP 5000 Than 1 % SL Is 50/ PointДокумент4 страницыExample: Crude CMP 5000 Than 1 % SL Is 50/ PointTrading IdeasОценок пока нет

- Scoring Supply and Demand ZonesДокумент1 страницаScoring Supply and Demand ZonesdarrellОценок пока нет

- Lifespan Investing: Building the Best Portfolio for Every Stage of Your LifeОт EverandLifespan Investing: Building the Best Portfolio for Every Stage of Your LifeОценок пока нет

- Linear Regression Slope: Sensitivity Test: Oxford Capital Strategies LTD: Trading Strategy: Commission & Slippage: $0Документ8 страницLinear Regression Slope: Sensitivity Test: Oxford Capital Strategies LTD: Trading Strategy: Commission & Slippage: $0Oxford Capital Strategies LtdОценок пока нет

- Market Commentary 6NOVT11Документ4 страницыMarket Commentary 6NOVT11AndysTechnicalsОценок пока нет

- Economic Calendar Economic CalendarДокумент5 страницEconomic Calendar Economic CalendarAtulОценок пока нет

- American University of Afghanistan: Career Action PlanДокумент4 страницыAmerican University of Afghanistan: Career Action PlanarzoОценок пока нет

- Candle Sticks: Support Level HammerДокумент8 страницCandle Sticks: Support Level HammerKeerthi Vasan SОценок пока нет

- Market Skill-Builder: Is That All !?Документ21 страницаMarket Skill-Builder: Is That All !?Visu SamyОценок пока нет

- Fibonacci Analysis and Elliott Wave TheoryДокумент4 страницыFibonacci Analysis and Elliott Wave Theoryirsanli3mОценок пока нет

- Chapter - IДокумент50 страницChapter - IshahimermaidОценок пока нет

- 200 DMA StocksДокумент6 страниц200 DMA Stockspmishra3Оценок пока нет

- 2011 08 05 Migbank Daily Technical Analysis Report+Документ15 страниц2011 08 05 Migbank Daily Technical Analysis Report+migbankОценок пока нет

- Price Action Real PowerДокумент10 страницPrice Action Real Powerclairton ribeiroОценок пока нет

- Tutorials in Applied Technical Analysis: Managing ExitsДокумент15 страницTutorials in Applied Technical Analysis: Managing ExitsPinky BhagwatОценок пока нет

- Options: The Upside Without The DownsideДокумент32 страницыOptions: The Upside Without The DownsidebalamanichalaОценок пока нет

- FTI Fibonacci LevelsДокумент6 страницFTI Fibonacci LevelsSundaresan SubramanianОценок пока нет

- Boomie Bounce PlaybookДокумент9 страницBoomie Bounce PlaybookJustin LimОценок пока нет

- What's in A Head??: Rounded or Square Skull Should Be Penalised To Encourage Breeders Not To LoseДокумент3 страницыWhat's in A Head??: Rounded or Square Skull Should Be Penalised To Encourage Breeders Not To LoseGoca JovančićОценок пока нет

- You Be The Judge - PointerДокумент4 страницыYou Be The Judge - PointerIryna LiashenkoОценок пока нет

- Comparative Assessment of A New Nonempirical Density Functional: Molecules and Hydrogen-Bonded ComplexesДокумент9 страницComparative Assessment of A New Nonempirical Density Functional: Molecules and Hydrogen-Bonded ComplexesBill HunterОценок пока нет

- Solubility PDFДокумент5 страницSolubility PDFHandugan Quinlog NoelОценок пока нет

- Inorganic Lab ManualДокумент53 страницыInorganic Lab ManualSivakavi NesanОценок пока нет

- MCSCF Study of Chemical Reactions in Solution Within The Polarizable Continuum Model and VB Analysis of The Reaction MechanismДокумент1 страницаMCSCF Study of Chemical Reactions in Solution Within The Polarizable Continuum Model and VB Analysis of The Reaction MechanismBill HunterОценок пока нет

- Solubility PDFДокумент5 страницSolubility PDFHandugan Quinlog NoelОценок пока нет

- Zeta Potential AnalysisДокумент3 страницыZeta Potential AnalysisBill HunterОценок пока нет

- Women in Science FinalДокумент6 страницWomen in Science FinalBill HunterОценок пока нет

- Non-Aquous SolventsДокумент2 страницыNon-Aquous SolventsBill HunterОценок пока нет

- Pivot Calculation: (Hemant)Документ9 страницPivot Calculation: (Hemant)Bill Hunter0% (1)

- This Is The Famous Nāsadīya Sūkta The 129 Suukta of The 10 Mandala of The RigvedaДокумент2 страницыThis Is The Famous Nāsadīya Sūkta The 129 Suukta of The 10 Mandala of The RigvedaBill HunterОценок пока нет

- UIDAI CircularДокумент1 страницаUIDAI CircularBill HunterОценок пока нет

- Gouy Magnetic Susceptibility BalanceДокумент11 страницGouy Magnetic Susceptibility BalanceBill HunterОценок пока нет

- Gann Intraday Calculator 694Документ2 страницыGann Intraday Calculator 694Bill HunterОценок пока нет

- S.No Company Na Price On 7 April Buy Amounquantitycurrent Priprofit/LosДокумент3 страницыS.No Company Na Price On 7 April Buy Amounquantitycurrent Priprofit/LosBill HunterОценок пока нет

- Establishment of Mints in INDIA: Security Printing and Minting Corporation of India Limited (SPMCIL)Документ14 страницEstablishment of Mints in INDIA: Security Printing and Minting Corporation of India Limited (SPMCIL)Bill HunterОценок пока нет

- Cost To CarryДокумент30 страницCost To CarryBill HunterОценок пока нет

- Fibonacci Ratios CalculatorДокумент2 страницыFibonacci Ratios CalculatorKhandaker DidarОценок пока нет

- UGC Guidelines API 4th-Amentment-Regulations-2016 PDFДокумент39 страницUGC Guidelines API 4th-Amentment-Regulations-2016 PDFshantan02Оценок пока нет

- 3.03.1 Simple Six Sigma CalculatorДокумент2 страницы3.03.1 Simple Six Sigma Calculatormuda1986Оценок пока нет

- Emf Equation of TransformerДокумент2 страницыEmf Equation of TransformerBill HunterОценок пока нет

- Taxpayer'S Counterfoil: PannoДокумент1 страницаTaxpayer'S Counterfoil: PannoBill HunterОценок пока нет

- रुद्राष्टकमДокумент2 страницыरुद्राष्टकमBill HunterОценок пока нет

- Technical Analysis FibonacciДокумент11 страницTechnical Analysis FibonacciBill HunterОценок пока нет

- Gartley's Gap Theory ExplainedДокумент2 страницыGartley's Gap Theory ExplainedBill HunterОценок пока нет

- Trendline AmibrokerДокумент9 страницTrendline AmibrokerBill HunterОценок пока нет

- ConnorsRSI Pullbacks GuidebookДокумент46 страницConnorsRSI Pullbacks GuidebookBill Hunter80% (5)

- Credit Spread CalculatorДокумент2 страницыCredit Spread CalculatorsdotdubОценок пока нет

- Template - Black-Scholes Option Value: Input DataДокумент2 страницыTemplate - Black-Scholes Option Value: Input Datamoneshivangi29Оценок пока нет

- Historical Volatility CalcДокумент1 страницаHistorical Volatility CalcBill HunterОценок пока нет

- Export Promotion Zone/Special Economic Zone (Epz/Sez) & Export Oriented Units (EOU)Документ17 страницExport Promotion Zone/Special Economic Zone (Epz/Sez) & Export Oriented Units (EOU)sakshiОценок пока нет

- Capital Market-venezuelaGroupДокумент6 страницCapital Market-venezuelaGroupTandog SamОценок пока нет

- The Mundel Fleming Model PDFДокумент23 страницыThe Mundel Fleming Model PDFTaningde YamnaОценок пока нет

- Submissions - B-BTAX211 BSA22 1st Sem (2021-2022) - Enabling Assessment - Dealings in Properties and The Withholding Tax System - DLSU-D College - GSДокумент3 страницыSubmissions - B-BTAX211 BSA22 1st Sem (2021-2022) - Enabling Assessment - Dealings in Properties and The Withholding Tax System - DLSU-D College - GSPran piyaОценок пока нет

- ABC BANK September - Active RMAДокумент7 страницABC BANK September - Active RMAUDAY100% (1)

- Solved Suppose Your Country Imports Wheat The Price of Wheat RisesДокумент1 страницаSolved Suppose Your Country Imports Wheat The Price of Wheat RisesM Bilal SaleemОценок пока нет

- Maharashtra State Electricity Distribution Co. LTD: Bill Revision ReportДокумент7 страницMaharashtra State Electricity Distribution Co. LTD: Bill Revision ReportSachin KhandareОценок пока нет

- UPSC Civil Services Examination: UPSC Notes (GS-III) Topic: Public Sector (UPSC Economy Notes)Документ3 страницыUPSC Civil Services Examination: UPSC Notes (GS-III) Topic: Public Sector (UPSC Economy Notes)thota shagunОценок пока нет

- 9708 w03 QP 4Документ4 страницы9708 w03 QP 4michael hengОценок пока нет

- Globalization and Indian Economy: One Mark QuestionsДокумент10 страницGlobalization and Indian Economy: One Mark Questionsaryan0% (1)

- Spark Organization ACC 322 Accounting Case Memo Write UpДокумент2 страницыSpark Organization ACC 322 Accounting Case Memo Write Upalka murarkaОценок пока нет

- Approaches in Calculating GDPДокумент3 страницыApproaches in Calculating GDPAsahi My loveОценок пока нет

- Euro CrisisДокумент13 страницEuro CrisisCeasar CoolОценок пока нет

- Characteristics and Grouping of Public Sector OrganizationsДокумент4 страницыCharacteristics and Grouping of Public Sector OrganizationsNabilah FajrinaОценок пока нет

- Case Study Sanchez Electronic DevicesДокумент2 страницыCase Study Sanchez Electronic DeviceszayikakaterinaОценок пока нет

- HI5016 Final Assessment V5Документ6 страницHI5016 Final Assessment V5Aakash SharmaОценок пока нет

- 03 9708 22 2023 2RP Afp M23 20022023Документ4 страницы03 9708 22 2023 2RP Afp M23 20022023Kalsoom SoniОценок пока нет

- Presentation SCOREДокумент20 страницPresentation SCOREzerazie50% (4)

- SL. No. Districts Name of The Govt. ITI Bank Name Bank Address/ Branch A/C No. IFSC CodeДокумент3 страницыSL. No. Districts Name of The Govt. ITI Bank Name Bank Address/ Branch A/C No. IFSC CodeRajendra Kumar MahalikОценок пока нет

- Trade and Investment Policies: True/False QuestionsДокумент24 страницыTrade and Investment Policies: True/False QuestionsAshok SubramaniamОценок пока нет

- FPP1x Country CaseДокумент87 страницFPP1x Country CasesamskritaОценок пока нет

- Pt. Diamitra Agung Perkasa: Tax InvoiceДокумент1 страницаPt. Diamitra Agung Perkasa: Tax InvoiceJoe AndarestaОценок пока нет

- Invoice PDFДокумент2 страницыInvoice PDFLeang'sОценок пока нет

- FY25 Budget in Brief FINAL 2.19.24Документ43 страницыFY25 Budget in Brief FINAL 2.19.24Ann DwyerОценок пока нет

- Multinational Business Finance - MiniCase-Chapter 12Документ21 страницаMultinational Business Finance - MiniCase-Chapter 12Khoa HuỳnhОценок пока нет

- JP Morgan Sachs &coДокумент15 страницJP Morgan Sachs &coAjeet YadavОценок пока нет

- Morales, Jerson Umambac: Contactcenter@osm - NoДокумент1 страницаMorales, Jerson Umambac: Contactcenter@osm - NoJerson MoralesОценок пока нет

- Gene E. Phillips, Chairman of Balkan Energy Company, Meets With Nigerian and Ghanaian Government and Business OfficialsДокумент1 страницаGene E. Phillips, Chairman of Balkan Energy Company, Meets With Nigerian and Ghanaian Government and Business Officialsoddhardware979Оценок пока нет

- Mongolia Country PresentationДокумент15 страницMongolia Country PresentationADBI EventsОценок пока нет

- MacroUnit6StudyGuide2 221207 115022Документ2 страницыMacroUnit6StudyGuide2 221207 115022izelvilliОценок пока нет