Академический Документы

Профессиональный Документы

Культура Документы

Full QT 2 Assignment

Загружено:

NicholasChoongИсходное описание:

Оригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Full QT 2 Assignment

Загружено:

NicholasChoongАвторское право:

Доступные форматы

UBEQ1123 Quantitative Techniques II (Jan 2013/2014)

1

UNIVERSITY TUNKU ABDUL RAHMAN

FACULTY OF BUSINESS AND FINANCE

ACADEMIC YEAR 2013/2014

ASSIGNMENT

UBEQ 1123

Quantitative Techniques II

Variable: Gross Saving (% of GDP)

Countries: Malaysia, Singapore and New Zealand

Tutorial Group: T14 Tutor: Miss. Tan Yan Teng

Group Members:

No Name ID Course

1 LIM SIN PEI 13ABB08313 BA

2 ONG HOU YIN 13ABB00533 BA

3 SOO PEI TING 13ABB04938 BA

4 WONG WEI MIN 11ABB01194 BF

5 WONG YOKE MUN 12ABB02003 BF

UBEQ1123 Quantitative Techniques II (Jan 2013/2014)

2

CONTENT

Total Page for assignment: 12 pages

Topic Page

1 Background Description 3-5

2 Statistical Results 6-12

3 Conclusion 13-14

4 Bibliography 15

UBEQ1123 Quantitative Techniques II (Jan 2013/2014)

3

a) Illustrate the background of the countries as well as describe the development,

performance, and trend of the variable in the 3 selected countries. Make use of

graphical presentation, table, descriptive statistics (mean, standard deviation and so

on), etc. to enhance your content.

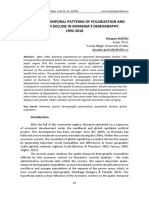

From the graph above, we able to observed that the Singaporean has a higher saving than

Malaysian in past two decades. The economic condition of Singapore is not comparable

as Malaysia economic condition when Singapore is independent from Malaysia. In

particular, household saving includes savings of unincorporated business (Susan M.

Collins, 1991). This is the reason why Singapore has a higher household savings than

Malaysia, Singapore citizen are more likely encounter to do the business than Malaysia

citizen. In year 1990 to 1997, both Malaysia and Singapore household saving trend has an

increase. This is because the economics of whole world is in optimistic condition and

reaching the peak of the session. As we can notice from the graph, 1997 will be the peak

and it is start to recession during the year which caused by the Asian financial crisis. This

crisis has affected majority of the Asian country (Dick K.Nanto, 1998). The crisis has put

a negative impact and lasting along to year 2002 and the economy start to recover, that

why the graph sloping upwards from year 2002. The average, mean of Malaysia Gross

Saving in percentage from year 1990 to 2012 is 30.01645 while Singapore is 45.08831.

0

10

20

30

40

50

60

1

9

9

0

1

9

9

1

1

9

9

2

1

9

9

3

1

9

9

4

1

9

9

5

1

9

9

6

1

9

9

7

1

9

9

8

1

9

9

9

2

0

0

0

2

0

0

1

2

0

0

2

2

0

0

3

2

0

0

4

2

0

0

5

2

0

0

6

2

0

0

7

2

0

0

8

2

0

0

9

2

0

1

0

2

0

1

1

2

0

1

2

G

r

o

s

s

S

a

v

i

n

g

s

(

%

o

f

G

D

P

)

Year

Malaysia & Singapore

Malaysia

Singapore

UBEQ1123 Quantitative Techniques II (Jan 2013/2014)

4

The plotted diagram has significantly shows the savings of New Zealand is far behind the

Malaysia savings. The New Zealand household had a poor saving record in these recent

years. According to New Zealands Institutional Sector Accounts, it shows that New

Zealand household has generally spent more money than they earned over the 20 years,

especially since year 2001 when the property market was buoyant. That was why the

curve has downward sloping since year 2001 and never trend back to the higher degree of

the saving power. Comparison of the average Gross Saving in percentage of Malaysia to

New Zealand is 30.01645 to 16.34252.

In the above diagram, we can have a conclusion about the saving ability of New Zealand

household is not comparable to the household of Singapore. Even though during the

financial crisis of year 1997, the saving power of Singapore household was still preceding

than the New Zealand. Besides that, the graph shows the degree of saving power of New

0

10

20

30

40

50

1

9

9

0

1

9

9

1

1

9

9

2

1

9

9

3

1

9

9

4

1

9

9

5

1

9

9

6

1

9

9

7

1

9

9

8

1

9

9

9

2

0

0

0

2

0

0

1

2

0

0

2

2

0

0

3

2

0

0

4

2

0

0

5

2

0

0

6

2

0

0

7

2

0

0

8

2

0

0

9

2

0

1

0

2

0

1

1

2

0

1

2

G

r

o

s

s

S

a

v

i

n

g

s

(

%

o

f

G

D

P

)

Year

Malaysia & NewZealand

Malaysia

NewZealand

0

10

20

30

40

50

60

1

9

9

0

1

9

9

1

1

9

9

2

1

9

9

3

1

9

9

4

1

9

9

5

1

9

9

6

1

9

9

7

1

9

9

8

1

9

9

9

2

0

0

0

2

0

0

1

2

0

0

2

2

0

0

3

2

0

0

4

2

0

0

5

2

0

0

6

2

0

0

7

2

0

0

8

2

0

0

9

2

0

1

0

2

0

1

1

2

0

1

2

G

r

o

s

s

S

a

v

i

n

g

s

(

%

o

f

G

D

P

)

Year

Singapore & NewZealand

Singapore

NewZealand

UBEQ1123 Quantitative Techniques II (Jan 2013/2014)

5

Zealand household is smooth and steady within 10% to 20%. The fluctuation of the graph

does not have radical changes because the saving power of New Zealand household is not

strong and they usually spent the whole salary of the months (New Zealand Institution,

2012).

UBEQ1123 Quantitative Techniques II (Jan 2013/2014)

6

b) i) Based on the 3 countries, please run an ANOVA analysis to verify the

statistical difference in mean of the variable among the 3 chosen countries.

1

= gross saving (% of GDP) of Malaysia.

2

= gross saving (% of GDP) of Singapore.

3

= gross saving (% of GDP) of New Zealand.

H

0

:

1

=

2

=

3

H

1

: at least one of the

i

is different. (i=1, 2, 3)

=0.05

Decision rule: Reject H

0

, is the test static is more than critical value, otherwise do not

reject.

Critical value: F

, k-1, n-k

= F

0.05, 2, 63

=3.15

F-test:

=457.1756

Decision making: Reject H0, since test statistic (457.1756) is more than critical value

(3.15).

Conclusion: We have sufficient evidence to conclude that there is at least one of the

i

is

different.

SUMMARY

Groups Count Sum Average Variance

Row 1 23 805.3783 35.0164478 8.179743

Row 2 20 326.8495 16.342475 2.855197

Row 3 23 1037.031 45.088313 17.54993

ANOVA

Source of

Variation SS df MS F P-value F crit

Between Groups 9002.753 2 4501.37637 457.1756

3.11E-

38 3.142809

Within Groups 620.3015 63 9.84605524

Total 9623.054 65

UBEQ1123 Quantitative Techniques II (Jan 2013/2014)

7

ii) Specifically, run two independent samples mean t-test with unequal variances to

verify the comparison in the performance of that variable between 2 countries.

There should be three separated t-test since 3 countries are selected to form three

pair-wise comparisons.

1) Malaysia V Singapore:

Let

1

= gross saving (% of GDP) of Malaysia

2

= gross saving (% of GDP) of Singapore

H

0

:

1

2

H

1

:

1

<

2

Significant level: = 0.05

Decision rule: Reject H

0,

if test statistic value is lower than lower bound critical value,

otherwise do not reject.

Critical value = t

,

= t

0.05,

=t

0.05, [1.25144 (0.005749+0.02646)]

=t

0.05, 38.85

=t

0.05, 39

= -1.684

Test Statistic: T-test =

(

)(

=

( )()

UBEQ1123 Quantitative Techniques II (Jan 2013/2014)

8

= -9.4799

Decision Making: Reject H

0

, since the test statistic (-9.4799) is lower than critical value

(-1.684).

Conclusion: Sufficient evidence to conclude that gross saving (%GDP) of Malaysia is

less than gross saving (%GDP) of Singapore.

UBEQ1123 Quantitative Techniques II (Jan 2013/2014)

9

2) Malaysia V New Zealand:

Let

1

= gross saving (% of GDP) of Malaysia

3

= gross saving (% of GDP) of New Zealand

H

0

:

1

3

H

1

:

1

3

Significant level: = 0.05

Decision Rule: Reject H

0,

if test statistic value is more than upper bound critical value,

otherwise do not reject.

Critical value = t

,

= t

0.05,

= t

0.05

,

[0.3556 + 0.1428]

2

(0.005749 + 0.0010727)]

= t

0.05, (0.2484 0.0068217)

= t

0.05, 36.4132

= t

0.05, 36

= 1.684 (right tailed test)

Test Statistic: t-test =

(

)(

=

( )()

()

()

= 26.4503

UBEQ1123 Quantitative Techniques II (Jan 2013/2014)

10

Decision Making: Reject H

0

, since the test statistic (26.4503) is greater than critical

value (1.684).

Conclusion: Sufficient evidence to conclude that gross saving (%GDP) of Malaysia is

greater than gross saving (%GDP) of New Zealand.

UBEQ1123 Quantitative Techniques II (Jan 2013/2014)

11

3) Singapore V New Zealand

Let

2

= gross savings (% of GDP) of Singapore

3

= gross savings (% of GDP) of New Zealand

H

0

:

2

3

H

1

:

2

3

Significant level: = 0.05

Decision Rule: Reject H

0,

if test statistic value is more than upper bound critical value,

otherwise do not reject.

Critical value = t

,

= t

0.05,

= t

0.05, [0.8205 (0.02646+0.001073)]

= t

0.05, 29.8006

= t

0.05, 30

= 1.697

Test Statistic: t-test =

(

)(

=

()()

=30.2047

UBEQ1123 Quantitative Techniques II (Jan 2013/2014)

12

Decision Making: Reject H

0

, since the test statistic (30.2047) is greater than critical

value (1.697).

Conclusion: Sufficient evidence to conclude that gross savings (% of GDP) of Singapore

is greater than gross savings (% of GDP) of New Zealand.

UBEQ1123 Quantitative Techniques II (Jan 2013/2014)

13

Conclusion

The statistics shown GDP of Singapore is higher than both GDP of Malaysia and

New Zealand, whereas GDP of Malaysia is higher than GDP of New Zealand (Knoema,

2011). The Economist Intelligence Unit found that, growth in industry was significant

contribute to Singapores one-third of GDP growth rate by boost the domestic demand

through multiplier effect. The industrial sector which including the construction sector

had gains notable benefits especially from manufacturing sector. Meanwhile, Singapore

has remained an important oil-refining centre. Furthermore, excellent exporting goods

services in external sector enable Singapore to dominate the economy sector. Their

exporting service was supported by the fast growth in fund-management and tourism.

Gross fixed investment will be strengthened by substantial government-funded projects,

whereas private consumption also keep contribute in GDP growth (Singapore economy:

Quick View - GDP growth remains strong: [1], 2010). These become the competitive

advantage for Singapore to have a higher GDP rate rather than the others countries such

as Malaysia and New Zealand.

With the advanced economies and improvement of export demand in recent years,

the acceleration of economic activities in Malaysia was mitigation the overall moderation

domestic demand. The ongoing export growth and demand from China and European

area lead Malaysias export services growth rapidly and help in boost the GDP of

Malaysia. Even though the GDP of Malaysia is lower than Singapore but its higher than

GDP rate of New Zealand. In addition, Petronas Dagangan Berhad, a provider of

petroleum products in Malaysia plans to catch up with Shell which is the market leader in

UBEQ1123 Quantitative Techniques II (Jan 2013/2014)

14

retail and lubricants segments nowadays. The competitiveness in the industry enables to

growth the GDP rate in Malaysia. Moreover, the high usage level of mobile internet

services allows Digi Companys increase more revenue rather than their expectations

revenue level and have a stable margins. The systematically growth in industry enable

Malaysias GDP maintain in moderate rate which lower than Singapore but higher than

New Zealand (Stocks In Focus MY (Malaysia GDP, Petronas Dagangan, DiGi.Com),

2014).

UBEQ1123 Quantitative Techniques II (Jan 2013/2014)

15

Bibliography

1)(2011). Retrieved March 15, 2014, from Knoema: http://knoema.com/nwnfkne/gdp-

ranking-2013-data-and-charts

2)(2010). Singapore economy: Quick View - GDP growth remains strong: [1]. New

York : The Economist Intelligence Unit.

3)Stocks In Focus MY (Malaysia GDP, Petronas Dagangan, DiGi.Com). (2014, February

10). Shares Investment : Facts & Figures . Malaysia United States: Pioneers &

Leaders (Publishers) Pte. Ltd.

4)Statistic New Zealand. (2012, April). Retrieved from The fall and rise of household saving:

http://www.stats.govt.nz/browse_for_stats/economic_indicators/NationalAccounts/ho

usehold-saving-fall-and-rise.aspx

5)Collins, S. M. (1991). National Saving and Economic Performance. Saving Behavior in Ten , 349-

376.

6)Nanto, D. K. (1998, February 6). FAS. Retrieved from THE 1997-98 ASIAN FINANCIAL CRISIS:

http://www.fas.org/man/crs/crs-asia2.htm

7)Zhou, P. (n.d.). Economic Geography. Retrieved from Singapore's Economic Development:

http://geography.about.com/od/economic-geography/a/Singapore-Economic-

Development.htm

UBEQ1123 Quantitative Techniques II (Jan 2013/2014)

16

Вам также может понравиться

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (895)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (344)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (121)

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (399)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- Narcissistic ParentДокумент5 страницNarcissistic ParentChris Turner100% (1)

- Elliot Kamilla - Literary Film Adaptation Form-Content DilemmaДокумент14 страницElliot Kamilla - Literary Film Adaptation Form-Content DilemmaDavid SalazarОценок пока нет

- G Steiner 10 Reasons For Sadness of ThoughtДокумент31 страницаG Steiner 10 Reasons For Sadness of ThoughtJenniferОценок пока нет

- Opinion - : How Progressives Lost The 'Woke' Narrative - and What They Can Do To Reclaim It From The Right-WingДокумент4 страницыOpinion - : How Progressives Lost The 'Woke' Narrative - and What They Can Do To Reclaim It From The Right-WingsiesmannОценок пока нет

- INTRODUCTION TO PROGRAMMING Exam QuestionsДокумент30 страницINTRODUCTION TO PROGRAMMING Exam Questionshorrett100% (4)

- Information Technology SECTORДокумент2 страницыInformation Technology SECTORDACLUB IBSbОценок пока нет

- Krok1 EngДокумент27 страницKrok1 Engdeekshit dcОценок пока нет

- Fornilda vs. Br. 164, RTC Ivth Judicial Region, PasigДокумент11 страницFornilda vs. Br. 164, RTC Ivth Judicial Region, PasigJenny ButacanОценок пока нет

- Jestine Seva - PEModuleWeek5&6Документ5 страницJestine Seva - PEModuleWeek5&6Mike AlbaОценок пока нет

- Interaksi Simbolik Dalam Komunikasi BudayaДокумент18 страницInteraksi Simbolik Dalam Komunikasi BudayaPrazzОценок пока нет

- Courtesy Begins at HomeДокумент2 страницыCourtesy Begins at Homell Snowitchy llОценок пока нет

- தசம பின்னம் ஆண்டு 4Документ22 страницыதசம பின்னம் ஆண்டு 4Jessica BarnesОценок пока нет

- DhamanДокумент20 страницDhamanAman BrarОценок пока нет

- Health Education ProgramДокумент4 страницыHealth Education ProgramZari Novela100% (1)

- Deep Learning Assignment 1 Solution: Name: Vivek Rana Roll No.: 1709113908Документ5 страницDeep Learning Assignment 1 Solution: Name: Vivek Rana Roll No.: 1709113908vikОценок пока нет

- Essay On NumbersДокумент1 страницаEssay On NumbersTasneem C BalindongОценок пока нет

- The AmazonsДокумент18 страницThe AmazonsJoan Grace Laguitan100% (1)

- Words From The FilmДокумент4 страницыWords From The FilmRuslan HaidukОценок пока нет

- What Does Nature MeanДокумент9 страницWhat Does Nature MeanSo DurstОценок пока нет

- Anatomy - Nervous System - Spinal Cord and Motor and Sensory PathwaysДокумент43 страницыAnatomy - Nervous System - Spinal Cord and Motor and Sensory PathwaysYAMINIPRIYAN100% (1)

- Safety Awareness TrainingДокумент20 страницSafety Awareness TrainingPl nagappanОценок пока нет

- Gutoiu - 2019 - Demography RomaniaДокумент18 страницGutoiu - 2019 - Demography RomaniaDomnProfessorОценок пока нет

- International Accounting Standard 36 (IAS 36), Impairment of AssetsДокумент10 страницInternational Accounting Standard 36 (IAS 36), Impairment of AssetsMadina SabayevaОценок пока нет

- AIX CommandsДокумент8 страницAIX CommandsKamal KantОценок пока нет

- Sonali IF CommodityДокумент22 страницыSonali IF CommoditySonali DhimmarОценок пока нет

- Spouses Benatiro V CuyosДокумент1 страницаSpouses Benatiro V CuyosAleli BucuОценок пока нет

- Create and Open Input Dialog Box - MATLAB InputdlgДокумент4 страницыCreate and Open Input Dialog Box - MATLAB InputdlgwhytheritoОценок пока нет

- Cost ContingenciesДокумент14 страницCost ContingenciesbokocinoОценок пока нет

- Market MikroДокумент21 страницаMarket Mikrogurumurthy poobalanОценок пока нет

- Law 431 Course Outline (Aug 22-23)Документ3 страницыLaw 431 Course Outline (Aug 22-23)Precious OmphithetseОценок пока нет