Академический Документы

Профессиональный Документы

Культура Документы

Linear Programming Sensitivity

Загружено:

Therese Chiu100%(1)100% нашли этот документ полезным (1 голос)

248 просмотров4 страницыLP Graph

Авторское право

© © All Rights Reserved

Доступные форматы

DOCX, PDF, TXT или читайте онлайн в Scribd

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документLP Graph

Авторское право:

© All Rights Reserved

Доступные форматы

Скачайте в формате DOCX, PDF, TXT или читайте онлайн в Scribd

100%(1)100% нашли этот документ полезным (1 голос)

248 просмотров4 страницыLinear Programming Sensitivity

Загружено:

Therese ChiuLP Graph

Авторское право:

© All Rights Reserved

Доступные форматы

Скачайте в формате DOCX, PDF, TXT или читайте онлайн в Scribd

Вы находитесь на странице: 1из 4

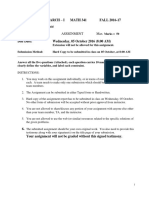

Linear Programming, Sensitivity Analysis

Case Problem..1 Product Mix

Par, Inc., is a small manufacturer of golf equipment and supplies whose management has decided

to move into the market for medium and high priced golf bags. Pars distributor is enthusiastic

about the new product line and has agreed to buy all the golf bags Par produces over the next three

months.

After thorough investigation of the steps involved in manufacturing a golf bag, management

determined that each golf bag produced will require the following operations:

1. Cutting and dyeing the material

2. Sewing

3. Finishing (inserting umbrella holder, club separators, etc.)

4. Inspection and packaging

The director of manufacturing analyzed each of the operations and concluded that if the company

produces a medium priced standard model, each bag will require 7/10 hour in cutting and dyeing

department, hour in the sewing department, 1 hour in finishing department and 1/10 hour in the

inspection and packaging department. The more expensive deluxe model will require 1 hour for

cutting and dyeing, 5/6 hour for sewing, 2/3 hour for finishing and hour for inspection and

packaging.

Pars production is constrained by a limited number of hours available in each department. After

studying departmental workload projections, the director of manufacturing estimates that 630 hours

for cutting and dyeing, 600 hours for sewing, 708 hours for finishing and 135 hours for inspection

and packaging will be available for the production of golf bags during the next three months.

The accounting department analyzed the production data, assigned all relevant variable costs and

arrived at prices for both bags that will result in a profit contribution of $10 for every standard bag

and $9 for every deluxe bag produced. Determine the number of bags of each type should be

produced in order to maximize total profit contribution.

Suppose the management is also considering producing a light weight model designed specifically

for golfers who prefer to carry their bags. The design department estimates that each new

lightweight model will require 0.8 hours for cutting and dyeing, 1 hour for sewing, 1 hour for

finishing and 0.25 hours for inspection and packaging. Because of the unique capabilities designed

into the new model, Pars management feels they will realize a profit contribution of $12.85 for

each lightweight model produced during the current production period. What is the effect of the

new product?

Linear Programming

Minimization Problems

1. Ashok Chemicals Company manufactures two chemicals A and B which are sold to the

manufacturers of soaps and detergents. On the basis of the next months demand, the

management has decided that the total production for chemicals A and B should be at least 350

kilograms. Moreover, a major customers order for 125 kilogram of product A must also be

supplied. Product A requires 2 hours of processing time per kilogram and product B requires

one hour of processing time per kilogram. For the coming month, 600 hours of processing time

are available.

The company wants to meet the above requirements at minimum total production cost. The

production costs are Rs.2 per kilogram for product A and Rs.3 per kilogram for product B.

Ashok Chemicals Company wants to determine its optimal product mix and the total minimum

cost relevant thereto.

2. Bluegrass Farms, located in Lexington, Kentucky has been experimenting with a special diet for

its race horses. The feed components available for the diet are a standard horse feed product, a

vitamin enriched oat product and a new vitamin and mineral feed additive. The nutritional

values in units per pound of the standard feed components are summarized below. For example,

each pound of the standard feed component contains 0.8 unit of ingredient A, 1 unit of

ingredient B and 0.1 unit of ingredient C. The minimum daily diet requirements for each horse

are three units of ingredient A, six units of ingredient B and four units of ingredient C. In

addition, to control the weight of the horses, the total daily feed for a horse should not exceed 6

pounds. Bluegrass Farms would like to determine the minimum-cost mix that will satisfy the

daily diet requirements.

Feed Component Standard Enriched Oat Additive

Ingredient A 0.8 0.2 0.0

Ingredient B 1.0 1.5 3.0

Ingredient C 0.1 0.6 2.0

Cost per pound ($) 0.25 0.50 3.00

3. National Insurance Associates carries an investment portfolio of stocks, bonds and other

investment alternatives. Currently $200,000 of funds are available and must be considered for

new investment opportunities. The four stock options National is considering and the relevant

financial data are as follows:

Stock

A B C D

Price per share ($) 100 50 80 40

Annual rate of return 0.12 0.08 0.06 0.10

Risk measure per dollar invested 0.10 0.07 0.05 0.08

The risk measure indicates the relative uncertainty associated with the stock in terms of its

realizing the projected annual return; higher values indicate greater risk. The risk measures are

provided by the firms top financial advisor.

Nationals top management has stipulated the following investment guidelines: the annual rate

of return for the portfolio must be at least 9% and no one stock can account for more than 50%

of the total dollar investment.

a) Use linear programming to develop an investment portfolio that minimizes risk.

b) If the firm ignores risk and uses a maximum return-on-investment strategy, what is the

investment portfolio?

c) What is the dollar difference between the portfolio in parts (a) and (b)? Why might the

company prefer the solution in part (a)?

Case Problem.. 2 Investment Strategy

J. D. Williams, Inc. is an investment advisory firm that manages more than $120 million in funds

for its numerous clients. The company uses an asset allocation model that recommends the portion

of each clients portfolio to be invested in a growth stock fund, an income fund and a money market

fund. To maintain diversity in each clients portfolio, the firm places limits on the percentage of

each portfolio that may be invested in each of the three funds. General guidelines indicate that the

amount invested in the growth fund must be between 20% to 40% of the total portfolio value.

Similar percentages for the other two funds stipulate that between 20% to 50% of the total portfolio

must be in the income fund and at least 30% of the total portfolio value must be in the money

market fund.

In addition, the company attempts to assess the risk tolerance of each client and adjust the portfolio

to meet the needs of the individual investor. For example, Williams just contracted with a new

client who has $800,000 to invest. Based on an evaluation of the clients risk tolerance, Williams

assigned a maximum risk index of 0.05 for the client. The firms risk indicators show the risk of the

growth fund at 0.10, the income fund at 0.07 and the money market fund at 0.01. An overall

portfolio risk index is computed as a weighted average of the risk rating for the three funds where

the weights are the fraction of the clients portfolio invested in each of the funds.

Additionally, Williams is currently forecasting annual yields of 18% for the growth fund, 12.5%

for the income fund and 7.5% fir the money market fund. Based on the information provided, how

should the new client be advised to allocate $800,000 among the growth, income and money

market funds? Develop a linear programming model that will provide the maximum yield for the

portfolio. Use your model to develop a managerial report.

Managerial Report:

a. Recommend how much of the $800,000 should be invested in each of the three funds. What is

the annual yield you anticipate for the investment recommendation change?

b. Assume that the clients risk index could be increased to 0.55. How much would the yield

increase and how would the investment recommendation change?

c. Refer again to the original situation where the clients risk index was assessed to be 0.05. How

would your investment recommendation change if the annual yield for the growth fund were

revised downward to 16% or even to 14%?

d. Assume that the client expressed some concern about having too much money in the growth

fund. How would the original recommendation change if the amount invested in the growth

fund is not allowed to exceed the amount invested in the income fund?

e. The asset allocation model you developed may be useful in modifying the portfolios for all the

firms clients whenever the anticipated yields for the three funds are periodically revised. What

is your recommendation as to whether use of this model is possible?

Case Workforce Assignment:

McCormick Manufacturing Company produces two products with contributions to profit per

unit of $10 and $9, respectively. The labour requirements per unit produced and the total hours

of labour available from personnel assigned to each of four departments are shown in the table.

Assuming that the number of hours available in each department is fixed, find the optimal

solution.

Labour-Hours per Unit

Department Product 1 Product 2 Total Hours Available

1 0.65 0.95 6500

2 0.45 0.85 6000

3 1.00 0.70 7000

4 0.15 0.30 1400

Suppose that McCormick has a cross-training program that enables some employees to be

transferred between departments. By taking advantage of the cross-training skills, a limited

number of employees and labour hours may be transferred as shown in the table below.

Cross-Training Transfers

Permitted to Department

From Maximum Hours

Department 1 2 3 4 Transferable

1 . yes yes . 400

2 . . yes yes 800

3 . . . yes 100

4 yes yes . . 200

Row 1 of this table shows that some employees assigned to department 1 have cross-training

skills that permit them to be transferred to department 2 or 3. The right hand column shows that,

for the current production planning period, a maximum of 400 hours can be transferred from

department 1. Similar cross-training transfer capabilities and capacities are shown for

departments 2, 3, 4.

If the production manager has the flexibility to assign personnel to different departments,

reduced workforce idle time, improved workforce utilization, how will the solution improve?

Вам также может понравиться

- Questions For CMA CandidateДокумент31 страницаQuestions For CMA CandidateIbrahim HafezОценок пока нет

- PGPM FM I Glim Assignment 3 2014Документ5 страницPGPM FM I Glim Assignment 3 2014sexy_sam280% (1)

- Cre PDFДокумент4 страницыCre PDFAnurag SharmaОценок пока нет

- LP ExamplesДокумент4 страницыLP ExamplesPinky PinkОценок пока нет

- Year After-Tax Cash FlowДокумент3 страницыYear After-Tax Cash FlowZehra KhanОценок пока нет

- LPP - MMS - Hand OutsДокумент46 страницLPP - MMS - Hand OutsDarren DОценок пока нет

- If The Coat FitsДокумент4 страницыIf The Coat FitsAngelica OlescoОценок пока нет

- BHP vs. Rio TintoДокумент54 страницыBHP vs. Rio Tintoeholmes80100% (2)

- Audit Trading Securities Problem 1Документ1 страницаAudit Trading Securities Problem 1Lourdios EdullantesОценок пока нет

- Topic 3 Bonds Volatility New SummerДокумент64 страницыTopic 3 Bonds Volatility New SummerChloe KoОценок пока нет

- Maximize Advertising Exposure for Biggs Department StoreДокумент3 страницыMaximize Advertising Exposure for Biggs Department StoreSumit SharmaОценок пока нет

- Assign-01 (Math341) Fall 2016-17Документ4 страницыAssign-01 (Math341) Fall 2016-17Rida Shah0% (1)

- Tip-Top Cleaning Supply budget and cash collection analysisДокумент39 страницTip-Top Cleaning Supply budget and cash collection analysisNguyễn Vũ Linh NgọcОценок пока нет

- 404 - WCM ExerciseДокумент9 страниц404 - WCM ExerciseChloe Quirona Policios0% (2)

- Spring2022 (July) Exam-Fin Part2Документ4 страницыSpring2022 (July) Exam-Fin Part2Ahmed TharwatОценок пока нет

- Sssojf PDFДокумент7 страницSssojf PDFSoukainael0% (1)

- Question and Answer - 43Документ30 страницQuestion and Answer - 43acc-expertОценок пока нет

- Banking on Solar EnergyДокумент7 страницBanking on Solar EnergyViral BhogaitaОценок пока нет

- Fina1003abc - Hw#4Документ4 страницыFina1003abc - Hw#4Peter JacksonОценок пока нет

- Examination Practice Questions 80Документ31 страницаExamination Practice Questions 80Amit SinghОценок пока нет

- PGP-25 OwS - Assignment-1Документ3 страницыPGP-25 OwS - Assignment-1Lakshmi Harshitha mОценок пока нет

- Kuis Bab 4Документ13 страницKuis Bab 4queenfire05Оценок пока нет

- Week7 Case StudyДокумент3 страницыWeek7 Case StudyAhmed UsaydОценок пока нет

- Institute of Innovation Financial Management PaperДокумент8 страницInstitute of Innovation Financial Management PaperGeetika MalhotraОценок пока нет

- 8508Документ9 страниц8508ZunairaAslamОценок пока нет

- 3-1 Scenario Analysis: Project Risk Analysis-ComprehensiveДокумент4 страницы3-1 Scenario Analysis: Project Risk Analysis-ComprehensiveMinh NguyenОценок пока нет

- CBA AssignmentsДокумент6 страницCBA AssignmentsBharath selvamОценок пока нет

- Capital Budgeting and Dividend Policy TutorialsДокумент7 страницCapital Budgeting and Dividend Policy TutorialsThuỳ PhạmОценок пока нет

- University of Cincinnati: Optimization Models BANA 7020 Fall 2018Документ8 страницUniversity of Cincinnati: Optimization Models BANA 7020 Fall 2018mahithaОценок пока нет

- ACF 103 Exam Revision Qns 20151Документ5 страницACF 103 Exam Revision Qns 20151Riri FahraniОценок пока нет

- CMA2 P2 Practice Questions PDFДокумент12 страницCMA2 P2 Practice Questions PDFMostafa Hassan100% (1)

- Lecture Ques-Sol.Документ9 страницLecture Ques-Sol.Rami RRKОценок пока нет

- Juan Pablo Merchan - Juan Esteban CasasДокумент4 страницыJuan Pablo Merchan - Juan Esteban CasasJuan David DuqueОценок пока нет

- BASIC PROBLEMS On LINEAR PROGRAMMING-2Документ3 страницыBASIC PROBLEMS On LINEAR PROGRAMMING-2Philip DyОценок пока нет

- Management Accounting 2Документ3 страницыManagement Accounting 2ROB101512Оценок пока нет

- Fin 370 Final Exam - New 2016 VersionДокумент7 страницFin 370 Final Exam - New 2016 Versionheaton073bradfordОценок пока нет

- FIN 371 TUTOR Begins EducationДокумент26 страницFIN 371 TUTOR Begins EducationFrankLStoddartОценок пока нет

- Should Charter Sports Discontinue Round TrampolinesДокумент13 страницShould Charter Sports Discontinue Round TrampolinesFyaj Rohan100% (1)

- Finals Exercise 2 - WC Management InventoryДокумент3 страницыFinals Exercise 2 - WC Management Inventorywin win0% (1)

- Case 1 Prod HartДокумент5 страницCase 1 Prod Harteldo0% (1)

- LPPДокумент28 страницLPPRahul PathrabeОценок пока нет

- Financial Management Assignment on LeverageДокумент3 страницыFinancial Management Assignment on LeverageHamza FayyazОценок пока нет

- Credit and Inventory ManagementДокумент3 страницыCredit and Inventory ManagementLinh HoangОценок пока нет

- Manufacturing Optimization ModelДокумент3 страницыManufacturing Optimization ModelViralbhai GamitОценок пока нет

- Sample Questions Part 1-Feb08webДокумент9 страницSample Questions Part 1-Feb08webDidacus Triphone PereraОценок пока нет

- 2023_Tutorial 11_ Dividend PolicyДокумент3 страницы2023_Tutorial 11_ Dividend PolicyKarry hằngОценок пока нет

- Accounting Textbook Solutions - 70Документ19 страницAccounting Textbook Solutions - 70acc-expertОценок пока нет

- Chapter OneДокумент5 страницChapter OneHazraphine LinsoОценок пока нет

- Long-Term and Short-Term Financial Decisions Problems Week 7Документ4 страницыLong-Term and Short-Term Financial Decisions Problems Week 7Ajeet YadavОценок пока нет

- Part 1: Multiple Choice 2 Points Each /140 Points 5 Points Deduction For Every 5 Items Answered IncorectlyДокумент22 страницыPart 1: Multiple Choice 2 Points Each /140 Points 5 Points Deduction For Every 5 Items Answered IncorectlyDanna Karen MallariОценок пока нет

- Chap 7 - Assignment - DTUT - Ver2022Документ8 страницChap 7 - Assignment - DTUT - Ver2022Đặng Trần Minh QuânОценок пока нет

- CH 14Документ7 страницCH 14AnsleyОценок пока нет

- LR Questions PDFДокумент10 страницLR Questions PDFkumassa kenyaОценок пока нет

- P2 Nov 2013 Question PaperДокумент20 страницP2 Nov 2013 Question PaperjoelvalentinorОценок пока нет

- UWI - MSC Corp Finance - SBRM6020 - Corporate Finance - Excel Models Assignment - Sept To Dec 2018Документ4 страницыUWI - MSC Corp Finance - SBRM6020 - Corporate Finance - Excel Models Assignment - Sept To Dec 2018Sta Ker0% (1)

- MANAGEMENT ADVISORY SERVICES QUANTITATIVE METHODSДокумент7 страницMANAGEMENT ADVISORY SERVICES QUANTITATIVE METHODSJonas MondalaОценок пока нет

- LP Sample Model Formulation, Duality, Sensitivity Analysis Product MixДокумент8 страницLP Sample Model Formulation, Duality, Sensitivity Analysis Product MixZed Alemayehu100% (1)

- MAS311 Financial Management Exercises On Accounts Receivable Management and Inventory ManagementДокумент3 страницыMAS311 Financial Management Exercises On Accounts Receivable Management and Inventory ManagementLeanne QuintoОценок пока нет

- Strategic Financial Management PaperДокумент6 страницStrategic Financial Management Papersanaskhh508Оценок пока нет

- Solved Assignment Online - 5Документ18 страницSolved Assignment Online - 5Prof Olivia0% (1)

- Quiz CorporateДокумент4 страницыQuiz CorporateYoussef Youssef Ahmed Abdelmeguid Abdel LatifОценок пока нет

- Expanded Syllabus BUSLAW3Документ41 страницаExpanded Syllabus BUSLAW3Therese ChiuОценок пока нет

- Buslaw Chapter 3Документ1 страницаBuslaw Chapter 3Therese ChiuОценок пока нет

- CJI's Supply Chain Expansion for Great Lakes ContractДокумент5 страницCJI's Supply Chain Expansion for Great Lakes ContractTherese Chiu0% (1)

- Expanded Syllabus BUSLAW3Документ41 страницаExpanded Syllabus BUSLAW3Therese ChiuОценок пока нет

- Case StudyДокумент29 страницCase StudyTherese ChiuОценок пока нет

- GEN PRIN TAX-REV RAISING,REGULATORY USES,LIMITSДокумент41 страницаGEN PRIN TAX-REV RAISING,REGULATORY USES,LIMITSTherese ChiuОценок пока нет

- PDFДокумент37 страницPDFheavensangelsОценок пока нет

- An Introduction To Franchising: Dorelene Villanueva Dimaunahan, MSCM, CfeДокумент14 страницAn Introduction To Franchising: Dorelene Villanueva Dimaunahan, MSCM, CfeTherese ChiuОценок пока нет

- GEN PRIN TAX-REV RAISING,REGULATORY USES,LIMITSДокумент41 страницаGEN PRIN TAX-REV RAISING,REGULATORY USES,LIMITSTherese ChiuОценок пока нет

- Chapter 3 Section 6 On BUSLAWДокумент1 страницаChapter 3 Section 6 On BUSLAWTherese Chiu83% (6)

- COMM 491: Business StrategyДокумент33 страницыCOMM 491: Business StrategyTherese ChiuОценок пока нет

- Differential Analysis: The Key To Decision MakingДокумент25 страницDifferential Analysis: The Key To Decision MakingJhinglee Sacupayo Gocela100% (1)

- ACCTBA3 QuizzerДокумент2 страницыACCTBA3 QuizzerTherese ChiuОценок пока нет

- Econtwo NotesДокумент6 страницEcontwo NotesTherese ChiuОценок пока нет

- COST-VOLUME-PROFIT RELATIONSHIPS (KEY TERMS & CONCEPTS TO KNOW) (ACC102-Chapter5new PDFДокумент21 страницаCOST-VOLUME-PROFIT RELATIONSHIPS (KEY TERMS & CONCEPTS TO KNOW) (ACC102-Chapter5new PDFBarbie GarzaОценок пока нет

- Linear Programming SensitivityДокумент4 страницыLinear Programming SensitivityTherese Chiu100% (1)

- Econtwo NotesДокумент6 страницEcontwo NotesTherese ChiuОценок пока нет

- Ias 12,7 Ifrs 9Документ10 страницIas 12,7 Ifrs 9AssignemntОценок пока нет

- 2013 Economy PrelimsДокумент135 страниц2013 Economy PrelimsNancy DebbarmaОценок пока нет

- The 5 C's of BankingДокумент5 страницThe 5 C's of BankingEman SultanОценок пока нет

- R.P 32, 2018Документ25 страницR.P 32, 2018sajid bhattiОценок пока нет

- Accenture Blockchain Investment Bank PDFДокумент8 страницAccenture Blockchain Investment Bank PDFbeginnerscribdОценок пока нет

- RBI Banking Awareness CapsuleДокумент118 страницRBI Banking Awareness CapsuleAbhishek Choudhary100% (1)

- Case Name: University of The Philippines College of LawДокумент6 страницCase Name: University of The Philippines College of LawYvette MoralesОценок пока нет

- Analysis of HDFC Mutual FundДокумент41 страницаAnalysis of HDFC Mutual FundjidnyasabhoirОценок пока нет

- CIR Vs Anglo California National Bank - FulltextДокумент1 страницаCIR Vs Anglo California National Bank - Fulltextscartoneros_1Оценок пока нет

- FДокумент11 страницFAnne Marieline BuenaventuraОценок пока нет

- Deoleo: Capital Reorganisation Authors Analyze Olive Oil Producer's History and StrategyДокумент13 страницDeoleo: Capital Reorganisation Authors Analyze Olive Oil Producer's History and StrategyEneida6736Оценок пока нет

- BIS CDO Rating MethodologyДокумент31 страницаBIS CDO Rating Methodologystarfish555Оценок пока нет

- NAS1Документ28 страницNAS1Gemini_0804Оценок пока нет

- Chapter8-Mean SD CAPM APTДокумент49 страницChapter8-Mean SD CAPM APTEdwin LawОценок пока нет

- Underwriting Placements and The Art of Investor Relations Presentation by Sherilyn Foong Alliance Investment Bank Berhad MalaysiaДокумент25 страницUnderwriting Placements and The Art of Investor Relations Presentation by Sherilyn Foong Alliance Investment Bank Berhad MalaysiaPramod GosaviОценок пока нет

- Glackin 1Документ64 страницыGlackin 1thestorydotieОценок пока нет

- Accounting PrinciplesДокумент8 страницAccounting Principlesaumit0099Оценок пока нет

- CH 12 Hull Fundamentals 8 The DДокумент25 страницCH 12 Hull Fundamentals 8 The DjlosamОценок пока нет

- Feasible & Efficient SetДокумент2 страницыFeasible & Efficient SetAnacleto59Оценок пока нет

- Powers of Corporation ExplainedДокумент44 страницыPowers of Corporation ExplainedGraciela InacayОценок пока нет

- Silver River Manufacturing Company Case StudyДокумент46 страницSilver River Manufacturing Company Case StudyPankaj Kunwar100% (3)

- Study of Financial Products Through IFA ChannelДокумент57 страницStudy of Financial Products Through IFA Channelpunit100% (3)

- Inv. Mechanism by Islami Bank Bangladesh LTDДокумент42 страницыInv. Mechanism by Islami Bank Bangladesh LTDshuvo100% (1)

- Harmony of Accounting STDДокумент4 страницыHarmony of Accounting STDRavi Thakkar100% (1)

- Problems and Prospects For Corporate Governance in BangladeshДокумент3 страницыProblems and Prospects For Corporate Governance in BangladeshAtequr100% (2)

- MCQДокумент105 страницMCQSourabh AgarwalОценок пока нет

- Earnings Per ShareДокумент15 страницEarnings Per ShareMuhammad SajidОценок пока нет