Академический Документы

Профессиональный Документы

Культура Документы

Finance Basics

Загружено:

Sneha Satyamoorthy100%(1)100% нашли этот документ полезным (1 голос)

26 просмотров5 страницCorporate finance deals with mergers and acquisitions advisory and underwriting. Investment banks assist with negotiating mergers between companies and shepherding the process of raising capital through stock or bond sales. Commercial banks take deposits and lend to consumers and businesses, while investment banks act as intermediaries matching stock and bond buyers and sellers. Common securities for investment include stocks, bonds, and mutual funds. Regulators like SEBI protect investors and ensure orderly market functioning. Short-term investment options include savings accounts and money market funds, while long-term options include postal savings schemes, public provident funds, and company fixed deposits.

Исходное описание:

a

Авторское право

© © All Rights Reserved

Доступные форматы

DOCX, PDF, TXT или читайте онлайн в Scribd

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документCorporate finance deals with mergers and acquisitions advisory and underwriting. Investment banks assist with negotiating mergers between companies and shepherding the process of raising capital through stock or bond sales. Commercial banks take deposits and lend to consumers and businesses, while investment banks act as intermediaries matching stock and bond buyers and sellers. Common securities for investment include stocks, bonds, and mutual funds. Regulators like SEBI protect investors and ensure orderly market functioning. Short-term investment options include savings accounts and money market funds, while long-term options include postal savings schemes, public provident funds, and company fixed deposits.

Авторское право:

© All Rights Reserved

Доступные форматы

Скачайте в формате DOCX, PDF, TXT или читайте онлайн в Scribd

100%(1)100% нашли этот документ полезным (1 голос)

26 просмотров5 страницFinance Basics

Загружено:

Sneha SatyamoorthyCorporate finance deals with mergers and acquisitions advisory and underwriting. Investment banks assist with negotiating mergers between companies and shepherding the process of raising capital through stock or bond sales. Commercial banks take deposits and lend to consumers and businesses, while investment banks act as intermediaries matching stock and bond buyers and sellers. Common securities for investment include stocks, bonds, and mutual funds. Regulators like SEBI protect investors and ensure orderly market functioning. Short-term investment options include savings accounts and money market funds, while long-term options include postal savings schemes, public provident funds, and company fixed deposits.

Авторское право:

© All Rights Reserved

Доступные форматы

Скачайте в формате DOCX, PDF, TXT или читайте онлайн в Scribd

Вы находитесь на странице: 1из 5

Corporate Finance

The bread and butter of a traditional investment bank, corporate finance

generally performs two different functions: 1) Mergers and acquisitions advisory

and 2) Underwriting. On the mergers and acquisitions (M&A) advising side of

corporate finance, bankers assist in negotiating and structuring a merger

between two companies. If, for example, a company wants to buy another

firm, then an investment bank will help finalize the purchase price, structure

the deal, and generally ensure a smooth transaction. The underwriting function

within corporate finance involves shepherding the process of raising capital for

a company. In the investment banking world, capital can be raised by selling

either stocks or bonds to investors.

Commercial banking vs. investment banking

The difference between how a typical investment bank and a typical

commercial operate bank is simple: A commercial bank takes deposits for

checking and savings accounts from consumers while an investment bank does

not.

The typical commercial banking process is fairly straightforward. You deposit

money into the bank, and the bank loans that money to consumers and

companies in need of capital (cash). You borrow to buy a house, finance a car,

or finance an addition to your home. Companies borrow to finance the growth

of their company or meet immediate cash needs. Companies that borrow from

commercial banks can range in size from the dry cleaner on the corner to a

multinational conglomerate.

Importantly, loans from commercial banks are structured as private legally

binding contracts between two parties - the bank and you (or the bank and a

company). Banks work with their clients to individually determine the terms of

the loans, including the time to maturity and the interest rate charged.

An investment bank operates differently. An investment bank does not have an

inventory of cash deposits to lend as a commercial bank does. In essence, an

investment bank acts as an intermediary, and matches sellers of stocks and

bonds with buyers of stocks and bonds. Note, however, that companies use

investment banks toward the same end as they use commercial banks. If a

company needs capital, it may get a loan from a bank, or it may ask an

investment bank to sell equity or debt (stocks or bonds). Because commercial

banks already have funds available from their depositors and an investment

bank does not, an I-bank must spend considerable time finding investors in

order to obtain capital for its client

Securities

What is meant by Securities?

The definition of Securities as per the Securities Contracts Regulation Act

(SCRA), 1956, includes instruments such as shares, bonds, scrips, stocks or

other marketable securities of similar nature in or of any incorporate company

or body corporate, government securities, derivatives of securities, units of

collective investment scheme, interest and rights in securities, security receipt

or any other instruments so declared by the Central Government.

What is the function of Securities Market?

Securities Markets is a place where buyers and sellers of securities can enter

into transactions to purchase and sell shares, bonds, debentures etc. Further,

it performs an important role of enabling corporates, entrepreneurs to raise

resources for their companies and business ventures through public issues.

Transfer of resources from those having idle resources (investors) to others who

have a need for them (corporates) is most efficiently achieved through the

securities market. Stated formally, securities markets provide channels for

reallocation of savings to investments and entrepreneurship. Savings are linked

to investments by a variety of intermediaries, through a range of financial

products, called Securities.

Which are the securities one can invest in?

Shares

Government Securities

Derivative products

Units of Mutual Funds etc., are some of the securities investors in the

securities market can invest in.

Regulator

Why does Securities Market need Regulators?

The absence of conditions of perfect competition in the securities market

makes the role of the Regulator extremely important. The regulator ensures

that the market participants behave in a desired manner so that securities

market continues to be a major source of finance for corporate and

government and the interest of investors are protected.

Who regulates the Securities Market?

The responsibility for regulating the securities market is shared by Department

of Economic Affairs (DEA), Department of Company Affairs (DCA), Reserve Bank

of India (RBI) and Securities and Exchange Board of India (SEBI).

What is SEBI and what is its role?

The Securities and Exchange Board of India (SEBI) is the regulatory authority

in India established under Section 3 of SEBI Act, 1992. SEBI Act, 1992 provides

for establishment of Securities and Exchange Board of India (SEBI) with

statutory powers for (a) protecting the interests of investors in securities (b)

promoting the development of the securities market and (c) regulating the

securities market. Its regulatory jurisdiction extends over corporates in the

issuance of capital and transfer of securities, in addition to all intermediaries

and persons associated with securities market. SEBI has been obligated to

perform the aforesaid functions by such measures as it thinks fit. In particular,

it has powers for:

Regulating the business in stock exchanges and any other securities markets

Registering and regulating the working of stock brokers, subbrokers etc.

Promoting and regulating self-regulatory organizations

Prohibiting fraudulent and unfair trade practices

Calling for information from, undertaking inspection, conducting inquiries and

audits of the stock exchanges, intermediaries, self regulatory organizations,

mutual funds and other persons associated with the securities market.

Options available for investment

What are various options available for investment?

One may invest in:

Physical assets like real estate, gold/jewellery, commodities etc. and/or

Financial assets such as fixed deposits with banks, small saving instruments

with post offices, insurance/provident/pension fund etc. or securities market

related instruments like shares, bonds, debentures etc.

What are various Short-term financial options available for investment?

Broadly speaking, savings bank account, money market/liquid funds and fixed

deposits with banks may be considered as short-term financial investment

options:

Savings Bank Account is often the first banking product people use, which

offers low interest (4%-5% p.a.), making them only marginally better than fixed

deposits.

Money Market or Liquid Funds are a specialized form of mutual funds that

invest in extremely short-term fixed income instruments and thereby provide

easy liquidity. Unlike most mutual funds, money market funds are primarily

oriented towards protecting your capital and then, aim to maximise returns.

Money market funds usually yield better returns than savings accounts, but

lower than bank fixed deposits.

Fixed Deposits with Banks are also referred to as term deposits and minimum

investment period for bank FDs is 30 days. Fixed Deposits with banks are for

investors with low risk appetite, and may be considered for 6-12 months

investment period as normally interest on less than 6 months bank FDs is likely

to be lower than money market fund returns.

What are various Long-term financial options available for investment?

Post Office Savings Schemes, Public Provident Fund, Company Fixed Deposits,

Bonds and Debentures, Mutual Funds etc.

Post Office Savings: Post Office Monthly Income Scheme is a low risk saving

instrument, which can be availed through any post office. It provides an

interest rate of 8% per annum, which is paid monthly. Minimum amount, which

can be invested, is Rs. 1,000/- and additional investment in multiples of

1,000/-. Maximum amount is Rs. 3,00,000/- (if Single) or Rs. 6,00,000/- (if held

Jointly) during a year. It has a maturity period of 6 years. A bonus of 10% is

paid at the time of maturity. Premature withdrawal is permitted if deposit is

more than one year old. A deduction of 5% is levied from the principal amount

if withdrawn prematurely; the 10% bonus is also denied.

Public Provident Fund: A long term savings instrument with a maturity of 15

years and interest payable at 8% per annum compounded annually. A PPF

account can be opened through a nationalized bank at anytime during the year

and is open all through the year for depositing money. Tax benefits can be

availed for the amount invested and interest accrued is tax-free. A withdrawal

is permissible every year from the seventh financial year of the date of

opening of the account and the amount of withdrawal will be limited to 50% of

the balance at credit at the end of the 4th year immediately preceding the

year in which the amount is withdrawn or at the end of the preceding year

whichever is lower the amount of loan if any.

Company Fixed Deposits: These are short-term (six months) to medium-term

(three to five years) borrowings by companies at a fixed rate of interest which

is payable monthly, quarterly, semi10 annually or annually. They can also be

cumulative fixed deposits where the entire principal along with the interest is

paid at the end of the loan period. The rate of interest varies between 6-9%

per annum for company FDs. The interest received is after deduction of taxes.

Bonds: It is a fixed income (debt) instrument issued for a period of more than

one year with the purpose of raising capital. The central or state government,

corporations and similar institutions sell bonds. A bond is generally a promise

to repay the principal along with a fixed rate of interest on a specified date,

called the Maturity Date.

Mutual Funds: These are funds operated by an investment company which

raises money from the public and invests in a group of assets (shares,

debentures etc.), in accordance with a stated set of objectives. It is a

substitute for those who are unable to invest directly in equities or debt

because of resource, time or knowledge constraints. Benefits include

professional money management, buying in small amounts and diversification.

Mutual fund units are issued and redeemed by the Fund Management

Company based on the fund's net asset value (NAV), which is determined at the

end of each trading session. NAV is calculated as the value of all the shares

held by the fund, minus expenses, divided by the number of units issued.

Mutual Funds are usually long term investment vehicle though there some

categories of mutual funds, such as money market mutual funds which are

short term instruments.

Вам также может понравиться

- IMF - docWORLD BANK & ITS OTHER INSTITUTIONSДокумент23 страницыIMF - docWORLD BANK & ITS OTHER INSTITUTIONSkirtiinityaОценок пока нет

- Key IMF ActivitiesДокумент4 страницыKey IMF ActivitiesDwani SangviОценок пока нет

- Notes On International Business Finance Portion - 2 Example On Balance of Payment (BOP) : Example 1Документ9 страницNotes On International Business Finance Portion - 2 Example On Balance of Payment (BOP) : Example 1Md Tabish RazaОценок пока нет

- FinanceДокумент3 страницыFinanceLovelie Peth VerzosaОценок пока нет

- Itl Unit IДокумент4 страницыItl Unit IShrabani KarОценок пока нет

- International InsititutionДокумент23 страницыInternational InsititutionNelsonMoseMОценок пока нет

- About The IMF: Bretton Woods System and ImfДокумент8 страницAbout The IMF: Bretton Woods System and ImfNilesh BhosaleОценок пока нет

- Report:The International Monetary Fund (IMF) : Tatarlî Anastasia, 102RIДокумент6 страницReport:The International Monetary Fund (IMF) : Tatarlî Anastasia, 102RIAnastasia TatarlîОценок пока нет

- International Finance Management Assignment: Topic-International Monetary FundДокумент19 страницInternational Finance Management Assignment: Topic-International Monetary Fundniks1190Оценок пока нет

- Different Contracts in Legal Aspect of BankingДокумент7 страницDifferent Contracts in Legal Aspect of Bankingdrishya3Оценок пока нет

- The Current Relationship Between Imf N World BankДокумент13 страницThe Current Relationship Between Imf N World Bankmishrasneha76439Оценок пока нет

- ImfДокумент11 страницImfHarsh KothariОценок пока нет

- Role of ImfДокумент41 страницаRole of ImfAasthaОценок пока нет

- Introduction of Imf: 1.1 MeaningДокумент58 страницIntroduction of Imf: 1.1 MeaningRiSHI KeSH GawaIОценок пока нет

- Why The IMF Was Created and How It WorksДокумент14 страницWhy The IMF Was Created and How It Worksnaqash sonuОценок пока нет

- Imf ProjectДокумент7 страницImf ProjectDeepali MestryОценок пока нет

- United States Court of Appeals, Third Circuit.: in No. 88-3395. Nos. 88-3385, 88-3389, 88-3393, 88-3394 and 88-3395Документ18 страницUnited States Court of Appeals, Third Circuit.: in No. 88-3395. Nos. 88-3385, 88-3389, 88-3393, 88-3394 and 88-3395Scribd Government DocsОценок пока нет

- CreditcardsДокумент22 страницыCreditcardsSandeep AroraОценок пока нет

- Trust ReceiptДокумент5 страницTrust ReceiptMyna Zosette MesiasОценок пока нет

- Contribution of IMF in Global TradeДокумент48 страницContribution of IMF in Global TradeNainaОценок пока нет

- Capital MarketДокумент53 страницыCapital MarketRonak ji100% (1)

- Deposit InsuranceДокумент14 страницDeposit InsuranceHarshdeep SinghОценок пока нет

- International Financial InstitutionsДокумент9 страницInternational Financial InstitutionsgzalyОценок пока нет

- ImfДокумент24 страницыImfKethavath Poolsing100% (2)

- Business Law AssignmentДокумент7 страницBusiness Law AssignmentRahul Kumar100% (1)

- Post-Graduate Diploma in Management (Banking & Financial Services) 2021-23 Term IДокумент5 страницPost-Graduate Diploma in Management (Banking & Financial Services) 2021-23 Term IAbhinav MahajanОценок пока нет

- Monetary Policy and Its Instruments: DefinitionДокумент11 страницMonetary Policy and Its Instruments: Definitionamandeep singhОценок пока нет

- Role of Banks in The Development of EconomyДокумент25 страницRole of Banks in The Development of EconomyZabed HossenОценок пока нет

- Proposals For The Treasury, The Federal Reserve, The FDIC, andДокумент6 страницProposals For The Treasury, The Federal Reserve, The FDIC, andapi-25896854Оценок пока нет

- Role of IMF in International Monetary System - 2 - 2Документ18 страницRole of IMF in International Monetary System - 2 - 2Sushma VegesnaОценок пока нет

- Banker Customer RelationshipДокумент30 страницBanker Customer RelationshipUtkarsh LodhiОценок пока нет

- The Banker-Customer RelationshipДокумент31 страницаThe Banker-Customer RelationshipStefan Adrian VanceaОценок пока нет

- Project On Banker and CustomersДокумент85 страницProject On Banker and Customersrakesh9006Оценок пока нет

- Central BankДокумент19 страницCentral BankNiranjan KumavatОценок пока нет

- Adverse Selection & Moral HazardДокумент4 страницыAdverse Selection & Moral HazardAJAY KUMAR SAHUОценок пока нет

- BBA-I Semester BBA N 105 Business LawsДокумент4 страницыBBA-I Semester BBA N 105 Business LawsArshul ChoudaryОценок пока нет

- Types of NBFCДокумент16 страницTypes of NBFCathiraОценок пока нет

- Theoritical FrameworkДокумент4 страницыTheoritical FrameworkMd Tarek Rahman0% (1)

- RBI Functions: 1. Monopoly of Note IssueДокумент5 страницRBI Functions: 1. Monopoly of Note Issueshivam shandilyaОценок пока нет

- Reserve Bank of India: An Analysis of Banking Vis A Vis GlobalizationДокумент11 страницReserve Bank of India: An Analysis of Banking Vis A Vis Globalizationarko banerjeeОценок пока нет

- Corporate Guarantee NormsДокумент3 страницыCorporate Guarantee Normsniravtrivedi72Оценок пока нет

- International Monetary System: Prof Mahesh Kumar Amity Business SchoolДокумент33 страницыInternational Monetary System: Prof Mahesh Kumar Amity Business Schoolasifanis100% (1)

- Investment LawДокумент6 страницInvestment LawVarsha ThampiОценок пока нет

- Banking Regulation Act-1949 RBI Act-1934 Negotiable Instrument Act-1881Документ7 страницBanking Regulation Act-1949 RBI Act-1934 Negotiable Instrument Act-1881Ashraf AliОценок пока нет

- The Main Features of The FEMAДокумент3 страницыThe Main Features of The FEMAAnonymous lfCVGjОценок пока нет

- Law and Practice of BankingДокумент151 страницаLaw and Practice of BankingAshok KumarОценок пока нет

- Investment LawДокумент22 страницыInvestment Lawmee myyОценок пока нет

- Reserve Bank of IndiaДокумент17 страницReserve Bank of IndiaShivamPandeyОценок пока нет

- WB Guidelines On Insolvency and Creditor RightsДокумент86 страницWB Guidelines On Insolvency and Creditor RightsAnonymous m2C4FCnscv100% (2)

- Project On Commercial PaperДокумент23 страницыProject On Commercial PaperSuryaОценок пока нет

- Debt MarketДокумент13 страницDebt MarketsunilОценок пока нет

- ILFS Group Companies - NCLT and NCLAT OrdersДокумент21 страницаILFS Group Companies - NCLT and NCLAT Ordersvismita diwanОценок пока нет

- Export FinanceДокумент6 страницExport FinanceMallikarjun RaoОценок пока нет

- Executive Summary of S.E.C. Madoff ReportДокумент22 страницыExecutive Summary of S.E.C. Madoff ReportDealBookОценок пока нет

- Unit 1Документ16 страницUnit 1Shivam YadavОценок пока нет

- Capital Market Midterm ExamДокумент4 страницыCapital Market Midterm ExamJessa Dela Cruz SahagunОценок пока нет

- Handbook On Basics of Financial Markets: National Stock Exchange of India LimitedДокумент20 страницHandbook On Basics of Financial Markets: National Stock Exchange of India Limitedहरिओम पांडेОценок пока нет

- Shivajirao S. Jondhale Institute of Management Science and Research, AsangaonДокумент13 страницShivajirao S. Jondhale Institute of Management Science and Research, AsangaonROHITОценок пока нет

- Ge AssignmentДокумент9 страницGe AssignmentNidhuОценок пока нет

- Banker Blueprint PDFДокумент37 страницBanker Blueprint PDFSangwoo Kim100% (1)

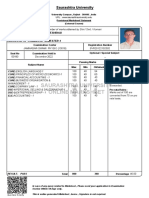

- Application Number: MB12239882 Roll No: 24040208Документ1 страницаApplication Number: MB12239882 Roll No: 24040208Sneha SatyamoorthyОценок пока нет

- 100 Crore in Bony Labs 200 Crore in CleanpowerДокумент1 страница100 Crore in Bony Labs 200 Crore in CleanpowerSneha SatyamoorthyОценок пока нет

- DCF FCFF ValuationДокумент0 страницDCF FCFF ValuationSneha SatyamoorthyОценок пока нет

- Dainik Bhaskar - Wikipedia, The Free EncyclopediaДокумент4 страницыDainik Bhaskar - Wikipedia, The Free EncyclopediaSneha SatyamoorthyОценок пока нет

- Reinsurance Market Outlook ExternalДокумент48 страницReinsurance Market Outlook ExternalSneha SatyamoorthyОценок пока нет

- IIM LucknowДокумент3 страницыIIM Lucknowapi-19739787Оценок пока нет

- Tut6Документ1 страницаTut6shini s gОценок пока нет

- SDM HDFC BankДокумент4 страницыSDM HDFC BankIndira CollegeОценок пока нет

- Providers and Their Payment IssuesДокумент10 страницProviders and Their Payment Issuesanon_720977331Оценок пока нет

- Thematic Global: Source: BIS Quarterly Review, HSBC ResearchДокумент6 страницThematic Global: Source: BIS Quarterly Review, HSBC ResearchS raoОценок пока нет

- Https WWW - Cimb.bizchannel - Com.my Corp Front Transactioninquiry - Do Action Doprint PDFДокумент1 страницаHttps WWW - Cimb.bizchannel - Com.my Corp Front Transactioninquiry - Do Action Doprint PDFSyed HanafieОценок пока нет

- ICT Product Technical Specification Template SA 1 1-CheiryДокумент5 страницICT Product Technical Specification Template SA 1 1-CheiryJONATHAN ALEXANDER NARVAEZ MONDRAGONОценок пока нет

- ADJUSTING ENTRIES PPT TacsanДокумент31 страницаADJUSTING ENTRIES PPT TacsanDanicaОценок пока нет

- Depreciation Question and Answers 2Документ2 страницыDepreciation Question and Answers 2AMIN BUHARI ABDUL KHADERОценок пока нет

- Acca Vs Icai (E&w) - DocДокумент6 страницAcca Vs Icai (E&w) - DocJayaram ParlikadОценок пока нет

- Account Statements-AprДокумент2 страницыAccount Statements-AprCAT ClusterОценок пока нет

- Dataset - Crawler Google Places Task 1 - 2023 03 01 - 18 16 43 698Документ1 218 страницDataset - Crawler Google Places Task 1 - 2023 03 01 - 18 16 43 698Bayu WiratmoОценок пока нет

- AA SD22 Examiner-11231Документ27 страницAA SD22 Examiner-11231Nguyễn Thu TrangОценок пока нет

- ICICI Bank Deposit SlipДокумент1 страницаICICI Bank Deposit SlipRadhika MishraОценок пока нет

- TCS Life Annuities Pensions - Abstract-16!03!21Документ3 страницыTCS Life Annuities Pensions - Abstract-16!03!21Abhinav SahaniОценок пока нет

- Company Profile - Future GroupДокумент16 страницCompany Profile - Future GroupHanu InturiОценок пока нет

- Railtel Corporation of India LTD: Developing Marketing Strategy ForДокумент54 страницыRailtel Corporation of India LTD: Developing Marketing Strategy ForSanjai KumarОценок пока нет

- journalsresaim,+IJRESM V3 I9 31Документ4 страницыjournalsresaim,+IJRESM V3 I9 31Mary DenizeОценок пока нет

- Excel Merchandising CompanyДокумент1 страницаExcel Merchandising Companygolemwitch01Оценок пока нет

- Kathleenannmbalucas : B90L7Adiazst Katarunganvillpoblacion 1776muntinlupacityДокумент6 страницKathleenannmbalucas : B90L7Adiazst Katarunganvillpoblacion 1776muntinlupacityAnjo BalucasОценок пока нет

- CPE 313-Data - and - Digital - Communication - Module-1Документ29 страницCPE 313-Data - and - Digital - Communication - Module-1RichardsОценок пока нет

- Fsbi NotesДокумент74 страницыFsbi Notessanthoshkalpavally5164100% (11)

- Basic Instructions For A Bank Reconciliation Statement PDFДокумент4 страницыBasic Instructions For A Bank Reconciliation Statement PDFAman KodwaniОценок пока нет

- Mifc Insight Report - Islamic Finance Technology & InnovationДокумент6 страницMifc Insight Report - Islamic Finance Technology & Innovationmuhammad taufikОценок пока нет

- Terms and Conditions: (Receipt For The Recipient)Документ1 страницаTerms and Conditions: (Receipt For The Recipient)sagar aroraОценок пока нет

- SSD ProjectДокумент8 страницSSD ProjectDebjit GangulyОценок пока нет

- Chapter 8 SolutionsДокумент11 страницChapter 8 Solutionsbellohales67% (3)

- Marksheet PDFДокумент1 страницаMarksheet PDFD igg v D oh vОценок пока нет

- 5G - WikipediaДокумент7 страниц5G - WikipediaYu KiОценок пока нет

- Concepts & Conventions in AccountingДокумент5 страницConcepts & Conventions in Accountingpratz dhakateОценок пока нет

- Kr. Meureubo-Meunasah RayekДокумент99 страницKr. Meureubo-Meunasah RayekDian Afifah RahmawatiОценок пока нет

- Ready, Set, Growth hack:: A beginners guide to growth hacking successОт EverandReady, Set, Growth hack:: A beginners guide to growth hacking successРейтинг: 4.5 из 5 звезд4.5/5 (93)

- 2019 Business Credit with no Personal Guarantee: Get over 200K in Business Credit without using your SSNОт Everand2019 Business Credit with no Personal Guarantee: Get over 200K in Business Credit without using your SSNРейтинг: 4.5 из 5 звезд4.5/5 (3)

- The Masters of Private Equity and Venture Capital: Management Lessons from the Pioneers of Private InvestingОт EverandThe Masters of Private Equity and Venture Capital: Management Lessons from the Pioneers of Private InvestingРейтинг: 4.5 из 5 звезд4.5/5 (17)

- These are the Plunderers: How Private Equity Runs—and Wrecks—AmericaОт EverandThese are the Plunderers: How Private Equity Runs—and Wrecks—AmericaРейтинг: 4.5 из 5 звезд4.5/5 (14)

- Value: The Four Cornerstones of Corporate FinanceОт EverandValue: The Four Cornerstones of Corporate FinanceРейтинг: 4.5 из 5 звезд4.5/5 (18)

- The Six Secrets of Raising Capital: An Insider's Guide for EntrepreneursОт EverandThe Six Secrets of Raising Capital: An Insider's Guide for EntrepreneursРейтинг: 4.5 из 5 звезд4.5/5 (8)

- Finance Basics (HBR 20-Minute Manager Series)От EverandFinance Basics (HBR 20-Minute Manager Series)Рейтинг: 4.5 из 5 звезд4.5/5 (32)

- The Caesars Palace Coup: How a Billionaire Brawl Over the Famous Casino Exposed the Power and Greed of Wall StreetОт EverandThe Caesars Palace Coup: How a Billionaire Brawl Over the Famous Casino Exposed the Power and Greed of Wall StreetРейтинг: 5 из 5 звезд5/5 (2)

- These Are the Plunderers: How Private Equity Runs—and Wrecks—AmericaОт EverandThese Are the Plunderers: How Private Equity Runs—and Wrecks—AmericaРейтинг: 3.5 из 5 звезд3.5/5 (8)

- 7 Financial Models for Analysts, Investors and Finance Professionals: Theory and practical tools to help investors analyse businesses using ExcelОт Everand7 Financial Models for Analysts, Investors and Finance Professionals: Theory and practical tools to help investors analyse businesses using ExcelОценок пока нет

- Summary of The Black Swan: by Nassim Nicholas Taleb | Includes AnalysisОт EverandSummary of The Black Swan: by Nassim Nicholas Taleb | Includes AnalysisРейтинг: 5 из 5 звезд5/5 (6)

- Financial Modeling and Valuation: A Practical Guide to Investment Banking and Private EquityОт EverandFinancial Modeling and Valuation: A Practical Guide to Investment Banking and Private EquityРейтинг: 4.5 из 5 звезд4.5/5 (4)

- Financial Risk Management: A Simple IntroductionОт EverandFinancial Risk Management: A Simple IntroductionРейтинг: 4.5 из 5 звезд4.5/5 (7)

- Burn the Boats: Toss Plan B Overboard and Unleash Your Full PotentialОт EverandBurn the Boats: Toss Plan B Overboard and Unleash Your Full PotentialРейтинг: 4.5 из 5 звезд4.5/5 (32)

- Financial Intelligence: A Manager's Guide to Knowing What the Numbers Really MeanОт EverandFinancial Intelligence: A Manager's Guide to Knowing What the Numbers Really MeanРейтинг: 4.5 из 5 звезд4.5/5 (79)

- The 17 Indisputable Laws of Teamwork Workbook: Embrace Them and Empower Your TeamОт EverandThe 17 Indisputable Laws of Teamwork Workbook: Embrace Them and Empower Your TeamОценок пока нет

- The Six Secrets of Raising Capital: An Insider's Guide for EntrepreneursОт EverandThe Six Secrets of Raising Capital: An Insider's Guide for EntrepreneursРейтинг: 4.5 из 5 звезд4.5/5 (34)

- Startup CEO: A Field Guide to Scaling Up Your Business (Techstars)От EverandStartup CEO: A Field Guide to Scaling Up Your Business (Techstars)Рейтинг: 4.5 из 5 звезд4.5/5 (4)

- Burn the Boats: Toss Plan B Overboard and Unleash Your Full PotentialОт EverandBurn the Boats: Toss Plan B Overboard and Unleash Your Full PotentialОценок пока нет

- Joy of Agility: How to Solve Problems and Succeed SoonerОт EverandJoy of Agility: How to Solve Problems and Succeed SoonerРейтинг: 4 из 5 звезд4/5 (1)

- Venture Deals, 4th Edition: Be Smarter than Your Lawyer and Venture CapitalistОт EverandVenture Deals, 4th Edition: Be Smarter than Your Lawyer and Venture CapitalistРейтинг: 4.5 из 5 звезд4.5/5 (73)

- Private Equity and Venture Capital in Europe: Markets, Techniques, and DealsОт EverandPrivate Equity and Venture Capital in Europe: Markets, Techniques, and DealsРейтинг: 5 из 5 звезд5/5 (1)

- Creating Shareholder Value: A Guide For Managers And InvestorsОт EverandCreating Shareholder Value: A Guide For Managers And InvestorsРейтинг: 4.5 из 5 звезд4.5/5 (8)

- Venture Deals: Be Smarter Than Your Lawyer and Venture CapitalistОт EverandVenture Deals: Be Smarter Than Your Lawyer and Venture CapitalistРейтинг: 4 из 5 звезд4/5 (32)

- John D. Rockefeller on Making Money: Advice and Words of Wisdom on Building and Sharing WealthОт EverandJohn D. Rockefeller on Making Money: Advice and Words of Wisdom on Building and Sharing WealthРейтинг: 4 из 5 звезд4/5 (20)