Академический Документы

Профессиональный Документы

Культура Документы

Valuation Concepts and Issues (IASB 2007)

Загружено:

So LokИсходное описание:

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Valuation Concepts and Issues (IASB 2007)

Загружено:

So LokАвторское право:

Доступные форматы

IASB Education Session

Valuation Concepts and Issues

Overview (Agenda Paper 11B)

October 2007

This document is provided as a convenience to

observers at IASB meetings, to assist them in following

the Boards discussion. It does not represent an official

position of the IASB. Board positions are set out in

Standards.

These notes are based on the staff papers prepared for

the IASB. Paragraph numbers correspond to paragraph

numbers used in the IASB papers. However, because

these notes are less detailed, some paragraph numbers

are not used.

Slide 2

October 2007 Valuation Concepts and Issues Overview

The views expressed in this

presentation are the views of the

individual presenters and do not

represent the views of their respective

firms.

Agenda

Value Concepts in IFRS

The Purchase Price Allocation Process

Overview of Valuation Methodologies

Cost Approach

Market Approach

Income Approach

Other Items

Summary

Section one

Value Concepts in IFRS

The Purchase Price Allocation Process

Overview of Valuation Methodologies

Cost Approach

Market Approach

Income Approach

Other Items

Summary

Slide 5

October 2007 Valuation Concepts and Issues Overview

Relevance of valuation as an essential part of accounting, for example:

IFRS 2 Fair value (definition as in other standards plus ... or an equity

instrument granted ...)

IFRS 3 Fair value

IFRS 4 Liability adequacy test, fair value

IFRS 5 Fair value less costs to sell

IFRS 6 Cost or revaluation model according to either IAS 16 or IAS 38

IAS 2 Cost or net realisable value

IAS 16 Fair value and revalued amount (i.e. fair value less accumulated

depreciation)

IAS 17 Fair value, present value and net investment value

IAS 19 Fair value

Relevance of Valuation for Financial Reporting

Value Concepts in IFRS

Slide 6

October 2007 Valuation Concepts and Issues Overview

Relevance of valuation as an essential part of accounting, for example:

IAS 26 Fair value

IAS 36 Recoverable amount as the higher of an assets or cash-

generating units fair value less costs to sell or its value in use

IAS 37 Best estimate of the expenditure required to settle the present

obligation or expected value

IAS 38 Fair value and revalued amount (i.e. fair value less accumulated

amortization or impairment loss)

IAS 39 Fair value, continuing involvement approach

IAS 40 Cost model vs. fair value model

IAS 41 Fair value

Relevance of Valuation for Financial Reporting (continued)

Value Concepts in IFRS

Slide 7

October 2007 Valuation Concepts and Issues Overview

Overview of todays discussion

Focus on fair value used in a business combination

Consistent with valuation concepts for other fair value measurements

Added complexity of identification of assets

Broadest usage of fair value

Focus on a typical business

Some industries require unique approaches

Value Concepts in IFRS

Section two

Value Concepts in IFRS

The Purchase Price Allocation Process

Overview of Valuation Methodologies

Cost Approach

Market Approach

Income Approach

Other Items

Summary

Slide 9

October 2007 Valuation Concepts and Issues Overview

Step 1

Analysis

Understand the transaction

Step 2

Identification

&

Valuation

Fair value measurement

Step 3

Subsequent

Treatment

Goodwill and financial statement impacts

Identification of assets acquired and liabilities assumed (including items not recorded in

balance sheet of the acquired entity)

Estimation of remaining useful lives and pattern of economic benefit

Fair value measurement of acquired assets (tangibles and intangibles) and liabilities

Calculation of remaining goodwill including deferred tax impact

Consideration of impairment test procedures

Consider facts and circumstances (transaction structure, rationale & objectives)

Understand the economics

Measurement of purchase price (cash deal / share deal, direct costs)

Key milestones in a purchase price allocation

The Purchase Price Allocation Process

Slide 10

October 2007 Valuation Concepts and Issues Overview

Identification of acquired assets

Must understand the sources of cash flows and the relationships to the

businesss assets, including:

Tangible assets,

Identifiable intangible assets, and

Future intangible assets (which are components of goodwill)

Understanding the economics is critical:

Why did they acquire this business?

What drives the value in this business?

Identification of assets is not straightforward judgment is often required

Understand the accounting model (e.g., acquisition of a business vs.

assets)

The Purchase Price Allocation Process

Slide 11

October 2007 Valuation Concepts and Issues Overview

Identification of acquired assets:

Components of Projected Financial Information

Working Capital

Cash Flow Projections in Excess of

Allocation to Working Capital, Fixed

Assets, AWF, IP and Customers

Fixed Assets

Assembled Work Force

Future IP

IP

Existing

Customers

Trade Name

The Purchase Price Allocation Process

C

a

s

h

f

l

o

w

Time

Slide 12

October 2007 Valuation Concepts and Issues Overview

Identification of acquired assets:

Components of Projected Financial Information

Working Capital

Cash Flow Projections in Excess of

Allocation to Working Capital, Fixed

Assets, AWF, IP and Customers

Fixed Assets

Assembled Work Force

Future IP

IP

Existing

Customers

Trade Name

Excess Purchase Price

(Goodwill - prior to accounting adjustments)

The Purchase Price Allocation Process

C

a

s

h

f

l

o

w

Time

Section three

Value Concepts in IFRS

The Purchase Price Allocation Process

Overview of Valuation Methodologies

Cost Approach

Market Approach

Income Approach

Other Items

Summary

Slide 14

October 2007 Valuation Concepts and Issues Overview

Valuation Approaches

Market Approach

Multiples

Market Pricing

Income Approach

Multi-period excess-earnings

method

Relief from Royalty Method

Incremental Cash Flow Method

Contingent Claims / Real

Option Models

Cost Approach

Reproduction Cost Method

Replacement Cost Method

Apply most appropriate method considering

economic benefits and valuation inputs available!

mark- to-cost mark- to-market mark-to model

Overview of Valuation Methodologies

Slide 15

October 2007 Valuation Concepts and Issues Overview

Quoted prices (unadjusted) in active markets for identical assets

or liabilities

Level 1 inputs

(observable)

Source: FAS 157.22-30

Quoted prices for similar assets or liabilities in active markets,

Quoted prices for identical or similar assets or liabilities in non-

active markets,

Inputs other than quoted prices,

Market-corroborated inputs, adjusted as appropriate for

differences

Level 2 inputs

(observable)

Unobservable inputs regarding the asset or liability (little, if any

market activity)

Should reflect market participant assumptions

Reporting entitys own assumptions might need to be adjusted

Level 3 inputs

(unobservable)

Fair value hierarchy under US GAAP

Source of valuation inputs

fair value is a market-based measurement

Overview of Valuation Methodologies

Slide 16

October 2007 Valuation Concepts and Issues Overview

Intangibles

Possible valuation methods

Brands and

trademarks

Relief from Royalty Method, Price-Premium-Method, and

recent market transactions (if available)

Technology

Relief from Royalty Method, Incremental Cash Flow Method,

would also consider MEEM if the technology is enabling

Customer relations

and order backlog

MEEM approach (most prevalent)

Customer lists Replacement costs

IPR&D Reproduction costs, DCF methods and MEEM

Software Relief from Royalty Method, and replacement costs

Tangibles

Possible valuation methods

Real property Market approach, and income approach

Machinery and

equipment

Replacement costs, may also consider market approach for

significant assets

Overview of Valuation Methodologies

Typical valuation methodologies

Slide 17

October 2007 Valuation Concepts and Issues Overview

Depreciated

replacement cost

Valuation of tangible assets

Cost approach Income approach

Capitalised earnings

Availability of market rents

and expenses

Example: Office buildings

Availability of historical cost,

index and total useful life

information

Example: Hospitals, industrial

buildings

Real

Estate

Machinery

&

Equipment

Availability of defined income

and expense information

attributable to the assets

Example: Production lines

Rare due to embedded intangibles

Availability of historical cost,

index and total useful life

information

Example: High number of assets,

special designed assets

Comparable market

transactions

Market approach

Availability of comparable

transactions

Example: Vacant land, residential

units

Availability of comparable

transactions

Example: Serial equipment

Standardised equipment

(computer, cars)

Valuation approaches tangible assets

Overview

Overview of Valuation Methodologies

Slide 18

October 2007 Valuation Concepts and Issues Overview

Depreciated

replacement cost

Valuation of intangible assets

Cost approach Income approach

Capitalised earnings

Relief from Royalty Method

Example: Brands and trademarks,

Technology, Software

Multi-period excess-earnings

method approach

Example: Customer relationships

and order backlog, Technology,

IPR&D

Incremental Cash Flow Method

Example: Brands and trademarks,

Technology

Reproduction Cost Method

Example: IPR&D

Replacement Cost Method

Example: Customer lists, Software

Comparable market

transactions

Market approach

Recent market transactions

Example: Brands and trademarks,

Customer lists

Valuation approaches intangible assets

Overview

Overview of Valuation Methodologies

Section four

Value Concepts in IFRS

The Purchase Price Allocation Process

Overview of Valuation Methodologies

Cost Approach

Market Approach

Income Approach

Other Items

Summary

Slide 20

October 2007 Valuation Concepts and Issues Overview

Concept an investor will pay no more for

an asset than the cost to purchase or

construct an asset of equal utility

Premise of value: Cost Approach

Cost Approach

Slide 21

October 2007 Valuation Concepts and Issues Overview

Derived fair value from these methods should be the same!

Using same materials,

production standards,

design ...

Using modern materials,

production standards,

design ...

cost to construct an

exact duplicate

cost to construct

equivalent utility

Cost approach

Cost approach valuation methods

Replacement cost method Reproduction cost method

Cost Approach

Slide 22

October 2007 Valuation Concepts and Issues Overview

From cost to value

Reproduction cost (new)

- Curable functional and technological obsolescence

=Replacement cost (new)

- Physical deterioration

- Economic obsolescence (external)

- Incurable functional and technological obsolescence

= Value of (used) asset

Cost approach provides a reasonable indication of value when all components

of cost are included and all forms of obsolescence are considered

Cost Approach

Slide 23

October 2007 Valuation Concepts and Issues Overview

Cost approach Pros and Cons

Cost Approach:

Useful when measuring a unique internally developed asset that is

used in conjunction with generating the cash flow of an enabling asset

(e.g. billing software and customer relationships)

Cost approach may not reflect value created through development of

the asset (e.g. discovery of unique technology)

Diversity in practice in its application

- Historical costs to create the asset or prospective view that

captures other lost profit elements

- Approach dependent upon facts and circumstances

- Pre-tax or after tax value?

Note SEC Staff has expressed concern about its reliability & ability to

capture all relevant costs.

Cost Approach

Section five

Value Concepts in IFRS

The Purchase Price Allocation Process

Overview of Valuation Methodologies

Cost Approach

Market Approach

Income Approach

Other Items

Summary

Slide 25

October 2007 Valuation Concepts and Issues Overview

Concept prices from previous

transactions provide empirical evidence

for the value of an asset

Premise of value: Market Approach

Market Approach

Slide 26

October 2007 Valuation Concepts and Issues Overview

Represents one specific

transaction only!

Adjustments to derive

fair value necessary!

Price Fair value

Changes in market conditions and

legislation

Marketplace conditions

Participant-specific influences &

motivations

Deal-specific issues, e.g. financing

terms, tax issues

Economic income

Remaining useful life

Asset-specific risk

Key value drivers:

Market approach

Market Approach

Slide 27

October 2007 Valuation Concepts and Issues Overview

Multiples may be used for valuation of individual asset

subject to comparable market information

Analyse similar assets that have recently been sold and compare these

assets to the subject asset.

Value of emission right

Tons of pollutants

allowed

x =

Value of customer list

Number of customers

x

=

Value of subject

asset

Factors influencing

subject asset

x =

Value per ton of pollutants

emitted

Value per customer

Factors influencing

comparable asset

Value of comparable asset

Multiples

Market Approach

Slide 28

October 2007 Valuation Concepts and Issues Overview

Market approach Pros and Cons

Can provide a reliable measure of fair value in a

homogeneous market, however such markets are rare

Captures incremental value created over cost and is generally

more reliable than the income approach when comparable

transactions are present

Frequently inseparable from a related asset and therefore

difficult to identify comparable transactions to determine fair

value

Due to uniqueness of intangible assets no active markets exist

Can be distorted by transaction specific facts of which outside

parties are not aware

Market Approach

Section six

Value Concepts in IFRS

The Purchase Price Allocation Process

Overview of Valuation Methodologies

Cost Approach

Market Approach

Income Approach

Other Items

Summary

Slide 30

October 2007 Valuation Concepts and Issues Overview

Concept an asset is worth

what it can earn

Premise of value : Income Approach

Income Approach

Slide 31

October 2007 Valuation Concepts and Issues Overview

Valuation principles

1. Isolate the future cash flows an investor would expect the subject asset

to generate

2. Discount future cash flows with an appropriate discount rate

FV =

Cash flow

t

(1 + Discount rate)

t

t=1

T

Income Approach

Slide 32

October 2007 Valuation Concepts and Issues Overview

Choose most appropriate prospective

financial information

AND

Eliminate any buyer specific synergies

AND

adjust projections such that

assumptions are consistent with those

of market participants

Valuation principles

Selecting prospective financial information

C

a

s

h

f

l

o

w

Time

Purchase price cash

flows

Enterprise value

cash flows at

valuation date

Buyer-specific

Synergies

Income Approach

Slide 33

October 2007 Valuation Concepts and Issues Overview

Apply effective tax rate of market participants!

Tax benefits

Amortisation

for income tax purposes

Tax expenses

Cash flows

attributable to intangible asset

Tax issues

Tax expenses and tax benefits

Income Approach

Slide 34

October 2007 Valuation Concepts and Issues Overview

Acquisition of an asset e.g. Machine 100,000

Asset deal Share deal

creates new tax basis

old book values are carried

forward - tax basis unchanged

Deal structure and tax basis should not impact fair value

Difference in tax basis is reflected in computation of deferred taxes

Concept of tax amortisation benefit

Income Approach

Slide 35

October 2007 Valuation Concepts and Issues Overview

Valuation approaches

Cost approach Market approach

Income approach

Already included in

market prices

Where to apply a tax amortisation benefit?

Income Approach

TAB to be included

dependent on tax legislation

Usually not applicable

Slide 36

October 2007 Valuation Concepts and Issues Overview

Discount Rate

Income Approach

An appropriate discount rate should be utilised based on the

risk profile of underlying asset, liability or business

Guideline benchmarks for selecting appropriate discount rates:

- Weighted average cost of capital (WACC)

- Internal rate of return (IRR)

- Weighted average return on assets (WARA)

- Other

Discount rate and cash flows need to be on a like for like basis

- taxes in cash flows, use a post tax rate

- risk in cash flows, use a risk free rate

Slide 37

October 2007 Valuation Concepts and Issues Overview

Discount Rate (continued)

Income Approach

As the valuation of an asset or liability is based on the future

cash flows associated with it, consideration should also be

given to the level that these projected cash flows have been

risk adjusted:

- Expected cash flows (most of the risk is captured in the

cash flows) WACC represents the best indication for a

discount rate

- Single scenario (optimistic or pessimistic) -- either adjust

the cash flows OR the discount rate

IRR becomes the mechanism by which the discount rate

is adjusted

Slide 38

October 2007 Valuation Concepts and Issues Overview

Cost of capital

Company WACC

Risk-free rate, market-risk premium and underlying index used for beta

regression should correspond.

Determinants of the WACC calculation should be derived from peer group.

Apply interest rate from hypothetical buyer (e.g. YTM of corporate bonds).

One index for the whole peer group.

WACC might not be acceptable for some industries

Take the perspective of a market participant!

D E

D

D

D E

E

E

t) - (1 r r WACC

+ +

x x + x =

Income Approach

Slide 39

October 2007 Valuation Concepts and Issues Overview

Should reflect an optimal capital structure for the target

company

But, an optimal structure is unknown, so a peer group is used

Might differ from the structures of the acquirer and acquiree

WACC

Based on a peer group

Yield-to-maturity for corporate bonds preferred to cost of debt

incurred

Cost of debt

Peer group preferred over the acquirer or acquiree

Risk-free rate, market-risk premium and the underlying index

used for Beta regression should interrelate (e.g. 20y US T-Bond

yield, US market risk premium and S&P 500 for beta regression)

Consideration of entity specific risk premiums and other

Cost of equity

Cost of capital considerations

Income Approach

Slide 40

October 2007 Valuation Concepts and Issues Overview

Income approach methods

Income approach

Relief-from-royalty method

Incremental cash-flow method

Multi-period excess-earnings method

Income Approach

Slide 41

October 2007 Valuation Concepts and Issues Overview

Relief-from-royalty method

Concept

relieves owner

The royalty savings are the expected cash flows

for the subject intangible asset!

from paying royalty rate

Ownership of the asset

e.g. trademark

Income Approach

Slide 42

October 2007 Valuation Concepts and Issues Overview

Relief-from-royalty method

Valuation steps

Determine royalty rate for comparable asset 1.

Subtract tax expenses 3.

Multiply with matching valuation base 2.

Calculate the present value of royalty savings 4.

Compute the tax amortisation benefit 5.

Income Approach

Slide 43

October 2007 Valuation Concepts and Issues Overview

Relief-from-royalty method

Royalty Rate Assessment

Evaluate royalty rates in the context of the subject group of

assets (e.g. cash generating unit) to determine if there is

sufficient profitability to support the market rates.

Assess the royalty rate in the context of the maximum implied

royalty for the enterprise and relative to other intangible

assets.

Determine whether the royalty rate is inclusive of maintenance

R&D (e.g. technology) or marketing (e.g. trade name). If not

deduct the maintenance expense from the royalty stream.

Income Approach

Slide 44

October 2007 Valuation Concepts and Issues Overview

Relief-from-royalty method:

Sources of inputs and common issues

Royalty rates derived from published sources:

- court cases,

- proprietary databases,

- actual agreements

Sources are assessed for comparability to the subject asset

However, public sources of information may not disclose all

the terms of the agreements, such as initial payments.

Income Approach

Slide 45

October 2007 Valuation Concepts and Issues Overview

Relief-from-royalty method

Example Total Excess Income

2007 2008 2009 2010 2011 Residual

Revenue 1,000 1,100 1,430 1,716 1,802 1,856

Gross Profit 60% 600 660 858 1,030 1,081 1,114

Operating Expenses 25% 250 275 358 429 450 464

Maintenance R&D 1% 10 11 14 17 18 19

EBITDA 340 374 486 583 613 631

Depreciation 15% 150 165 215 257 270 278

EBITA 190 209 272 326 342 353

Taxes @ 40% 76 84 109 130 137 141

Debt-Free Net Income 114 125 163 196 205 212

Capital Charges 5% 50 55 72 86 90 93

Excess Income 64 70 92 110 115 119

Capitalized Residual Value 2,375

Present Value Factor 12% 0.9449 0.8437 0.7533 0.6726 0.6005 0.6005

PV Excess Income 60 59 69 74 69 1,427

Total PV Excess Income 1,758

Income Approach

Slide 46

October 2007 Valuation Concepts and Issues Overview

Relief-from-royalty method

Example Total Implied Royalty Rate for All Intangible Assets

2007 2008 2009 2010 2011 Residual

Revenue 1,000 1,100 1,430 1,716 1,802 1,856

Gross Profit 60% 600 660 858 1,030 1,081 1,114

Operating Expenses 25% 250 275 358 429 450 464

Maintenance R&D 1% 10 11 14 17 18 19

Total Implied Royalty 10.7% 107 117 153 183 192 198

EBITDA 233 257 334 400 420 433

Depreciation 15% 150 165 215 257 270 278

EBITA 83 92 119 143 150 155

Taxes @ 40% 33 37 48 57 60 62

Debt-Free Net Income 50 55 72 86 90 93

Capital Charges 5% 50 55 72 86 90 93

Excess Income - - - - - (0)

Capitalized Residual Value (0)

Present Value Factor 12% 0.9449 0.8437 0.7533 0.6726 0.6005 0.6005

PV Excess Income - - - - - (0)

Total PV Excess Income 0

Income Approach

Slide 47

October 2007 Valuation Concepts and Issues Overview

Relief-from-royalty method

Example Fair Value of Technology

2007 2008 2009 2010 2011

Revenue 1,000 800 600 400 200

Royalty 3% 30 24 18 12 6

Maintenance R&D 1%

10 8 6 4 2

Net Royalty 20 16 12 8 4

Taxes @ 40%

8 6 5 3 2

After Tax Net Royalty 12 10 7 5 2

Present Value Factor 12%

0.9449 0.8437 0.7533 0.6726 0.6005

PV After Tax Net Royalty 11 8 5 3 1

Total Present Value 30

Tax Amortization Benefit

6

Fair Value - Technology 35

Income Approach

Slide 48

October 2007 Valuation Concepts and Issues Overview

Relief from royalty approach Pros and Cons

Dependent on the comparability of the subject asset to market based

royalty agreements

Market based agreements may or may not disclose sufficient information

to evaluate the royalty rate

It is intended to reflect the profit that a licensor and licensee would require

for their respective efforts and use of other assets

Should be evaluated in the context of the subject business to ensure there

is sufficient income to support the royalty rate

Income Approach

Slide 49

October 2007 Valuation Concepts and Issues Overview

Income approach methods

Income approach

Relief-from-royalty method

Incremental cash-flow method

Multi-period excess-earnings method

Income Approach

Slide 50

October 2007 Valuation Concepts and Issues Overview

Incremental cash-flow method

Concepts

Cost savings

The intangible asset

allows the owner

to lower costs

Incremental cash-flow method

Incremental revenue

The intangible asset

allows the owner

to earn incremental

revenue, e.g. to charge a

price-premium

Income Approach

Slide 51

October 2007

Trademark-

premium

Trademark-

forecast

Trademark-

risk

Trademark specific

revenues

Price effect

Volume effect

Distribution effect

Risk survey and present value calculation

Volume

Price

Branded product

Unbranded product

Price per bottle

1,30

Price per bottle

1,00

t

R (x)

Total revenues

Trademark specific revenues

Trademark specific

contribution to income

Tradem

ark relevant costs

C (x)

CI (x)

Valuation of intangible assets

Valuation of a trademark by the Incremental Cash Flow method (example)

Slide 52

October 2007 Valuation Concepts and Issues Overview

Incremental cash-flow method

Valuation steps

Derive pre-tax incremental cash flows of subject intangible 1.

Consider incremental contributory asset charges 3.

Subtract tax expenses 2.

Calculate the present value of incremental cash flows 4.

Compute the tax amortisation benefit 5.

Income Approach

Slide 53

October 2007 Valuation Concepts and Issues Overview

Incremental cash flow method Pros and Cons

Provides a direct measure of the economic benefit provided by the asset

The application of contributory asset charges is dependent upon the

nature of the increment. For example premium pricing would not require a

contributory asset charge for PP&E, but a working capital charge would be

appropriate. Note the concepts of contributory asset charges are

discussed later in the presentation.

Cost savings and premium pricing are more readily measurable, however

incremental market share becomes more subjective

Baseline assumptions may only be available within the subject entity and

may be difficult to identify for market participants

Income Approach

Slide 54

October 2007 Valuation Concepts and Issues Overview

Income approach methods

Income approach

Relief-from-royalty method

Incremental cash-flow method

Multi-period excess-earnings method

Income Approach

Slide 55

October 2007 Valuation Concepts and Issues Overview

MEEM

Valuation steps

Derive future cash flows for subject intangible asset 1.

Apply contributory asset charges 3.

Subtract tax expenses 2.

Calculate present value of future cash flows 4.

Compute the tax amortisation benefit 5.

Income Approach

Slide 56

October 2007 Valuation Concepts and Issues Overview

MEEM

Valuation steps

Question:

Would the subject intangible asset generate the same revenues

independent from other assets?

Charge an economic rent for the

other assets needed to generate the

aggregate cash flows.

NO

Concept of

contributory

asset charges

Apply contributory asset charges 3.

Income Approach

Slide 57

October 2007 Valuation Concepts and Issues Overview

Working capital

Assembled workforce

Machinery & equipment

Land & buildings

MEEM

Valuation steps

Possible contributory asset charges:

Other intangible

assets

Income Approach

Slide 58

October 2007 Valuation Concepts and Issues Overview

Contributory Asset Charges

Contributory asset charges are a means of allocating cash flows such that

an adequate rate of return is provided for the supporting assets

Excess earnings are those that remain after consideration of all

contributory assets

It should not be presumed that contributory assets are more reliably

measured than the subject asset and they do not have a priority in the

process.

The application of the MEEM is an iterative process whereby the results

are evaluated in the context of all of the assets of the group and

adjustments may be made to the contributory assets

Diversity in practice in calculating contributory asset charges

Income Approach

Slide 59

October 2007 Valuation Concepts and Issues Overview

MEEM General Framework

Example - Customer Relationship Intangible Assets

2006 2007 2008 2009 2010

Total Revenue 1,000 $ 1,000 $ 1,000 $ 1,000 $ 1,000 $

Attributable to current customers 100% 80% 60% 40% 20%

Revenue - Current Customers 1,000 800 600 400 200

Gross Profit 650 520 390 260 130

Operating Expenses 200 160 120 80 40

Depreciation 150 120 90 60 30

Technology (Income allocation) 20 16 12 8 4

Brand Intangibles (Income allocation) 120 96 72 48 24

EBITA 160 128 96 64 32

Taxes 64 51 38 26 13

Debt-Free Net Income 96 77 58 38 19

Contributory Asset Charges:

Working Capital 20 16 12 8 4

Fixed Assets 30 24 18 12 6

Workforce 10 8 6 4 2

Excess Income - Current Customers 36 29 22 14 7

Income Approach

Slide 60

October 2007 Valuation Concepts and Issues Overview

MEEM Pros and Cons

The MEEM is dependent upon the ability to prepare reasonable expected

cash flows. This is mitigated somewhat by assessing the projections in

the context of the total business unit.

Suffers from inability to recognise ALL relevant going concern

components in the contributory assets charges.

All of the excess income is attributed to an amortisable intangible asset

and/or goodwill.

Goodwill is created, in part, by the mortality of the current customers.

Period of charge for contributory assets needs to be carefully assessed.

Future assets are also considered in estimating the excess income.

Other intangible assets are considered in the contributory asset charges.

Income Approach

Slide 61

October 2007 Valuation Concepts and Issues Overview

MEEM:

Rates of return and reasonableness checks

Rates of return for the contributory assets are based on the

nature of the assets and their respective risk characteristics

Implied rate of return for future assets (e.g. goodwill) should

also be evaluated and compared to the related assets of the

business as a reasonableness check

The fair values of the identifiable assets should be reconciled

to the fair value of the business unit

Income Approach

Slide 62

October 2007 Valuation Concepts and Issues Overview

Evaluation of the components of Goodwill

Goodwill is defined as a residual value

Gain an understanding of the components of goodwill in order

to assess the reasonableness of the fair values of the

identifiable intangible assets and other assets and liabilities.

Such components may consist of:

- Future customer relationships

- Future technology

- Future brands

Understanding the nature of the future assets assists in

evaluating the value drivers of the subject business

Also provides a vehicle to assess the relative rates of return

for the current and future assets

Income Approach

Slide 63

October 2007 Valuation Concepts and Issues Overview

Weighted Average Return on Assets (WARA)

WARA is a commonly accepted approach to calculate the

implied rate of return on residual goodwill

It is a general approach based on fair values and respective

rates of return

In principal the weighted average rate of return, including

goodwill, should equate to the enterprise value discount rate

(WACC or IRR)

WARA does not give consideration to the pattern of projected

cash flows and may result in a skewed outcome

A more refined approach to calculating the implied rate of

return on goodwill is to explicitly discount the cash flows

attributable to goodwill (e.g. enterprise value cash flows less

those attributable to the identified assets)

Income Approach

Slide 64

October 2007 Valuation Concepts and Issues Overview

Issue is generally not which model, but how employed

- WACC (discounts & premia, beta, peer group, tax regime)

- Relevant Business Plan

- Synergies (market participants vs. buyer specific)

- Avoid double-counting of cash flows

- Tax Amortization Benefit (tax rate, duration)

Determination of useful life

Stand-alone valuation vs. portfolio approach

Nature of reasonability checks employed (WARA vs. IRR)

Level of professional scepticism applied to management inputs

Use of subjective assumptions/judgements

Drivers of Diversity

Income Approach

Section seven

Value Concepts in IFRS

The Purchase Price Allocation Process

Overview of Valuation Methodologies

Cost Approach

Market Approach

Income Approach

Other Items

Summary

Slide 66

October 2007 Valuation Concepts and Issues Overview

Expected use by the company and market participants

Typical product life cycles for the asset

Industry, demand, competitors

Technical, technological, commercial or other types of obsolescence

Period of control over the asset ...

Many factors are considered in determining the useful life

Useful life

Determination

the useful life of an intangible asset is related to the expected cash inflows that

are associated with that asset. (IAS 38.BC61)

Other Items

Slide 67

October 2007 Valuation Concepts and Issues Overview

Contingent liabilities of subsidiary Contingent assets of subsidiary

No recognition

For recognition IFRS 3 dominates IAS 37

Probability determines valuation, not recognition

After initial recognition: Value at higher of

Amount that would be recognised in

accordance with IAS 37, and

The amount initially recognised less, when

appropriate, cumulative amortisation

recognised in accordance with IAS 18 (IFRS

3.48)

Recognition at fair value

Measuring a contingent liability of the acquiree

Other Items

Source: IFRS 3.47ff.

Slide 68

October 2007 Valuation Concepts and Issues Overview

Limited experience in valuing contingent liabilities within the

appraisal profession

Most practioners will use an expected value approach

Might not be consistent with the exit price concept in SFAS

157

Significant judgment required as these risks are often unique

Can be difficult to appropriately identify the market participants

How do you achieve completeness?

Issues in valuing contingent liabilities

Other Items

Section eight

Value Concepts in IFRS

The Purchase Price Allocation Process

Overview of Valuation Methodologies

Cost Approach

Market Approach

Income Approach

Other Items

Summary

Slide 70

October 2007 Valuation Concepts and Issues Overview

Valuation is part art, part science

Practitioners often agree on the model to use, but inputs are

often subjective

Valuation practice is guided by the concepts of corporate

finance

Underlying standards and rules are scarce

Guidance is often designed for multiple purposes

Accounting standards, such as SFAS 157, help to mitigate

diversity in practice

Key takeaway points

Summary

Вам также может понравиться

- Guide to Contract Pricing: Cost and Price Analysis for Contractors, Subcontractors, and Government AgenciesОт EverandGuide to Contract Pricing: Cost and Price Analysis for Contractors, Subcontractors, and Government AgenciesОценок пока нет

- Business Valuation PresentationДокумент43 страницыBusiness Valuation PresentationNitin Pal SinghОценок пока нет

- Business Combinations - PPAДокумент83 страницыBusiness Combinations - PPAAna SerbanОценок пока нет

- Purchase Price AllocationДокумент8 страницPurchase Price AllocationTharnn KshatriyaОценок пока нет

- Lbo Model Short FormДокумент4 страницыLbo Model Short FormAkash PrasadОценок пока нет

- Mid MonthДокумент4 страницыMid Monthcipollini50% (2)

- Fp&a Questions v2Документ11 страницFp&a Questions v2wokif64246Оценок пока нет

- Siddhant Jena: Qualifications College/Institution Grade/Marks (%) /C.G.P.A Year of PassingДокумент2 страницыSiddhant Jena: Qualifications College/Institution Grade/Marks (%) /C.G.P.A Year of Passingsiddhant jenaОценок пока нет

- DCF DCF Modeling Modeling: Sample Pages From Tutorial GuideДокумент20 страницDCF DCF Modeling Modeling: Sample Pages From Tutorial GuideShan Kumar100% (1)

- Cash FlowДокумент3 страницыCash FlowTubagus Donny SyafardanОценок пока нет

- Critical Financial Review: Understanding Corporate Financial InformationОт EverandCritical Financial Review: Understanding Corporate Financial InformationОценок пока нет

- Handbook Iberico 2018 WebДокумент329 страницHandbook Iberico 2018 WebspachecofdzОценок пока нет

- The Locked Box MechanismДокумент3 страницыThe Locked Box MechanismAnish NairОценок пока нет

- IPEV Valuation Guidelines - December 2022Документ81 страницаIPEV Valuation Guidelines - December 2022oldemar sotoОценок пока нет

- Depreciation: Depreciation Is A Term Used inДокумент10 страницDepreciation: Depreciation Is A Term Used inalbertОценок пока нет

- Process and Asset Valuation A Complete Guide - 2019 EditionОт EverandProcess and Asset Valuation A Complete Guide - 2019 EditionОценок пока нет

- UNIT 5 Working Capital FinancingДокумент24 страницыUNIT 5 Working Capital FinancingParul varshneyОценок пока нет

- M - I Merger Model GuideДокумент65 страницM - I Merger Model GuideCherie SioОценок пока нет

- ICAI Valuation StandardsДокумент43 страницыICAI Valuation StandardsBala Guru Prasad TadikamallaОценок пока нет

- Some Insights Into IPO Underpricing in IndiaДокумент2 страницыSome Insights Into IPO Underpricing in IndiaSuneesh LazarОценок пока нет

- Credit Suisse S&T Cover Letter 1Документ1 страницаCredit Suisse S&T Cover Letter 1Dylan AdrianОценок пока нет

- 6 Unit 8 Corporate RestructureДокумент19 страниц6 Unit 8 Corporate RestructureAnuska JayswalОценок пока нет

- 2.3 Fra and Swap ExercisesДокумент5 страниц2.3 Fra and Swap ExercisesrandomcuriОценок пока нет

- 2 Real Options in Theory and PracticeДокумент50 страниц2 Real Options in Theory and Practicedxc12670Оценок пока нет

- Corporate Valuation Methods PDFДокумент28 страницCorporate Valuation Methods PDFHarsh Vora0% (1)

- Private Company Valuation: Presenter Venue DateДокумент35 страницPrivate Company Valuation: Presenter Venue DateSayan GuptaОценок пока нет

- A Review of Valuation Tech - 13-1-09Документ22 страницыA Review of Valuation Tech - 13-1-09weiycheeОценок пока нет

- Case Interviews 2 11-12 PDFДокумент194 страницыCase Interviews 2 11-12 PDFPoojaKumariОценок пока нет

- UBS Outlook 2024Документ120 страницUBS Outlook 2024Vivek TiwariОценок пока нет

- Key Terms of The Investment AgreementДокумент7 страницKey Terms of The Investment AgreementYsmari Maria TejadaОценок пока нет

- Creating Value From Mergers and Acquisitions - ToCДокумент7 страницCreating Value From Mergers and Acquisitions - ToCredaek0% (1)

- How To Get Into Equity Research AnalystДокумент20 страницHow To Get Into Equity Research Analystsmita.devneОценок пока нет

- Reading 31 Slides - Private Company ValuationДокумент57 страницReading 31 Slides - Private Company ValuationtamannaakterОценок пока нет

- On Buy Back of ShareДокумент30 страницOn Buy Back of Shareranjay260Оценок пока нет

- M&a Private FirmsДокумент24 страницыM&a Private FirmsmarwanОценок пока нет

- FMДокумент77 страницFMYawar Khan KhiljiОценок пока нет

- Collective Investement SchemesДокумент28 страницCollective Investement SchemesEmeka Nkem100% (1)

- Capital Structure: Capital Structure Refers To The Amount of Debt And/or Equity Employed by AДокумент12 страницCapital Structure: Capital Structure Refers To The Amount of Debt And/or Equity Employed by AKath LeynesОценок пока нет

- Business Valuation: Economic ConditionsДокумент10 страницBusiness Valuation: Economic ConditionscuteheenaОценок пока нет

- Gyration Keyboard ManualДокумент24 страницыGyration Keyboard Manualichung819Оценок пока нет

- If I Would Like To Protect My Downside, How Would I Structure The Investment?Документ6 страницIf I Would Like To Protect My Downside, How Would I Structure The Investment?helloОценок пока нет

- Intangible Assets and Goodwill PDFДокумент27 страницIntangible Assets and Goodwill PDFSandor MolnarОценок пока нет

- Cash Flow Analysis, Target Cost, Variable CostДокумент29 страницCash Flow Analysis, Target Cost, Variable CostitsmenatoyОценок пока нет

- Corporate BondsДокумент36 страницCorporate BondsCharlene LeynesОценок пока нет

- Chapter 3 - Relative ValuationДокумент5 страницChapter 3 - Relative ValuationSteffany RoqueОценок пока нет

- Ratio AnalysisДокумент24 страницыRatio Analysisrleo_19871982100% (1)

- OPIM 220 Session 09Документ7 страницOPIM 220 Session 09jkkkkkkkkkretretretrОценок пока нет

- SynergyДокумент19 страницSynergyYash AgarwalОценок пока нет

- The OpportunityДокумент46 страницThe Opportunitygileraz90100% (1)

- Cub Energy Reverse TakeoverДокумент331 страницаCub Energy Reverse TakeoverAlex VedenОценок пока нет

- Value Added Metrics: A Group 3 PresentationДокумент43 страницыValue Added Metrics: A Group 3 PresentationJeson MalinaoОценок пока нет

- N1591 2019-20 - Sample Exam QuestionsДокумент11 страницN1591 2019-20 - Sample Exam QuestionsMandeep SОценок пока нет

- 108 04 Merger Model AC Case Study AfterДокумент2 страницы108 04 Merger Model AC Case Study AfterPortgas H. NguyenОценок пока нет

- BOD - Final Rates StandardizationДокумент35 страницBOD - Final Rates StandardizationRai RiveraОценок пока нет

- Order FormДокумент2 страницыOrder FormSo LokОценок пока нет

- I GAAPДокумент3 страницыI GAAPSo LokОценок пока нет

- Agriculture: Hong Kong Accounting Standard 41Документ38 страницAgriculture: Hong Kong Accounting Standard 41So LokОценок пока нет

- US Social Housing Bond (Colonial Capital) PDFДокумент6 страницUS Social Housing Bond (Colonial Capital) PDFSo LokОценок пока нет

- Global Islamic FinanceДокумент88 страницGlobal Islamic FinanceSo LokОценок пока нет

- Business Valuations: Fundamentals, Techniques and Theory.Документ772 страницыBusiness Valuations: Fundamentals, Techniques and Theory.Matthew Parham100% (12)

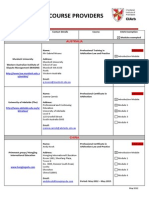

- Recognised Course Providers ListДокумент13 страницRecognised Course Providers ListSo LokОценок пока нет

- PARTNERSHIPДокумент84 страницыPARTNERSHIPJohn Rey LabasanОценок пока нет

- QuestionsДокумент8 страницQuestionsHannah AbeloОценок пока нет

- P2 Business Combination - GuerreroДокумент18 страницP2 Business Combination - GuerreroCelen OchocoОценок пока нет

- Caso HertzДокумент31 страницаCaso HertzIsabel Cristina Davila VillaОценок пока нет

- Statement From GlencoreДокумент11 страницStatement From GlencoreABC Four CornersОценок пока нет

- CH 19Документ45 страницCH 19Abdulrahman Alotaibi100% (1)

- Afar Section 402: Business CombinationsДокумент3 страницыAfar Section 402: Business CombinationsDianna Tercino IIОценок пока нет

- HQ01 Partnership Formation and OperationДокумент9 страницHQ01 Partnership Formation and OperationJean Ysrael Marquez50% (4)

- CH 8 - PartnershipДокумент112 страницCH 8 - PartnershiprananaveedkhalidОценок пока нет

- ASSIGNMENTДокумент4 страницыASSIGNMENTJelwin Enchong BautistaОценок пока нет

- MCQ in Bca-Accounting & CobolДокумент20 страницMCQ in Bca-Accounting & CobolSagar KansalОценок пока нет

- Axis BankДокумент37 страницAxis BankVipul KeshwaniОценок пока нет

- XIIAccountancySQP 2018-19 PDFДокумент10 страницXIIAccountancySQP 2018-19 PDFShivam SinghОценок пока нет

- Solution Chapter 1Документ12 страницSolution Chapter 1YenОценок пока нет

- EXAM Chapter 14 HW, Practice Quiz, Quiz, ProblemsДокумент15 страницEXAM Chapter 14 HW, Practice Quiz, Quiz, Problemsj loОценок пока нет

- 2022 9 27 Q Merged - PagenumberДокумент11 страниц2022 9 27 Q Merged - PagenumberMike HKОценок пока нет

- LKT Sipd 2018Документ91 страницаLKT Sipd 2018Oktavia IsnaniaОценок пока нет

- 三部曲之一 Partnership 1 (Basic) PDFДокумент27 страниц三部曲之一 Partnership 1 (Basic) PDFJennifer LauОценок пока нет

- Cash Flow ExerciseДокумент1 страницаCash Flow ExercisecoeprodpОценок пока нет

- Elpl 2009 10Документ43 страницыElpl 2009 10kareem_nОценок пока нет

- Practice Question On Group AccountsДокумент12 страницPractice Question On Group Accountsemerald75% (4)

- IAS 36 - Presentation PDFДокумент17 страницIAS 36 - Presentation PDFRizwanChowdhuryОценок пока нет

- Reflection - PPE and Intangible AssetsДокумент2 страницыReflection - PPE and Intangible AssetsJohn Christopher GozunОценок пока нет

- Prelim Examination 2021-2022Документ29 страницPrelim Examination 2021-2022Jenny Rose M. YocteОценок пока нет

- Crash MysoreДокумент40 страницCrash MysoreyashbhardwajОценок пока нет

- Mixed Accounting QuestionsДокумент10 страницMixed Accounting QuestionsSVTKhsiaОценок пока нет

- Practical Accounting II - 2nd PreboardДокумент9 страницPractical Accounting II - 2nd PreboardKim Cristian Maaño0% (1)

- EduInsight - Accounting 2014 Support Seminar Answer PaperДокумент18 страницEduInsight - Accounting 2014 Support Seminar Answer PaperSanduni WijewardaneОценок пока нет

- Accounts 2018 AnsДокумент32 страницыAccounts 2018 AnsAshish YadavОценок пока нет

- FA - PartnershipДокумент109 страницFA - PartnershipRafay RashidОценок пока нет