Академический Документы

Профессиональный Документы

Культура Документы

Barangay Budgeting Workbook: User'S Manual: A. Introduction A. Introduction

Загружено:

Juvy RascoОригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Barangay Budgeting Workbook: User'S Manual: A. Introduction A. Introduction

Загружено:

Juvy RascoАвторское право:

Доступные форматы

MODULE 4

1

BARANGAY BUDGETING WORKBOOK:

USERS MANUAL

(17 FEBRUARY 2008 VERSION)

A. INTRODUCTION

The barangay budgeting workbook provides a worksheet-based facility

for preparing the barangay budget, particularly the Annual Investment Plan

(AIP).

The worksheet has the following features:

User-friendliness

Internally linked

Provides a warning for statutory requirements

Generates indicators for gender-responsiveness

Minimizes error protecting formulas (to be done)

The worksheets used the forms found in the 2006 Budget Operations

Manual for Barangays (BOMB).

There are several worksheets in the workbook, namely: (a) the Information

Worksheet; (b) the Barangay Budget Preparation Form Worksheets; (c) the AIP

Form Worksheets; (d) the Revenue forecasting worksheet; (e) the AIP Project

Worksheets; and (f) the personnel time utilization worksheet. Each of these

worksheets is discussed subsequently.

B. THE WORKSHEETS

Information Worksheet (InfoSheet)

This worksheet provides summary information on the barangay, including

name, budget year, and demographic information, to be used as input in individual

worksheets. Figure 1 provides a picture of the information worksheet.

Budgeting workbook manual.indd 1 1/26/2010 5:31:26 PM

BARANGAY BUDGETING WORKBOOK

2

Figure1. Information Sheet

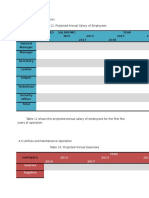

Barangay Budget Preparation Form No. 2-4 (BBPF2-4)

These worksheets provide the actual income and expenditure for the

past (next preceding) budget year (BBPF2), the current (preceding) budget

year (BBPF3), and the budget year (BBPF4). The worksheets have identical

elements except that the budget preparation form for the current (preceding)

year (BBPF3) divides the revenues and expenditures into actual gures for the

rst six months of the year and estimated gures for the second six months of

the year, to reect the availability of actual data.

Figure 2 is a picture of Income and Expenditure for the Budget Year

(BBPF4).

Budgeting workbook manual.indd 2 1/26/2010 5:31:41 PM

MODULE 4

3

Figure 2. Income and Expenditure for the Budget Year (BBPF4).

Barangay Budget Preparation Form No. 4

Barangay: ABC

City/Municipality: DEF

Part A. Income TOTAL

Beginning Balance 10,690.37

Share on Internal Revenue Collections 1,620,159.00

Share on Real Property Tax 221,988.07

Business Taxes (Stores & Retailers) 11,000.00

Shares on Sand & Gravel Tax

Share on National Wealth

Share on EVAT

Miscellaneous Taxes on Goods & Services 2,200.00

Other Taxes

Other Specific Income

Subsidy from Other LGUs

Total Available Resources 1,866,037.44

Part B. Expenditures

Program/Project/Activity Personal Maintenance & Capital

Major Final Output Services Other Operating Outlay TOTAL

Expenses

Agricultural Services

1.1 Establishment of Plant Nursery

Daycare Services

Health and Nutrition Services 89,899.00 89,899.00

Peace & Order Services 32,964.00 32,964.00

Administrative & Legislative Services 814,419.74 88,083.43 75775.099 978,278.27

Implementation of Development Projects

(20% of IRA) 324,031.80

Implementation of SK Projects (10% SK

Funds) 184,396.63

Implementation of Projects/Activities for

Unforseen Events (5% Calamity Fund) 92,198.32

Other Services 92,198.32

Total Expenditures 937,282.74 88,083.43 75,775.10 1,793,966.34

Balance/Deficit 72,071.10

Prepared By: Certified By: Approved By:

______________________ _______________________ _______________________

Barangay Treasurer City/Municipal Accountant Punong Barangay

Instructions:

A. Indicate in Part A the estimated income (less beginning balance for the Budget Year.

B. Indicate in Part B the estimated expenditure allotment by class and by Program/Project/Activity

or major Final Output.

INCOME AND EXPENDITURE ESTIMATES FOR BUDGET YEAR

AIP Form 4 (AIP F4)

This worksheet provides a summary of the barangays priority development

projects, funded out of the Development Fund (at least 20% of internal revenue

allotment or IRA)

Budgeting workbook manual.indd 3 1/26/2010 5:31:41 PM

BARANGAY BUDGETING WORKBOOK

4

Figure 3. Projects Funded from Development Fund (AIP F4)

AIP Form No. 4

Barangay: ABC

City/Municipality: DEF

TOTAL IRA for Barangay 1,620,159

x 20% 324,032

Priority Developmet Projects funded by the

20% of IRA

Project Description (1)

Nutrition Program 15,500 15,500

Sanitary toilet 75,576 91,076

Education Program (Conditional Cash transfer) 103,474 194,550

Livelihood (animal dispersal) 126,454 321,004

Unallocated 3,027 324,032

Instructions:

(3) Indicate the total project cost that will complete the project.

(4) Add all project costs from Rank 1 to the last rank equivalent to the 20% of the IRA or higher.

(2) Indicate in this column the ranking of development projects in their proper order, Rank 1 is the first

priority, Rank 2 is the second, etc.

RANK (2)

PROJECT COST

(3)

CUMULATIVE

TOTAL (4)

PRIORITIES FOR DEVELOPMENT PROJECTS

(20% OF IRA), BY ____________________

Note: Formulated and endorsed in a BDC planning workshop conducted last

______________________. For approval by the SB.

(1) Describe the project to be implemented like construction of a Day Care Center, acquisition of a

computer etc. in their order of priority.

AIP Form 5 (AIP F5)

This worksheet summarizes a barangays priority development projects to

be funded from external sources.

AIP Project Budget (AIProj?)

This worksheet provides the costing details of each AIP project. This is

the heart of the budgeting workbook.

Worksheet Sections. The worksheet is divided into ve sections (A to E).

Section A identies the nancing options. Each nancing option is contained in

a column. Section B provides the costs. Costs are disaggregated into personnel

(B1), material (B2), and capital expense (B3). B4 simply sums B1, B2 and

B3. Section C provides the distribution of the budget across local funding

(Barangay Development Fund), Municipal/City Development fund, and other

external funding. Section D provides the details of the computation of per unit

cost. Together with the number of prospective beneciaries, this computation

provides the basis for budget allotments thereby improving the transparency

of fund allocations. Finally, Section E provides the sex disaggregation of the

prospective beneciaries, to provide some prospective incidence analysis. If

the service to be provided is at the individual level, e.g. nutrition intervention

Budgeting workbook manual.indd 4 1/26/2010 5:31:41 PM

MODULE 4

5

or education intervention, then CBMS data on these outcomes provides the

disaggregation by sex of the intended beneciaries. When the services to be

provided are for households, e.g. toilet facilities or livelihood programs, then

it will be assumed initially that the household members will equally benet

from the program. Thus, the sex disaggregation of the household members

beneted is used. This will provide a direct measurement of the beneciaries

of the programs/projects being proposed. This assumption of equal benet

can be improved if data becomes available that will allow renement of this

assumption.

Providing figures on the number and the sex-disaggregation of the

beneciaries demonstrates the strength of the CBMS data. It connects plans

and budgets to identied and quantied community needs. It also provides a

sex-disaggregate accounting of prospective beneciaries of programs, projects

and activities (PPAs).

Computing Unit Cost. Computing unit cost requires the denition of the

unit of costing. This can either be per person or per household. For instance,

in the nutrition project (AIPProj1) the unit of cost is on per child basis. The

number of beneciaries (malnourished children) is taken from the CBMS

tabulation. Computing for per unit cost is usually based on administrative

data on programs. In the nutrition project, the cost of the food for the feeding

program is P20 and P5 is the cost of gas for cooking per day. Feeding is done

5 school days per week and will run for 12 weeks, yielding a unit cost of 1,500

per child. The personnel cost will be based on the wage of the personnel

directly involved the project and the proportion of time he/she will spend

on the project. Again using the nutrition program as an example, the BHW

is assumed to spend one-fourth of his/her time on the project, so one-fourth

of his salary will be charged to the project. Similarly, a proportional allocation

will be done for capital equipment if these are used only part of the time for

the project. If it is fully utilized for the project alone then this should be fully

charged to the project. If the equipment is rented, the rental value should be

used. If the equipment is purchased, the capital consumption allowance or

depreciation would be budgeted. For instance, in the nutrition program, for

cooking facilities costing 10,000 pesos with a useful life of 5 years the presumed

depreciation is 2,000 per year.

Sex-disaggregation of beneficiaries. To generate sex-disaggregation

for the beneficiaries one needs to determine the recipient unit of the

service a person or a household. This is also the unit of costing. For

instance, in the case of the nutrition project (AIPProj1) the costing unit

is per person. The sex disaggregation of would be beneficiaries is given

by tabulating the CBMS data on malnourished children as it is presumed

that they will be the recipients of the intervention. In the case where the

recipient is a household, such as the Sanitary Toilet project (AIPProj2), one

Budgeting workbook manual.indd 5 1/26/2010 5:31:41 PM

BARANGAY BUDGETING WORKBOOK

6

needs to assume a distribution of the benefits. The simplest assumption is

proportional to the sex-disaggregation of the members of the beneficiary

household. If the specific beneficiary household cannot as yet be identified,

such as in the case where projects do not intend to cover the whole subject

population, the community sex disaggregation (provided in the InfoSheet)

can be used as proxy. The presumption is that selection of beneficiaries is

at random so that the sex disaggregation of the community is presumed to

be maintained. If necessary, the attribution of benefits can be fine-tuned

some more based on the programmed implementation of the project. In

addition, project implementation programming can be done with desired

sex-differentiated impacts as an important consideration.

Allowing for several nancing options. When a project has several nancing

options, one can use different columns to dene these choices. For instance,

AIPProj2 has two nancing options while AIPProj3 has three nancing options.

The nancing options for AIPProj2 are 100% LGU (i.e., DF) funded or 50%

LGU funded. For AIPProj3, three nancing options were presented, namely:

(a) 100% LGU funded at 5% coverage, (b) 50% LGU funded at 10% coverage,

and (c) 20% LGU funded at 30% coverage.

To enable the use financing option selections one needs to define and

attach a name to the financing option data range. The financing option data

range is from the A. Financing Option row to the last row in Section C

and from the Financing label column to the last financing options column.

In the case of AIPProj2 the financing option data range is from B3:D25.

To attach a name to the financing option data range, do the following: (a)

select Financing Options Data Range; (b) click Insert/Name/Define; (c) in

the Names in workbook, input the name for the range (this is Financing_

Option_P2 of AIPProj2); note that in the Refers to: window, the appropriate

range has already been provided because the range selection had been done

earlier; (d) select OK. The range has been named. The name is useful for

selecting the financing options automatically.

Figure 4 provides a sample project worksheet where the sections described

above are shown.

Budgeting workbook manual.indd 6 1/26/2010 5:31:41 PM

MODULE 4

7

Figure 4. Sample Project Budget Worksheet

Title of Project Sanitary toilet

1 A. Financing Option Option 1 Option 2

2 Description 100% LGU 50% LGU

3

4 B. Costs

5 B1. Personnel 12000 12000

6 BHW (P4000/month) (1/4 time) 12000 12000

7

8

9 B2. Material 139,153 139,153

10

11 No of households without

12 sanitary toilet (CBMS 2006) 835 835

13 Unit Cost 500.00 500.00

14 Coverage for the budget year (over 3 years) 33.33 33.33

15

16 B3. Capital Equipment

17

18

19 B4. Total 151,153 151,153

20

21 C. Financing

22 Bgy Development Fund 151,153 75,576

23 Mun/City Development Fund 0 75,576

23 External 0 0

D. Unit cost (per household) computation

Material 500

Cost of toilet bowl plus installation 400

Information/Educ. campaign 100

Personel (BHW) 12000

Time in the project 0.25

Salary per month 4000

Months 12

Capital Equipment

E. Sex-disaggregation of beneficiaries

Total 1,392

Male 716

Female 675

Male/Female Ratio (Male per 100 Female) 106

AIP Project Summary (AIPProjSum)

This worksheet provides the summary of the AIP projects both funded

from the Development Fund and External sources.

Specic cells in this worksheet are linked to specic cells in the other

AIPProj worksheets:

(a) Amount of development fund (B4) is linked to the development fund

in the current budget year (BBPF4!E32).

(b) The sources of nancing column are linked to the corresponding

nancing cells in each of the project worksheets.

The Budget Total column is merely the sum of the Development Fund and

External Fund columns.

Budgeting workbook manual.indd 7 1/26/2010 5:31:41 PM

BARANGAY BUDGETING WORKBOOK

8

Linking Financing Cells. To get the summary of the AIP project budgets,

one needs to link specic cells in the summary worksheet to specic cells in

the project worksheet. The cells in the Development Fund and External Fund

columns need to be linked to corresponding cells in the project worksheets.

When there is only one nancing option, one needs to link specic cells in the

summary worksheet to the corresponding cell in the project worksheet. For

instance, the Development Fund cell for the nutrition program is linked to cell

C22 of the AIPProj1. To link, just type = in the destination cell then move to

the specic cell in the project worksheet e.g. C22 in the AIPProj1, then press

Return/Enter. The data in that specic cell is shown in the destination cell. The

link is now established. All changes in the source cell will be reected in the

destination cells as well; this is what linked cells mean. This can be done for

the External fund column as well.

In case the project has several nancing options, one can automate the

selection of the nancing options by dening the options in the nancing

options column.

Dening nancing options needs a listing of the options in the corresponding

cell. To dene options do the following: (a) go to the cell where options are to

be dened (e.g. E13 in the budget workbook), (b) Click Data/Validation, (c)

in the Allow: window select List, (d) in the Source: window, type in <Option

1, Option 2>, (e) then select OK. A drop down button would be added to the

cell and clicking at the button will show the option list. If there are more than

two nancing options, input the required number. To activate the nancing

option selection the HLOOKUP( ) function is used. The syntax of HLOOKUP

function is given in Box 1.

Box 1: Syntax of the HLOOKUP function

Description: Searches for a value in the top row of a table or any array of values, and then returns a value in

the same column from a row you specify in the table or array.

HLOOKUP(lookup_value, table_array, row_index_num, range_lookup)

Lookup_value is the value to be found in the first row of the table. Lookup_value can be a value, a

reference, or a text string.

Table_array is a table of information in which data is looked up. Use a reference to a range or a range name.

The values in the first row of table_array can be text, numbers, or logical values.

If range_lookup is TRUE, the values in the first row of table_array must be placed in ascending order;

otherwise, HLOOKUP may not give the correct value. If range_lookup is FALSE, table_array does not

need to be sorted.

Row_index_num is the row number in table_array from which the matching value will be returned. A

row_index_num of 1 returns the first row value in table_array, a row_index_num of 2 returns the second row

value in table_array, and so on.

Range_lookup is a logical value that specifies whether you want HLOOKUP to find an exact match or an

approximate match. If TRUE or omitted, an approximate match is returned. In other words, if an exact match

is not found, the next largest value that is less than lookup_value is returned. If FALSE, HLOOKUP will find

an exact match. If one is not found, the error value #N/A is returned.

Source: MS Excel Help File.

Budgeting workbook manual.indd 8 1/26/2010 5:31:41 PM

MODULE 4

9

In the Sanitary toilet example (AIPProj2) the HLOOKUP function has

the following parameters: the Lookup_value is given by the corresponding

cell in the Financing Options column (E13 in the Sanitary Toilet project); the

Table_array is named Financing_Option_P2 of the Sanitary Toilet project; the

Row_index_num is 22 (see the sequence numbers in column A of AIPProj2,

the corresponding number of External is 23); the Range_lookup is FALSE

because we need not sort the options. The HLOOKUP function parameters

of the External Fund cell are identical except that the Row_index_num is 23,

rather than 22.

The Remarks column also uses the HLOOKUP function. In the example,

this would refer to the nancing label row, i.e. the Row_index_num is 2.

Figure 5 provides the Sample AIP program structure. Note the HLOOKUP

function in the selected cell (C13).

Figure 5. Sample AIP Program Structure (AIPProjSum)

HLOOKUP Formula

Revenue Forecasting Worksheets (RevFor)

This worksheet provides the forecast of revenues from the different sources.

It also provides estimates of the basis for statutory allocation such as regular

income or general fund.

The forecast of revenues for the budget year uses the MS Excel function

TREND to automate the forecasting of revenue sources using the linear trend

method. The syntax of the TREND function is given in Box 2.

Budgeting workbook manual.indd 9 1/26/2010 5:31:42 PM

BARANGAY BUDGETING WORKBOOK

10

Box 2. Syntax of the TREND function

TREND computes the values along a linear trend (y=mx+b) fitted through a method of least squares.

TREND(known_revenues,known_years,forecast_year,const)

Known_revenues is the set of revenue values that are available

Known_years is an optional set of year values where revenues are available

If known_year is omitted, it is assumed to be the array {1,2,3,...} that is the same size as

known_revenues.

Const is a logical value specifying whether to force the constant b to equal 0.

If const is TRUE (non-zero value) or omitted, b is calculated normally.

If const is FALSE, b is set equal to 0 (zero), and the m-values are adjusted so that y = mx.

Source: MS Excel Help File

Figure 6. Sample Revenue Forecasting Worksheet.

Revenue Forecast

Next

Preceding Preceding Budget

Year Year Year

2006 2007 2008

1 Beginning balance 0.00 0.00 10,690.37

2 Internal Sources 213,807.34 224,497.71 235,188.07

3 Tax Revenues 213,807.34 224,497.71 235,188.07

4 Share on Real Property Tax 201,807.34 211,897.71 221,988.07

5 Business Taxes (Stores & Retailers) 10,000.00 10,500.00 11,000.00

6 Shares on Sand & Gravel Tax

7 Miscellaneous Taxes on Goods & Services 2,000.00 2,100.00 2,200.00

8 Other Taxes

9 Non-tax revenue 0 0 0

10 Permit and licenses

11 Clearance and certification fees

12 Business income

13 Sale of assets

14 Other Specific Income

15

16 External Sources

17 Tax Revenues 1,492,912.00 1,493,168.00 1,620,159.00

18 Share on Internal Revenue Collections (IRA) 1,492,912.00 1,493,168.00 1,620,159.00

19 Share on National Wealth

20 Share on EVAT

21

22 Non-tax revenues 0 0 0

23 Subsidy from Other LGUs

24 Loan proceeds

25 Others

26

27 Regular Income (1+3+10+11+12+14+17+23+25) 1,706,719.34 1,717,665.71 1,866,037.44

28 General Fund (26+12+23) 1,706,719.34 1,717,665.71 1,866,037.44

Statutory Requirements

SK (10% of 28) 170,671.93 171,766.57 186,603.74

DF (20% of 18) 298,582.40 298,633.60 324,031.80

Calamity (5% of 27) 85,335.97 85,883.29 93,301.87

GAD (5% of 28) 85,335.97 85,883.29 93,301.87

PS (55% of 27 of next preceeding year) 938,695.64

Unallocated 230,102.52

Budgeting workbook manual.indd 10 1/26/2010 5:31:42 PM

MODULE 4

11

Personnel Time Utilization (Personnel)

This worksheet provides an accounting of the time utilization of personnel

directly involved in the AIP projects.

AIP Project Budget Form (AIPProjForm)

This worksheet provides a blank form for new projects. Use this worksheet

to add a new worksheet for a new project.

Adding a new project worksheet. To do this, right-click on the Worksheet

tab; select Move or Copy; in Before sheet list select the worksheet where you

want to pla ce the new project worksheet; check the box labeled Create a copy;

select OK. A new worksheet is then added. Double click on the tab of the new

worksheet to rename it. One can now input data on the new project. Once

the budgeting for the new project is done, add the project to the summary

worksheet (AIPProjSum) by establishing the needed links to the new project

worksheet.

Figure 7. AIP Project Worksheet Form

Worksheet tab

Budgeting workbook manual.indd 11 1/26/2010 5:31:42 PM

Вам также может понравиться

- Annex C Data Capture Form For Use of CHDs (Municipalities and CCS)Документ13 страницAnnex C Data Capture Form For Use of CHDs (Municipalities and CCS)JRОценок пока нет

- Lecture - 5 - CFI-3-statement-model-completeДокумент37 страницLecture - 5 - CFI-3-statement-model-completeshreyasОценок пока нет

- ATT vs. Verizon FinancialsДокумент75 страницATT vs. Verizon Financialsaditya jainОценок пока нет

- 5 GAD Planning and Budgeting - JMC 2013Документ83 страницы5 GAD Planning and Budgeting - JMC 2013versmajardo100% (1)

- Local Development Investment Program, CY 2012 To 2014Документ61 страницаLocal Development Investment Program, CY 2012 To 2014Lgu Leganes100% (21)

- New Form Barangay Budget Preparation FileДокумент10 страницNew Form Barangay Budget Preparation FileReynold Renzales Aguilar100% (3)

- Chapter 19 Auditing Theory: Multiple-Choice QuestionsДокумент14 страницChapter 19 Auditing Theory: Multiple-Choice QuestionsMaria Ferlin Andrin MoralesОценок пока нет

- ACCA F7 Revision Mock June 2013 ANSWERS Version 4 FINAL at 25 March 2013 PDFДокумент24 страницыACCA F7 Revision Mock June 2013 ANSWERS Version 4 FINAL at 25 March 2013 PDFPiyal Hossain100% (1)

- Real Estate Development - Accounting ChallengesCAДокумент35 страницReal Estate Development - Accounting ChallengesCA891966100% (1)

- PA1 Mock ExamДокумент18 страницPA1 Mock Examyciamyr67% (3)

- Budget Cycle ProcessДокумент54 страницыBudget Cycle ProcessNico of the Faint SmileОценок пока нет

- National IncomeДокумент14 страницNational Incomevmktpt100% (1)

- MPA 261 The Budget PhasesДокумент42 страницыMPA 261 The Budget PhasesRea LahoylahoyОценок пока нет

- Inventory Control, Theory and PracticeДокумент21 страницаInventory Control, Theory and PracticeBiribal Naidu0% (1)

- JD Sdn. BHD Study CaseДокумент5 страницJD Sdn. BHD Study CaseSuperFlyFlyers100% (2)

- Barangay GADДокумент12 страницBarangay GADCharlie James GomezОценок пока нет

- Preparing A Budget For The Small HospitalДокумент27 страницPreparing A Budget For The Small Hospitalkatarina.sienaОценок пока нет

- Presentation of Business PlanДокумент24 страницыPresentation of Business PlanEduardo Canela100% (8)

- Brgy Budget Execution-2019Документ70 страницBrgy Budget Execution-2019Giovanni Ondong TabanaoОценок пока нет

- Barangay Landican Annual Budget 2022Документ25 страницBarangay Landican Annual Budget 2022Maya AdovoОценок пока нет

- Budget ProcessДокумент17 страницBudget ProcessLouie GerenteОценок пока нет

- Performance Informed Budgeting - BrochureДокумент12 страницPerformance Informed Budgeting - BrochureraineydaysОценок пока нет

- FY 2019 Annual Investment Program (AIP) by Program/Project/Activity by SectorДокумент24 страницыFY 2019 Annual Investment Program (AIP) by Program/Project/Activity by SectorJohn DatorОценок пока нет

- LET Reviewer Prof EducationДокумент39 страницLET Reviewer Prof EducationBhong Libantino88% (60)

- Barangay Budget ProcessДокумент188 страницBarangay Budget ProcessRaquel dg.Bulaong100% (7)

- MC 1 Series of 2022 Joint Memo of DILG - DSWD To Support The Program Implementation of Pantawid Pamilya ImplementationДокумент8 страницMC 1 Series of 2022 Joint Memo of DILG - DSWD To Support The Program Implementation of Pantawid Pamilya ImplementationJeshella Roxas100% (1)

- Final SAMPLE Proposal Format Final For KKB CFW For PWDДокумент6 страницFinal SAMPLE Proposal Format Final For KKB CFW For PWDNI Ca Grace TabujaraОценок пока нет

- (DLSU) Statutory Construction - Reviewer PDFДокумент64 страницы(DLSU) Statutory Construction - Reviewer PDFAmicus Curiae100% (1)

- 4ps JMC Slides For SharingДокумент45 страниц4ps JMC Slides For SharingANNA LISA DAGUINOD100% (1)

- ACC 309 FinalДокумент42 страницыACC 309 FinalSalman Khalid77% (22)

- IRR of Republic Act 9003Документ73 страницыIRR of Republic Act 9003Juvy RascoОценок пока нет

- PB June, 2019 June, 2019 Capacity Development Training For KP Members 12 KP Members TrainedДокумент7 страницPB June, 2019 June, 2019 Capacity Development Training For KP Members 12 KP Members TrainedJuken yuriОценок пока нет

- City and Mun - Cost Estimate Workbook - v.3Документ130 страницCity and Mun - Cost Estimate Workbook - v.3Rhu Pugo, La UnionОценок пока нет

- Fiscal Planning, Programming - Budgeting Aspec TsДокумент5 страницFiscal Planning, Programming - Budgeting Aspec TsBars DenskieОценок пока нет

- PC-I Social SectorДокумент10 страницPC-I Social Sectorsresearcher7Оценок пока нет

- Lakeport City Council - RDA Public HearingДокумент8 страницLakeport City Council - RDA Public HearingLakeCoNewsОценок пока нет

- Attachment A - General Fund Budget Update Narrative and Schedule of Sources and UsesДокумент11 страницAttachment A - General Fund Budget Update Narrative and Schedule of Sources and UsesReno Gazette JournalОценок пока нет

- CY - Annual Investment Program (AIP)Документ5 страницCY - Annual Investment Program (AIP)Felicitas RelatoОценок пока нет

- AIP Form - PPDO-Hon. AlundayДокумент11 страницAIP Form - PPDO-Hon. Alundayjojazz74Оценок пока нет

- Appendix 5 - Model Budget - For Phase 2 OnlyДокумент17 страницAppendix 5 - Model Budget - For Phase 2 OnlyKOLAAN BENОценок пока нет

- ANNEX D 1 Barangay GPB Form JMC 2016 01Документ7 страницANNEX D 1 Barangay GPB Form JMC 2016 01Jonathan MartinezОценок пока нет

- Budgetary ControlДокумент7 страницBudgetary Controlaksp04Оценок пока нет

- Planning: Problems, Oriented Predominantly Toward The Future, Collective Decisions and Strives For ComprehensivenessДокумент24 страницыPlanning: Problems, Oriented Predominantly Toward The Future, Collective Decisions and Strives For ComprehensivenessNolita Laberinto AceroОценок пока нет

- 2021 Galing Pook Awards Application Form (Without Guidelines)Документ5 страниц2021 Galing Pook Awards Application Form (Without Guidelines)Lgu San Juan AbraОценок пока нет

- Budget Message Cy 2021Документ5 страницBudget Message Cy 2021Amelia BersamiraОценок пока нет

- Project Proposal: Schools Division of Sorsogon Cocok-Cabitan Elementary SchoolДокумент4 страницыProject Proposal: Schools Division of Sorsogon Cocok-Cabitan Elementary SchoolJessa BurgosОценок пока нет

- 9 GK 8 I7 M RRywnh 6 JCH PEPLs E5 XB Zyo Ao DO0 UtlcwpДокумент14 страниц9 GK 8 I7 M RRywnh 6 JCH PEPLs E5 XB Zyo Ao DO0 Utlcwpaniket singhОценок пока нет

- 10232012-Department Head Responses To Budget Study Committee Report 10-19-12Документ23 страницы10232012-Department Head Responses To Budget Study Committee Report 10-19-12keithmontpvtОценок пока нет

- Assignment AcctДокумент4 страницыAssignment Acctbilal mamanurОценок пока нет

- 2022 PHA Plan - DRAFT - Obtained by WCBU Sept. 10 - AdobeДокумент138 страниц2022 PHA Plan - DRAFT - Obtained by WCBU Sept. 10 - AdobehannahОценок пока нет

- Financial Aspect LandscapeДокумент19 страницFinancial Aspect LandscapeErnestОценок пока нет

- CHAPTER 2..ritchelle DelgadoДокумент40 страницCHAPTER 2..ritchelle DelgadonicahОценок пока нет

- Description: Tags: By08datastratДокумент22 страницыDescription: Tags: By08datastratanon-881070Оценок пока нет

- CHAPTER 2..ritchelle Delgado.1Документ39 страницCHAPTER 2..ritchelle Delgado.1richelledelgadoОценок пока нет

- MPA 103 BUDGETARY PROCESS For NGAДокумент15 страницMPA 103 BUDGETARY PROCESS For NGAJan Paul ValdoviezoОценок пока нет

- PreliminaryДокумент18 страницPreliminarykalkidan kassahunОценок пока нет

- Budget Mannual - BhadohiДокумент9 страницBudget Mannual - BhadohilkovijayОценок пока нет

- Aspire March 2023 Psaf Intervention - 04-03-2023Документ46 страницAspire March 2023 Psaf Intervention - 04-03-2023Desmond Grasie ZumankyereОценок пока нет

- 2014-2015 City of Sacramento Budget OverviewДокумент34 страницы2014-2015 City of Sacramento Budget OverviewCapital Public RadioОценок пока нет

- A. General Public SectorДокумент6 страницA. General Public SectorSanJoaquinIloiloОценок пока нет

- BMGF Budget Report Nov2012Документ10 страницBMGF Budget Report Nov2012Julian A.Оценок пока нет

- Gomez Analea P. Written ReportДокумент8 страницGomez Analea P. Written ReportJERRALYN ALVAОценок пока нет

- BUDGET (12) : Agency Plan: Mission, Goals and Budget SummaryДокумент7 страницBUDGET (12) : Agency Plan: Mission, Goals and Budget SummaryMatt HampelОценок пока нет

- Description: Tags: By08addevДокумент16 страницDescription: Tags: By08addevanon-574266Оценок пока нет

- Code of Best Practice For Corporate Governance (2001)Документ84 страницыCode of Best Practice For Corporate Governance (2001)Nejash Abdo IssaОценок пока нет

- KRA 2 OkДокумент12 страницKRA 2 OkMichelle De RamosОценок пока нет

- NHM Pip 2020-21Документ18 страницNHM Pip 2020-21Harish ThapliyalОценок пока нет

- Description: Tags: By08gapsДокумент23 страницыDescription: Tags: By08gapsanon-678184Оценок пока нет

- Pilot Centrally-Sponsored Scheme of Pradhan Mantri Adarsh Gram YojanaДокумент36 страницPilot Centrally-Sponsored Scheme of Pradhan Mantri Adarsh Gram YojanaakhilchibberОценок пока нет

- BPC Projects For InterviewДокумент61 страницаBPC Projects For InterviewSandeep SagarОценок пока нет

- Barangay Budget ExecutionДокумент43 страницыBarangay Budget ExecutionNonielyn SabornidoОценок пока нет

- International Public Sector Accounting Standards Implementation Road Map for UzbekistanОт EverandInternational Public Sector Accounting Standards Implementation Road Map for UzbekistanОценок пока нет

- Implementing Results-Based Budget Management Frameworks: An Assessment of Progress in Selected CountriesОт EverandImplementing Results-Based Budget Management Frameworks: An Assessment of Progress in Selected CountriesОценок пока нет

- Dilg Memocircular 202381 SGLG BДокумент19 страницDilg Memocircular 202381 SGLG BJuvy RascoОценок пока нет

- Jmcno.1s2016 - Dilg-Neda-Dbm-Dof - November 18, 2016Документ27 страницJmcno.1s2016 - Dilg-Neda-Dbm-Dof - November 18, 2016Juvy RascoОценок пока нет

- Dilg Memocircular 202382 - 43a2396769Документ2 страницыDilg Memocircular 202382 - 43a2396769Juvy RascoОценок пока нет

- Dilg Memocircular 20171117 ConventionДокумент2 страницыDilg Memocircular 20171117 ConventionJuvy RascoОценок пока нет

- Dilg Memocircular 2017531 - NDPR PDFДокумент3 страницыDilg Memocircular 2017531 - NDPR PDFJuvy RascoОценок пока нет

- Dilg MC 2014-135 Lccap GuidelinesДокумент8 страницDilg MC 2014-135 Lccap GuidelinesJuvy RascoОценок пока нет

- Beginning Organic Gardening Resources - 1Документ8 страницBeginning Organic Gardening Resources - 1Juvy RascoОценок пока нет

- FMSM - Secret Superstar Notes - All in One-Executive-RevisionДокумент419 страницFMSM - Secret Superstar Notes - All in One-Executive-RevisionSiddhant SoniОценок пока нет

- ContrsctДокумент23 страницыContrsctMohammed Naeem Mohammed NaeemОценок пока нет

- Mari Gas Annual Report 2005Документ32 страницыMari Gas Annual Report 2005Nauman IqbalОценок пока нет

- Chapter 5 DepreciationДокумент20 страницChapter 5 DepreciationanuradhaОценок пока нет

- All About Annual Information Statement (AIS)Документ79 страницAll About Annual Information Statement (AIS)NEERAJ MAURYAОценок пока нет

- Double Account SystemДокумент14 страницDouble Account SystemRizul96 GuptaОценок пока нет

- AAA - Mock Exam 2Документ34 страницыAAA - Mock Exam 2Myo NaingОценок пока нет

- 01-IlocosNorteProvince2020 Audit ReportДокумент89 страниц01-IlocosNorteProvince2020 Audit ReportRuffus TooqueroОценок пока нет

- Accounting Clinic IДокумент40 страницAccounting Clinic IRitesh Batra100% (1)

- The Growth of The Marijuana Industry Warrants Increased Tax Compliance Efforts and Additional GuidanceДокумент53 страницыThe Growth of The Marijuana Industry Warrants Increased Tax Compliance Efforts and Additional GuidancesandydocsОценок пока нет

- T6int 2009 Jun QДокумент9 страницT6int 2009 Jun QRana KAshif GulzarОценок пока нет

- 07 Service CostingДокумент11 страниц07 Service CostingAkash DasОценок пока нет

- VIT MES Elements Coaching Notes 1and 2Документ512 страницVIT MES Elements Coaching Notes 1and 2Solayao, Jan Marvin J.Оценок пока нет

- Frequently Asked Questions (FAQ) : State Aid: Just Transition Fund (JTF)Документ15 страницFrequently Asked Questions (FAQ) : State Aid: Just Transition Fund (JTF)amicoadrianoОценок пока нет

- Q.1) From The Following Balance Sheet of Kiero Ltd. and The Additional Information As On 31-3-2018 Prepare A Cash Flow StatementДокумент5 страницQ.1) From The Following Balance Sheet of Kiero Ltd. and The Additional Information As On 31-3-2018 Prepare A Cash Flow StatementNoor SehgalОценок пока нет

- Tally Under GroupДокумент7 страницTally Under GroupAkash DhibarОценок пока нет

- PES Question-Accounting Exercise 2.1 SalamДокумент11 страницPES Question-Accounting Exercise 2.1 SalamSolomon Tekalign100% (2)

- 1 Commerce Merged FileДокумент130 страниц1 Commerce Merged FileCrazy GamerОценок пока нет

- Investment PropertyДокумент3 страницыInvestment PropertyJohn Ray RonaОценок пока нет