Академический Документы

Профессиональный Документы

Культура Документы

How Islamic Finance Can Be An Alternative To The Conventional Banking System ?

Загружено:

Mouncef Assouli0 оценок0% нашли этот документ полезным (0 голосов)

17 просмотров14 страницHow Islamic Finance can be an alternative to the conventional banking system ?

Оригинальное название

How Islamic Finance can be an alternative to the conventional banking system ?

Авторское право

© © All Rights Reserved

Доступные форматы

DOCX, PDF, TXT или читайте онлайн в Scribd

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документHow Islamic Finance can be an alternative to the conventional banking system ?

Авторское право:

© All Rights Reserved

Доступные форматы

Скачайте в формате DOCX, PDF, TXT или читайте онлайн в Scribd

0 оценок0% нашли этот документ полезным (0 голосов)

17 просмотров14 страницHow Islamic Finance Can Be An Alternative To The Conventional Banking System ?

Загружено:

Mouncef AssouliHow Islamic Finance can be an alternative to the conventional banking system ?

Авторское право:

© All Rights Reserved

Доступные форматы

Скачайте в формате DOCX, PDF, TXT или читайте онлайн в Scribd

Вы находитесь на странице: 1из 14

Special Topics in Finance

Islamic Finance and the Financial Crisis

Islamic Finance is a financial system that doesnt work like other conventional

banking systems. It follows the Islamic law, Shariah, which doesnt allow certain aspects

of a normal banking system such as usury and speculation (Kettell viii). There are some

main principles to be followed in Islamic banking. First of all, it prohibits interest, or

Riba. Riba is forbidden in Islam, and therefore Islamic banking system adopts the

principle of profit and loss sharing. It also prohibits uncertainty, gambling, and prohibits

certain products and industries such as alcohol and tobacco (Kettell viii). Islamic Finance

needs to be in accordance with the Shariah. All products and contracts follow Islamic

principles that conventional financial systems do not, such as interest and risk sharing,

and uncertainty (Kettell viii). Conventional financial systems have never worked this way

and it worked for them for many years until they were hit by the financial crisis. The

crisis had a minimal impact on the Islamic financial systems because they did not comply

with all the factors that created the crisis in the first place. There were 3 main factors in

the creation of the financial crises. First, subprime loans, which was lending to certain

people who did not have a good credit history and were bound to default. The banks than

charged them with higher rates that increased their risk of defaulting. Secondly, there was

securitization, which was creating securities from un-liquid assets. This process is used

by banks to create securities from loans and other income producing assets, and then

these securities are sold to investors. Finally, it was the credit default swaps that

increased the effect of the crisis. There would be many different people having an

insurance on the same house (for example both the lender and the borrower), which

makes it that insurance companies at one point would have to pay more than the amount

of just the house. In the case of the crisis, we can say that the Islamic banking systems

would have avoided it. It would be a more suitable system in the sense that all of the

reasons above that were the cause of the crisis, would not have been done if all the

systems were Islamic. With a good implementation of profit and loss sharing, Islamic

finance promotes fairness. Subprime loans would not have been allowed, and credit done

with profit loss sharing would have avoided having so many people taking loans and

defaulting in the first place. In Islamic finance, assets should back up all loans. Finally,

Islamic finance is against insurance companies. They use another way where a group of

people will all pitch in and put some money together in case someone loses their home or

something important. In this case, people are helping each other and promoting safe

economic needs. With an Islamic system, credit default sways would not have occurred

because insurance companies are not allowed. So this 3

rd

effect on the crisis, which

actually made things worse for everyone, would not have occurred. Islamic Finance is a

system that could have avoided the financial crisis.

Following the Shariah, there are many laws and regulations that are in fact for the benefit

of the whole. The only problem is that we have been used to the conventional system and

all of its principles and ways of working. The Islamic system seems harder to understand

and to work with, especially for non-Muslims who do not have the same beliefs and

therefore do not see why they should comply with it. Even Muslim believers, who follow

the Shariah for their everyday life, do not all use an Islamic banking system. The benefits

of this system do not look appealing at first, compared to the conventional system

everyone is used to working with, but when you think about it, this new system could

have avoided many troubles people are facing today because of the crisis. Maybe the

crisis would have still occurred, but it wouldnt have hit as hard.

The current global financial crisis, also called the subprime mortgage crisis, has been the

worst kind of crisis since the Great Depression. It started in 2007, with the collapse of

many financial companies in the United States. The crisis started with people buying

expensive houses they could not actually afford. It was an easy time to get a loan for

housing. This caused the price of houses to increase, and financing firms gave subprime

loans to borrowers who did not have a good credit history. The crisis did not only affect

mortgage credits to risky borrowers, it also affected the banking and financial system. It

has shown that conventional finance is vulnerable. Such a financial crisis would not have

happened under the Islamic finance, due primarily to the fact that Islamic finance

complies with Islamic laws, Shariah. Shariah prohibits most, if not all of the factors that

contributed to starting this crisis. These factors include: negative relationship between

borrowers and lenders, faulty and risky behaviors, asymmetry of information, and actions

who lead to a deliberate underpricing of risk. With the crisis, Islamic finance is

presenting itself as being a more reliable alternative to the conventional financial system.

Islamic Finance is an expanding industry that is sustaining a secure and steady growth.

The concept of Islamic finance started only 40 years ago, and was able to remain

positively steady throughout the current financial crisis. Eventually, it is starting to

appear more efficient and capable of bringing stability to financial systems. Economists

and financial experts all agree upon the causes of the crisis, however finding solutions to

the crisis is proving itself to be very difficult. Some think the market will repair itself on

its own, others believe governments should intervene in the markets. For now, there is no

long-term solution and no guarantee that an identical crisis will not happen again in the

future. The only think that can be seen is that the crisis has shown that markets are not

always efficient on their own.

The aim of this paper is to try to find an alternative that would be able to bring back

stability to financial markets. We will be analyzing Islamic finance principles and doing

a cross-section with causes of the crisis in order to show how the crisis could have been

prevented under an Islamic financial system.

The Islamic finance industry is prosperous, with a market representing about 1000 billion

dollars. Islamic finance is developing due to an increase in Muslim populations who are

looking for Shariah compliant products, and also due to the efficiency of their products

and their good performance in financial markets. For many, choosing Islamic finance is

part of making ethical choices and having such values as trust, which is lacking these

days in conventional finance. Under Islamic finance principles, it is forbidden to invest in

sectors such as alcohol and gambling, and interest and speculation are prohibited.

Investments are limited to such things as tangible assets, which makes it more secure.

Islamic finance is going through annual growth rates of up to 20%, making it one of the

fastest growing sectors in the finance industry.

Both Islamic finance and the conventional financial system are there to assemble

resources and allocate them into investment projects, but the basic principles behind

Islamic finance are very different from those of the conventional system. The

conventional system is much more based on making profit than the Islamic system.

Islamic finance is primarily based on the principles of Shariah, which is a set of Islamic

laws, which govern Muslim life. This system tries to assure that their financial products

are compliant with the principles of Islam and its ethics. There are 6 basic principles of

Islamic finance.

1. The prohibition of riba, which is interest or usury. In Islam, interest is prohibited and it

is seen as wrongful earnings.

2. The prohibition of gharar, which is uncertainty. This means there should be no

asymmetry of information and full disclosure in a contract.

3. The prohibition of investing or financing any sinful activity such as alcohol, pork,

prostitution, and gambling.

4. Sharing profits and losses, which is risk sharing. The profits and losses are to be shared

by all the parties in a financial transaction.

5. Materiality, which means all financial transactions need to be linked to a real economic

transaction.

6. All financial transactions should not lead to the exploitation of a party.

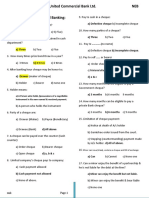

The financial crisis is associated with easy credit, debt, and speculation. Below is a table

of the main factors that caused the current financial crisis:

It's quite difficult to decide on one main factor that caused the crisis, but one of them is

the bad lending decisions made that were driven by the need of higher profits. This was

facilitated by the fact that government regulations were absent. This new way of lending

was practiced for an extended period of time and caused damage to both lenders and

borrowers.

The question is why did banks change their lending norms even though they were aware

of the risks and damage it could cause? Chapra explains that they were motivated by

three leading factors which are lack of profit and loss sharing between lenders and

borrowers, too big expansions in the size of derivatives such as credit default swaps, and

finally the assurance that the central bank would help banks out in order to avoid a

collapse.

Every economic crisis is usually caused by bad credit. It starts with low interest rates,

which attracts more customers for loans, and when the interest rates increase the loans

aren't repaid. For the borrowers low interest rates made it more affordable to get houses,

which increased the demand. On the other hands, banks whose only motives where to

make profit decided to make it easier for people to get loans. The problem got bigger

when banks started to sell their customers on subprime loans, and when default risk

started to be transferred by the creation of new complex products.

Many Islamic finance experts believe the global financial crisis is especially due to the

failure of morality and ethics, which is mainly caused by greed. They also consider it to

be a failure in maintaining a good relationship between banks and their customers. Those

who started subprime loans didn't effectively communicate the risks that were in hand.

The current financial crisis has made it urgent today to completely reshape the

international was financial systems work. So far, no one has been able to deliver an

achievable long-term solution to the crisis. Maurice Allais, a Nobel prize winner and

French economist was said to have warned against the consequences of such a crisis. He

says that the best way to cure the system is by structural reforms that will prevent the

crisis from happening again. He first proposes that interest rates should be 0%, and tax

rate should be 2%. We can notice that this resembles very much the Islamic financial

system. Under this system, interest is prohibited and requires that people should pay a tax

of 2.5% of yearly earnings, zakat.

Muslim scholars think that Islamic finance has the potential to become an alternative

model for global system (Ayub, 2007) . Islamic finance works under values such as

fairness, justice, caring for future generations and the environment. Its purpose is to

create a financial system that is fair for both the rich and the poor. The ultimate goal is to

be able to spread social and economic justice. Taymiyyah, a highly respected scholar,

says: Hence, justice towards everything and everyone is an imperative for everyone, and

injustice is prohibited to everything and everyone. Injustice is absolutely not permissible

irrespective of whether it is to a Muslim or a non-Muslim or even to an unjust person".

When we look at the causes of the financial crisis, we can notice that the underlying

principles of Islamic finance show potential as an alternative to the conventional system.

We first see that under Islamic finance, there are moral guidelines to be followed about

how to deal with money. It works in order that money supply is always equivalent to real

growth in the economy. We also notice that under Islamic finance, some activities are

forbidden because they are harmful and unlawful. In such a system, there are no assets

without risk and financial transactions are based on profit and loss sharing. Options,

swaps, and speculation are forbidden under the principle of Gharar.

The global crisis did have an effect on Islamic banks, however Islamic finance remained

quite resistant compared to other financial institutions. If global financing followed the

Islamic principles, the crisis would have never occurred or would have had a significantly

less important effect. This argument is mainly based on the fact that most of the factors

that caused the crisis are prohibited in the Shariah compliant financial institutions. A

crisis that was due to subprime mortgage, poor evaluation of risk, use of complex

financial instruments to shift the risk, speculation, and bad lending, could not have

occurred under Islamic finance for many reasons:

1. Under Shariah law, debt shouldnt be sold against another debt. A person is not

allowed to sell or lease an asset they dont own, and it is prohibited to sell debt

and risky speculative transactions. All financial transactions are supposed to be

fair and just, with full disclosure in contracts in order for the risk to be correctly

assessed by all parties

2. Rather than being based on debt, Islamic finance is more based on equity. When they

lend, all assets need to be backed up by solid assets. In this system housing loans

would all have had to been backed up, which would have stopped the defaults on

loans. This would therefore mean that in no way would defaulting, occurring

under Islamic finance, affect other banking systems. In the conventional system,

trillions of dollars were lent out without being backed up with assets, which was

one of the main causes of the crisis. Under Islamic finance, this would have never

happened. Muslims are expected to live within their means and what they can

afford, and are not supposed to get a loan they are not able to repay just because

the interest is low. There would be none of this because interest under Islamic

finance is prohibited.

3. In Islamic institutions, it is very important for them to keep a good and trustworthy

relationship between the institution and clients or investors. A high level of

transparency is supposed to be kept, in order for the relationship to be an honest

one. Both the institution and the investor open up to each other. The institution

then knows when to give loans to those who need them and will be able to repay

them through business activity that is known to the institution.

4. One of the causes of the crisis was the lack of regulatory control systems, which are

supposed to help investors. Under the Islamic regulatory system, all parties are

aware of all the opportunities and risks in a contract. Islamic banks have an

obligation towards their investors of full disclosure and transparency. Full

disclosure and transparency helps to control lending and enables a financial

stability to take place.

5. Under Mudarabah and Musharakah contracts, with the concept of Profit and loss

sharing, risk is easily managed. Investors can see the opportunities of gain as well

as losses, which does not give place to speculation and uncertainty.

6. In Islamic Finance, the relationship between the institution and the borrower is seen as

a partnership. Both parties have a mutual interest in the business transaction,

which makes subprime and default shifting very unlikely to occur. Siddiqi says

that risk shifting is gambling. Under profit and loss sharing, all parties will

share the losses, whereas in risk shifting only one party will incur the losses.

We can link Islamic principles with market failures to show how market failures could

have been reduced, or even stopped under Islamic finance. Below is a graph explaining

this:

To conclude, it is hard to decide on one main factor that caused the crisis. There are many

factors in cause such as bad lending done by conventional financial institutions, whose

main goal was the returns. In this paper, we aimed to explain how the current financial

crisis could have been avoided under Islamic financing. Evidence shows that Islamic

finance is more stable, and a good implementation of this kind of financing could

possible be a solution to the crisis and would not let another crisis happen again. This is

simply due to the fact that most, if not all of the factors that caused or contributed to the

financial crisis are prohibited under Islamic finance.

References

Ayub, M. (2007). Understanding Islamic finance. USA: John Wiley & Sons.

Chapra, U. (2009). The global financial crisis: Can Islamic finance help?

Hassan, K., & Lewis, K. (2007). Handbook of Islamic banking, UK: Edward Elgar

Publishing Iqbal, Z. (1997), Islamic Financial Systems

Iqbal, M., & Llewellyn, D. (eds.) (2002). Islamic banking and finance, Cheltenham:

Edward Elgar Publishing.

Kayed, Rasem N. and M. Kabir Hassan (2009), The Global Financial Crisis and Islamic

Finance Response, University of New Orleans Working Paper.

Kettell, Brian. Islamic Finance in a Nutshell. New York: Wiley, 2010. Print.

Siddiqi, M. N. (2008). Current financial crisis and Islamic economics.

Winners of the Bank of Sweden Prize in Economics. (2008). Bank of Sweden prize in

economic sciences in memory of Alfred Nobel 2008-1969.

Вам также может понравиться

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (895)

- Porter 5 Forces PEPSICOДокумент1 страницаPorter 5 Forces PEPSICOMouncef AssouliОценок пока нет

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5794)

- Key Competitors - Marketing StudyДокумент1 страницаKey Competitors - Marketing StudyMouncef AssouliОценок пока нет

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- Islamic CivДокумент2 страницыIslamic CivMouncef AssouliОценок пока нет

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- Ritz Carlton Case ManagementДокумент1 страницаRitz Carlton Case ManagementMouncef AssouliОценок пока нет

- B.R.S. Test 3Документ5 страницB.R.S. Test 3Sudhir SinhaОценок пока нет

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (399)

- Union Bank of India - Application - 230317 - 073648Документ6 страницUnion Bank of India - Application - 230317 - 073648CA N RajeshОценок пока нет

- Privy BroucherДокумент8 страницPrivy Broucherrajkamal eshwarОценок пока нет

- CreditДокумент17 страницCreditMyra Dela Llana TagalogОценок пока нет

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- IFB FINAL THESIS May 2018Документ89 страницIFB FINAL THESIS May 2018Getnat BahiruОценок пока нет

- Treasury Manager Back-Office Management: Main Purposes of The FunctionДокумент2 страницыTreasury Manager Back-Office Management: Main Purposes of The FunctionDuma DumaiОценок пока нет

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- Cash & GB MCQ NEW ESKATON FДокумент18 страницCash & GB MCQ NEW ESKATON FJubaida Alam Juthy57% (7)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (266)

- Governor's Statement - August 6, 2020: TH TH TH THДокумент13 страницGovernor's Statement - August 6, 2020: TH TH TH THThe QuintОценок пока нет

- 21-2012 PNB 1054 - Ann I - Application-Cum-Appraisal-Cum-Sanction For Housing LoanДокумент9 страниц21-2012 PNB 1054 - Ann I - Application-Cum-Appraisal-Cum-Sanction For Housing Loanrisk_j2546Оценок пока нет

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (344)

- Suggested Answers To The Merc Bar by Fiscal Rocille Aquino TambasacanДокумент16 страницSuggested Answers To The Merc Bar by Fiscal Rocille Aquino TambasacanMelvin PernezОценок пока нет

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- BLACKBOOKДокумент27 страницBLACKBOOKKushОценок пока нет

- LenDenClub - New Product Development in The Digital SpaceДокумент10 страницLenDenClub - New Product Development in The Digital SpacePrabhat BistОценок пока нет

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- Tender 58800Документ213 страницTender 58800adhirajn4073Оценок пока нет

- CasesДокумент20 страницCasesmaximum jicaОценок пока нет

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1090)

- Chinmaya Kumar Behera SipДокумент27 страницChinmaya Kumar Behera SipChinmaya Kumar BeheraОценок пока нет

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- The Icarus Paradox in The Indian Banking Sector: The Story of Yes BankДокумент8 страницThe Icarus Paradox in The Indian Banking Sector: The Story of Yes BankANUSHKA SHARMA 20111307Оценок пока нет

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2259)

- Financial InclusionДокумент53 страницыFinancial InclusionMeghana VyasОценок пока нет

- Clipper Logistics PLC PDFДокумент156 страницClipper Logistics PLC PDFWilliamK96Оценок пока нет

- Basic Cash Operations (BFB) - Process DiagramsДокумент9 страницBasic Cash Operations (BFB) - Process Diagramsanon_707289574Оценок пока нет

- Statement PDFДокумент3 страницыStatement PDFVenu MadhavОценок пока нет

- Tally Unit - 1Документ10 страницTally Unit - 1muniОценок пока нет

- 3 Day Notice To ReportДокумент1 страница3 Day Notice To ReportMarsha MainesОценок пока нет

- Financial and Accounting Procedures ManualДокумент60 страницFinancial and Accounting Procedures ManualjewelmirОценок пока нет

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (120)

- Avaloq Case Study DBSДокумент6 страницAvaloq Case Study DBSAnirudh PrabhuОценок пока нет

- SEC Guidelines For The Investment Requirement of Foreign Corporations Under Section 126 of The Corporation Code of The PhilippinesДокумент4 страницыSEC Guidelines For The Investment Requirement of Foreign Corporations Under Section 126 of The Corporation Code of The PhilippinesAlvin HalconОценок пока нет

- AFI Egypt Report AW DigitalДокумент12 страницAFI Egypt Report AW DigitalkamaОценок пока нет

- Marketing Strategies of ICICI BankДокумент8 страницMarketing Strategies of ICICI BankSidharth AggarwalОценок пока нет

- النظام القانوني لتاسيس المؤسسات البنكية في التشريع الجزائر يДокумент17 страницالنظام القانوني لتاسيس المؤسسات البنكية في التشريع الجزائر يamina h0% (1)

- Jürgen Kocka, Marcel Van Der Linden - Capitalism - The Reemergence of A Historical Concept-Bloomsbury Academic (2016) PDFДокумент292 страницыJürgen Kocka, Marcel Van Der Linden - Capitalism - The Reemergence of A Historical Concept-Bloomsbury Academic (2016) PDFLeonardo MarquesОценок пока нет

- Internship On Unilever - Executive SummaryДокумент5 страницInternship On Unilever - Executive SummaryMuntasirОценок пока нет