Академический Документы

Профессиональный Документы

Культура Документы

Gartner - Hypecycle For Retail 2012

Загружено:

Prashant GuptaОригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Gartner - Hypecycle For Retail 2012

Загружено:

Prashant GuptaАвторское право:

Доступные форматы

Industry Research

G00234233

Hype Cycle for Retail Technologies, 2012

Published: 27 July 2012

Analyst(s): Gale Daikoku

Executing a seamless cross-channel shopping experience remains a critical

priority for Tier 1 multichannel retailers. CIOs and IT leaders must diligently

monitor customer requirements to balance the introduction of new

technologies. This research features 43 technologies that should be on the

radar.

Table of Contents

Analysis.................................................................................................................................................. 3

What You Need to Know.................................................................................................................. 3

The Hype Cycle................................................................................................................................ 3

The Priority Matrix.............................................................................................................................8

Off the Hype Cycle......................................................................................................................... 10

On the Rise.................................................................................................................................... 11

3D Printing in Retail.................................................................................................................. 11

Augmented Reality Applications................................................................................................13

Data Visualization in Merchandising.......................................................................................... 15

Multichannel Merchandise Planning.......................................................................................... 16

At the Peak.....................................................................................................................................18

E-Paper Signage...................................................................................................................... 18

Multichannel Feedback Management........................................................................................19

Real-Time Store-Monitoring Platform........................................................................................ 20

Social Media Analytics for Retail................................................................................................22

Multichannel Master Content Management for Retail................................................................ 23

Social Coupons........................................................................................................................ 25

Real-Time Customer Offer Engines........................................................................................... 26

Mobile Coupons....................................................................................................................... 27

Multichannel Loyalty................................................................................................................. 28

Biometrics for Time and Attendance......................................................................................... 29

F-Commerce............................................................................................................................ 30

Sliding Into the Trough....................................................................................................................32

Retail Mobile Shopping (Nonpayments).....................................................................................32

Web Experience Analytics.........................................................................................................34

Retail Mobile Payments............................................................................................................ 35

Integrated Demand and Replenishment Planning......................................................................39

Store Location Analysis............................................................................................................ 41

Store Replenishment Optimization............................................................................................ 42

Multichannel Order Fulfillment................................................................................................... 44

Java-Based POS Software....................................................................................................... 46

Multichannel Order Management.............................................................................................. 47

Time and Labor Optimization.................................................................................................... 49

Multichannel Master Data Management for Retail..................................................................... 50

RFID (Item)................................................................................................................................53

Contactless Payments.............................................................................................................. 54

Customer-Centric Merchandising............................................................................................. 55

In-Store Self-Service: Customer-Facing Applications................................................................ 57

Microblogging for Retailers....................................................................................................... 59

Online Product Recommendation Engines................................................................................60

Retail Biometric Payments........................................................................................................ 61

Store Task Management...........................................................................................................62

Retail Digital Signage................................................................................................................ 64

LCD-Based ESLs..................................................................................................................... 65

Climbing the Slope......................................................................................................................... 66

E-Coupons............................................................................................................................... 66

Merchandise and Category Optimization.................................................................................. 67

Unified Price, Promotion and Markdown Optimization...............................................................69

Mobile POS.............................................................................................................................. 71

Entering the Plateau....................................................................................................................... 73

Self-Check-Out.........................................................................................................................73

Community Reviews................................................................................................................. 75

In-Store Applications: Employee-Facing....................................................................................76

Appendixes.................................................................................................................................... 78

Hype Cycle Phases, Benefit Ratings and Maturity Levels.......................................................... 80

Recommended Reading.......................................................................................................................81

Page 2 of 83 Gartner, Inc. | G00234233

List of Tables

Table 1. Hype Cycle Phases................................................................................................................. 80

Table 2. Benefit Ratings........................................................................................................................80

Table 3. Maturity Levels........................................................................................................................ 81

List of Figures

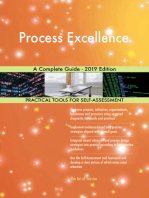

Figure 1. Hype Cycle for Retail Technologies, 2012................................................................................ 7

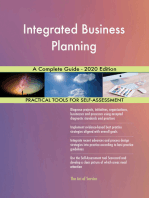

Figure 2. Priority Matrix for Retail Technologies, 2012...........................................................................10

Figure 3. Hype Cycle for Retail Technologies, 2011.............................................................................. 79

Analysis

This document was revised on 6 September 2012. For more information, see the Corrections

page on gartner.com.

What You Need to Know

For several years, Gartner has been tracking consumer empowerment through growing use of the

Web, mobile and social technologies as they take greater control of their shopping processes,

including a more personal approach to their shopping experience. This consumerization of retail has

resulted in major retailers continuing their investments in the specific technologies that enable them

to innovate and improve their ability to execute a seamless, cross-channel shopping environment,

and create meaningful interactions with customers.

Multichannel retailing is becoming business as usual for Tier 1 retailers, which are defined as those

with more than $2 billion and operating several channels, including stores. However, four IT forces

including cloud computing, social networking, mobility, and an explosion of information or "big

data" (described by Gartner as the Nexus of Forces) continue to elevate the hype surrounding

several retail technologies. While these technologies on their own can be innovative and disruptive,

the nexus highlights the convergence of these four forces, which will transform the way customers

shop. Tier 1 retail IT leaders who are actively seeking guidance on the right mix of technology

investments and delivery models can use this Hype Cycle to understand how these technologies

can be used now and in the future to support their customers' real-time shopping journeys,

regardless of touchpoints.

The Hype Cycle

This Hype Cycle represents Gartner's global market view of the progress, development and

evolution of the key retail technologies that affect the way Tier 1 retailers do business that is, how

Gartner, Inc. | G00234233 Page 3 of 83

the technologies support the way customers want to interact with retailers through their shopping

experiences. The technologies included in the 2012 Hype Cycle were selected and reviewed by

Gartner on the basis of ongoing consumer and retailer surveys, market forecasts and analyst

opinions, based on our daily conversations with large retail clients and vendors that serve the retail

market. Key consideration was given to each technology's ability to affect a retailer's core business

processes, to improve a retailer's ability to interact with its customers, and to improve the

effectiveness and efficiency of operations.

The target audience for this research includes:

CIOs and CTOs

Vice presidents of store operations

Vice presidents of merchandising

Vice presidents/heads of commerce/mobile/multichannel

Vice presidents/heads of application management

Heads of enterprise architecture

Vice presidents/heads of business intelligence (BI)/information management

Retail CIOs and their leadership teams must continue to diligently monitor customer requirements

that arise from the actual shopping processes, and balance the introduction of new technologies to

meet shoppers' needs. While the timing of implementations will vary depending on a retailer's

tier, segment and geography of operations, as well as on the maturity and ROI considerations of

technologies being implemented retail IT leaders can use this Hype Cycle as a starting point to

refine technology road maps.

The 43 technologies included in the 2012 Hype Cycle update are down slightly from the 47

technologies published in 2011. Here is a summary of the key changes for 2012:

Seven technologies were dropped and are detailed in the Off the Hype Cycle section of this

research: retail mobile commerce (transactional), social software for retail employee

collaboration, retail real estate portfolio management, public social networks in retail, next-

generation retail OSs for POS, video and rich media for e-commerce, and store-based e-

recruitment.

Four technologies were renamed to more accurately reflect their inclusion in the 2012 Hype

Cycle: "retail mobile phone payment" is now "retail mobile payments"; "retail mobile websites

and applications nontransactional" is now renamed "retail mobile shopping (nonpayments)";

"master data management for retail" is now called "multichannel master data management for

retail"; and "multichannel retail enterprise content management" is now called "multichannel

master content management for retail."

Three new profiles appear on the 2012 Hype Cycle:

3D printing in retail: 3D fabricating technologies have been available for some time, and have

enabled the creation of one-off and customized pieces in the manufacturing environment. In the

Page 4 of 83 Gartner, Inc. | G00234233

past year, we have seen a noticeable interest in this technology that retailers could use to

produce low-volume manufacturing of high-margin, custom-designed pieces to support a key

customer basic: stock availability. This interest supports the addition of this profile to the 2012

Hype Cycle.

Data visualization in merchandising: The complexity of the multichannel merchandising

process combined with a new focus on the customer by Tier 1 retailers has limited the

potential impact of BI insights that must be translated across thousands of stores, and has

become unmanageable. Data visualization tools have emerged as a must-have for Tier 1

retailers to use the knowledge that merchants rely on to drive analytic views of information from

broad data sources, including social media and other contextual data points. This justifies why

this profile has been added to the 2012 Hype Cycle.

Store location analysis: This has been around for many years, and was previously covered as

a subset of retail real estate portfolio management, which was dropped from the 2012 Hype

Cycle. In the past few years, store location analysis has become vitally important to

multichannel retailers that need the ability to analyze an increasingly dynamic set of cross-

channel variables and key determinants for store locations, particularly as the store has become

the operational hub for cross-channel shoppers. This particular aspect and its importance to

multichannel retailers' physical store strategy are why this technology was added to the Hype

Cycle.

Three fast-moving technologies on the 2012 Hype Cycle are:

F-commerce: Gartner research shows that 91% of U.S. consumers surveyed report Facebook

as their primary social network. As a result, we expect this technology to move quickly through

the Hype Cycle over the next two to five years. The recent initial public offering and its mixed

performance have increased interest and will drive new revenue generation opportunities for

Facebook that will likely reinvigorate product sales activity. Facebook's recently opened App

Store will also increase activity and hype surrounding F-commerce.

Microblogging: Twitter has become a household name. It allows retailers to connect directly

with people who are interested in their products and services, as well as their sales and support

activities. Microblogging is low-cost; the cost to the retailer consists of the personnel costs to

create the feeds and the analytic software to monitor the microblogging feeds. This is part of

the reason why this technology has accelerated through the Hype Cycle as fast as it has.

Community reviews: This technology advanced rapidly to plateau from the 2011 Hype Cycle

position of post-trough 30% because it has become widely accepted and is considered a must-

have for retailers selling on the Web. As such, Gartner expects that this technology will be

retired in the next 12 to 24 months.

The following technologies have reached the plateau:

In-store applications: employee-facing: On the 2011 Hype Cycle, this technology had just

reached the plateau stage, with less than two years to maturity, and we expected to retire it

from the 2012 Hype Cycle. However, in the past 12 months, we have seen retailers keep up

their interest in these solutions, while also slowly beginning to transition to newer next-

Gartner, Inc. | G00234233 Page 5 of 83

generation solutions. For this reason, we have retained this technology in its current form on

this year's Hype Cycle. We expect to move it off the Hype Cycle next year and replace with a

technology that describes the next-generation type of solutions.

Community reviews: As previously stated, this fast mover is a widely accepted part of doing

business, and we expect this technology will continue to advance to the plateau and be retired

within the next 12 to 24 months.

Through 2012, we expect all 43 of these technologies to have increasing relevance to multichannel

retailers as they adjust to their "new normal," where multichannel retailing is becoming business as

usual (see Figure 1).

Page 6 of 83 Gartner, Inc. | G00234233

Figure 1. Hype Cycle for Retail Technologies, 2012

Technology

Trigger

Peak of

Inflated

Expectations

Trough of

Disillusionment

Slope of Enlightenment

Plateau of

Productivity

time

expectations

Plateau will be reached in:

less than 2 years 2 to 5 years 5 to 10 years more than 10 years

obsolete

before plateau

Customer-Centric Merchandising

As of July 2012

Augmented Reality Applications

Data Visualization in Merchandising

F-Commerce

Social Coupons

Multichannel Merchandise Planning

Multichannel Master Content

Management for Retail

Real-Time Store-Monitoring Platform

Multichannel Feedback Management

E-Paper Signage

Social Media Analytics for Retail

Real-Time Customer Offer Engines

Mobile Coupons

Multichannel Loyalty

Integrated Demand and Replenishment Planning

Biometrics for Time and Attendance

Retail Mobile Payments

Multichannel

Order

Fulfillment

Web Experience Analytics

Multichannel Order Management

Store Location Analysis

Java-Based POS Software

Time and Labor Optimization

Multichannel Master Data

Management for Retail

In-Store Self-Service: Customer-Facing Applications

Microblogging for Retailers

RFID (Item)

Contactless Payments

Online Product Recommendation Engines

Retail Biometric Payments

Retail Digital

Signage

Store Task Management

LCD-Based ESLs

E-Coupons

Merchandise and Category Optimization

Unified Price, Promotion and Markdown

Optimization

Community Reviews

Mobile POS

Self-Check-Out

In-Store Applications:

Employee-Facing

3D Printing in Retail

Store Replenishment Optimization

Retail Mobile Shopping (Nonpayments)

Source: Gartner (July 2012)

Gartner, Inc. | G00234233 Page 7 of 83

The Priority Matrix

In the past year, key customer cross-channel processes such as order online/pick up in store,

buy online/return in store, or using a mobile device to browse have continued to emerge as

must-have capabilities for multichannel specialty retailers, such as consumer electronics,

bookstores and apparel.

IT decision makers in these formats need to stay focused on helping the business identify the right

investments that improve the shopping process across the channels, and not overlook the

importance of investing in stores in particular. For grocery and other segments that invest in stores,

but may have underinvested in emerging channels (such as Web and mobile), Gartner research

highlights the relative importance of all key touchpoints on cross-channel shoppers.

According to Gartner's 2011 multichannel forecast, revenue through mobile channels for U.S. and

U.K. retailers is expected to be less than 2% of total revenue by 2015, while e-commerce revenue in

both countries is expected to nearly double by 2015 according to the published forecast figures for

2010. However, while stores' growth rates in both countries will be the lowest of all channels, the

majority of retailers' revenue will continue to come through stores for some time. Also, multichannel

retailers should not lose sight that, for cross-channel-enabled processes, the store becomes the

operational hub for their operations. This means that stores should remain an investment priority for

multichannel retailers. As Tier 1 retailers prioritize their technology investments to deliver innovation

and business value to customers, Gartner reminds retailers using the Priority Matrix to start by

mapping customers' shopping processes and identifying deficiencies that prohibit or constrain a

seamless cross-channel shopping experience.

Four benefit ratings are used to describe each technology included in this Hype Cycle:

transformational, high, moderate and low. Three technologies were labeled as transformational

because they have the potential to "enable new ways of doing business across industries that will

result in major shifts in industry dynamics," as per the Gartner Hype Cycle definition of

"transformational"; however, the time frame to deliver transformation remains several years out.

Contactless payments and RFID (item) have been around for several years, but these technologies

are still at least five to 10 years away from mainstream adoption of these industry payment

processes. 3D printing in retail, a new profile on the 2012 Hype Cycle, is a technology that could

physically deliver a 3D print out of a prototype or item for purchase at a retail location which, for

IT leaders, could potentially change the way they support how inventory is managed,

merchandised, sourced and sold in stores in the future.

Although these technologies have the potential to transform the industry, the customers will

determine how fast they move in terms of adoption and this is especially the case for contactless

payments and 3D printing in retail.

Nearly half (20) of the technologies appearing on the 2012 Hype Cycle are labeled as having a high

benefit rating, which means that they will enable new ways of "performing horizontal or vertical

processes that will result in significantly increased revenue or cost savings." Many of the

technologies with a high benefit rating are expected to reach mainstream adoption in two to five

years, and these predominantly focus on enhancing core retailers' processes in the areas of

merchandising, inventory management, workforce management and other customer shopping

Page 8 of 83 Gartner, Inc. | G00234233

processes. The technologies that enhance merchandising or inventory management capabilities

include customer-centric merchandising; data visualization in merchandising; integrated demand

and replenishment planning; merchandise and category optimization; store replenishment

optimization; and unified price, promotion and markdown optimization. The technologies that

improve workforce management include store task management and time and labor optimization.

The technologies that improve customer shopping include in-store self-service: customer-facing

applications; retail mobile shopping (nonpayments); and social media analytics for retail.

A few technologies with high benefit rating were not expected to reach mainstream adoption for five

to 10 years. This reflects the very complex nature regarding the data requirements and application

integration needed to execute the cross-channel processes that these technologies will enable and

support. The technologies we can ascribe to this category are multichannel feedback management;

multichannel merchandise planning; multichannel order fulfillment; multichannel order management;

multichannel master content management for retail; and integrated demand and replenishment

planning.

Eighteen technologies had a moderate benefit rating. Those with this rating are defined as providing

"incremental improvements to established processes that will result in increased revenue or cost

savings" for retailers. Some of these had a two- to five-year maturity rating because they enable or

extend existing retailer processes for the customer, such as e-coupons, mobile coupons,

multichannel loyalty, self-check-out and F-commerce. Other technologies with two- to five-year

maturity including microblogging for retailers, online product recommendation engines and Web

experience analytics are investments that can enhance the cross-channel shopping experience

for the customer. Several other technologies were rated five to 10 years their ability to provide

incremental improvements was constrained because they required more time to improve or replace

established processes. They are biometrics for time and attendance, e-paper signage, Java-based

POS software, LCD-based ESLs, mobile POS, retail biometric payments, retail digital signage and

retail mobile payments. For two technologies real-time customer offer engines and real-time

store-monitoring platform integration with established processes for real-time review/response

was a factor in the years to mainstream adoption.

Two technologies on the 2012 Hype Cycle received a low benefit rating, which is defined as "slightly

improves processes (for example, improved user experience) that will be difficult to translate into

increased revenue or cost savings" for retailers. Social coupons, which are projected to achieve

mainstream adoption in two to five years, are a form of e-coupon; however, their effectiveness and

efficiency for retailers are still largely unproven. Similarly, augmented reality applications which

have drawn considerable interest in the past year, particularly as retailers explore their use though

mainstream adoption are between five and 10 years away from reaching the Plateau of

Productivity, because these interactive and immersive technologies are still emerging (see Figure 2).

Gartner, Inc. | G00234233 Page 9 of 83

Figure 2. Priority Matrix for Retail Technologies, 2012

benefit years to mainstream adoption

less than 2 years 2 to 5 years 5 to 10 years more than 10 years

transformational

3D Printing in Retail

Contactless Payments

RFID (Item)

high

Community Reviews

In-Store Applications:

Employee-Facing

Customer-Centric

Merchandising

In-Store Self-Service:

Customer-Facing

Applications

Merchandise and

Category Optimization

Retail Mobile Shopping

(Nonpayments)

Social Media Analytics for

Retail

Store Location Analysis

Store Replenishment

Optimization

Store Task Management

Time and Labor

Optimization

Unified Price, Promotion

and Markdown

Optimization

Integrated Demand and

Replenishment Planning

Multichannel Feedback

Management

Multichannel Master

Content Management for

Retail

Multichannel Master Data

Management for Retail

Multichannel Merchandise

Planning

Multichannel Order

Fulfillment

Multichannel Order

Management

moderate

Data Visualization in

Merchandising

E-Coupons

F-Commerce

Microblogging for

Retailers

Mobile Coupons

Multichannel Loyalty

Online Product

Recommendation Engines

Self-Check-Out

Web Experience Analytics

Biometrics for Time and

Attendance

E-Paper Signage

Java-Based POS Software

LCD-Based ESLs

Mobile POS

Real-Time Customer Offer

Engines

Real-Time Store-

Monitoring Platform

Retail Biometric Payments

Retail Digital Signage

Retail Mobile Payments

low

Social Coupons Augmented Reality

Applications

As of July 2012

Source: Gartner (July 2012)

Off the Hype Cycle

The following seven technologies are off the 2012 Hype Cycle:

Retail mobile commerce (transactional): This technology has been removed, and its largely

overlapping content has been incorporated into "retail mobile payments" to avoid duplication

and prevent unnecessary confusion.

Page 10 of 83 Gartner, Inc. | G00234233

Social software for retail employee collaboration: This is a cross-industry solution and was

dropped for 2012 because it is covered in the "internal community platforms" technology on the

"Hype Cycle for Social Software, 2012."

Retail real estate portfolio management: Store location analysis, as a process, has been

around for many years and was previously covered as a subset in retail real estate portfolio

management. However, in the past 36 months, it has become vitally important, as well as an

increasingly riskier and more complex activity, and we have seen lots of interest in this topic.

This has caused us to write a separate profile called "store location analysis," which we have

introduced on the 2012 Hype Cycle.

Public social networks in retail: This technology was dropped because it is not specific to

retail only. Gartner research shows that 72% of U.S. consumers are members of at least one

social network, with 91% using Facebook as their primary social network. See the F-commerce

profile.

Next-generation retail OSs for POS: Over the past few years, the coverage of technology

profiles on the Retail Hype Cycle has focused more and more on retail business applications,

rather than devices or client operating systems. In light of this criterion, we have decided to

remove this technology from this year's Hype Cycle. Also, it is unlikely that retailers will

implement these OSs for POS as stand-alone initiatives outside of POS upgrades.

Video and rich media for e-commerce: This was dropped because it was not specific to retail.

Store-based e-recruitment: This technology was dropped because e-recruitment is now part

of a broader cross-industry talent management suite, where there have been several mergers

and acquisitions during the past few years. See the talent management suites profile on the

"Hype Cycle for Human Capital Management Software, 2012."

On the Rise

3D Printing in Retail

Analysis By: Mim Burt; Pete Basiliere

Definition: 3D printing is a method of converting a 3D model for example, created through a

computer-aided design (CAD) software package, into a physical solid, detailed and potentially

functional model, or salable new or replacement part.

Position and Adoption Speed Justification: For a while now, 3D fabricating technologies have

been available for product prototyping and short-run parts manufacturing. More recently, the

technology has advanced to enable the creation of one-off and customized pieces in a much wider

range of robust materials. In retail, 3D printing is an emerging technology, and we are adding this as

a new technology to our Hype Cycle for Retail Technologies, 2012, because, in the past 12 months,

we have seen a noticeable increase in interest in this technology from retailers and vendors

Gartner, Inc. | G00234233 Page 11 of 83

Six basic 3D printing technologies are in use or under development: extrusion, lamination, fused

deposition modeling, inkjet, stereolithography and selective heat sintering. Additive 3D printers

deposit ink, resin, plastic or another material, layer by layer, to build up a physical mode. Although

at the low end, parts are generally produced in plastics, the same principles are also being used to

create high-end parts from ceramics, stainless steel, cobalt chrome and titanium alloys.

Continued quality improvements and price decreases mean enterprises can justify a modest

investment that streamlines their product design and development programs. In the past 24

months, the number and type of 3D printers has increased, and printer and supply costs have

decreased to a level that broadened 3D printing's appeal to a wider range of businesses, schools

and consumers. 3D printers with multicolor capabilities (less than $15,000) and single,

monochromatic 3D printers (approximately $10,000) are available for a wide range of applications,

with simple build-your-own-printer kits costing a few hundred dollars.

A sign of the market's growth is the consolidation of its technology providers. So far in 2012, we

have seen 3D Systems complete its acquisition of Z Corp. (January) and Stratasys announce its

intention to acquire Objet (April). Interestingly, the major 2D printer manufacturers basically remain

on the sidelines, mainly conducting research or providing OEM capabilities to third parties. HP

remains the only 2D printer provider with a 3D product offering, which is basically a rebranded

Stratasys printer.

User Advice: Advances in 3D scanners and design tools, as well as the commercial and open-

source development of additional design software tools, make 3D printing technology available for a

modest investment. While continuing to keep abreast of this technology, Tier 1 retailers should now

take advantage of the lower cost to begin exploring the use of this technology by experimenting

with low-volume manufacturing of high-margin, custom-designed pieces for example, fashion

jewelry and eyeglass frames. Feasibility studies should include finding out the most appropriate

materials, printing methods and 3D model formats that will best support the ways in which you want

to use 3D printing in your business model. Very importantly, retailers should ensure that they

adequately manage the risk of violating or infringing copyright and patenting laws with regard to the

creation of "knock-offs."

Bottom line: Retailers need to think carefully about how this technology will support the customer

service basics the essential things that a customer expects when shopping with the retailer, such

as stock availability.

Business Impact: This technology makes it possible for the introduction of a new retail business

model a 3D "copying service." In this type of model, the retailer could use its stores for

customers to bring in 3D CAD models of objects they would like to have produced, which the

retailer could "manufacture" using 3D printing. Customers could also use a Web-based service,

where the 3D models are emailed, and physical parts are mailed back to them. The retailer may

even be able to provide a full service from using 3D scanning to scan an object and then using 3D

printing technology to produce one or more copies for the customer. This technology has the

potential to transform several industries, including retailing and manufacturing. For example, in

retailing, as printer costs continue to come down and as they become more readily available,

consumers could these 3D printers to "manufacture" their own custom-designed products.

Page 12 of 83 Gartner, Inc. | G00234233

Benefit Rating: Transformational

Market Penetration: Less than 1% of target audience

Maturity: Emerging

Sample Vendors: 3D Systems; HP; Objet; Stratasys

Recommended Reading: "Cool Vendors in Imaging and Print Services, 2012"

"Innovation Insight: 3D Printing Enhancements, Low Price Bring Design Process Improvements

Within Reach"

"Multichannel Retailers Will Fail in Their Multichannel Strategy If They Do Not Execute Strongly on

in-Store Customer Basics"

Augmented Reality Applications

Analysis By: Mim Burt

Definition: Augmented reality (AR) overlays real-time integration of text, graphics, audio and other

virtual enhancements onto screens displaying real-world objects. Elements of AR applications are

becoming social, and are increasingly centered on context-aware location-based services for

mobile devices.

Position and Adoption Speed Justification: AR applications are slowly, but surely, gaining more

visibility in the retail market due to the exponential growth of the smartphone market, the

proliferation of QR (quick response) codes and RFID tags, and the increased hype from technology

vendors highlighting advancements in areas such as GPS, digital camera technology and real-time

analytics. AR is also showing a convergence with the trend of gamification the use of game

mechanics in nonentertainment environments to change user behavior and drive engagement.

The main usage scenarios for AR applications include discovering things in the vicinity of the user,

showing a user where to go or what to do, and providing additional information about an object of

interest. In retail, this translates to customers being able to find locations or products with maps

and real-time directions, having access to detailed product information, being able to contextualize

products and receive personalized promotions.

Tier 1 retailers continue to experiment with AR applications in-store, online and on mobile devices,

and this technology continues to climb steadily up the Hype Cycle. Examples of implementations

include enabling customers to virtually try on clothing online or in a "virtual dressing room" in the

store, seeing how furniture items look in their home or room, seeing what unconstructed models of

objects look like in 3D and allowing customers to interact with animated characters.

With the growth of AR applications for mobile devices, we expect to see more hype and activity in

the retail market in the next 12 months, although we do not expect this to translate into large

numbers of Tier 1 implementations.

Gartner, Inc. | G00234233 Page 13 of 83

User Advice: Retailers should not be dazzled by the current hype surrounding AR applications for

mobile devices, because it will be a while before technology will deliver the refinements needed for

a good customer experience. AR is very demanding, even for high-end smartphones. Small

screens, imprecise GPS locations and inconsistent data mean that the AR user experience does not

always live up to the concept. First and foremost, AR applications should be reviewed in the light of

how they will support customer expectations and enhance the shopping experience in more-

immersive channels such as the store or when shopping at home by accessing the retailer's

website on a PC or laptop.

Due diligence should be performed on what integration is needed at the back end, including

fulfillment processes for example, integration of the real-time offer engines to robust cross-

channel content management systems. This will be the backbone for AR applications to deliver a

good cross-channel experience. For example, an AR application could allow online home shoppers

with webcams to place items of digital clothing over their own image, giving an experience close to

an in-store fitting room. The shoppers can then check stock availability and either order online or

come into the store to purchase the item. Retailers must, therefore, ensure that the AR solution is

integrated with cross-channel stock management systems to ensure that items tried on are in stock,

particularly in store, as on-shelf stock availability is a key basic that customers expect when

shopping in store.

Retailers should also remember to tie up their promotions driven by AR experiences to the other

channels, because customers also expect retailers to deliver a consistent cross-channel shopping

experience.

Business Impact: In the more-immersive environments, such as the store, interaction with AR

applications could drive conversion from interest to actual sales. For example, AR applications in-

store could be used to give the customer detailed information when purchasing complex products,

or customers can get information when trying on apparel in a virtual dressing room, which could

enhance the customer experience and drive sales. AR applications can also be used post-sale (for

example, easily downloadable AR manuals for do-it-yourself projects) to increase customer

satisfaction, improve loyalty and encourage positive customer recommendations to other

consumers who have yet to make their purchasing decisions.

Benefit Rating: Low

Market Penetration: Less than 1% of target audience

Maturity: Emerging

Sample Vendors: GoldRun; Iryss; Layar; Metaio; Total Immersion; Zugara

Recommended Reading: "Multichannel Retailing: Customers Want Consistency in Cross-Channel

Shopping Processes"

"Cross-Channel Consistency: Customer Expectations Vary by Product Category"

Page 14 of 83 Gartner, Inc. | G00234233

Data Visualization in Merchandising

Analysis By: Robert Hetu

Definition: Data visualizing enables retail buyers and planners to problem solve by dynamically

creating views of business intelligence (BI) data in the best format for analysis, including

autoselection of display format and trend identification, and creates temporary hierarchies on the

fly.

Position and Adoption Speed Justification: During the past 10 years, retailers have invested in BI

and retail analytics tools to help associates make better business decisions, although they do not

provide integration to core systems. The complexity of the merchandising process, combined with a

renewed focus on the technology-enabled consumer, is limiting the potential impact of BI insights.

Its translation into action across thousands of stores has become unmanageable without

integration. The use of visualization tools will move quickly through the Hype Cycle. As business

leaders are exposed to the benefits provided, the hype will accelerate and move the technology

along quickly.

The availability of nonstandard data that delivers a more complete picture of consumer behavior

through context, or big data, now provides merchandising with the opportunity to personalize

customer service on a grand scale. This promised level of personalization is reflective of the past

customer experience, where all retail was local, and merchants knew their customers and

anticipated their needs. The central issue preventing the transition to personalization is a lack of a

set of tools that can sort through the volume to find data that make a significant difference in

providing a personalized experience.

User Advice:

BI and retail analytics must be integrated within the merchandising process. Sophisticated, yet

simple to use, data visualization tools must be added to the analytical toolkits of retailers,

because they are required to utilize the knowledge that merchants rely on to drive analytic views

of information from broad data sources and drive the discovery of knowledge. Beneficial

capabilities include:

Dynamic presentation The application automatically determines the best method to

display the data graphically or in a tabular format

Pattern matching The application looks for patterns in the data and drives analysis of

exceptions

Predictive analytics The application attempts to model future results, allowing what-if

scenarios that provide decision guidance for merchants.

Ensure applications are available to support analysis of social media and other contextual data

points. Social media has predominantly been associated with marketing activities, and although

there is not a well-defined science to managing social media, most C-level executives believe

the activity is paying off. Most important for success here is the ability to visualize data, allowing

Gartner, Inc. | G00234233 Page 15 of 83

knowledgeable merchants to search for trends and actionable insights that drive sales and

profits through more-targeted execution.

Evaluate core merchandising, planning and assortment tools to ensure they are capable of

utilizing customer analytic information. If merchandising systems cannot integrate analytics (for

example, building assortments by location cluster based on customer analytics), benefits will

not be maximized.

Ensure speed is acceptable; the application quickly retrieves big data elements, while the user

is actively performing analysis in real time. Subsecond response rates are required.

Business Impact: Without the addition of new tools that are much easier to use than traditional

fare, users will find that their BI investments will pay off even less than before, potentially leading to

merchandising decisions that are worse than before. For example, if a fashion buyer makes a

significant investment in an unproven style for a large group of stores based on incomplete or

inaccurate analysis of customer transaction data, simply due to faulty interpretation of trends, the

consequences will be costly for sales, profits and the BI initiative.

Benefit Rating: Moderate

Market Penetration: 1% to 5% of target audience

Maturity: Emerging

Sample Vendors: Oracle; SAP; SAS

Recommended Reading: "Integrating Analytics with Customer-Centric Merchandising"

"An Overview of the Strategic Technology Map for Tier 1 Multichannel Retailers"

Multichannel Merchandise Planning

Analysis By: Robert Hetu

Definition: Multichannel merchandise planning provides the ability to simultaneously plan

merchandise assortments, purchases and inventory levels across all sales channels, while taking

into account various marketing and event planning calendars, as well as seasonal influences.

Position and Adoption Speed Justification: Many multichannel retailers use separate and siloed

merchandising and planning processes, based on the channel, to bring their product offerings to

the consumer. This can result in an inconsistent customer experience, and may fail to facilitate a

cross-channel sales path. In many ways, an extension of the concept of customer-centric

merchandising, a key aspect of multichannel merchandise planning involves recognition of the

various touchpoints that consumers experience with the retailer, when they occur during the

purchase process, and how they intersect to close a transaction. The ultimate goal is to build a

planning process that supports customer-centric merchandising. Multichannel merchandise

planning is developing at roughly the same pace as customer-centric merchandising. Performance

metrics for each channel are well-defined. However, the way the channels interact and can be used

Page 16 of 83 Gartner, Inc. | G00234233

to influence customer shopping behavior remains elusive. Once resolved, this knowledge can be

utilized to maximize customer experience, transactions and the lifetime value of each customer.

The fast-paced evolution of e-commerce, social media and mobile commerce (m-commerce) is

driving much consolidation and acquisition within the vendor community. This technology will move

to the forefront for investment as retailers continue to look for ways to personalize service.

User Advice: Multichannel consumers have expressed a desire for consistency in pricing,

assortments, promotions and product information, so successful cross-channel planning will

provide a unique opportunity for retailers to develop a point of differentiation by providing

consistency for cross-channel shoppers. Channel-based silos built into the retailer structure are a

significant impediment to the development of multichannel merchandise planning. Organizational

structure change, cross-channel workflows and change management have to be addressed.

Software providers have picked up on the hype surrounding multichannel merchandise planning

and have incorporated this into their language and capabilities. Because planning is central to the

retail process, and multichannel has such a significant impact on organizational structures, a careful

approach to discovery and evaluation is required to ensure that the technology solution will provide

the desired impact. Retailers currently using a homegrown legacy planning system, an Excel-based

approach or an aged software platform should look at packaged solutions that address the entire

planning process. Others that have recently implemented a new planning suite will need to identify

multichannel capabilities within the existing package and consider best-of-breed additions to

supplement capabilities.

In addition, multichannel merchandise planning requires the ability to analyze, share and utilize

consumer information gathered from transactions, customer loyalty programs, credit cards and so

on. This analysis must include channel-based data and lead to a retailerwide view of the customer.

Retailers need to determine how channel growth will impact the consumer profile and which

channels will lead the way to future growth. Various demand planning forecasts from different sales

channels must use the cost elements and planned promotional activity to more accurately

determine margin plans, develop vendor forecasts and inform key stakeholders of performance

expectations.

Business Impact: When done correctly, multichannel merchandise planning will provide

differentiation and competitive advantage for Tier 1 retailers. Customer loyalty, service and brand

perception will be enhanced, driving growth in sales and market share. A cross-channel planning

workflow and business process will ensure that performance and profitability targets are achieved.

Integrated demand planning activities will support better forecasting and inventory management,

accurate open-to-buy planning, and supply chain information for vendors, logistics and

transportation functions.

Benefit Rating: High

Market Penetration: Less than 1% of target audience

Maturity: Emerging

Gartner, Inc. | G00234233 Page 17 of 83

Sample Vendors: Island Pacific; JDA Software; Oracle; SAS

Recommended Reading: "Multichannel Pressures Drive Optimized Merchandising"

"An Overview of the Strategic Technology Map for Tier 1 Multichannel Retailers"

"Cross-Channel Merchandising Success Requires Consistency"

"Multichannel Retailing: Customers Want Consistency in Cross-Channel Shopping Processes"

"How Retailers Can Use Multichannel Customer Intelligence in Merchandising"

At the Peak

E-Paper Signage

Analysis By: Gale Daikoku

Definition: E-paper-based signage is programmable, wireless electronic signage that can be affixed

to store shelves/shelf channels and be displayed as electronic shelf labels (ESLs). It is typically used

in larger form factors as a replacement for paper-based end-cap, department or category signage,

and has higher-resolution displays with pixilated graphics that can appear in two or more colors.

Position and Adoption Speed Justification: "E-paper" is an electronic display technology that has

similar attributes to paper, but it can be written on and erased electronically. Less than 1 millimeter

thick and made of plastic, e-paper does not require a projection device (unlike an LCD-based ESL).

However, the labels typically require a casing to affix and power the labels on store shelves.

Interest in e-paper display technology continues from retailers that are exploring it to power new

types of LCD-based ESLs or as a replacement for paper signage. E-paper requires even less

battery power than LCD-based ESL technology, and Gartner continues to see pricing for shelf-edge

e-paper label costs dropping to be competitive with LCD ESLs at scale, with pricing around $5 per

label.

In the past 12 to 18 months, Gartner has seen a number of North American retailers across a variety

of segments (especially nonfood) revisit the business cases for LCD-based ESLs or e-paper signage

for stores. Several large retailers have trialed e-paper signs, including Tesco, Sainsbury's, Metro,

Groupe Casino, Dixons, Saturn, Best Buy and Sears; however, because deployments in e-paper

signage have been limited to trials, the maturity of the technology is still classified as emerging or

first-generation.

While it can be expected that e-paper ESLs and signage will coexist with LCD-based ESL shelf-

label installations for some time, Gartner believes that the visual quality improvements of e-paper

will continue to generate demand from customers with legacy installations that want to modernize

the look of their signage with the newer e-paper labels. Assuming this demand remains steady, we

expect that the prices of labels will continue to drop, because we have seen competitive pricing for

e-paper shelf-edge labels (which are comparable in size to LCD-based ESLs) that are in the range

of $5 per unit.

Page 18 of 83 Gartner, Inc. | G00234233

User Advice: Ensure that e-paper improves the execution process for price changes, with

readability that is comparable or better than existing formats. Retailers should also ensure that the

necessary change management associated with the price execution process is not overlooked

during implementation.

Business Impact: This technology affects labor productivity, price accuracy and legal compliance

(for example, weights and measures), and can support dynamic pricing. It can also support retailers'

efforts to be more operationally green by eliminating the printing of paper signage in stores. Flexible

displays using e-paper technology offer many potential benefits over other display technologies,

including reduced weight, decreased thickness, improved ruggedness and nonlinear form factors.

Significant improvements in the readability and usability aspects of e-paper score highly in terms of

ease of consumer use.

Benefit Rating: Moderate

Market Penetration: Less than 1% of target audience

Maturity: Emerging

Sample Vendors: Altierre; Pricer; ZBD

Recommended Reading: "Case Study: Groupe Casino and Electronic Shelf Labels"

Multichannel Feedback Management

Analysis By: Mim Burt; Gale Daikoku

Definition: Multichannel feedback management solutions provide surveying and feedback analysis

tools suitable for use across a retailer's channels and brands, including mobile and social. Their use

ranges from one-off, tactical surveys (for example, customers taking a brief survey about their

shopping experience delivered on their point-of-sale receipt, or texting feedback via a keyword or

code that appears on store signage) to ongoing strategic feedback to better understand customers,

employees, products and processes.

Position and Adoption Speed Justification: In retail, the shift of multichannel retailing to business

as usual has heightened interest in multichannel feedback management, which can be implemented

to enable consumers to give retailers instant feedback on the shopping experience in and across

any of the retailer's channels. This type of engagement can create a real-time dialogue with

customers as feedback is captured during the shopping experience.

However, this technology has not had much upward movement on the Hype Cycle, because trials

and the few implementations in Tier 1 retailers understandably focus mainly on customer feedback,

whereas the technology includes other stakeholders, such as employees and suppliers, as well.

Functional enhancements continue to focus on analytics (to determine what to do with the data

collected), including feedback from social media. It is clear that vendors are also beginning to align

with specific vertical industries, such as retail, in an attempt to provide differentiated retail-specific

preconfigured solutions.

Gartner, Inc. | G00234233 Page 19 of 83

User Advice: Retailers should take a strategic view of multichannel feedback management. Data

collected should be analyzed, and the results used to enable real-time decision making, such as

making sure there is good product availability in the store or adjusting staffing levels in the store, or

as a feed into buying or product development decisions. For example, the No. 1 topic of feedback

to date is on product availability, especially in the store.

Retailers can use this information to keep track of channel performance in terms of execution, to

input information into merchandising decisions for example, to fine-tune range selections.

Retailers can also feed the information into the supply chain allocation process to improve product

availability at the store shelf.

Retailers starting out on enterprise feedback projects should follow proper best practices for survey

creation to ensure good response rates and valid responses. They could start with customers in

store, because today and for the near future, the store will remain the hub of the cross-channel

shopping process. When assessing vendors, perform due diligence on whether the vendor has

multichannel capability, because some cover only one channel for example, online customer

reviews.

Business Impact: Multichannel enterprise feedback management provides an integrated view of

feedback data across customers, employees and suppliers in and across the retailer's channels. If

implemented correctly, these deployments will ensure that the right individuals are surveyed at the

right time, in the right channel and with the right questions, thus ensuring maximum response rates

and business insights. This will help you to prioritize customers' issues for attention, such as

improving on-shelf availability, influencing staff motivation and performance, and also improving key

marketing and merchandising decisions.

Benefit Rating: High

Market Penetration: 1% to 5% of target audience

Maturity: Emerging

Sample Vendors: Allegiance; Medallia; Mindshare; Nice Systems; QuickSearch; ResponseTek

Real-Time Store-Monitoring Platform

Analysis By: Mim Burt; Gale Daikoku

Definition: Real-time store-monitoring platforms are a solution that combines dashboards,

business activity monitoring and a real-time data infrastructure to bring together signals from real-

time data sources available in the retail store. These can include traffic counters, queue

management sensors, point-of-sale transaction logs, electronic article surveillance, Internet

Protocol video, Wi-Fi triangulation, mobile triangulation, remote sensors on in-store devices,

pressure sensors and RFID.

Position and Adoption Speed Justification: Today, most retailers that use real-time systems in

the store do so in siloed applications and infrastructures (for example, closed-circuit TV [CCTV] and

traffic counters). Many Tier 1 retailers have focused activity more around queue management

Page 20 of 83 Gartner, Inc. | G00234233

solutions. For example, grocery retailers that have already implemented these solutions for manned

check-out lanes are also implementing the solution for self-check-outs. Retailers are also starting to

use digital video surveillance systems, coupled with analytics software, to measure the

effectiveness of displays, signage and promotions, and to try to sell to shoppers based on their in-

aisle behavior.

However, in the past few years, retailers have been exploring how these real-time technologies

should be combined on a single platform to leverage assets to gain more intelligence in the store.

These platforms can give retailers a real-time monitor of what is happening in their stores.

Vendors have also released next-generation software advancements that include real-time alerts,

shelf inventory monitoring, 360-degree camera integration and employee tracking. Newer solutions

include the use of dual thermal imaging with digital video and stereo video replacing monocular

cameras, as well as software as a service (SaaS)-based delivery models. These monitoring

platforms are complemented with algorithms that can combine and analyze real-time signals to

provide alerts that help retailers take action to avoid stock-outs, keep check-out queues short,

support merchandising decisions and mitigate loss prevention.

In the past 12 months, increased vendor activity has driven more interest around these solutions,

and this is reflected in the movement of this technology nearer to the Peak of Inflated Expectations.

Despite the hype, we still believe that this concept is still relatively new to the retail industry.

User Advice: As retailers upgrade their customer traffic and queue management systems, or any

system that monitors real-time store activity (for example, electronic article surveillance), they

should also think about how to develop a real-time store-monitoring platform. Retailers should look

for vendors that can tie all the real-time sources together and, more importantly, those that have the

expertise to manage the huge data streams from source systems and provide simple, meaningful

actions to store staff and headquarters. Retailers will also need to clearly define how this technology

will aid the various functional roles in their businesses. For example, real-time conversion data can

benefit store staff, even though, traditionally, conversion has been a marketing and merchandising

responsibility. Joint pilots paid for and conducted with consumer packaged goods (CPG)

companies can help retailers to gain insight into customer in-aisle behavior.

Business Impact: At a high level, real-time store monitoring can increase sales and margins, and

reduce costs in the store. More specifically, real-time monitoring with analysis of store operations

can lead to the following benefits: improvement in stock availability; improved customer service;

reduced loss prevention; better execution of processes, including cross-channel processes;

increased sales; and increased loyalty.

Benefit Rating: Moderate

Market Penetration: 1% to 5% of target audience

Maturity: Emerging

Sample Vendors: Brickstream; Checkpoint Systems; Irisys; RetailNext; ShopperTrak

Gartner, Inc. | G00234233 Page 21 of 83

Recommended Reading: "BVI Networks Delivers Real-Time Store Monitoring"

"Why Task Management is a Priority for Multichannel Retailers"

Social Media Analytics for Retail

Analysis By: Robert Hetu; Gale Daikoku

Definition: Social analytics for retail describes the process of collecting, measuring, analyzing and

interpreting the results of interactions and associations among people, topics and ideas. These

interactions occur on various social media sources and provide an important source of feedback for

retailers. Social media analytics is an umbrella term that includes a number of specialized analysis

techniques, such as social filtering, social network analysis, sentiment analysis and social media

analytics.

Position and Adoption Speed Justification: The influence of social networks is growing, and

microblogs can spread news as well as misinformation rapidly. As a result of the growing

influence of social media, and its potential to significantly disrupt or enhance business activities,

retailers need to put tools in place to monitor sentiment about their businesses, as well as the

products and manufacturers that they rely on for revenue generation. They have been used to track

brands as marketers try to determine whether brand assets are appreciating or depreciating based

on consumer statements as evidenced in social media postings, blog entries, microblogging posts

and other Internet media available publicly. By applying these tools in the retail environment,

retailers can not only identify sentiments associated with their brands, but also identify positive and

negative trends regarding the brands that they sell and the individual products that they carry.

Social media is an important source of feedback for retailers. When used by retailers, social media

analytics can identify product trends that are appearing on consumer radars prior to the product

entering the mainstream. These tools can also identify a product or manufacturer that has a

problem in the market, allowing the retailer to adjust pending orders or shipments if necessary.

Most importantly, these tools can help retailers identify potential problems they have with customer

support or sales associate training that may be impacting their businesses on a daily basis more

quickly than they would have if surfaced via other means. Additionally, they can identify members of

social networks that are influential over other customers that may be part of their customer base,

and take efforts to ensure that these influential customers are satisfied with the retailer and its

product offerings; happy customers tend to be advocates for the retailer. Given the level of hype

surrounding social media, we expect this technology to move through the phases of the Hype Cycle

rapidly, reaching the Plateau of Productivity within five years.

User Advice: A retailer that has not yet investigated the social media analytics applications

available in the market should evaluate potential providers of these tools for their usability and

applicability to the retailer's customer segment. When evaluating vendors for social media analytics,

look for vendors that have strengths in other product offerings that involve retail so they can

demonstrate competency and understanding of the retail market segment. If you have other

analytics applications, assess those vendors for planned or existing social media offerings to

maximize the benefits of the social media analytics. If your existing vendors do not offer social

media analytics, evaluate the integration potential for these analytics with other applications that

Page 22 of 83 Gartner, Inc. | G00234233

you have, such as merchandising analytics or real-time offer engines. This technology segment is

also related to the multichannel feedback management entry in this Hype Cycle. Social media

analytics stands on its own, but it needs to be considered with analytics from other channels/

touchpoints for example, analytics derived through solutions for multichannel feedback

management, to give retailers an overall assessment of their customers' shopping experiences.

Business Impact: The impact of social media analytics on your business can be substantial,

especially if your existing customers are avid users of social media. Even if this is not the case, the

capability to identify emerging popular products or problem products before an issue surfaces in

sales figures can be valuable. These tools have the potential to decrease the inventory that may

need to be discounted to sell through, or increase margins on your overall selection. For example, if

a fashion buyer makes a significant investment in an unproven style for a large group of stores

based on incomplete or inaccurate analysis of customer social media, simply due to faulty

interpretation of trends, the consequences will be costly for sales and profits. Expect that in the

future these analytics will offer some predictive insight into what should sell well, helping to manage

inventory more effectively.

Most importantly, these tools can deliver an early indicator of problems in the customer base and

allow a retailer to be proactive in addressing the issues that surface in social media, thereby

preventing damage to the retailer's brand.

Benefit Rating: High

Market Penetration: 1% to 5% of target audience

Maturity: Emerging

Sample Vendors: Alterian; Buddy Media; Klout; Kontagent; Lithium Technologies; Oracle; Radian6;

SAS; Sysomos; Webtrends

Recommended Reading: "An Overview of the Strategic Technology Map for Tier 1 Multichannel

Retailers"

"Turn Information Into Insight With Social Analytics"

Multichannel Master Content Management for Retail

Analysis By: Mim Burt; John Davison

Definition: Multichannel retail enterprise content management relates to all types of structured and

unstructured content for products, customers, employees and suppliers. Included in this definition

is structured content, such as master data, as well as unstructured content for example,

documents, images of forms, photographs, XML components, video clips, podcasts and email

messages. Having a combined, consistent view of structured and unstructured content underpins

the knowledge needed to make effective multichannel business decisions.

Gartner, Inc. | G00234233 Page 23 of 83

Position and Adoption Speed Justification: There are many vendors that provide enterprise

content management (ECM) and master data management (MDM) systems with components such

as product information management and customer data integration. However, retailers are starting

to realize that all the disciplines previously associated with the management of structured

information like master data need to be applied to unstructured data as well. This is particularly so

when taking into account the emerging touchpoints that the consumer has with the retailer, such as

mobile and social networks.

This is a major issue for multichannel retailers. However, although there has been increased interest

and some hype, there have not been any implementation references in major Tier 1 retailers, and in

the past 12 months, retailers have largely focused their investments on multichannel item master

projects. Retailers are also coming to grips with the implications of multichannel retailing becoming

"business as usual," which will, in some cases, necessitate complex projects to implement master

content management across the channels. There is also a dearth of vendors that are in a position to

deliver this type of truly comprehensive multichannel retail content management solution.

User Advice: Before implementing a content management system, perform due diligence on

identifying and mapping the "as is" position on all the sources of structured and unstructured data

and information, where they are currently stored, and how they are used in the context of the core

retail business processes. This will afford opportunities to streamline business processes and also

helps to remove redundancies and duplication in preparation for a phased implementation of a

multichannel content management system. To deliver a master content management solution

across the channels also requires a merging of the metadata models for both structured content

(MDM) and unstructured content (ECM), with MDM taking the governing role.

Business Impact: As the multichannel shopping experience becomes more and more important,

retailers are being driven to create, capture, manage, store, and deliver content and documents

related to multichannel customer and business processes to provide a single view of business

information across the enterprise. Supported by good master data management, multichannel retail

content management solutions will enable retailers to increase efficiency in their core business

processes to improve the multichannel customer shopping experience and minimize multichannel

operating costs for example, real-time feedback provided by customers through any channel that

leads retailers to analyze structured data (such as store operations metrics and contact center

metrics) and to adjust staffing levels "on the fly."

Benefit Rating: High

Market Penetration: 1% to 5% of target audience

Maturity: Emerging

Sample Vendors: hybris; IBM

Recommended Reading: "The Multichannel Revolution Is Ending: The Consumerization of Retail

Continues With Personalization and Customization"

"Multichannel Retailing: Customers Want Consistency in Cross-Channel Shopping Processes"

Page 24 of 83 Gartner, Inc. | G00234233

"Cross-Channel Consistency: Customer Expectations Vary by Product Category"

Social Coupons

Analysis By: Gale Daikoku

Definition: Social coupons are a form of e-coupon that is delivered through a website community.

Social coupons are found on membership sites that offer a local retailer's products/services to

consumers at steep discounts for example, selling a coupon at face value of $10 for $20 worth of

a retailer's product/service. The purpose of these communities is to provide consumers access to

discounts, and as a result, they do not typically drive customer loyalty, at times discounting

purchases that might have been made by the customer without the coupon.

Position and Adoption Speed Justification: Social coupon sites originally saw strong growth

because they offered significant discounts many offered up to 50% discounts to consumers that

buy the coupons. Social coupons typically require a minimum number of buyers for the offer to

become effective and can have a limit imposed on the number of consumers who can take

advantage of the offer. The social coupon provider then shares the proceeds with the local

merchant.

Retailers were originally attracted to the sites because they offered the ability to attract new

customers to their businesses. There were few barriers to entry for social coupon sites, and thus the

market has seen hundreds of variations launched in just a couple years. This has led to a high

degree of hype, creating fragmentation in a hypercompetitive environment with many sites for

retailers to qualify and consumers to find. Given the continued hype surrounding social media,

Gartner expects this technology will continue to advance rapidly through the Hype Cycle, reaching

the Plateau of Productivity within a few years.

User Advice: The greatest appeal of social coupon sites has been for small retailers needing to

expand their customer bases. As such, large retailers may find that these sites are less than

effective unless they are opening new locations and want to attract customers using the social

coupon instrument. Large retailers may want to consider these sites to close out an end-of-life

product in an overstocked position. Retailers that choose to participate in social coupons should

ensure that they place limits on the promotion so they can be certain they can fulfill on the offer

particularly if in stores to avoid upsetting and potentially losing customers. A recent Gartner

survey shows that, while 41% of all U.S. consumers are currently members of a social coupon site

with 15% showing interest in joining, 44% are not at all interested in joining. And just because

consumers join a site does not guarantee these customers want these coupons. Given this

guidance, retailers may be best-served by taking a wait-and-see attitude about social coupon sites.

Business Impact: Assuming the social coupon sites continue to maintain popularity and

membership, smaller retailers or large retailers entering new markets may find that they are

invaluable in establishing a new business or launching new products/services.

Benefit Rating: Low

Market Penetration: Less than 1% of target audience

Gartner, Inc. | G00234233 Page 25 of 83

Maturity: Emerging

Sample Vendors: 1SaleADay.com; Groupon; LivingSocial; Woot

Real-Time Customer Offer Engines

Analysis By: Gale Daikoku; Robert Hetu