Академический Документы

Профессиональный Документы

Культура Документы

On The Economics of 3G Mobile Virtual Network Operators (Mvnos)

Загружено:

Tran Quoc TamИсходное описание:

Оригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

On The Economics of 3G Mobile Virtual Network Operators (Mvnos)

Загружено:

Tran Quoc TamАвторское право:

Доступные форматы

Wireless Personal Communications (2006) 36: 129142

DOI: 10.1007/s11277-006-0027-5

C

Springer 2006

On the Economics of 3G Mobile Virtual Network Operators

(MVNOs)

D. VAROUTAS, D. KATSIANIS, TH. SPHICOPOULOS, K. STORDAHL and I. WELLING

Department of Informatics & Telecommunications, University of Athens, Panepistimiopolis, Ilisia, GR 157-84,

Athens, Greece

E-mail: D.Varoutas@di.uoa.gr

Abstract. The paper assesses the market conditions and dynamics, the architectures and the different approaches

for deployment of 3G Mobile Virtual Network Operators (MVNOs), in an attempt to address specic advantages

and pitfalls. Following the denition of appropriate service sets and tariff structures, and taking into account

demand scenarios, a techno-economic model has been developed, in order to compute key economic indicators.

The paper presents techno-economic results of specic business cases and deployment alternatives for an average

large European country and a smaller, Nordic-type country. Fixed and variable costs have been identied and the

business case shows how different service sets lead to different costs. Different MVNO business proles have been

investigated. Protability for all scenarios and business proles has been calculated, presented and discussed. Major

opportunities and threats, as well as critical parameters and uncertainties have been identied through sensitivity

analysis.

Keywords: mobile virtual network operators, (MVNOs), UMTS, 3G market, 3G systems, 3G economics, mobile

internet economics, techno-economics, mobile operators, virtual network operators

1. Introduction

While the majorityof Europeancounties have alreadyassignedthirdgenerationmobile licenses

and a growing number of countries worldwide are starting to assign their licenses, there is a

number of rms working in this sector which have been left without a license in the race towards

mobile telecommunications, widely regarded as a business opportunity characterized by an

extraordinary potential for prot. On the other hand, license fees have risen to such heights

in some countries that they now act as an economic burden for the winning companies. For

those companies the question is how to exploit third generation (3G) mobile markets with

other partners. This situation favours solutions for those building their business without a

radio access network. Many rms, either working in the mobile sector worldwidely or not,

have expressed their interest to enter this market through the networks operation or the service

provision channel. For those, which have been left without a license, a new channel to enter

the market and take part in this big game is the Mobile Virtual Network Operator (MVNO)

channel.

The ability and the attractiveness of MVNOs to offer competition will be severely limited

if Mobile Network Operators (MNOs), who effectively control facilities and infrastructure

and share available frequencies with MVNOs, are in a position to charge monopoly prices for

their services. Because MNOs are in many cases vertically integrated into the competitive 3G

markets, they may also have incentives to restrict access to the facilities required by competitors

130 D. Varoutas et al.

through the imposition of prices, which make it unprotable for MVNOs to enter the market

and effectively compete for 3G customers.

As mobile market becomes more competitive and mature, cost-based charging for access

to a 3G MNOs network by MVNOs would become less necessary but could also damage

incentives to invest in infrastructure, particularly in the early stages of investment in 3G

systems. These arguments should be assessed within the context of the overall objective of

promoting and strengthening the competitive framework for mobile services, which is the

prime rationale for allowing MVNOs to operate in the market in the rst place [1]. Market

factors such as population density, customer type, timing of entry and penetration levels by

new entrants will determine which strategy is used in different areas and at different stages of

market development.

The European Union (EU) Information Society Technologies (IST) TONIC project [2] is a

precursor in the investigation of the economic side of telecom investment projects and conse-

quently this paper based on TONICMVNObusiness case is a rst step in the assessment of the

market conditions, the architectures and the potential for a protable business case of a MVNO.

The MVNO business case is based on 3G business cases, particularly regarding the technical

infrastructure, but the 2,5Gunderlying infrastructure as an initial step is also taken into account.

Following the denition of appropriate service sets, and taking into account demand scenarios

established within the project, this work has focused on developing a techno-economic model,

based on TONIC tool. Tariff structures have been applied to compute the key economic indi-

cators, Net Present Value (NPV), Internal Rate of Return (IRR) and Payback Period.

2. Current Situation Regarding MVNOs

2.1. MVNO BUSI NESS MODELS

According to press releases and company reports [3, 4], by next year there will be more than

100 virtual operators in the European markets, and almost 40 existing and planned virtual

operators in USA. In the 2G world, a lot of markets are coming fast to a phase of maturity,

above all thanks to the results obtained with the rst 2G licenses. In many countries, the

reserved 2G frequency band is nearly saturated at least in the urban areas, so not much room

is left for new players. Obviously, the existence of a market for mobile services is more than

conrmed today and there are always more people who see in UMTS the possibility to take

part in a big game.

While entry into xed telecom markets may be relatively straightforward, the story is

different for those seeking to become a cellular operator. Traditionally, there are two main

routes used to supply cellular telephony services: network operation or service provision

channels. But supplying services through ones own network requires spectrum; a resource

that is limited in supply.

One of the possible ways to enter the world of 3G services, which in recent times have

drawn considerable attention, is that of the MVNO model, which assumes the conclusion of

commercial agreements with an MNO.

An obvious doubt hangs over the degree to which an operator is considered virtual in

comparisonwithactual networkoperators. The points of viewcanbe verydifferent, particularly

if the denitionof the virtual operator is takentooliterallyandrestrictively. For example, certain

analysts afrm that a MVNO must necessarily have a network code and SIM cards of its own

On the Economics of 3G Mobile Virtual Network Operators (MVNOs) 131

Figure 1. MVNO types and operations vs MNOs and ESPs.

[5]. On the other hand, the UK Regulator (OFCOM) considers as a MVNO, those without

a SIM card, which can be considered as Enhanced Service Providers (ESPs) [6]. A MVNO

provides cellular services without owning spectrum access rights. From the customers point

of view, a MVNO looks like any MNO, but a MVNO does not imply ownership or operating

base station infrastructure. Figure 1 illustrates the MVNO idea comparing to other mobile

business schemes.

There are different scenarios for a MVNO approach and consequently different architec-

tures for the MVNO such as:

A full MVNO, with its own SIM card, network selection code and switching capabilities as

well as service center but without spectrum [5].

Indirect Access MVNO (IA-MVNO) or ESP without SIM card, but with own core network

(circuit switched and/or packet) and service facilities, e.g. own IN or IP application servers

[6].

Wireless Internet Service Provider (WISP) without own core network; basically an Internet

portal providing wireless IP services.

Technological developments such as Virtual Home Environment (VHE) services [7] open a

newmarket for MVNOs and therefore exploitation opportunities for their MNOs. It is foreseen

that MVNOs can act as an important driver for emerging 3G markets since potentially they

would offer customers additional choices of services.

In a few countries, the 3G witness the emergence of one or two new operators but, in many

cases, the licenses have been assigned to existing 2G operators. The mobile market is, without

doubt, considered important by a lot of rms and in view of the surrounding uncertainty, big

new entrants will be content with taking the opportunity of the virtual model, at least for the

time being.

Considering the fact that, for the user, the emphasis is placed on the user interface and much

less on the network infrastructure management, the virtual model, combined with a careful

preparation of the contents and portals, could bring many advantages for operators addressing

family users, for example. The new entrants inclined towards the virtual model, will in most

cases be quite well known names, with considerable experience in the marketing, distribution

andthe management of customer relations. These companies will focus prevailinglyonservices

of great added value and, above all, on m-commerce.

The virtual operator can represent a threat for new entrants on the 3G markets. In an

environment of mass market, where social, emotional and cultural criteria often prevail, each

132 D. Varoutas et al.

new entrant will attract a lot of attention. It is nonetheless reminded that the network operator,

following an agreement such as that of the Virgin model (which according to OFCOM is an

ESP [6]) obtains new clients and new earnings without investing actually anything additional

in infrastructure and in the management of new services.

This prospect, in the 3G world, could become clearer, bringing 3G network operators

immediate revenues so as to recover, as soon as possible, at least a part of the investment

made. Furthermore, the virtuality offers prospects of expansion at an international level in

markets that, up to now, have been closed to the participation of operators from different

areas. For example, the European 2G operators could become virtual operators on the CDMA

networks in U.S. and vice versa. However, at least for the time being, the reticence towards the

virtual model will in all the likelihood go on creating impediments and brakes to its diffusion.

In reality, both in the long and short run, the MVNOmodel represents a protable option for all

parties involved. The fear of losing customers to a virtual operator could in fact make mobile

network operators lose an opportunity for development.

2.2. REGULATORY FRAMEWORK REGARDI NG MVNOS

Regulators views towards MVNOs vary signicantly at present and in many countries reg-

ulators are still considering whether and to what extent regulatory intervention is necessary.

Within the EU, directives on telecommunications regulation currently do not mandate MVNOs

access to a licensed 3G operators network. In many European countries, discussions and con-

sultation about MVNO regulation have been initiated but no regulation actions have been

undertaken so far.

Those in favour of regulation argue that the mobile network operators control the available

radio spectrum, which is a scarce resource and an entry barrier for new mobile network

operators. Also, mobile network operators are less likely to provide MVNO access unless it is

a regulatory requirement. On the other hand, mobile operators have very high prot margins

and in some cases signicantly over costs. Current regulation, as interpreted by some national

regulatory authorities, already gives themthe power to enforce an access obligation on existing

operators following the paradigm of local loop unbundling.

OFCOM recently assessed the state of policy development on MVNOs in other European

countries and found that, with a few exceptions, it is premature for European regulators. Is-

sues surrounding the MVNO concept have not been discussed in great detail, and hence most

regulators are not yet in a position to provide statements of policy, with the exception of Scan-

dinavian regulators which have formally ruled on disputes relevant to the MVNO concept in

response to requests they have received from Sense Communications (a Norwegian based ser-

vice provider), which had attempted to negotiate access to airtime from the existing operators.

The Hong Kong regulator, the Ofce of the Telecommunications Authority (OFTA), has

indicated that 3G networks should be opened up to MVNOs. In an analysis paper based on an

industry-wide consultation [8], OFTA proposed a 3G licensing framework based on an open

network requirement. Under this requirement, 3G service provision would be separated from

network operation in order to enhance competition in services and provide customers with

more choice and price packages. Successful bidders of 3G licenses have been required to

make at least 30 per cent of their network capacity available to unafliated MVNOs and

content and service providers. Furthermore, any successful bidder that currently operates a 2G

network must agree to offer domestic roaming service to all new entrants.

On the Economics of 3G Mobile Virtual Network Operators (MVNOs) 133

2.3. I NTERCONNECTI ON MODELS

Cost-based prices are desirable, especially for regulatory efciency, in situations where com-

petition is ineffective or immature as in the 3G markets. However, the determination of costs

is anything but uncontroversial and objective [9, 10]. In general, it is widely accepted that

termination costs are higher on mobile networks than on xed-line networks [11]. This is

mainly based on the additional costs associated with mobile network elements such as stations

that do not exist in xed-line networks. The costing of xed-mobile interconnection is similar

to those of interconnection in general with the exception of the different investments and the

rapid changes in the technology. It is not clear which is the best methodology, or even if the

resulting prices are consistent with what happens in the competitive mobile market.

A recent study of Europe-wide mobile costs for the European Competitive Telecommu-

nications Association (ECTA) [12], indicated the controversy and the sensitivity of costing

methodologies in the rapid changing mobile market. The Long Run Incremental Costs (LRIC)

methodology, used in this analysis, showed that mobile operators charge around 40 to 70%

above their LRIC costs and operators argue that LRIC methodology was inappropriate for

dynamic and rapidly growing markets [13].

As already described, there are different strategies that could be employed by an MVNO

in order to enter the 3G markets. As a consequence, the pricing principles that apply to the

provision of services to MVNOs should reect the nature of an MVNOand the extent to which

it is engaging in interconnection or pure resale of network capacity. An operator-like MVNO

with extensive networks of its own will only make minimum use of the MNOs infrastructure

and should be entitled to interconnection on the same basis as the MNO.

OFCOM takes the view that the logical principle for MVNO charging would be retail-

minus which sets an interconnection price by looking at foregone costs and deducting these

fromthe retail price. The costs foregone would be those associated with customer care, billing,

provision of value-added services and transportation. OFCOM concludes that simple resale

of 3G capacity can encourage entry of efcient service providers of retail 3G services.

3. Methodology and Assumptions

The techno-economic modeling was carried out using the TONIC tool, which has been devel-

oped by the IST-TONIC project [2]. This tool is an implementation of the techno-economic

modeling methodology developed by a series of EUco-operation projects in this eld. The tool

has been extensively used in several techno-economic studies [1416] among major European

telecom organizations and academic institutes.

The core of the models operation is a database, where the cost gures of the various network

components are reposited. These gures are constantly updated with data gathered from the

biggest European telecommunication companies. The database outputs the cost evolution of

the components over time. A dimensioning model is used to calculate the number of network

components as well as their cost, for the set of services and the network architectures dened.

Finally, the future market penetration of these services and the tariffs associated with them,

which have been calculated through market forecasts and benchmarking, are inserted into the

tool. All these data are forwarded into the nancial model of the tool that calculates revenues,

investments, cash ows and other nancial results for the network architectures for each year of

the study period. An analytical description of the methodology and the tool can be found in [17].

134 D. Varoutas et al.

The MVNO business case has exploited useful insights from previous 2G and 3G business

cases [15, 16]. Following the denition of appropriate service sets, specic demand scenarios

and tariff structures, the key economic indicators have been calculated, namely NPV, IRR and

payback period. Risk analysis has also been performed to identify the most critical parameters

inuencing the protability of this business case.

A time frame of ten years (20032012) has been selected, as well as a discount rate of

10% reecting a mean value among the major European Telecommunication Operators. The

modeling takes into account two kinds of basic deployment areas: a large European country

such as Germany or France, and a small European country exemplied by Scandinavian

countries.

Two different business proles of a Full MVNO have been constructed and analysed. In

the rst prole, the MVNO is a telecom operator or a power company without a mobile

license but well known as an operator aiming to complement/expand other services such as

xed broadband services. This will be the Operator-like MVNO business prole. This kind of

MVNO take advantage of several issues such as initial market share, lower training costs etc.

In the other prole, the MVNO is a high brand-value and large customer base company

aiming to expand its business in the mobile area and therefore to attract market share from

every MNO. Therefore several advantages (e.g marketing costs) and pitfalls (e.g. leased lines

costs and personnel costs) must be taken into account as key element in this case. This is

actually a Service-oriented MVNO business prole.

Different demand models and service penetration rates have been dened in order to take

into account these two different cases for a MVNO. This business classication leads to specic

service packages offered by these potential MVNOs and has been attributed to MVNObusiness

proles.

The country types differ in several points, in addition to their geographical and demographic

features. Firstly, the operator in the large country is assumed to have signicant license costs

100 per inhabitant. As in the case of France, these fees are staggered. Secondly, the subscriber

saturation level is estimated to be higher in the small country type 95% versus 90% in the

large country type. Thirdly, consumption differs in that the Scandinavian users are assumed to

have 20% greater usage than their counterparts in the larger country. This consumption leads

to a proportionately larger ARPU. Lastly, terminal subsidies are 150 per newsubscriber in the

large country type and 40 in the small country type. The two proles for each type of country

are differentiated in terms of greater usage (20% increase of the service-oriented MVNO) and

associated consumption and ARPU. In addition, different initial market position is taken for

granted between them. For the operator-like MVNOan initial market share of 2%is considered

which is based on observations among all third and fourth entrants in the 2G markets.

4. Results and Discussion

In this analysis, which is based on assumptions described previously, the protability of the

two full MVNO proles both in large and small countries has been presented through specic

calculations.

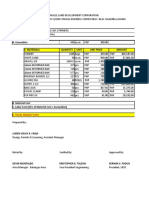

The main economic results for the four basic scenarios are illustrated in Table 1. These

results show that companies aiming to operate 3G services can be beneted from acceptable

NPV and IRR gures. In more detail, operators investing in MVNO rollout benet from more

or less the same payback period and rather interesting economic gures. It can be also observed

On the Economics of 3G Mobile Virtual Network Operators (MVNOs) 135

Table 1. Summary of the basic results

Large Small

Country type

MVNO type Operator like Service oriented Operator like Service oriented

NPV (M ) 111 332 259 28

IRR 12% 15% 40% 14%

Rest Value (M ) 48 39 5 2

Pay-back period (years) 8.2 7.7 5.0 7.6

Number of customers 4,800,000 3,600,000 640,000 210,000

Total mobile penetration end 90% 90% 95% 95%

Total UMTS penetration end 76% 76% 80% 80%

Investments (M ) 144 121 55 49

that the investments are more or less proportional to the population for the large country but

almost double for the small country. This difference is based on the necessity to offer coverage

and therefore buy equipment that is not fully utilised. The below-described gures are for

rather pessimistic market shares (all are considered more or less new entrants) and surely

MVNO can expect more optimistic results.

For the case of a small country, the initial position of the MVNO in the 2G world, is

mandatory for a successful business in the emerging 3G market. On the other hand, stronger

service differentiation is followed by larger investments while the payback period is remaining

the same (Figure 2).

The breakdown of total investments in the large country case is given in Figure 3. This

chart conrms that the bulk of the OPEX (>70%) is accounted for the interconnection costs.

The Running cost items include the following:

Figure 2. Cash balance and cash ows for a operator-like MVNO operating in two different countries. (Large

country Left axis, Small Country Right axis) (LC = Large Country, SC = Small Country).

136 D. Varoutas et al.

Figure 3. Breakdown of non-discounted Operational Expenditures (OPEX), large country scenario (operator-like).

Leased Line Costs for connecting to MNO network, the number of which is calculated

according to the downlink capacity needed.

Interconnection Costs: calculated on a retail-minus basis through the trafc generated by

MVNOs customers.

Terminal subsidies which differ between country types; 150 in the large country and 40

in the small country.

Employee and Training Costs which are related to customer service and incurred essentially

during the rst years.

Marketing Costs including advertising and sales costs.

Maintenance for all equipment on an annual basis as 5% of the investment cost.

The main difference between running costs in the large and small country types is the

marketing costs, which is associated with the population. Terminal subsidies are also lower in

the small country (40 versus 150 ). Personnel costs included both technical training costs,

and customer service costs, which increase in proportion to customer numbers, then tend to

atten. Marketing costs largely predominate in the starting year. These costs will also most

likely continue at a high level during the actual service launch year.

Outlining the ndings of this work, acceptable business opportunities can be observed

through these calculations in terms of forecasted and actual mobile penetration across Eu-

rope. Agreements with Mobile Network Operators (MNOs) for spectrum usage and inter-

connection give to MVNO enough space for business opportunities and acceptable prot

margins.

Sensitivityanalysis is usedtoidentifythe most critical parameters affectingthe performance

of the MVNO but also to nd the impact of specic uncertainties regarding market inputs and

On the Economics of 3G Mobile Virtual Network Operators (MVNOs) 137

Figure 4. Sensitivity results for an operator-like MVNO in a large country (NPV in Meuros).

business agreements such as interconnection costs, which could be the turning point for this

business case and the MVNO must have hard negotiation with the MNO in order to keep

the interconnection costs as low as possible. In the other hand the regulators should protect

the new companies and ensure that the interconnection price level will boost the overall

competition.

Regarding the other cost structures, usage and tariff levels have greatest impact. All the

sensitivity results are illustrated in Figures 4 and 5. The low value represents the value

obtained when the nominal parameter value is reduced by 50%and the high value represents

the result when the nominal parameter value is increased by 50%.

The tariff and usage levels are the most critical parameter for the economic criteria

NPV and IRR outside the interconnection related costs. The model links revenues with

usage levels, which means that a 50% increase in revenue corresponds to a 50% increase

in usage. Under these circumstances, it would be expected that network costs would in-

crease accordingly. However, since network costs are essentially dictated by coverage con-

straints and not by capacity constraints, an increase in usage translates only as greater rev-

enues, while the corresponding increase in costs is minimal, and relates to core network

elements.

In the large country scenario, a 50% reduction in tariff/usage levels leads to a negative

Net Present Value over the study period (6166 Meuros, Figure 4), and a 35% reduction

leads to a null NPV, i.e., cumulative costs (CAPEX +OPEX) are only just recovered by 2011

(Figure 4). This information provides the operator with an idea of its latitude for changing

rates in response, say, to sharp price reductions triggered by a competitor, all other parameters

remaining equal.

In the small country scenario, NPV is becoming negative for a 50% reduction with respect

to the nominal usage level (which is 20%greater than in the large country). In the large country,

if this saturation level is reduced to 50%, the NPVis negative (114 MEuros), and it is zero for

a 20% reduction, which means a level of 72% for the total mobile penetration (Figure 4). This

138 D. Varoutas et al.

Figure 5. Sensitivity results for an operator-like MVNO in a small country (NPV in Meuros).

information is good news for the operator, since overall mobile penetration already exceeds

this critical point. In the small country (Figure 5), we cannot nd a null NPVfor overall mobile

penetration of 50%. Here again, this level has been largely exceeded in the Nordic countries,

hence there is no cause for concern over this parameter.

In the large country scenario, the 3G MVNO is assumed to have a 2% market share

throughout the study period. However, the impacts of variations in both start and end market

share is of great interest. The graphs show that the beginning and end market shares indeed

affect NPV and IRR. For the small country, only an initial position of more than 1% can lead

to a protable business. But this is probably the case for every company aiming to enter 3G

market. On the other hand, a larger end market share can overcome this.

Regarding the other parameters, only Operations and Maintenance costs seem to have a

signicant impact. However, these costs are quite inelastic since they are related to personnel

costs, and the operator does not usually have much leverage to reduce them signicantly.

5. Conclusions

The interest of companies, working or not in the mobile sector, entering this market is self-

evident and many of them are looking for specic channels to start offering services. The

channel of MVNOis either complementary to service provision channel or to operator channel

but it is still a way to take part in this big game.

This paper is a rst step in the assessment of the market conditions, the architectures and

the potential for a protable business case of a full MVNOaiming to operate in a large or small

European country focusing on either wide market or lucrative market segments. In this analysis,

subject to assumptions described herein, the protability of MVNO both in large and small

countries has been presented. Furthermore, the two different business proles associated with

different plans for service provisions have been analysed. The protability for all these cases

has been presented and acceptable for shareholders NVP and IRRgures have been calculated.

On the Economics of 3G Mobile Virtual Network Operators (MVNOs) 139

Acceptable business opportunities can be observed through these calculations in terms of

forecasted and actual mobile penetration across Europe. Agreements with Mobile Network

Operators (MNOs) for spectrum usage and interconnection give to MVNO enough space for

business opportunities and acceptable prot margins.

Both infrastructure costs (which are high due to difculties to obtain volume discounts)

and interconnection costs are too critical for the success of MVNOs. Marketing and entry

costs in general can be a burden for a potential MVNO but this can be overcome by means

of a high brand rm or an already operating company. Although revenues from the provision

of broadband services are missing from current MVNO business plans this could be another

opportunity for the MVNOto expand its business in the future. In reality, the MVNOway to 3G

games represents a protable option for all involved parties and a key enabler for technology,

network and services providers.

Acknowledgments

This work has been performed in the framework of the IST project IST-2000-25172 TONIC,

which is partlialy funded by the European Union. The authors would like to acknowledge the

contributions of their colleagues from Nokia Coorporation, Telenor AS Research And Devel-

opment, France T el ecomResearch and Development, National and Kapodistrian University of

Athens, ATLANTIDE, Swisscom AG, Universidade de Aveiro and T-Systems Nova GmbH.

References

1. ITU, Mobile Virtual Network Operators, ITU News, 2001. Available at http://www.itu.int/itunews/issue/

2001/08/mvno.html.

2. IST-TONIC, EUIST, Techno-economics of IPOptimised Networks and Services, IST-2000-25172. Available

at http://www-nrc.nokia.com/tonic/.

3. Analysys, 3G, MVNOs & Acquisitions: Opportunities for Entering New markets, Available at

www.analysys.co.uk.

4. G. Zibi, Pyramid Research, MVNOs in Emerging Markets, 2005. Available at www.pyramidresearch.com.

5. OVUM, Virtual Mobile Services: Strategies for Fixed and Mobile Operators, Available at www.ovum.com.

6. OFCOM (ex OFTEL), Statement on Mobile Virtual Network Operators, September 1999. Available at

http://www.oftel.gov.uk/competition/mvno1099.htm.

7. F. Daoud and S. Mohan, Strategies for Provisioning and Operating VHE Services in Multi-Access Networks,

IEEE Commun. Mag., Vol. 40, p. 78, 2002.

8. OFTA, Open Network: Regulatory Framework for Third Generation Public Mobile Radio Services in Hong

Kong, Discussion Paper, January 2001.

9. D.M. Leive, ITU, Interconnection: Regulatory Issues, 4th Regulatory Colloquium, Geneva, 1921 April

1995, Available at http://www7.itu.int/treg/RelatedLinks/LinksAndDocs/interconnect.asp.

10. W.H. Melody, Telecom Reform: Principles, Policies and Regulatory Practices. Technical University of

Denmark, 1997.

11. OECD, Cellular Mobile Pricing Structures and Trends, DSTI/ICCP/TISP(99)11/FINAL, May 2000.

Available at http://www.oecd.org/dsti/sti/it/index.htm.

12. Analysys, Economic Studies on the Regulation of the Mobile Industry: Final Report for ECTA, February

2000. Available at www.analysys.co.uk.

13. V. Clark, Total Telecom, Business & Regulatory: ECTA Pressures Regulators on Fixed-Mobile Access

Charges, Available at http://www.totaltele.com/view.asp?ArticleID=26961&Pub=tt

14. T. Monath, et al., Economics of Fixed Broadband Access Network Strategies, IEEE Commun. Mag., Vol. 41,

pp. 132139, 2003.

15. D. Varoutas, et al., Business Opportunities Through UMTS-WLAN Networks, Ann. Telecommun., Vol. 58,

pp. 553575, 2003.

140 D. Varoutas et al.

16. D. Katsianis, et al., The Financial Perspective of the Mobile Networks in Europe, IEEE Pers. Commun.,

Vol. 8, pp. 5864, 2001.

17. L. Ims, Broadband Access Networks Introduction Strategies and Techno-economics Evaluation. Chapman &

Hall, 1998.

Dimitris Varoutas holds Physics degree and M.Sc. and Ph.Ddegrees in electronics and radio-

communications from the University of Athens. He is a research fellow and adjunct lecturer

in the Department of Informatics and Telecommunications of University of Athens. He is also

an adjunct lecturer in the Department of Telecommunications of the newly founded University

of Peloponnese. He has participating in numerous European R&D projects in the RACE I

&II, ACTS, Telematics, RISI and IST framework in the areas of telecommunications and

Technoeconomics. He is an adviser in several organisations including OTE and EETT (Greek

NRA for telecommunications) in the elds of telecommunications, broadband and mobile

services, licensing, spectrum management, pricing and legislation. His research interests are

optical, microwave communications and technoeconomic evaluation of network architectures

and services. He has more than 30 publications in refereed journal and conferences in the area

of telecommunications, optoelectronics and technoeconomics. He is a member of IEEE and

serves as reviewer in several journals and conferences.

Dimitris Katsianis received the Informatics degree and the M.Sc in Signal Processing and

Computational Systems fromthe University of Athens. He is a research fellowin the Informat-

ics Department of University of Athens. He was technical consultant scientic co-operator for

Hellenic TelecommunicationOrganisation(OTE) innetworkingaspects concerningsimulation

of ATMnetworks and Management in an all Optical network, participating in several Eurescom

(European Institute for Research and Strategic Studies in Telecommunication) projects. He

was consultant in investment analysis projects for OTE Consulting S.A. He was also tech-

nical consultant in Telecommunication and signal processing for Space Hellas and technical

On the Economics of 3G Mobile Virtual Network Operators (MVNOs) 141

consultant in Networking Applications for ICL-Hellas. He was participating in several ACTS

and IST projects (AC364 OPTIMUM, AC364TERA, IST 25172-TONIC, etc.) as the case

study leader for 3G and 4G business cases. He has more than 25 publications in journal and

conferences in the eld of techno-economics and 3G-network design.

Thomas Sphicopoulos received the Physics degree from Athens University in 1976, the

D.E.A. degree and Doctorate in Electronics both from the University of Paris VI in 1977

and 1980 respectively, the Doctorat Es Science from the Ecole Polytechnique Federale de

Lausanne in 1986. From 1976 to 1977 he worked in Thomson CSF Central Research Lab-

oratories on Microwave Oscillators. From 1977 to 1980 he was an Associate Researcher in

Thomson CSF Aeronautics Infrastructure Division. In 1980 he joined the Electromagnetism

Laboratory of the Ecole Polytechnique Federal de Lausanne where he carried out research on

Applied Electromagnetism. Since 1987 he is with the Athens University engaged in research

on Broadband Communications Systems. In 1990 he was elected as an Assistant Professor of

Communications in the Department of Informatics, in 1993 as Associate Professor and since

1998 he is a Professor in the same Department. His main scientic interests are Microwave and

Optical Communication Systems and Networks and Techno-economics. He is leading about 30

National and European R&D projects (RACE I and II, ACTS, RISI, HCM, COST, Eurescom,

etc.) including Synthesis and TITAN. He has more than 80 publications in scientic journals

and conference proceedings. He is also a reviewer in journals of IEEE and IEE and auditor

and evaluator of RACE and ACTS projects. He is the Chairman of the IEEE LEOS Chapter

(Bulgaria, Greece, Romania and Yugoslavia). From1999 he is advisor in several organisations

including EETT (Greek NRA for telecommunications) in the elds of market liberalisation,

spectrum management techniques and technology convergence.

Kjell Stordahl received his M.Sc. from Oslo University in 1972. He has been at the Research

Department Telenor for 15 years; 7 years as a manager of the Teletrafc eld. He joined Telenor

142 D. Varoutas et al.

Networks in 1989 as Chief Planning Manager until 1996. He has been manager of Market

analysis in Telenor Networks 19972002. Kjell Stordahl was appointed associated reporter

and special reporter 19811988 in CCITT SGII for Forecasting International Trafc. From

1985 to 1988 he participated in CCITT GAS 10 and developed a forecasting handbook. He

has also worked for ITUs headquarter as a specialist on forecasting. From 1994 to 1997

he was on the Board of Telenor Consult AS. He was referee for Project Imagine 21 in the

ESPRIT Programme 19992001. Kjell Stordahl was on the Technical Advisory Board of

Virtual Photonics 20002002. Since 1992 he has participated in various projects funded by

the European Commission: RACE/TITAN, ACTS/OPTIMUM and TERA, IST/TONIC and

CELTIC/ECOSYS. Kjell Stordahl has published over 150 papers in International Journals and

Conferences.

Вам также может понравиться

- Economic Viability of 3G Mobile Virtual Network Operators: NtroductionДокумент5 страницEconomic Viability of 3G Mobile Virtual Network Operators: NtroductionMoe KyawОценок пока нет

- Project On Mobile Virtual Network Operator: Submitted To Submitted byДокумент14 страницProject On Mobile Virtual Network Operator: Submitted To Submitted byRam RaikwarОценок пока нет

- Future Telco: Successful Positioning of Network Operators in the Digital AgeОт EverandFuture Telco: Successful Positioning of Network Operators in the Digital AgePeter KrüsselОценок пока нет

- Mobile Virtual Network Operators: Case FinlandДокумент13 страницMobile Virtual Network Operators: Case FinlandsudanoneОценок пока нет

- SAE and the Evolved Packet Core: Driving the Mobile Broadband RevolutionОт EverandSAE and the Evolved Packet Core: Driving the Mobile Broadband RevolutionРейтинг: 3 из 5 звезд3/5 (2)

- Whitepaper HowtobecomeanmvnoormvneДокумент15 страницWhitepaper HowtobecomeanmvnoormvneHisham Abd El AleemОценок пока нет

- Cellular Technologies for Emerging Markets: 2G, 3G and BeyondОт EverandCellular Technologies for Emerging Markets: 2G, 3G and BeyondОценок пока нет

- Mobile Virtual OperatorsДокумент5 страницMobile Virtual OperatorsdwiaryantaОценок пока нет

- Mobile Virtual Network Operator Strategies: Case FinlandДокумент13 страницMobile Virtual Network Operator Strategies: Case FinlandramycaspiОценок пока нет

- Mobile Virtual Network OperatorДокумент38 страницMobile Virtual Network OperatorvishwajeetgОценок пока нет

- Handset Leasing - Unlock Opportunities To Regain Financial Position in Telecom IndustryДокумент7 страницHandset Leasing - Unlock Opportunities To Regain Financial Position in Telecom IndustryHoàng NguyễnОценок пока нет

- MVNOs Key Legal IssuesДокумент8 страницMVNOs Key Legal IssuesSibel ÖçalОценок пока нет

- Current Analysis Best Practices in M2M Operator PerspectiveДокумент11 страницCurrent Analysis Best Practices in M2M Operator PerspectiveRishi PatelОценок пока нет

- MVNO Business Creating A Win Win ModelДокумент14 страницMVNO Business Creating A Win Win ModelNathan Li100% (2)

- Essential Reading 5Документ20 страницEssential Reading 5Rahul AwtansОценок пока нет

- Identifying The Challenges of Mvno in Digital AgeДокумент13 страницIdentifying The Challenges of Mvno in Digital AgeMadivas JuniorОценок пока нет

- M Commerce NotesДокумент16 страницM Commerce NotesSalmon Prathap SinghОценок пока нет

- IMS Next Gen Comm Networks 080905Документ16 страницIMS Next Gen Comm Networks 080905api-3807600Оценок пока нет

- Electronics 09 00640 v2Документ32 страницыElectronics 09 00640 v2Diogo SoaresОценок пока нет

- Rohan Kariyawasam & Rahul GoelДокумент8 страницRohan Kariyawasam & Rahul GoelHomeОценок пока нет

- Paradigm Shift in Telecom Service ProvisionДокумент12 страницParadigm Shift in Telecom Service ProvisionnetsanetОценок пока нет

- MVNO BasicsДокумент10 страницMVNO BasicsLeo WaingartenОценок пока нет

- MVNOs - Key Legal IssuesДокумент8 страницMVNOs - Key Legal Issuesabgup12111953Оценок пока нет

- 4D Tip ReportДокумент16 страниц4D Tip ReportGeorge GuОценок пока нет

- WP - Mobile Operator Strategies For SuccessДокумент18 страницWP - Mobile Operator Strategies For SuccessJMassapinaОценок пока нет

- BICS White Paper On RoamingДокумент7 страницBICS White Paper On RoamingSoubhagya PОценок пока нет

- IMS-IP Multimedia Subsystem: IMS Overview and The Unified Carrier NetworkДокумент11 страницIMS-IP Multimedia Subsystem: IMS Overview and The Unified Carrier NetworkManas RanjanОценок пока нет

- Zhong Wei and Zhang YangДокумент5 страницZhong Wei and Zhang Yangashish9dubey-16Оценок пока нет

- Analysis of Mobile Payment Influencing FactorsДокумент7 страницAnalysis of Mobile Payment Influencing FactorsCS & ITОценок пока нет

- Bresson BissonДокумент13 страницBresson Bissonafzallodhi736Оценок пока нет

- From Value Chain To Value NetworkДокумент14 страницFrom Value Chain To Value Networkaulloa99Оценок пока нет

- EGPRS - Based Design Solution For Tariff Transparency Issue in Mobile Number PortabilityДокумент5 страницEGPRS - Based Design Solution For Tariff Transparency Issue in Mobile Number PortabilityAnonymous BkmsKXzwyKОценок пока нет

- Machine - To - Machine: The Next Big Mobile Opportunity?Документ8 страницMachine - To - Machine: The Next Big Mobile Opportunity?sa_bariОценок пока нет

- Comparison of Itsg5 With CellularДокумент8 страницComparison of Itsg5 With CellularLeviОценок пока нет

- Combined and UncombinedДокумент10 страницCombined and UncombinedBala SubramanianОценок пока нет

- Wimax Forum Utilitieswp Finalt 081010Документ18 страницWimax Forum Utilitieswp Finalt 081010pietouОценок пока нет

- Wimax Forum Utilitieswp Finalt 081010 3Документ18 страницWimax Forum Utilitieswp Finalt 081010 3Harish ParinamОценок пока нет

- Risk Management Notes (Revised)Документ13 страницRisk Management Notes (Revised)Imtiaz KaziОценок пока нет

- (S) 1711-0035945 (V16) BROC Network Sharing StudyДокумент32 страницы(S) 1711-0035945 (V16) BROC Network Sharing StudyKeshav JhaОценок пока нет

- Alex FaresДокумент10 страницAlex FaresSudip MokashiОценок пока нет

- Policy Identity Sec WPДокумент18 страницPolicy Identity Sec WPabohemadeОценок пока нет

- Climate Change Adaptibility of A Smart CityДокумент5 страницClimate Change Adaptibility of A Smart CityNathaniel RasosОценок пока нет

- DMR Article: From King To King Maker - Mobile Service Strategies For The Telecom OperatorsДокумент7 страницDMR Article: From King To King Maker - Mobile Service Strategies For The Telecom OperatorsDetecon InternationalОценок пока нет

- Telecomm Products Marketing PlanДокумент21 страницаTelecomm Products Marketing PlanReshma WalseОценок пока нет

- By Rafael Junquera,: Smartphones: Are They The Real Deal?Документ5 страницBy Rafael Junquera,: Smartphones: Are They The Real Deal?kallolshyam.roy2811Оценок пока нет

- McKinsey Telecoms. RECALL No. 17, 2011 - Transition To Digital in High-Growth MarketsДокумент76 страницMcKinsey Telecoms. RECALL No. 17, 2011 - Transition To Digital in High-Growth MarketskentselveОценок пока нет

- Awoleye Et Al 2012 - C - ALGORITHMДокумент7 страницAwoleye Et Al 2012 - C - ALGORITHMMichael O. AwoleyeОценок пока нет

- Extraction of Knowledge Complexity in 3G Killer Application Construction For Telecommunications National StrategyДокумент6 страницExtraction of Knowledge Complexity in 3G Killer Application Construction For Telecommunications National StrategyLupe FernandezОценок пока нет

- Telecom Industry Value Chain - enДокумент2 страницыTelecom Industry Value Chain - ennarayan_umallaОценок пока нет

- Tellabs Insight Magazine - 4G Networks Demand Multidimensional PerformanceДокумент1 страницаTellabs Insight Magazine - 4G Networks Demand Multidimensional PerformanceTellabsОценок пока нет

- Competition Policy Ternds in TelecommunicationДокумент3 страницыCompetition Policy Ternds in Telecommunicationphuonganh285Оценок пока нет

- Mobile Virtual Network OperatorДокумент3 страницыMobile Virtual Network OperatorFarhan KhanОценок пока нет

- Sensors: Towards Efficient Mobile M2M Communications: Survey and Open ChallengesДокумент27 страницSensors: Towards Efficient Mobile M2M Communications: Survey and Open ChallengesAhmedAzriОценок пока нет

- Next Gen A Ration Mobile NetworkДокумент8 страницNext Gen A Ration Mobile NetworkarunkvkОценок пока нет

- Consumer Survey Findings On Mobile Number Portability Experience in Georgia and BelarusДокумент14 страницConsumer Survey Findings On Mobile Number Portability Experience in Georgia and BelarusPremier PublishersОценок пока нет

- Best Practice Guide West Africa (2013:4)Документ8 страницBest Practice Guide West Africa (2013:4)Kwame AsamoaОценок пока нет

- Medudula 2016Документ20 страницMedudula 2016Toan Bastar-Huu NguyenОценок пока нет

- Blinking LED Circuit With Schematics and ExplanationДокумент3 страницыBlinking LED Circuit With Schematics and ExplanationTran Quoc TamОценок пока нет

- TTPPsummaryDocumentsP SpratleyДокумент28 страницTTPPsummaryDocumentsP SpratleyTran Quoc TamОценок пока нет

- 30 LED ProjectsДокумент55 страниц30 LED ProjectsTran Quoc TamОценок пока нет

- 2013 Motorcycle CatДокумент106 страниц2013 Motorcycle Catennyazniey100% (1)

- MVNO BasicsДокумент10 страницMVNO BasicsLeo WaingartenОценок пока нет

- ZiaeiДокумент14 страницZiaeiTran Quoc TamОценок пока нет

- MVNOs - Key Legal IssuesДокумент8 страницMVNOs - Key Legal Issuesabgup12111953Оценок пока нет

- Cambodia 3844Документ25 страницCambodia 3844Tran Quoc TamОценок пока нет

- Service Manual IBM ThinkPad T61 T61p 14.1 InchДокумент178 страницService Manual IBM ThinkPad T61 T61p 14.1 Inchyam666Оценок пока нет

- 54M Wireless Adapter User's ManualДокумент6 страниц54M Wireless Adapter User's ManualTran Quoc TamОценок пока нет

- Ky Thuat Dam Phan Quoc TeДокумент219 страницKy Thuat Dam Phan Quoc Tethanhquy100% (1)

- Unpan043423 101229073751 Phpapp01Документ14 страницUnpan043423 101229073751 Phpapp01Tran Quoc TamОценок пока нет

- Lao Presentation 100601190125 Phpapp01Документ12 страницLao Presentation 100601190125 Phpapp01Tran Quoc TamОценок пока нет

- S4C LaoДокумент16 страницS4C LaoTran Quoc TamОценок пока нет

- Manual Ibm r40Документ184 страницыManual Ibm r40LUCHY43Оценок пока нет

- KX-TG2420: Operating InstructionsДокумент56 страницKX-TG2420: Operating InstructionsMwSrzОценок пока нет

- 9 MR Chaleun Sibounheuang Lao 101211054148 Phpapp01Документ19 страниц9 MR Chaleun Sibounheuang Lao 101211054148 Phpapp01Tran Quoc TamОценок пока нет

- Alcatel-Lucent Corporate OverviewДокумент35 страницAlcatel-Lucent Corporate OverviewTran Quoc TamОценок пока нет

- Sony TAD905 AmpДокумент15 страницSony TAD905 AmpTran Quoc Tam0% (1)

- Industrial Automation Guide 2016Документ20 страницIndustrial Automation Guide 2016pedro_luna_43Оценок пока нет

- PMO PresentationДокумент30 страницPMO PresentationHitesh TutejaОценок пока нет

- (01 33 23) Shop Drawings, Product Data and SamplesДокумент4 страницы(01 33 23) Shop Drawings, Product Data and SamplesĐinh Thiện SỹОценок пока нет

- Nirala2018.pdf Springer PDFДокумент20 страницNirala2018.pdf Springer PDFNigus TeklehaymanotОценок пока нет

- Home Visit Record (HVR) #1Документ2 страницыHome Visit Record (HVR) #1Nicole Arriana ResumaОценок пока нет

- Ilovepdf MergedДокумент426 страницIlovepdf Mergedyara majed aldayelОценок пока нет

- Statistische Tabellen (Studenmund (2014) Using Econometrics. A Practical Guide, 6th Ed., P 539-553)Документ15 страницStatistische Tabellen (Studenmund (2014) Using Econometrics. A Practical Guide, 6th Ed., P 539-553)Рус ПолешукОценок пока нет

- Tektronix P6015a 1000x HV TastkopfДокумент74 страницыTektronix P6015a 1000x HV TastkopfMan CangkulОценок пока нет

- Power BI DesktopДокумент7 страницPower BI DesktopZaklina TrajkovskaОценок пока нет

- RSH Consulting RACF Admin Authorities Oct 2005Документ31 страницаRSH Consulting RACF Admin Authorities Oct 2005asimОценок пока нет

- How To Create FaceplateДокумент12 страницHow To Create FaceplateDadan Hamdani100% (1)

- Openfoam Open Source CFD On Anselm: Supercomputing For Industry - Sc4IndustryДокумент65 страницOpenfoam Open Source CFD On Anselm: Supercomputing For Industry - Sc4IndustrytensianОценок пока нет

- Physics Chapter 4 Form 5Документ11 страницPhysics Chapter 4 Form 5violetОценок пока нет

- F7400 Vs BHT8048Документ1 страницаF7400 Vs BHT8048Arief RahardjoОценок пока нет

- Module 1 Web Systems and Technology 2Документ19 страницModule 1 Web Systems and Technology 2Ron Marasigan100% (2)

- PSAT 8/9 Practice TestДокумент10 страницPSAT 8/9 Practice Testpkien100% (1)

- Project ManagementДокумент10 страницProject ManagementVanessa NacarОценок пока нет

- God The Myth: by 6litchДокумент4 страницыGod The Myth: by 6litchAnonymous nJ1YlTWОценок пока нет

- Learning Disabilities 2Документ29 страницLearning Disabilities 2Sarah Emmanuel HaryonoОценок пока нет

- Saumya Shandilya: Work ExperienceДокумент3 страницыSaumya Shandilya: Work Experiencevegaciy144Оценок пока нет

- Salterbaxter - Directions Supplement - Online Investor CentresДокумент6 страницSalterbaxter - Directions Supplement - Online Investor Centressalterbaxter100% (2)

- How To Register The HospitalДокумент55 страницHow To Register The HospitalAkhilesh Dwivedi0% (1)

- What Is Electronic WritingДокумент2 страницыWhat Is Electronic WritingPriyaОценок пока нет

- Digital DocumentationДокумент5 страницDigital DocumentationTushar DeshwalОценок пока нет

- Question Text: Complete Mark 1.00 Out of 1.00Документ39 страницQuestion Text: Complete Mark 1.00 Out of 1.00Muhammad AliОценок пока нет

- Tc14.0.0.0 ActiveWorkspace6.2.2 READMEДокумент5 страницTc14.0.0.0 ActiveWorkspace6.2.2 READMEgyuregabiОценок пока нет

- A. Excavation E. Materials Quantity Unit Unit Price Amount: E. Total Project CostДокумент6 страницA. Excavation E. Materials Quantity Unit Unit Price Amount: E. Total Project CostPermits LicensingОценок пока нет

- Ipt NotesДокумент2 страницыIpt Notesapi-259582083Оценок пока нет

- Slide Sosialisasi PULDATANДокумент52 страницыSlide Sosialisasi PULDATANKJSB LALU UBAI ABDILLAH - PHLN 2022Оценок пока нет

- 03 - LT Ib enДокумент42 страницы03 - LT Ib enjmmОценок пока нет

- Defensive Cyber Mastery: Expert Strategies for Unbeatable Personal and Business SecurityОт EverandDefensive Cyber Mastery: Expert Strategies for Unbeatable Personal and Business SecurityРейтинг: 5 из 5 звезд5/5 (1)

- The Dark Net: Inside the Digital UnderworldОт EverandThe Dark Net: Inside the Digital UnderworldРейтинг: 3.5 из 5 звезд3.5/5 (104)

- The Internet Con: How to Seize the Means of ComputationОт EverandThe Internet Con: How to Seize the Means of ComputationРейтинг: 5 из 5 звезд5/5 (6)

- Grokking Algorithms: An illustrated guide for programmers and other curious peopleОт EverandGrokking Algorithms: An illustrated guide for programmers and other curious peopleРейтинг: 4 из 5 звезд4/5 (16)

- How to Do Nothing: Resisting the Attention EconomyОт EverandHow to Do Nothing: Resisting the Attention EconomyРейтинг: 4 из 5 звезд4/5 (421)

- Practical Industrial Cybersecurity: ICS, Industry 4.0, and IIoTОт EverandPractical Industrial Cybersecurity: ICS, Industry 4.0, and IIoTОценок пока нет

- More Porn - Faster!: 50 Tips & Tools for Faster and More Efficient Porn BrowsingОт EverandMore Porn - Faster!: 50 Tips & Tools for Faster and More Efficient Porn BrowsingРейтинг: 3.5 из 5 звезд3.5/5 (24)

- The Digital Marketing Handbook: A Step-By-Step Guide to Creating Websites That SellОт EverandThe Digital Marketing Handbook: A Step-By-Step Guide to Creating Websites That SellРейтинг: 5 из 5 звезд5/5 (6)

- Nine Algorithms That Changed the Future: The Ingenious Ideas That Drive Today's ComputersОт EverandNine Algorithms That Changed the Future: The Ingenious Ideas That Drive Today's ComputersРейтинг: 5 из 5 звезд5/5 (7)

- Ten Arguments for Deleting Your Social Media Accounts Right NowОт EverandTen Arguments for Deleting Your Social Media Accounts Right NowРейтинг: 4 из 5 звезд4/5 (388)

- The Wires of War: Technology and the Global Struggle for PowerОт EverandThe Wires of War: Technology and the Global Struggle for PowerРейтинг: 4 из 5 звезд4/5 (34)

- HTML5 and CSS3 Masterclass: In-depth Web Design Training with Geolocation, the HTML5 Canvas, 2D and 3D CSS Transformations, Flexbox, CSS Grid, and More (English Edition)От EverandHTML5 and CSS3 Masterclass: In-depth Web Design Training with Geolocation, the HTML5 Canvas, 2D and 3D CSS Transformations, Flexbox, CSS Grid, and More (English Edition)Оценок пока нет

- Python for Beginners: The 1 Day Crash Course For Python Programming In The Real WorldОт EverandPython for Beginners: The 1 Day Crash Course For Python Programming In The Real WorldОценок пока нет

- The Ultimate LinkedIn Sales Guide: How to Use Digital and Social Selling to Turn LinkedIn into a Lead, Sales and Revenue Generating MachineОт EverandThe Ultimate LinkedIn Sales Guide: How to Use Digital and Social Selling to Turn LinkedIn into a Lead, Sales and Revenue Generating MachineОценок пока нет

- React.js Design Patterns: Learn how to build scalable React apps with ease (English Edition)От EverandReact.js Design Patterns: Learn how to build scalable React apps with ease (English Edition)Оценок пока нет

- How to Start a Blog with WordPress: Beginner's Guide to Make Money by Writing OnlineОт EverandHow to Start a Blog with WordPress: Beginner's Guide to Make Money by Writing OnlineРейтинг: 3.5 из 5 звезд3.5/5 (2)