Академический Документы

Профессиональный Документы

Культура Документы

Pannew 1

Загружено:

Anonymous czrvb3hОригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Pannew 1

Загружено:

Anonymous czrvb3hАвторское право:

Доступные форматы

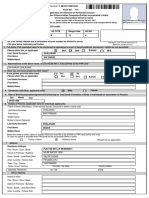

Form No.

49A

Application for Allotment of Permanent Account Number

[In the case of Indian Citizens/Indian Companies/Entities incorporated in India/

Unincorporated entities formed in India]

Under section 139A of the Income Tax Act, 1961

To avoid mistake (s), please follow the accompanying instructions and examples before filling up the form

Assessing officer (AO code)

Sir,

I/We hereby request that a permanent account number be allotted to me/us.

I/We give below necessary particulars:

1 Full Name (Full expanded name to be mentioned as appearing in proof of identity/address documents: initials are not permitted)

Please select title, Das applicable Shri Smt. Kumari M/s

Last Name / Surname

First Name

Middle Name

2 Abbreviation of the above name, as you would like it, to be printed on the PAN card

3 Have you ever been known by any other name? Yes No (Please tick as applicable)

If yes, please give that other name

Please select title, Das applicable Shri Smt. Kumari M/s

AO No. Area code AO type Range code Sign/ leftTumb impression across

this photo

Last Name / Surname

First Name

Middle Name

4 Gender (for Individual applicants only) Male Female (Please tick as applicable)

5 Date of Birth/Incorporation/Agreement/Partnership or Trust Deed/ Formation of Body of individuals or Association of Persons

6 Father's Name (Only 'Individual' applicants: Even married women should fill in father's name only)

Last Name / Surname

First Name

Middle Name

7 Address

Residence Address

Flat/Room/ Door / Block No.

Name of Premises/ Building/ Village

Road/Street/ Lane/Post Office

Area / Locality / Taluka/ Sub Division

Town / City / District

State / Union Territory Pincode / Zip code Country Name

Office Address

Name of office

Flat/Room/ Door / Block No.

Name of Premises/ Building/ Village

Road/Street/ Lane/Post Office

Day Month Year

Area / Locality / Taluka/ Sub Division

Town / City / District

State / Union Territory Pincode / Zip code Country Name

8 Address for Communication Residence Office (Please tick as applicable)

9 Telephone Number & Email ID details

Country code Area/STD Code Telephone / Mobile number

Email ID

10 Status of applicant

Please select status, Das applicable Government

Individual Hindu undivided family Company Partnership Firm Association of Persons

Trusts Body of Individuals Local Authority Artificial Juridical Persons Limited Liability Partnership

11 Registration Number (for company, firms, LLPs, etc.)

12 In case of a citizen of India, then

Please mention your AADHAAR number (if allotted)

13 Source of Income Please select status, Das applicable

Salary Capital Gains

Income from Business / Profession Business/Profession code [For Code: Refer instructions] Income from Other sources

Income from House property No income

14 Representative Assessee (RA)

Full Name (Full expanded name: initials are not permitted)

Please select title, Das applicable Shri Smt. Kumari M/s

Last Name / Surname

First Name

Middle Name

Address

Flat/Room/ Door / Block No.

Name of Premises/ Building/ Village

Road/Street/ Lane/Post Office

Area / Locality / Taluka/ Sub Division

Town / City / District

State / Union Territory Pincode

15 Documents submitted as Proof of Identity(POI) and Proof of Address (POA)

I/We have enclosed as proof of identity and

as proof of address.

[Please refer to the instructions (as specified in Rule 114 of I.T. Rules, 1962) for list of mandatory certified documents to be submitted as applicable]

16 I/We , the applicant, in the capacity of

do hereby declare that what is stated above is true to the best of my/our information and belief.

Place

D D M M Y Y Y Y

Signature / Left Thumb Impression of

Full name, address of the Representative Assessee, who is assessable under the Income Tax Act in respect of the person, whose particulars have been given in the

column 113.

Date

Signature / Left Thumb Impression of

Applicant (inside the box)

Вам также может понравиться

- New Pan Card Application Form 49aДокумент2 страницыNew Pan Card Application Form 49ahindeazadОценок пока нет

- 49A 49AA in Excel FormatДокумент7 страниц49A 49AA in Excel Formatneedhikhurana@gmail.comОценок пока нет

- Form 49a Wef 08042012Документ2 страницыForm 49a Wef 08042012m_veluОценок пока нет

- Pan 49 AДокумент4 страницыPan 49 ARajasekhar KollaОценок пока нет

- New PAN Form 49A V1.07Документ2 страницыNew PAN Form 49A V1.07vermanavalОценок пока нет

- Please Tick As ApplicableДокумент4 страницыPlease Tick As ApplicableAnand ThackerОценок пока нет

- Pan Card Application FormДокумент2 страницыPan Card Application FormKaran AggarwalОценок пока нет

- PAN FormДокумент3 страницыPAN FormStephen GreenОценок пока нет

- Pan Card FormДокумент3 страницыPan Card Formmarketno1Оценок пока нет

- Pan FormДокумент2 страницыPan FormamitОценок пока нет

- Pan FormДокумент3 страницыPan Formasok31575Оценок пока нет

- 49A Pan-Card-Application-Form - New - PDFДокумент2 страницы49A Pan-Card-Application-Form - New - PDFThota MaheshОценок пока нет

- Adv. Jitendra Kumar Porwal 807, Alka Puri - Etawah 6:55 AM: Assessee NameДокумент30 страницAdv. Jitendra Kumar Porwal 807, Alka Puri - Etawah 6:55 AM: Assessee Namerajendra82Оценок пока нет

- New Pan Card Form 49aДокумент7 страницNew Pan Card Form 49aParas ShahОценок пока нет

- Form 49 AДокумент8 страницForm 49 AvvkrishnaОценок пока нет

- Form49A 01062015 PDFДокумент9 страницForm49A 01062015 PDFAshok JaswalОценок пока нет

- Form 49 AAДокумент8 страницForm 49 AAPrabhu PonnalaguОценок пока нет

- Form 49 AAДокумент8 страницForm 49 AASunil KumarОценок пока нет

- Form49A PDFДокумент7 страницForm49A PDFAsh RkОценок пока нет

- Form 49 AДокумент9 страницForm 49 Asenthilmask80Оценок пока нет

- Assessing Officer (AO Code)Документ2 страницыAssessing Officer (AO Code)DineshОценок пока нет

- Auto Pan FormДокумент13 страницAuto Pan FormKulbhushan SharmaОценок пока нет

- Pan Card ApplicationДокумент8 страницPan Card ApplicationashokkumarnklОценок пока нет

- Pan Card Application Form Updated 2017 With Aadhaar DetailsДокумент2 страницыPan Card Application Form Updated 2017 With Aadhaar DetailsManasib AshrafОценок пока нет

- PAN Application UtilityДокумент17 страницPAN Application Utilitygozita2009Оценок пока нет

- PAN Form 49A 1Документ2 страницыPAN Form 49A 1Kumar KS VelОценок пока нет

- Assessing Officer (AO Code)Документ2 страницыAssessing Officer (AO Code)Subbaraju GvОценок пока нет

- Form No. 49AДокумент4 страницыForm No. 49Agowthami ACCOUNTSОценок пока нет

- Assessing Officer (AO Code)Документ2 страницыAssessing Officer (AO Code)SivaShankarОценок пока нет

- Format Revised Pan Card Form From 1st JulyДокумент8 страницFormat Revised Pan Card Form From 1st JulyAnand sОценок пока нет

- Salary: Signature / Left Thumb Impression of Applicant (Inside The Box)Документ1 страницаSalary: Signature / Left Thumb Impression of Applicant (Inside The Box)nagababuОценок пока нет

- Please Select Title, As ApplicableДокумент3 страницыPlease Select Title, As ApplicableCA Amit MehtaОценок пока нет

- Encrypt Signedfinal-Unlocked PDFДокумент2 страницыEncrypt Signedfinal-Unlocked PDFRishabh PathaniaОценок пока нет

- Pan Card FormДокумент3 страницыPan Card FormMehul ShahОценок пока нет

- UnlockedДокумент2 страницыUnlockedlol JtsОценок пока нет

- Pan ApplicationДокумент2 страницыPan ApplicationDoulat SonejiОценок пока нет

- Assessing Officer (AO Code)Документ3 страницыAssessing Officer (AO Code)Mohamed Abrar AliОценок пока нет

- Letest - Form49A PDFДокумент9 страницLetest - Form49A PDFVivekanandОценок пока нет

- 49A Form PDFДокумент8 страниц49A Form PDFgovind dasОценок пока нет

- SignedfinalДокумент2 страницыSignedfinalALL ABOUT INDIAОценок пока нет

- Pan49aa - PAN Application - PIOДокумент3 страницыPan49aa - PAN Application - PIORonak MorjariaОценок пока нет

- Pancard Form NewДокумент2 страницыPancard Form NewambikaОценок пока нет

- Pan Form Form - 49A 2019Документ8 страницPan Form Form - 49A 2019veer karanОценок пока нет

- Assessing Officer (AO Code)Документ2 страницыAssessing Officer (AO Code)Deepak ThakurОценок пока нет

- 49a Pan FormДокумент3 страницы49a Pan FormSimu MatharuОценок пока нет

- Pan ApplicationДокумент2 страницыPan Applicationamrut9Оценок пока нет

- Pan CR FormДокумент1 страницаPan CR FormPrashant DarekarОценок пока нет

- ASERДокумент3 страницыASERRamОценок пока нет

- Pan New 49aДокумент8 страницPan New 49aShaik NoorshaОценок пока нет

- Form No. 49A: See Rule 114Документ8 страницForm No. 49A: See Rule 114Kuntal MandalОценок пока нет

- US Immigration Exam Study Guide in English and Albanian: Study Guides for the US Immigration TestОт EverandUS Immigration Exam Study Guide in English and Albanian: Study Guides for the US Immigration TestОценок пока нет

- A Guide to District Court Civil Forms in the State of HawaiiОт EverandA Guide to District Court Civil Forms in the State of HawaiiОценок пока нет

- Innocent Spouse Relief: How You May Not Have To Pay Your Taxes!От EverandInnocent Spouse Relief: How You May Not Have To Pay Your Taxes!Оценок пока нет

- The Face Looking Company: The Beginning Love Walk Around the WorldОт EverandThe Face Looking Company: The Beginning Love Walk Around the WorldОценок пока нет

- Drafting Applications Under CPC and CrPC: An Essential Guide for Young Lawyers and Law StudentsОт EverandDrafting Applications Under CPC and CrPC: An Essential Guide for Young Lawyers and Law StudentsРейтинг: 5 из 5 звезд5/5 (4)

- 08 - Chapter 3 The Traditional Arts of Kerala and Their Ritualistic AspectsДокумент48 страниц08 - Chapter 3 The Traditional Arts of Kerala and Their Ritualistic AspectsAnonymous czrvb3hОценок пока нет

- Bala BhumiДокумент100 страницBala BhumiAnonymous czrvb3h100% (1)

- 09 - Chapter 4 PDFДокумент48 страниц09 - Chapter 4 PDFAnonymous czrvb3h100% (1)

- Not 0142016 4142016Документ5 страницNot 0142016 4142016Anonymous czrvb3hОценок пока нет

- VanithaДокумент100 страницVanithaAnonymous czrvb3h33% (6)

- Sensors: Analysis and Design of A Speed and Position System For Maglev VehiclesДокумент18 страницSensors: Analysis and Design of A Speed and Position System For Maglev VehiclesAnonymous czrvb3hОценок пока нет

- Hemiplegia Resource Book ModifiedДокумент60 страницHemiplegia Resource Book ModifiedAnonymous czrvb3hОценок пока нет

- To Whomsoever It May Concern: (Hotel Name)Документ1 страницаTo Whomsoever It May Concern: (Hotel Name)Anonymous czrvb3hОценок пока нет

- Diploma in Computer Application: Total Time: 3 (Three) Hours Maximum: 100 MarksДокумент4 страницыDiploma in Computer Application: Total Time: 3 (Three) Hours Maximum: 100 MarksAnonymous czrvb3hОценок пока нет

- MT ApplicationformДокумент4 страницыMT ApplicationformAnonymous czrvb3hОценок пока нет

- Capacitor Voltage TransformerrДокумент3 страницыCapacitor Voltage TransformerrAnonymous czrvb3hОценок пока нет

- Bugatti Automobiles Road Car: Composite Technologies at AutomotiveДокумент29 страницBugatti Automobiles Road Car: Composite Technologies at AutomotiveAnonymous czrvb3hОценок пока нет

- Design and Assemble of Low Cost Prepaid Smart Card Energy Meter - A Novel DesignДокумент9 страницDesign and Assemble of Low Cost Prepaid Smart Card Energy Meter - A Novel DesignAnonymous czrvb3hОценок пока нет

- NizamДокумент9 страницNizamAnonymous czrvb3hОценок пока нет

- LET171271ScoreCard PDFДокумент1 страницаLET171271ScoreCard PDFAnonymous czrvb3hОценок пока нет

- Let 171150 ScorecardДокумент1 страницаLet 171150 ScorecardAnonymous czrvb3hОценок пока нет

- Huge Document PDFДокумент4 страницыHuge Document PDFAnonymous czrvb3hОценок пока нет

- Phone:-Director Office FAX WWW - Kerala.gov - in 0471-2305230 0471-2305193 0471-2301740Документ2 страницыPhone:-Director Office FAX WWW - Kerala.gov - in 0471-2305230 0471-2305193 0471-2301740Anonymous czrvb3hОценок пока нет

- Department of Technical Education: Diploma in EngineeringДокумент1 страницаDepartment of Technical Education: Diploma in EngineeringAnonymous czrvb3hОценок пока нет

- 4Документ5 страниц4Anonymous czrvb3h100% (3)

- Curriculum Vitae: Midhun CДокумент2 страницыCurriculum Vitae: Midhun CAnonymous czrvb3hОценок пока нет

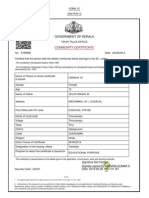

- Government of Kerala: Community CertificateДокумент1 страницаGovernment of Kerala: Community CertificateAnonymous czrvb3hОценок пока нет

- Mantoux TestДокумент10 страницMantoux TestAnonymous czrvb3hОценок пока нет

- Liquid Keyboard: Govt. Women'S Polytechnic College Kottakkal - MalappuramДокумент4 страницыLiquid Keyboard: Govt. Women'S Polytechnic College Kottakkal - MalappuramAnonymous czrvb3hОценок пока нет

- Detection of Lost Mobile On Android Platform: Shreya K. Patil, Bhawana D. Sarode, Prof. P.D.ChowhanДокумент3 страницыDetection of Lost Mobile On Android Platform: Shreya K. Patil, Bhawana D. Sarode, Prof. P.D.ChowhanAnonymous czrvb3hОценок пока нет

- Civ-Pro Avena Q&A ReviewerДокумент2 страницыCiv-Pro Avena Q&A Reviewercmv mendozaОценок пока нет

- Pag-Asa Fishpond vs. JimenezДокумент22 страницыPag-Asa Fishpond vs. JimenezRommel P. Abas0% (1)

- Section 408Документ3 страницыSection 408Google ClientОценок пока нет

- Amtrak Response To CSX and NS Motion To Dismiss (PUBLIC)Документ80 страницAmtrak Response To CSX and NS Motion To Dismiss (PUBLIC)John SharpОценок пока нет

- International Business Lawst200813 - 0 PDFДокумент340 страницInternational Business Lawst200813 - 0 PDFkanika1Оценок пока нет

- Chapter 05Документ23 страницыChapter 05Hammam MustafaОценок пока нет

- Heirs of Cadeliña Vs CadizДокумент9 страницHeirs of Cadeliña Vs CadizMary Fatima Tolibas BerongoyОценок пока нет

- 11 7 12 0204 62337 Bates 1 To 618 Pleading Created by Zach Coughlin Volume 1 SBN Violates SCR 105 (2) (C) With LinkДокумент618 страниц11 7 12 0204 62337 Bates 1 To 618 Pleading Created by Zach Coughlin Volume 1 SBN Violates SCR 105 (2) (C) With LinkNevadaGadflyОценок пока нет

- United Merchants Corp Vs Country Bankers Insurance CorpДокумент1 страницаUnited Merchants Corp Vs Country Bankers Insurance CorpMilcah MagpantayОценок пока нет

- Damai City SDN BHDДокумент20 страницDamai City SDN BHDFaqihah FaidzalОценок пока нет

- Consumer Protection Act Case LawsДокумент2 страницыConsumer Protection Act Case LawsPeter Parker100% (1)

- Management Control System Group 11 Chapter 6Документ4 страницыManagement Control System Group 11 Chapter 6Rifqi HuseinОценок пока нет

- Adoption With Change of NameДокумент2 страницыAdoption With Change of NameTine Tine100% (1)

- EN BANC OPINION, Denying Petition For Rehearing en BancДокумент3 страницыEN BANC OPINION, Denying Petition For Rehearing en BancLindsey Kaley100% (1)

- Transfer: Another Appeal (2000) 1 MLJ 134Документ3 страницыTransfer: Another Appeal (2000) 1 MLJ 134LIA170033 STUDENTОценок пока нет

- Province of Batangas vs. Romulo Case DigestДокумент1 страницаProvince of Batangas vs. Romulo Case DigestPaola Camilon0% (1)

- Abatment and Withdrawal of SuitsДокумент3 страницыAbatment and Withdrawal of SuitsAdan Hooda100% (2)

- Substance and ProcedureДокумент3 страницыSubstance and ProcedureHemant VermaОценок пока нет

- Teck Seing and Co. LTD vs. Pacific CommercialДокумент1 страницаTeck Seing and Co. LTD vs. Pacific CommercialValora France Miral AranasОценок пока нет

- Tennessee State Attorney General Suing Texas Law Firm For Contacting Woodmore Bus Crash FamiliesДокумент2 страницыTennessee State Attorney General Suing Texas Law Firm For Contacting Woodmore Bus Crash FamiliesJohnny BaileyОценок пока нет

- Microsoft Corporation v. Ronald Alepin Morrison & Foerster Et Al - Document No. 21Документ2 страницыMicrosoft Corporation v. Ronald Alepin Morrison & Foerster Et Al - Document No. 21Justia.comОценок пока нет

- Civil Service LawДокумент19 страницCivil Service LawRoldan ParangueОценок пока нет

- 037-Davao Fruits Corporation v. Associated Labor Unions, G.R. No. 85073, Aug 24, 1993Документ4 страницы037-Davao Fruits Corporation v. Associated Labor Unions, G.R. No. 85073, Aug 24, 1993Jopan SJОценок пока нет

- Bank - of - The - Philippine - Islands - v. - CA - GR No 168313Документ10 страницBank - of - The - Philippine - Islands - v. - CA - GR No 168313Timmy RodriguezОценок пока нет

- Important Supreme Court DecisionsДокумент7 страницImportant Supreme Court DecisionsDorothy DandridgeОценок пока нет

- Low Heng Leon Andy V Low Kian Beng Lawrence (2013) 3 SLR 710 PDFДокумент21 страницаLow Heng Leon Andy V Low Kian Beng Lawrence (2013) 3 SLR 710 PDFHenderikTanYiZhouОценок пока нет

- LTD Cases DigestДокумент9 страницLTD Cases DigestLeah Joy DadivasОценок пока нет

- Office of The Court Vs Judge YuДокумент16 страницOffice of The Court Vs Judge YuArtisticLawyer100% (2)

- 9 29 13 Notice of Filings in 1332 0552 63342 62821 63041 Etc CR13-0011-3932469Документ133 страницы9 29 13 Notice of Filings in 1332 0552 63342 62821 63041 Etc CR13-0011-3932469NevadaGadflyОценок пока нет

- Sample Engagement Letters 2Документ6 страницSample Engagement Letters 2Jun RiveraОценок пока нет