Академический Документы

Профессиональный Документы

Культура Документы

Super Regulator in India

Загружено:

rkaran22Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Super Regulator in India

Загружено:

rkaran22Авторское право:

Доступные форматы

NATIONAL LAW SCHOOL OF INDIA UNIVERSITY

BANGALORE

NEED FOR A SUPER REGULATOR IN INDIA IN THE CONTEXT

OF JURISDICTIONAL OVERLAP OF FINANCIAL REGULATORS:

A COMPARATIVE ANALYSIS BETWEEN UK and INDIA

Dissertation submitted in the partial fulfilment of the requirements for

the Degree in Master of Law (LL.M.)

Under the supervision of Prof (Dr.) V. Vijayakumar

By

Ronak Karanpuria

ID NO. 534

June 2014

TABLE OF CONTENTS

Certificate I

Declaration II

Acknowledgment III

List of Abbreviation IV

List of statues V

Chapter I Introduction.01

Chapter II Overview of Financial Market

2.1 Financial Market and its Role in Nation Economy.09

2.2 Regulatory Function............10

2.3 Policy goals of Regulation...12

Chapter III Financial regulators in Indian Financial Market

3.1 Changing scenario in Indian Financial Sector............17

3.2 Multiple regulators in Indian Financial Market...........20

Chapter IV What does Super Regulator means in Financial Market?

4.1 Institutional Framework..25

4.2 Functional Framework25

4.3 Integrated Framework.26

4.4 Twin peak Framework...........26

Chapter V Indian Regulatory jurisdiction overlaps and arbitrage

5.1 Indias Financial Regulatory Jurisdiction overlaps..31

5.2 Regulatory gap.40

Chapter VI UK financial regulator model development

6.1 Pre FSA phase [1980]...44

6.2 Transactional Phase [1990].45

6.3 FSA regulation [1990-2007] 47

6.4 Post FSA [after 2007]: New Regime..54

Chapter VII Restructuring of Indian Financial Market: Need for a Super

Regulator

7.1 Problems with multiple regulator.58

7.2 Which regulatory model is suitable? ......................................60

7.3 Arguments in favour..61

7.4 Arguments against.62

Chapter VIII Conclusion.....66

Bibliography...71

Annexure I (fig 1 and 2)....78

Figure 1 The Financial Services System Regulatory Structure, India..78

Figure 2 The Financial Services System Regulatory Structure, UK79

I

CERTIFICATE

This is to certify that the work contained in this dissertation entitled NEED

FOR A SUPER REGULATOR IN INDIA IN THE CONTEXT OF

JURISDICTIONAL OVERLAP OF FINANCIAL REGULATORS: A

COMPARATIVE ANALYSIS BETWEEN UK and INDIA submitted by

Ronak Karanpuria for the Degree of Master of Law (LL.M.) for the session

2012-14, of NLSIU is the product of bonafide research carried out under my

guidance and supervision. The dissertation or any part thereof has not been

submitted elsewhere for any other degree

Place: NLSIU, Bangalore Prof. (Dr.) V. Vijayakumar

Date:

II

DECLARATION

I, Ronak Karanpuria, do hereby declare that this Dissertation titled NEED

FOR A SUPER REGULATOR IN INDIA IN THE CONTEXT OF

JURISDICTIONAL OVERLAP OF FINANCIAL REGULATORS: A

COMPARATIVE ANALYSIS BETWEEN UK and INDIA is a result

of bonafide research undertaken by me in partial fulfilment of LL.M. programme

at NLSIU, Bangalore. This dissertation has been prepared by me under the

guidance and supervision of Prof. (Dr.) V. Vijayakumar.

I hereby declare that this dissertation is the outcome of original work and the

relevant material taken from other sources have been properly cited at

appropriate places and which are duly acknowledge.

I further declare that this work has not been submitted either in part or whole

for any degree or any other University or like Institution.

Place: NLSIU, Bangalore Ronak Karanpuria

Date: I.D. No. 534

LL.M. (Business Law)

NLSIU, Bangalore

III

ACKNOWLEDGMENTS

I am enormously grateful to my supervisor, Prof. (Dr.) V. Vijayakumar for his

generous and thoughtful guidance throughout the course of this project.

I gratefully acknowledge the Librarian of NLSIU who helped me finding out

research materials. I am indebted to my friends and colleagues for many

sanity-preserving discussions over the years on law, academics, work, and

everything in between.

Finally, I thank my parents for their endless love and support throughout this

and every other stage of my lengthy student career.

IV

LIST OF ABBREVIATIONS

CCI Competition Commission of India

CERC Central Electricity Regulatory Commission

DBOD Department of Banking Operations and Development

DBS Department of Banking Supervision

DNBS Department of Non-Banking Supervision

FCA Financial Conduct Authority

FMC Forward Markets Commission

FSAT Financial Sector Appellate Tribunal

FSA Financial Services Authority

FSLRC Financial Sector Legislative Reforms Commission

GOI Government of India

IMF International Monetary Fund

IRDA Insurance Regulatory and Development Authority

MCA Ministry of Company Affairs, Government of India

NABARD National Bank for Agriculture and Rural Development

NBFC Non-Banking Financial Company

PFRDA Pension Fund Regulatory and Development Authority

RBI Reserve Bank of India

RRB Regional Rural Bank

SEBI Securities and Exchange Board of India

UFA Unified Financial Agency

UK FSMA 2000 UK Financial Services and Markets Act, 2000

UK United Kingdom

ULIP Unit Linked Insurance Plan

US United States

V

LIST OF STATUTES

1. Banking Regulation Act, 1949

2. Chit Fund Act, 1982

3. Insurance Act, 1938

4. Insurance Regulatory And Development Authority Act, 1999

5. National Bank For Agriculture And Rural Development Act, 1981

6. Pensions Act, 1871

7. Pension Fund Regulatory And Development Authority Act, 2013

8. Reserve Bank Of India Act, 1934

9. Securities And Exchange Board Of India Act, 1992

1

CHAPTER I

INTRODUCTION

1.1 Problem of study

The financial system is regulated to achieve a wide variety of purposes.

However, the objective that distinguishes financial regulation from other kinds

of regulation is that of safeguarding the economy against systemic risk.

Regulators in India are statutory entities headed by a board. It is the

responsibility of the Government to appoint the members on the board of the

regulator. The financial System of any country consists of financial markets,

financial intermediaries and financial instruments or financial products.

1

A

financial system work as a medium to facilitate the flow of funds from the areas

of surplus to the areas of deficit. A financial System comprises of various

institutions, markets, regulations, instruments and laws, practices, analysts,

transactions and claims

The five key functions of a financial system in a country are: (i) information

production ex ante about possible investments and capital allocation; (ii)

monitoring investments and the exercise of corporate governance after

providing financing; (iii) facilitation of the trading, diversification, and

management of risk; (iv) mobilization and pooling of savings; and (v) promoting

the exchange of goods and services.

2

1

Ibid, at 1

2

Cihak, Martin and Levine, Benchmarking financial systems around the world, Policy

Research working paper; no. WPS 6175. Washington, DC: World Bank,

http://documents.worldbank.org/curated/en/2012/08/16669897/benchmarking-financial-

systems-around-world Accessed on7/5/14

2

A Financial Market

3

can be divided into following parts based on the nature of

transactions:

Money Market- The money market ifs a wholesale debt market for low-risk,

highly-liquid, short-term instrument. Funds are available in this market for

periods ranging from a single day up to a year. This market is dominated

mostly by government, banks and financial institutions. Some of the important

money market instruments are Treasury bills, term money, Certificate of

Deposit and Commercial papers.

Capital Market - The capital market is designed to finance the long-term

investments. The transactions taking place in this market will be for periods

over a year. Financial instruments involved in these market are Equity shares,

preference shares, convertible preference shares, non-convertible preference

shares etc. and in the debt segment debentures, zero coupon bonds, deep

discount bonds etc.

Forex Market - The Forex market deals with the multicurrency requirements,

which are met by the exchange of currencies. Depending on the exchange

rate that is applicable, the transfer of funds takes place in this market. This is

one of the most developed and integrated market across the globe.

Credit Market- Credit market is a place where banks, FIs and NBFCs purvey

short, medium and long-term loans to corporate and individuals.

3

D. Aruna Kumar, An Overview of Indian Financial System,

http://www.indianmba.com/Faculty_Column/FC177/fc177.html Accessed on2/5/14

3

The rationale for regulation is built on the objective of economic policy to create

a sustainable level of economic growth through investment, employment and

production and to cease the possibilities of market failure by regulation of

financial market. Neo-classical economics talks about three classes of market

failures: natural monopolies, asymmetric information and externalities. These

describe scenarios in which markets do not serve us well and have to be

regulated. The responsibility for ensuring healthy contributions from each

sector towards sustainable economic growth are generally split between three

parties. Firstly, governments responsibility is to create a stable environment

and infrastructure of legal rules supported by regulatory and supervisory

arrangements. Secondly, the central bank is responsible for contributing

towards the achievement and maintenance of a stable financial

system. Thirdly, the financial market regulators that enable the private sector

to create economic growth through investment, employment and physical

production by creating a competitive environment with legal rules and ensure

sufficient disclosures in the respective sectors following the pattern followed

throughout the world.

Generally financial regulator in any sector in a country has two main tasks

independent in itself i.e. regulation and supervision. Prudential financial

regulation refers to the set of general principles or legal rules that are standard

to pursue as their objective for stable and efficient performance of financial

institutions and markets. These rules represent boundaries and limitations

placed on the actions of financial intermediaries to ensure the safety and

soundness of the system. Regulation is a preventive action in that it limits the

range of permissible actions for the intermediary and specifies prohibited

activities. On the other hand, it do financial intermediary supervision in contrast

to regulation examination and monitoring mechanisms which the authorities

verify compliance with and enforce prudential financial regulation.

4

In view of these critical contributions to economic performance it is not

surprising that the health of the financial sector is a matter of public policy

concern and that nearly all national governments have chosen to regulate the

financial sector. It is undoubtedly correct that the overall objective of regulation

of the financial sector should be to ensure that the system functions efficiently

in helping to deploy, transfer and allocate resources across time and space

under conditions of uncertainty. In fact, at least four broad rationales for

financial regulation may be identified: safeguarding the financial system

against systemic risk, protecting consumers from opportunistic behaviour,

enhancing the efficiency of the financial system, and achieving a broad range

of social objectives from increasing home ownership to combating organized

crime.

4

In India different financial sectors are regulated by different sector regulators

but the financial market is evolving day by day. One consequence of this is

blurring of boundaries among these markets and inefficient handling of such

borderline behaviour by sector regulators, regulatory arbitrage and inefficient

governance. This has led to the demand for unification of regulation of different

sectors. In terms of sector regulation the evolution of new and innovative

financial products have created a scenario where the boundaries are blurring.

Unified regulatory approach may take many forms depending on maturity of a

financial market. One extreme of that is a single super regulator for the whole

economy. This model has been adopted by a few countries and is in operation

for a while. In this regard the experience gained by operation of such structure

in UK is very relevant.

4

Richard J. Herring and Anthony M. Santomero, What is optimal financial regulation? The

Wharton School University of Pennsylvania

< http://fic.wharton.upenn.edu/fic/papers/00/0034.pdf> Accessed on 1

st

May 2014

5

The slowdown of economy and failure of financial institutions like banking all

over the world and their cross border effect led to rethinking in four different

aspects (1) how financial institutions and markets work and operate (2)

innovation of financial instruments (3) the extent of market imperfections and

failures in the financial system and the power of regulation and supervision to

address them, and (4) the extent to which financial products and contracts are

significantly different from the generality of goods and services which are not

regulated to anywhere near the same degree as financial institutions.

5

To

address these issue, papers will cover such topics as the rationale for

regulation, the costs and benefits of various aspects of regulation, and the

structure and development of the financial services industry comparing with

UK regulatory model and challenges for regulators.

1.2 Aim and Objectives

The aim of the research is to understand the scope and functions of different

regulatory approach adopted in various jurisdiction, understanding their

breakdown and reason for success and need of super regulator in India to

overcome the financial arbitrage and regulatory overlap with improved

performance, consumer protection and stability. To understand the regulatory

aspect, it is necessary to understand following things as mentioned below:

1. Tracing the evolution of Unified Regulator in the Financial Market in UK.

2. Identifying the intrinsic differences and similarities of the nature of the

financial regulation under jurisdictions.

5

The Economic Rationale for Financial Regulation, April 1999, FSA working papers, 5,

<http://www.fsa.gov.uk/pubs/occpapers/op01.pdf> Accessed on 1

st

May 2014

6

3. Analysing the performance of Unified Regulator in respective financial

market.

4. Current trend in global scenario seems that almost 30-40 countries all

over the world have made major changes in financial regulatory system

which include reconstruction of regulatory structure.

5. To understand the effects of structural changes of financial sector

because it effect the economy of a country.

6. To understand that shape of Indias financial sector evolve over coming

decades. Whether the current regulatory system is hinder in financial

innovation.

1.3 Hypotheses

The blurring of financial market boundaries and with the advent of innovative

hybrid financial instruments calling for reform of existing financial market

regulators for controlling and supervision of financial market with the unification

of financial market regulators has been adopted in different countries as per

their market requirement based on economic, social and political

circumstances is not a strait jacket formula for each and every country not an

absolute method in reducing the instances of mismanagement, regulatory

overlap and regulatory gap to ensure efficient performance of financial

markets, stability and consumer protection.

1.4 Research Questions

1. What are common traits of different finance sector regulator and the

effect of consolidation of different functions in single regulator in

financial market?

2. Are there any inadequacies in current financial regulatory system in

India?

7

3. What does incorporation of single regulator mean and how is it different

from other regulatory concepts in a financial market in terms of

structure.

4. Does reconstruction and reforming of financial sector regulator

substantially improves the well-being of customer?

5. Whether single regulator can prevent regulatory arbitrage present

across different intermediaries and markets which circumvent the

macro-prudential regulations?

6. Whether the structural change of financial regulatory can brings stability

and increase efficiency in financial market.

7. What has been the experience in United Kingdom with unified

regulation?

8. How unification can help in solving the complications of Indian financial

market?

9. How apt are recommendations of FSLRC in arriving at optimum

regulatory architecture?

1.5 Research Methodology

The research methodology adopted is comparative and descriptive.

Sources: The researcher would be referring to primary resources like the

legislative enactments of the respective jurisdiction under study pertaining to

different financial regulator. The researcher would also be relying upon

secondary sources like Commission report, Legislative Committee reports,

Books and Journals

Chapter II entitled Overview of Financial Market deals with the basic

structure of financial market, financial instruments, functions of financial

8

regulator and policy goals of regulations namely safety, soundness, mitigation

of systemic risk, fairness and accountability and consumer protection. Chapter

III entitled Financial Regulators in Indian Financial Market deals with the

historical changes in Indian financial market, legal framework of regulatory

system in India and their regulatory functions and powers. Chapter IV entitled

What does Super Regulator means in Financial Market? deals with the

type of financial regulation typology adopted by various countries and its

benefits. Chapter V entitled Indian Financial Regulatory Mechanism

Pitfalls. Chapter VI entitled UK Model deals with the development in UK in

financial regulatory system, reason for such adoption with their fall back from

1960 to 2013. Chapter VII entitled Restructuring of Indian Financial

Market deals with the current regulatory system in India with FSLRC

commission report and scope of possibility of new financial regulator in India.

The concluding chapter provides an analysis of discussion of as well as about

the possibility of adoption of super regulator in India.

1.6 Limitation

This research is meant to analyse the effect of inclusion of Super Regulator in

the financial market. Due to the wide range of the topic, the researcher would

be confining the study to two jurisdictions namely United Kingdom and India

and for the purpose of achieving the objective.

1.7 Mode of Citation:

A uniform mode of citation will be followed throughout this paper.

9

CHAPTER II

OVERVIEW OF FINANCIAL MARKET

2.1 Financial Market and its Role in Indian Economy

The financial sector in any country relates to the economy it serves in a manner

in which the circulatory system serves. Financial System of any country

consists of financial markets, financial intermediaries and financial instruments

or financial products.

6

A financial system work as a medium to facilitate the

flow of funds from the areas of surplus to the areas of deficit. A financial

System comprises of various institutions, markets, regulations, instruments

and laws, practices, analysts, transactions and claims. At present, financial law

in India is fairly complex. Financial sector can be divided into banking and non-

banking activities which until 1993 was supervised and regulated by DBOD,

finally in the year 1997 DBOD was split into DBS and DNBS.

Indias growth although among the highest in the world projected at 4.6% in

2013 which rises to 5.4% in 2014 improved by export competitiveness, a

favourable monsoon and by approved investment projects through FDI

7

are

implemented and as global growth improves. But India should take substantive

measures to narrow external and fiscal imbalances, tighten monetary policy,

move forward on structural reforms,

8

and address market volatility.

6

Ibid, at 1

7

BCC Global Monthly Economic Review

<http://www.bcctaipei.com/bcc-global-monthly-economic-review-may-2014/ > Accessed on

9

th

June 2014

8

India: Economy Stabilizes, but High Inflation, Slow Growth Key Concerns,

<http://www.imf.org/external/pubs/ft/survey/so/2014/car022014a.htm> Accessed on 3

rd

May 2014

10

2.2 Regulatory Functions

Regulation refers to controlling human or societal behaviour by rules or

regulations or alternatively a rule or order issued by an executive authority or

regulatory agency of a government and having the force of law.

9

Regulation

covers all activities of private or public behaviour that may be detrimental to

societal or governmental interest but its scope varies across countries.

Generally financial regulator in any sector in a country has two main tasks

independent in itself i.e. regulation and supervision

Prudential financial regulation refers to the set of general principles or legal

rules that are standard to pursue as their objective for stable and efficient

performance of financial institutions and markets. These rules represent

boundaries and limitations placed on the actions of financial intermediaries to

ensure the safety and soundness of the system. Regulation is a preventive

action in that it limits the range of permissible actions for the intermediary and

specifies prohibited activities. The choice of weights between prevention in the

form of regulation and criminal prosecution and tort liability must be

differentiate and within the ambit of regulator to ensure regulation which varies

across countries.

10

Financial intermediary supervision

11

in contrast to regulation examination and

monitoring mechanisms which the authorities verify compliance with and

enforce prudential financial regulation. It refers to the specific procedures

adopted in order to determine the actual risks faced by an intermediary for

9

Regulation (2009), Merriam-Webster Online Dictionary, <www.merriam-

webster.com/dictionary/regulation> Accessed on 2

nd

May 2014

10

Rodrigo A. Chaves and Claudio Gonzalez-Vega, Principles of regulation and prudential

supervision: should they be different for microenterprise finance organizations?, Economics

and Sociology Occasional Paper No. 1979, 6, The Ohio State University, Ohio (1992)

11

Ibid

11

compliance. Objectives of supervision is to promote stability and efficiency

which is important for financial progress. An efficient mechanism for the

surveillance

12

of financial intermediaries should have two basic components.

The first component would be an early-warning system based on data reported

to the supervisory authority by the intermediaries themselves. This is the off-

site component of the supervisory structure. Its main purpose is to provide a

frequent depiction of the financial health and risks of each intermediary

supervised. On-site supervision is necessary to practice those inspections

that, because of their nature, cannot be performed by an off-site analysis (such

as quality of internal control) and to verify that the data fed to the off-site

surveillance system are correct. The supervision activities directly or indirectly

help to lay down proper regulation for compliance.

Why is regulation needed? Whether risk taken by one firm or companies

in one sector suffers loss which badly effects other market/sector can be

avoided by efficient regulation? Another question that raises the curiosity

is how much needs to be regulated by government. Well, the answers is

not more regulation or intervention by government but better and effective

regulation.

13

This is, in turn, divided into two sub-questions: Why do

markets by themselves not suffice? And if there is to be government

intervention, why does it take the form of regulations? Some economist

like Adam Smith (it is widely believed) argued that markets by themselves

are efficient and others believe that public has faith in government as a

neutral agency. We have regulation everywhere like air, water pollution

control, traffic and labor regulation etc. directly or indirectly everyone works

under regulation. Similarly to manage such financial market which are

12

Should Principles of Regulation and Prudential Supervision Be Different for Microenterprise

Finance Organizations?

13

<http://economix.blogs.nytimes.com/2008/10/28/better-not-just-more-

regulation/?_php=trueand_type=blogsand_r=0> Accessed on 6

th

May 2014

12

cross borders connected it is necessary to have regulation which suits the

demands of market player, safety and confidence to investors and brings

soundness and stability to financial market.

For the functioning of financial sector various arrangements and frameworks

are required which include the legal framework within which the financial sector

operates. Like most of the financial dealings are contracts, it is necessary to

formulate legal framework within which such contracts can be drawn, enforced

and the recourse in the event of breach of contract are very important

determinants of the efficacy of any financial system. As it needs to be

emphasised financial sector are intertwined and interdependent with

developments elsewhere in the economy. Therefore, the efficiency level of any

financial system to a large extent is constrained by the efficiency of the overall

economic set up within which it operates.

2.3 Policy goals of Regulation

Financial crisis and great depression worldwide creates unemployment, failing

businesses, falling home prices and declining savings. Sometimes

sophisticated financial firms, risk management systems did not keep pace with

the complexity of new financial products. The lack of transparency and

standards in markets for securitized loans helped to weaken underwriting

standards. Market discipline broke down as investors relied excessively on

credit rating agencies. Gaps and weaknesses in the supervision and regulation

of financial firms presented challenges to our governments ability to monitor,

prevent, or address risks as they built up in the system. No regulator saw its

job as protecting the economy and financial system as a whole. It is the duty

of regulator to restore confidence in the integrity of our financial system.

14

The

14

Richard A .Posner, Theories of Economic Regulation, Working Paper No. 41, Center

for Economic Analysis of Human Behavior and Social Institutions (2004)

13

objective of regulation is to achieve safety and soundness, mitigate systemic

risk, consumer protection, fairness and accountability.

2.3.1 Safety and soundness of Financial Regulation

Effective regulation should be designed to promote the safety and soundness

of individual financial institutions. They focuses on the solvency of institutions

and protection of customer assets which have been regulated through a

combination of rules and prudential examinations and supervision. The

regulatory bodies have their tools to analyse the working of institution lying in

their jurisdiction to maintain the stability in the system.

a. Robust Supervision:

Due to sudden economic failure of financial institutions which can directly or

indirectly effect other sectors institution make them critical to market

functioning and should be subject to strong oversight. No financial firm that

poses a significant risk to the financial system should be unregulated or weakly

regulated. Generally, a separate department or body is entrusted with the task

of identifying emerging systemic risks and to supervise all firms that could pose

a threat to financial stability, even those that do not own banks.

15

b. Risk Assessment:

The major financial markets must be strong enough to withstand both system

wide stress and the failure of one or more large institutions. Enhanced

regulation of securitization markets including new requirements for market

transparency, stronger regulation of credit rating agencies and a requirement

15

Regulatory And Supervisory Challenges in Banking

<http://rbidocs.rbi.org.in/rdocs/Publications/PDFs/86737.pdf > Accessed on 9

th

June 2014

14

that issuers and originators retain a financial interest in securitized loans. Due

to the fact that scam like Harshad Mehta Stock Market Scam (1992) and Ketan

Parek Scam (2001) taking benefit of loopholes challenge the market regulators

to better assess the risk and compliance of regulation which need to financial

regulator to tackle such situations.

2.3.2. Mitigation of systematic risk

The dominant goal of financial supervision is to monitor the overall functioning

of the financial system as a whole and to mitigate systemic risk that would

seem to be the most challenging to achieve. Financial systems cannot function

effectively without confidence in the markets and financial institutions. A major

disruption to the financial system can reduce confidence in the ability of

markets to function, impair the availability of credit and equity and adversely

impact real economic activity. Systemic risk generally refers to impairment of

the overall functioning of the system caused by the breakdown of one or more

of the key market components like failure of Lehman Brothers.

16

Systemically

important players would include multinational banks, hedge funds, securities

firms, and insurance companies.

2.3.3 Fairness and accountability

The main requirement of market is transparency of all material information to

investors, by mandating disclosure of key information, whether it is about

business and financial performance about the prices at which securities are

bought or sold, or other key information that is important to investors.

16

Wall St.s Turmoil Sends Stocks Reeling, The New York Times Business Day,

<http://www.nytimes.com/2008/09/16/business/worldbusiness/16markets.html?hpand_r=0 >

Accessed on 4

th

May 2014

15

Disclosure

17

permits market participants to make optimal decisions with

complete information. These transparency goals may conflict with the interests

of a particular institution at any point in time and thus they may be contrary to

other goals of regulation such as maintenance of safety and soundness and

market continuity. For example, a financial institution that is experiencing

liquidity issues may want to keep that information private in order to minimize

speculation that could disrupt efforts to work out its problems. At the same

time, investors in the institution would want the most timely and accurate

information in order to make an investment decision.

18

These divergent

considerations may lead to disparate responses by different regulators and

locations. Prof Nicolaides states that a regulator must be accountable for their

decisions which involves two dimensions: one democratic, and the other more

procedural, that is often used to justify regulators' decisions.

19

2.3.4 Consumer protection

Financial regulation is also designed to protect customers and investors

through business conduct rules by bringing transparency where investors are

protected by rules that mandate fair treatment and high standards of business

conduct by intermediaries. Conduct-of-business rules ultimately lead to greater

confidence in the financial system and therefore potentially greater market

participation. Business conduct regulation has a quite different focus from

safety and soundness oversight. Its emphasis is on transparency, disclosure,

suitability, and investor protection. It is designed to ensure fair dealing. Such

17

SEBI proposes new listing, disclosure requirement norms, The Hindu Business,

<http://www.thehindu.com/business/markets/sebi-proposes-new-listing-disclosure-

requirement-norms/article5979243.ece,> Accessed on 4

th

May 2014

18

Sebis arguments in Tayal case simply dont wash, Live Mint,

<http://www.livemint.com/Opinion/RbIhoxg4dcB4HLN6XkjQGP/Sebis-arguments-in-Tayal-

case-simply-dont-wash.html> Accessed on 4

th

May 2014

19

Designing independent and accountable regulatory authorities for high quality regulation,

OECD, 7, (10-11 January 2005) <http://www.oecd.org/regreform/regulatory-

policy/35028836.pdf> Accessed on 6

th

May 2014

16

standards have been widely adopted in securities regulation for several

decades. Classic examples of business conduct rules include conflict-of-

interest rules, advertising restrictions, and suitability standards. Some

observers claim that business conduct rules per se were less common in the

banking sector, although fiduciary principles applied. Even at global level, G20,

World Bank and OECD aimed at making policies which are favourable and in

the interest of consumers by promoting financial education and by developing

innovative communication channels.

20

20

Draft effective Approaches to support the Implementation of the Remaining G20/ECD high

level principles on Financial consumer Protection, OECD, 6, (14 May, 2014)

<http://www.oecd.org/daf/fin/financial-education/FCP-Effective-Approaches-2014.pdf>

Accessed on 6

th

May14

Financial consumer protection should be an integral part of the legal, regulatory and

supervisory framework, and should reflect the diversity of national circumstances and global

market and regulatory developments within the financial sector. Financial consumer

protection legislation can cover the following areas; institutional frameworks; the role of

oversight bodies; financial literacy/education; access to basic financial products and services;

disclosure requirements and transparency; responsible business conduct; responsible

lending practices; data protection and privacy; effective resolution schemes and complaint

handling mechanisms.

17

CHAPTER III

FINANCIAL REGULATORS IN INDIAN FINANCIAL MARKET

3.1 Changing Scenario in India

A. Deregulation of 1990s

The financial sector in India has undergone dramatic changes during the last

fifteen years. Deregulation and liberalization of the financial industry had led to

the development of the financial sector. This period also witnessed the

emergence of new players in the financial services industry. The financial

industry was no longer confined to banks and development financial

institutions. The development and growth of the securities markets

21

and the

insurance industry has increased the breadth of the Indian financial markets.

It appeared that the distinction between these financial service providers

blurred significantly as they were providing services which were not falling

within the realm of the regulators e.g. Nonbanking financial companies,

collective investment schemes. It was also felt that the growing complexity of

the financial conglomerates was putting an enormous strain on the existing

system with multiple and often overlapped supervisory structure.

22

B. Financial Conglomerates

The existing regulatory and supervisory framework in India is based on

institutional lines. In some cases, like RRBs, the regulation is directed at the

21

Mr. Mohammad Fazal, A Historical Perspective of the Securities Market Reforms in India ,

<http://www.sebi.gov.in/sebiweb/home/document_detail.jsp?link=http://www.sebi.gov.in/cms/

sebi_data/docfiles/2975_t.html> Accessed on 10

th

May 2014

22

Ankit Sharma, Should there be an integrated regulator for the Indian Financial System, SEBI

BULLETIN, Vol 1 no 12(Dec.2003) p7

< http://www.sebi.gov.in/bulletin/bulldec03.pdf> Accessed on 9

th

May 2014

18

specific institution, whereas activities related to securities markets are being

regulated and supervised by a specific regulator. Critics have argued that

multiple regulatory agencies reduce regulatory efficiency and leaves regulatory

gaps which may lead to financial contagion. The idea of a super regulator for

the Indian financial system was first mooted by the Khan Working Group for

harmonizing the Role and Operations of Banks and DFIs in 1998. It appears

that though the Group had used the term super regulator, it meant creation of

an agency which would function as a lead regulator and would coordinate the

activities of various regulators. The Narasimhan Committee II (1998) did not

comment on this issue. However, it had recommended that an integrated

system of regulation and supervision be put in place to regulate and supervise

the activities of banks, financial institutions and NBFCs. The Deepak Parekh

Advisory Group on Securities Market Regulation (2001) referred to the

diffusion of regulatory responsibilities and suggested granting of legal status

to the High Level Group on Capital Markets (HLGCM). The Group also

recommended creation of a system to allow sharing specified market

information between the regulators on a routine and automatic basis. Dr. Y.V.

Reddy, former Governor, Reserve Bank of India, propounded the Reddy

Formula which recommended creation of an umbrella regulatory legislation

which creates an apex regulatory authority without disturbing the existing

jurisdiction. The Joint Parliamentary Committee (2002) in its report has also

cursorily mentioned about super regulator but stresses upon more co-

ordination amongst the various regulatory and supervisory agencies.

23

The issue for having an integrated regulator in India has emanated for two

basic reasons:

1. Eliminate regulatory overlaps, gaps and inconsistencies in order to

reduce risk.

23

Ibid at 8

19

2. Emergence of financial conglomerates in the Indian financial sector.

24

The existence of a range of supervisory and regulatory authorities also poses

the risk that financial firms will engage in some form of regulatory arbitrage.

This involves placement of financial services in such a sector where the

supervisory sight is least intrusive. Examples which immediately come to mind

are NBFCs and plantation companies. Since, these entities did not fall under

the ambit of RBI, SEBI and DCA as far as their fund raising activities were

concerned, the hapless investor was left to the mercies of the unscrupulous

promoters of these companies. It was only after the amendment of the RBI Act

and the SEBI Act, the NBFCs and the Plantation companies were brought

under the regulatory and supervisory jurisdiction of the respective regulators.

With the financial sector expanding at a dramatic speed, it is very difficult to

imagine as to which regulatory gap may be exploited by an unscrupulous

individuals.

During the last decade, several significant developments have taken place in

the Indian financial sector. The Indian financial system has expanded and is

developing at a breakneck speed. The introduction of new products and new

concepts has revolutionized the markets and has also led to development of

financial conglomerates. In terms of major changes for example the banks

have diversified into a number of activities including insurance, securities,

mutual fund etc. (e.g. SBI, ICICI, etc.). Some banks have set up subsidiaries

to conduct merchant banking business, launch mutual funds (e.g. Canara

Bank, Bank of Baroda etc.).Then a DFI (IDBI) has set up subsidiaries to

undertake banking and mutual fund business. A mutual fund (UTI) has set up

a bank. Two insurance companies (LIC and GIC) have entered into mutual

fund business. A Housing Finance Company (HDFC) has set up a bank,

24

Ibid

20

mutual fund and insurance company. An NBFC (Kotak Mahindra) has set up

a bank, mutual fund, broking and merchant banking outfit.

25

3.2 Multiple regulators in Indian Financial Market

The financial system in India is regulated by independent and specialized

regulators in the respective field of banking, insurance, capital market,

commodities market, and pension funds. However, Government of India plays

a significant role in controlling the financial system in India and influences the

roles of such regulators at least to some extent.

The five major financial regulatory bodies in India.

3.2.1 Reserve Bank of India

Reserve Bank of India

26

is the apex monetary Institution of India. It is also

called as the central bank of the country. It acts as the apex monetary authority

of the country. The Central Office is where the Governor sits and is

where policies are formulated. Though originally privately owned, since

nationalization in 1949, the Reserve Bank is fully owned by the Government of

India.

The preamble of the Reserve bank of India Act 1934 is as follows"...to regulate

the issue of Bank Notes and keeping of reserves with a view to securing

25

Ibid at 9

26

<http://www.rbi.org.in/scripts/AboutusDisplay.aspx> Accessed on 10

th

May 2014

The Reserve Bank of India was established on April 1, 1935 in accordance with the provisions

of the Reserve Bank of India Act, 1934. The Central Office of the Reserve Bank was initially

established in Calcutta but was permanently moved to Mumbai in 1937. The Central Office is

where the Governor sits and where policies are formulated. Though originally privately owned,

since nationalization in 1949, the Reserve Bank is fully owned by the Government of India.

21

monetary stability in India and generally to operate the currency and

credit system of the country to its advantage."

RBI focuses on:

supervision of financial institutions

consolidated accounting

legal issues in bank frauds

divergence in assessments of non-performing assets and

supervisory rating model for banks

In terms of section 20 of the RBI Act 1934, RBI has the obligation to undertake

the receipts and payments of the Central Government and to carry out the

exchange, remittance and other banking operations, including the

management of the public debt of the Union.

3.2.2 Securities and Exchange Board of India: SEBI Act, 1992

Securities and Exchange Board of India (SEBI)

27

was first established in the

year 1988 as a non-statutory body for regulating the securities market. It

became an autonomous body in 1992 and more powers

28

were given through

an ordinance.

27

http://www.sebi.gov.in/sebiweb/stpages/about_sebi.jsp Accessed on10th May 2014

28

S. 11 SEBI Act, 1992

Powers and Functions of SEBI as follows

(a) regulating the business in stock exchanges and any other securities markets; (b)

registering and regulating the working of stock brokers, sub-brokers, share transfer agents,

bankers to an issue, trustees of trust deeds, registrars to an issue, merchant bankers,

underwriters, portfolio managers, investment advisers and such other intermediaries who may

be associated with securities markets in any manner;[(ba) registering and regulating the

working of the depositories, [participants,] custodians of securities, foreign institutional

investors, credit rating agencies and such other intermediaries as the Board may, by

notification, specify in this behalf;](c) registering and regulating the working of [venture capital

funds and collective investment schemes],including mutual funds; (d) promoting and regulating

self-regulatory organisations; (e) prohibiting fraudulent and unfair trade practices relating to

securities markets; (f) promoting investors' education and training of intermediaries of

22

SEBIs basic function is "...to protect the interests of investors in securities and

to promote the development of, and to regulate the securities market and for

matters connected therewith or incidental thereto"

3.2.3 Insurance Authority

The Insurance Regulatory and Development Authority (IRDA)

29

is a national

agency of the Government of India. The mission of IRDA as stated in the act

is "to protect the interests of the policyholders, to regulate, promote and ensure

orderly growth of the insurance industry and for matters connected therewith

or incidental thereto."

Sec 14 of IRDA Act, prescribes the duties to regulate the insurance companies

and to attain the mission.

30

securities markets; (g) prohibiting insider trading in securities; (h) regulating substantial

acquisition of shares and take-over of companies; (i) calling for information from, undertaking

inspection, conducting inquiries and audits of the [ stock exchanges, mutual funds, other

persons associated with the securities market] intermediaries and self- regulatory

organizations in the securities market; [(ia) calling for information and record from any bank

or any other authority or board or corporation established or constituted by or under any

Central, State or Provincial Act in respect of any transaction in securities which is under

investigation or inquiry by the Board;] (j) performing such functions and exercising such

powers under the provisions of [...]the Securities Contracts (Regulation) Act, 1956(42 of

1956), as may be delegated to it by the Central Government; (k) levying fees or other charges

for carrying out the purposes of this section; (l) conducting research for the above

purposes; [(la) calling from or furnishing to any such agencies, as may be specified by the

Board, such information as may be considered necessary by it for the efficient discharge of its

functions;](m) performing such other functions as may be prescribed.

29

<http://www.irda.gov.in/ADMINCMS/cms/NormalData_Layout.aspx?page=PageNo1332an

dmid=1.9> Accessed on 10th May 2014

30

S. 14 of IRDA Act, 1999 lays down the duties, powers and functions of IRDA..

Without prejudice to the generality of the provisions contained in sub-section (1), the powers

and functions of the Authority shall include, -

(1) issue to the applicant a certificate of registration, renew, modify, withdraw, suspend or

cancel such registration; (2) protection of the interests of the policy holders in matters

concerning assigning of policy, nomination by policy holders, insurable interest, settlement of

insurance claim, surrender value of policy and other terms and conditions of contracts of

insurance; (3)specifying requisite qualifications, code of conduct and practical training for

intermediary or insurance intermediaries and agents, (4) specifying the code of conduct for

surveyors and loss assessors; (5) promoting efficiency in the conduct of insurance business;

23

3.2.4 Forward Market Commission India (FMC)

Forward Markets Commission (FMC)

31

headquartered at Mumbai, is a

regulatory authority which is overseen by the Ministry of Consumer Affairs,

Food and Public Distribution, Government of India.

Its mission is: to provide for the regulation of certain matters relating to forward

contracts, the prohibition of options in goods and for matters connected

therewith.

The functions

32

of the Forward Markets Commission are as follows:

(a) To advise the Central Government in respect of the recognition or the

withdrawal of recognition from any association or in respect of any other matter

arising out of the administration of the Forward Contracts (Regulation) Act

1952.

(b) To keep forward markets under observation and to take such action in

relation to them.

(c) To collect and whenever the Commission thinks it necessary, to publish

information regarding the trading conditions in respect of goods including

information regarding supply, demand and prices

(6)promoting and regulating professional organisations connected with the insurance and re-

insurance business; (7)levying fees and other charges for carrying out the purposes of this

Act; (8)calling for information from, undertaking inspection of, conducting enquiries and

investigations including audit of the insurers, intermediaries, insurance intermediaries and

other organisations connected with the insurance business

31

, http://www.fmc.gov.in/index1.aspx?lid=26andlangid=2andlinkid=18 Accessed on10th May

2014

It is a statutory body set up in 1953 under the Forward Contracts (Regulation) Act, 1952.

The Commission has been keeping the commodity futures markets well regulated. In order to

protect market integrity, the Commission has prescribed the following measures

1. Limit on open position of an individual members as well as client to prevent over trading;

2. Limit on price fluctuation (daily/weekly) to prevent abrupt upswing or downswing in prices;

3. Special margin deposits to be collected on outstanding purchases or sales to curb

excessive speculative activity through financial restraints;

32

<http://www.fmc.gov.in/index3.aspx?sslid=27andsubsublinkid=13andlangid=2> Accessed

on 12th May 2014

24

(d) To make recommendations generally with a view to improving the

organization and working of forward markets;

(e) To undertake the inspection of the accounts and other documents of any

recognized association or registered association or any member of such

association whenever it considers it necessary.

25

CHAPTER IV

WHAT DOES SUPER REGULATOR MEAN IN FINANCIAL MARKET?

This chapter examines the concept of a unified financial services regulator,

highlighting differences in the approaches taken by different countries.

Countries such as UK had formed an informal club of integrated supervisors

after 1997 financial crisis all over the world to restructure their financial market

based on their social, economic and political environment. In many countries,

the unified regulator is structured on either a functional or principal or a silos

matrix, depending on local conditions and the objectives of regulation and to

incorporate various departments of a regulatory agency, such as the legal,

licensing, supervision, and investment Policy Departments etc.

To mitigate the problems posed by the blurring of activities among

providers of various financial services and operations of financial

conglomerates, the following four broad approaches

33

have been suggested:

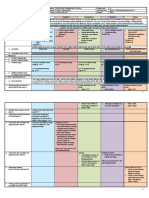

4.1 Institutional

Approach

The Institutional Approach is one in which a firms

legal status (for example, a bank, broker dealer or

insurance company) determines which regulator is

tasked with overseeing its activity from both a safety

and soundness

Eg. China, Hong Kong and Mexico

4.2 Functional

Approach

The Functional approach is one in which supervision

is oversight is determined by business that is being

transacted by the entity without regards to its legal

33

The Structure Of Financial Supervision Approaches And Challenges In A Global

Marketplace, Group 30 report, <

http://www.group30.org/images/PDF/The%20Structure%20of%20Financial%20Supervision.p

df > Accessed on 9

th

June 2014

26

status. Each type of business has its own functional

regulator.

E.g. Brazil, France.

4.3 Integrated

Approach

The Integrated approach is one in which a single

universal regulator conducts both safety and

soundness oversight and conduct of business

regulation of all financial sectors

E.g. U.K., Singapore and Germany

4.4 Twin Peak

Approach

The Twin peak approach, a form of regulation by

objective is one in which there is a separation of

regulatory function between two regulators one that

performs the safety and soundness supervision

function and the other focus on conduct of business

regulation

Eg. Australia, U.S.

In practicality No pure form of regulatory model actually exist but mixed

approaches are prevalent. Some countries have single regulators regulating

all major segments of the financial sector like banking, insurance, pension and

securities. The reconstruction of regulatory architecture involve substantive

issues of the design and performance of financial markets which are important

when considering supervisory and regulatory reforms. Central bank,

supervisors and ministries of finance must ensure that important public policy

goals continue to be achieved in a dynamic global marketplace. Financial

innovation enhanced the profitability of the financial sector for a period of time

but at the same time create significant challenges in managing the risks of

these cutting-edge products. For example, derivative or CCD or ULIP clearly

altered the financial sector over a period of time, involvement of banks in

27

insurance sector and securities market. Private equity firms and hedge funds

represent an increasing percentage of financial markets activity, but they have

generally not been subject to direct supervisory oversight. The specific way in

which regulation and supervision have been structured in each jurisdiction

reflects, among other things their unique history, politics, culture, size,

economic development, and local business structure.

In an attempt to focus on the topic of unified financial services supervision, de

Luna Martinez and Rose conducted a survey in 15 countries that have adopted

integrated supervision. They examined (a) the reasons countries cited for

establishing an integrated supervisory agency; (b) the scope of the regulatory

and supervisory powers of these agencies; (c) the progress these agencies

had made in harmonizing their regulatory and supervisory practices across the

intermediaries they supervise; and (d) the practical problems policy makers

faced in adopting integrated supervision.

34

In their analysis they concluded that integrated supervisory agencies is not as

homogeneous as it seems, differences arise with regard to the scope of

regulatory and supervisory powers the agencies have been given and less

than that 50 per cent of the agencies can be categorized as mega-supervisors.

Another finding is that in most countries progress toward the harmonization of

prudential regulation and supervision across financial intermediaries remains

limited. Interestingly, the survey revealed that practically all countries believed

that they have achieved a higher degree of harmonization in the regulation and

supervision of banks and securities companies than between banks and

insurance firms.

35

34

J. de Luna Martinez and T. A. Rose, International Survey of Integrated Financial Sector

Supervision, Financial Sector Operations Policy Department, Policy Research Working Paper

No. 3096, Abstract(World Bank 2003)

<http://elibrary.worldbank.org/doi/pdf/10.1596/1813-9450-3096> Accessed on 13th May 2014

35

Ibid

28

A set of question arosed whether professionals, policy makers, and institutions

are concerned with restructuring of new frameworks for financial services

supervision via a single or multiple independent regulator? What are the key

features or them to consider when promoting the independence of a financial

services regulator? Is it important that regulator should be politically

independent, transparent and accountable? Whether central bank in making

of monetary and fiscal policy and regulation of currency should be separated

from prudential regulation?

World Bank,

36

puts it succinctly that an independent central bank when

focused exclusively on price stability has become a central part of the mantra

of economic reform. Research suggests that if central banks focus on

inflation, they do a better job at controlling inflation. But controlling inflation is

not an end in itself: it is merely a means of achieving faster, more stable growth,

with lower unemployment. These are the real variables that matter, and there

is little evidence that independent central banks focusing exclusively on price

stability do better in these crucial respects....

While the term independence, in its ordinary meaning, could entail the idea

of not being influenced or controlled by others, the independence of any

regulatory agency can be viewed from four related angles: regulatory,

supervisory, institutional, and budgetary.

37

Regulatory independence in the

financial sector means that regulators have wide autonomy in setting, at a

minimum, prudential regulations that follow from the special nature of financial

36

Kenneth Kaoma Mwenda, Legal Aspects of Banking Regulation: Common Law Perspectives

from Zambia, 81 (2010) <http://www.pulp.up.ac.za/cat_2010_07.html> Accessed on 16th May

2014

37

M. Quintyn and M. W. Taylor, Should Financial Sector Regulators Be Independent?34

Economic Issues, 6 (IMF 2004),

<www.imf.org/external/pubs/ft/issues/issues39/ei39.pdf> Accessed on16th May 2014

29

intermediation.

38

These regulations concern practices that financial institutions

must adopt to maintain their safety and stability, including minimum capital

adequacy ratios, exposure limits, and loan provisioning.

39

It has been argued

that regulators who are able to set these rules independently are more likely

to be motivated to enforce them. But is the fact that the regulators and

supervising financial services business are independent an end in itself, or

should these regulators also be committed to transparency and accountability?

Supervisory regulation is crucial to financial sector difficult to establish and

guarantee not only in inspecting and monitoring but also in enforcing sanctions.

Thus, steps to protect supervisors integrity include offering legal protection

(for example, repealing laws that, in some countries, allow supervisors to be

sued personally for their work) and providing financial incentives that allow

supervisory agencies to attract and keep competent staff and discourage

bribery. Crafting a rules-based system of sanctions and interventions also

lessens the scope for supervisory discretion and thus for political or industry

interference.

40

To protect supervisors from political or industry intimidation during a lengthy

court process, banking law should also limit the time allowed for appeals by

institutions facing sanctions. Independent supervisors, not a government

agency or minister, should be given sole authority to grant and withdraw

licenses because they best understand the financial sectors proper

compositionand because the threat to revoke a license is a powerful

supervisory tool.

41

38

Ibid.

39

Ibid.

40

Ibid

41

Ibid.

30

Other issues that should be considered while examining the concept of an

independent financial services regulator include as what impact would rampant

corruption in either the financial services industry or the civil service have on

the efficacy of the legal, regulatory, and institutional framework for financial

services supervision? ; and If a financial services regulator is part of the civil

service, and is housed in the Ministry of Finance, how independent could the

regulator be and to what extent can the regulator be shielded from corrupt

practices.

31

CHAPTER V

INDIAS FINANCIAL REGULATORY MECHANISM PITFALLS

5.1 Indias Financial Regulatory Jurisdiction overlaps cases

With the introduction of competition and sector regulatory laws, new

mechanisms are needed to ensure effective interface between the two

regimes. There is an increased need to exploit complementary expertise

and perspectives of different financial regulators. The regulatory interface

problem is centered on the degree to which sectors being opened up to greater

competition should also be subject to general competition laws and how and

by whom such laws are to be administered. One of the functions of economic

policy is to enable markets to play their role. Well-functioning, efficient markets

are an important factor in the creation and safeguarding of welfare, as they are

one of the drivers of the competitiveness of an economy. As a branch of

economic policy, competition policy is an important instrument to keep markets

efficient. The core business of competition policy is to fight restrictive

competitive practices. Usually, a control mechanism on mergers and

acquisitions is part of the coverage of competition policy Except for merger

cases, competition policy is applied ex post (i.e. competition authorities only

take action after certain facts have occurred). Moreover, it is general in nature,

as it covers all economic activities, in all sectors and markets. The observation

of competition rules by companies is usually controlled by specially designed

institutions, competition authorities which as a rule act relatively independently

from politics. These competition authorities prohibit activities that are deemed

to be incompatible with competition rules and impose fines on the companies

that engage in such activities.

The overlap is situated at several levels. First of all, there can be an overlap

between general competition rules and sector-specific rules. Many issues

32

situated in the nucleus of sector regulation can be translated towards

competition law (cf. access to markets). Access in network industries can also

be dealt with by competition policy using the doctrine of the 'essential facilities'.

The same broadly applies to issues such as cross-subsidization and the non-

discrimination between affiliates and other clients. Another kind of overlap can

occur between jurisdictions. Competition authorities as well as sector

regulators can offer remedies, while sector regulators sometimes have dispute

settlement procedures to offer to operators. Furthermore, several countries

have given sanctioning powers to sector regulators. Finally, there can be

regulatory inconsistencies and jurisdictional confusion when plaintiffs have

several options, e.g. in the choice of dispute settlement procedure. This can

lead to contradictory decisions, thus introducing the need for a system of case

allocation.

5.1.1 SEBI v/s IRDA (ULIP)

Unit-linked insurance plans (ULIP), a favourite among the investor community

and insurance industry, is a product offered by insurance companies that

unlike a pure insurance policy gives investors the benefits of both insurance

and investment under a single integrated plan. A part of the premium paid is

utilized to provide insurance cover to the policy holder while the remaining

portion is invested in various equity and debt schemes. The money collected

by the insurance provider is utilized to form a pool of fund that is used to invest

in various markets instruments (debt and equity) in varying proportions just the

way it is done for mutual funds. Policy holders have the option of selecting the

type of funds (debt or equity) or a mix of both based on their investment need

and appetite.

An important dispute aroused between regulators i.e. SEBI and IRDA as to

which regulator has jurisdiction to deal with the ULIP. The tussle is due to the

33

fact that the money charged for ULIP as insurance product which comes under

IRDA at the same time charged money are investment in securities market

under the control of SEBI. For which SEBI has issued the order

42

restraining

the 14 insurance companies to deal further.

Certain controversies arose are (1) aren't all companies dealing with securities

and mutual funds in India registered with SEBI and following its Regulations?

Why are the insurance companies so special that they are not required to

follow these Regulations? And most importantly, what brings IRDA in picture?;

(2) What are those 14 insurance companies, required to do? To follow the

SEBI order and stop business or to follow IRDA order and continue business

in ULIPs?; (3) What is the recourse available to either SEBI or IRDA if the

insurance companies defy either of their orders? Will legal sanctions follow the

insurance companies in case of their failure to meet out either of the orders?;

and (4) What happens to investors in these ULIPs? What is the legal status of

the policies purchased/renewed by them after the SEBI order?

In the financial year 2008-09, 7.03 crore ULIP policies were sold and

companies garnered premium of more than Rs 90,645 crores. Till February

2010, the life insurance industry had sold 16.7 lakh policies.

43

It is due to the

fact that IRDA which has jurisdiction to regulate and monitor insurance

companies has already sanction the scheme proposed by insurance

companies relating to ULIP, on the contrary SEBI has passed the restraining

order to carry out further operations. In such situation, companies has no

further choice has to which order should they appeal and before whom? Either

way, they are bound to face regulatory action from either SEBI or IRDA,

depending upon which order they decide to follow. Another big question arose

42

<http://www.sebi.gov.in/cmorder/ULIPOrder.pdf> Accessed on16th May 2014

43

Suneet Ahuja Kholi, SEBI vs IRDA, The Indian Express, (12 April 2010)

<http://archive.indianexpress.com/news/sebi-vs-irda/604835/2> Accessed on 14th May 2014

34

is that both SEBI and IRDA is the creature of statute and neither has power to

restrain other or interfere or give directions to each other, till that time matter

is sub-judice. As the matter is stayed for a period of time, companies are legally

barred from renewing or offering any ULIPs. Thus the new/renewed scrips are

contrary to law (being the order passed in terms of the SEBI Act). The law of

contracts entitles the agreements not enforceable by law as 'void'. Thus the

ULIPs, which are nothing but agreements between the subscribers and the

insurance companies, are void till the time the SEBI order stay. In this scenario,

a subscriber cannot bring an action for violation of any of the terms of the ULIP

by the company and vice versa.

In fact the object of such agreements, under the law of contracts, is also

unlawful as it is forbidden by law and thus no legal rights flow from ULIP. The

effective stoppage of the sale of the said products will cause a complete drying

up of the revenue flows to the insurance companies which could disrupt the

payment of benefits on maturity, on death and on other admissible claims,

putting the policyholder and the general public to irreparable financial loss. The

financial position of the insurers will be seriously jeopardized thus destabilizing

the market and upsetting financial stability are the concerns of IRDA. It means

that subscribers of ULIP has to wait till the further direction by SEBI, or if the

matter is settled by court of law.

44

The issue at hand is not simple reason being it concerns with the power and

jurisdiction of various market regulator to be defined, financial effect of order

issued by respective regulator and incapacity of other regulator in such

scenario. When the matter raised before Supreme Court, the government

44

Tarun Jain, SEBI vs IRDA: Exploring the tussle between regulators over ULIPS, Law in

Perspective, <http://legalperspectives.blogspot.in/2010/04/sebi-v-irbi-exploring-tussle-

between.html> Accessed on 15th May 2014

35

instead of giving their arguments issue an ordinance

45

, provides that "the

decision of the Joint Committee shall be binding on the Reserve Bank of India,

the Securities and Exchange Board of India, the Insurance Regulatory and

Development Authority and the Pension Fund Regulatory and Development

Authority". It give the authority to override any other act which are contrary to

their provision, it would now not be open to the regulators to go ahead and act

contrary to the Ministry's instructions. Thus its not just for SEBI or IRDA but

the Government has gone ahead to ensure that no such jurisdictional tussles

do not take place in full public view in future.

Another effect of this ordinance is that it create a virtual extension of jurisdiction

of IRDA contrary to SEBI in which Life Insurance product has been extended

to "include any unit linked insurance policy or scrips or any such instrument

or unit, by whatever name called, which provides a component of investment

and a component of insurance issued by an insurer" while simultaneously

excluding them from within the definition of 'securities' such that SEBI shall not

be able to bring them within its fold. This raised another aspects that regulators

are creature of statute passed by parliament i.e. supreme authority but Joint

Committee established by executive order of Ministry get an edge over

respective regulators and undermine the laws in force in India, as the decisions

of joint committee is binding on regulators which has overturn the power and

duties concepts of institutional mechanics.

The SEBI took into account the provisions of the SEBI Act, Securities Contract

Regulation Act and the IRDA Act, all three of which stand amended to the

effect that ULIPs and other similar insurance products are not covered within

the definition of 'securities' but are instead a part and parcel of 'life insurance'

45

, Securities and Insurance Laws (Amendment and Validation) Ordinance, 2010

<http://www.taxmann.com/TaxmannFlashes/flashst21-6-10_1.htm> Accessed on14th May

2014

36

products, then deleting the very basis on which the SEBI order was passed.

Further the aspect of having given retrospective operation to the Ordinance

implies that legally it would be presumed that the amended provisions as

introduced by the Ordinance were in place at all times and thus the very basis

(i.e. the statutory provisions) which were examined by the SEBI to find giving

jurisdiction to SEBI over ULIPs never existed and thus the SEBI order is now

without legal basis looking elsewhere for its sustenance.

However, after this court restrain themselves to entertain the matter due to

which questions raised before court of law are unsettled and create an

ambiguity in the institutional framework.

Firstly that there has been constantly rise in new types of financial products

being developed by financial firms, the joint committee would need frequent

legislative interventions to be operable. For example, the joint committee in its

current form, does not include the Forwards Markets Commission (FMC) and

if in case products of hybrid nature like steel futures and steel companies

futures were formulated then the FMC would not be allowed to approach the

joint committee as the Commission is not a recognized regulator under the

ordinance. Secondly there is possibility of involving issues concerning ``hybrid"

or ``composite" instruments disputes could arise between regulators that do

not involve an underlying hybrid or composite instrument. Thirdly an instrument

governed by one regulator that has a negative effect on the market regulated

by another regulator, as with the regulatory arbitrage hypothesis suggested

above, could not be referred to the joint committee.

Fourth, the structure of the joint committee points to problems of institutional

design. The ordinance is largely silent about the procedures the joint

committee would follow. This is not simply a technical matter. How would

differences of opinion in the board be settled? By majority vote? Consensus?

37

Would there be staffing? Who would be responsible for expenses? In case of

discrepancies which is the higher forum to deal with issues in case matter is

unsettled? The method adopted by executive in large are arbitrary yet these

are not simply mundane questions and impact, materially, how extensively the

committee could study and resolve matters before it. Fifth, the process by

which the ordinance was passed is worrisome, regulators were not consulted

on the ordinance that amends four major acts of parliament, and there is no

consultation as to expertness and democratic process?

Sixth, the ULIP dispute has been presented as a contest between SEBI and

IRDA. Implicitly, one regulator had to win, and the other, lose. This is

misleading. One scenario would have each regulator govern the portion of

ULIPs which fall within their domain. IRDA would govern the insurance

component of these instruments and SEBI would govern the investment

component. For example, take an example of case of motor vehicle in case it

cause damage matter goes to civil liability but when it cause hurt or injury or

death criminal liability occur and simultaneously remedy is in MV Act, IPC and

Tort law. The government would never declare that all motor vehicle drivers

are immune from civil or criminal laws. The more complex the transaction, the

more regulation might apply.

5.1.2 SEBI v/s RBI (CURRENCY DERIVATIVE)

Currency derivative

46

are efficient risk management tools which means an

instrument derivative indicates its value from some underlying based

inference is foreign exchange rates and flow. Another controversial issue

aroused between the Reserve Bank of India and the Securities and Exchange

46

<http://www.moneycontrol.com/glossary/currency/what-is-currency-derivatives_845.html>

Accessed on12th May 2014

38

Board of India about the currency futures market. By definition, a currency

futures is an exchange-traded product, where on one hand currency is involved

as well as trading where one matter is regulated by RBI and another by SEBI.

Perhaps currency trading is important based on four arguments that it

concerns with economies of scope and economies of scale for India to become