Академический Документы

Профессиональный Документы

Культура Документы

IAG's Keys to Success in Life Insurance

Загружено:

Everson BoyDayz PetersОригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

IAG's Keys to Success in Life Insurance

Загружено:

Everson BoyDayz PetersАвторское право:

Доступные форматы

Snapshot of a Successful Life Company

Does Size Matter?

Industrial Alliance Insurance and Financial Services

CIBC World Markets Frontenac Institutional Investor Conference

Quebec City, September 18, 2003

1

Snapshot of a Successful Life Company

Does Size Matter?

CIBC World Markets

Frontenac Institutional Investor Conference

Quebec City, September 18, 2003

2

Key Success Factors of a Life Company

n Sound business strategy

n Good financial strength

n Strong operational efficiency

Which lead to strong growth and

high and consistent profits

Snapshot of a Successful Life Company

Does Size Matter?

Industrial Alliance Insurance and Financial Services

CIBC World Markets Frontenac Institutional Investor Conference

Quebec City, September 18, 2003

3

Excel in one functional skill

Build dominant positions in chosen markets

Stake out position less vulnerable to

head-to-head competition

Exploit industry changes

Develop permanent competitive advantages

Sound Business Strategy

Impact of size

-

-

4

Good Financial Strength

Strong asset quality

Adequate actuarial reserves

Proven risk management

Capacity to raise long-term capital

High ratings

Impact of size

-

-

-

Snapshot of a Successful Life Company

Does Size Matter?

Industrial Alliance Insurance and Financial Services

CIBC World Markets Frontenac Institutional Investor Conference

Quebec City, September 18, 2003

5

Strong Operational Efficiency

Cost-efficient

Competitive and up-to-date technology

Performance-driven environment

Well-developed people system

Impact of size

-

-

6

Industry Characteristics

n Products No differentiation

n Growth potential Moderate for insurance products

High for wealth management

n Distribution Distributors have significant power in

consumer purchasing decisions

n Fixed costs Represent a small proportion of the

cost structure (beyond a certain critical

mass, relatively few economies of scale)

Conclusion: Distribution is the key

Snapshot of a Successful Life Company

Does Size Matter?

Industrial Alliance Insurance and Financial Services

CIBC World Markets Frontenac Institutional Investor Conference

Quebec City, September 18, 2003

7

Industry Characteristics

Claims

53%

Compensation

19%

Expenses

14%

Profit and

taxes (incl. IIT)

14%

Distribution of the Price of an Individual Insurance Policy

Example of a UL level cost of insurance policy

Expenses are not a key differentiating factor

8

Sound Business Strategy

Snapshot of a Successful Life Company

Does Size Matter?

Industrial Alliance Insurance and Financial Services

CIBC World Markets Frontenac Institutional Investor Conference

Quebec City, September 18, 2003

9

Sound Business Strategy

Key Elements of IAGs Business Strategy

1. Excel in one functional skill: Distribution (underpins strategy)

2. Build dominant positions in chosen markets

3. Stake out a position that is less vulnerable to head-to-head

attacks from competitors

4. Exploit industry changes (forward-looking management)

5. Develop permanent competitive advantages

10

1. Excel in One Functional Skill: Distribution

n The key paradigm of the life insurance industry: life

insurance is a product that is sold to consumers,

not a product that is bought by consumers

n Success is therefore achieved through distribution

IAGs strategy

Serve all the needs of a segment of distributors, captive or

independent, where our global offering can make a difference

Snapshot of a Successful Life Company

Does Size Matter?

Industrial Alliance Insurance and Financial Services

CIBC World Markets Frontenac Institutional Investor Conference

Quebec City, September 18, 2003

11

1. Excel in One Functional Skill: Distribution

Insurance

brokers

64%

Securities

brokers

9%

Other

2%

Exclusive

agents

25%

Insurance

brokers

59%

Exclusive

agents

41%

Exclusive Insurance Securities Mutual funds

agents brokers dealers planners

1,280 Over 12,000 Over 300 Over 1,000 (new)

IAGs Key Strength: Manage Large and Multi-Channel Networks

Individual Insurance

H1 2003 sales: $61.3 million

Individual Annuities

H1 2003 sales: $365.1 million

12

2. Build Dominant Positions in Chosen Markets

Individual Insurance Segregated Funds

Top 5

2002

Sales Premiums Net sales Assets

1 Sun/Clarica Sun/Clarica Great-West Great-West

2 IAG Great-West Sun/Clarica Manulife

3 Manulife Manulife IAG Maritime

4 Great-West IAG TD Bank Sun/Clarica

5 Transamerica Maritime Manulife IAG

IAG market

share

1 12.9% 6.9% 14.4% 7.3%

Among the top 5 providers in each line of business

in which we choose to operate

IAG: Key Player in the Retail Insurance and Annuity Markets

1

2002 figures, except for seg fund assets (June 30, 2003)

Sources: CLHIA, LIMRA, IFIC, Investor Economics and Beyond 20/20

Snapshot of a Successful Life Company

Does Size Matter?

Industrial Alliance Insurance and Financial Services

CIBC World Markets Frontenac Institutional Investor Conference

Quebec City, September 18, 2003

13

Current Price Pressures

2. Build Dominant Positions in Chosen Markets

n Not a new element

n Usually only lasts for a very short period

n If pressure is maintained for a longer period, there are only

two possible outcomes for each company:

n Move back towards more disciplined pricing

n Lose margins

14

3. Stake Out a Position That is Less Vulnerable

to Head-to-Head Attacks From Competitors

IAG Avoids Competing on Price Only

n Develop a smart product mix

n IAG is not a single product company

n Rely on a loyal sales force

n Exclusive career agents and dedicated brokers

n More concentrated in the family market (less crowded),

while pursuing development in the high-income market

n Stand out with:

n New complementary products: RESPs, hedge funds

n Original sales concepts: new insured annuities

n Innovative features: critical illness refund

Snapshot of a Successful Life Company

Does Size Matter?

Industrial Alliance Insurance and Financial Services

CIBC World Markets Frontenac Institutional Investor Conference

Quebec City, September 18, 2003

15

Take Advantage of Convergence in Distribution

n Stock brokers 74% have a life license

n Mutual fund agents 60% have a life license

n Life agents 65% have a mutual funds license

4. Exploit Industry Changes

And many agents have more than two licenses

16

Year Company Sector

2001 Concorde Mutual fund dealer

2002 ISL-Lafferty Securities broker

2002 BNP (Canada) Securities broker

2002/03 FundEX (75%) Mutual fund dealer

2002 Leduc Securities broker

2003 Global Allocation Mutual fund dealer

2003 Co-operators MF Mutual fund manufacturer

IAGs Wealth Management Strategy: Recent Acquisitions

Aimed at Enhancing Distribution

4. Exploit Industry Changes

Total purchase price: less than $14 million

1,000 new brokers and some $4.5 billion in AUA

Snapshot of a Successful Life Company

Does Size Matter?

Industrial Alliance Insurance and Financial Services

CIBC World Markets Frontenac Institutional Investor Conference

Quebec City, September 18, 2003

17

5. Develop Permanent Competitive Advantages

n We help our distributors grow their business,

attract new agents and improve their head office

n No key decision is made without their input

n We focus on distributors for which our support

can make a difference

IAG Focuses on Distribution

18

Good Financial Strength

Snapshot of a Successful Life Company

Does Size Matter?

Industrial Alliance Insurance and Financial Services

CIBC World Markets Frontenac Institutional Investor Conference

Quebec City, September 18, 2003

19

Good Financial Strength

Strong asset quality

Adequate actuarial reserves

Proven risk management

Capacity to raise long-term capital

High ratings

Impact of size

-

-

-

20

Prudent Long-Term Management Approach

n Strong asset quality

n Everyone agrees that IAG has a high, above-average

quality of assets

n Adequate actuarial reserves

n Compares favorably to peers on any criteria (PADs, EmV)

n Conservative seg fund reserving: highest standard at CTE 80

n Proven risk management

n Conservatively-designed seg fund guarantee

n Optimal/limited use of reinsurance: not used to front-end profits

Good Financial Strength

Snapshot of a Successful Life Company

Does Size Matter?

Industrial Alliance Insurance and Financial Services

CIBC World Markets Frontenac Institutional Investor Conference

Quebec City, September 18, 2003

21

Capacity to Raise Long-Term Capital

Successful Issue of Innovative Tier 1 (IATS)

on July 4, 2003

n Issue of $150 million

n Permanent capital now accounts for 87% of total capital

n Securities carry an annual yield of 5.714%

n Represents a spread of 120 basis points over 10-year

Canada bonds

n IATS spread is only 15 basis points higher than Sun Life,

Manulife and Great-West

22

High Ratings

Rating agency Rating Level Trend First rating

Standard & Poors A+ 4/21 Stable 1995

1

DBRS IC-2 2/5 Stable 2000

A.M. Best A (Excellent) 3/16 Stable 1995

1

Originally from CBRS

n A+ rating from S&P, similar to that of 3 out of the 5 largest

Canadian banks

n Rating influence on ability to attract new business

n Very low for retail and group insurance businesses

n Somewhat important for large Group Pensions accounts

Snapshot of a Successful Life Company

Does Size Matter?

Industrial Alliance Insurance and Financial Services

CIBC World Markets Frontenac Institutional Investor Conference

Quebec City, September 18, 2003

23

Strong Operational Efficiency

24

Strong Operational Efficiency

Cost-efficient

Competitive and up-to-date technology

Performance-driven environment

Well-developed people system

Impact of size

-

-

Snapshot of a Successful Life Company

Does Size Matter?

Industrial Alliance Insurance and Financial Services

CIBC World Markets Frontenac Institutional Investor Conference

Quebec City, September 18, 2003

25

IAG is a Low-Cost Producer

n Our strategy favours policy count over size

n IAG sells over 100,000 individual life insurance policies a year

(17% market share in 2002)

n Top managements ability to penetrate to business

microlevels

n Culture: one sponsor for every dollar of expenses

n Quebec City is a cost-efficient location to operate

Cost-Efficient

We improve what we measure

26

Competitive and Up-To-Date Technology

n Invest in technology if strategic, important and profitable

n Close follower, except where we can make a difference

n Software at points-of-sale

n Customer relationship management (CRM) for agents

n Technology decision-making process is geared to meet

real needs and deliver benefits

n Job rotation for information system users and professionals

n Investments chosen by head of business unit (not head of IS)

Snapshot of a Successful Life Company

Does Size Matter?

Industrial Alliance Insurance and Financial Services

CIBC World Markets Frontenac Institutional Investor Conference

Quebec City, September 18, 2003

27

Focus on Achieving Long-Term Goals

n Performance-driven environment

n Managers responsible for both the top and the bottom line

n Demanding work place

n Systematically learn from mistakes

n Well-developed people system

n Focus on performance and motivation

n Low turnover rate: 5%

n Average length of service with the Company: 18 years

n Training programs: 3% of payroll

Strong Operational Efficiency

28

And the Future...

Snapshot of a Successful Life Company

Does Size Matter?

Industrial Alliance Insurance and Financial Services

CIBC World Markets Frontenac Institutional Investor Conference

Quebec City, September 18, 2003

29

And the Future...

n Beyond a certain critical mass, that IAG easily satisfies,

size is not a key success factor

n Sound business strategy matters more than size

n Excel in one functional skill: Distribution

n IAGs distribution strategy is what distinguishes it from

its competitors

Well-Nurtured Success Factors Lead

to Successful Results

IAG can be as successful in the future

as it has in the past

30

Snapshot of a Successful Life Company

Does Size Matter?

CIBC World Markets

Frontenac Institutional Investor Conference

Quebec City, September 18, 2003

Вам также может понравиться

- A Votre SantéДокумент4 страницыA Votre SantéAiswarya Johny RCBSОценок пока нет

- Ortho 500 Sales StrategyДокумент4 страницыOrtho 500 Sales Strategyavi201567% (6)

- Group Accounts Consolidation Questions BankДокумент43 страницыGroup Accounts Consolidation Questions BankAli Sheikh93% (14)

- EC11PS6Документ2 страницыEC11PS6jamesОценок пока нет

- Top 5 Philippine Insurance Companies Competitive Profile MatrixДокумент4 страницыTop 5 Philippine Insurance Companies Competitive Profile MatrixJayОценок пока нет

- Asia Nova Ceramics Case AnalysisДокумент7 страницAsia Nova Ceramics Case Analysisrj carreraОценок пока нет

- FINS 1612 homework on Disney film re-releaseДокумент12 страницFINS 1612 homework on Disney film re-releaserickОценок пока нет

- Pricing Products Pricing Considerations and ApproachesДокумент19 страницPricing Products Pricing Considerations and ApproachesMhel DemabogteОценок пока нет

- Smbp14 Caseim Section C Case 03Документ5 страницSmbp14 Caseim Section C Case 03Hum92re100% (1)

- SubaruДокумент7 страницSubaruclaude terizlaОценок пока нет

- Services Marketing Christopher LovelockДокумент297 страницServices Marketing Christopher LovelockKapilGhanshaniОценок пока нет

- Stein Stan - Secrets For Profiting in Bull and Bear MarketsДокумент5 страницStein Stan - Secrets For Profiting in Bull and Bear MarketsAnmol Bajaj100% (3)

- Purchase and Sales Entry in Journal ModeДокумент9 страницPurchase and Sales Entry in Journal ModeBiplab SwainОценок пока нет

- Critical Success FactorsДокумент17 страницCritical Success FactorsKanu Sharma100% (1)

- Benefits of Life InsuranceДокумент3 страницыBenefits of Life InsuranceAgarwal SumitОценок пока нет

- Space Matrix SampleДокумент3 страницыSpace Matrix SampleAngelicaBernardoОценок пока нет

- of InsuranceДокумент18 страницof InsuranceDeepika verma100% (4)

- Broker Tenders Guide 2015 WEBДокумент32 страницыBroker Tenders Guide 2015 WEBLestijono LastОценок пока нет

- Transformational Business - Philippine Business Contributions To The Un SdgsДокумент166 страницTransformational Business - Philippine Business Contributions To The Un SdgsblackcholoОценок пока нет

- Ethics in Insurance SectorДокумент40 страницEthics in Insurance SectorRohan DhamiОценок пока нет

- Chapter 1 Page NoДокумент70 страницChapter 1 Page NoKaran PandeyОценок пока нет

- A Report On: Customer Relationship Management of Idbi Federal Life InsuranceДокумент95 страницA Report On: Customer Relationship Management of Idbi Federal Life InsuranceamitОценок пока нет

- Vice CosmeticsДокумент37 страницVice CosmeticsBlessie BinabiseОценок пока нет

- Critical Analysis of Northern Rock S Failure - Free Finance Essay - Essay UKДокумент6 страницCritical Analysis of Northern Rock S Failure - Free Finance Essay - Essay UKZekria Noori AfghanОценок пока нет

- Duties of Insurance Brokers ExplainedДокумент6 страницDuties of Insurance Brokers ExplainedStevan PknОценок пока нет

- Micro InsuranceДокумент17 страницMicro InsurancerishipathОценок пока нет

- Health Insurance and Risk ManagementДокумент7 страницHealth Insurance and Risk ManagementPritam BhowmickОценок пока нет

- Insurance and Risk ManagementДокумент140 страницInsurance and Risk Managementgg100% (1)

- Marketing MixДокумент6 страницMarketing MixHimanshu PaliwalОценок пока нет

- Marketing Plan to Expand NepalLife Insurance in Rural NepalДокумент18 страницMarketing Plan to Expand NepalLife Insurance in Rural NepalSharad PyakurelОценок пока нет

- Marketing Mix Insurance SectorДокумент4 страницыMarketing Mix Insurance SectorSantosh Pradhan100% (1)

- Activities of Delta Life Insurance Company LimitedДокумент42 страницыActivities of Delta Life Insurance Company LimitedrayhanrabbiОценок пока нет

- Competitive Analysis and Strategic Planning for Be Grand ResortДокумент14 страницCompetitive Analysis and Strategic Planning for Be Grand ResortChristian CagasОценок пока нет

- Woolworths Limited Risk Management PolicyДокумент3 страницыWoolworths Limited Risk Management PolicyQuang HuyОценок пока нет

- Insurance OperationsДокумент12 страницInsurance OperationsIsunni AroraОценок пока нет

- Training Need of Insurance AgentsДокумент10 страницTraining Need of Insurance Agentssshikhapari20Оценок пока нет

- Strategic Management: The Art and Science of Cross-Functional That Enable The Organization To Achieve Its ObjectivesДокумент60 страницStrategic Management: The Art and Science of Cross-Functional That Enable The Organization To Achieve Its Objectivesnackvi_395087413100% (2)

- Market Driven Strategy Practicing in Bangladesh in Contest of RAHIMAFROOZДокумент28 страницMarket Driven Strategy Practicing in Bangladesh in Contest of RAHIMAFROOZMd. Hasnain Chowdhury100% (5)

- Business Level StrategyДокумент33 страницыBusiness Level StrategyAngelica PagaduanОценок пока нет

- Final Project On Lums - University Strengths-1Документ35 страницFinal Project On Lums - University Strengths-1Mobeen MohammadОценок пока нет

- Tows FinalДокумент11 страницTows FinalTijo GeorgeОценок пока нет

- Strategic Management - MGMT 689Документ20 страницStrategic Management - MGMT 689Mohammed ZamanОценок пока нет

- STRAMAДокумент7 страницSTRAMACheryl Arcega PangdaОценок пока нет

- Insurance Promotion - IIДокумент12 страницInsurance Promotion - IIAditi JainОценок пока нет

- Fraud Triangle OriginsДокумент3 страницыFraud Triangle Originsjared soОценок пока нет

- Charlote Rep. FINANCIAL RISK MANAGEMENTДокумент18 страницCharlote Rep. FINANCIAL RISK MANAGEMENTJeanette FormenteraОценок пока нет

- Strategic Management Accounting by Austin SamsДокумент29 страницStrategic Management Accounting by Austin SamsSamson A Samson50% (2)

- A Study On The Growth of Indian Insurance SectorДокумент16 страницA Study On The Growth of Indian Insurance SectorIAEME Publication100% (1)

- STRAMA Table of ContentsДокумент7 страницSTRAMA Table of ContentsKareen RanteОценок пока нет

- Reinsurance Guidelines - Ir Guid 14 10 0017Документ11 страницReinsurance Guidelines - Ir Guid 14 10 0017Steven DreckettОценок пока нет

- Marketing Mix of Life InsuraneДокумент73 страницыMarketing Mix of Life Insuranerahulhaldankar100% (1)

- Chapter 6-7 Strategic ManagementДокумент5 страницChapter 6-7 Strategic ManagementMariya BhavesОценок пока нет

- Company ProfileДокумент44 страницыCompany ProfileBheeshm SinghОценок пока нет

- Swot Analysis of Indian Insurance IndustryДокумент2 страницыSwot Analysis of Indian Insurance Industryprasanth38% (8)

- Aboitizpower Believes in The Power of BalanceДокумент18 страницAboitizpower Believes in The Power of BalanceHaclOo BongcawilОценок пока нет

- MarketingДокумент42 страницыMarketingKarishma RajputОценок пока нет

- Proportional Treaty SlipДокумент3 страницыProportional Treaty SlipAman Divya100% (1)

- Impact of Career Factors on DevelopmentДокумент20 страницImpact of Career Factors on DevelopmentRaja AhsanОценок пока нет

- California Auto Club Reengineers Customer ServiceДокумент5 страницCalifornia Auto Club Reengineers Customer ServiceJennifer Guanco100% (2)

- Insurance & Risk Management JUNE 2022Документ11 страницInsurance & Risk Management JUNE 2022Rajni KumariОценок пока нет

- And Development Authority of India: Insurance RegulatoryДокумент21 страницаAnd Development Authority of India: Insurance RegulatoryHaseef LoveforeverОценок пока нет

- Competitive Structure AnalysisДокумент20 страницCompetitive Structure AnalysistkhurОценок пока нет

- WCE Reviewer Sy 16 - 082116Документ20 страницWCE Reviewer Sy 16 - 082116Trish BustamanteОценок пока нет

- DOC009Документ1 страницаDOC009Everson BoyDayz PetersОценок пока нет

- VinciДокумент21 страницаVinciEverson BoyDayz PetersОценок пока нет

- Section 2017.11.27 EPДокумент1 страницаSection 2017.11.27 EPEverson BoyDayz PetersОценок пока нет

- Purlins, Rails & Eaves Beams: Design GuideДокумент44 страницыPurlins, Rails & Eaves Beams: Design GuideMinhphuc DaoОценок пока нет

- C CS Poland Sept08Документ4 страницыC CS Poland Sept08Everson BoyDayz PetersОценок пока нет

- Nonlinear Analysis SolidworksДокумент16 страницNonlinear Analysis SolidworkslcoraoОценок пока нет

- RCC Bundled BarsДокумент7 страницRCC Bundled BarsVSMS8678Оценок пока нет

- APETT Council Meeting Attendance Record 2017/2018Документ1 страницаAPETT Council Meeting Attendance Record 2017/2018Everson BoyDayz PetersОценок пока нет

- Pci Manual For The Design Hollow Core SlabsДокумент141 страницаPci Manual For The Design Hollow Core Slabsmedodo100% (4)

- QuestionnaireДокумент8 страницQuestionnaireEverson BoyDayz PetersОценок пока нет

- Earthquake Design of Tied-Back Retaining WallДокумент15 страницEarthquake Design of Tied-Back Retaining WallEverson BoyDayz PetersОценок пока нет

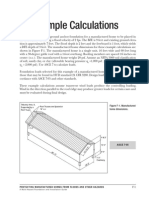

- Wind Example Claculations FEMA ExcerptДокумент20 страницWind Example Claculations FEMA ExcerptEverson BoyDayz PetersОценок пока нет

- FIFA IndictmentДокумент164 страницыFIFA IndictmentCTV NewsОценок пока нет

- SEISMIC BASE ISOLATION AND ENERGY ABSORBING DEVICES - Kubilay KaptanДокумент14 страницSEISMIC BASE ISOLATION AND ENERGY ABSORBING DEVICES - Kubilay KaptanLevente SikoОценок пока нет

- Underpinning Article 3Документ8 страницUnderpinning Article 3Everson BoyDayz PetersОценок пока нет

- Drawing List and Building Summary S 100: Residence For Mr. Amrit BalkaranДокумент12 страницDrawing List and Building Summary S 100: Residence For Mr. Amrit BalkaranEverson BoyDayz PetersОценок пока нет

- TimetableДокумент1 страницаTimetableEverson BoyDayz PetersОценок пока нет

- Me ScopeДокумент112 страницMe ScopeEverson BoyDayz PetersОценок пока нет

- Carino NDT History and ChallangesДокумент56 страницCarino NDT History and ChallangesMoncef ThabetОценок пока нет

- Plasticity TheoryДокумент540 страницPlasticity TheoryMukesh Muthu100% (2)

- Fema 547Документ571 страницаFema 547Stefan Stefanov100% (1)

- Worked Examples Ec2 Def080723Документ120 страницWorked Examples Ec2 Def080723dan_ospir67% (3)

- README - Andrew KeeneДокумент5 страницREADME - Andrew KeeneInfomesa Training and ConsultingОценок пока нет

- Chapter 13 Akun Keuangan TugasДокумент2 страницыChapter 13 Akun Keuangan Tugassegeri kec0% (1)

- El Pueblo del Café Market Needs AnalysisДокумент2 страницыEl Pueblo del Café Market Needs AnalysisKen TaОценок пока нет

- Understand and Recognize The Potential CustomerДокумент22 страницыUnderstand and Recognize The Potential CustomerMay Renely RodillasОценок пока нет

- Merged Sample QuestionsДокумент55 страницMerged Sample QuestionsAlaye OgbeniОценок пока нет

- Accounting Test Bank 2Документ73 страницыAccounting Test Bank 2likesОценок пока нет

- Making An Investment PlanДокумент10 страницMaking An Investment Plananon_118801Оценок пока нет

- BMNG5121Ta THTДокумент5 страницBMNG5121Ta THTShriya ParsadОценок пока нет

- Sample QuestionsДокумент2 страницыSample QuestionsKajal JainОценок пока нет

- QUESTION - Mid Term Exam - CH 1-2Документ2 страницыQUESTION - Mid Term Exam - CH 1-2Akib AbdullahОценок пока нет

- Ch-11 - Input Demand - The Capital Market and The Investment DecisionДокумент46 страницCh-11 - Input Demand - The Capital Market and The Investment DecisionAnubhab KhanraОценок пока нет

- Guidance Note On Accounting For Derivative ContractsДокумент25 страницGuidance Note On Accounting For Derivative Contractsca.atakОценок пока нет

- Feasibility Study For Coffee and Flower ShopДокумент7 страницFeasibility Study For Coffee and Flower ShopdsdsassaОценок пока нет

- Colgate Vs P&GДокумент2 страницыColgate Vs P&Gsakshita palОценок пока нет

- Airborne Express Discussion QuestionsДокумент5 страницAirborne Express Discussion QuestionsPeter LiedmanОценок пока нет

- 11 August GMAT Club AnalysisДокумент17 страниц11 August GMAT Club AnalysisMANOUJ GOELОценок пока нет

- Answers HW17Документ3 страницыAnswers HW17summanahОценок пока нет

- Literature ReviewДокумент28 страницLiterature ReviewIshaan Banerjee50% (2)

- Green MarketingДокумент2 страницыGreen Marketingzakirno19248Оценок пока нет

- Jay Abraham - How To Think Like A Marketing Genius NOTESДокумент29 страницJay Abraham - How To Think Like A Marketing Genius NOTESRyan S. Nickel100% (2)

- Principles of MicroeconomicsДокумент8 страницPrinciples of MicroeconomicsJoshua PatrickОценок пока нет

- Exercise 3: Chapter 3Документ5 страницExercise 3: Chapter 3ying huiОценок пока нет

- Scarcity and Choice NotesДокумент54 страницыScarcity and Choice Notessirrhouge100% (1)

- Class Notes - 1Документ23 страницыClass Notes - 1ushaОценок пока нет