Академический Документы

Профессиональный Документы

Культура Документы

Lmurillo Benefit Letter

Загружено:

loretta0050 оценок0% нашли этот документ полезным (0 голосов)

437 просмотров2 страницыRETIREMENT VERIFICATION

Авторское право

© © All Rights Reserved

Доступные форматы

PDF, TXT или читайте онлайн в Scribd

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документRETIREMENT VERIFICATION

Авторское право:

© All Rights Reserved

Доступные форматы

Скачайте в формате PDF, TXT или читайте онлайн в Scribd

0 оценок0% нашли этот документ полезным (0 голосов)

437 просмотров2 страницыLmurillo Benefit Letter

Загружено:

loretta005RETIREMENT VERIFICATION

Авторское право:

© All Rights Reserved

Доступные форматы

Скачайте в формате PDF, TXT или читайте онлайн в Scribd

Вы находитесь на странице: 1из 2

CALSIITS

HOW WltL YOU SPEND YOU R FUTURE?

09/t4t2012

LINDA A. MURILLO

17117 RED ASH CT

FONTANA CA 92337

service

27.7A0 leacs Of Service X

Unmodified benefit

T^J-=l rad',lrr rafi,ahonF 1. ar6fi'

Califomia Slare Teachers'

Retiremcnr Syslem

P.O. Box ls:75

Sacramcnlo. CA 95851,027J

800-228-5453

su \\.CdSTRS.com

ClienclD 1562418181

sR 1210.1

11 is extremely impoftant that you keep this letter. You will

need it lor your state and federal income tax preparation.

Dear LINDA A. MURILLO

Congratulations on your retirement. According to our records, your retirement is effective

07/0U2012.

Your first retirement payment of $8,124.52 will be issued on or about O912212012. This

amount is for the period from 0710112012 through 08/31/2012. Your regular monthly

retirement benefit rs $4,062.26 and will be issued on or about 10/01/2012. Your

retirement benefit is a lifetime benefit.

Please be aware that this award letter may not reflect your final monthly benefit. We often

receive additional earnings information fiom employers up to six months after your retirement

date. If we receive additional information from your employer that affects your monthly

benefit, we will adjust your payments accordingly and send you a letter explaining the

adjustment.

Your retirement benefit has been calculated as follows:

Your seruice credit automatically qualifies you for one year final compensation, so your

highest annual eamable salary was used to determine your final compensation.

We are required to pay interest if your first retirement benefit payment was not paid within 45

days ofthe effective date ofyour retirement, or from the date we received your application,

whichever is later.

Aqe Flnal Unrnodi f i ed

Factor compensation Beneflt

a'02357 x

$5'1es'5e

-

i:,:2:,:2

$100,823.01

$66 ,433 .92

$2,658.43

Tax-Def erred Contributions

Inlerest on Tax-Deferred ConLributions

Taxed contributions

Our ltissior: .i?.!rirg the Fi ancial Futwe ana Sustaining the Trust of Califurnia's Educators

InteresL on Taxed Contributions

$6,048.64

The Intemal Revenue Service's Simplified Method is used to determine the taxable nortion oi'

servlce retirement benefits. Procedures for using the Simplified Merhod can be found in

Intemal Revenue Service Publication 575, "Pension

and Annuity Income."

The service retirement benefit you receive may result in taxable income. The Intemal

Revenue code provides that member contributions paid by the employer were non-taxable at

the time they were paid. However, these employer-paid contributions (tax deferred

contdbutions) become taxable when they are paid out as a monthly benefit.

we are required to withhold state and federal income taxes from your monthly benefit unless

you instruct us otherwise. The withholding amounts indicated on your

warrant stub reflect the

instructions specified by you on the Income Tax withholding

preference

certificate that you

submitted. If no specification was made, the standard withholding rate, married with three

exemptions, provided by the tax laws was used. Benefit recipients who live outside

Califomia will not have state tax withheld, unless requested by filing an AD 0908.

Ifyou need assistance in computing your taxes, you may wish to contact the Internal Revenue

Service and the Califomia State Franchise Tax Board, or your attorney or tax consultant.

Ifyou write to us, please include your name, address, client ID 1562418181 and telephone

number with area code. This information enables us to locate your account quickly and

accurately. Please send all correspondence to the address on page l. For security reasons, we

are now using your client ID as your identifier instead ofyour Social Security number.

please

do not include your Social Security number in any correspondence unless we specifically

request that you use it on our lorm or letter.

Ifyou have any questions or concems, please call us at l-800-228-5453 or visit

www.calstrs.com and click on Contact Us.

Sincerely,

Service Retirement

Вам также может понравиться

- Fifth Third Bank StatementДокумент2 страницыFifth Third Bank StatementNadiia Avetisian100% (1)

- SS$0benefit Verification LetterДокумент2 страницыSS$0benefit Verification LetterTerre ChilicasОценок пока нет

- Change Advice Letter For Customer PaymentsДокумент1 страницаChange Advice Letter For Customer PaymentsLiu Inn100% (2)

- Statement 1Документ4 страницыStatement 1donaldlinkous100% (1)

- Truliant Federal Credit Union Bank Statement - January - 2022Документ4 страницыTruliant Federal Credit Union Bank Statement - January - 2022Lena Palomena100% (1)

- TX Utility BillДокумент4 страницыTX Utility Billfehijan689Оценок пока нет

- Trader TemplateДокумент4 страницыTrader TemplateAndre ParnellОценок пока нет

- Minimum Payment Due: $25.00 New Balance: $412.44 Payment Due Date: 03/20/15Документ4 страницыMinimum Payment Due: $25.00 New Balance: $412.44 Payment Due Date: 03/20/15MaathiaasElopoldiel100% (1)

- Temporary Auto Identification CardДокумент1 страницаTemporary Auto Identification Cardcraig litОценок пока нет

- Account Number:: Rate: Date Prepared: RS-Residential ServiceДокумент4 страницыAccount Number:: Rate: Date Prepared: RS-Residential ServiceRoopa Roopavathy0% (1)

- BenefitVerificationLetter PDFДокумент1 страницаBenefitVerificationLetter PDFWilliam WilliamsonОценок пока нет

- p85 Form - HMRC - Leaving The UkДокумент4 страницыp85 Form - HMRC - Leaving The Ukanthonyorourke813982Оценок пока нет

- Account # 0306977871: Lifegreen CheckingДокумент8 страницAccount # 0306977871: Lifegreen CheckingAmanda ConryОценок пока нет

- Renters InsuranceДокумент1 страницаRenters InsuranceQuintinaОценок пока нет

- Renters Policy PDFДокумент18 страницRenters Policy PDFMumy MoraОценок пока нет

- Alex Roman XfiДокумент1 страницаAlex Roman XfiyanizleОценок пока нет

- Get PDF For Bill ViewДокумент4 страницыGet PDF For Bill ViewKrishna8765Оценок пока нет

- Your Adv Plus Banking: Account SummaryДокумент4 страницыYour Adv Plus Banking: Account SummaryYazmin UrbinaОценок пока нет

- 2018-09-05 DOC Re Articles of Incorporation (DSJ Real Estate Holdings, LLC)Документ2 страницы2018-09-05 DOC Re Articles of Incorporation (DSJ Real Estate Holdings, LLC)Doo Soo KimОценок пока нет

- CODE - 00491630201020000022: Declaration of Insurance PolicyДокумент2 страницыCODE - 00491630201020000022: Declaration of Insurance PolicyKeller Brown Jnr100% (1)

- John Henry CFSB Card ActivitiesДокумент1 страницаJohn Henry CFSB Card ActivitiesSolomon100% (1)

- Detailed Instructions: Please SelectДокумент7 страницDetailed Instructions: Please Selectflrpatel81Оценок пока нет

- EIL-on-off Valve PDFДокумент162 страницыEIL-on-off Valve PDFSreekanth Suresh KamathОценок пока нет

- Chloe SocalgasДокумент2 страницыChloe SocalgasJaimee TepperОценок пока нет

- BenefitVerificationLetter July August 2015Документ1 страницаBenefitVerificationLetter July August 2015Steven SchoferОценок пока нет

- Account Summary Amount DueДокумент4 страницыAccount Summary Amount Duedgaborko2544Оценок пока нет

- Harvey Metabank Jan22Документ1 страницаHarvey Metabank Jan22Mark Dewey0% (1)

- State Farm Proof of Insurance PDFДокумент1 страницаState Farm Proof of Insurance PDFAnonymous RZZiNulОценок пока нет

- CPA Bill Sample 2019 - WCAGДокумент8 страницCPA Bill Sample 2019 - WCAGAlberto CayetanoОценок пока нет

- Earnings Statement: D Lane Agency Inc. 3348 Peachtree RD NE Suite 700 Atlanta, GA 30326Документ1 страницаEarnings Statement: D Lane Agency Inc. 3348 Peachtree RD NE Suite 700 Atlanta, GA 30326Muhammad AdeelОценок пока нет

- Your Consolidated Statement: Contact UsДокумент4 страницыYour Consolidated Statement: Contact UsBraeylnn bookerОценок пока нет

- ListДокумент2 страницыListRichrad SmithОценок пока нет

- Hello Frank N Tsamoutales,: Your Bill at A GlanceДокумент4 страницыHello Frank N Tsamoutales,: Your Bill at A GlanceRaez Rodillado100% (1)

- TD Simple Checking: Account SummaryДокумент6 страницTD Simple Checking: Account SummaryElizabeth HacheyОценок пока нет

- 656219-226730Документ1 страница656219-226730Mohammad FarhanОценок пока нет

- Ryan Pay Stub 2Документ1 страницаRyan Pay Stub 2Ryan Baker100% (1)

- Your Adv Safebalance Banking: Account SummaryДокумент4 страницыYour Adv Safebalance Banking: Account SummaryvanminОценок пока нет

- Earnings Statement: Non-NegotiableДокумент1 страницаEarnings Statement: Non-Negotiablesivajyothi1973Оценок пока нет

- Estmt - 2023 12 05Документ6 страницEstmt - 2023 12 05alejandro860510Оценок пока нет

- Citi 201205Документ10 страницCiti 201205sinnlosОценок пока нет

- Hi Michael, Here's Your Bill For This MonthДокумент11 страницHi Michael, Here's Your Bill For This MonthClare Molis100% (1)

- Checking Summary: Customer Service InformationДокумент4 страницыChecking Summary: Customer Service InformationAnonymous 66MlThiiОценок пока нет

- Main Account: Vaska's Account Monthly FeeДокумент4 страницыMain Account: Vaska's Account Monthly FeeAkingbade VictorОценок пока нет

- Billing Summary Your Electric Usage Profile: Bill Acct. No. Due Date Amount DueДокумент2 страницыBilling Summary Your Electric Usage Profile: Bill Acct. No. Due Date Amount DueKeyla ZuletaОценок пока нет

- Fifth Third Business Plus: MR John Doe 2 Post Alley, Seattle, WA 98101 Statement Period: Cust Ref#: Primary Account#Документ2 страницыFifth Third Business Plus: MR John Doe 2 Post Alley, Seattle, WA 98101 Statement Period: Cust Ref#: Primary Account#johan dee100% (1)

- COLLINS N OKONKWO Paystub Feb 12 2024Документ1 страницаCOLLINS N OKONKWO Paystub Feb 12 2024ellamaekitchensОценок пока нет

- 2010 08 15 - BillДокумент2 страницы2010 08 15 - Billteporocho9Оценок пока нет

- Cpa Bill Sample 2019 - WcagДокумент8 страницCpa Bill Sample 2019 - WcagAmina chahalОценок пока нет

- Bank of America Bank StatementДокумент2 страницыBank of America Bank Statementcar audio guyОценок пока нет

- Confirmation: 1-888-205-8118 M-F 6:30am PST To 5:30pm PSTДокумент1 страницаConfirmation: 1-888-205-8118 M-F 6:30am PST To 5:30pm PSTKarthik SheshadriОценок пока нет

- Allstate Liability MoanoДокумент4 страницыAllstate Liability MoanoMichael ClorОценок пока нет

- Estmt - 2018 10 15Документ8 страницEstmt - 2018 10 15Luis RodriguezОценок пока нет

- Estmt - 2022 12 31Документ4 страницыEstmt - 2022 12 31anastasiya DubininaОценок пока нет

- Hersey K Delynn PayStubДокумент1 страницаHersey K Delynn PayStubSharon JonesОценок пока нет

- PayStub 10384757Документ1 страницаPayStub 10384757Alberto PerezОценок пока нет

- Simply Jordan TD Bank Statement Castillo May 2020Документ2 страницыSimply Jordan TD Bank Statement Castillo May 2020MD MasumОценок пока нет

- AchДокумент2 страницыAchValdi PokerОценок пока нет

- 5419 N Sheridan RD Chicago, IL 60640-1917 773-878-7340 Restaurant Personnel IncДокумент2 страницы5419 N Sheridan RD Chicago, IL 60640-1917 773-878-7340 Restaurant Personnel IncLizbhet PazОценок пока нет

- Message Board Account SummaryДокумент2 страницыMessage Board Account SummaryKristy FieldsОценок пока нет

- Account Summary - 7382041247: ChecksДокумент4 страницыAccount Summary - 7382041247: ChecksJack SheldenОценок пока нет

- Bill CE Alexandra Reyes 02-25-20 0303 CSДокумент8 страницBill CE Alexandra Reyes 02-25-20 0303 CSMike MarchukОценок пока нет

- SSPUSADVДокумент1 страницаSSPUSADVJamesОценок пока нет

- Latest BillДокумент2 страницыLatest BillAshley GoodmanОценок пока нет

- Redundancy Payments Are TaxedДокумент2 страницыRedundancy Payments Are TaxedVivian KongОценок пока нет

- TDS Rate Chart For FY 2023-2024 (AY 2024-2025)Документ8 страницTDS Rate Chart For FY 2023-2024 (AY 2024-2025)sourabh tamhankarОценок пока нет

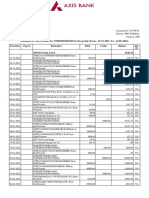

- Account Statement From 1 Sep 2021 To 30 Sep 2021: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalanceДокумент1 страницаAccount Statement From 1 Sep 2021 To 30 Sep 2021: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalanceSarat BeheraОценок пока нет

- Quote 2020-10-7Документ1 страницаQuote 2020-10-7Miguel CuisiaОценок пока нет

- Performed 5000 Worth of Service For A Customer On Account: AccrualДокумент10 страницPerformed 5000 Worth of Service For A Customer On Account: AccrualShin Shan JeonОценок пока нет

- Rajasthan Housing Board, Circle - Ii, JaipurДокумент3 страницыRajasthan Housing Board, Circle - Ii, Jaipurrakshit_2000Оценок пока нет

- Detailed StatementДокумент19 страницDetailed StatementPushpendra ChauhanОценок пока нет

- Statement 11105685 USD 20230626Документ2 страницыStatement 11105685 USD 20230626Sarah DavidОценок пока нет

- Customer Inquiry ReportДокумент4 страницыCustomer Inquiry ReportHartito HargiastoОценок пока нет

- FAKE ITC SCN Instructions Cir-171!03!2022-CgstДокумент4 страницыFAKE ITC SCN Instructions Cir-171!03!2022-CgstGroupA PreventiveОценок пока нет

- Umali Vs EstanislaoДокумент2 страницыUmali Vs EstanislaoReyna RemultaОценок пока нет

- JanДокумент1 страницаJanAnaya RantaОценок пока нет

- Diploma in Cambodia Tax Pilot ExamДокумент7 страницDiploma in Cambodia Tax Pilot ExamVannak2015Оценок пока нет

- Ilovepdf MergedДокумент4 страницыIlovepdf MergedShikhar GuptaОценок пока нет

- Guide On IT ServicesДокумент9 страницGuide On IT ServicesEqbal GubranОценок пока нет

- Tax Bar QuestionsДокумент14 страницTax Bar QuestionsPisto PalubosОценок пока нет

- Account STMTДокумент3 страницыAccount STMTMohamad NaseerОценок пока нет

- Uucms - Karnataka.gov - in ExamGeneral PrintExamApplicationДокумент1 страницаUucms - Karnataka.gov - in ExamGeneral PrintExamApplicationb90451578Оценок пока нет

- Bill of SupplyДокумент2 страницыBill of SupplyGitesh PagarОценок пока нет

- RMC 38-2018Документ3 страницыRMC 38-2018Nikki SiaОценок пока нет

- Aib Ways To BankДокумент4 страницыAib Ways To BankBuga CristinaОценок пока нет

- Introduction To Income TaxДокумент36 страницIntroduction To Income TaxDeep ShahОценок пока нет

- GRID CTS Implementation Northern GridДокумент22 страницыGRID CTS Implementation Northern GridRHS ProductionОценок пока нет

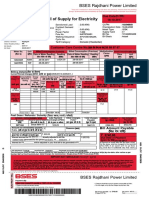

- Bill of Supply For Electricity: BSES Rajdhani Power LimitedДокумент4 страницыBill of Supply For Electricity: BSES Rajdhani Power LimitedHema KatiyarОценок пока нет

- Wa0082.Документ3 страницыWa0082.Poet FaroukОценок пока нет

- Confirmation1Документ2 страницыConfirmation1Ignas Getsema Agasi SuryaОценок пока нет

- Kinds of TaxДокумент1 страницаKinds of TaxMaricar Corina CanayaОценок пока нет