Академический Документы

Профессиональный Документы

Культура Документы

PF Pension Settlement Form-TCS

Загружено:

Sridhara Krishna Bodavula0 оценок0% нашли этот документ полезным (0 голосов)

517 просмотров4 страницыPF Pension Settlement Form-TCS

Авторское право

© © All Rights Reserved

Доступные форматы

PDF, TXT или читайте онлайн в Scribd

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документPF Pension Settlement Form-TCS

Авторское право:

© All Rights Reserved

Доступные форматы

Скачайте в формате PDF, TXT или читайте онлайн в Scribd

0 оценок0% нашли этот документ полезным (0 голосов)

517 просмотров4 страницыPF Pension Settlement Form-TCS

Загружено:

Sridhara Krishna BodavulaPF Pension Settlement Form-TCS

Авторское право:

© All Rights Reserved

Доступные форматы

Скачайте в формате PDF, TXT или читайте онлайн в Scribd

Вы находитесь на странице: 1из 4

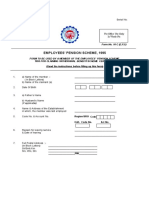

Serial No:

Form No. 10 C (E.P.S)

__________________________________________________________________________________________

EMPLOYEES PENSION SCHEME, 1995

FORM TO BE USED BY A MEMBER OF THE EMPLOYEES PENSION SCHEME,

1995 FOR CLAI MI NG WI THDRAWAL BENEFI T/SCHEME CERTI FI CATE

(Read the instructions before filling up this form)

__________________________________________________________________________________________

6. Reason for leaving services _____________________________________

& Date of leaving _____________________________________

7. Full Postal Address :-

(In Block Letters) _____________________________________

Sh/Smt./Km _____________________________________

S/o, W/o, D/o _____________________________________

____________________PIN______________

Email Id:

Mob. No.

For Office Use Only

In Words No.

1. a) Name of the member :- _____________________________

( In Block Letters)

b) Name of the claimant (s) _____________________________

2. Date Of Birth

3. a) Fathers Name _____________________________

b) Husbands Name _____________________________

(If applicable)

4. Name & Address of the Establishment Tata Consultancy Services Limited

in which, the member was last employed 10

th

Floor, Air India Building,

Nariman Point, Mumbai 400021.

5. Code No. & Account No. MH/BAN/48475/

8. Are you willing to accept Scheme (a) (b)

Certificate in lieu of withdrawal benefits Yes No

9. Particulars of Family (Spouse & Children & Nominee)

Name Date of Birth Relationship with Member Name of the guardan of minor

(a) Family

Members

(b) Nominee

(b)

Note: 1. If opting for Scheme Certificate they should provide age proof of nominees and family members.

2. Withdrawal benefits are not payable if opted for Scheme Certificate.

10. In case of death of member after attaining the age of 58 years without filling the claim:- (to be filled up

by the family member or relative of the employee for claiming the withdrawal benefit in case of the

death of the member )

(a) Date of death of the member:

(b) Name of the Claimant(s) / and relationship with the members :

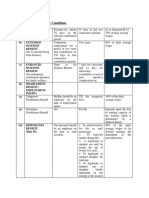

11. MODE FOR REMITTANCE [PUT A TIC IN THE BOX AGAINST THE ONE OPTED]

(a) By postal money order at my cost to address given against item No. 7

(c) Account payee cheque sent direct for credit to my Savings Bank A/c (Scheduled Bank) under

intimation to me

Savings Bank Account No. _______________________________________________

Name of the Bank _______________________________________________

(in block letters) _______________________________________________

Branch _______________________________________________

(in block letters) _______________________________________________

Full Address Of the Branch _______________________________________________

12. Are your availing pension under EPS-95? (As of now keep it blank)

If so indicate : PPO NO.________________By Whom issued________________

__________________________________________________________________________

Certified THAT THE PARTICULARS ARE TRUE TO THE BEST OF MY KNOWLEDGE.

Date:

Signature or left hand thumb

Impression of the member/claimant

ADVANCE STAMPED RECEIPT

[To be furnished only in case of (b) above]

Received a sum of Rs..(Rupees..)

Only from Regional Provident Fund Commissioner / Officer-in charge of Sub-Regional

Office ____________________

By deposit in my saving Bank A/c towards the settlement of my Pension Fund Accounts.

(The Space should be left blank which shall be filled by Regional Provident Fund Commissioner /Officer-

in-Charge)

Signature & left hand thumb impression of the member on the stamp

Affix revenue stamp

_________________________________________________

Certified that the particulars of the member given are correct and the member has signed/thumb impressed

before me.

The details of wages and period of non-contributory service of the member are as under:-

Form 3A/7 (EPS) enclosed for the period for which it was not sent to employees Provident Fund Office)

Wages (Basic + D.A) as on 15.11.95(if applicable)

Wages as on the date of exit

Period of non contributory Service

Year/Month No. of days

Stamp of the establishment and

Authorized Signatory

Rs 1/-

Revenue

Stamp

(FOR THE USE OF COMMISSIONERS OFFICE)

(Under Rs...

P.I. No. M.O./Cheque

Passed for payment for Rs. .(in words)..

M.O. Commission (if any) ..net amount to be paid by M.O.

D.H. S.S. A.A.O

____________________________________________________________________________________

(FOR USE I N CASH SECTI ON)

Paid by inclusion in cheque NoDt..vide cash Book (Bank) Account

No. 10 Debit item No. .

D.H S.S AC(A/cs)

____________________________________________________________________________________

For issue if S.S;. IDS is enclosed.

D.H. S.S. A.A.O/APFC(A/cs)

____________________________________________________________________________________

(FOR USE IN PENSION SECTION)

Scheme Certificate bearing the control No..Issued onand

entered in the scheme Certificate Control Register-

D.H. S.S A.A.O

APFC (PENSION)

Вам также может понравиться

- What Is General InsuranceДокумент249 страницWhat Is General InsuranceSandhya TambeОценок пока нет

- Form 10c Form 19 Word Format Doc Form 10cДокумент6 страницForm 10c Form 19 Word Format Doc Form 10cshaikali1980Оценок пока нет

- Retail Invoice Cash-: RepairДокумент1 страницаRetail Invoice Cash-: RepairAfiya AliОценок пока нет

- Credit Risk Management of Sonali Bank LiДокумент7 страницCredit Risk Management of Sonali Bank LiKamrul Hassan50% (2)

- Old Vs New Tax Rates Regime (6 Cases)Документ6 страницOld Vs New Tax Rates Regime (6 Cases)Jigeesha BhargaviОценок пока нет

- Salary, Net Salary, Gross Salary, Cost To Company Are They Same or Different. For Most People It IsДокумент6 страницSalary, Net Salary, Gross Salary, Cost To Company Are They Same or Different. For Most People It IsAnonymous CwxsRiwОценок пока нет

- Priority BankingДокумент17 страницPriority Bankinganoop_newОценок пока нет

- CBLM and Assessment ToolДокумент32 страницыCBLM and Assessment ToolKenneth Catalan Sael100% (3)

- Star Health ProjectДокумент52 страницыStar Health ProjectParvat Patil83% (6)

- Artifact 5 - Employee Pension Scheme Form 10 CДокумент4 страницыArtifact 5 - Employee Pension Scheme Form 10 CSiva chowdaryОценок пока нет

- Income Tax DepartmentДокумент19 страницIncome Tax DepartmentSharathОценок пока нет

- Compliance Manual F.Y. 2020 21 A.Y.2021 22 PDFДокумент52 страницыCompliance Manual F.Y. 2020 21 A.Y.2021 22 PDFTHERMAL TECH ENGINEERINGОценок пока нет

- Employees' State Insurance Corporation E-Pehchan Card: Insured Person: Insurance No.: Date of RegistrationДокумент3 страницыEmployees' State Insurance Corporation E-Pehchan Card: Insured Person: Insurance No.: Date of RegistrationGoutam HotaОценок пока нет

- Statutory ComplianceДокумент2 страницыStatutory Compliancemax997Оценок пока нет

- Contract Labour RegisterДокумент34 страницыContract Labour Registerravinder.singh19853857Оценок пока нет

- Income Under The Head "Salaries": Shubhangi Gupta Roll No. 11 Financial Management Bhartiya Vidya BhavanДокумент44 страницыIncome Under The Head "Salaries": Shubhangi Gupta Roll No. 11 Financial Management Bhartiya Vidya Bhavanhny0910Оценок пока нет

- Kar Shops Commercial Forms FormatДокумент16 страницKar Shops Commercial Forms FormatbelvaisudheerОценок пока нет

- RegistrationДокумент15 страницRegistrationpratikdhond100% (3)

- Esic ChallanДокумент7 страницEsic Challanrgsr2008Оценок пока нет

- Online Registration of Establishment With DSC: User ManualДокумент39 страницOnline Registration of Establishment With DSC: User ManualroseОценок пока нет

- Employees' State Insurance Corporation E-Pehchan Card: Insured Person: Insurance No.: Date of RegistrationДокумент2 страницыEmployees' State Insurance Corporation E-Pehchan Card: Insured Person: Insurance No.: Date of RegistrationTontadarya PolytechnicОценок пока нет

- CCENT Notes Part-3Документ63 страницыCCENT Notes Part-3Anil JunagalОценок пока нет

- Attendance Register FormatДокумент1 страницаAttendance Register Formatvishal_mtoОценок пока нет

- AgricultureДокумент4 страницыAgriculturemohan rathoreОценок пока нет

- Benefits & Contributory Conditions: (I) (A) Sickness BenefitДокумент4 страницыBenefits & Contributory Conditions: (I) (A) Sickness BenefitKunwar Sa Amit SinghОценок пока нет

- USSP User Manual v1.0Документ18 страницUSSP User Manual v1.0Siva ChОценок пока нет

- MCSE PracticalsДокумент88 страницMCSE PracticalsMayur UkandeОценок пока нет

- EPF CalenderДокумент1 страницаEPF CalenderAmitav TalukdarОценок пока нет

- CCNA Cisco Routing Protocols and Concepts Final Exam-PracticeДокумент22 страницыCCNA Cisco Routing Protocols and Concepts Final Exam-Practicesabriel69100% (1)

- CCS LTC RULES PPT 20210617141434Документ28 страницCCS LTC RULES PPT 20210617141434Kumar KumarОценок пока нет

- YTD Statement-1326013854886Документ108 страницYTD Statement-1326013854886deepson800Оценок пока нет

- Higher Pension As Per SC Decision With Calculation - Synopsis1Документ13 страницHigher Pension As Per SC Decision With Calculation - Synopsis1hariveerОценок пока нет

- Salary AdministrationДокумент17 страницSalary AdministrationMae Ann GonzalesОценок пока нет

- Form of Pension Proposals FormДокумент14 страницForm of Pension Proposals Formlakshmi naryanaОценок пока нет

- Karnataka Shops and Commercial Establishments Act, 1961Документ44 страницыKarnataka Shops and Commercial Establishments Act, 1961Latest Laws TeamОценок пока нет

- Spice Growing States of IndiaДокумент1 страницаSpice Growing States of IndiahemachalОценок пока нет

- All Forms Under Factories Act 1948Документ2 страницыAll Forms Under Factories Act 1948jagshishОценок пока нет

- Cheklist For Employers: Statutory Deposits & ReturnsДокумент4 страницыCheklist For Employers: Statutory Deposits & ReturnsVas VasakulaОценок пока нет

- Compliance PDFДокумент20 страницCompliance PDFSUBHANKAR PALОценок пока нет

- Overtime AllowanceДокумент3 страницыOvertime AllowanceKumudha Devi100% (1)

- Sbi Service Rules 2015Документ25 страницSbi Service Rules 2015Jeeban MishraОценок пока нет

- Relevant Dates: 15-Apr QuarterlyДокумент6 страницRelevant Dates: 15-Apr Quarterlysanyu1208Оценок пока нет

- What Is A Flexible Benefit Plan in A Salary Breakup? - QuoraДокумент8 страницWhat Is A Flexible Benefit Plan in A Salary Breakup? - QuoraSiОценок пока нет

- PF TransferДокумент11 страницPF TransfersinniОценок пока нет

- EPF Provident Fund CalculatorДокумент6 страницEPF Provident Fund CalculatorUtkal SolankiОценок пока нет

- Major Spice State Wise Area Production Web 2015 PDFДокумент3 страницыMajor Spice State Wise Area Production Web 2015 PDFbharatheeeyuduОценок пока нет

- 0064 - Form L - Annual Return of Indian Trade Union ActДокумент4 страницы0064 - Form L - Annual Return of Indian Trade Union ActSreedharanPN63% (8)

- EPF Book PDFДокумент47 страницEPF Book PDFKrishnarao MadhurakaviОценок пока нет

- Salary Structure: Please Put The Gross Salry in Red Column in Any Slab, U Will Find StructureДокумент6 страницSalary Structure: Please Put The Gross Salry in Red Column in Any Slab, U Will Find StructureSagar ShindeОценок пока нет

- Salary Taxation and Related Concepts: Malik Faisal Mehmood, ACAДокумент25 страницSalary Taxation and Related Concepts: Malik Faisal Mehmood, ACAMalik FaisalОценок пока нет

- Salary Slip Format in PDF All PDFДокумент3 страницыSalary Slip Format in PDF All PDFRajeev GunasekaranОценок пока нет

- CTS Marriage Loan PolicyДокумент5 страницCTS Marriage Loan PolicyshaannivasОценок пока нет

- Form No. 9: (See Rule 107)Документ1 страницаForm No. 9: (See Rule 107)13sandipОценок пока нет

- All FormsДокумент27 страницAll FormsSathyanarayana Reddy Antham100% (1)

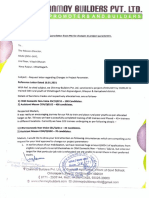

- Chinmoy Builders Pvt. LTD.: Promoters and Build ErsДокумент17 страницChinmoy Builders Pvt. LTD.: Promoters and Build Ersvipin shrivastavaОценок пока нет

- HR ComplianceДокумент4 страницыHR ComplianceAchuthan RamanОценок пока нет

- Organisational Implications of Coaching: Jane StubberfieldДокумент13 страницOrganisational Implications of Coaching: Jane Stubberfieldarjun.ec633Оценок пока нет

- 10c New - 2Документ4 страницы10c New - 2mak76Оценок пока нет

- Employees' Pension Scheme, 1995Документ4 страницыEmployees' Pension Scheme, 1995prakash_6849Оценок пока нет

- EPS 10C Scheme Certificate FormДокумент3 страницыEPS 10C Scheme Certificate Formytduyyuli yufyufОценок пока нет

- Employees' Pension Scheme, 1995Документ5 страницEmployees' Pension Scheme, 1995surencaОценок пока нет

- EPF Form No 10 CДокумент4 страницыEPF Form No 10 Capi-370495693% (14)

- 10 CformДокумент4 страницы10 CformGurmukhSingh100% (2)

- Employees' Pension Scheme, 1995: Form No. 10 C (E.P.S)Документ4 страницыEmployees' Pension Scheme, 1995: Form No. 10 C (E.P.S)nasir ahmedОценок пока нет

- PF Withdrawal Application (Trust Form)Документ5 страницPF Withdrawal Application (Trust Form)karthik76Оценок пока нет

- Form 10C RevisedДокумент4 страницыForm 10C Revisedadityajain104Оценок пока нет

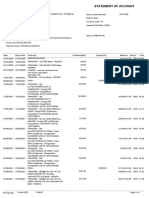

- Account Statement NCC Bank (01.07.2020-30.06.06.2020)Документ2 страницыAccount Statement NCC Bank (01.07.2020-30.06.06.2020)ashif.cloudaccОценок пока нет

- Revenue Cycle Management Services OverviewДокумент9 страницRevenue Cycle Management Services OverviewvasudevanОценок пока нет

- Unit 12 - BankingДокумент92 страницыUnit 12 - BankingNhung Cẩm NguyễnОценок пока нет

- Bookkeeping Vs AccountingДокумент7 страницBookkeeping Vs AccountingEfren VillaverdeОценок пока нет

- 5G WirelessДокумент25 страниц5G WirelessShailendra Singh100% (1)

- CE On Cash CДокумент3 страницыCE On Cash CChesterTVОценок пока нет

- MBA - Financial and Management AccountingДокумент234 страницыMBA - Financial and Management AccountingSyed AmeenОценок пока нет

- Ryan Dickerson'ResumeДокумент2 страницыRyan Dickerson'ResumeRyan DickersonОценок пока нет

- DssДокумент2 страницыDssKim JonesОценок пока нет

- UCO1501Документ4 страницыUCO1501PRIYA LAKSHMANОценок пока нет

- Blockchain Based Cloud Computing Architecture and Research ChallengesДокумент16 страницBlockchain Based Cloud Computing Architecture and Research Challengesunnati srivastavaОценок пока нет

- Renewal Premium Receipt: Har Pal Aapke Sath!!Документ1 страницаRenewal Premium Receipt: Har Pal Aapke Sath!!ankit vermaОценок пока нет

- Application Areas of Intelligent Transport System: READ MORE: GIS in TransportationДокумент2 страницыApplication Areas of Intelligent Transport System: READ MORE: GIS in TransportationIonut CarstovОценок пока нет

- Internship Report On Foreign Exchange Operations at DCB BANKДокумент65 страницInternship Report On Foreign Exchange Operations at DCB BANKAMBIYA JAGIRDARОценок пока нет

- FAQs FampayДокумент4 страницыFAQs FampayManisha HinguОценок пока нет

- WSC London-Surrey Round Registration Form 2024Документ5 страницWSC London-Surrey Round Registration Form 2024Studio TaivasОценок пока нет

- Insights Treasures in China Warehouse SectorДокумент152 страницыInsights Treasures in China Warehouse Sectordrmohamed120Оценок пока нет

- India Post Payments BankДокумент18 страницIndia Post Payments BankVijeta ManralОценок пока нет

- Vijay Bank ProjectДокумент80 страницVijay Bank Projectram801100% (1)

- Theory of AccountДокумент1 страницаTheory of Accountzee abadilla100% (1)

- Naukri ChandanSarkar (5y 0m)Документ2 страницыNaukri ChandanSarkar (5y 0m)Babji RohitОценок пока нет

- Mobile Communications Chapter 4: Wireless Telecommunication SystemsДокумент74 страницыMobile Communications Chapter 4: Wireless Telecommunication SystemsRAJESHОценок пока нет

- Keeping India Happy, Healthy and FreshДокумент41 страницаKeeping India Happy, Healthy and FreshBipin DevОценок пока нет

- Leadway Savings Plan Flyer August 2020 - 18-8Документ2 страницыLeadway Savings Plan Flyer August 2020 - 18-8skyremedyhubОценок пока нет