Академический Документы

Профессиональный Документы

Культура Документы

14374752

Загружено:

Anshul MehtaАвторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

14374752

Загружено:

Anshul MehtaАвторское право:

Доступные форматы

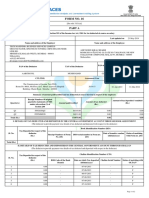

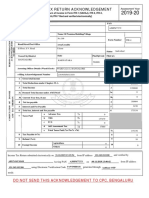

FORM NO.

16

[See rule 31(1)(a)]

Certificate under Section 203 of the Income-tax Act, 1961 for tax deducted at source on salary

Name and address of the Employer

SCOPE INTERNATIONAL (P) LTD

BRANCH BLDG, 2ND & 3RD FLOOR, GRINDLAYS GARDEN,

HADDOWS ROAD, CHENNAI - 600006

Tamilnadu

+(91)44-30818185

RajeshKumar.Surana@sc.com

Name and address of the Employee

PRANSHU SRIVASTAVA

B119-10B, SCHEEME, GOPAL PURA BY PASS, JAIPUR - 302018

Rajasthan

PAN of the Deductor

AAECS9043E

TAN of the Deductor

CHES06237A

PAN of the Employee

BIIPS5922E

Assessment Year

2014-15

CIT (TDS)

The Commissioner of Income Tax (TDS)

7th Floor, New Block, Aayakar Bhawan, 121 , M.G. Road,

Chennai - 600034

Period with the Employer

To

31-Mar-2014

From

01-Apr-2013

Summary of amount paid/credited and tax deducted at source thereon in respect of the employee

Quarter(s)

Receipt Numbers of original

quarterly statements of TDS

under sub-section (3) of

Section 200

Amount of tax deducted

(Rs.)

Amount of tax deposited / remitted

(Rs.) Amount paid/credited

Q1 CUUXBGVC 9970.00 9970.00 136941.00

Q2 OKKXGCBD 6000.00 6000.00 118206.00

Q3 QASNSDQA 6000.00 6000.00 118206.00

Q4 QQQZRVHG 36610.00 36610.00 261037.00

Total (Rs.) 58580.00 58580.00 634390.00

Sl. No.

Tax Deposited in respect of the

deductee

(Rs.)

Book Identification Number (BIN)

Receipt Numbers of Form

No. 24G

DDO serial number in Form no.

24G

Date of transfer voucher

(dd/mm/yyyy)

Status of matching

with Form no. 24G

Total (Rs.)

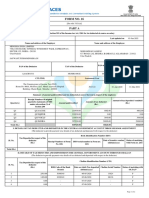

Sl. No.

Tax Deposited in respect of the

deductee

(Rs.)

Challan Identification Number (CIN)

BSR Code of the Bank

Branch

Date on which Tax deposited

(dd/mm/yyyy)

Challan Serial Number Status of matching with

OLTAS*

1 5968.00 0004329 07-05-2013 81576 F

2 2001.00 0004329 07-06-2013 75590 F

3 2001.00 0004329 06-07-2013 00103 F

4 2000.00 0004329 07-08-2013 84493 F

PART A

Certificate No. RFZNZOH Last updated on 27-May-2014

Employee Reference No.

provided by the Employer

(If available)

I. DETAILS OF TAX DEDUCTED AND DEPOSITED IN THE CENTRAL GOVERNMENT ACCOUNT THROUGH BOOK ADJUSTMENT

(The deductor to provide payment wise details of tax deducted and deposited with respect to the deductee)

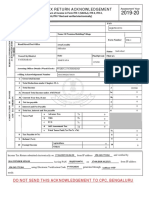

II. DETAILS OF TAX DEDUCTED AND DEPOSITED IN THE CENTRAL GOVERNMENT ACCOUNT THROUGH CHALLAN

(The deductor to provide payment wise details of tax deducted and deposited with respect to the deductee)

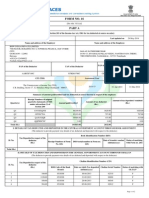

Page 1 of 2 Signed By:C S RAJESH

Signing Date:04.06.2014 20:03

Signature Not Verified

Certificate Number: RFZNZOH TAN of Employer: CHES06237A PAN of Employee: BIIPS5922E Assessment Year: 2014-15

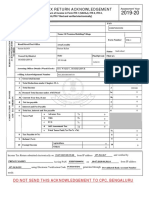

I, RAJESH CHANDRASEKAR, son / daughter of working in the capacity of MANAGER HRSD (designation) do hereby certify that a sum of Rs.58580.00 [Rs. Fifty

Eight Thousand Five Hundred and Eighty Only (in words)] has been deducted and a sum of Rs.58580.00 [Rs. Fifty Eight Thousand Five Hundred and Eighty Only]

has been deposited to the credit of the Central Government. I further certify that the information given above is true, complete and correct and is based on the

books of account, documents, TDS statements, TDS deposited and other available records.

Verification

Place

Date (Signature of person responsible for deduction of Tax)

CHENNAI

04-Jun-2014

MANAGER HRSD Designation: Full Name:RAJESH CHANDRASEKAR

Notes:

1. Part B (Annexure) of the certificate in Form No.16 shall be issued by the employer.

2. If an assessee is employed under one employer during the year, Part 'A' of the certificate in Form No.16 issued for the quarter ending on 31st March of the financial year shall contain the details

of tax deducted and deposited for all the quarters of the financial year.

3. If an assessee is employed under more than one employer during the year, each of the employers shall issue Part A of the certificate in Form No.16 pertaining to the period for which such

assessee was employed with each of the employers. Part B (Annexure) of the certificate in Form No. 16 may be issued by each of the employers or the last employer at the option of the assessee.

4. To update PAN details in Income Tax Department database, apply for 'PAN change request' through NSDL or UTITSL.

Sl. No.

Tax Deposited in respect of the

deductee

(Rs.)

Challan Identification Number (CIN)

BSR Code of the Bank

Branch

Date on which Tax deposited

(dd/mm/yyyy)

Challan Serial Number Status of matching with

OLTAS*

5 2000.00 0004329 06-09-2013 34457 F

6 2000.00 0004329 07-10-2013 82446 F

7 2000.00 0004329 07-11-2013 43524 F

8 2000.00 0004329 06-12-2013 36142 F

9 2000.00 0004329 07-01-2014 51610 F

10 2000.00 0004329 07-02-2014 63462 F

11 2335.00 0004329 06-03-2014 39807 U

12 32275.00 0004329 28-04-2014 09037 F

Total (Rs.) 58580.00

Legend used in Form 16

* Status of matching with OLTAS

Legend Description Definition

U Unmatched

Deductors have not deposited taxes or have furnished incorrect particulars of tax payment. Final credit will be reflected only when payment

details in bank match with details of deposit in TDS / TCS statement

P Provisional

Provisional tax credit is effected only for TDS / TCS Statements filed by Government deductors."P" status will be changed to Final (F) on

verification of payment details submitted by Pay and Accounts Officer (PAO)

O Overbooked

Payment details of TDS / TCS deposited in bank by deductor have matched with details mentioned in the TDS / TCS statement but the

amount is over claimed in the statement. Final (F) credit will be reflected only when deductor reduces claimed amount in the statement or

makes new payment for excess amount claimed in the statement

F Final

In case of non-government deductors, payment details of TDS / TCS deposited in bank by deductor have matched with the payment details

mentioned in the TDS / TCS statement filed by the deductors. In case of government deductors, details of TDS / TCS booked in Government

account have been verified by Pay & Accounts Officer (PAO)

Page 2 of 2 Signed By:C S RAJESH

Signing Date:04.06.2014 20:03

Signature Not Verified

Вам также может понравиться

- Form 16 651746Документ4 страницыForm 16 651746Arslan1112Оценок пока нет

- Atppn7354l 2020 21 PDFДокумент2 страницыAtppn7354l 2020 21 PDFPratik MeswaniyaОценок пока нет

- Form16Документ5 страницForm16er_ved06Оценок пока нет

- Form16 PDFДокумент9 страницForm16 PDFHarish KumarОценок пока нет

- 1040 Exam Prep: Module II - Basic Tax ConceptsОт Everand1040 Exam Prep: Module II - Basic Tax ConceptsРейтинг: 1.5 из 5 звезд1.5/5 (2)

- UtilitarianismДокумент37 страницUtilitarianismLeiya Lansang100% (2)

- Form 16-2017-18Документ4 страницыForm 16-2017-18Yaswitha SadhuОценок пока нет

- b5047 Form16 Fy1819 PDFДокумент9 страницb5047 Form16 Fy1819 PDFBhumika JoshiОценок пока нет

- Form No. 16A: Certificate Under Section 203 of The Income-Tax Act, 1961 For Tax Deducted at SourceДокумент2 страницыForm No. 16A: Certificate Under Section 203 of The Income-Tax Act, 1961 For Tax Deducted at SourceAnonymous glyBR9Оценок пока нет

- DD ProjectДокумент2 страницыDD Projectjatin kuashikОценок пока нет

- Form No. 16: Part AДокумент2 страницыForm No. 16: Part AasifОценок пока нет

- Biapg2824f - Partb - 2019-20 Sameer PDFДокумент3 страницыBiapg2824f - Partb - 2019-20 Sameer PDFGanesh LohakareОценок пока нет

- Kaushik Sarkar Form 16 DynProДокумент5 страницKaushik Sarkar Form 16 DynProKaushik SarkarОценок пока нет

- Form 16 FY 19-20Документ6 страницForm 16 FY 19-20Anurag SharmaОценок пока нет

- Form No. 16: Part AДокумент10 страницForm No. 16: Part ARAJASHEKAR KYAROLLAОценок пока нет

- Digest NegoДокумент9 страницDigest NegoMichael RentozaОценок пока нет

- Form 16: Certificate Under Section 203 of The Income-Tax Act, 1961 For Tax Deducted at Source On SalaryДокумент4 страницыForm 16: Certificate Under Section 203 of The Income-Tax Act, 1961 For Tax Deducted at Source On SalarySyedОценок пока нет

- Itr 20-21Документ1 страницаItr 20-21Rohit kandpalОценок пока нет

- Clhps7458a 2019-20Документ2 страницыClhps7458a 2019-20Gurudeep singhОценок пока нет

- Beso v. DagumanДокумент3 страницыBeso v. DagumanMarie TitularОценок пока нет

- Form No. 16: Part AДокумент5 страницForm No. 16: Part APunitBeriОценок пока нет

- Form16 Till 14 Dec 2019Документ11 страницForm16 Till 14 Dec 2019Aviral SankhyadharОценок пока нет

- Form 16: Wipro LimitedДокумент8 страницForm 16: Wipro LimitedpadduОценок пока нет

- QUA05242 Form16Документ5 страницQUA05242 Form16saurabhОценок пока нет

- Form No. 16: Part AДокумент5 страницForm No. 16: Part AHarish KumarОценок пока нет

- Payslip For 16831 (2daf)Документ1 страницаPayslip For 16831 (2daf)omkassОценок пока нет

- FSRID11020Документ8 страницFSRID11020SaleemОценок пока нет

- 255 PartA PDFДокумент2 страницы255 PartA PDFRamyaMeenakshiОценок пока нет

- Non Banking Financial CompanyДокумент39 страницNon Banking Financial Companymanoj phadtareОценок пока нет

- BSBDIV501 Assessment 1Документ7 страницBSBDIV501 Assessment 1Junio Braga100% (3)

- Hydro Resources Contractors Corp V Pagalilauan G.R. No. L-62909Документ3 страницыHydro Resources Contractors Corp V Pagalilauan G.R. No. L-62909fgОценок пока нет

- A 40029127 Part-AДокумент2 страницыA 40029127 Part-Adeepak_cool4556Оценок пока нет

- PrintTax14 PDFДокумент2 страницыPrintTax14 PDFarnieanuОценок пока нет

- Sungf9tIqDhAO64RjsPj Form16 PartAДокумент2 страницыSungf9tIqDhAO64RjsPj Form16 PartARAJIV RANJAN PRIYADARSHIОценок пока нет

- ADEPJ433Документ2 страницыADEPJ433ravibhartia1978Оценок пока нет

- Form 16Документ4 страницыForm 16Aruna Kadge JhaОценок пока нет

- DFCPS4106B Ay201920 16 Unsigned PDFДокумент6 страницDFCPS4106B Ay201920 16 Unsigned PDFAnuj SrivastavaОценок пока нет

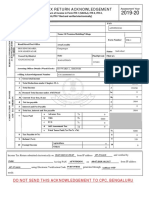

- Indian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruДокумент1 страницаIndian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruAnsar ValiОценок пока нет

- 2019 08 30 10 26 32 104 - 1567140992104 - XXXPK6719X - Acknowledgement PDFДокумент1 страница2019 08 30 10 26 32 104 - 1567140992104 - XXXPK6719X - Acknowledgement PDFRaviranjan KumarОценок пока нет

- 2019 07 09 15 30 29 717 - 1562666429717 - XXXPI9203X - Acknowledgement PDFДокумент1 страница2019 07 09 15 30 29 717 - 1562666429717 - XXXPI9203X - Acknowledgement PDFindu chauhanОценок пока нет

- Rahasyathraya SaramДокумент1 страницаRahasyathraya SaramGopalachari RagunathanОценок пока нет

- 2019 10 01 16 36 43 414 - 1569928003414 - XXXPK7141X - Acknowledgement PDFДокумент1 страница2019 10 01 16 36 43 414 - 1569928003414 - XXXPK7141X - Acknowledgement PDFAtul TiwariОценок пока нет

- Indian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruДокумент1 страницаIndian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, Bengalururambabu peddapalliОценок пока нет

- 2019 11 01 21 37 31 963 - 1572624451963 - XXXPP7803X - Acknowledgement PDFДокумент1 страница2019 11 01 21 37 31 963 - 1572624451963 - XXXPP7803X - Acknowledgement PDFKunal PaulОценок пока нет

- 2019 12 20 11 04 21 881 - 1576820061881 - XXXPJ2291X - Acknowledgement PDFДокумент1 страница2019 12 20 11 04 21 881 - 1576820061881 - XXXPJ2291X - Acknowledgement PDFArjunJaiОценок пока нет

- Indian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruДокумент1 страницаIndian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruKunda MalleshОценок пока нет

- AAFREEN MANSURI - CXVPM5640J - AY201920 - 16 - PartAДокумент2 страницыAAFREEN MANSURI - CXVPM5640J - AY201920 - 16 - PartAmanishОценок пока нет

- Balwinder Singh ITR 2Документ1 страницаBalwinder Singh ITR 2Pawan KumarОценок пока нет

- Computation 3Документ2 страницыComputation 3Sai DyОценок пока нет

- Apfpm0726b 2019-20 (1527)Документ2 страницыApfpm0726b 2019-20 (1527)Basant Kumar MishraОценок пока нет

- Indian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruДокумент1 страницаIndian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruSagar Kumar GuptaОценок пока нет

- Form 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961Документ4 страницыForm 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961rajen sahaОценок пока нет

- Indian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruДокумент1 страницаIndian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, Bengalurujasvir singhОценок пока нет

- Aekpy3088c 2019Документ4 страницыAekpy3088c 2019Ajay YadavОценок пока нет

- Computation of Total Income Income From Other Sources (Chapter IV F) 289381Документ2 страницыComputation of Total Income Income From Other Sources (Chapter IV F) 289381Ashish AgarwalОценок пока нет

- Account StatementДокумент12 страницAccount StatementAnurag DwivediОценок пока нет

- Aabpf9762b 2018-19Документ2 страницыAabpf9762b 2018-19piyushkumar patelОценок пока нет

- TaxyДокумент4 страницыTaxyNeevinternational NeevОценок пока нет

- Pay Slip March 2017Документ4 страницыPay Slip March 2017Anonymous AsVoWD04c0% (1)

- Form 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961Документ4 страницыForm 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961Kapil KaroliyaОценок пока нет

- LNL Iklcqd /: Page 1 of 10Документ10 страницLNL Iklcqd /: Page 1 of 10Manoj ValeshaОценок пока нет

- Employee: Empno, Desig. Dev Narayan Sah, 52406419756, 2414600, Bela, Awm Pan of The EmployeeДокумент2 страницыEmployee: Empno, Desig. Dev Narayan Sah, 52406419756, 2414600, Bela, Awm Pan of The EmployeeGjjnnmОценок пока нет

- Form16 (2020-2021)Документ2 страницыForm16 (2020-2021)Saras ShendeОценок пока нет

- Format Appointment Letter Doc Download Appointment LetterДокумент2 страницыFormat Appointment Letter Doc Download Appointment LetterVinay KhatriОценок пока нет

- Form 16: Wipro LimitedДокумент5 страницForm 16: Wipro LimitedRishabh PareekОценок пока нет

- LetterДокумент2 страницыLetterShiv Kiran SademОценок пока нет

- Voip As A Communication Tool For Businesses: BackgroundДокумент1 страницаVoip As A Communication Tool For Businesses: BackgroundAnshul MehtaОценок пока нет

- New Microsoft Power Point PresentationДокумент23 страницыNew Microsoft Power Point PresentationAnshul MehtaОценок пока нет

- Telecom DMS, IIT Delhi FinICKYДокумент7 страницTelecom DMS, IIT Delhi FinICKYAnshul MehtaОценок пока нет

- Open PosterДокумент1 страницаOpen PosterAnshul MehtaОценок пока нет

- AimДокумент39 страницAimAnshul MehtaОценок пока нет

- Meru Cabvertise Fact SheetДокумент3 страницыMeru Cabvertise Fact SheetAnshul MehtaОценок пока нет

- Systems Thinking Assignment Hard & Soft Systems ThinkingДокумент9 страницSystems Thinking Assignment Hard & Soft Systems ThinkingAnshul MehtaОценок пока нет

- Evolution of Dabur Finally FinalДокумент10 страницEvolution of Dabur Finally FinalAnshul MehtaОценок пока нет

- Evolution of Dabur Finally FinalДокумент10 страницEvolution of Dabur Finally FinalAnshul MehtaОценок пока нет

- Chapter Xiii: Department of Public Enterprises: 13.1.1 Irregular Payment To EmployeesДокумент6 страницChapter Xiii: Department of Public Enterprises: 13.1.1 Irregular Payment To EmployeesbawejaОценок пока нет

- APSA2011 ProgramДокумент191 страницаAPSA2011 Programsillwood2012Оценок пока нет

- Merger, Akuisisi Dan Konsolidasi Compile 14.00 NisaДокумент18 страницMerger, Akuisisi Dan Konsolidasi Compile 14.00 Nisaalfan halifa100% (1)

- ASME - Lessens Learned - MT or PT at Weld Joint Preparation and The Outside Peripheral Edge of The Flat Plate After WДокумент17 страницASME - Lessens Learned - MT or PT at Weld Joint Preparation and The Outside Peripheral Edge of The Flat Plate After Wpranav.kunte3312Оценок пока нет

- Cases NOvember 21Документ31 страницаCases NOvember 21Wilfredo Guerrero IIIОценок пока нет

- Chapter Eight Cross-National Cooperation and Agreements: ObjectivesДокумент13 страницChapter Eight Cross-National Cooperation and Agreements: ObjectivesSohni HeerОценок пока нет

- DENTAL JURIS - Dental Legislation PDFДокумент2 страницыDENTAL JURIS - Dental Legislation PDFIsabelle TanОценок пока нет

- Cases 3Документ283 страницыCases 3Tesia MandaloОценок пока нет

- Dasa SandhiДокумент1 страницаDasa SandhishivasudhakarОценок пока нет

- Central India Version (Cin)Документ2 страницыCentral India Version (Cin)Pallavi ChawlaОценок пока нет

- UOK-Ph.D. Fee StructureДокумент2 страницыUOK-Ph.D. Fee StructureNeeraj MeenaОценок пока нет

- Oracle Optimized Solution For Backup and RecoveryДокумент37 страницOracle Optimized Solution For Backup and Recoverywish_newОценок пока нет

- English LicenseДокумент4 страницыEnglish LicenseasdfОценок пока нет

- Chapter 20 Mutual Fund IndustryДокумент55 страницChapter 20 Mutual Fund IndustryrohangonОценок пока нет

- NEW GL Archiving of Totals and DocumentsДокумент5 страницNEW GL Archiving of Totals and Documentsantonio xavierОценок пока нет

- Parole and ProbationДокумент12 страницParole and ProbationHare Krishna RevolutionОценок пока нет

- 86A141FH16-iCare InstallationДокумент26 страниц86A141FH16-iCare Installationaccel2008Оценок пока нет

- Advintek CP 1Документ6 страницAdvintek CP 1mpathygdОценок пока нет

- Ifm BopДокумент18 страницIfm Bopsunil8255Оценок пока нет

- Tanganyika Buffer SDS 20160112Документ8 страницTanganyika Buffer SDS 20160112Jorge Restrepo HernandezОценок пока нет

- Install HelpДокумент318 страницInstall HelpHenry Daniel VerdugoОценок пока нет

- Business Ethics Session 5Документ9 страницBusiness Ethics Session 5EliaQazilbashОценок пока нет

- Military Discounts For Universal Studio Tours 405Документ2 страницыMilitary Discounts For Universal Studio Tours 405Alex DA CostaОценок пока нет

- Classroom Objects Vocabulary Esl Unscramble The Words Worksheets For Kids PDFДокумент4 страницыClassroom Objects Vocabulary Esl Unscramble The Words Worksheets For Kids PDFLocky HammerОценок пока нет