Академический Документы

Профессиональный Документы

Культура Документы

MTP BCSM PDF

Загружено:

NirajGBhaduwala0 оценок0% нашли этот документ полезным (0 голосов)

18 просмотров9 страницqus

Оригинальное название

Mtp Bcsm PDF

Авторское право

© © All Rights Reserved

Доступные форматы

PDF, TXT или читайте онлайн в Scribd

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документqus

Авторское право:

© All Rights Reserved

Доступные форматы

Скачайте в формате PDF, TXT или читайте онлайн в Scribd

0 оценок0% нашли этот документ полезным (0 голосов)

18 просмотров9 страницMTP BCSM PDF

Загружено:

NirajGBhaduwalaqus

Авторское право:

© All Rights Reserved

Доступные форматы

Скачайте в формате PDF, TXT или читайте онлайн в Scribd

Вы находитесь на странице: 1из 9

BSEs Certification for Stock Markets (BCSM) Examination

BSE Institute Limited Page 1 of 9

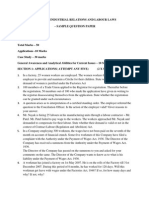

MODEL TEST PAPER FOR BCSM

Q. Id Question Option 1 Option 2 Option 3 Option 4

1

Indian Securities market is one

among top______ securities

markets of the world.

Four Eight Three Six

2

The Bombay Stock Exchange was

established in ______

1875 1873 1874 1872

3

The Bombay Stock Exchange was

established as a ___________

Limited

Liability

Firm

A

partnership

firm

A company

Voluntary

non-profit

organization

4

As of December 31, 2009 the

Bombay Stock Exchange was

among the top_____ of global

exchanges in terms of market

capitalization of its listed companies

Six Eight Ten nine

5

As of December 31, 2009 the

Bombay Stock Exchange was the

worlds number _____ exchange in

the world in terms of listed

companies

One Two Five Three

6

The first exchange in India to get

ISO 9001:2000 certification was

_____

The Multi

Commodity

Exchange

The Bombay

Stock

Exchange

The OTCEI

The National

Stock

Exchange

7

Bombay Stock Exchange was the

__________ in the world to obtain

the ISO 9001:2000 certifications

First Second Fifth Third

8

Exchange traded fund (ETF) on

SENSEX are listed on BSE and

Exchange in ________

UK USA Hong Kong Japan

9

The debt market in India covers all,

except

Letters of

Credit

External

Commercial

Borrowings

State Govt.

debts

Central Govt.

debts

10

Currently, Indian Securities market

comprised of _________ stock

exchanges spread throughout the

country

15 22 19 17

11

Which of the following is not a

market regulator

Ministry of

Corporate

Affairs

Securities

and

Exchange

Board of

India (SEBI)

Ministry of

commerce

Department

of Economic

Affairs

BSEs Certification for Stock Markets (BCSM) Examination

BSE Institute Limited Page 2 of 9

12

Contracts for sale and purchase of

government securities, gold-related

securities, money market securities

and securities derived from these

securities and ready forward

contracts in debt securities shall be

regulated by ______, once they are

not traded on any stock exchange

DCA SEBI SBI RBI

13

Majority of the powers granted

under SCRA are exercisable

by______

DEA SEBI MCA RBI

14

The powers under the Companies

Act relating to issue and transfer of

securities and non-payment of

dividend are administered by

_________ in case of listed public

companies and public companies

proposing to get their securities

listed

FMC SEBI RBI DEA

15

Which of the following is not a key

regulations currently governing

Indian securities market

The

Foreign

Exchange

Manageme

nt Act,

1999

The

Securities

Contracts

Regulation

Act, 1956

The SEBI

Act, 1992

The

Companies

Act, 1956

16

Securities Contracts (Regulation)

Act (SCRA), 1956 gives SEBI

regulatory jurisdiction over

Stock

Exchanges

Real Estates

Markets

Commodities Banks

17

The Securities Contracts

(Regulation) Act, 1956 was enacted

to _______ undesirable

transactions in securities by

regulating the business of dealing

therein and by providing for certain

other matters connected therewith

exempt prevent receive promote

18

Under the Securities Contracts

(Regulation) Act (SCRA), 1956,

section 2(h) does not include which

as Securities

Commoditi

es

Mutual Fund

Units

Government

securities

Derivatives

19 Derivative includes

Mutual

Funds

A contract

which

derives its

value from

the prices,

or index of

prices, of

underlying

securities

Rights issue ETF

BSEs Certification for Stock Markets (BCSM) Examination

BSE Institute Limited Page 3 of 9

20

Every recognised stock exchange

and every member thereof shall

maintain and preserve for such

periods not exceeding __________

such books of account, and other

documents as the Central

Government, after consultation

with the stock exchange concerned,

may prescribe in the interest of the

trade or in the public interest

Five years One year Two years Four years

21

A member of a ________ shall not

in respect of any securities enter

into any contract as a principal with

any person other than a member of

a recognised stock exchange,

unless he has secured the consent

or authority of such person and

discloses in the note, memorandum

or agreement of sale or purchase

that he is acting as a principal

commodity

exchange

financial

institution

recognised

stock

exchange

Mutual Fund

22

The Companies Act, 1956 does not

deal with

Commodity

markets

Issues of

Securities

Allotment

and transfer

of securities

Money

markets

23

Under Section 31 of The Companies

Act, 1956, any company could be of

the form except

Limited

Liability

Firm

Public

Companies

Private

Companies

Trust

24

Broad indices are expected to

capture the __________ of equity

market and need to represent the

return obtained by typical portfolios

in the country

selective

behaviour

Overall

behavior

Liquidity

behavior

Price behavior

25

The primary function of a stock

index is to serve as _________ of

the equity market

A

benchmark

a barometer A litmus test A yardstick

26

"Spot delivery contract" has been

defined in Section 2(i) to mean a

contract which does not provide for

Sale of

shares on a

spot date

Actual

delivery of

securities

and the

payment

thereof

Transfer of

the securities

by the

depository

from the

account of a

beneficial

owner to the

account of

another

beneficial

owner

All given

options are

correct

BSEs Certification for Stock Markets (BCSM) Examination

BSE Institute Limited Page 4 of 9

27

SEBI may direct a recognised stock

exchange to suspend such of its

business for such period not

exceeding ________and subject to

such conditions as may be specified

in the notification

Seven days One day Two days Five days

28

The Companies Act, 1956 stipulates

that a meeting of the Board of

Directors shall be held atleast

_______ in every quarter of the

calendar year and committees of

the Board like investment

committee, audit committee,

compensation committee etc. shall

meet as and when required

Three

times

Once Twice Five times

29

As per The Companies Act, 1956,

excluding directorship in private

companies, unlimited companies,

Section 25 companies and alternate

directors, an individual can be a

Director maximum to how many

companies

15 20 25 10

30

The stock exchanges provide

facilities for _________________

to the common masses

Trading in

commoditie

s

Trading in

securities

Accumulation

of wealth

Gambling

31

All are various components of

securities markets, except

Commercia

l Banks

Derivatives

Issuers of

securities

Securities

32

As per The Securities Contract

(Regulation) Act, 1956 Securities

includes all, except

Commercia

l Banks

Bonds Derivatives

Post Office

Fixed Deposit

33

Stock exchanges serve all

purposes, except

Providing

liquidity to

holders of

common

shares

Providing a

place for

lawful

gambling

Try to seek

the best

price for the

securities

Providing a

secondary

market to

investors of

securities

34

______________ set out the code

of conduct for the corporate sector

in relation to issue, allotment and

transfer of securities, disclosures to

be made in public issues and non

payment of dividend

The

Companies

Act, 1956

The

Companies

Act, 1963

The Reserve

Bank of India

Act, 1934

The SEBI Act,

1992

35

__________________ provides for

regulation of transaction in

securities through control over

stock exchanges

The

Securities

Contract

(Regulation

) Act, 1946

The

Companies

Act, 1956

The

Securities

Contract

(Regulation)

Act, 1956

The SEBI Act,

1992

BSEs Certification for Stock Markets (BCSM) Examination

BSE Institute Limited Page 5 of 9

36

_______________ provides for the

electronic maintenance and transfer

of ownership of dematerialized

securities

The

Securities

Contract

(Regulation

) Act, 1956

The

Depository

Act, 1956

The

Companies

Act, 1956

None of the

above

37

Section ________of the SEBI Act

provides that it shall be the duty of

the Board to protect the interests of

investors in securities and to

promote the development of, and

to regulate the securities market,

by such measures as it thinks fit

12(1) 11(1) 11 (5) 11 (2)

38 Which is not an activity of SEBI

Regulating

Banking

Treasuries

It regulates

the business

in stock

exchanges

and any

other

securities

markets and

the working

of collective

investment

schemes,

including

mutual

funds,

registered

by it

Regulating

Commodity

Exchanges

Regulating

Financial

Markets

39

Section ________of the SEBI Act

provides that it shall be the duty of

the Board to protect the interests of

investors in securities and to

promote the development of, and

to regulate the securities market,

by such measures as it thinks fit

12(1) 11(1) 11 (5) 11 (2)

40 Which is not an activity of SEBI

Regulating

Banking

Treasuries

It regulates

the business

in stock

exchanges

and any

other

securities

markets and

the working

of collective

investment

schemes,

including

mutual

funds,

registered

by it

Regulating

Commodity

Exchanges

Regulating

Financial

Markets

BSEs Certification for Stock Markets (BCSM) Examination

BSE Institute Limited Page 6 of 9

41

The cash flows associated with

________ are difficult to evaluate

due to the uncertainty and

variability associated with them

common

stocks

preference

shares

bonds debentures

42

An increase in a firm's expected

growth rate would normally cause

the firm's required rate of return to

remain

unchanged

Increase Decrease

All given

options are

correct

43

If the expected rate of return on a

stock exceeds the required rate,

The stock

is a bad

buy.

The stock is

a good buy

The stock

should be

sold

The stock is

experiencing

supernormal

growth

44

Which of the following statements

is most correct?

The

constant

growth

model

takes into

considerati

on the

capital

gains

earned on

a stock

It is

appropriate

to use the

constant

growth

model to

estimate

stock value

even if the

growth rate

never

becomes

constant

Two firms

with the

same

dividend and

growth rate

must also

have the

same stock

price

The constant

growth model

takes into

consideration

the

proportional

capital gains

increased on

a stock

45

Which of the following statements

is most correct?

If your

uncle earns

a return

similar to

the overall

stock

market,

this means

the stock

market is

inefficient

If a market

is strong-

form

efficient this

implies that

the returns

on bonds

and stocks

should be

identical

If a market

is weak-form

efficient this

implies that

all public

information

is rapidly

incorporated

into market

prices

If your uncle

earns a return

higher than

the overall

stock market,

this means

the stock

market is

inefficient

46

Which of the following statements

is most correct?

Weak-form

market

efficiency

implies

that recent

trends in

stock

prices

would be of

tremendou

s use in

selecting

stocks

Weak-form

market

efficiency

implies that

recent

trends in

stock prices

would be of

no use in

selecting

stocks

Market

efficiency

implies that

all stocks

should have

the same

expected

return

Semistrong-

form market

efficiency

implies that

all private and

public

information is

rapidly

incorporated

into stock

prices

BSEs Certification for Stock Markets (BCSM) Examination

BSE Institute Limited Page 7 of 9

47

Which of the following statements

is most correct?

Semistrong

-form

market

efficiency

means that

stock

prices

reflect all

public

information

An

individual

who has

information

about past

stock prices

should be

able to

profit from

this

information

in a weak-

form

efficient

market

An individual

who has

inside

information

about a

publicly

traded

company

should be

able to profit

from this

information

in a strong-

form efficient

market

Strong-form

market

efficiency

means that

stock prices

reflect all

public

information

48

The effective rate of interest differs

from the nominal rate of interest in

that it reflects the impact of :

compoundi

ng

frequency

future value

compounding

frequency

volatility

49

For any interest rate and for a

given period of time, the more

frequently interest is compounded,

the future value becomes______.

higher lower

remains the

same

difficult to

compute

50

The tighter the probability

distribution of expected future

returns, the smaller the risk of a

given investment as measured by

the _____________

skewness mean

standard

deviation

mode

BSEs Certification for Stock Markets (BCSM) Examination

BSE Institute Limited Page 8 of 9

Answers:

Q. Id Answer

1 Eight

2 1875

3 Voluntary non-profit organisation

4 Ten

5 One

6 The Bombay Stock Exchange

7 Second

8 Hong Kong

9 External Commercial Borrowings

10 22

11 Ministry of commerce

12 RBI

13 DEA

14 SEBI

15 The Foreign Exchange Management Act, 1999

16 Stock Exchanges

17 prevent

18 Commodities

19

A contract which derives its value from the prices, or index of prices, of

underlying securities

20 Five years

21 recognised stock exchange

22 Money markets

23 Trust

24 Overall behavior

25 a barometer

26 All given options are correct

27 Seven days

28 Once

29 15

30 Trading in securities

31 Commercial Banks

32 Post Office Fixed Deposit

33 Providing a place for lawful gambling

34 The Companies Act, 1956

35 The Securities Contract (Regulation) Act, 1956

36 The Depository Act, 1996

37 11(1)

38 Regulating Banking Treasuries

39 11(1)

40 Regulating Banking Treasuries

41 common stocks

42 All given options are correct

43 The stock is a good buy

44

The constant growth model takes into consideration the capital gains

earned on a stock

45 If your uncle earns a return higher than the overall stock market, this

BSEs Certification for Stock Markets (BCSM) Examination

BSE Institute Limited Page 9 of 9

means the stock market is inefficient

46

Weak-form market efficiency implies that recent trends in stock prices

would be of no use in selecting stocks

47

Semistrong-form market efficiency means that stock prices reflect all

public information

48 compounding frequency

49 higher

50 standard deviation

Вам также может понравиться

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (119)

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (265)

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (399)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2219)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5794)

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1090)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (344)

- 35 - Motion For More Definite StatementДокумент18 страниц35 - Motion For More Definite StatementRipoff Report100% (1)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (890)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- Presented By: Ajatshatru Sharma Anita Sharma Sakshi Arora Mba 3 SemДокумент18 страницPresented By: Ajatshatru Sharma Anita Sharma Sakshi Arora Mba 3 SemAnita SharmaОценок пока нет

- Mcdo vs. Mcjoy (Speccom)Документ2 страницыMcdo vs. Mcjoy (Speccom)nikkimayorОценок пока нет

- The Grand Duchy of Karameikos: Players Guide v1.0Документ29 страницThe Grand Duchy of Karameikos: Players Guide v1.0Fabiano RodriguesОценок пока нет

- Nestle India marketing strategy overviewДокумент21 страницаNestle India marketing strategy overviewDeepali SinghОценок пока нет

- (Defamation) Cassidy V Daily Mirror NewspapersДокумент4 страницы(Defamation) Cassidy V Daily Mirror NewspapersHoey Lee100% (4)

- Project Report of SHRM On NestleДокумент27 страницProject Report of SHRM On Nestleshrutikapoor100% (21)

- CH 9.intl - Ind RelnДокумент25 страницCH 9.intl - Ind RelnAnoushkaОценок пока нет

- PPL Law R13Документ13 страницPPL Law R13Dhruv JoshiОценок пока нет

- Metro Manila Development Authority v. Viron Transportation Co., Inc., G.R. No. 170656Документ2 страницыMetro Manila Development Authority v. Viron Transportation Co., Inc., G.R. No. 170656catrina lobatonОценок пока нет

- Export Import PoliciesДокумент28 страницExport Import PoliciesNirajGBhaduwalaОценок пока нет

- Export Import PoliciesДокумент28 страницExport Import PoliciesNirajGBhaduwalaОценок пока нет

- Role of Investment BanksДокумент60 страницRole of Investment Banksapi-246907195Оценок пока нет

- Ethics in The WorkplaceДокумент14 страницEthics in The WorkplacekiranmesaОценок пока нет

- Nestle 131217174646 Phpapp02Документ29 страницNestle 131217174646 Phpapp02NirajGBhaduwalaОценок пока нет

- Nestle 131217174646 Phpapp02Документ29 страницNestle 131217174646 Phpapp02NirajGBhaduwalaОценок пока нет

- Managerial Ethics and Social RespondsibilityДокумент28 страницManagerial Ethics and Social RespondsibilitySue RyaОценок пока нет

- Nestle India DistributionДокумент28 страницNestle India DistributionSantanu KararОценок пока нет

- Nestlé's Channel & Distribution System in IndiaДокумент18 страницNestlé's Channel & Distribution System in IndiaNirajGBhaduwalaОценок пока нет

- Strategic Human Resource Management (SHRM)Документ5 страницStrategic Human Resource Management (SHRM)NirajGBhaduwalaОценок пока нет

- External Schedule at Glance Summer 2016Документ2 страницыExternal Schedule at Glance Summer 2016NirajGBhaduwalaОценок пока нет

- Investment BankingДокумент4 страницыInvestment BankingNirajGBhaduwalaОценок пока нет

- Contents RevisedДокумент92 страницыContents RevisedAnoopKumarMangarajОценок пока нет

- Suggestion For Literature ReviewДокумент1 страницаSuggestion For Literature ReviewNirajGBhaduwalaОценок пока нет

- 12 Ethical Principles For Business Executives by Michael JosephsonДокумент4 страницы12 Ethical Principles For Business Executives by Michael JosephsonNirajGBhaduwalaОценок пока нет

- India-Norway Bilateral Trade EconomyДокумент3 страницыIndia-Norway Bilateral Trade EconomyNirajGBhaduwalaОценок пока нет

- MANAGING INDUSTRIAL RELATIONS AND LABOUR LAWS EXAMДокумент3 страницыMANAGING INDUSTRIAL RELATIONS AND LABOUR LAWS EXAMNirajGBhaduwala100% (2)

- PNB V CAДокумент7 страницPNB V CAAriana Cristelle L. PagdangananОценок пока нет

- Heirs of Marcelino Doronio, Petitioners v. Heirs of Fortunato Doronio, RespondentsДокумент2 страницыHeirs of Marcelino Doronio, Petitioners v. Heirs of Fortunato Doronio, RespondentsMichael DonascoОценок пока нет

- TranscriptДокумент10 страницTranscriptAnonymous 4pbJ6NtОценок пока нет

- MC 2021-086 General Guidelines On The International Organization For Standardization ISO Certification of The PNP Office Units Revised 2021Документ10 страницMC 2021-086 General Guidelines On The International Organization For Standardization ISO Certification of The PNP Office Units Revised 2021Allysa Nicole OrdonezОценок пока нет

- Inventory Accounting and ValuationДокумент13 страницInventory Accounting and Valuationkiema katsutoОценок пока нет

- 2007 Onwards Evidence BarqsДокумент4 страницы2007 Onwards Evidence Barqsjade123_129Оценок пока нет

- HR 1861 - Inquiry On Harassment Against Philippine Airlines Employees AssociationДокумент2 страницыHR 1861 - Inquiry On Harassment Against Philippine Airlines Employees AssociationBayan Muna Party-listОценок пока нет

- 15562711-ad97-4f6d-9325-e852a0c8add9Документ7 страниц15562711-ad97-4f6d-9325-e852a0c8add9Julia FairОценок пока нет

- ETHICAL PRINCIPLES OF LAWYERS IN ISLAM by Dr. Zulkifli HasanДокумент13 страницETHICAL PRINCIPLES OF LAWYERS IN ISLAM by Dr. Zulkifli HasansoffianzainolОценок пока нет

- Avr42783: Using Usart To Wake Up Atmega328Pb From Sleep ModeДокумент12 страницAvr42783: Using Usart To Wake Up Atmega328Pb From Sleep ModeMartin Alonso Cifuentes DazaОценок пока нет

- Written ComplianceДокумент2 страницыWritten ComplianceKriselle Joy ManaloОценок пока нет

- 1 Air India Statutory Corporation vs. United Labour Union, AIR 1997 SC 645Документ2 страницы1 Air India Statutory Corporation vs. United Labour Union, AIR 1997 SC 645BaViОценок пока нет

- File No. AI 22Документ8 страницFile No. AI 22Lori BazanОценок пока нет

- WWW - Csc.gov - PH - Phocadownload - MC2021 - MC No. 16, S. 2021Документ6 страницWWW - Csc.gov - PH - Phocadownload - MC2021 - MC No. 16, S. 2021esmie distorОценок пока нет

- INTERNATIONAL ACCOUNTING FINAL TEST 2020Документ8 страницINTERNATIONAL ACCOUNTING FINAL TEST 2020Faisel MohamedОценок пока нет

- Antiquera v. PeopleДокумент4 страницыAntiquera v. PeopleIan TaduranОценок пока нет

- Biological Science - September 2013 Licensure Examination For Teachers (LET) - TuguegaraoДокумент8 страницBiological Science - September 2013 Licensure Examination For Teachers (LET) - TuguegaraoScoopBoyОценок пока нет

- Akshay SuryavanshiДокумент5 страницAkshay SuryavanshisataraladcsОценок пока нет

- Entering and Leaving The Traffic Separation SchemeДокумент2 страницыEntering and Leaving The Traffic Separation SchemeAjay KumarОценок пока нет

- Why Discovery Garden Is The Right Choice For Residence and InvestmentsДокумент3 страницыWhy Discovery Garden Is The Right Choice For Residence and InvestmentsAleem Ahmad RindekharabatОценок пока нет

- Oracle Application Express Installation Guide PDFДокумент221 страницаOracle Application Express Installation Guide PDFmarcosperez81Оценок пока нет

- REC Infra Bond Application FormДокумент2 страницыREC Infra Bond Application FormPrajna CapitalОценок пока нет

- Guidelines For The Writing of An M.Phil/Ph.D. ThesisДокумент2 страницыGuidelines For The Writing of An M.Phil/Ph.D. ThesisMuneer MemonОценок пока нет