Академический Документы

Профессиональный Документы

Культура Документы

Indonesia Market (Back To Java Where Wealth Resides and Flourishes) 20140205

Загружено:

Hans WidjajaОригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Indonesia Market (Back To Java Where Wealth Resides and Flourishes) 20140205

Загружено:

Hans WidjajaАвторское право:

Доступные форматы

Indonesia market

Special report

Find CLSA research on Bloomberg, Thomson Reuters, CapIQ and themarkets.com - and profit from our evalu@tor proprietary database at clsa.com

Merlissa Trisno

merlissa.trisno@clsa.com

+62 21 2554 8821

Amie Liem

+62 21 2554 8829

Robert Pranata

+62 21 2554 8825

5 February 2014

Indonesia

Thematics

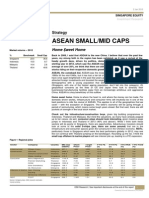

Top 10 picks

Ace Hardware (O-PF)

BCA (O-PF)

BTN (BUY)

Indocement (BUY)

Kalbe Farma (BUY)

Pakuwon (BUY)

Perusahaan Gas (O-PF)

Sritex (BUY)

Telkom (BUY)

Wijaya Karya (BUY)

www.clsa.com

Watch Merlissa and

Amie on CLSA TV

Prepared for EV: fsudjono@henanputihrai.com

Back to Java

2 merlissa.trisno@clsa.com 5 February 2014

Contents

Executive summary ............................................................................ 3

Investment thesis .............................................................................. 4

Powerful demographics ...................................................................... 9

Fruits of decentralisation ................................................................. 14

Hitting the ground, getting a feel! .................................................... 22

Stocks to own ................................................................................... 69

Company profiles

Ace Hardware ............................ 73

BCA .......................................... 77

BTN .......................................... 81

Indocement ............................... 85

Kalbe Farma .............................. 89

Pakuwon ................................... 93

Perusahaan Gas ......................... 97

Sritex ..................................... 101

Telkom ................................... 105

Wijaya Karya ........................... 109

Appendices

1: GDP by sector ................................................................................ 113

2: Reformist leaders profile ................................................................. 115

3: The rise of online traders ................................................................. 117

All prices quoted herein are as at close of business 27 January 2014, unless otherwise stated

Following the Komodo

In September 2007, our

Not j ust J akarta special report

projected that the booming

commodities industry and

decentralisation would spur

the countrys growth. Back

then, BCA and Telkom were

among our top picks and they

remain so today.

Prepared for EV: fsudjono@henanputihrai.com

Executive summary Back to Java

5 February 2014 merlissa.trisno@clsa.com 3

Back to Java

More than six years after our seminal Not just Jakarta report, we go Back to

Java to gauge this densely populated islands development, especially outside

the metropolis. Over the past few months, our intrepid team trekked across

Java to see the progress first-hand. What did we find? The provinces are

booming and growth should continue to outstrip that in the capital as

decentralisation continues. An expanding middle class, strong credit growth and

new infrastructure investment cycle will drive the expansion. Companies with a

sound strategy and a strong foothold in Java ex-Jakarta will be the winners.

Forming more than half of Indonesias population with 37m households, Java is

the worlds most populous island and is still adding 2m people every year. A

growing middle class (driven by rapid urbanisation), widening labour cost gap

(Jakarta minimum wage is double the Java average), and lower penetration of

consumer products have led to an accelerating business expansion shift from

Greater Jakarta to other Java regions. Eventually, money will follow the

demographics and cheap labour will attract business people.

Jakartas GDP growth lagged the total of Javas provinces for the first time in

2012, although this is based on preliminary data. This is due to

decentralisation efforts, which have given greater control to local

governments. Some early indicators also suggest that expansion in Java ex-

Jakarta regions has been accelerating, be it for investment, bank loans,

cement or the retail sector. Outer Javas low base will also allow for strong

growth potential in the long term.

We hit the ground over the past few months to get a feel for some of the fastest-

growing cities in Java as well as commodity-exposed islands like Sumatra and

Kalimantan to see the purchasing-power trend. Our team of intrepid investigators

visited 13 cities and spoke with the locals to gauge the situation today. Our

conclusion? The Java provinces are booming and Java ex-Jakarta growth should

continue to outstrip that in the capital for some time to come. We believe the

growth will flourish from West to Central and East Java in the future.

Companies with a great strategy and strong foothold in Java ex-Jakarta

regions should benefit. We like retail chain Ace Hardware, banks BCA and

BTN, cement producer Indocement, healthcare player Kalbe Farma,

developer Pakuwon, gas distributor Perusahaan Gas, textiles firm Sritex,

mobile operator Telkom and infrastructure group Wijaya Karya.

GDP by geography

Source: Statistics Indonesia (BPS)

Sumatra

21%

DKI Jakarta

18%

Java ex-Jakarta

43%

Bali & Nusa

Tenggara

3%

Kalimantan

8%

Sulawesi

5%

Maluku & Papua

2%

Java: the pulse

of Indonesia

Java ex-Jakarta accounts

for 43% of GDP

Powerful demographics

Fruits of decentralisation

Hitting the ground,

getting a feel!

Stocks to play

the theme

Prepared for EV: fsudjono@henanputihrai.com

Investment thesis Back to Java

4 merlissa.trisno@clsa.com 5 February 2014

The rise of Java regions

Nations need attractive cities to attract businesses and talents. Great

cities are not predestined, but rather created by designs and based on

key decisions. Development of the environmental, social and cultural

aspects is crucial.

Mike Harcourt, co-author of City Making in Paradise

Indonesia is big and diverse, with over 17,000 islands, 240m people and 360

ethnic groups. Since the fall of Suharto in 1998, the country has embarked on

a radical experiment to prevent it from breaking apart, while gradually

striving to create more attractive cities, thanks to decentralisation.

It is also encouraging to see the latest leaders elections in some of the

largest cities like Jakarta, Bandung and Surabaya being won by the reformers

(see their profiles in Appendix 2). Voters in Java regions are becoming more

sophisticated due to growing internet penetration.

Key statistics

Province Land area

(km

2

)

Population

(2010)

GDP

(2012)

2012 GDP growth

(%)

GDP per-capita

(US$)

Jakarta 740 9,607,787 1,103,738 6.53 9,990

West Java 34,817 43,053,732 946,861 6.21 1,912

Central Java 40,801 32,382,657 556,480 6.34 1,494

Yogyakarta 3,186 3,457,491 57,034 5.32 1,434

East Java 47,922 37,476,757 1,001,721 7.27 2,324

Banten 9,163 10,632,166 212,857 6.15 1,741

Java 138,794 136,610,590 3,878,690 6.57 2,469

Indonesia 1,904,569 237,641,326 8,241,864 6.20 3,016

Source: CLSA, BPS

With decentralisation in place, regional growth should continue to outstrip

the centre, supported by a strong demographic profile, a widening

minimum-wage gap and faster investment flow to the cities, albeit less so in

outer Java due to soft-commodity price volatility. The Java ex-Jakarta

regions should continue to expand their power and companies exposed to

this will be big winners.

Powerful demographics

Forming more than 50% of Indonesias population, Java is the most populous

island in the world with nearly 140m people. Javas land area is one-third that

of Japan but it has a larger population and is adding about 2m people every

year compared with Japan, which is losing 250k people). By simple

extrapolation, Javas population will be double that of Japan within 50 years.

Java (including Jakarta) has nearly 37m households in total - similar to the

Philippines and Thailand combined - with West Java having the highest

number. Out of Indonesias top five provinces with the largest number of

households, four are located in Java.

Striving to create

more attractive cities

Java adds about

2m people every year

Prepared for EV: fsudjono@henanputihrai.com

Investment thesis Back to Java

5 February 2014 merlissa.trisno@clsa.com 5

Population by geography Minimum wage

Source: BPS

A growing middle class (driven by rapid urbanisation), widening labour cost

discrepancy (Jakartas minimum wage is double the Java average), and low

penetration have led to the shift from Greater Jakarta to other Java regions.

Eventually, money will follow the demographics and cheap labour will attract

business people (particularly labour-intensive industries).

We are already seeing some companies, such as Pan Brothers, moving their

production facilities from Greater Jakarta to other Java cities. Initially, the

reason to expand to Central Java was more labour availability in Central Java,

not cost. But, as the minimum wage discrepancy widens, the company has

preferred to expand capacity in its Central Java facility.

In 2007, the company started its Central Java operation with about 1k sewing

machines, or 30% of its total capacity. Currently, the Central Java facility runs

about 10k sewing machines, or 75% of the total capacity and still rising.

Fruits of decentralisation

Jakartas GDP growth for the first time lagged the total of Javas provinces in

2012, though this is still based on preliminary figures. This makes sense as

decentralisation has given greater control to local governments, thereby

aiding the development of Javas provinces. With Suharto no longer

controlling the purse strings and the economy in better shape, more central

government money has flowed.

GDP growth Jakarta vs Java Infrastructure spending

preliminary figure, very preliminary figure;

Source: BPS

Source: Government of Indonesia

Regional autonomy has also coincided with another long-run demographic

trend: urbanisation, which consequently leads to some logistics challenges in

the country. Infrastructure spending has continued to rise for both government

and private sectors. Government infrastructure spending saw a 28% Cagr

during 2009-12 and a chunky 52% Cagr for the private sector over the same

period, which implies about 2.6% of GDP as of 2012, the highest ever.

Sumatra

21%

Jakarta

4%

Java

ex-Jakarta

53%

Bali & Nusa

Tenggara

6%

Kalimantan

6%

Sulawesi

7%

Maluku &

Papua

3%

0

500

1,000

1,500

2,000

2,500

3,000

2000 2002 2004 2006 2008 2010 2012 2014

Java ex-Jakarta

Jakarta

(Rp'000)

4.0

4.5

5.0

5.5

6.0

6.5

7.0

2006 2007 2008 2009 2010 2011 2012

Jakarta

Java

(%)

0

50,000

100,000

150,000

200,000

250,000

0.0

0.5

1.0

1.5

2.0

2.5

3.0

2005 2006 2007 2008 2009 2010 2011 2012

Government

Private

GDP (LHS)

(%) (Rpbn)

Jakartas GDP growth

for the first time

lagged Javas total

Urbanisation, greater

budget needed

for infrastructure

Money will follow

demographics

Widening labour cost

differential

Prepared for EV: fsudjono@henanputihrai.com

Investment thesis Back to Java

6 merlissa.trisno@clsa.com 5 February 2014

Indonesia still has long way to go. However, thanks to decentralisation, local

problems allow for local solutions. These logistics problems create more

opportunities for both public and private sectors, eg, Jasa Marga is to build

200km of new toll-road sections within three years, while AKR Corp and

Kawasan Industri Jababeka are developing industrial estates in East Java and

Central Java, respectively.

Some early indicators also suggest that Java ex-Jakarta growth has been

accelerating, be it in investment, bank loans, cement or the retail sector.

Outer Javas low base will also trigger strong growth potential in the longer

term, yet the short-term outlook is less rosy given the low-commodity

price burden.

FDI realisation Cement growth per region (2013 YoY)

Source: BKPM

Hitting the ground, getting a feel!

We hit the ground to get a feel for some of the fastest-growing cities in Java

as well as commodity-exposed islands like Sumatra and Kalimantan to see the

purchasing-power trend. Sumatra and Kalimantan have about 50% of

employees working in the agriculture and mining industries, in contrast to

Java ex-Jakarta, which has more manufacturing capability.

Our conclusion? The Java provinces are booming and Java ex-Jakarta growth

should continue to outstrip the centre for some time to come. We believe the

growth will flourish from West to Central and East Java in the future.

Sumatra employment by sector Java ex-Jakarta employment by sector

Source: BPS

0

10

20

30

40

50

60

0

5,000

10,000

15,000

20,000

25,000

30,000

2

0

0

7

2

0

0

8

2

0

0

9

2

0

1

0

2

0

1

1

2

0

1

2

1

Q

1

3

2

Q

1

3

3

Q

1

3

FDI realisation (LHS)

% Java ex-Jakarta

(US$m) (%)

8.1

7.6

5.6

3.9

1.4

0 1 2 3 4 5 6 7 8 9

Java ex-Jakarta

Kalimantan

Jakarta

Sulawesi

Sumatra

(%)

Agriculture

45.9%

Mining

1.7%

Manufacturing

7.3%

Utilities

0.2%

Construction

5.6%

Wholesale

& retail

18.4%

Transport

4.1%

Finance

1.9%

Others

14.8%

Agriculture

29.3%

Mining

0.8%

Manufacturing

19.1%

Utilities

0.2%

Construction

6.9%

Wholesale

& retail

22.4%

Transport

4.4%

Finance

2.3%

Others

14.5%

Logistics problems as

an opportunity

Early indicators

suggest stronger

growth in Java

ex-Jakarta

Half of Sumatra and

Kalimantan

employees work in

agri and mining

Java ex-Jakarta

should continue to

outgrow the centre

Prepared for EV: fsudjono@henanputihrai.com

Investment thesis Back to Java

5 February 2014 merlissa.trisno@clsa.com 7

We provide fresh on-the-ground perspective on 13 cities spread over three key

islands. This report is not a catch-all to these themes, the island is too broad to

do it in just one report. Rather we have tried to highlight future growth potential

and better understand how these will propel the country going forward.

Our Indonesia team went out and about across Java

Source: CLSA

Stocks to own

Our medium-term strategy is based on the view that Java ex-Jakarta growth

should accelerate given powerful demographics; strong bank-loan growth;

and a new investment cycle with massive infrastructure development.

Companies with great strategies and strong footholds in Java ex-Jakarta

should benefit. We also consider their penetration of provinces and the

sustainability of their strategies. We like BCA, BTN, Perusahaan Gas,

Indocement, Pakuwon, Kalbe Farma, Ace Hardware, Telkom, Wijaya Karya

and Sritex.

Stocks with Java ex-Jakarta exposure

Companies Ticker Market cap

(US$m)

Rec Performance (%) PE (x) EV/Ebitda (x) ROE (%)

3M 1Y 14CL 15CL 14CL 15CL 14CL 15CL

Bank Central Asia BBCA IJ 19,764 O-PF (9) 5 16 13 na na 23 24

Telekom Indonesia TLKM IJ 17,728 BUY (1) 10 14 13 5 4 23 23

Perusahaan Gas PGAS IJ 9,042 O-PF (8) (2) 10 11 8 7 32 29

Indocement INTP IJ 6,090 BUY (1) (6) 14 12 8 7 22 21

Kalbe Farma KLBF IJ 5,196 BUY (0) 28 28 23 19 16 26 27

Pakuwon PWON IJ 1,194 BUY (2) 12 10 7 7 5 33 34

Ace Hardware ACES IJ 996 O-PF 4 (13) 23 19 16 13 24 24

Wijaya Karya WIKA IJ 922 BUY (10) 9 14 11 7 5 23 24

Bank Tabungan BBTN IJ 788 BUY (9) (43) 6 5 na na 13 16

Sritex SRIL IJ 455 BUY 9 - 11 9 7 6 15 18

Source: CLSA

Why Java should

grow stronger?

Who has strong

foothold and great

strategy in Java

ex-Jakarta?

Fresh on-the-ground

perspective on

13 cities

Prepared for EV: fsudjono@henanputihrai.com

Did you know?

Java fast facts

Lots of people

Java is the worlds most populous island. Although it

is only the 13

th

largest in the world in terms of its

size, it is home to 136 million people. The population

density is over 1,000 people per square kilometre.

By GDP, Java comes 30

th

in the world, ahead of

every other Asean country, assuming around

US$380bn in GDP. If Java was a country, it would be

the 10

th

largest by population.

The biggest tribe

The Javanese are Indonesias largest tribe with

more than 100 million people. Their ancestors are

thought to have originated in Taiwan and migrated

through the Philippines, reaching Java between

1,500BC and 1,000BC.

Kopi Jawa

Coffee has been one of the biggest

exports since the Dutch began

cultivation in the 17

th

Century. The local

Kopi Jawa is a distinct style of coffee

that is very strong, black and sweet.

The birth place of presidents

Every president, from Soekarno

to Susilo Bambang Yudhoyono,

is Javanese. BJ Habibie was the

only exception, yet this was

during a transition period from

the New Order to the

Reformation era. On many

occasions, they will choose a

running partner from outside

Java to boost their popularity

with the non-Java people.

Accounting for 53% of the

population, Javanese people will play an important

role this year in determining the next president.

Traditional Gamelan music

The 1889 Paris Exposition

Universelle hosted many

musical groups from

exotic countries and one

was the Javanese

Gamelan. It was there

that French composer

Claude Debussy first

heard a performance by the Java ensemble.

Debussy was so impressed with what he heard

that it influenced his later works. The piece most

often quoted as an example of gamelans influence

on Debussy is Pagodes, from the piece Estampes

of 1903. Gamelan is a collection of mostly metallic

musical instruments, with gong or bell-like sounds.

Borobudur Temple

Built in the 9

th

Century, this is

the worlds oldest Buddhist

temple. Located in Magelang

in Central Java, the monument

is a shrine to Lord Buddha and

is the countrys single most

visited tourist attraction.

Lots of eruptions

Situated on the Pacific Ring of Fire, Indonesia has

abundant volcanoes. There are over 30 in Java alone.

One of the most active is Mount Merapi, which lies

2,968 metres above sea level. In 1930, one eruption

destroyed 13 villages and killed over 1,400 people.

Photos: Thomas Hirsch, Benny Lin, Gunawan Kartapranata (Wikimedia Commons)

Prepared for EV: fsudjono@henanputihrai.com

Section 1: Powerful demographics Back to Java

5 February 2014 merlissa.trisno@clsa.com 9

Powerful demographics

Forming more than half of Indonesias population, Java is the most populous

island in the world with nearly 140m people. Javas land area is one-third that

of Japan but it has a much larger population, with around 2m new additions

every year while Japans population dropped by a record 250k people last

year. Java overtook Japan in 2010 and, by simple extrapolation, Javas

population will be more than double Japans within 50 years.

Java (including Jakarta) has nearly 37m households in total - similar to the

Philippines and Thailand combined - with West Java home to the most

households. Of the top-five provinces with the largest household numbers in

Indonesia, four are located in Java with North Sumatra joining this group.

Figure 1

Map of Indonesia and Java

Source: CLSA, BPS

Figure 2 Figure 3

Population by geography Java: the most populous island in the world

Source: BPS. NT: Nusa Tenggara Source: BPS, United Nations, Japan civil registry

Jakarta

Bali Java

Serpong

Bandung

Krakatau

Islands

Semarang

Yogyakarta

Surakarta

(Solo)

Madiun

Surabaya

Malang

Indonesia

Java stats

Population: 136 million

Land area: 138,794 km

2

Density: 1,064 people per km

2

Sumatra

21%

Jakarta

4%

Java

ex-Jakarta

53%

Bali & Nusa

Tenggara

6%

Kalimantan

6%

Sulawesi

7%

Maluku &

Papua

3%

0 20 40 60 80 100 120 140

Java

Honsh

Great Britain

Luzon

Sumatra

Taiwan

Sri Lanka

Madagascar

Mindanao

Hispaniola

Borneo

Sulawesi

Salsette

Kysh

Cuba

(m)

Java is the worlds most

populous island

Total Java households

similar to the Philippines

and Thailand combined

Prepared for EV: fsudjono@henanputihrai.com

Section 1: Powerful demographics Back to Java

10 merlissa.trisno@clsa.com 5 February 2014

Figure 4

Java vs Japan population

Source: World Bank, CLSA (assuming 16m additional people for every 10 years in Java)

Indeed, Java has eight cities with populations over a million, with Medan and

Palembang (Sumatra) as well as Makassar (Sulawesi) joining this group.

Jakarta is the second-most crowded city in the world, behind Salsette (India),

as anyone who has experienced Jakarta traffic can attest. Despite being

densely populated, unemployment in Java (ex-Jakarta) still hovers at a

manageable level of 6.6%, much lower than Jakartas 9.9%.

Figure 5

Population over a million

City Province Population (m)

Jakarta Jakarta 9.6

Surabaya East Java 2.8

Bandung West Java 2.4

Bekasi West Java 2.3

Tangerang Banten 1.8

Depok West Java 1.7

Semarang Central Java 1.5

South Tangerang Banten 1.3

Source: BPS

Figure 6 Figure 7

Unemployment rate Indonesias urbanisation rate

Source: BPS Source: UN

0

50

100

150

200

250

1950 1960 1970 1980 1990 2000 2010 2020F 2030F 2040F 2050F

Java population Japan population (m people)

3.3

4.9

5.2

5.3

5.7

6.1

6.6

9.9

0 2 4 6 8 10

Bali & NT

Maluku & Papua

Sulawesi

Kalimantan

Sumatra

Indonesia

Java ex-Jakarta

Jakarta

(%) 0

10

20

30

40

50

60

70

80

1

9

5

0

1

9

5

5

1

9

6

0

1

9

6

5

1

9

7

0

1

9

7

5

1

9

8

0

1

9

8

5

1

9

9

0

1

9

9

5

2

0

0

0

2

0

0

5

2

0

1

0

2

0

1

5

2

0

2

0

2

0

2

5

2

0

3

0

2

0

3

5

2

0

4

0

2

0

4

5

2

0

5

0

(%)

Java population overtook

Japan in 2010

Java has eight cities with

populations over a million

Jakarta is second-most

crowded city in the world

Prepared for EV: fsudjono@henanputihrai.com

Section 1: Powerful demographics Back to Java

5 February 2014 merlissa.trisno@clsa.com 11

In 2008, for the first time ever, half of the world population lived in cities. For

Indonesia, it was in 2010 when half of the countrys population lived in urban

areas. The figure was 13% in 1990. By 2050, up to three-quarters of the

worlds population will be urbanised and most of the incremental growth will

be in Asian second-tier cities, according to the UN.

Figure 8

Minimum wage

Source: Government of Indonesia

A growing middle class (driven by rapid urbanisation), widening labour cost

discrepancy, and low penetration of consumer products have led to the

business expansion shift from Greater Jakarta to other Java regions.

Eventually, money will follow the demographics and cheap labour will attract

business people (particularly labour-intensive industries).

Indonesia in maps

Back in September 2009, we

published our Unveiling the

Komodo report, which aimed to

illustrate Indonesias economy

through maps. Through graphical

representations, the report shows

the countrys demographics, the

industries, the services, the

natural resources, the transport

infrastructure, the finance

networks as well as the popular

tourist areas.

Beyond its ethnic and cultural diversity, Indonesia is

blessed with an abundance of natural resources.

Globally, it is the largest thermal-coal exporter and

palm-oil producer, and the third-largest natural-gas

exporter. It also boasts the worlds biggest gold mine.

But many of these assets are located in remote regions,

far from the modern world. Our maps and charts

provide investors with a better understanding of the

global significance of such commodities.

0

500

1,000

1,500

2,000

2,500

3,000

2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014

Java ex-Jakarta Jakarta (Rp'000)

Gap has widened, leading

to the shift from

greater Jakarta

In 2010, half of Indo

population lived in

urban areas

Money will follow the

demographics

Prepared for EV: fsudjono@henanputihrai.com

Section 1: Powerful demographics Back to Java

12 merlissa.trisno@clsa.com 5 February 2014

Figure 9

Minimum wage in selected cities

Provinces/Cities (Rp000/month) 2013 2014

East Java

Surabaya 1,724 2,165

Malang, Batu 1,317 1,601

Kediri 1,128 1,165

Madiun, Ngawi, Magetan, Nganjuk, Ponorogo 927 1,047

Provincial average 1,140 1,315

Central Java

Semarang 1,130 1,230

Solo, Sragen, Klaten 884 1,184

Cilacap 888 978

Pemalang, Pekalongan 950 1,044

Provincial average 914 1,067

West Java

Bandung 1,424 1,825

Bogor 2,002 2,242

Cirebon 1,082 1,220

Provincial average 1,351 1,638

Banten

Tangerang 2,201 2,443

Cilegon 2,200 2,443

Serang 1,939 2,166

Provincial average 1,881 2,126

DI Yogyakarta

Yogyakarta 1,065 1,173

Jakarta

DKI Jakarta 2,200 2,440

Java (ex-Jakarta) average 1,167 1,366

Source: CLSA, Government of Indonesia

Already, we see some companies, such as Pan Brothers, moving their

production facilities from Greater Jakarta to other Java cities. Established in

1980 in Tangerang, Greater Jakarta, it is Indonesias largest garment

manufacturer employing about 18,500 employees.

In 2007, the company started its Central Java operation with about 1,000

sewing machines or about 30% of the firms total capacity. This facility now

operates with about 10,000 sewing machines or 75% of the total capacity and

is still expanding. Meanwhile, the Tangerang production facility did not see

any expansion.

Initially, the reason for expanding to Central Java was down to more labour

availability, not cost. In terms of labour skill (productivity), the company

claims that Central Javas labour productivity was low at first and eventually

caught up; they just needed a learning period. Going forward, it will focus its

expansion on the Central Java facility due to cost advantages and will leave

the Tangerang facility as it is.

Textile company moving

its production facility

Labour availability is

key concern

Jakarta minimum

wage is doubled than

Java average

Prepared for EV: fsudjono@henanputihrai.com

Section 1: Powerful demographics Back to Java

5 February 2014 merlissa.trisno@clsa.com 13

Figure 10

Pan Brothers sewing machine expansion

Source: Company

Indeed, low penetration is also a key attraction to invest in Java regions as it

still offers huge room to grow. Data from cement and retailers suggest that

penetration is at least about three times higher in the Jakarta region, as

measured by sales/GDP ratio and home-improvement spending per capita.

Figure 11 Figure 12

Cement consumption per capita (2012) Retailers sales to GDP ratio (2012)

Source: CLSA, Company, Indonesia Cement Association (ASI)

Figure 13

Home-improvement spending per capita

Source: CLSA, Company

8,450

11,750

13,250

16,250

20,625

25,000

0

5,000

10,000

15,000

20,000

25,000

30,000

2010 2011 2012 2013F 2014F 2015F

(unit)

0

100

200

300

400

500

600

Jakarta Java (ex-Jakarta) Outer Java

(kg/person)

0

1

2

3

4

5

6

Ace

Hardware

Mitra

Adiperkasa

Ramayana Matahari

Dept Store

Jakarta Java (ex-Jakarta) Outer Java (x)

0

5

10

15

20

25

30

35

40

HomePro

(Bangkok)

HomePro

(provinces)

Ace Hardware

(Jakarta)

Ace Hardware

(Java ex-Jakarta)

Ace Hardware

(ex-Java)

(US$)

Pan Brothers expansion

will be more towards its

Central Java facility

Low penetration, as

measured by cement

and retail data

Java is still

underpenetrated

Java ex-Jakarta has

the lowest cement

consumption per capita

Prepared for EV: fsudjono@henanputihrai.com

Section 2: Fruits of decentralisation Back to Java

14 merlissa.trisno@clsa.com 5 February 2014

Fruits of decentralisation

With decentralisation in place, we see greater opportunity for Indonesia to

create more attractive cities (see Section 3 for in-depth discussion on these

cities). In fact, Jakartas GDP growth for the first time lagged that for the total

of Javas provinces in 2012, although this is still based on preliminary data.

This makes sense, in our view, as decentralisation has given greater control

to local governments, thereby aiding the development of Javas provinces.

The country has developed quickly since the end of Suhartos dictatorship in

1998. With Suharto no longer controlling the purse strings and the economy

in better shape, more central government money has flowed to the outer

provinces. See our July 2012 report, Otonomi daerah, for more.

Figure 14

GDP growth Jakarta vs Java

preliminary figure, very preliminary figure. Source: CLSA, BPS

Figure 15 Figure 16

Province GDP growth (2012) Government budget spending on regions

Source: BPS APBN-P, RAPBN; Source: Government of Indonesia

4.0

4.5

5.0

5.5

6.0

6.5

7.0

2006 2007 2008 2009 2010 2011 2012

Jakarta Java (%)

6.5

6.2

6.3

7.3

5.8

4.8

6.2

0

1

2

3

4

5

6

7

8

J

a

k

a

r

t

a

W

e

s

t

J

a

v

a

C

e

n

t

r

a

l

J

a

v

a

E

a

s

t

J

a

v

a

S

u

m

a

t

r

a

K

a

l

i

m

a

n

t

a

n

I

n

d

o

n

e

s

i

a

(%)

0

100

200

300

400

500

600

700

2

0

0

0

2

0

0

1

2

0

0

2

2

0

0

3

2

0

0

4

2

0

0

5

2

0

0

6

2

0

0

7

2

0

0

8

2

0

0

9

2

0

1

0

2

0

1

1

2

0

1

2

2

0

1

3

2

0

1

4

(Rptn)

11% 3-year Cagr

16% 3-year Cagr

GDP growth for

Jakarta lagged total

Javas provinces

More opportunity to

create attractive cities

More money from

central government

Prepared for EV: fsudjono@henanputihrai.com

Section 2: Fruits of decentralisation Back to Java

5 February 2014 merlissa.trisno@clsa.com 15

As the nation needs more attractive cities to lure businesses and talent, it is

encouraging to see that the latest leaders elections in some of the largest cities

like Jakarta, Bandung and Surabaya won by the reformers (see Appendix 2 for

their profiles). Definitely, voters in Java are becoming more sophisticated due

to growing internet penetration.

Figure 17

Joko Widodo

Figure 18

Ridwan Kamil

Figure 19

Tri Rismaharini

Source: DKI Jakarta Source: Ridwan Kamil (Wikimedia) Source: JayaGood (Wikipedia)

At the Jakarta gubernatorial election in 2012, Joko Widodo - better known as

Jokowi - won the contest despite scepticism over the trustworthiness of the

electoral process. Jokowi received 42% of the votes in the first round and

because no candidates achieved more than 50%, Jakarta conducted a second

round of voting, whereby Jokowi won 54% of the votes.

Figure 20 Figure 21

Jakarta gubernatorial election 2012 (first round) Internet penetration (% of population)

Source: KPU Jakarta Source: Euromonitor

Logistics: Challenge yet opportunity

Regional autonomy has also coincided with another long-run demographic

trend: urbanisation. Over time, this will lead to greater budgets needed for

infrastructure and education. For sure, logistics is the key challenge to

penetrate into the Indonesian market, yet there is opportunity for incumbents

with vast distribution network to maintain their competitiveness.

The logistics challenge serves as a great entry barrier in the short term, with

Indonesia logistics costs one of the highest in the region. The nations total

logistics costs account for 27% of GDP, with transport expenses contributing

about 50% of the cost.

Joko Widodo

42%

Fauzi Bowo

34%

Hidayat Nur

Wahid

12%

Faisal Basri

5%

Alex Noerdin

5%

Hendarji

Supanji

2%

0

2

4

6

8

10

12

14

16

18

2007 2008 2009 2010 2011 2012

(%)

Encouraging to see

reformists win leaders

elections in big cities

Joko Widodo won in 2012

in Jakarta after a second

round of voting

Greater budget needed

for infrastructure

Logistic costs account for

27% of GDP

Reformers in Java cities

Prepared for EV: fsudjono@henanputihrai.com

Section 2: Fruits of decentralisation Back to Java

16 merlissa.trisno@clsa.com 5 February 2014

Figure 22 Figure 23

Logistic costs as % to GDP Logistic costs breakdown as % to GDP

Source: World Bank

Jakartas Tanjung Priok port, for example, has a dwelling time of 8.7 days,

compared to five days in Thailand and 1.2 days in Singapore due to border

administration issues, business practices and poor road infrastructure.

Consequently, terminal handling charges in Indonesia is the highest after

Hong Kong.

Research by The Asia Foundation and University of Indonesia in 2008 found

that the operational cost of trucks in Indonesia was 34 cents per kilometre,

50% higher than average cost for all of Asia.

Figure 24

Logistic cost increment and fuel price

Source: Center for Logistics and Supply Chain Studies

What does our on-the-ground check show?

In our latest Komodo report, our roving analyst

Amie Liem took a road trip from Jakarta to

Central Javas Semarang. From her adventure,

we conclude that it is very slow for people to

move things from one place to another.

The average speed is 58km/hour versus 97km/hour in

China and 110km/hour in America; Amies Jakarta-

Semarang-Klaten-Jakarta trip used more than 315.5km of

toll roads, or 42% of Indonesias

total toll-road network, spending

over 20 hours in total and

traversing more than half of Jasa

Margas toll roads.

Visit clsa.com to see more of our

on-the-ground Komodo reports

from Amie.

0

5

10

15

20

25

30

S

i

n

g

a

p

o

r

e

U

S

A

J

a

p

a

n

M

a

l

a

y

s

i

a

S

.

K

o

r

e

a

T

h

a

i

l

a

n

d

V

i

e

t

n

a

m

I

n

d

o

n

e

s

i

a

(%)

12.6 12.8 13.3

12.3

11.0 10.9

11.8 11.6

10.2 9.9

10.5

9.0

9.6 9.7 8.0 8.7

4.8 4.8

5.0

4.5

4.3 4.3

4.2

4.3

0

5

10

15

20

25

30

2004 2005 2006 2007 2008 2009 2010 2011

Transportation costs Inventory costs Administration costs (%)

0.0

0.1

0.2

0.3

0.4

0.5

0.6

0.7

0

5

10

15

20

25

30

2005 2006 2007 2008 2009 2010 2011

Logistic cost increase Fuel price (RHS) (%) (US$/lt)

Increasing dwelling time

in Tanjung Priok port

Logistic cost is highly

correlated with fuel price

Prepared for EV: fsudjono@henanputihrai.com

Section 2: Fruits of decentralisation Back to Java

5 February 2014 merlissa.trisno@clsa.com 17

Figure 25 Figure 26

Dwelling time in Tanjung Priok port Infrastructure spending

Source: JICT Source: Government of Indonesia

Indonesia definitely has long way to go. However, thanks to decentralisation,

local problems allow for local solutions. These logistic problems are gradually

being addressed.

The logistics challenge has lifted infrastructure spending for both government

and the private sector. Government infrastructure spending jumped by a 28%

Cagr during 2009-12 and a chunky 52% Cagr for private firms, which implies

about 2.6% of GDP as of 2012, the highest ever.

Opportunity for public . . .

Indonesian toll-road operator Jasa Marga, for example, plans to develop close

to 200km new section within the next three years, or about an additional

30% on top its current portfolio.

Figure 27

Jasa Margas toll-road plan

Expected Completion Toll road Section Province Length (km)

4Q 2013 JORR W2 North Kb Jeruk-Meruya Jakarta 1.8

JORR W2 North Meruya- Joglo Jakarta 1.5

Nusa Dua-Ngurah Rai-Benoa Bali 10.0

Semarang-Solo (Stage 1: Sec 2) Ungaran Bawen Central Java 12.3

1Q 2014 Gempol-Pandaan East Java 13.6

Bogor Outer Ring Road Kd Halang-Kd Badak Greater Jakarta 2.0

2Q 2014 Gempol-Pasuruan Gempol-Rembang East Java 13.9

JORR W2 North Joglo-Ciledug Greater Jakarta 2.35

JORR W2 North Ciledug-Ulujami Greater Jakarta 2.05

Surabaya-Mojokerto Krian-Mojokerto East Java 18.5

3Q 2014 Surabaya-Mojokerto Sepanjang-WRR East Java 4.3

4Q 2014 Surabaya-Mojokerto WRR-Driyorejo East Java 5.1

Surabaya-Mojokerto Driyorejo-Krian East Java 6.1

2Q 2015 Gempol-Pasuruan Rembang-Pasuruan East Java 8.1

Gempol-Pasuruan Pasuruan-Grati East Java 12.2

Kunciran-Serpong Greater Jakarta 11.2

3Q 2015 Semarang-Solo (Stage 2) Bawen-Salatiga Central Java 17.5

Semarang-Solo (Stage 2) Salatiga-Boyolali Central Java 24.4

Semarang-Solo (Stage 2) Boyolali-Solo Central Java 7.64

Cengkareng-Kunciran Greater Jakarta 14.2

2Q 2016 Bogor Outer Ring Road Kd Badak-Yasmin Greater Jakarta 2.2

Bogor Outer Ring Road Yasmin-Darmaga Greater Jakarta 3.0

Source: Jasa Marga

4.9

5.8

6.4

8.7

0

1

2

3

4

5

6

7

8

9

10

2010 2011 2012 2013

(days)

0

50,000

100,000

150,000

200,000

250,000

0.0

0.5

1.0

1.5

2.0

2.5

3.0

2005 2006 2007 2008 2009 2010 2011 2012

Government

Private

GDP (LHS)

(%) (Rpbn)

Local problems allow

for local solution

Rising infrastructure

spending, both public and

private sectors

Jasa Marga plans to build

200km new section

within three years

Prepared for EV: fsudjono@henanputihrai.com

Section 2: Fruits of decentralisation Back to Java

18 merlissa.trisno@clsa.com 5 February 2014

Figure 28

Jasa Marga: Taman Mini Indonesia Indah Interchange, Jagorawi Toll Road

Figure 29

Automated toll booth at Cililitan gate, Cawang-Tomang-Cengkareng Toll Road

Source: Jasa Marga annual report

. . . as well as private companies

Two large-scale industrial estate projects in Central and East Java plan to

capitalise upon industrial investment in alternate locations outside Jakarta.

AKR Corporindo and its joint-venture partner, the state-owned ports

corporation Pelindo 3, plan to construct a 2,150-hectare estate between

Gresik and Surabaya in East Java while Kawasan Industri Jababeka (KIJA)

and its partner Sembcorp of Singapore plan to construct a 2,770-hectare

estate in Central Java near Semarang.

To make investment attractive by export-focused industries (both local and

international), each has allocated space for an adjacent port. At present, the

average undeveloped industrial estate space is about 20km away from the

nearest port facility. The total cost of AKRs project is estimated to be around

Rp10tn (US$870m) over a 5-10-year period with the joint venture recently

securing Rp3tn (US$261m) in debt commitments for phase 1.

Two partnerships in East

and Central Java

Allocation for an

adjacent port

Jasa Marga looking

to expand

Prepared for EV: fsudjono@henanputihrai.com

Section 2: Fruits of decentralisation Back to Java

5 February 2014 merlissa.trisno@clsa.com 19

Figure 30

Industrial estate development in Java

Java Integrated Industrial

Port Estate (JIIPE)

Kendal Industrial Park

Location East Java,

between Gresik and Surabaya

Central Java,

near Semarang

Area (ha) 2,150 2,770

Port area allocation (ha) 250 58

Total indicated investment Rp10t Rp7.8t

Target first operation 2014 2015

Estate ownership AKR 60%: Pelindo 3 40% KIJA 51%, Sembcorp 49%

Port ownership AKR 40%: Pelindo 3 60% KIJA 51%, Sembcorp 49%

Source: Companies

Both estates plan to sell land in stages with about 70% of the designated

area being able to be developed by industry, commencing first with heavy

industry (such as metal smelting) then medium density (agriculture and

fertilisers for instance) and then light commercial. The projects also have

residential areas held adjacent, such as AKRs which will have 700 hectares of

residential land (external to the project).

Figure 31 Figure 32

Kendal industrial estate land area JIIPE industrial estate land area

Source: Company

For these projects to be attractive, the differential in wages between the

respective locations and Greater Jakarta needs to persist and the usual

logistical challenges have to be overcome, including land acquisition (AKR

currently has 900 hectares or about half its planned area), permits and

infrastructure connection with nearby road and rail networks.

Some early indicators

Within the last five years, bank loan growth in Java has been growing above

20% level, despite a high base (25% of total loan), while the latest bank loan

data suggest that the growth has been accelerating in Java areas.

Mapping Batavia

Our property team has produced a series of maps on properties in Jakarta.

These have featured the capitals landmark properties (Batavia Reborn),

industrial estates (Industrious Batavia) and retail malls (Shopping in Batavia).

They provide a practical and user-friendly guide to Greater Jakartas developing

landscape. Visit clsa.com to check them out.

972

792

468

0

200

400

600

800

1,000

1,200

Stage 1 Stage 2 Stage 3

(ha)

346

452

435

528

0

100

200

300

400

500

600

Stage 1A Stage 1B Stage 2 Stage 3

(ha)

Industrial estate

development by

AKR and KIJA

Taking a view that wage

differential should persist

Accelerating bank loan

growth in Java

70% of the area is

allocated for industry

Both estates to sell

land in stages

Prepared for EV: fsudjono@henanputihrai.com

Section 2: Fruits of decentralisation Back to Java

20 merlissa.trisno@clsa.com 5 February 2014

Supporting the growth is domestic investment as well as foreign direct

investment (FDI) which has continued to pour into Java (ex-Jakarta) regions

despite the high base. FDI in Java ex-Jakarta has increased by 20% within

2007-12 Cagr and now represents about 49% of total FDI as of 3Q13 (vs.

39% in 2012).

Figure 33 Figure 34

Bank loan growth is accelerating in Java FDI breakdown (3Q13)

Source: BI Source: BKPM

Figure 35 Figure 36

FDI realisation Cagr 2007-12 FDI realisation

Source: BKPM

Domestic investment data also suggests that the growth in Java (ex-Jakarta)

regions has been accelerating much faster in 2013, despite the high base. Up

to 1H13, domestic investment in Java (ex-Jakarta) areas rose by 87% YoY, as

compared to the national average of 50%.

Consequently, cement sales in Java (ex-Jakarta) areas has also shown a

strong recovery trend, contributing about 47% of total national sales as of

2013 and showing the strongest growth of 8.1% in 2013 (versus national

average of 5.5%).

0

5

10

15

20

25

30

J

a

k

a

r

t

a

J

a

v

a

e

x

-

J

a

k

a

r

t

a

S

u

m

a

t

r

a

S

u

l

a

w

e

s

i

K

a

l

i

m

a

n

t

a

n

B

a

l

i

&

N

T

M

a

l

u

k

u

&

P

a

p

u

a

2007-12 Cagr 9M13 YoY (%)

Sumatra

14%

Java

ex-Jakarta

49%

Jakarta

6%

Kalimantan

13%

Sulawesi

5%

Bali & Nusa

Tenggara

2%

Maluku & Papua

11%

(3)

20

22

61

80

82

246

(50) 0 50 100 150 200 250 300

Jakarta

Java ex-Jakarta

Sumatra

Kalimantan

Sulawesi

Bali & NT

Maluku & Papua

(%)

0

10

20

30

40

50

60

0

5,000

10,000

15,000

20,000

25,000

30,000

2

0

0

7

2

0

0

8

2

0

0

9

2

0

1

0

2

0

1

1

2

0

1

2

1

Q

1

3

2

Q

1

3

3

Q

1

3

FDI realisation (LHS)

% Java ex-Jakarta

(US$m) (%)

FDI still grew by 20% in

Java ex-Jakarta despite

high base

Positive sign from

cement data

Prepared for EV: fsudjono@henanputihrai.com

Section 2: Fruits of decentralisation Back to Java

5 February 2014 merlissa.trisno@clsa.com 21

Figure 37 Figure 38

Cement growth by region (2013 vs 2012) Java (ex-Jakarta) as % to cement sales

Source: CLSA

As suggested by the data below, it seems that most retailers delivered higher

same-store-sales growth (SSSg) in Java ex-Jakarta regions, including Ace

Hardware and Alfamart. They claimed that outer-Java weakness was due to

low commodity prices, particularly in Sumatra. Consumer staple companies

like Unilever also claimed similar.

Figure 39 Figure 40

Ace Hardware Alfamart

Source: Ace Hardware Source: Alfamart

Figure 41 Figure 42

Ace Hardwares SSSg breakdown (2013) Alfamarts SSSg breakdown (2013)

Source: CLSA, Company

8.1

7.6

5.6

3.9

1.4

0 1 2 3 4 5 6 7 8 9

Java ex-Jakarta

Kalimantan

Jakarta

Sulawesi

Sumatra

(%)

42

44

46

48

50

52

54

1

9

9

9

2

0

0

0

2

0

0

1

2

0

0

2

2

0

0

3

2

0

0

4

2

0

0

5

2

0

0

6

2

0

0

7

2

0

0

8

2

0

0

9

2

0

1

0

2

0

1

1

2

0

1

2

2

0

1

3

(%)

0

1

2

3

4

5

6

7

Jakarta Java ex-Jakarta Outer Java Total

(%)

0

2

4

6

8

10

12

14

Jakarta Java ex-Jakarta Outer Java Total

(%)

Stronger same-store-

sales growth in

Java ex-Jakarta

Prepared for EV: fsudjono@henanputihrai.com

Section 3: Hitting the ground, getting a feel! Back to Java

22 merlissa.trisno@clsa.com 5 February 2014

Hitting the ground, getting a feel!

We hit the ground to get a feel for some of the fastest-growing cities in Java

as well as commodity-exposed islands like Sumatra and Kalimantan to see the

purchasing-power trend. Our conclusion? The provinces are booming and Java

ex-Jakarta growth should continue to outstrip the centre for some time to

come. We believe growth will flourish from the West to Central and East Java

in the future.

We believe purchasing power in outer-Java regions such as Sumatra and

Kalimantan will continue to be more volatile following soft commodity prices.

Sumatra and Kalimantan have about 50% of employees working in the

agriculture and mining industries, in contrast to Java ex-Jakarta, which has a

large manufacturing base.

Figure 43 Figure 44

Sumatras employee by sector Java ex-Jakartas employee by sector

Figure 45

Region with soft commodity exposure (based on production)

Source: BPS

In the following pages, we provide our on-the-ground perspective on 13 cities

spread over three key islands. While this report is not a catch-all to these

themes - the island is too broad to do it in just one report - we have tried to

highlight future growth potential and better understand how these will propel

the country going forward.

Agriculture

45.9%

Mining

1.7%

Manufacturing

7.3%

Utilities

0.2%

Construction

5.6%

Wholesale

& retail

18%

Transport

4.1%

Finance

1.9%

Others

14.8%

Agriculture

29.3%

Mining

0.8%

Manufacturing

19.1%

Utilities

0.2%

Construction

6.9%

Wholesale

& retail

22.4%

Transport

4.4%

Finance

2.3%

Others

14.5%

72.6

33.2

74.2 75.2

20.7

33.7

16.7

3.0

0

10

20

30

40

50

60

70

80

90

100

Palm Coconut Rubber Coffee Cocoa Sugar

cane

Tea Tobacco

Sumatra Java Kalimantan Sulawesi Others (%)

Java ex-Jakarta growth

should continue to

outstrip the centre

Over 70% production of

palm oil, rubber and

coffee are from Sumatra

Half of employees in

Sumatra and Kalimantan

working in agriculture

Visiting 13 cities spread

over three key islands

Prepared for EV: fsudjono@henanputihrai.com

Section 3: Hitting the ground, getting a feel! Back to Java

5 February 2014 russell.cranwell@clsa.com 23

Jakarta: Were jamming

In musing about writing a discussion paper on Jakarta while looking over the

sea in Sulawesi on the Idul Adha holiday and getting ready to sacrifice a cow

for the local villagers, the word that popped in to my head to describe Jakarta

today was Cosmopolitan.

The more I thought about it, I realised it was true. The number of new meeting

places (including our many brand new, high-quality malls such as Grand

Indonesia, Gandaria City and Lippo Mall) along with events such as Jakarta

Fashion Week, the restaurants which cater to all tastes (and pockets) has

dramatically changed the habits of local Jakartans and is spread rapidly with the

increasing connectivity between the Big Durian and other parts of the country as

evidenced by the massive increase in air travel across the archipelago.

Last year, my favourite events were the visits by three English Premier

League teams (Arsenal and two other more minor teams - in my opinion -

Manchester Utd and Chelsea). To put my observations in perspective, I have

been visiting Jakarta since 1984, a frequent flyer since 1995 from Singapore,

a property owner since 2000 by virtue of being married to an Indonesian and

a resident since 2004. In my view, there is no more exciting place to live in

the world, despite our many challenges.

Figure 46 Figure 47

Arsenal FC in Jakarta Gunner Cranwell at Bung Karno Stadium

Source: CLSA

One of the takeaways from our original Not just Jakarta and Enter the

Komodo! themes was that increases in agricultural and commodity prices in

the provinces would slow, or possibly reverse, the move from the villages to

the cities and Jakarta in particular. This has not proved to be the case for a

number of reasons due in part to commodity prices themselves having come

off, but also due to the fact that Jakarta has become an even more attractive

place to live (and work if you can get a job) over the past five years, of

course with the sole exception of our notorious traffic.

Talking of traffic, there have been a number of initiatives to improve traffic

flow, such as the banning of heavy trucks except from the hours of 10pm to

5am in central Jakarta, which, while it may not have done a lot for traffic, has

certainly improved the atmosphere downtown. The completion of the Antasari

flyover on the outskirts of Kemang has changed traffic patterns considerably,

making the journey to and from work much better for residents.

The imminent completion of the Casablanca flyover will hopefully have an equally

beneficial effect on the notorious bottleneck there. This will be important for the

development of what I remember being described by Pak Chandra Ciputra some

years ago as Jakartas future Orchard Road, with the opening of four new malls

over the past three years, including Ciputra World.

Managing the

notorious traffic

Near-term completion of

the Casablanca flyover

Favourite events

in Jakarta

Russell Cranwell

MD, Head of Indonesia

Corporate Finance

russell.cranwell@clsa.com

+62 21 2554 8833

Jakarta

Prepared for EV: fsudjono@henanputihrai.com

Section 3: Hitting the ground, getting a feel! Back to Java

24 russell.cranwell@clsa.com 5 February 2014

Figure 48 Figure 49

Antasari Flyover Uncompleted Casablanca Flyover

Source: CLSA

The other most notable feature of the traffic in Jakarta has been the

improvement in the age and quality of the cars (and buses) on the streets,

more evidence of the general upward movement of the population, which is

contributing, to a degree, to the improved environment. There has certainly

been no impact on traffic volumes due to the various increases in fuel prices,

proving that subsidies are totally unnecessary and the monies would be

better spent on adding road and other infrastructure.

It will be interesting to see over the next few years what impact the proposed

MRT will have, firstly on making our famous macet or traffic jam initially

significantly worse as we have seen in other places in the region such as

Kuala Lumpur and Bangkok and later in improving the travel times and

comfort and convenience of public transport

In our household, we have taken our own initiatives to deal with higher fuel

prices and reduce pollution. The first was the purchase of a three-wheeler

cycle including an integral wire shopping basket (which fits the dog too!) and,

most importantly, Starbucks coffee holder, from our favourite Ace Hardware

at a cost of Rp5 million, which is now used for local shopping rather than the

car and also a fun way to exercise.

Figure 50

Russells three-wheeler cycle with shopping basket

Source: CLSA

Two important

flyovers to reduce

notorious bottleneck

The MRT impact?

Pedal power

Prepared for EV: fsudjono@henanputihrai.com

Section 3: Hitting the ground, getting a feel! Back to Java

5 February 2014 russell.cranwell@clsa.com 25

One of the ways we have found to deal with the traffic problems, which limits

our ability to meet (clients) face to face, is to arrange meetings in locations

everyone is happy to go to, such as Pacific Place Mall, which is both in the

SCBD and has a wide array of meeting places.

For example, a day of meetings could include breakfast at the Ritz Carlton,

coffee at Starbucks and Liberica, lunch at Potatohead or Sopra, further

meetings in the offices around the mall and dinner at another of the

restaurants in the area, so achieving seven or eight meetings in a day as

opposed to a maximum of four going from office to office.

Figure 51 Figure 52

Liberica coffee shop Starbucks coffee

Source: Ahmad Saiful Muhajir (flickr) Source: nSeika (flickr)

This doesnt count all the informal meetings with all the other bankers doing

the same thing! Efficient, saving on the environment by reducing traffic flows,

but maybe not so good for the waistline (but its ok, the mall has a gym). The

use of in-car Wi-Fi is beginning to take off, which is partly a result of the time

we do spend in traffic and the poor signal quality generally of our wireless

service operators. Incidentally this latter explains why we Jakartans each have

so many mobile phones, we need at least two to have two operators and one

foreign (Singapore) registered simply to ensure continuity of service.

The election of the fresh (and untainted) new governor of Jakarta, Pak Jokowi

in 2012 and the acts his team has taken to push forward the Jakarta MRT and

monorail and in repositioning some of the detriments to traffic flow such as

the street vendors around Tanah Abang have given us great encouragement

that a real focus has been given to improving the situation and I may be

going against the accepted wisdom, but the traffic flows do seem on normal

days (ie, not floods or APEC forums) to be better.

Another notable feature of Jakarta over the past few years has been the

dramatic increase in the usage of English (not helpful to those of us who want

to practice our Bahasa Indonesia). In talking to young Jakartans in hotels,

malls and restaurants as well as family, a lot of this seems to have been

driven by the desire to have full access to the internet, compounded by the

increased availability of access to cable TV through First Media (Lippo),

Indovision (MNC) and TelkomVision (Telkom).

Indonesians are very big on technology and we have been the second-largest

users of BlackBerrys for a number of years. This is good news for Indonesias

ability to participate in the global economy, where for good or bad, English is

a prerequisite and is only likely to further encourage FDI as well as being

good for the tourist industry, which perhaps with the exception of Bali, is still

in its infancy.

Pacific Place as one-stop

meeting point solution

Dramatic increase in the

usage of English

Two ground breakings

in a week

Convenient meeting

points

Prepared for EV: fsudjono@henanputihrai.com

Section 3: Hitting the ground, getting a feel! Back to Java

26 russell.cranwell@clsa.com 5 February 2014

Perhaps partly as a result of our traffic problems and the access to cable TV

and YouTube etc (and of course our general weather, so the need for air

conditioners), Jakartans have taken to a mall culture, especially where all

needs are catered to; shopping, eating, bookshops, cinemas, childrens play

areas (Kidzania at Pacific Place has to be experienced to be believed),

hairdressing salons (a daily visit is entirely normal for Indonesian ladies) and

of course gyms are available as well as the most important (family) Karaoke

rooms. An increasing number of more middle to upper-tier brands are

arriving, not just the ultra-luxury goods. For example, we recently attended

the opening of the first H&M store in Gandaria City (Pakuwon) and it was

packed for days!

Figure 53 Figure 54

CLSA ladies during H&M opening Posing with celebrity

Figure 55 Figure 56

Queuing up early for H&M opening H&M attracts Jakartans

Source: CLSA

The malls are not just venues for the more affluent to attend either, the

increases in general earnings exemplified by the large hikes in minimum wage

have allowed a broad range of shoppers to go to the malls. Many of the newer

and European fusion types of restaurants-cum-bars that have opened up

(many associated with the newer malls), such as Potatohead at Pacific Place,

Loewys in Kuningan, Union at Plaza Senayan and most recently Odysseia (just

outside the ultra-chic Galeries Lafayette, French cool) and which, according to

my London-based, sophisticated foodie son and daughter-in-law has, fantastic

ambiance, great food, we could really do with one of these in London.

Ultra chic restaurants

Everyone just loves malls

The crowd during first

H&M opening

H&M opening in

Gandaria City

Prepared for EV: fsudjono@henanputihrai.com

Section 3: Hitting the ground, getting a feel! Back to Java

5 February 2014 russell.cranwell@clsa.com 27

Figure 57 Figure 58

Loewy Union

Figure 59 Figure 60

Hard Rock Caf (reborn) Potato Head Garage

Source: CLSA

The less well-off consumers are also catered for too, one example of which is

the (now much copied) 7-11 franchise here, with its 24-hours opening,

coffee, slurpy and hot dog offerings among others, which has gone from zero

to 140 stores in only three years and is a huge hit with teenagers/students.

One impact of the devolution of power from the centre to the provinces

through the regional autonomy programmes has been the increased demand

for air travel, such that Jakartas main airport Soekarno Hatta is bursting at

the seams, now processing up to 50 million passengers a years from a design

capacity of 20. Hence, starting early this year, some domestic routes have

been diverted to Halim Perdanakusuma airport

Figure 61 Figure 62

Busy Soekarno Hatta airport Opening ceremony of Halim airport

Source: Naif Alas (flickr) Source: CLSA

7-11 has gone from zero

to 140 stores in only

three years

Increasing demand

for air travel

Famous hang-out spots

in Jakarta

Shifting some domestic

routes to Halim airport

Prepared for EV: fsudjono@henanputihrai.com

Section 3: Hitting the ground, getting a feel! Back to Java

28 russell.cranwell@clsa.com 5 February 2014

This has meant an influx of people from the provinces, both on commercial

and political business who have recently been buying second homes, mainly

apartments, no doubt adding to the property price inflation we have seen but

is also having other impacts on the demand for (private) schooling for their

children who would rather study here than at home. This has also incidentally

increased the demand for Jakarta favourites like Starbucks to open in these

peoples home cities to cater to these expat Jakartans.

For example, our home town in Sulawesi now boasts a J.Co (Indonesian

doughnut and coffee shop, reputedly and bizarrely in a country which loves its

sugar, less sweet than Dunkin Donut or Krispy Kreme) as well as a Solaria

(a local chain of restaurants) as well as a Lippo Group hypermart in its first

mall developed by the Kencana Group. This minor city, which only became a

province in the past 10 years, now has five flights a day to Jakarta, by each

of Garuda (2), Lion (2) and Sriwijaya. All flights have heavy load factors.

On a recent trip to Surabaya, trying to change a Garuda flight back to

Jakarta, it proved impossible to get on any other flight, including business

class as all flights full. This on a Sunday from a city which Garuda has 112

flights a week, implying close to 300 once the other airlines such as Lion,

Sriwijaya, Air Asia Indonesia and (the newly resurrected) Mandala are

included. The inevitable conclusion from this, despite the recent turmoil in the

equity markets, is crisis, what crisis?

Figure 63

Garuda has plenty of flights

Source: Gunawan Kartapranata (Wikimedia Commons)

Sitting here in Jakarta, it is hard to ignore the problems with infrastructure we

face on a daily basis and it is clear the new government (with parliament and

presidential elections scheduled in April and July 2014 respectively) will have to

deal with the subsidy issue as soon as possible in order to free up money to

invest in the road, rail, water treatment, schooling, healthcare issues we face.

However, it is hard not to feel optimistic about the future given the huge progress

we have seen since the Asian financial crisis in particular and the countrys ability

to withstand external shocks as we saw during the global financial crisis (which

was a six-month event here). I hope to have the privilege to still be here in what

will by then be the dominant Southeast Asian economy by some distance and

Jakarta will still be the best city to work and have fun.

Makassar now has five

flights a day to Jakarta

It proved impossible to

change flight schedule,

even including

business class

Government has to deal

with infrastructure and

subsidy issue

Still, it is hard not to feel

optimistic about the future

Property price inflation

Prepared for EV: fsudjono@henanputihrai.com

Section 3: Hitting the ground, getting a feel! Back to Java

5 February 2014 sarina.lesmina/andreas.kongoasa@clsa.com 29

Serpong - Greater Jakarta

We visited thriving Serpong in South Tangerang, a West Jakarta suburb and

home to many prominent developers such as Summarecon, Bumi Serpong

and Alam Sutera. The face of Serpong has changed dramatically in recent

years, from just residential housing estates to a full-blown township where we

are seeing a notable increase in commercial activities.

It is not a surprise that the population in South Tangerang, including Serpong,

had increased by about 50% since 2007. In the past two years, the

population has grown by 4.2% pa, or 57,000 people (which translates into

11,400 households); the highest population growth in Banten province; and

tripled the growth of the total Indonesian population.

Figure 64

Population growth of South Tangerang

Source: BPS

From previously just landed housing, we are seeing more and more vertical

development, including apartments, a rare sight previously. With the growth

of population in the city we have also seen numerous facilities being added to

the community such as schools, universities and hospitals etc.

Figure 65

Large numbers of high rise buildings under construction

Source: CLSA

918,783

1,051,374

1,203,099

1,303,569

1,358,319

1,415,368

600,000

700,000

800,000

900,000

1,000,000

1,100,000

1,200,000

1,300,000

1,400,000

1,500,000

2007 2008 2009 2010 2011 2012

(people)

Serpong - not so

flat anymore

Andreas Kongoasa

andreas.kongoasa@clsa.com

+62 21 2554 8809

Sarina Lesmina

Head of Indonesia Research

sarina.lesmina@clsa.com

+62 21 2554 8820

Serpong

Prepared for EV: fsudjono@henanputihrai.com

Section 3: Hitting the ground, getting a feel! Back to Java

30 sarina.lesmina/andreas.kongoasa@clsa.com 5 February 2014

Figure 66 Figure 67

Binus campus - phase 2 Alam Suteras Silkwood apartments

Source: CLSA

Serpong developers mentioned that it is not enough to just sell houses

anymore - but to ensure steady demand growth for its residential projects,

they have to try to boost job creation by building offices and more

commercial areas.

Hence, Alam Sutera Realty launched The Prominence office, and Bumi

Serpongs Green Office Park is under development with Unilever Indonesia in

the process of building its headquarter in the park. The Green Park has been

awarded the 1

st

Green Mark District in Jakarta by The Building and

Construction Authority Singapore.

Figure 68 Figure 69

The Prominence office of Alam Sutera BSDE Headquarter in Green Office Park

Source: CLSA

More offices to boost

job creation

Growing office

development in Serpong

Binus University is being

built in Serpong

Prepared for EV: fsudjono@henanputihrai.com

Section 3: Hitting the ground, getting a feel! Back to Java

5 February 2014 sarina.lesmina/andreas.kongoasa@clsa.com 31

Figure 70

BCA office in BSD City

Source: CLSA

Retail area is blossoming in Serpong; compared to a few years ago where

only Summarecon Mall Serpong was the mall to go to. Alam Suteras

66,300m

2

NLA Mall @ Alam Sutera was opened on 12 December 2012; the

companys first sizable commercial property. IKEA is setting up its flagship

retail space which will cover 4-5ha; slated to commercially open in 3Q14.

AEON Mall (a joint venture between AEON and Bumi Serpong) was

groundbroke in August 2013; the mall is targeted to cover 160,000m

2

GFA on

10ha of land in BSD City. The mall is targeted to open at the end of 2014.

Some 30% of tenants are expected to be Japanese.

Hongkong Land is also partnering with Bumi Serpong to build a mixed-use

development on 65ha of land in BSD City.

We also heard that Flavor Bliss, an open space food centre in Alam Sutera is a

very popular place to hang out during the weekends.

Figure 71 Figure 72

Mall @ Alam Sutera IKEA under construction

Source: CLSA

More places to shop

and hangout

Retail area is also

blossoming in Serpong

Prepared for EV: fsudjono@henanputihrai.com

Section 3: Hitting the ground, getting a feel! Back to Java

32 sarina.lesmina/andreas.kongoasa@clsa.com 5 February 2014

Figure 73 Figure 74

AEON Mall BSD City

(artists impression)

Kompas Gramedia convention hall

(artists impression)

Source: Company

Kompas Gramedia and BSD are also developing a large convention hall

(150,000m

2

), targeted to be completed by the middle of 2014.

Hotel chains are also coming to Serpong with affordable choices compared to

hotels in the city. There is now a Best Western, and Mercure will also open in

the future.

Figure 75 Figure 76

Best Western Mercure (Alam Sutera)

Source: Company

On the weekends, there are also a lot of outdoor activities, such as biking. In

fact, Serpong also recently hosted the Standard Chartered Half Marathon

wherein 3,000 runners participated.

Hotel chains are coming

AEON mall, a JV between

AEON and Bumi Serpong

New affordable

hotel chains

Serpong has recently

hosted the Standard

Chartered half marathon

Prepared for EV: fsudjono@henanputihrai.com

Section 3: Hitting the ground, getting a feel! Back to Java

5 February 2014 merlissa.trisno@clsa.com 33

Bandung - West Java

West Java is the most populous province in Indonesia. Its capital, Bandung,

was formerly known as the Paris of Java due to its European-style

architecture. The countrys third-largest city and second-largest metropolitan

area in Indonesia had a 2.4m population as of 2010.

The city is well known for its volcanoes and large tea plantations. A 54km toll

road linking Bandung and Jakarta (Cipularang), completed by April 2005, has

made it easier to reach the city, cutting travel time from four hours to two.

Figure 77

West Java map

Source: CLSA

Figure 78 Figure 79

Big advertisement in Cipularang Bandung GDP by sector

Source: CLSA Source: BPS

Agri

0.2%

Manufacture

23.5%

Electricity,

Gas, & Water

Supply

2.3%

Construction

4.6%

Trade, Hotel &

Restaurant

41.2%

Transport &

Communication

12.4%

Finance, Real

Estate & Business

Services