Академический Документы

Профессиональный Документы

Культура Документы

Asia Maxima (Delirium) - 3Q14 20140703

Загружено:

Hans WidjajaОригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Asia Maxima (Delirium) - 3Q14 20140703

Загружено:

Hans WidjajaАвторское право:

Доступные форматы

Asia Maxima

Quarterly review and asset allocation

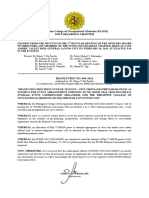

G7 credit-to-GDP gap and asset-to-GDP gap

Note: The gaps measure deviations of the credit and asset to GDP ratios from their long-term trends.

Credit includes lending to the non-financial private sector. Assets are total household assets.

Source: CLSA, BIS, Datastream, CEIC Data, IIF

Find CLSA research on Bloomberg, Thomson Reuters, CapIQ and themarkets.com - and profit from our evalu@tor proprietary database at clsa.com

(10)

(5)

0

5

10

15

(50)

(40)

(30)

(20)

(10)

0

10

20

30

40

50

2000 2002 2004 2006 2008 2010 2012 2014

(ppt)

G7 household asset-to-GDP gap

G7 credit-to-GDP gap (RHS)

(ppt)

Christopher Wood

christopher.wood@clsa.com

+852 2600 8516

Joe Man

joe.man@clsa.com

+852 2600 8570

3Q14

Asia

Strategy

Includes:

Asia ex-Japan

thematic equity

portfolio for long-only

absolute-return

investors

Japan thematic equity

portfolio for long-only

absolute-return

investors

Recommended long-

only asset allocation

for US-dollar-based

pension funds

www.clsa.com

Delirium

Extremely low volatility. Financial markets are in a condition of false

euphoria, characterised by extremely low volatility, the result of more

than five years of unconventional monetary policy. The Achilles heel in

the system is exposed by the divergent trend between asset prices and

credit growth in the developed world.

Fed tapering continues. The Federal Reserve continues to taper but the

US economy remains far from robust. A successful exit from quantitative

easing remains as unlikely as ever, though there is growing possibility that

wage pressures in a structurally constrained US labour market could trigger

a tightening scare.

ECBs version of QE. The European Central Bank is likely to have adopted

its own version of quantitative easing before the end of the current

quarter. Investors will be particularly excited if the ECB follows through on

its talk of buying asset-backed securities.

BoJs attempt to end deflation. The coming quarter will be critical for

judging the success of the Bank of Japans attempt to end deflation. For now,

the Japanese central bank believes its policy is working, which would be

positive for the stock market. But if that view is proven wrong by the data,

then another bout of unconventional monetary policy becomes likely, which

would also support the stock market, albeit at the cost of a weaker yen.

Beijings commitment to reform. China remains the main area of systemic

risk in emerging markets, given the massive build-up of debt in recent years,

amid growing evidence of an increasingly porous capital account. But

investors are still advised for now to give Beijing the benefit of the doubt,

given the apparent commitment to reform. The two main areas to monitor

remain the residential property market and capital flows.

Gold insurance. With central banks in the developed world remaining

committed to unconventional monetary policies, the case for gold bullion as

essential insurance remains clear. Gold will be the best asset to own when

investors finally question the efficacy of quantitative easing. This will only

occur when the consensus realises that unorthodox monetary policy does not

lead to healthy sustainable growth but only boom-bust asset-inflation cycles.

Prepared for EV: fsudjono@henanputihrai.com

Asia Maxima

2 christopher.wood@clsa.com 3Q14

Contents

Global and regional overview ............................................................ 3

Asia asset allocation ........................................................................24

Country views

Japan: Inflation stress test ................................................................... 38

Australia: Mining and housing paradox ................................................... 42

China: Conflicting signals ..................................................................... 46

Hong Kong: A degree of tension ............................................................ 50

India: Gujarat model on national stage .................................................. 54

Indonesia: Close election race .............................................................. 58

Korea: Growing pressure to ease .......................................................... 62

Malaysia: More macro than micro .......................................................... 66

Philippines: Macro positives .................................................................. 70

Singapore: Affordability issue ............................................................... 74

Taiwan: Technology driven ................................................................... 78

Thailand: After the coup ...................................................................... 82

Appendix: Tables and charts ............................................................86

All prices quoted herein are as of 30 June 2014

GREED & fear gives you regular updates

To subscribe to this weekly email, please contact your CLSA representative.

Prepared for EV: fsudjono@henanputihrai.com

Section 1: Global and regional overview Asia Maxima

3Q14 christopher.wood@clsa.com 3

Global and regional overview

There have been numerous crises and mini crises in financial markets in

recent decades. But the markets ended the past quarter in a situation where

the dominant sentiment among investors was a growing focus on the lack of

volatility. If moves in the worlds major equity markets have been relatively

subdued, the major area characterised by such a lack of volatility has been

the foreign-exchange market. Here volatility has sunk to record lows. Thus,

JPMorgans Global FX Volatility Index has fallen from a recent high of 11.8 in

mid-2013 to a record low of 5.5 in late June (see following chart). But the

same trend of declining volatility is also clear in the world of stocks and bonds.

JPMorgan Global FX Volatility Index

Source: Bloomberg

One way of interpreting this is that central banks in the developed world have

succeeded in persuading investors that interest rates will stay very low for a

very long time. It is also this confidence in the continuation of low interest

rates which has resulted in the chief feature of current markets. That is a

growing reach for yield as investors buy ever more complex debt securities,

often with leverage, to generate a greater return. This process, which has

been aptly described as a yield bubble, is a direct consequence of more than

five years of zero interest rates and unconventional monetary policy. It can be

chronicled by the continuing revival of risky lending practices, which were

discredited in the financial crisis.

This trend is worth going into in some detail to demonstrate the point since it

is in one sense truly remarkable that the appetite for aggressive debt

structures has rebounded so strongly just six years after such structures were

discredited in the global financial crisis. Yet in another sense, of course, it is

quite logical since this is the behaviour encouraged by unconventional

monetary policy. One obvious example is the surge in high yield issuance,

which is now back above pre-financial crisis levels. Thus, US high-yield

corporate bond issuance has risen from US$43bn in 2008 to a record

US$336bn in 2013 and US$146bn in the first five months of 2014 (see

following chart). But as yields on more conventional subordinated debt have

come down, debt investors have increased their exposure again to structured

products. Consider, for example, collateralised loan obligations (CLOs). CLO

issuance totalled US$82bn in 2013, a mere 15% below its peak level in 2006,

and is forecast to reach US$100bn this year. A further example is the

3

6

9

12

15

18

21

24

27

1

9

9

2

1

9

9

3

1

9

9

4

1

9

9

5

1

9

9

6

1

9

9

7

1

9

9

8

1

9

9

9

2

0

0

0

2

0

0

1

2

0

0

2

2

0

0

3

2

0

0

4

2

0

0

5

2

0

0

6

2

0

0

7

2

0

0

8

2

0

0

9

2

0

1

0

2

0

1

1

2

0

1

2

2

0

1

3

2

0

1

4

A lack of volatility

The reach for yield

The revival of

risky lending

Prepared for EV: fsudjono@henanputihrai.com

Section 1: Global and regional overview Asia Maxima

4 christopher.wood@clsa.com 3Q14

renewed appetite for so-called covenant-lite loans, often coupled with bullet

repayments, where interest is rolled up and not paid to the end of the loan.

Thus, US cov-lite loan volume rose by 41% YoY to US$84bn in the year to

mid-June, according to Dealogic. Meanwhile, US leveraged loan issuance rose

by 68% YoY to a record US$1.1tn in 2013 (see following chart).

US high-yield corporate bond issuance

Note: YTD14 = January-May 2014. Source: SIFMA, Thomson Reuters

US leveraged loan issuance

Source: Bloomberg

These sorts of imprudent lending and investing practices are normally

associated with credit bubbles. But an interesting feature of the Western

world post-financial crisis is that there has not been a credit bubble. Rather,

credit growth has remained subdued in the developed world post-2008, be it

in America, Europe or Japan. US bank loans rose by 4.8% YoY in June,

compared with the pre-crisis average growth rate of 10%, while Japanese

bank loans rose by 2.4% YoY in May. As for the Eurozone, loans to the private

sector declined by 2.0% YoY in May (see following chart). Indeed, this

ongoing subdued credit growth, and related deleveraging dynamic as

reflected in continuing declining velocity, is the reason why central banks

have continued to indulge in unconventional monetary policy as economic

growth has remained subpar. Thus, annualised real GDP growth in America

has averaged only 2.1% between 2Q09 and 1Q14, while in the Eurozone it

has been only 0.7% during the same period (see following chart).

0

50

100

150

200

250

300

350

1

9

9

6

1

9

9

7

1

9

9

8

1

9

9

9

2

0

0

0

2

0

0

1

2

0

0

2

2

0

0

3

2

0

0

4

2

0

0

5

2

0

0

6

2

0

0

7

2

0

0

8

2

0

0

9

2

0

1

0

2

0

1

1

2

0

1

2

2

0

1

3

Y

T

D

1

4

(US$bn)

0

200

400

600

800

1,000

1,200

2

0

0

2

2

0

0

3

2

0

0

4

2

0

0

5

2

0

0

6

2

0

0

7

2

0

0

8

2

0

0

9

2

0

1

0

2

0

1

1

2

0

1

2

2

0

1

3

1

H

1

4

(US$bn)

Still sluggish

credit growth

Prepared for EV: fsudjono@henanputihrai.com

Section 1: Global and regional overview Asia Maxima

3Q14 christopher.wood@clsa.com 5

US, Japan and Eurozone bank loan growth

Source: Federal Reserve, Bank of Japan, ECB

US and Eurozone real GDP growth

Source: Datastream

The resulting paradox is perhaps best highlighted by research done of late by

the Institute of International Finance (see IIF reports: Capital Markets Monitor,

April and May 2014 issues). This research has focused on the divergent trend

since the crisis in the developed world between the credit-to-GDP ratio and

what the IIF describes as the asset-to-GDP ratio, which is defined as

household wealth or assets to nominal GDP. This shows that the asset-to-GDP

ratio has shown a large positive deviation of nine percentage points from its

long-term trend in the G7 world based on IIF data. By contrast the credit-to-

GDP ratio has shown a contrasting trend. The G7 credit-to-GDP ratio, which

includes all lending to the non-financial private sector, has collapsed since the

crisis to eight percentage points below its long-term trend, down from a

positive deviation of over 10 percentage points in mid-2009.

The obvious conclusion from this is that there is a growing risk that asset

prices are becoming increasingly disconnected from the realities of the

underlying economy. A similar chart to the one shown in the IIF report

highlighting the relevant divergent trends is shown below (see following

chart). It should be noted that the data is based on the BISs long-term series

on credit to the private sector and the central banks flow of funds data on

household assets.

(10)

(5)

0

5

10

15

J

a

n

9

8

A

u

g

9

8

M

a

r

9

9

O

c

t

9

9

M

a

y

0

0

D

e

c

0

0

J

u

l

0

1

F

e

b

0

2

S

e

p

0

2

A

p

r

0

3

N

o

v

0

3

J

u

n

0

4

J

a

n

0

5

A

u

g

0

5

M

a

r

0

6

O

c

t

0

6

M

a

y

0

7

D

e

c

0

7

J

u

l

0

8

F

e

b

0

9

S

e

p

0

9

A

p

r

1

0

N

o

v

1

0

J

u

n

1

1

J

a

n

1

2

A

u

g

1

2

M

a

r

1

3

O

c

t

1

3

M

a

y

1

4

(% YoY) US Eurozone Japan

(8)

(6)

(4)

(2)

0

2

4

6

2

0

0

0

2

0

0

1

2

0

0

2

2

0

0

3

2

0

0

4

2

0

0

5

2

0

0

6

2

0

0

7

2

0

0

8

2

0

0

9

2

0

1

0

2

0

1

1

2

0

1

2

2

0

1

3

2

0

1

4

(% YoY)

Eurozone real GDP growth

US real GDP growth

The asset-price credit-

growth divergence

Prepared for EV: fsudjono@henanputihrai.com

Section 1: Global and regional overview Asia Maxima

6 christopher.wood@clsa.com 3Q14

G7 credit-to-GDP gap and asset-to-GDP gap

Note: The gaps measure deviations of the credit and assets to GDP ratios from their long-term trends.

Credit includes lending to the non-financial private sector by domestic banks and non-bank, as well as

non-residents. Assets are total household assets. Source: CLSA, BIS, Datastream, CEIC Data, IIF

The above is interesting because it provides a conceptual framework to help

understand what is going on in a world of quantitative easing where it has

become increasingly evident in recent years that the rich or asset owners

have been the chief beneficiaries of such unorthodox monetary policies. Thus,

in the world of equities, multiple expansion not earnings has been the chief

driver of equity gains in America and Europe in recent years, whereas wages

have remained subdued. On this point, price-earnings ratio expansion

contributed to an estimated 75% of the gains in the US stock market last

year and 43% so far in 2014, and accounted for all the gains in Europe in

both 2013 and 1H14 (see following chart). By contrast, US average hourly

earnings rose by only 2.1% YoY in May, while Eurozone hourly wages rose by

just 1.5% YoY in 1Q14 (see following chart). Similarly, in the world of fixed-

income capital gains and related yield compression have been driven by the

leverage employed in carry trades, leverage only available in a post-financial

crisis world to the affluent.

MSCI USA and Europe: 2013 and 2014 performance attribution

Note: Price performance in local currency terms. Source: MSCI, Datastream, CLSA evaluator

(10)

(5)

0

5

10

15

(50)

(40)

(30)

(20)

(10)

0

10

20

30

40

50

2000 2002 2004 2006 2008 2010 2012 2014

(ppt)

G7 household asset-to-GDP gap

G7 credit-to-GDP gap (RHS)

(%)

(10)

(5)

0

5

10

15

20

25

30

35

USA 2013 Europe 2013 USA 1H14 Europe 1H14

PE contribution EPS contribution Price change (%)

(ppt)

Multiple expansion driver

Prepared for EV: fsudjono@henanputihrai.com

Section 1: Global and regional overview Asia Maxima

3Q14 christopher.wood@clsa.com 7

US and Eurozone hourly wage growth

Source: CLSA

If asset prices are increasingly disconnected from economic reality, this

situation can only be addressed either by developed economies achieving a

more healthy recovery or by asset prices correcting. Yet, the risk is that if

Western economies show signs of an accelerating recovery, market-driven

interest rates will rise sharply, hurting leveraged investors in credit, while

the higher cost of servicing debt will threaten the recovery. Yet, if economies

do not sustain a growth rate acceptable to modern central bankers, then they

will continue with their unconventional monetary policies so further

encouraging asset bubbles.

This is the dilemma the central bankers have created by their now orthodox

unorthodox monetary policies and it remains far from evident to this writer

that there is a painless way out, as argued here in many preceding Asia

Maxima quarterlies. Yet, investors have also to operate in the context of the

official narrative of the market consensus, and this is that the Fed is tapering

this year with a view to normalising monetary policy sometime in 2015 by

raising interest rates for the first time since June 2006.

If this is the consensus expectation, it remains the case that the Fed at its

June FOMC meeting lowered its forecast for real GDP growth for the fifth year

in succession since this lukewarm recovery began in 2009. Thus, the Fed now

estimates 2014 economic growth at 2.1-2.3%, down from the March

projection of 2.8-3%. This would keep American real GDP growth in the same

2-2.5% range it has running at since the recovery began.

Such a continuing level of subpar growth will not incline an extreme dove like

Fed Chairwoman Janet Yellen to want to start raising rates. Indeed, dovish

comments by Yellen during the past quarter caused expectations of the first

Fed rate hike to be pushed back by about three to six months to 4Q15,

though expectations have of late been brought forward again to 3Q15. It is

also highly unlikely that Yellen would have begun tapering this year, given the

relatively soft data, if former chairman Ben Bernanke had not already

launched the tapering process at his second-last Fed meeting in December.

0.5

1.0

1.5

2.0

2.5

3.0

3.5

4.0

4.5

J

a

n

0

7

M

a

y

0

7

S

e

p

0

7

J

a

n

0

8

M

a

y

0

8

S

e

p

0

8

J

a

n

0

9

M

a

y

0

9

S

e

p

0

9

J

a

n

1

0

M

a

y

1

0

S

e

p

1

0

J

a

n

1

1

M

a

y

1

1

S

e

p

1

1

J

a

n

1

2

M

a

y

1

2

S

e

p

1

2

J

a

n

1

3

M

a

y

1

3

S

e

p

1

3

J

a

n

1

4

M

a

y

1

4

(% YoY) US average hourly earnings growth

Eurozone hourly wage & salaries growth

The consensus view

The Fed lowers

growth forecast

Prepared for EV: fsudjono@henanputihrai.com

Section 1: Global and regional overview Asia Maxima

8 christopher.wood@clsa.com 3Q14

Still, if Yellen has a doveish bias, it is also the case that history shows that

there is a well-established tendency for financial markets to test a new Fed

chairman in the first few months in office. Given the almost eerie sense of calm,

if not complacency, hanging over markets as reflected in record low volatility

measures, the suspicion is rising that such a test may be approaching.

Catalysts for market-driven scares are, by their nature, almost impossible to

predict with recent newsflow from the Middle East a reminder that geopolitical

events can always trigger shocks in terms of, say, a spike in the oil price.

Such an oil price spike to, say US$120/bbl and higher, would likely trigger an

inflation scare in markets, even though its impact would ultimately be

deflationary. Still there is one area where a market driven inflation scare is

becoming increasingly plausible even if it is in the continuing context of the

secular deleveraging trend still engulfing the Western world. That is if there is

suddenly evidence that wage increases are finally getting traction in the USA.

Brent crude oil price

Source: Bloomberg

The point to note here is that such a tightening in the US labour market is

possible, if not probable, if Americas declining labour-force participation ratio

is structural, not cyclical. This declining participation rate has attracted

growing focus in recent years with more unemployed Americans leaving the

workforce than found a job in 48 out of the past 49 months (see following

chart). It has also become the subject of a lively debate among economists

about whether this phenomenon is cyclical or structural. Yellen, an academic

economist specialising in the labour market, remains firmly of the view that it

is cyclical and has reiterated as much of late. Yet, many others, including this

writer, are more persuaded by the argument that it is structural as America

has entered the European dynamic, where rising government benefits reduce

the incentive to work at the lower end of the labour market.

If this sounds a dry academic subject, it has become critically important for

markets. For if the declining participation rate is indeed structural, then there

is less slack in the labour market than the Fed currently believes, which

means, more than five years into an economic recovery in America, that

sooner or later wages should get traction.

30

40

50

60

70

80

90

100

110

120

130

140

J

a

n

0

9

A

p

r

0

9

J

u

l

0

9

O

c

t

0

9

J

a

n

1

0

A

p

r

1

0

J

u

l

1

0

O

c

t

1

0

J

a

n

1

1

A

p

r

1

1

J

u

l

1

1

O

c

t

1

1

J

a

n

1

2

A

p

r

1

2

J

u

l

1

2

O

c

t

1

2

J

a

n

1

3

A

p

r

1

3

J

u

l

1

3

O

c

t

1

3

J

a

n

1

4

A

p

r

1

4

J

u

l

1

4

(US$/bbl)

A test for Yellen?

Americas

declining labour force

participation ratio

Prepared for EV: fsudjono@henanputihrai.com

Section 1: Global and regional overview Asia Maxima

3Q14 christopher.wood@clsa.com 9

Unemployed Americans who found jobs or leaving the labour force

Note: Data measures the labour force status flows from "unemployed" to "employed" or from

"unemployed" to "not in labour force". Source: Bureau of Labour Statistics

While this traction is not yet really visible from the all-important average

hourly earnings growth data, such evidence should be forthcoming in the not

too distant future if the structural argument is correct. If so, it could have

significant market impact in the context of ultra-low volatility, where leverage

has been piled on in the world of credit in the pursuit of yield. Sudden

evidence of wage pressures in America would certainly trigger a hue and cry

that Mrs Yellen has been wrong in her analysis of the labour market and that

the Fed is behind the curve. Monetary tightening expectations would come

forward sharply in time, the US dollar would rally and there would be a real

risk of a repeat or worse of last years so-called tapering scare hitting, this

time, not only emerging-market debt, but also all other credit instruments

where investors have put on the carry.

US bond market average daily trading volume

Note: Data up to May 2014. Source: SIFMA

1.2

1.4

1.6

1.8

2.0

2.2

2.4

2.6

2.8

3.0

3.2

1

9

9

0

1

9

9

1

1

9

9

2

1

9

9

3

1

9

9

4

1

9

9

5

1

9

9

6

1

9

9

7

1

9

9

8

1

9

9

9

2

0

0

0

2

0

0

1

2

0

0

2

2

0

0

3

2

0

0

4

2

0

0

5

2

0

0

6

2

0

0

7

2

0

0

8

2

0

0

9

2

0

1

0

2

0

1

1

2

0

1

2

2

0

1

3

2

0

1

4

(m) Unemployed leaving labour force

Unemployed found jobs

0

100

200

300

400

500

600

700

800

900

1,000

1,100

1

9

9

6

1

9

9

7

1

9

9

8

1

9

9

9

2

0

0

0

2

0

0

1

2

0

0

2

2

0

0

3

2

0

0

4

2

0

0

5

2

0

0

6

2

0

0

7

2

0

0

8

2

0

0

9

2

0

1

0

2

0

1

1

2

0

1

2

2

0

1

3

Y

T

D

1

4

(US$bn)

The pursuit of yield

Prepared for EV: fsudjono@henanputihrai.com

Section 1: Global and regional overview Asia Maxima

10 christopher.wood@clsa.com 3Q14

Such an unwind would also be aggravated significantly, as was certainly the

case in last years tapering scare, by the fact that, as a result of post financial

crisis regulatory initiatives, the sell side does not have anything like the

same inventory of debt securities to make a market. This can be seen in the

somewhat ironic situation that while debt issuance has been exploding, most

particularly issuance of low credit quality debt, secondary market trading

volume in debt instruments has declined significantly - just as has also been

the case in the foreign exchange market.

Thus, US bond market average daily trading volume, including Treasuries,

agency securities and corporate bonds, has fallen from US$894bn in 2010 to

US$721bn in the first five months of 2014 (see previous chart). While

average daily currency trading volume on the ICAP-owned EBS platform, one

of the main venues for the global FX market, declined by 42% YoY to

US$73.5bn in May (see following chart).

Average daily FX trading volume on the EBS platform

Source: ICAP

US pending home sales index and total existing home sales

Source: CLSA, National Association of Realtors

0

50

100

150

200

250

300

J

a

n

0

6

M

a

y

0

6

S

e

p

0

6

J

a

n

0

7

M

a

y

0

7

S

e

p

0

7

J

a

n

0

8

M

a

y

0

8

S

e

p

0

8

J

a

n

0

9

M

a

y

0

9

S

e

p

0

9

J

a

n

1

0

M

a

y

1

0

S

e

p

1

0

J

a

n

1

1

M

a

y

1

1

S

e

p

1

1

J

a

n

1

2

M

a

y

1

2

S

e

p

1

2

J

a

n

1

3

M

a

y

1

3

S

e

p

1

3

J

a

n

1

4

M

a

y

1

4

(US$bn)

70

80

90

100

110

120

130

3.5

4.0

4.5

5.0

5.5

6.0

6.5

7.0

7.5

2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014

US total existing home sales (LHS)

US pending home sales index (2-mth lead)

(m units, saar) (sea adj)

The sell sides

lack of inventory

Declining trading volumes

Prepared for EV: fsudjono@henanputihrai.com

Section 1: Global and regional overview Asia Maxima

3Q14 christopher.wood@clsa.com 11

There is, therefore, scope for significant market dislocation which would feed,

via fixed income, into the world of equities if investors started to discount

nearer term Fed tightening. Still, this does not mean that such a sign of rising

wage pressures in the USA would signal the sudden transition from a

deflationary era to an inflationary one. For an interest-rate hike at the short

end, or even the perception that monetary tightening is coming much sooner

than previously expected, and any resulting related back up in long-term

interest rates, is likely to prove deflationary, in the sense that an economy

like Americas with continuing high debt levels, will prove ultra-sensitive to

the impact of higher interest rates, as was demonstrated last year in terms of

the US housing markets stalling in the face of higher mortgage rates (see

previous chart).

Indeed the housing market has not really revived since then, despite the

decline in mortgage rates seen in the first half of this year as a

consequence of the Treasury bond rally. In this respect, it has become

increasingly evident that the rapid recovery seen in US housing in 2011

and 2012 was driven primarily by investors not end users, as those with

capital to deploy arbitraged the spread between low financing costs and

high rental yields.

The same financing dynamic has been behind the significant rise in US

corporate debt post the financial crisis, as corporates have used the cheap

funding costs available to finance share buyback programmes to boost their

return on equity, the formula against which many executives continue to be

compensated. Thus, S&P500 share buybacks surged by 23% QoQ and 59%

YoY to US$159bn in 1Q14, the highest level since 3Q07 when buyback activity

peaked at US$172bn (see following chart).

S&P500 share buybacks

Source: Standard & Poor's

0

20

40

60

80

100

120

140

160

180

1

9

9

9

2

0

0

0

2

0

0

1

2

0

0

2

2

0

0

3

2

0

0

4

2

0

0

5

2

0

0

6

2

0

0

7

2

0

0

8

2

0

0

9

2

0

1

0

2

0

1

1

2

0

1

2

2

0

1

3

2

0

1

4

(US$bn)

Surging US

share buybacks

Prepared for EV: fsudjono@henanputihrai.com

Section 1: Global and regional overview Asia Maxima

12 christopher.wood@clsa.com 3Q14

The consequence of the above is that any monetary tightening scare, or

related inflation scare, is likely to prove short lived. In this sense, evidence

of rising wages pressures, if such a development occurs, will likely turn out to

be late cycle confirmation that the US economic recovery, which began in

2009, is nearing its end, not its beginning.

And, in such a macroeconomic context a dove like Yellen will want to

accelerate quantitative easing, not end it. That is unless there starts to be

more vocal opposition from within the Fed, from Congress and from the

executive arm of the federal government to what by now should be seen as

the obvious negative consequences of what has been aptly described by

CLSAs Australian bank analyst Brian Johnson as QE-ternity. See the

Australian country section on page 42.

Still, if this would be a development to applaud, it also remains unlikely. Much

more likely is that the policy-making establishment in such a context will look

to expand quantitative easing with the result that the distinction between

monetary policy and fiscal policy will become ever more blurred. For, with the

Fed already owning 22% of outstanding Treasury bonds and buying over 70%

of net Treasury debt issuance since the beginning of 2013 (see following

chart), without seemingly nasty inflationary ramifications, QE advocates in a

continuing low growth world will increasingly be tempted to argue that central

banks should buy all government debt and simply cancel it. Indeed, such

arguments can already be heard in some quarters.

Fed buying of US Treasuries and increase in Treasury debt outstanding

Note: Fed buying data up to 18 June, Treasury debt outstanding data up to May 2014. Source: Federal

Reserve, SIFMA, CLSA

Meanwhile, as the market consensus for now focuses on continuing tapering

and normalisation of US monetary policy next year, ECB boss Mario Draghi

has spent most of 2014 preparing the way for quantitative easing in the

Eurozone, as he has increasingly drawn attention to falling inflation pressures

in the Eurozone. On this point, Eurozone CPI inflation fell from 0.7% YoY in

April to 0.5% YoY in May, the lowest inflation rate since November 2009 (see

following chart).

(200)

0

200

400

600

800

1,000

1,200

1,400

1,600

1,800

2009 2010 2011 2012 2013 2014

(US$bn)

Fed buying of US Treasuries

Increase in Treasury debt outstanding

QE-ternity

Draghis QE preparation

Prepared for EV: fsudjono@henanputihrai.com

Section 1: Global and regional overview Asia Maxima

3Q14 christopher.wood@clsa.com 13

Eurozone CPI inflation

Source: Eurostat

In the June ECB meeting, Draghi announced a series of measures, including

negative interest rates (see following chart) and a new version of the LTRO

known as targeted longer-term refinancing operations or TLTROs, which

amount to going as far in the direction of quantitative easing as possible

without actually doing it. This probably sets up the ECB for a formal move to

quantitative easing by the end of the third quarter, with Draghi whetting risk-

seeking investors appetite with his announcement in June that the ECB has

decided to intensify preparatory work related to its proposed outright

purchases of asset-backed securities where the debt securitised could be

Eurozone SME debt.

ECB key policy interest rates

Source: ECB

The above pending development clearly marks the exact opposite of the

anticipated normalisation of monetary policy in America. Still Draghi has been

building the case carefully for more unorthodox monetary policy initiatives in

the Eurozone because of his awareness of German sensitivities. Still, having

successfully floated the QE balloon and not been visibly shot down by

opposition in Germany, he is now preparing to launch it with the rational

acceptable to Berlin being that inflation threatens to decline to well below the

ECBs formal target of 2%.

(1.0)

(0.5)

0.0

0.5

1.0

1.5

2.0

2.5

3.0

3.5

4.0

1

9

9

7

1

9

9

8

1

9

9

9

2

0

0

0

2

0

0

1

2

0

0

2

2

0

0

3

2

0

0

4

2

0

0

5

2

0

0

6

2

0

0

7

2

0

0

8

2

0

0

9

2

0

1

0

2

0

1

1

2

0

1

2

2

0

1

3

2

0

1

4

(% YoY)

(0.5)

0.0

0.5

1.0

1.5

2.0

2.5

3.0

3.5

4.0

4.5

5.0

5.5

6.0

1

9

9

9

2

0

0

0

2

0

0

1

2

0

0

2

2

0

0

3

2

0

0

4

2

0

0

5

2

0

0

6

2

0

0

7

2

0

0

8

2

0

0

9

2

0

1

0

2

0

1

1

2

0

1

2

2

0

1

3

2

0

1

4

(%)

Marginal lending facility

Main refinancing operations

Deposit facility

The ECB buying asset-

backed securities?

Prepared for EV: fsudjono@henanputihrai.com

Section 1: Global and regional overview Asia Maxima

14 christopher.wood@clsa.com 3Q14

Eurozone and PIIGS current account balance

Note: PIIGS = Portugal, Italy, Ireland, Greece and Spain. Source: ECB, Datastream, CLSA

In the meantime, it is also the case that the deflationary pressures are the

natural consequence of the Eurozones decision, led by Germany, to

implement a macroeconomic adjustment within the context of a fixed

exchange-rate system, where the adjustment is made by a decline in internal

costs and a restoration of internal competitiveness. This process at work can

be seen in the Eurozones still rising current account surplus (see previous

chart), primarily triggered by weakening domestic demand, and the related

resilience of the euro as well as the dramatic collapse in periphery bond yields,

which now appear to be in the process of converging with German bund yields.

Thus, the Spanish 10-year bond yield declined below the 10-year US Treasury

bond yield last quarter, with the yield spread falling to a negative 3bp on 9

June and was only a positive 13bp at the end of 2Q14 (see following chart).

As for the spread with the 10-year German bund yield, it was only 142bp at

the end of last quarter, down from a peak of 639bp in July 2012.

Spanish 10-year government bond yield spreads

Source: CLSA, Bloomberg

(250)

(200)

(150)

(100)

(50)

0

50

100

150

200

250

2

0

0

0

2

0

0

1

2

0

0

2

2

0

0

3

2

0

0

4

2

0

0

5

2

0

0

6

2

0

0

7

2

0

0

8

2

0

0

9

2

0

1

0

2

0

1

1

2

0

1

2

2

0

1

3

2

0

1

4

Eurozone current account PIIGS current account

(bn, annualised)

(200)

(100)

0

100

200

300

400

500

600

700

J

a

n

0

7

M

a

y

0

7

S

e

p

0

7

J

a

n

0

8

M

a

y

0

8

S

e

p

0

8

J

a

n

0

9

M

a

y

0

9

S

e

p

0

9

J

a

n

1

0

M

a

y

1

0

S

e

p

1

0

J

a

n

1

1

M

a

y

1

1

S

e

p

1

1

J

a

n

1

2

M

a

y

1

2

S

e

p

1

2

J

a

n

1

3

M

a

y

1

3

S

e

p

1

3

J

a

n

1

4

M

a

y

1

4

(bp) Spread over 10Y US Treasury bond yield

Spread over 10Y German bund yield

Converging Eurozone

bond yields

Prepared for EV: fsudjono@henanputihrai.com

Section 1: Global and regional overview Asia Maxima

3Q14 christopher.wood@clsa.com 15

So Draghi is now trying to mitigate this adjustment process with his own

reflationary initiatives. But the political realities mean he has to engage in

continued double talk. Thus, Draghi still described inflation expectations as

being firmly anchored at the June meeting, while the ECB officially forecasts

headline inflation to be 1.1% in 2015, even though it has just lowered its

2014 forecast from 1.1% to 0.7%. But such conflicting signals should be

ignored, since the reality is that monetary policy in the Eurozone is likely to

become ever more unconventional.

Meanwhile, in another major economy already committed to the worlds most

aggressive quantitative-easing policy, namely Japan, there has been relative

conservatism displayed by the Bank of Japan (BoJ) in terms of a failure to

launch new unorthodox monetary policy initiatives during the first half of this

year. This reflects the fact that the Japanese central bank hopes that a further

expansion of monetisation will not be necessary, given the massive BoJ

balance-sheet expansion that has already taken place. The Bank of Japans

total assets have increased by 92tn or 56% since Governor Haruhiko Kuroda

launched the aggressive quantitative easing programme back in early April

2013 to 257tn or 53% of GDP on 20 June (see following chart).

Bank of Japan total assets as a percentage of nominal GDP

Source: CLSA, Bank of Japan, CEIC Data

The acid test for Japan will come in the coming quarter. There will be two

areas to focus on. The first is whether the economy proves resilient to the

impact of the sales-tax increase at the start of April. The official BoJ view is

that the economy will recover in 3Q after an annualised 4% QoQ decline in

the second quarter caused by the sales tax hike. The second point is whether

inflation starts to decline again once the impact of last years yen devaluation

falls out of the data on a year-on-year basis, as it will do from May on. In this

respect, while the BoJ focuses on core CPI in terms of its formal target, the

critical inflation data point to monitor is so-called core-core CPI, which

excludes both food and energy. This is because core CPI includes energy,

which has been distorted by higher imported energy bills as a result of the

continuing shut down of Japans 48 nuclear plants.

True, nationwide core-core CPI inflation, adjusted for the sales tax hike effect

by the methodology proposed by the BoJ, slowed from 0.8% YoY in April to

0.5% YoY in May. But, more encouragingly, Tokyos adjusted core-core

15

20

25

30

35

40

45

50

55

2

0

0

0

2

0

0

1

2

0

0

2

2

0

0

3

2

0

0

4

2

0

0

5

2

0

0

6

2

0

0

7

2

0

0

8

2

0

0

9

2

0

1

0

2

0

1

1

2

0

1

2

2

0

1

3

2

0

1

4

(% GDP)

Japans coming acid test

The BoJ stance

Japanese inflation data

Prepared for EV: fsudjono@henanputihrai.com

Section 1: Global and regional overview Asia Maxima

16 christopher.wood@clsa.com 3Q14

inflation picked up from 0.4% YoY in May to 0.5% YoY in June, after slowing

from 0.6% YoY in April (see following chart). If core-core CPI inflation can

remain at around current levels for the next six months, that will encourage

expectations that Japan is finally emerging out of deflation.

Japan and Tokyo core-core CPI inflation (adjusted for sales tax hike effect)

Note: Adjusted for the sales tax hike effect by the methodology proposed by the Bank of Japan. Source:

CLSA, Bank of Japan, Statistics Bureau

This is not as unlikely as might be imagined as evidence continues to mount

that Japans labour market is tightening as a consequence of natural

demographic pressures, amid growing focus on labour shortages, not only in

the construction sector, but also in growing number of service sectors. Thus,

the working-age population has been declining for the past 19 years while, for

related reasons, the working-age female participation rate had its biggest

increase on record last year. The working-age population has fallen by 9.1m

or 10% from 87.26m or 69.5% of the total population in 1995 to 78.15m or

61.5% of the total in June (see following chart). Meanwhile, the female

working-age labour participation rate rose by 1.6ppts in 2013 to 65%, the

biggest annual increase since the data series began in 1968 (see following

chart). This compares with 67.2% in the USA and 72% in the UK. If such

pressures continue, it is entirely possible that Japans female participation

rate could end up higher than in any other developed economy.

Japan working-age (15-64) population

Source: Japan Statistics Bureau

(2.0)

(1.5)

(1.0)

(0.5)

0.0

0.5

1.0

2

0

0

0

2

0

0

1

2

0

0

2

2

0

0

3

2

0

0

4

2

0

0

5

2

0

0

6

2

0

0

7

2

0

0

8

2

0

0

9

2

0

1

0

2

0

1

1

2

0

1

2

2

0

1

3

2

0

1

4

(% YoY) Japan core-core CPI inflation (excl. food & energy)

Tokyo core-core CPI inflation (excl. food & energy)

56

58

60

62

64

66

68

70

72

60

65

70

75

80

85

90

1

9

6

1

1

9

6

3

1

9

6

5

1

9

6

7

1

9

6

9

1

9

7

1

1

9

7

3

1

9

7

5

1

9

7

7

1

9

7

9

1

9

8

1

1

9

8

3

1

9

8

5

1

9

8

7

1

9

8

9

1

9

9

1

1

9

9

3

1

9

9

5

1

9

9

7

1

9

9

9

2

0

0

1

2

0

0

3

2

0

0

5

2

0

0

7

2

0

0

9

2

0

1

1

2

0

1

3

Working age (15-64) population (LHS)

Working age as % of total population

(m) (%)

Japans tightening

labour market

Prepared for EV: fsudjono@henanputihrai.com

Section 1: Global and regional overview Asia Maxima

3Q14 christopher.wood@clsa.com 17

Japan, US and UK working-age (15-64) female labour participation rate

Source: CLSA, Japan Statistics Bureau, US Bureau of Labour Statistics, UK Office for National Statistics

Meanwhile, if inflation does surprise by staying positive in Japan in coming

months, it will present a problem of success for the Bank of Japan, in that

it will need to start to send the appropriate market signal by allowing the

yield curve to steepen gradually. But for now, BoJ buying has continued to

keep the 10-year JGB yield at around the 60bp level, a central bank buying

operation that has allowed growing selling of JGBs by domestic

institutional investors. Thus, Japanese city banks holdings of JGBs have

fallen by 34.3tn or 32% since the end of March 2013 (see following

chart). While Japanese life insurers and public pensions sold a net 1tn

and 1.85tn worth of JGBs in 1Q14, according to the BoJs latest flow of

funds data (see following chart).

Japanese city banks' holdings of JGBs

Source: Bank of Japan

45

50

55

60

65

70

75

1

9

6

9

1

9

7

1

1

9

7

3

1

9

7

5

1

9

7

7

1

9

7

9

1

9

8

1

1

9

8

3

1

9

8

5

1

9

8

7

1

9

8

9

1

9

9

1

1

9

9

3

1

9

9

5

1

9

9

7

1

9

9

9

2

0

0

1

2

0

0

3

2

0

0

5

2

0

0

7

2

0

0

9

2

0

1

1

2

0

1

3

(%) Japan US UK

30

40

50

60

70

80

90

100

110

120

2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014

(tn)

The BoJs JGB

management

Prepared for EV: fsudjono@henanputihrai.com

Section 1: Global and regional overview Asia Maxima

18 christopher.wood@clsa.com 3Q14

Net buying of JGBs by Japanese life insurers and public pensions

Source: Bank of Japan Flow of Funds Accounts

If the debate as regards the developed economies remains, from a financial-

market perspective, dominated by the ebb and flow of initiatives in monetary

policy, the dominant focus in the world of emerging markets remains on the

structural challenges facing China as it continues to try to rebalance the

growth model away from investment to consumption in what is described by

PRC officialdom as a process of careful deleveraging.

There is certainly a clear understanding among officials that implementation

of structural reform requires a willingness to tolerate slower growth. This is

why the central government has spent most of the year trying to resist calls

for aggressive stimulus in the face of slowing growth, a deceleration better

reflected in nominal GDP data than real GDP data. Thus, nominal GDP growth

has slowed from 18.5% YoY in 3Q11 to 7.9% YoY in 1Q14 (see following

chart). This reluctance to stimulate is despite a number of fine tuning easing

measures announced in the past quarter, in terms of the acceleration of some

infrastructure projects and the tweaking of reserve requirement ratios for

smaller banks.

China nominal and real GDP growth

Source: CEIC Data

(3)

(2)

(1)

0

1

2

3

4

M

a

r

0

6

J

u

n

0

6

S

e

p

0

6

D

e

c

0

6

M

a

r

0

7

J

u

n

0

7

S

e

p

0

7

D

e

c

0

7

M

a

r

0

8

J

u

n

0

8

S

e

p

0

8

D

e

c

0

8

M

a

r

0

9

J

u

n

0

9

S

e

p

0

9

D

e

c

0

9

M

a

r

1

0

J

u

n

1

0

S

e

p

1

0

D

e

c

1

0

M

a

r

1

1

J

u

n

1

1

S

e

p

1

1

D

e

c

1

1

M

a

r

1

2

J

u

n

1

2

S

e

p

1

2

D

e

c

1

2

M

a

r

1

3

J

u

n

1

3

S

e

p

1

3

D

e

c

1

3

M

a

r

1

4

(tn)

Life insurers Public pensions

6

7

8

9

10

11

12

13

14

15

4

6

8

10

12

14

16

18

20

22

24

26

2

0

0

0

2

0

0

1

2

0

0

2

2

0

0

3

2

0

0

4

2

0

0

5

2

0

0

6

2

0

0

7

2

0

0

8

2

0

0

9

2

0

1

0

2

0

1

1

2

0

1

2

2

0

1

3

2

0

1

4

(% YoY) Nominal GDP growth Real GDP growth (RHS) (% YoY)

China focus

Resisting stimulus

Prepared for EV: fsudjono@henanputihrai.com

Section 1: Global and regional overview Asia Maxima

3Q14 christopher.wood@clsa.com 19

China urban employment

Source: CEIC Data

If one reason the authorities have so far been willing to resist aggressive

stimulus is the reform agenda, the other is the more practical issue that so

far there remains little evidence, if any, of strains in the labour market. In this

respect, perhaps the most positive point about China today, amid the

continuing focus among investors on the structural problems concerning SOEs,

local-government debt and related problems in the banking sector, is that

based on official data the private sector already accounts for about 80% of

urban employment and that at least 90% of new job generation is currently

generated by the private sector (see previous chart). It is also estimated that

13m jobs were generated in 2013, well above the official target of 10m.

In this context, it is clear that reform-orientated officials understand the

importance of improving the operating environment for the private sector by

reducing tax and regulatory burdens. On a related point, it is also the case

that job generation can expand dramatically if a private-sector dominated

services sector is allowed to flourish in urban areas, most particularly given

Chinas dramatic economies of scale. Indeed, Chinas private sector-driven e-

commerce boom is already a good example of this dynamic at work.

These positives are worth remembering. Still there is no doubt that there are

some minefields to step through in coming quarters, given the looming overhang

of maturing trust products discussed at some length here last quarter (see Asia

Maxima - Financial osmosis, 2Q14). The hope is that the authorities will

introduce some discipline into the system, in terms of imposing some losses on

investors, without precipitating a full scale panic. Still, it is also possible that the

maturing trust products are simply moved from retail hands to institutional

owners, thereby, simply yet again, deferring a problem.

The reality remains then that China is engaged in a delicate balancing act

between encouraging a more market-driven private-sector orientated economy

which can generate job growth, while maintaining all important social stability. In

the meantime, the two key critical variables for investors to monitor as regards

China remain the residential property market, where the authorities are for now

at least allowing a market-driven slowdown, and capital flows.

0

50

100

150

200

250

300

350

400

1

9

9

0

1

9

9

1

1

9

9

2

1

9

9

3

1

9

9

4

1

9

9

5

1

9

9

6

1

9

9

7

1

9

9

8

1

9

9

9

2

0

0

0

2

0

0

1

2

0

0

2

2

0

0

3

2

0

0

4

2

0

0

5

2

0

0

6

2

0

0

7

2

0

0

8

2

0

0

9

2

0

1

0

2

0

1

1

2

0

1

2

2

0

1

3

(m)

State-controlled urban employment

Private urban employment

Chinas delicate

balancing act

Prepared for EV: fsudjono@henanputihrai.com

Section 1: Global and regional overview Asia Maxima

20 christopher.wood@clsa.com 3Q14

China average new home price growth in four tier-one cities

Note: Average of new home price growth in Beijing, Shanghai, Shenzhen and Guangzhou. Source:

National Bureau of Statistics

For now, while the property market is weakening and while there is some

evidence of moderate capital outflows last quarter, the evidence on both

fronts is not yet a cause for alarm. In the case of residential property, last

year saw big price gains in tier-one cities so there is a base effect to

incorporate into the data. New home prices in four tier-one cities fell by an

average 0.1% MoM in May, the first month-on-month decline in two years.

While on a year-on-year basis, new home-price growth in tier-one cities

slowed to 9.9% YoY in May, down from 21.2% YoY in November 2013 (see

previous chart).

As for capital flows, there was some initial evidence of renewed outflows last

quarter, albeit not dramatic. Estimated hot money flows, measured as the

change in financial institutions positions for forex purchases less the trade

balance and net FDI, fell to an outflow of Rmb15bn in April and Rmb204bn in

May, compared with a Rmb118bn inflow in March (see following chart).

China hot money flow estimate

Note: Estimated hot money flow = Change in financial institutions' positions for forex purchases - trade

balance - utilised FDI + Outward direct investment. Source: CLSA, CEIC Data, PBOC

(8)

(4)

0

4

8

12

16

20

24

(1.0)

(0.5)

0.0

0.5

1.0

1.5

2.0

2.5

3.0

J

a

n

1

1

F

e

b

1

1

M

a

r

1

1

A

p

r

1

1

M

a

y

1

1

J

u

n

1

1

J

u

l

1

1

A

u

g

1

1

S

e

p

1

1

O

c

t

1

1

N

o

v

1

1

D

e

c

1

1

J

a

n

1

2

F

e

b

1

2

M

a

r

1

2

A

p

r

1

2

M

a

y

1

2

J

u

n

1

2

J

u

l

1

2

A

u

g

1

2

S

e

p

1

2

O

c

t

1

2

N

o

v

1

2

D

e

c

1

2

J

a

n

1

3

F

e

b

1

3

M

a

r

1

3

A

p

r

1

3

M

a

y

1

3

J

u

n

1

3

J

u

l

1

3

A

u

g

1

3

S

e

p

1

3

O

c

t

1

3

N

o

v

1

3

D

e

c

1

3

J

a

n

1

4

F

e

b

1

4

M

a

r

1

4

A

p

r

1

4

M

a

y

1

4

(% MoM)

New home price average

New home price average (RHS)

(% YoY)

(600)

(400)

(200)

0

200

400

600

J

a

n

0

7

M

a

y

0

7

S

e

p

0

7

J

a

n

0

8

M

a

y

0

8

S

e

p

0

8

J

a

n

0

9

M

a

y

0

9

S

e

p

0

9

J

a

n

1

0

M

a

y

1

0

S

e

p

1

0

J

a

n

1

1

M

a

y

1

1

S

e

p

1

1

J

a

n

1

2

M

a

y

1

2

S

e

p

1

2

J

a

n

1

3

M

a

y

1

3

S

e

p

1

3

J

a

n

1

4

M

a

y

1

4

(Rmbbn)

Chinas property market

Capital flows

Prepared for EV: fsudjono@henanputihrai.com

Section 1: Global and regional overview Asia Maxima

3Q14 christopher.wood@clsa.com 21

Renminbi/US$ spot rate (inverted scale)

Source: Bloomberg, China Foreign Exchange Trade System (CFETS)

This trend will probably have been welcomed by the PBOC since the large hot

money inflows seen in preceding quarters were seemingly driven by a desire

to invest in high yielding renminbi-denominated wealth-management

products. Indeed the desire to send a signal that this carry trade was not

without risk was one reason why the PBOC engineered a depreciation of the

renminbi in March by widening the daily trading band from 1% to 2%. As a

consequence, the renminbi depreciated by 3.5% against the US dollar from

its high reached in mid-January to a recent low reached at the end of April

(see previous chart). But here again the PBOC is engaged in its own delicate

balancing act since it will not want to see large capital outflows, which would

lead to a contraction of liquidity, putting pressure on it to engage in more

aggressive easing. That would counter its strategic goal to bring credit growth

back more in line with nominal GDP growth, as was the case between 2003

and 2008 before the massive post-Lehman stimulus.

In this respect, there remains a continuing focus among investors on the

volatile monthly bank lending and social financing data in China. The point to

note is that, when looked at from an annualised basis, the trend is clearly

slowing. Thus, renminbi bank-loan growth has slowed from 16.3% YoY in

September 2012 to 13.9% YoY in May, while the growth in social financing

outstanding has slowed from 22.7% YoY in April 2013 to 16.3% YoY in May.

Still if this is arguably evidence of careful deleveraging, it is also the case

that nominal GDP growth is also slowing, which means that the gap between

credit growth and nominal GDP growth is not really contracting as much as

would be hoped for the overall health of the system. Thus, renminbi bank-

loan growth and the growth in social financing outstanding, are now still

6ppts and 8.4ppts above nominal GDP growth of 7.9%, down from a recent

high of 7.8ppts and 13ppts reached in September 2012 and April 2013,

respectively, (see following chart).

6.0

6.2

6.4

6.6

6.8

7.0

7.2

7.4

7.6

7.8

8.0

8.2

8.4

2005 2006 2007 2008 2009 2010 2011 2012 2013 2014

The PBOCs balancing act

Chinas slowing

credit growth

Prepared for EV: fsudjono@henanputihrai.com

Section 1: Global and regional overview Asia Maxima

22 christopher.wood@clsa.com 3Q14

China credit growth vs nominal GDP growth

Note: Outstanding social financing estimated as the sum of reported renminbi bank loans outstanding

and the cumulative total since 2002 of all other social financing components. Source: CLSA, CEIC

Data, PBOC

Meanwhile, there is a complicating issue as regards the massive explosion in

credit in China in the years following the Lehman crisis, most particularly if

measured by the social-financing data series, which is the nearest thing in

China to a broad credit aggregate. On this point, annual social financing

volume surged from Rmb6.98tn in 2008 to a record Rmb17.3tn in 2013 (see

following chart). Still, it is important to note that the estimates are that

between one third to one half of the new lending incorporated in this social

financing data comprise maturing loans being refinanced, most particularly

loans made to local government financing vehicles, which were the chief

recipients of Chinas 2009 post-Lehman Rmb4tn panic stimulus.

China annual social financing volume and increase in nominal GDP

Note: YTD14 = January-May 2014 for social financing and 1Q14 for GDP. Source: CEIC Data, PBOC, CLSA

0

5

10

15

20

25

30

35

40

J

a

n

0

3

J

u

l

0

3

J

a

n

0

4

J

u

l

0

4

J

a

n

0

5

J

u

l

0

5

J

a

n

0

6

J

u

l

0

6

J

a

n

0

7

J

u

l

0

7

J

a

n

0

8

J

u

l

0

8

J

a

n

0

9

J

u

l

0

9

J

a

n

1

0

J

u

l

1

0

J

a

n

1

1

J

u

l

1

1

J

a

n

1

2

J

u

l

1

2

J

a

n

1

3

J

u

l

1

3

J

a

n

1

4

(% YoY) Renminbi bank loan growth

Outstanding social financing growth

Nominal GDP growth

0

2

4

6

8

10

12

14

16

18

20

2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 YTD14

(Rmbtn) Annual total social financing volume

Annual increase in nominal GDP

The nature of

social financing

Prepared for EV: fsudjono@henanputihrai.com

Section 1: Global and regional overview Asia Maxima

3Q14 christopher.wood@clsa.com 23

There are two ways to look at this phenomenon, one positive and one

negative. The positive point is that the money lent has not been speculated

away since it has gone into infrastructure, which will have some form of

public utility, even if it may not be currently generating an adequate cash flow

to service the debt, while at the end of the day local governments operate on

the same balance sheet as the central government thereby reducing

significantly the potential for a systemic crisis.

The negative point, of course, is that constantly rolling over the same loans is

a negative drag on the economy, which is why it is logical that velocity has

been declining ever since that 2009 post-Lehman stimulus. Thus, Chinas

money velocity, measured as the nominal GDP to M2 ratio, has fallen from

0.68x in late 2008 to an estimated 0.49x in May (see following chart).

China velocity of money (Nominal GDP/M2)

Source: CLSA, CEIC Data, PBOC

So, as ever with China, the story remains more nuanced than is suggested by

the extreme bullish or bearish stances of many commentators. Meanwhile the

positive point is that for now China, and the other emerging markets, have

avoided the temptation to succumb to the allure of quantitative easing with

their own monetary policies remaining orthodox.

0.48

0.50

0.52

0.54

0.56

0.58

0.60

0.62

0.64

0.66

0.68

0.70

2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014

(x)

Prepared for EV: fsudjono@henanputihrai.com

Section 2: Asia asset allocation Asia Maxima

24 christopher.wood@clsa.com 3Q14

Asia asset allocation

There was a return to a more risk on mood last quarter. Asia and emerging

markets were the best performers. The MSCI AC Asia Pacific ex-Japan Index

rose by 5% in US-dollar terms last quarter, while the MSCI Emerging Markets

Index rose by 5.6%. By contrast, the MSCI Europe Index rose by only 1.9%

in US-dollar terms last quarter. This compared with a 4.7% gain in the

S&P500 and, more positively, a 6.7% gain in Japans Topix in US-dollar terms.

Overall, the MSCI AC World Index rose by 4.3% in 2Q14.

This performance raises the hope that the three-year period of emerging-

market underperformance may have come to an end, though Asia and

emerging markets are still slightly underperforming the S&P500 year to date

and are performing almost in line with the MSCI AC World Index. The MSCI AC

Asia Pacific ex-Japan Index and the MSCI Emerging Markets Index have risen

by 5.5% and 4.8% respectively in US-dollar terms year to date, compared with

a 6.1% gain in the S&P500 and a 4.9% gain in the MSCI AC World Index.

CLSA Asia-Pacific universe market valuations

PE

(x)

Earnings

growth (%)

PB

(x)

Div yield

(%)

ROE

(%)

Net gearing

(%)

14CL 15CL 14CL 15CL 14CL 15CL 14CL 15CL 14CL 15CL 14CL 15CL

AsiaPac ex-Japan 12.2 11.0 7.0 10.0 1.5 1.4 3.5 3.7 13.5 13.5 26.6 21.9

Japan 13.5 12.2 17.4 11.1 1.3 0.3 1.9 2.0 10.2 10.4 35.4 29.7

Australia 13.9 13.5 9.1 3.1 1.9 1.8 4.7 5.0 14.5 14.1 40.4 38.3

China 8.7 7.8 7.7 10.5 1.3 1.1 3.9 4.2 15.8 15.5 34.7 30.1

Hong Kong 12.9 12.5 6.6 3.4 1.2 1.1 4.2 4.0 10.6 9.3 16.2 14.1

India 16.8 14.3 13.4 17.4 2.5 2.2 1.5 1.7 17.4 17.8 46.1 37.7

Indonesia 14.5 12.9 11.0 12.4 2.8 2.5 2.5 2.8 21.1 20.6 21.7 16.4

Korea 9.9 8.3 9.5 20.3 1.0 0.9 1.3 1.6 11.0 12.0 15.0 7.8

Malaysia 16.9 15.4 6.8 9.6 2.2 2.0 3.0 3.2 14.0 14.2 19.7 15.8

Philippines 18.9 16.5 4.6 14.8 2.5 2.3 2.3 2.4 14.0 14.7 50.0 47.2

Singapore 14.0 12.8 (1.5) 9.5 1.4 1.3 3.4 3.6 10.3 10.6 34.3 35.1

Taiwan 14.7 13.3 19.8 11.0 2.0 1.8 3.5 3.9 14.1 14.4 (1.9) (8.3)

Thailand 13.1 11.4 5.9 15.4 2.0 1.8 3.4 3.8 15.9 16.7 53.6 43.2

Note: Based on CLSA universe of companies under coverage. Calendarised valuations in local currency terms. Source: CLSA evalu@tor

Still the continuing risk of more of a Fed normalisation scare, combined with

the structural headwinds still facing China, mean that it continues to be

risky to recommend an aggressive Overweight for Asia and emerging

markets on a benchmark-related basis. But a Neutral position remains

certainly justified, as was formally recommended here last quarter. The

relative valuation case for Asia remains compelling, given that most of the

gains in America and Europe last year were driven by multiple expansion.

The best guide to valuation remains the trailing PB ratio. Trailing valuations

remain below the mean of the past 19 years. The MSCI AC Asia Pacific ex-

Japans trailing PB is now 1.66x, compared with a mean of 1.83x over the

past 19 years (see following chart). Similarly, the index is now trading at