Академический Документы

Профессиональный Документы

Культура Документы

Poram

Загружено:

Hendrawan DarmalimИсходное описание:

Оригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Poram

Загружено:

Hendrawan DarmalimАвторское право:

Доступные форматы

PERSPECTIVES ON

DOWNSTREAM ACTIVITIES

PRESENTATION TO

PROFESSOR IWASA KAZUYUKI, KOCHI UNIVERSITY, JAPAN

14

TH

AUGUST 2012

1

OUTLINE OF PRESENTATION

1. PORAM AND ITS OBJECTIVE

2. PALM OIL REFINING IN MALAYSIA

3. CURRENT STATUS OF THE INDUSTRY

4. CHALLENGES AND PROSPECTS

2

3

4

OUTLINE OF PRESENTATION

1. PORAM AND ITS OBJECTIVE

2. PALM OIL REFINING IN MALAYSIA

3. CURRENT STATUS OF THE INDUSTRY

4. CHALLENGES AND PROSPECTS

5

INDUSTRY ORGANIZATIONS IN

THE MALAYSIAN PALM OIL

INDUSTRY

Malaysian Palm Oil Association (MPOA)

Palm Oil Millers Association (POMA)

Palm Oil Refiners Association Of Malaysia

(PORAM)

Malayan Edible Oil Manufacturers

Association (MEOMA)

Malaysian Oleochemical Manufacturers

Group (MOMG)

6

The Palm Oil Refiners Association of Malaysia

The Palm Oil Refiners Association of Malaysia,

more widely known as PORAM, was formed in

1975.

PORAM is a voluntarily-joined, non-profit

organization

Objective is to collectively support and advance

the status and interest of the palm oil refining

and/or processing industry

7

PORAM

ORGANISATION STRUCTURE

Management Board

4

Committees

Commercial & Technical Committee

Associate Members Committee

Price Settlement Committee

Arbitration Rules Execution Committee

Secretariat

(9 Staffs)

8

PORAM MEMBERSHIP

3 CATEGORIES

Firm/company in the business of

processing palmoil

Full Member

Firm/company connected with oils/fats

trade but not directly in processing,

refining and fractionating of palmoil.

Associate

Member

Firm/company who is in the business of

processing and is an associate

company/subsidiary of any Full Member

Supplementary

Member

9

Sime Darby Kempas Sdn. Bhd. (1975)

Southern Edible Oil Industries (M) Sdn. Bhd. (1975)

Unitata Berhad. (1975)

Felda Vegetable Oil Products Sdn Bhd. (1976)

Sime Darby Jomalina Sdn. Bhd. (1976)

Lam Soon Edible Oils Sdn Bhd/ (1979)

Intercontinental Specialty Fats S.B.

PGEO Edible Oils Sdn Bhd. (1980)

KL-Kepong Edible Oils Sdn Bhd. (1981)

Cargill Palm Products Sdn. Bhd. (1982)

Ngo Chew Hong Oils and Fats (M) Sdn. Bhd. (1989)

Keck Seng (M) Bhd. (1991)

Wilmar Edible Oils Sdn. Bhd. (1999)

FULL REFINERS MEMBERS - 25

10

IOI Edible Oils Sdn Bhd / (2000)

IOI Loders Croklaan Oils Sdn Bhd.

Pan Century Edible Oils Sdn Bhd

Pacific Oils and Fats Industries Sdn. Bhd. (2002)

Malaysian Vegetable Oil Refinery Sdn. Bhd. (2006)

Assar Refinery Services Sdn. Bhd. (2007)

Global Biodiesel Sdn. Bhd. (2007)

Sime Darby Austral Sdn. Bhd. (2008)

Kirana Palm Oil Refinery Sdn Bhd (2008)

Kwantas Oil Sdn Bhd. (2009)

Kunak Refinery Sdn Bhd. (2009)

Palmaju Edible Oil Sdn. Bhd. (2010)

Premium Vegetable Oils Sdn Bhd. (2010)

Felda IFFCO Sdn. Bhd. (2010)

SOP Edible Oils Sdn. Bhd. (2010)

11

ASSOCIATE MEMBERS - 82

Category Local Overseas Total

Brokers 6 4 10

Bulking 2 - 2

Shipowners/

Shipbrokers

4 6 10

Surveyors/

Analysts

10 - 10

Trading /

Dealers

8 11 19

Others 16 15 30

TOTAL 46 36 82

12

ASSOCIATE MEMBERS (OVERSEAS)

BROKERS

1.

Agri Commodities International Holdings Pte. Ltd., Singapore

2.

MJ Vegoil Services (S) Pte. Ltd., Singapore

3.

Noble Resources Pte. Ltd., Singapore

4.

Tropical Oil Products Pte. Ltd., Singapore

TRADING/ DEALERS

1. Cargill Int. Trading Pte. Ltd., Singapore

2. ED & F MAN Asia Pte. Ltd., Singapore

3. Golden Agri International Trading Ltd., Singapore

4. Itochu Singapore Pte. Ltd., Singapore (2010)

5. Just Commodity Software Solution Pte. Ltd, Singapore

6. Louis Dreyfus Asia Pte. Ltd, Singapore

7. Marex Commodities, France

8. Pacific Rim Plantation Services Pte. Ltd, Singapore

9. PT Bina Karya Prima, Indonesia

10. Virgoz Oils & Fats Pte. Ltd, Singapore

11. Wilmar Trading Pte. Ltd, Singapore

13

ASSOCIATE MEMBERS (OVERSEAS)

SHIPOWNERS/ SHIPBROKERS

1.

Aurora Tankers Management Sdn. Bhd., Singapore

2.

Eastport Maritime Pte. Ltd., Singapore

3.

Glory Ship Management Pte. Ltd., Singapore

4.

Omega Chartering Pte. Ltd., Singapore

5.

Stolt-Nielsen Transportation Group Pte. Ltd., Singapore

6.

Tokyo Marine Co. Ltd., Japan (2006)

14

ASSOCIATE MEMBERS

OTHERS

1.

Mitsubishi Corporation LED, Malaysia (1986)

2.

Mitsui & Co Ltd., Malaysia (1987)

3.

GMS Line Co. Ltd., Japan (1997)

4.

Tokyo Marine Co. Ltd., Japan (2006)

5.

The Nisshin Oillio Group Ltd., Malaysia (2007)

6.

Fuji Oil, Singapore (2011)

15

16

Information

Dissemination

Government

Interaction/

Representation

Training /

Courses

1

2

3

Trade Facilitation

Trade/Export

Promotion

Trade Dispute

Resolution

4

5

6

ROLES AND FUNCTIONS

SERVICES TO MEMBERS

17

TRADE FACILITATION

Issue Trading Contracts and

Joint Contracts

Formulation of international

specifications for palm products

Publish handbooks & other

documents to facilitate trade

SERVICES TO MEMBERS

4

b

a

c

TYPE OF PORAM CONTRACTS

Short Form Contract

Contract No. 1 -

Domestic Contract for Malaysian Crude

Unbleached Palm Oil in Bulk

Contract No. 2 -

FOB Contract for Processed Palm Oil

and Palm Kernel Oil Products in Bulk

Contract No. 3 -

Domestic Contract for Malaysian

Processed Palm Oil in Bulk (For Delivery/

Collection within Malaysia including

Singapore)

Contract No. 4 - FOB Contract for Processed Palm Oil

Products in Drums

Contract No. 5 -

CIF Contract for Processed Palm Oil

Products in Drums

18

TYPE OF PORAM CONTRACTS

Contract No. 6 -

Domestic Sales Contract for Malaysian

Crude Unbleached Palm Oil in Bulk CIF

Delivered Weights for Sales between East

and Peninsular Malaysia

Contract No. 7 -

Joint FOB Contract for Crude Palm Oil

and Crude Palm Kernel Oil in Bulk Issued

by The Palm Oil Refiners Association of

Malaysia, Malayan Edible Oil

Manufacturers Association and

Malaysian Palm Oil Association

19

TYPE OF PORAM CONTRACTS

Contract No. 8 - FOB Contract for Processed Palm Oil

Products in Packed Form

Contract No. 9 -

Contract No. 10 -

CIF Contract for Processed Palm Oil

Products in Packed Form

Contract for Palm Oil Products in Bulk

(CIF) Issued Jointly by FOSFA

International/PORAM/MEOMA

20

PORAM STANDARD SPECIFICATIONS FOR

PROCESSED PALM OIL PRODUCTS

Neutralised palm oil/palm olein/stearin

Neutralised & bleached palm oil/palm

olein/palm stearin

Refined, bleached & deodorised palm

oil/palm olein/palm stearin

Neutralised, bleached & deodorised palm

oil/palm olein/palm stearin

Crude palm olein/crude palm stearin

Palm acid oil (PAO)

Palm fatty acid distillate (PFAD)

21

Trade/Export Promotion

Receiving trade delegations

Receiving trade enquiries and

channeling them to members

Facilitate/arranging for members

participation in trade missions

5

b

a

c

SERVICES TO MEMBERS

22

MALAYSIAN PO TECHNICAL AND PROMOTIONAL OFFICES WORLDWIDE

Red MPOB TAS Office 5 Offices

Blue MPOC Regional Office 10 Offices

23

Trade /Dispute Resolution

Platform for members to meet

and resolve common trade issues

Provide facilities for arbitration

Provide price settlement facility

6

b

a

c

SERVICES TO MEMBERS

24

OUTLINE OF PRESENTATION

1. PORAM AND ITS OBJECTIVE

2. PALM OIL REFINING IN MALAYSIA

3. CURRENT STATUS OF THE INDUSTRY

4. CHALLENGES AND PROSPECTS

25

26

NUMBER OF REFINERIES AND CAPACITIES

IN 2011 (TONNES/YEAR)

State

In Operation Under Planning* Total

No. Capacity No. Capacity No Capacity

Johor 17 7,016,400 2 1,080,000 19 8,096,400

Perak 4 1,039,500 1 965,000 5 2,004,500

Selangor 11 3,684,000 2 1,350,000 13 5,034,000

Others 5 2,326,500 2 214,000 7 2,540,500

Penisular Malaysia 37 14,066,400 7 3,609,000 44 17,675,400

Sabah 13 7,669,500 15 5,522,300 28 13,191,800

Sarawak 5 2,242,000 3 834,000 8 3,076,000

Sabah/Sarawak 18 9,911,500 18 6,356,300 36 16,267,800

MALAYSIA 55 23,977,900 25 9,965,300 80 33,943,200

Source : MPOB

Note : *Licence has been issued by MIDA

27

CATEGORIES OF REFINERIES

1. Integrated Refineries (with plantations, mills,

specialty fats, oleochemicals, biodiesel etc.

eg. Sime Darby, IOI, KLK, FELDA

2. Malaysian based refineries with limited

plantations

eg. Southern Edible Oil, Kirana, SOP Edible Oils

3. Independent Refineries

eg. Wilmar, Cargill, Mewah, ISF, Palmaju Edible Oil

28

BREAKDOWN OF MALAYSIA REFINING

CAPACITY IN 2009

29

Plantation

Houses +

Small Holders

Independent

Estates

Fresh

Fruit

Bunches

(FFB)

Oil Mills

Crude Palm

Oil (CPO) +

(Palm

Kernels)

Domestic

Commodity

Brokers

Domestic

Dealers

Domestic

Refiners

Processed

Palm Oil

(PPO)

Domestic

Commodity

Brokers

International

Dealers

Selling

Agents

State

Trading

House

Importing

Refiners

Oils &

Fats

Processors

E

N

D

U

S

E

R

S

Direct Sales

Palm oil trading specifications and standard contracts developed by PORAM

have been instrumental to promote healthy trade and market practices

MARKETING CHAIN OF

MALAYSIAN PALM OIL

30

THE IMPORTANCE OF

THE REFINING SECTOR

Is the workhorse of the industry

It generates tremendous benefits in terms of

industrialization to the country, namely;

1. Provides huge outlet for the CPO, in the form of

processed oils

2. Provides feed-stocks for food industry, packing

plants, oleochemicals, animal feeds, etc.

3. Generates employment and other spin-off

ancillary services e.g. transportation, trading

houses, bulking installations, financing, etc. 31

MALAYSIAN PO AND PKO PRODUCTS

EXPORT FROM 2009 TO 2011 (MIL. MT)

2009 2010 2011 % Value Added

CRUDE PALM OIL 2.53 2.73 3.47 20%* -

RBD PALM 0IL 2.13 1.81 1.55 9%* +

RBD P OLEIN 7.48 8.21 9.00 52%* +++

RBD P STEARIN 1.58 1.73 1.78 10%* Co-product

COOKING OIL 0.90 0.87 0.78 4.5%* +++

PFAD 0.57 0.54 0.64 3.7%* By-product

CRUDE PKO 0.18 0.18 0.20 24%** -

RBD PKO 0.34 0.34 0.36 44%** ++

RBD PK STEARIN 0.09 0.14 0.13 16%** +++

RBD PK OLEIN 0.13 0.15 0.13 16%** Co-product

Note: Source: MPOB

RBD - Refined Bleached and Deodorized * Based on 17.22 mil.MT

PFAD - Palm Fatty Acid Distillate ** Based on 0.82 mil. MT

PKO - Palm Kernel Oil

PK - Palm Kernel

P - Palm

32

OUTLINE OF PRESENTATION

1. PORAM AND ITS OBJECTIVE

2. PALM OIL REFINING IN MALAYSIA

3. CURRENT STATUS OF THE INDUSTRY

4. CHALLENGES AND PROSPECTS

33

MALAYSIAN PO & PKO PRODUCTION

& EXPORT (MT) FROM 1975 TO 2010

PALM OIL PALM KERNEL OIL

PRODUCTION EXPORT PRODUCTION EXPORT

1975 1,257,573 93% 108,260 100%

1980 2,573,173 88% 222,285 98%

1985 4,134,463 83% 511,908 52%

1990 6,094,622 94% 827,233 83%

1995 7,810,546 83% 1,036,538 37%

2000 10,842,095 83% 1,384,685 37%

2005 14,961,654 90% 1,842,628 46%

2010 16,993,717 98% 2,014,942 57%

Note: * 5 Year Incremental Increase 2011

Source: MPOB PO Production 18.91 mil. Export 95%

PKO Production 2.14 mil. Export 54%

34

35

IMPORT OF PALM OIL TO SELECTED

MAJOR DESTINATIONS (MILLION MT)

FROM 2006 - 2011

2006 2007 2008 2009 2010 2011 % Inc.

CHINA PR 5.46 5.49 5.59 6.55 5.80 6.17 13%

FRM MSIA 3.57 3.72 3.65 3.97 3.45 3.81 6%

FRM INDO 1.93 1.69 1.91 2.58 2.33 2.35 21%

EU 27 4.59 4.65 5.29 5.85 5.87 5.46 19%

FRM MSIA 2.58 2.06 2.05 1.82 2.05 1.94 -25%

FRM INDO 2.01 2.00 2.59 3.12 3.08 2.50 24%

PAKISTAN 1.76 1.73 1.85 1.93 2.01 2.01 14%

FRM MSIA 0.96 0.99 1.29 1.70 1.92 1.75 82%

FROM INDO 0.40 0.74 0.56 0.22 0.09 0.26 -35%

INDIA 3.19 3.69 5.75 6.83 6.65 6.74 111%

FRM MSIA 0.56 0.51 0.98 1.54 1.19 1.68 200%

FROM INDO 2.62 3.12 4.68 5.26 5.44 5.01 91%

Source : Oil World 2012 Note: % Increase 2011 vs 2006

MALAYSIA IMPORTS RECORD QUANTITY OF

PROCESSED PALM OIL (PPO) IN FEB 2012

36

ISSUES CONFRONTING

THE REFINERY

1. Indonesian export duty structure that give

advantage to export of processed oils

2. EU import tax structure that gives

advantage to import of CPO (3.8%) and

disadvantage to processed oils (9%)

3. Indonesian CPO is selling at a discount

4. Malaysian CPO price is artificially held up

caused by the export of duty-free CPO

37

Calculation for Indonesian CPO FOB Basis :

Based on new structure which has been implemented

14

th

September 2011 onwards

1. Calculation for I ndonesian CPO FOB Basis: I ndonlocal CPO = USD 905

Indonesian local CPO, for May 2012 delivery: RM/USD 3.0560

( PTP Tender in Belawan/Dumai/Medan ) IDR/kg 9,189 = 2,766

Less: 10 % VAT / 1.1

= CPO local price in IDR/Kg: 8,354 Msianlocal CPO = RM/mt 3,360

Convert to USD: / {IDR/USD} 9,230

Convert to per mt: X 1,000

Indonesian Local CPO price ( Equivalent in

USD/mt):

USD/mt 905 I ndonlocal CPO

Add: Fobbing: USD/mt 5 Price advantage: RM/mt 594

CPO Export Duty, for April 2012 shipment ( 19,5 % ) USD/mt 218.40 USD/mt 194

CPO FOB Indonesia: USD/mt 1,128

38

Calculation for Indonesian RBD Palm Olein FOB Basis

: Based on new structure which has been implemented

14

th

September 2011 onwards

2

Calculation For I ndonesian RBD Palm Olein FOB Basis:

Indonesian local CPO in USD/mt, for May 2012 delivery: USD/mt 905

Add: Current market differential between Malaysian USD/mt

FOB RBD Palm Olein vs Malaysian local delivered CPO

( equivalent to RM 85/mt ): 28.0

Add: Fobbing: USD/mt 5

938

Add: RBD Palm OleinExport Duty (10 % ): USD/mt 115.10

( a ) Indonesian RBD Palm Olein FOB: USD/mt 1,053.00 ( a )

( b ) Malaysian RBD Palm Olein FOB: USD/mt 1,127.50 ( b )

Comment: I ndonesian RBD Palm OleinFOB has

cost advantage vsthat of Malaysian's [ (b) - (a) ]: USD/mt 74

39

INDONESIAN REFINERS MARGIN

ADVANTAGE OVER MALAYSIAN REFINERS

40

KEY CHANGES IN EXPORT TAX FOR MAJOR

PALM PRODUCTS

41

EXPORT TAX GAP BETWEEN KEY PALM

PRODUCTS AND CPO UNDER OLD AND NEW

TAX REGIMES

42

RISING EXPORTS OF CPO IN RECENT YEARS

DUE TO THE CPO TAX-FREE QUOTA

43

MALAYSIAN REFINING CAPACITY AND

UTILISATION RATE

44

SURVEY ON IMPACT ON INDONESIAN

EXPORT DUTY STRUCTURE

Company

Total Refining

Capacity per

year

No. of

Refinery

Refinery

Operating

Capacity

pre Sept

2011

Refinery

Operating

Capacity

post Sept

2011

Refining

margin

pre Sept

2011

Refining margin

post Sept 2011

Should the

current COP

export duty free

quota

amounting 3.5M

MT be

abolished?

Refinery 1 270,000 mt 1

More than

60%

More than

60%

Negative -

Fluctuates

from

positive to

negative

Negative - more

than RM100 pmt

negative during

Feb - Mar 2012

Yes

Refinery 2 540,000 mt 1

Between

31%-59%

Between

31%-59%

Below

RM50 /

tonne

Negative Yes

Refinery 3 720,000 mt 1

Between

31%-59%

Between

31%-59%

Below

RM50 /

tonne

Negative Yes

Refinery 4 2.8 million mt 3

More than

60%

Between

31% -

59%

Below

RM50 /

tonne

Negative Yes

Refinery 5 2,000 mt/day 2

Below

30%

Below

30%

Negative Negative Yes

Refinery 6 200,000 mt 2

Below

30%

Below

30%

Negative Negative Yes

45

MALAYSIAN REFINERS PROFIT MARGIN

TREND

46

LOSS OF REVENUE TO THE

ECONOMY

YEAR EXPORT

(MIL. TONNES)

AVERAGE

PRICE (RM)

EXPORT DUTY (%) LOSS REVENUE

(RM BILLION)

2 011

2010

2009

2008

2007

3.47

2.73

2.53

2.33

1.93

3,218

2,704

2,244

2,777

2,530

22%

22%

22%

22%

22%

2.45

1.62

1,24

1.42

1.07

TOTAL 12.99 7.80

In Indonesia, all CPO export has to be taxed to protect and expand their

downstream capacity and collect revenue

Malaysia has excess capacity and strong justification to keep CPO for own

downstream industries

Every tonne export of CPO will mean loss of market potential for a tonne of

processed oils

47

OUTLINE OF PRESENTATION

1. PORAM AND ITS OBJECTIVE

2. PALM OIL REFINING IN MALAYSIA

3. CURRENT STATUS OF THE INDUSTRY

4. CHALLENGES AND PROSPECTS

48

WE ARE NOT PROPHET OF DOOM

NO ONE IS DISPUTING THAT THE MALAYSIAN REFINING

SECTOR IS IN DIRE NEEDS

OUR MEMBERS HAVE BEEN PATIENCE AND RESPONSIBLE

WE ARE SEEKING A LEVEL PLAYING FIELD TO BE

COMPETITIVE

REFINING INDUSTRY IS AN ENGINE OF

INDUSTRIALIZATION

CONSEQUENCE TO THE WHOLE SUPPLY CHAIN IN THE

MALAYSIAN PALM OIL INDUSTRY

1. RM 80 BILLION INDUSTRY AT STAKE

2. LOST OF INVESTMENTS

3. LOST OF EMPLOYMENT, SPIN-OFF SERVICES, INCOME

ETC.

4. A STEP BACKWARD IN INDUSTRIALIZATION

5. CAN WE ACHIEVE A HIGH INCOME STATUS BY 2020?

49

WHO IS MAKING ALL THE MONEY

IN THE PALM OIL BUSINESS?

It is a misconception that the refining sector is making a decent

profit

As per MPOB Statistics 2012:

Average CPO Local Delivered = RM 3,218.00 per tonne

Estimate cost of CPO production = RM 1,500.00 per tonne

TOTAL GROSS PROFIT = RM 1,718.00 per tonne

Assume pay various tax/cess/etc

at 50% (as claimed by MEOA) = RM 859.00 per tonne

If you compared with average net refining margin of RM 45.14 per

tonne, it is only 5.2% of the plantation net profit

In 2011, the average refining margin is only 1.4% or RM 45.14 to the

cost of CPO at RM 3,286 on per tonne basis.

In order to survive, refiners need to have 5-6% average refining

margin.

50

51

MALAYSIAN POLICY OPTIONS

NO CHANGES IN POLICY

Maintain CPO Export Duty Free Quota

No export duty on processed palm oil products

POSSIBLE IMPACT

Negative refining margins

Independent refiners will close down/relocate

Plantation based refiners will leverage position

Increase CPO Export Duty Free Quota

52

MALAYSIAN POLICY OPTIONS

FOLLOW/ MIMIC INDONESIAN DUTY STRUCTURE

Match the full structure of Indonesian duty

Improvised Malaysian CPO export duty structure

POSSIBLE IMPACT

Neutralized the advantages enjoyed by Indonesia

Improved refining margins in Malaysia

Strengthen value addition activities

Provide confidence to independent refiners

Resistance by Malaysian plantation companies

53

MALAYSIAN POLICY OPTIONS

PROVIDE SUBSIDY TO THE MALAYSIAN REFINERS

Support local refiners margins

Create a level playing field on feed-stocks price

POSSIBLE IMPACT

Government to suffer financially

Price distortion in the market

Breaching of WTO rules

Earnings of smallholders will be affected

Politically un-popular

MY VIEWS

IF EVERYTHING IS STATUS QUO

Independent refiners will relocate to Indonesia

Plantation based companies (GLC) will be

pressured to take-up refining capacity

Malaysia will export more CPO

WHAT WILL INDONESIA GAIN ?

Competition among new refineries will put upward

pressure on Indonesian CPO prices

Intense focus on sustainability and environment

54

IMMEDIATE SOLUTIONS TO

ENHANCE COMPETITIVENESS

1. Suspension of CPO duty-free export quota

2. Concurrent reduction of CPO export duty (from

max 23%)

3. Imposition of CPKO export duty with a variable

structure

4. Removal of the current 5% export duty on RBD

Palm Kernel Oil

55

PROPOSED REVIEW ON

CPO AND CPKO EXPORT DUTY

The export duty on CPO and CPKO should be maintained. The advantage

of this position:-

1. To equalize the differential export duty structure in favour of

processed oils in Indonesia

2. To equalize the preferential import duty structure in favour of CPO

import in the EU

3. To make CPO and CPKO available for Malaysian refineries overseas

For CPO:

Duty should be based on the prevailing duty differences between

that of the Indonesian CPO and that of RBD Palm Olein

For CPKO:

Same structure as CPO. The duty should be based on the prevailing

export duty difference between that of Indonesian CPKO and that of

RBD Palm Kernel Oil.

56

DOMO ARIGATO

GONZAIMAS

57

For Further Enquiries

The Palm Oil Refiners Association

of Malaysia (PORAM)

801C/ 802A, Block B

Executive Suites, Kelana Business Centre

97 Jalan SS7/2

47301 Kelana Jaya

Selangor, Malaysia

Tel. No : +603-7492 0006

Fax No : +603-7492 0128

E-mail : poram@poram.org.my

Website : www.poram.org.my

58

Вам также может понравиться

- GVC-Palm OilДокумент27 страницGVC-Palm Oilsend2wish100% (1)

- Refinery of Palm OilДокумент14 страницRefinery of Palm OilEvantono Balin Christianto100% (1)

- Hungrystock CPO OutlookДокумент28 страницHungrystock CPO OutlooknindyОценок пока нет

- Case Study Palm Oil Refinery NewДокумент2 страницыCase Study Palm Oil Refinery NewFong Leong Chee 馮亮智100% (2)

- PORAM Heating Instructions Recd Nov 2014Документ1 страницаPORAM Heating Instructions Recd Nov 2014lu asenОценок пока нет

- Properties and Uses of Palm StearinДокумент4 страницыProperties and Uses of Palm StearinShu ShuadaОценок пока нет

- Interband Enterprise: Blackstone Impex SDN BHDДокумент3 страницыInterband Enterprise: Blackstone Impex SDN BHDFarooq AliОценок пока нет

- Palm Oil Mill EffluentДокумент6 страницPalm Oil Mill Effluentankitsaxena123100% (2)

- Crude Palm OilДокумент19 страницCrude Palm OilmarpadanОценок пока нет

- Properties of Palm Oil MargarineДокумент7 страницProperties of Palm Oil Margarinemcalidonio5656Оценок пока нет

- Oleochem Chap 1Документ47 страницOleochem Chap 1lolahonez100% (4)

- Chemical Properties Palm OilДокумент21 страницаChemical Properties Palm OilAmirah Mohd ZuberОценок пока нет

- A General Review of Palm Oil Mill EffluentДокумент3 страницыA General Review of Palm Oil Mill EffluentMykel-Deitrick Boafo DuoduОценок пока нет

- Edible Oil GheeДокумент25 страницEdible Oil GheeLTE00233% (3)

- Malaysia's Palm Oil Export Potential to 2035Документ8 страницMalaysia's Palm Oil Export Potential to 2035BagasNurWibowowОценок пока нет

- Wenzhou Bangcheng Grain and Oil Machinery Co.,Ltd: 20T/D Soybean & Sunflower Oil Full Continuous Refinery Plant QuotationДокумент3 страницыWenzhou Bangcheng Grain and Oil Machinery Co.,Ltd: 20T/D Soybean & Sunflower Oil Full Continuous Refinery Plant QuotationMuhammad aliОценок пока нет

- Coconut Oil - WikipediaДокумент11 страницCoconut Oil - WikipediaYusuf Aliyu UОценок пока нет

- Handbook For Oleochemical in IndustriesДокумент2 страницыHandbook For Oleochemical in Industriesbotakmbg6035Оценок пока нет

- A Palm Oil Mill in Oyo StateДокумент10 страницA Palm Oil Mill in Oyo StateindiamillersОценок пока нет

- Malaysian Palm Oil IndustryДокумент14 страницMalaysian Palm Oil IndustryFrz Haikal100% (1)

- Indian Edible Oil Industry: Types of Oils Commonly in Use in IndiaДокумент11 страницIndian Edible Oil Industry: Types of Oils Commonly in Use in IndiaMani BmvОценок пока нет

- Palm Oil RefiningДокумент10 страницPalm Oil Refiningharrison_sОценок пока нет

- Dokumen - Tips - Westfalia in Palm Oil Mill PDFДокумент24 страницыDokumen - Tips - Westfalia in Palm Oil Mill PDFagus rasidОценок пока нет

- Chapter 3 - Part 1 RefiningДокумент46 страницChapter 3 - Part 1 RefiningAzhan FikriОценок пока нет

- Palm OilДокумент55 страницPalm Oilhemanggor100% (1)

- PIPOC 2011 Congress on Palm Oil Fortification and EnergizationДокумент42 страницыPIPOC 2011 Congress on Palm Oil Fortification and EnergizationBung HarunОценок пока нет

- Greasy Palms BuyersДокумент70 страницGreasy Palms BuyersEmun KirosОценок пока нет

- BiodieselДокумент42 страницыBiodieselFachrurrozi IyunkОценок пока нет

- DegummingДокумент1 страницаDegummingvanessa100% (1)

- Engineering Proposal and Quotation: 50T/D Continuous Refining Workshop EquipmentДокумент26 страницEngineering Proposal and Quotation: 50T/D Continuous Refining Workshop EquipmentMuhammad aliОценок пока нет

- Using DOBI to Characterize Crude Palm Oil QualityДокумент5 страницUsing DOBI to Characterize Crude Palm Oil QualityEffy SaifulОценок пока нет

- Process Lines For Crude Palm Oil Production - tcm11 55437 PDFДокумент24 страницыProcess Lines For Crude Palm Oil Production - tcm11 55437 PDFLim Zamora Gemota100% (1)

- PETДокумент13 страницPETSyed Israr HussainОценок пока нет

- Biogas from Palm Oil Mill EffluentДокумент10 страницBiogas from Palm Oil Mill EffluentRyan HofmannОценок пока нет

- Risk Assessment Palm OilДокумент22 страницыRisk Assessment Palm Oilanniq141100% (1)

- Project Profile On Petroleum JellyДокумент10 страницProject Profile On Petroleum JellyG.p.AiyerОценок пока нет

- Indonesian OIL PALM & REFINERY Directory, 2012Документ5 страницIndonesian OIL PALM & REFINERY Directory, 2012Central Data MediatamaОценок пока нет

- India's edible oil imports projected to rise 9% in 2010Документ18 страницIndia's edible oil imports projected to rise 9% in 2010Ln Chakky100% (1)

- A Pragmatic Study On Buyers of Edible OilsДокумент36 страницA Pragmatic Study On Buyers of Edible OilsNeha Motwani100% (3)

- Poram Standard Specifications For Processed Palm Oil PDFДокумент2 страницыPoram Standard Specifications For Processed Palm Oil PDFlaboratory ITSI100% (1)

- Palm Fatty Acid Distillate BiodieselДокумент4 страницыPalm Fatty Acid Distillate Biodieseldwi anggraeniОценок пока нет

- Nandan Petrochem LTD - Company ProfileДокумент12 страницNandan Petrochem LTD - Company ProfileNandan Petrochem LtdОценок пока нет

- World Bank Group - Palm Oil - Econsultation On Draft Framwork For Engagement - EtranscriptДокумент131 страницаWorld Bank Group - Palm Oil - Econsultation On Draft Framwork For Engagement - EtranscriptRichard Anthony AitkenОценок пока нет

- WWF Palm Oil Scorecard 2016Документ59 страницWWF Palm Oil Scorecard 2016edienews100% (1)

- PWC Palm Oil Plantation 1Документ16 страницPWC Palm Oil Plantation 1Anonymous DJrec2Оценок пока нет

- Edible Oil SourcesДокумент22 страницыEdible Oil Sourcesshym hjrОценок пока нет

- Edible Oil.Документ9 страницEdible Oil.Bilal RiazОценок пока нет

- Logistic-Management in OilДокумент65 страницLogistic-Management in OilSamuel DavisОценок пока нет

- Palm Oil MillДокумент20 страницPalm Oil Millharrison_sОценок пока нет

- Activation of Spent Bleaching Earth For Dehumidification ApplicationДокумент8 страницActivation of Spent Bleaching Earth For Dehumidification ApplicationWorld-Academic JournalОценок пока нет

- Oil and Fat Technology Lectures IIIДокумент42 страницыOil and Fat Technology Lectures IIIaulger100% (1)

- Oil PalmДокумент74 страницыOil PalmdadokaidoОценок пока нет

- MPOCPOTSДокумент37 страницMPOCPOTSOng Yee SengОценок пока нет

- Palm Oil Summit 2012Документ38 страницPalm Oil Summit 2012Ong Yee SengОценок пока нет

- Lecture 8-Sustainability of Palm OilДокумент55 страницLecture 8-Sustainability of Palm OilAdrianaBuitragoGonzálezОценок пока нет

- Palm Oil Crystallisation: A ReviewДокумент11 страницPalm Oil Crystallisation: A Reviewn73686861Оценок пока нет

- (Part 4) LCA of refined palm oil production and fractionationДокумент15 страниц(Part 4) LCA of refined palm oil production and fractionationdwikusОценок пока нет

- Life Cycle Assessment of Refined Palm Oil Production and Fractionation (Part 4)Документ14 страницLife Cycle Assessment of Refined Palm Oil Production and Fractionation (Part 4)darwin dacier peña gonzalezОценок пока нет

- Industrial Report ShimaДокумент21 страницаIndustrial Report ShimaAina DienaОценок пока нет

- MPOB GMP Palm Oil MillsДокумент21 страницаMPOB GMP Palm Oil MillsAbu Navaradeeforty88% (8)

- DSR 250 Manual 104 en CAДокумент233 страницыDSR 250 Manual 104 en CAHendrawan DarmalimОценок пока нет

- Install W7Документ1 страницаInstall W7Hendrawan DarmalimОценок пока нет

- ReadmeДокумент4 страницыReadmeMuhammad RafsanzaniОценок пока нет

- Install W7Документ1 страницаInstall W7Hendrawan DarmalimОценок пока нет

- ReadPlease SerialДокумент2 страницыReadPlease SerialHendrawan DarmalimОценок пока нет

- MSPOДокумент59 страницMSPOlowyuyao2850% (2)

- Mspo TraceДокумент50 страницMspo TraceIshakОценок пока нет

- (123dok - Com) Millref Name Parent Sourced m0005 Kilang Kelapa Sawit Siang Aa Sawit SDN BHD Direct m0006 Ace Oil MiДокумент23 страницы(123dok - Com) Millref Name Parent Sourced m0005 Kilang Kelapa Sawit Siang Aa Sawit SDN BHD Direct m0006 Ace Oil MiHendi KarnainОценок пока нет

- Our Businesses: PlantationДокумент2 страницыOur Businesses: PlantationVeloo GunasagaranОценок пока нет

- Sri Lanka Palm OilДокумент26 страницSri Lanka Palm OilSarawananNadarasaОценок пока нет

- 140-2nd ICBER 2011 PG 389-414 IOI CorporationДокумент26 страниц140-2nd ICBER 2011 PG 389-414 IOI CorporationVivek BanerjeeОценок пока нет

- IOI Group - Sustainability Progress Update: Date: 1 August 2017Документ10 страницIOI Group - Sustainability Progress Update: Date: 1 August 2017Mul YadiОценок пока нет

- Minimum Wage PolicyДокумент3 страницыMinimum Wage PolicyMillyОценок пока нет

- MEC Company Profile 202211Документ36 страницMEC Company Profile 202211wahyudiОценок пока нет

- IOI Edible Oils Sandakan Full Mill ListДокумент1 страницаIOI Edible Oils Sandakan Full Mill ListBruce KingОценок пока нет

- RowingДокумент35 страницRowingRizky LubisОценок пока нет

- The Oleochemical Industry in MalaysiaДокумент8 страницThe Oleochemical Industry in MalaysiaIra MunirahОценок пока нет

- M3-12. - Marcello Brito - RSPOДокумент20 страницM3-12. - Marcello Brito - RSPOCarlos FernándezОценок пока нет

- Mohd Fazlieman List of Companies For Industrial Training PlacementДокумент4 страницыMohd Fazlieman List of Companies For Industrial Training PlacementFazlie IslamОценок пока нет

- PoramДокумент58 страницPoramHendrawan Darmalim100% (1)

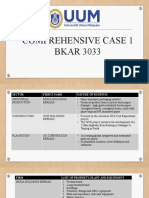

- Comprehensive Case 1 BKAR 3033Документ7 страницComprehensive Case 1 BKAR 3033nadiahОценок пока нет

- IOI_AR2022Документ73 страницыIOI_AR2022Ali RanggaОценок пока нет

- MGT 162 Individual Assingment - Ioi GroupДокумент10 страницMGT 162 Individual Assingment - Ioi GroupFarahin SaidОценок пока нет

- Ioi Corporation Berhad: Others Plantations Resource-Based ManufacturingДокумент1 страницаIoi Corporation Berhad: Others Plantations Resource-Based ManufacturingAmin AkasyafОценок пока нет

- Mspo TraceДокумент8 страницMspo TraceIshakОценок пока нет

- Narrowing GapДокумент12 страницNarrowing Gaplester wollisОценок пока нет

- Palm Oil Mill ListДокумент68 страницPalm Oil Mill ListBruce KingОценок пока нет

- National Biomass Strategic Communication Plan AДокумент30 страницNational Biomass Strategic Communication Plan ANad DaniОценок пока нет

- ZKO-00001-25 Batch W8871A9891Документ2 страницыZKO-00001-25 Batch W8871A9891dicky bhaktiОценок пока нет

- Berita: of Palm OilДокумент17 страницBerita: of Palm OilAgus BudiantoОценок пока нет

- IOI Group CoreДокумент12 страницIOI Group CoreSarah Emy SalmanОценок пока нет

- Mill Location Data by Parent Company, Mill Name, and CountryДокумент91 страницаMill Location Data by Parent Company, Mill Name, and Countryferdial2005Оценок пока нет

- Average Score: Nestle (Malaysia) (Nestle-Ku)Документ11 страницAverage Score: Nestle (Malaysia) (Nestle-Ku)Zhi Ming CheahОценок пока нет

- Rt10 Participant List (19 October 2012)Документ10 страницRt10 Participant List (19 October 2012)Indra AndolaОценок пока нет

- Malaysian Palm Oil Mills Location DataДокумент12 страницMalaysian Palm Oil Mills Location DataOperation LNVОценок пока нет