Академический Документы

Профессиональный Документы

Культура Документы

CMWF Gaining Gound July 2014

Загружено:

iggybauИсходное описание:

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

CMWF Gaining Gound July 2014

Загружено:

iggybauАвторское право:

Доступные форматы

The mission of The

Commonwealth Fund is to

promote a high performance

health care system. The Fund

carries out this mandate by

supporting independent research

on health care issues and making

grants to improve health care

practice and policy. Support for

this research was provided by The

Commonwealth Fund. The views

presented here are those of the

authors and not necessarily those

of The Commonwealth Fund or

its directors, officers, or staff.

Tracking Trends in

Health system performance

The

COMMONWEALTH

FUND

For more information about this

brief, please contact:

Sara R. Collins, Ph.D.

Vice President, Health Care

Coverage and Access

The Commonwealth Fund

src@cmwf.org

To learn more about new

publications when they become

available, visit the Funds website

and register to receive email

alerts.

Commonwealth Fund pub. 1760

Vol. 16

Gaining Ground: Americans Health

Insurance Coverage and Access to Care

After the Affordable Care Acts First

Open Enrollment Period

Sara R. Collins, Petra W. Rasmussen, and Michelle M. Doty

Abstract A new Commonwealth Fund survey finds that in the wake of the

Affordable Care Acts first open enrollment period, significantly fewer working-age

adults are uninsured than just before the sign-up period began, and many have used

their new coverage to obtain needed care. The uninsured rate for people ages 19 to

64 declined from 20 percent in the July-to-September 2013 period to 15 percent

in the April-to-June 2014 period. An estimated 9.5 million fewer adults were unin-

sured. Young men and women drove a large part of the decline: the uninsured rate

for 19-to-34-year-olds declined from 28 percent to 18 percent, with an estimated

5.7 million fewer young adults uninsured. By June, 60 percent of adults with new

coverage through the marketplaces or Medicaid reported they had visited a doctor

or hospital or filled a prescription; of these, 62 percent said they could not have

accessed or afforded this care previously.

OVERVIEW

The Affordable Care Acts first open enrollment period for health insur-

ance coverage lasted from October 2013 through March 2014. By the end

of that period, as many as 14 million people had either selected a private

health plan through the marketplaces or newly enrolled in Medicaid.

1

To

see how this new enrollment has affected the nations uninsured rate and

peoples access to health care, the Commonwealth Fund Affordable Care

Act Tracking Survey interviewed a nationally representative sample of 19-to-

64-year-old adults, including a sample of individuals who were potentially

eligible for the laws new coverage options. The survey firm SSRS inter-

viewed 4,425 adults by telephone from April 9 to June 2, 2014. Where pos-

sible, results are compared to a similar survey that SSRS conducted for The

Commonwealth Fund from July 15 to September 8, 2013.

JULY 2014

2 The Commonwealth Fund

Here is what the survey found:

The uninsured rate for the 19-to-64 age group declined from 20 percent in JulySeptember

2013 to 15 percent in AprilJune 2014, which means there were an estimated 9.5 million

fewer uninsured adults.

The uninsured rate for young adults 19 to 34 declined the most of any adult age group, fall-

ing from 28 percent to 18 percent, or 5.7 million fewer uninsured young adults.

The uninsured rate fell significantly for people with low and moderate incomes and for

Latinos.

The decisions by states to expand Medicaid or not have had significant implications for

the nations poorest people. In the 25 states that, along with the District of Columbia, had

expanded their Medicaid programs by April, the uninsured rate for adults with incomes

under 100 percent of the federal poverty level declined from 28 percent to 17 percent. In

the states that had not expanded their programs, the rate remained essentially unchanged

at 36 percent.

The adult uninsured rate fell significantly in the nations two largest states, California

and Texas. Among the six largest states, Texas and Floridaneither of which expanded

Medicaidhave the highest uninsured rates.

Four of five people with new marketplace or Medicaid coverage areoptimistic that it will

improve their ability to get the care they need. More than half said they are better off now

than they were before enrolling in their new insurance.

By June, six of 10 adults with new marketplace or Medicaid coverage said they had used their

insurance to go to a doctor or hospital or to fill a prescription. A majority said they would

not have been able to access or afford this care before enrolling.

More than half of adults with new coverage said their plan included all or some of the doc-

tors they wanted.

One of five adults with new coverage tried to find a new primary care physician; three-quar-

ters found it very or somewhat easy to do so.

SURVEY FINDINGS IN DETAIL

The Affordable Care Act expands health insurance coverage in three ways: by subsidizing private

plans offered through the health insurance marketplaces, by substantially increasing eligibility for

Medicaid, and by banning insurance practices that penalized people with even minor health prob-

lems. These provisions are targeted to Americans who have long been at the highest risk of going

without coverage: people with low and moderate incomes; those with less access to employer-based

coverage, such as young adults; and individuals who have great difficulty buying a comprehensive

insurance policy because of their health status, gender, or other characteristics.

2

The Congressional

Budget Office projects that these provisions will gradually reduce the number of people without

health insurance by 12 million people in 2014 and 26 million in 2017.

3

Gaining Ground 3

The percentage of Americans who are uninsured is falling, with young adults

experiencing the largest decline of any age group.

The Commonwealth Fund survey findings suggest that, so far, the law is on track to meeting first-

year coverage projections. The percentage of adults ages 19 to 64 who are uninsured fell from 20 per-

cent in the JulySeptember 2013 period, just prior to the Affordable Care Acts first open enrollment

period, to 15 percent in AprilJune 2014 (Exhibit 1).

4

This translates into an estimated 9.5 million

fewer uninsured working-age adultsnot including children who also are likely to have gained cover-

age this year.

5

Particularly benefiting from the coverage expansions are young adults, who had the highest

uninsured rate of any adult age group prior to open enrollment. In the survey, the uninsured rate for

19-to-34-year-olds fell from 28 percent in JulySeptember 2013 to 18 percent in AprilJune 2014,

the largest decline among age groups. There are now approximately 5.7 million fewer uninsured

young adults, representing more than half the overall decline in the number of uninsured adults.

6

The sliding-scale insurance premium subsidies and the Medicaid expansion appear to be

helping adults with low and moderate incomes as intended. Across the income spectrum, these indi-

viduals were most likely to be uninsured prior to open enrollment and, since then, have experienced

the largest gains in coverage. Among adults with incomes under 138 percent of poverty ($15,856

for an individual and $32,499 for a family of four), the uninsured rate dropped from 35 percent to

24 percent (Exhibit 2). Among adults with incomes in the next-higher income group, between 138

percent and 249 percent of poverty ($28,725 for an individual and $58,875 for a family of four), the

uninsured rate fell from 32 percent to 22 percent.

Similarly, Latinos, who have been the most likely of any racial or ethnic group to lack insur-

ance, also made strong gains in the past year. In JulySeptember 2013, 36 percent of Latinos were

without health insurance, compared with 21 percent of African Americans and 16 percent of whites.

By AprilJune 2014, 23 percent of Latinos were uninsured.

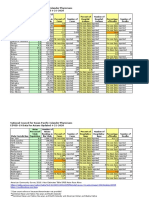

Exhibit 1. After the End of Open Enrollment, the Percentage of U.S. Adults

Who Are Uninsured Declined from 20 Percent to 15 Percent, or by 9.5 Million;

Young Adults Experienced the Largest Decline Among All Adult Age Groups

Source: The Commonwealth Fund Affordable Care Act Tracking Surveys, JulySept. 2013 and AprilJune 2014.

Percent adults ages 1964 uninsured

20

28

18

14

15

18

15

11

0

10

20

30

40

50

Total Ages 1934 Ages 3549 Ages 5064

JulySept. 2013 AprilJune 2014

4 The Commonwealth Fund

Uninsured rates for the nations poorest adults are highest in states that did not

expand eligibilty for Medicaid.

In the aftermath of the Supreme Courts 2012 decision that turned the Affordable Care Acts expan-

sion of Medicaid eligibility into a state option, 25 states and the District of Columbia had chosen to

expand their programs and were enrolling people as of April 2014.

7

In states that are not expanding

Medicaid, adults at 100 percent of the poverty level and above are eligible for subsidized private plans

offered through the marketplaces. But because Congress assumed that people below poverty would be

eligible for Medicaid under the expansion, the poorest adults in states that do not expand eligibility

have no new subsidized coverage options (the exception is legal immigrants who are in the five-year

waiting period for Medicaid).

As a result, we see significant differences across states in uninsured rates for adults living

below poverty. Where Medicaid eligibility has been expanded and people were enrolling as of April,

the uninsured rate for adults with incomes under 100 percent of poverty declined from 28 percent

to 17 percent (Exhibit 3). In states that had not expanded eligibility for Medicaid by April, the unin-

sured rate for the poorest adults remained statistically unchanged at 36 percent.

Texas and Florida have the highest uninsured rates among the six largest states.

The survey oversampled adults in the nations six largest states to allow for a preliminary look at the

laws early effects on state uninsured rates. The most accurate state estimates of uninsured rates gener-

ally use two years of data from large federal surveys like the Current Population Survey. These esti-

mates should be viewed as preliminary state-level measures of the early effects of the law.

Among the six states, Texas and Florida, both of which have yet to expand Medicaid eligibil-

ity, continue to have the highest uninsured rates for the overall working-age population (Exhibit 4).

Other factors besides Medicaid expansion also contribute to state-by-state differences in coverage.

Although the Affordable Care Act sets a national floor of standards and rules for the marketplaces,

for the Medicaid expansion, and for private insurance market reforms, the law, together with the

Exhibit 2. Across Incomes and Racial and Ethnic Groups, Adults with Low Incomes

and Latinos Experienced the Largest Declines in Uninsured Rates

Note: FPL refers to federal poverty level.

Source: The Commonwealth Fund Affordable Care Act Tracking Surveys, JulySept. 2013 and AprilJune 2014.

Percent adults ages 1964 uninsured

20

35

32

12

4

16

21

36

20

15

24

22

10

3

12

20

23

11

0

10

20

30

40

50

Race/Ethnicity Income

Total <138%

FPL

138%

249%

FPL

250%

399%

FPL

400% FPL

or more

White African

American

Latino Other

JulySept. 2013 AprilJune 2014

Gaining Ground 5

2012 Supreme Court decision, affords states considerable flexibility in implementing these changes.

In addition, states are starting in different places with regard to coverage because of longstanding

variation in how states regulate their individual insurance markets, the degree to which people have

employer-based coverage, income eligibility levels for public insurance programs, and demographics.

Moreover, some states have passed laws restricting the ability of navigators and other personnel who

assist eligible people with the enrollment process.

8

Exhibit 3. The Percent of Uninsured Adults with Incomes Under 100 Percent of Poverty

Fell Sharply in States That Expanded Medicaid; More Than a Third of Poor Adults

Remained Uninsured in States That Did Not Expand Medicaid

Note: States were coded as expanding their Medicaid program if they began enrolling individuals in April or earlier. These states include

AR, AZ, CA, CO, CT, DE, HI, IA, IL, KY, MA, MD, MI, MN, ND, NJ, NM, NV, NY, OH, OR, RI, VT, WA, WV, and the District of Columbia. All other

states were coded as not expanding.

Source: The Commonwealth Fund Affordable Care Act Tracking Surveys, JulySept. 2013 and AprilJune 2014.

Percent adults ages 1964 uninsured with incomes below 100 percent of poverty who were uninsured

33

28

38

26

17

36

0

10

20

30

40

50

Total Expanded Medicaid Did not expand Medicaid

JulySept. 2013 AprilJune 2014

(25 states + D.C.) (25 states)

Exhibit 4. Uninsured Rates Fell Sharply in California and Texas;

Florida and Texas Continue to Have the Highest Uninsured Rates Among Largest States

Source: The Commonwealth Fund Affordable Care Act Tracking Surveys, JulySept. 2013 and AprilJune 2014.

Percent adults ages 1964 uninsured

20

22

30

15

12

14

34

15

11

26

8

10

14

22

0

10

20

30

40

50

Total California Florida Illinois New York Pennsylvania Texas

JulySept. 2013 AprilJune 2014

6 The Commonwealth Fund

California, the largest state, was the first state to pass legislation to develop its own market-

place. It also has expanded eligibility for Medicaid and pursued an aggressive outreach and enrollment

campaign over the first enrollment period. The survey finds that the uninsured rate has fallen by half

in that state, dropping from 22 percent prior to open enrollment to 11 percent by June 2014.

Texas and Florida, on the other hand, opted for federally operated marketplaces in addition

to not expanding their Medicaid programs. Both states also have implemented laws restricting the

work of navigators and other assisters.

9

Nevertheless, enrollment through the marketplaces in both

states exceeded expectations: nearly 1 million people in Florida and more than 700,000 in Texas had

selected a plan through the marketplace by the end of March.

10

The survey shows that the uninsured

rate in Texas dropped significantly, from 34 percent to 22 percent; Floridas decline was not statisti-

cally significant. The current uninsured rates in Texas and Florida are statistically the same, and sig-

nificantly higher than those in California, Illinois, New York, and Pennsylvania.

Public awareness of the marketplaces and visits to them climbed over the

enrollment period.

During the first open enrollment period, people without access to affordable employer-based coverage

in every state and the District of Columbia could shop for health insurance in the marketplaces and

apply for financial assistance to pay their premiums and reduce their cost-sharing. They also could

find out if they were eligible for Medicaid.

The survey found that marketplace awareness among adults potentially eligible for the new

coverage optionsthose who either are uninsured or have individually purchased coveragedoubled

during the enrollment period (Exhibit 5).

11

Awareness also rose significantly across the full population

of adults ages 19 to 64 (39% to 73%) (Table 1).

Exhibit 5. Awareness of the Affordable Care Acts Marketplaces and Financial Assistance

Among Potentially Eligible Adults Doubled by the End of Open Enrollment

* Question wording changed between the JulySeptember survey and the AprilJune survey.

Source: The Commonwealth Fund Affordable Care Act Tracking Surveys, JulySept. 2013 and AprilJune 2014.

Percent aware

Adults ages 1964 who are uninsured or have individual coverage

32

27

34

49

30

27

30

46

68

55

75

81

59

43

67

80

0

25

50

75

100

Total <138%

FPL

138%

399% FPL

400% FPL

or more

Total <138%

FPL

138%

399% FPL

400% FPL

or more

JulySept. 2013* AprilJune 2014

Many people without affordable health benefits

through a job may be eligible for financial help to pay

for their health insurance in these new marketplaces.

Are you aware that financial assistance for

health insurance is available under the reform law?

Since the beginning of October, under the health reform law,

also known as the Affordable Care Act, new marketplaces

have been open in each state where people who do not

have affordable health insurance through a job can shop

and sign up for health insurance.

Are you aware of this new marketplace in your state?

Gaining Ground 7

People also are significantly more aware of the availability of the laws financial assistance.

During the enrollment period, awareness doubled among adults who are potentially eligible for cover-

age and climbed from 40 percent to 68 percent across the full adult population (Exhibit 5, Table 1).

12

Awareness of the new coverage options also increased among those who stand to benefit the

most, people with low and moderate incomes and the uninsured. But their awareness continues to lag

that of higher-income and insured adults. Only two of five adults (43%) who are potentially eligible

for coverage with incomes under 138 percent of poverty, and fewer than half (47%) of uninsured

adults, know that financial assistance is available to buy health insurance (Exhibit 5, Table 1).

As awareness climbed, more people visited the marketplaces over the enrollment period. In

two Commonwealth Fund surveys conducted by SSRS in late 2013, visits by adults who are poten-

tially eligible for coverage rose from 17 percent in October to 24 percent in December (Exhibit 6). By

June of this year, 43 percent of the potentially eligible population had visited a marketplace.

Visitors to the marketplaces enrolled in both private plans and Medicaid; more

young adults than older adults enrolled in Medicaid.

During the first open enrollment period, people in 14 states shopped for health coverage in state-run

marketplaces (the District of Columbia also runs its own marketplace), while residents of 36 states

shopped for coverage on the federally operated website, HealthCare.gov. Technical problems with

the federal website made enrollment very difficult in October and November. A few states, includ-

ing Maryland, Massachusetts, and Oregon, also had serious problems with their sites that dampened

enrollment for the duration of the signup period.

According to the survey, half (51%) of adults who visited the marketplaces during the open

enrollment period enrolled in new coverage (Exhibit 7). More adults reported selecting a private plan

than enrolling in Medicaid (29% vs. 19%). But there were significant differences by age. Among

visitors who were between 19 and 34, the number who enrolled in Medicaid was roughly equal to

Exhibit 6. More Than Two of Five Adults Who Were Potentially Eligible for Coverage

Had Visited a Marketplace by June, Up from 24 Percent in December

Source: The Commonwealth Fund Affordable Care Act Tracking Surveys, Oct. 2013, Dec. 2013, and AprilJune 2014.

Percent who visited marketplace

Have you gone to this new marketplace to shop for health insurance?

This could be by mail, in person, by phone, or on the Internet.

Adults ages 1964 who are uninsured or have individual coverage

17

24

43

Oct. 2013 Dec. 2013 AprilJune 2014

0

25

50

75

8 The Commonwealth Fund

the number who selected a private plan. In contrast, a much larger share of those between 50 and 64

selected a private plan than enrolled in Medicaid (36% vs. 16%).

This means that young adults comprised the largest share of new adult enrollment in

Medicaid by June, and older adults comprised the largest share of adult enrollment in private plans

sold through the marketplaces. Forty-two percent of survey respondents who enrolled in Medicaid

through the marketplaces or who had been enrolled in Medicaid for less than one year were ages

19 to 34, compared with 25 percent who were ages 50 to 64 (Exhibit 8). In contrast, 43 percent of

adults selecting a marketplace plan were between 50 and 64, versus 24 percent between 19 and 34.

Exhibit 7. Of Adults Who Visited the Marketplaces, Three of 10 Selected a Private Plan

and One of Five Enrolled in Medicaid, by June 2014

Note: Bars may not sum to indicated total because of rounding. This question was asked only of those individuals who said they had visited

a marketplace. More people may have enrolled in coverage through Medicaid or a qualified health plan outside of the marketplace.

Source: The Commonwealth Fund Affordable Care Act Tracking Survey, AprilJune 2014.

Did you select a private health plan or enroll in Medicaid through the marketplace?

Adults ages 1964 who went to marketplace

36

29

21

29

56 16

48 17

48 26

51 19

3

3

1

2

42

49

47

46

Ages 5064

Ages 3549

Ages 1934

Total

Selected a private

health plan

Enrolled in

Medicaid

Selected a plan,

but not sure if

private or Medicaid

Did not select a

private plan or

enroll in Medicaid

Exhibit 8. Young Adults Composed a Greater Share of New Adult Medicaid Enrollment,

Older Adults a Greater Share of Marketplace Enrollment

Notes: Segments may not sum to 100 percent because of rounding. * New enrollees include those who signed up for private coverage

through the marketplace, those who signed up for Medicaid through the marketplace, those who signed up for coverage through the

marketplace but are not sure if it is Medicaid or private coverage, and those who have been enrolled in Medicaid for less than 1 year.

** This includes some individuals who enrolled in Medicaid outside of the marketplace, but have been covered by Medicaid for less than 1 year.

Source: The Commonwealth Fund Affordable Care Act Tracking Survey, AprilJune 2014.

5064

34%

1934

33%

3549

32%

Total new enrollees*

ages 1964 Enrolled in Medicaid**

Selected a private plan

through marketplace

Refused

2%

5064

43%

1934

24%

3549

30%

Refused

3%

5064

25%

1934

42%

3549

33%

Refused

1%

Gaining Ground 9

The majority of adults who enrolled in coverage during the first open enrollment period were

previously uninsured. Nearly three of five adults (59%) who selected a private plan and 66 percent of

those who enrolled in Medicaid were uninsured (Exhibit 9, Table 2).

13

The findings also show that some new enrollment comprised people who previously had

employer coverage or a plan they had purchased in the individual market. Under the Affordable Care

Act, in states that expand Medicaid, people with incomes under 138 percent of poverty are eligible

for the program regardless of their current employer coverage. Those with incomes between 100 per-

cent and 400 percent of poverty are eligible for subsidized coverage through the marketplaces if they

have an offer of employer insurance that is deemed not affordable to them or does not meet mini-

mum coverage standards.

People with new private plans or Medicaid hold positive views of their new health

insurance.

The survey asked adults who had selected a private plan through the marketplaces or newly enrolled

in Medicaid about their views of their new health insurance. Large majorities of adults with new cov-

erageregardless of prior insurance status, age, political affiliation, or new coverage sourceare opti-

mistic that their new insurance will improve their ability to get the health care that they need (Exhibit

10). Equal shares of people who had prior insurance or those were previously uninsured expressed

optimism. Medicaid enrollees (86%), young adults (85%), people who identified themselves as

Democrats (88%), and people with low and moderate incomes (85%) were the most optimistic about

their new coverage. (There were no statistically significant differences between new enrollees with

varying health status.)

Exhibit 9. More Than Three of Five Adults Who Selected a Private Plan or Enrolled in

Medicaid Were Uninsured Prior to Gaining Coverage

* New enrollees include those who signed up for private coverage through the marketplace, those who signed up for Medicaid through

the marketplace, those who signed up for coverage through the marketplace but are not sure if it is Medicaid or private coverage, and

those who have been enrolled in Medicaid for less than 1 year. ** This includes some individuals who enrolled in Medicaid outside of the

marketplace, but have been covered by Medicaid for less than 1 year.

Source: The Commonwealth Fund Affordable Care Act Tracking Survey, AprilJune 2014.

Adults ages 1964 who selected a private plan or enrolled in Medicaid through marketplace

or have had Medicaid for less than 1 year

Percent

What type of health insurance did you have prior to getting your new coverage?

63

59

66

18

21

17

9

17

1

4

1

8

1 1 1

0

25

50

75

100

Total new enrollees* Selected a private plan

through marketplace

Enrolled in Medicaid**

Uninsured Employer coverage Individual coverage Medicaid Other

10 The Commonwealth Fund

More than half of adults with new coverage consider themselves to be better off now than

they were before they got their new insurance (Exhibit 11). A majority (61%) of people who had

been uninsured prior to getting their new insurance and those who had been insured (52%) said they

Exhibit 10. Four of Five Adults with New Coverage Said They Were Very or Somewhat

Optimistic That Their New Coverage Would Improve Their Ability to Get the Care They Need

Notes: Segments may not sum to indicated total because of rounding. Bars may not sum to 100 percent because of dont know/refusal to

respond. FPL refers to federal poverty level. * This includes some individuals who enrolled in Medicaid outside of the marketplace, but have

been covered by Medicaid for less than 1 year.

Source: The Commonwealth Fund Affordable Care Act Tracking Survey, AprilJune 2014.

Adults ages 1964 who selected a private plan or enrolled in Medicaid through marketplace

or have had Medicaid for less than 1 year

Overall, how optimistic are you that your new health insurance is going to

improve your ability to get the health care that you need?

4

10

6

13

5

9

7

6

10

5

7

7

7

7

12

4

18

7

10

11

6

13

6

9

10

10

48

49

41

42

42

39

41

46

35

46

36

45

42

38

29

48

24

43

39

40

39

39

40

45

36

39

Independent

Republican

Democrat

250% FPL or more

Below 250% FPL

Ages 5064

Ages 3549

Ages 1934

Selected a private plan

Enrolled in Medicaid*

Previously insured

Previously uninsured

Total 81

85

81

78

17

12

18

19

85

66

88

13

31

78

85

11

22

12

17

16

81

81

23

11

75

86

Not at all optimistic Not very optimistic Somewhat optimistic Very optimistic

Exhibit 11. A Majority of Adults with New Coverage Said They Were Better Off Now

* This includes some individuals who enrolled in Medicaid outside of the marketplace, but have been covered by Medicaid for less than 1 year.

** Respondent said health status was fair or poor or said they had at least one of the following chronic diseases: hypertension or high blood

pressure; heart disease; diabetes; asthma, emphysema, or lung disease; high cholesterol; depression or anxiety.

Source: The Commonwealth Fund Affordable Care Act Tracking Survey, AprilJune 2014.

Adults ages 1964 who selected a private plan or enrolled in Medicaid through marketplace

or have had Medicaid for less than 1 year

Would you say you are better off now or worse off now than you were

before you had this new plan, or has there been no effect?

Percent

58

61

52

67

49

61

54

27

26

28

23

30

23

32

9

6

16

6

13

9 9

6

7

4 4

7 7

5

0

25

50

75

100

Total Previously

uninsured

Previously

insured

Enrolled in

Medicaid*

Selected a

private plan

Health

problem**

No health

problem

Better off No effect Worse off Too soon to tell or dont know

Gaining Ground 11

were better off now. Larger shares of people who newly enrolled in Medicaid (67%) said they are bet-

ter off now compared with people who selected a private plan (49%).

In addition, people who had already used their plan to get care were more likely than those

who had not used their plan to say they are better off now (70% vs. 41%) (data not shown). People

who had used their plan were also much less likely to say their plan had no effect than those who had

not used their plan (20% vs. 37%) (data not shown).

More than three-quarters of adults with new coverage are satisfied with their new insurance

(Exhibit 12). People who were insured prior to gaining their new coverage and those who were unin-

sured are similarly satisfied. The satisfaction rate is higher for new Medicaid enrollees (84%) than for

people who selected a private plan (73%). More young adults expressed satisfaction with their new

insurance than older adults (87% vs. 73%).

People are using their new insurance to access health care.

One of the biggest concerns during the early phase of the rollout of the law is that many people with

new coverage might not be able to find physicians or get appointments in a timely fashion. When the

survey asked newly enrolled adults about their experiences, a majority (60%) said they had used their

private plan or Medicaid coverage to go to a doctor or hospital or to fill a prescription (Exhibit 13).

14

Of those, 62 percent said they would not have been able to access or afford this care prior to getting

their new insurance. Three-quarters (75%) of people who were previously uninsured and had used

their new coverage said they would not have been able to get this care prior to gaining insurance (data

not shown). But a large share (44%) of adults who had insurance when they enrolled also said they

would not otherwise have been able to get this care.

Exhibit 12. More Than Three-Quarters of Adults with New Coverage Said They Were

Very or Somewhat Satisfied with It

Notes: Segments may not sum to indicated total because of rounding. Bars may not sum to 100 percent because of dont know/refusal

to respond. FPL refers to federal poverty level. * This includes some individuals who enrolled in Medicaid outside of the marketplace, but

have been covered by Medicaid for less than 1 year.

Source: The Commonwealth Fund Affordable Care Act Tracking Survey, AprilJune 2014.

Adults ages 1964 who selected a private plan or enrolled in Medicaid through marketplace

or have had Medicaid for less than 1 year

Overall, how satisfied are you with this new health insurance?

5

4

2

16

3

5

7

5

8

4

5

6

6

8

12

6

12

8

10

8

5

10

7

11

7

8

38

30

37

40

34

33

29

43

35

36

31

37

35

44

44

48

25

48

40

49

44

37

48

47

42

43

Independent

Republican

Democrat

250% FPL or more

Below 250% FPL

Ages 5064

Ages 3549

Ages 1934

Selected a private plan

Enrolled in Medicaid*

Previously insured

Previously uninsured

Total 78

87

78

73

14

10

15

15

82

65

85

10

27

74

82

9

17

13

13

16

79

77

19

11

73

84

Not at all satisfied Not very satisfied Somewhat satisfied Very satisfied

12 The Commonwealth Fund

Exhibit 13. Three of Five Adults with New Coverage Said They Had Used Their Plan; of Those,

Three of Five Said They Would Not Have Been Able to Access or Afford This Care Before

Note: Segments may not sum to 100 percent because of rounding.

Source: The Commonwealth Fund Affordable Care Act Tracking Survey, AprilJune 2014.

Adults ages 1964 who selected a private plan

or enrolled in Medicaid through the marketplace

or have had Medicaid for less than 1 year

Adults ages 1964 who have used

new health insurance plan

Have you used your new health insurance plan

to visit a doctor, hospital, or other health care

provider, or to pay for prescription drugs?

Prior to getting your new health

insurance plan, would you have

been able to access and/or

afford this care?

No

34%

Yes

60%

No

62%

Yes

36%

Dont know

or refused

2%

Plan has not yet

gone into effect

6%

Exhibit 14. Among Adults Who Enrolled in New Coverage, More Than Half Said

Their Plan Included All or Some of the Doctors They Wanted; Two of Five Did Not

Know Which Doctors Were on Their Plan

Source: The Commonwealth Fund Affordable Care Act Tracking Survey, AprilJune 2014.

Adults ages 1964 who selected a private plan or enrolled in Medicaid

through the marketplace or have had Medicaid for less than 1 year

Does the plan you selected or your new Medicaid coverage

include all, some, or none of the doctors that you wanted?

Percent

37

17

5

39

0

25

50

75

All of the doctors

you wanted

Some of the doctors

you wanted

None of the doctors

you wanted

Dont know which

doctors are included

Gaining Ground 13

People who enrolled in new coverage appeared to find plans that include at least some of the

doctors they want to go to. Just over half of adults with new coverage (54%) said their plan includes

all or some of the doctors they wanted (Exhibit 14). But 39 percent of people with new coverage did

not know which doctors are included in their network. People who had not yet used their plans to get

care were much more likely to say they didnt know which doctors were included than those that had

used their plans (56% vs. 28%; data not shown).

About 20 percent of survey respondents with new coverage looked for new primary care doc-

tors. A majority of this group appeared to find new doctors relatively easily and were able to secure

appointments within a reasonable time frame (Exhibit 15). Two-thirds of those who found a new

primary care doctor were able to get an appointment within two weeks, including 41 percent who

got an appointment within one week and 26 percent within one to two weeks. Waits for first-time

appointments were longer for some: 11 percent got an appointment within two weeks to one month,

and 15 percent waited longer than one month (Exhibit 16).

Newly covered adults who said they needed to see a specialist reported somewhat longer wait

times for appointments (Exhibit 17). Fifty-eight percent were able to get an appointment within two

weeks; 33 percent waited longer than two weeks.

Exhibit 15. One of Five Adults with New Coverage Tried to Find a Primary Care Doctor;

Three-Quarters Found It Easy or Somewhat Easy to Find One

Note: Segments may not sum to 100 percent because of rounding.

Source: The Commonwealth Fund Affordable Care Act Tracking Survey, AprilJune 2014.

Adults ages 1964 who selected a private plan

or enrolled in Medicaid through marketplace

or have had Medicaid for less than 1 year

Adults ages 1964 who have tried to

find new primary care or general doctor

Since getting your new health plan or

Medicaid coverage, have you tried to find a

new primary care doctor or general doctor?

How easy or difficult was it for you

to find a new primary care doctor

or general doctor?

No

78%

Yes

21%

Very easy

39%

Somewhat

easy

36%

Could not

find a doctor

7%

Somewhat

difficult

10%

Very

difficult

7%

Dont know

or refused

1%

14 The Commonwealth Fund

Exhibit 16. Two-Thirds of Those Who Found a Primary Care Doctor

Got an Appointment Within Two Weeks

* Does not include those who were not able to find a doctor.

Source: The Commonwealth Fund Affordable Care Act Tracking Survey, AprilJune 2014.

Adults ages 1964 who selected a private plan or enrolled in Medicaid through

marketplace or have had Medicaid for less than 1 year and tried to find a

primary care doctor or general doctor since getting new coverage*

How long did you have to wait to get your first appointment to see this doctor?

Percent

41

26

11

15

2

4

0

25

50

75

Within 1 week 8 to 14

days

15 to 30

days

More than

30 days

Have not tried

to make an

appointment

Have not been

able to make an

appointment

Exhibit 17. Thirty Percent of Adults with New Coverage Saw or Needed a Specialist;

Fifty-Eight Percent Got an Appointment Within Two Weeks

Note: Segments may not sum to 100 percent because of rounding.

Source: The Commonwealth Fund Affordable Care Act Tracking Survey, AprilJune 2014.

Adults ages 1964 who selected a private plan

or enrolled in Medicaid through marketplace

or have had Medicaid for less than 1 year Adults ages 1964 who needed

to see specialist

Since getting your new health plan or

Medicaid coverage, have you seen or

needed to see any specialist doctors? How long did you have to wait

to get your first appointment

to see this specialist?

No

70%

Yes

30%

Within 1

week

36%

15 to 30

days

17%

Dont know

or refused

2%

Dont know or

refused

1%

8 to 14

days

22%

More than

30 days

16%

Have not tried

to make

appointment

5%

Still

waiting

2%

Gaining Ground 15

Many with new coverage chose plans with narrow provider networks.

In 2014, premiums for plans sold through the marketplaces were on average 16 percent lower than

the Congressional Budget Office had projected.

15

A contributing factor to lower-than-anticipated

premiums is the widespread use of so-called narrow provider networks, which feature a more limited

number of participating physicians and hospitals than traditional networks.

16

In general, these plans

are being sold at lower prices than plans with broader networks.

17

Among people who selected a private plan through the marketplaces, 42 percent said they

had been given the option of choosing a less expensive plan that included fewer doctors or hospitals

than other plans. Twenty-five percent didnt know whether they had this option (Exhibit 18). Of

those who said they had a choice, half (51%) selected the narrow network plan.

Exhibit 18. More Than Two of Five Adults Who Selected a Private Plan Had the Option to

Choose a Narrow Network Plan; Half Chose One

Note: Segments may not sum to 100 percent because of rounding.

Source: The Commonwealth Fund Affordable Care Act Tracking Survey, AprilJune 2014.

Adults ages 1964 who selected a private

plan through the marketplace

Adults ages 1964 who had the

option to choose less expensive plan

with fewer providers

Some health plans provide more limited choices for doctors,

clinics, and hospitals and charge lower premiums than plans with a

larger selection of doctors and hospitals. When you were deciding

which plan to choose, did you have the option of choosing a less

expensive plan with fewer doctors or fewer hospitals?

Did you select the less expensive

plan with fewer doctors or hospitals?

No

33%

Yes

42%

Yes

51%

No

44%

Dont know

5%

Dont know

25%

16 The Commonwealth Fund

CONCLUSION

The survey findings provide early evidence that the Affordable Care Acts coverage provisions are

helping those Americans most at risk for lacking health insurance. Uninsured rates have declined

since September 2013 among working-age adults, with particularly large gains in coverage among

those historically most at risk of being uninsured: young adults, Latinos, and people with low and

moderate incomes.

Young adults in particular are benefitting: 19-to-34-year-olds account for more than half

of the estimated decline in the number of uninsured adults since September 2013. As new entrants

to the labor force, they are far less likely to have job-based health insurance than are older adults, a

problem exacerbated by the protracted period of slow employment growth since 2008.

18

And like all

adults without coverage, the majority of uninsured young adults have low or moderate incomes.

19

Not surprisingly, the survey finds that young men and women make up the largest share of new

enrollment in Medicaid among all adult age groups.

The survey also reveals evidence that the new insurance coverage is helping people gain new

access to the health care system, with nearly three-fourths of previously uninsured adults who used

their new plan to go to a doctor reporting they would not have been able to do so prior to gaining

coverage. And in an indication that the law has the potential to reduce the number of people who are

underinsured, two of five adults with new coverage who had been previously insured said they would

not have been able to get this care in the past.

Most adults with new coverage also appear to be finding new physicians with relative ease

and getting appointments within reasonable time frames. Still, a quarter of those who found a new

primary care doctor and a third of those who needed a specialist had to wait more than two weeks to

get an appointment. Based on a 2013 study of wait times for doctor appointments, the experiences

reported in the survey are similar to the experiences of many Americans, suggesting problems that are

systemwide, and also highly variable across the country.

20

In that study, average wait times for family

physicians ranged from six days in Dallas to 66 days in Boston.

While many Americans have gained ground in this first year of implementation of the laws

major coverage provisions, the survey points to remaining vulnerabilities. First, it shows in stark

relief the implications of states reluctance to expand their Medicaid programs. In states that had not

expanded Medicaid by April 2014, the uninsured rate for adults living under the poverty level was

twice that for poor residents of states that had expanded eligibility. To ensure that the nations poorest

families have access to the health insurance that Congress intended them to have, all states will need

to expand their Medicaid programs.

Second, while awareness of the Affordable Care Acts coverage options is rising among

adults who are potentially eligible for them, awareness among the uninsured and those with the

lowest incomes continues to lag awareness among the insured and those with higher incomes. The

Congressional Budget Office projects that of the 31 million people who are estimated to remain

uninsured in 2024, 65 percent will be eligible for coverage under the laws reforms. It will be the

ongoing work of federal and state policymakers, health care providers, insurers, and other stakehold-

ers to provide the necessary outreach and assistance to help people enroll in the coverage for which

they are eligible.

Gaining Ground 17

Notes

1

D. Blumenthal and S. R. Collins, Health

Care Coverage Under the Affordable Care

ActA Progress Report, New England

Journal of Medicine, published online July 2,

2014.

2

The law provides premium and cost-sharing

subsidies on a sliding scale to adults and chil-

dren with incomes from 100 percent of pov-

erty ($11,490 for an individual and $23,550

for a family of four) to 400 percent of poverty

($45,960 for an individual and $94,200 for

a family of four) and expands eligibility for

Medicaid to those with incomes up to 138

percent of poverty ($15,856 for an individual

and $32,499 for a family of four). Subsidies

are highest for those with the lowest incomes.

3

Congressional Budget Office, Updated esti-

mates of the effects of the insurance coverage

provisions of the Affordable Care Act, April

2014, http://www.cbo.gov/sites/default/files/

cbofiles/attachments/45231-ACA_Estimates.

pdf.

4

All reported differences are statistically sig-

nificant at the p 0.05 level or better, unless

otherwise noted.

5

In the JulySeptember 2013 survey, 37.1 mil-

lion adults ages 19 to 64 were uninsured, +/

2.8 million. In the AprilJune 2014 survey,

27.6 million adults ages 19 to 64 were unin-

sured, +/ 2.5 million.

6

In the JulySeptember 2013 survey, 17.1

million young adults ages 19 to 34 were

uninsured, +/ 2.1 million. In the AprilJune

2014 survey, 11.4 million young adults ages

19 to 34 were uninsured, +/ 1.7 million.

7

The states that expanded their Medicaid pro-

gram by April 2014 include: AR, AZ, CA,

CO, CT, DE, HI, IA, IL, KY, MA, MD, MI,

MN, ND, NJ, NM, NV, NY, OH, OR, RI,

VT, WA, WV, and the District of Columbia.

Three additional states are planning to expand

their Medicaid programs in the near future.

New Hampshire has begun to enroll people in

Medicaid, with coverage to begin in August.

Pennsylvania and Indiana have submitted

section 1115 waivers to the federal govern-

ment to use a customized version of Medicaid

expansion. Virginias governor is exploring

options to expand Medicaid.

8

J. Giovannelli, K. Lucia, and S. Corlette,

State Restrictions on Health Reform

Assisters May Violate Federal Law, The

Commonwealth Fund Blog,June 23, 2014.

9

Ibid.

10

Health Insurance Marketplace: Summary

Enrollment Report, For the Initial Annual

Open Enrollment Period: October 1, 2013

March 31, 2014 (Including Additional

Special Enrollment Period Activity Reported

Through 4-19-2014), ASPE Issue Brief,

U.S. Department of Health and Human

Services, May1, 2014, http://aspe.hhs.gov/

health/reports/2014/MarketPlaceEnrollment/

Apr2014/ib_2014Apr_enrollment.pdf.

11

The phrasing of the question about awareness

of health insurance marketplaces was modi-

fied between the JulySeptember 2013 and

AprilJune 2014 surveys. The description of

what a marketplace is was slightly changed

and in the AprilJune 2014 survey the ques-

tion referred directly to the state-specific name

of the marketplace in the state where the

respondent reported residing, when this was

relevant.

18 The Commonwealth Fund

12

The phrasing of the question about aware-

ness of the availability of financial assistance

for purchasing health insurance through the

health insurance marketplaces was modified

between the JulySeptember 2013 and April

June 2014 surveys. In the AprilJune 2014

survey the question referred directly to the

state-specific name of the marketplace in the

state where the respondent reported residing,

when this was relevant.

13

The difference between those who selected

a private plan and those who enrolled in

Medicaid in being previously uninsured is not

statistically significant.

14

Approximately equal shares of adults who

selected a private plan or newly enrolled in

Medicaid said they had used their new insur-

ance to get health care.

15

T. Spiro and J. Gruber, The Affordable Care

Acts Lower-Than-Projected Premiums Will

Save $190 Billion (New York: Center for

American Progress, Oct. 23, 2013), http://

www.americanprogress.org/issues/healthcare/

report/2013/10/23/77537/the-affordable-

care-acts-lower-than-projected-premiums-

will-save-190-billion.

16

S. R. Collins, Young Adult Participation

In the Health Insurance Marketplaces Just

How Important Is It? (New York: The

Commonwealth Fund Blog, Feb. 2014).

17

D. Blumenthal, Reflecting on Health

ReformNarrow Networks: Boon or Bane?

The Commonwealth Fund Blog, Feb. 24, 2014.

18

S. R. Collins, P. W. Rasmussen, T. Garber,

and M. M. Doty, Covering Young Adults

Under the Affordable Care Act: The Importance

of Outreach and Medicaid Expansion (New

York: The Commonwealth Fund, Aug. 2013).

19

Analysis of the March 2013 Current

Population Survey by Claudia Solis-Roman

and Sherry Glied of New York University for

The Commonwealth Fund.

20

The average wait time for appointments with

family physicians in 15 major metropolitan

areas before the Affordable Care Acts provi-

sions went into effect in 2013 was 19.5 days.

Merrit-Hawkins, Physician Appointment

Wait Times and Medicaid and Medicare

Acceptance Rates, 2014 Survey, http://

www.merritthawkins.com/uploadedFiles/

MerrittHawkings/Surveys/mha2014wait-

survPDF.pdf.

Gaining Ground 19

Table 1. Uninsured Rates and Awareness of Health Reform by Demographics

Total

(1964) Uninsured

Aware of

Marketplaces

Aware of

Financial Assistance

JulySept.

2013

AprilJune

2014

JulySept.

2013

AprilJune

2014

JulySept.

2013

AprilJune

2014

JulySept.

2013

AprilJune

2014

Percent distribution 100% 100% 20% 15% 39% 73% 40% 68%

Unweighted n 6,132 4,425 1,112 894 2,487 3,252 2,500 2,952

Current insurance status

Insured 80 85 41 76 42 72

Uninsured 20 15 31 57 29 47

Age

1934 32 33 28 18 34 69 39 66

3549 32 32 18 15 40 74 37 67

5064 33 33 14 11 44 76 42 71

Gender

Male 48 49 22 16 42 73 43 67

Female 52 51 18 14 37 74 37 68

Base: Young adults

(ages 1934)

Male 51 53 31 20 35 68 41 63

Female 49 47 26 17 32 69 37 70

Race/Ethnicity

White 63 63 16 12 44 78 45 72

African American 12 12 21 20 25 72 26 62

Latino 16 16 36 23 32 58 32 60

Other/Mixed 6 7 20 11 35 68 34 63

Poverty status

Below 138% poverty 30 32 35 24 29 62 32 59

138%249% poverty 18 20 32 22 34 75 32 66

250%399% poverty 20 20 12 10 38 74 40 71

400% poverty or more 32 29 4 3 52 83 51 77

Below 250% poverty 48 52 34 23 31 67 32 62

250% poverty or more 52 48 7 6 47 80 47 75

Family status

Married, no children 22 21 16 12 47 78 43 72

Married, has children 35 36 15 12 40 76 40 70

Not married, no children 29 29 25 19 36 68 40 65

Not married, has children 14 13 27 23 33 68 31 64

Fair/Poor health status, or

Any chronic condition or

disability*

47 48 20 16 37 73 35 65

Political affiliation

Republican 20 20 11 11 38 74 42 72

Democrat 30 31 18 13 41 76 40 68

Independent 24 25 19 14 44 77 44 70

Marketplace type

State-based marketplace 36 36 19 10 43 75 45 69

Federally run marketplace 64 64 20 17 37 72 37 67

Notes: The questions on awareness of marketplaces and availaiblity of financial assistance changed somewhat between the JulySept. 2013 and AprilJune 2014

surveys, including the addition of the usage of state-specific names of marketplaces. * Respondent said health status was fair or poor or said they had at least one

of the following chronic diseases: hypertension or high blood pressure; heart disease; diabetes; asthma, emphysema, or lung disease; high cholesterol; depression

or anxiety.

Not applicable.

Source: The Commonwealth Fund Affordable Care Act Tracking Surveys, JulySept. 2013 and AprilJune 2014.

20 The Commonwealth Fund

Table 2. Demographics of Marketplace Visitors and Enrollees

Visited

Marketplace

Selected Private Plan or

Enrolled in Medicaid

Through Marketplace or

Enrolled in Medicaid

for Less Than 1 Year*

Selected

Private Plan

Enrolled in Medicaid

Through Marketplace or

Enrolled in Medicaid for

Less Than 1 Year

Unweighted n 1,130 690 371 291

Prior insurance status

Uninsured 55 63 59 66

Employer 25 18 21 17

Individual 12 9 17 1

Medicaid 4 4 1 8

Other 2 1 1 1

Age

1934 33 33 24 42

3549 30 32 30 33

5064 35 34 43 25

Gender

Male 46 45 52 37

Female 54 55 48 63

Race/Ethnicity

White 64 55 61 50

African American 14 15 13 17

Latino 14 21 16 24

Other/Mixed 7 7 8 7

Poverty status

Below 250% poverty 63 73 53 91

250% poverty or more 37 27 47 9

Family status

Married, no children 22 19 23 13

Married, has children 36 33 36 32

Not married, no children 29 31 30 32

Not married, has children 13 18 11 24

Health status

Fair/Poor health status, or

Any chronic condition or

disability**

50 58 51 64

No health problem 50 42 49 36

Political affiliation

Republican 16 15 15 15

Democrat 34 37 33 41

Independent 29 27 26 27

Marketplace type

Reside in state with state-run

marketplace

35 43 36 52

Reside in state with federally run

marketplace

64 56 64 47

Medicaid expansion decision

Reside in state expanding

Medicaid

50 61 50 73

Reside in state not expanding

Medicaid

49 38 50 26

* Includes 28 people who did not know whether they enrolled in Medicaid or selected a private plan through the marketplace.

** Respondent said health status was fair or poor or said they had at least one of the following chronic diseases: hypertension or high blood pressure; heart

disease; diabetes; asthma, emphysema, or lung disease; high cholesterol; depression or anxiety.

Source: The Commonwealth Fund Affordable Care Act Tracking Survey, AprilJune 2014.

Gaining Ground 21

Table 3. State-Level Data on Uninsured Rates and Marketplace Awareness and Visits

Total California Florida Illinois New York Pennsylvania Texas

July

Sept.

2013

April

June

2014

July

Sept.

2013

April

June

2014

July

Sept.

2013

April

June

2014

July

Sept.

2013

April

June

2014

July

Sept.

2013

April

June

2014

July

Sept.

2013

April

June

2014

July

Sept.

2013

April

June

2014

Unweighted n 6,132 4,425 463 376 343 253 470 271 343 219 245 203 399 323

Insurance status

Uninsured 20 15 22 11 30 26 15 8 12 10 14 14 34 22

Insured 80 85 78 89 70 74 85 92 88 90 86 86 66 78

Awareness

Percent aware of

marketplace

39 73 42 75 37 67 39 76 37 70 34 77 37 66

Percent aware of financial

assistance availability

40 68 41 70 33 58 37 73 41 68 40 71 34 64

Marketplace experience

Percent who visited

marketplace

22 21 22 16 18 22 25

Not applicable.

Source: The Commonwealth Fund Affordable Care Act Tracking Surveys, JulySept. 2013 and AprilJune 2014.

22 The Commonwealth Fund

ABOUT THE SURVEY

The Commonwealth Fund Affordable Care Act Tracking Survey, AprilJune 2014, was conducted

by SSRS from April 9 to June 2. The survey consisted of 17-minute telephone interviews in

English or Spanish, and was conducted among a random, nationally representative

sample of 4,425 adults, ages 1964, living in the United States. Overall, 2,098 interviews were

conducted on landline telephones and 2,327 interviews on cellular phones, including 1,481 with

respondents who lived in households with no landline telephone access.

This survey is the fourth in a series of Commonwealth Fund surveys to track the implementation

and impact of the Affordable Care Act. The first was conducted by SSRS from July 15 to

September 8, 2013, by telephone among a random, nationally representative U.S. sample

of 6,132 adults ages 19 to 64. The survey had an overall margin of sampling error of +/ 1.8

percent at the 95 percent confidence level.

The second and third surveys in the series were conducted by SSRS in October and December

of 2013. Both were included as a series of questions on SSRSs nationally representative

omnibus telephone survey. For these surveys, only those adults ages 19 to 64 who reported

that they were uninsured or had purchased health insurance through the individual market were

surveyed. The October survey was in the field October 927, 2013, and had a sample of 682

adults. The survey had an overall margin of sampling error of +/ 4.3 percent at the 95 percent

confidence level. The December survey was in the field December 1129, 2013, and had a

sample of 622 adults. That survey had an overall margin of sampling error of +/ 4.6 percent at

the 95 percent confidence level.

The sample for the AprilJune 2014 survey was designed to increase the likelihood of surveying

respondents who were most likely eligible for new coverage options under the ACA. As

such, respondents in the JulySeptember 2013 survey who said they were uninsured or had

individual coverage were asked if they could be recontacted for the AprilJune 2014 survey.

SSRS also recontacted households reached through their omnibus survey of adults who were

uninsured or had individual coverage prior to open enrollment. The data are weighted to

correct for the stratified sample design, the use of prescreened and recontacted respondents

from earlier surveys, the overlapping landline and cellular phone sample frames, and

disproportionate nonresponse that might bias results. The data are weighted to the U.S. 19-to-64

adult population by age, gender, race/ethnicity, education, household size, geographic division,

and population density using the U.S. Census Bureaus 2011 American Community Survey,

and weighted by household telephone use using the U.S. Centers for Disease Control and

Preventions 2012 National Health Interview Survey.

The resulting weighted sample is representative of the approximately 186.1 million U.S. adults

ages 19 to 64. Data for income, and subsequently for federal poverty level, were imputed for

cases with missing data, utilizing a standard regression imputation procedure.

The survey has an overall margin of sampling error of +/ 2.1 percentage points at the 95

percent confidence level. The landline portion of the main-sample survey achieved a 19 percent

response rate and the cellular phone main-sample component achieved a 15 percent response

rate. The overall response rate, including prescreened and recontacted sample, was 14 percent.

For more information on the JulySeptember 2013 survey, please refer to: http://www.

commonwealthfund.org/publications/issue-briefs/2013/sep/insurance-marketplaces-and-

medicaid-expansion.

For more information on the October 2013 survey, please refer to: http://www.

commonwealthfund.org/Publications/Data-Briefs/2013/Nov/Americans-Experiences-

Marketplaces.aspx.

For more information on the December 2013 survey, please refer to: http://www.

commonwealthfund.org/publications/data-briefs/2014/jan/experiences-in-the-health-

insurance-marketplaces.

Gaining Ground 23

About the Authors

Sara R. Collins, Ph.D., is vice president for Health Care Coverage and Access at The

Commonwealth Fund. An economist, Dr. Collins joined the Fund in 2002 and has led the Funds

national program on health insurance since 2005. Since joining the Fund, she has led several

national surveys on health insurance and authored numerous reports, issue briefs, and journal

articles on health insurance coverage and policy. She has provided invited testimony before several

Congressional committees and subcommittees. Prior to joining the Fund, Dr. Collins was associ-

ate director/senior research associate at the New York Academy of Medicine. Earlier in her career,

she was an associate editor at U.S. News & World Report, a senior economist at Health Economics

Research, and a senior health policy analyst in the New York City Office of the Public Advocate.

Dr. Collins holds a Ph.D. in economics from George Washington University.

Petra W. Rasmussen, M.P.H., is senior research associate for the Funds Health Care Coverage

and Access program. In this role, Ms. Rasmussen is responsible for contributing to survey ques-

tionnaire development, analyzing survey results through statistical analysis, and writing survey

issue briefs and articles. In addition, she is involved in tracking and researching emerging policy

issues regarding health reform and the comprehensiveness and affordability of health insurance

coverage and access to care in the United States. Ms. Rasmussen holds an M.P.H. in health policy

and management from Columbia Universitys Mailman School of Public Health.

Michelle McEvoy Doty, Ph.D., is vice president of survey research and evaluation for The

Commonwealth Fund. She has authored numerous publications on cross-national comparisons

of health system performance, access to quality health care among vulnerable populations, and

the extent to which lack of health insurance contributes to inequities in quality of care. Dr. Doty

holds an M.P.H. and a Ph.D. in public health from the University of California, Los Angeles.

Acknowledgments

The authors thank Robyn Rapoport and Arina Goyle of SSRS; and David Blumenthal, John

Craig, Don Moulds, Barry Scholl, Chris Hollander, Paul Frame, Suzanne Augustyn, David

Squires, and Sophie Beutel of The Commonwealth Fund.

Editorial support was provided by Chris Hollander.

www.commonwealthfund.org

The

COMMONWEALTH

FUND

Вам также может понравиться

- HR 4004 Social Determinants Accelerator ActДокумент18 страницHR 4004 Social Determinants Accelerator ActiggybauОценок пока нет

- AAFP Letter To Domestic Policy Council 6-10-2020Документ3 страницыAAFP Letter To Domestic Policy Council 6-10-2020iggybauОценок пока нет

- Bostock v. Clayton County, Georgia DecisionДокумент119 страницBostock v. Clayton County, Georgia DecisionNational Content DeskОценок пока нет

- Boston Mayor Executive Order 6-12-2020Документ3 страницыBoston Mayor Executive Order 6-12-2020iggybauОценок пока нет

- HR 6437 Coronavirus Immigrant Families Protection AcfДокумент16 страницHR 6437 Coronavirus Immigrant Families Protection AcfiggybauОценок пока нет

- A Bill: in The House of RepresentativesДокумент2 страницыA Bill: in The House of RepresentativesiggybauОценок пока нет

- S 3609 Coronavirus Immigrant Families Protection ActДокумент17 страницS 3609 Coronavirus Immigrant Families Protection ActiggybauОценок пока нет

- Cook County v. Wolf Denial Motion To Dismiss Equal ProtectionДокумент30 страницCook County v. Wolf Denial Motion To Dismiss Equal ProtectioniggybauОценок пока нет

- Doe v. Trump Preliminary Injunction Against Proclamation Requiring Private Health InsuranceДокумент48 страницDoe v. Trump Preliminary Injunction Against Proclamation Requiring Private Health InsuranceiggybauОценок пока нет

- HR 6763 COVID-19 Racial and Ethnic Disparities Task ForceДокумент11 страницHR 6763 COVID-19 Racial and Ethnic Disparities Task ForceiggybauОценок пока нет

- 7th Circuit Affirming Preliminary Injunction Cook County v. WolfДокумент82 страницы7th Circuit Affirming Preliminary Injunction Cook County v. WolfiggybauОценок пока нет

- HR 6585 Equitable Data Collection COVID-19Документ18 страницHR 6585 Equitable Data Collection COVID-19iggybauОценок пока нет

- S 3721 COVID-19 Racial and Ethnic Disparities Task ForceДокумент11 страницS 3721 COVID-19 Racial and Ethnic Disparities Task ForceiggybauОценок пока нет

- NCAPIP Recommendations For Culturally and Linguistically Appropriate Contact Tracing May 2020Документ23 страницыNCAPIP Recommendations For Culturally and Linguistically Appropriate Contact Tracing May 2020iggybauОценок пока нет

- Milwaukee Board of Supervisors Ordinance 20-174Документ9 страницMilwaukee Board of Supervisors Ordinance 20-174iggybauОценок пока нет

- COVID 19 FaceCovering 1080x1080 4 SPДокумент1 страницаCOVID 19 FaceCovering 1080x1080 4 SPiggybauОценок пока нет

- Doe v. Trump 9th Circuit Denial of Stay of Preliminary InjunctionДокумент97 страницDoe v. Trump 9th Circuit Denial of Stay of Preliminary InjunctioniggybauОценок пока нет

- COVID-19 Data For Native Hawaiians and Pacific Islanders UPDATED 4-21-2020 PDFДокумент2 страницыCOVID-19 Data For Native Hawaiians and Pacific Islanders UPDATED 4-21-2020 PDFiggybauОценок пока нет

- SF StayHome MultiLang Poster 8.5x11 032620Документ1 страницаSF StayHome MultiLang Poster 8.5x11 032620iggybauОценок пока нет

- ND California Order On Motion To CompelДокумент31 страницаND California Order On Motion To CompeliggybauОценок пока нет

- Covid-19 Data For Asians Updated 4-21-2020Документ2 страницыCovid-19 Data For Asians Updated 4-21-2020iggybauОценок пока нет

- Doe v. Trump Denial of All Writs Injunction Against April 2020 Presidential ProclamationДокумент9 страницDoe v. Trump Denial of All Writs Injunction Against April 2020 Presidential ProclamationiggybauОценок пока нет

- WA v. DHS Order On Motion To CompelДокумент21 страницаWA v. DHS Order On Motion To CompeliggybauОценок пока нет

- MMMR Covid-19 4-8-2020Документ7 страницMMMR Covid-19 4-8-2020iggybauОценок пока нет

- Democratic Presidential Candidate Positions On ImmigrationДокумент10 страницDemocratic Presidential Candidate Positions On ImmigrationiggybauОценок пока нет

- CDC Covid-19 Report FormДокумент2 страницыCDC Covid-19 Report FormiggybauОценок пока нет

- Tri-Caucus Letter To CDC and HHS On Racial and Ethnic DataДокумент3 страницыTri-Caucus Letter To CDC and HHS On Racial and Ethnic DataiggybauОценок пока нет

- Physician Association Letter To HHS On Race Ethnicity Language Data and COVID-19Документ2 страницыPhysician Association Letter To HHS On Race Ethnicity Language Data and COVID-19iggybauОценок пока нет

- Booker-Harris-Warren Letter To HHS Re Racial Disparities in COVID ResponseДокумент4 страницыBooker-Harris-Warren Letter To HHS Re Racial Disparities in COVID ResponseStephen LoiaconiОценок пока нет

- Pete Buttigieg Douglass PlanДокумент18 страницPete Buttigieg Douglass PlaniggybauОценок пока нет

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5794)

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (895)

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (400)

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (344)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1090)

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (121)

- New Health Insurance Marketplace Coverage Options and Your Health CoverageДокумент2 страницыNew Health Insurance Marketplace Coverage Options and Your Health CoverageJessica Cruz CruzОценок пока нет

- Cadillac Tax: An Offset To The Tax Subsidy For Employer-Sponsored Health InsuranceДокумент285 страницCadillac Tax: An Offset To The Tax Subsidy For Employer-Sponsored Health InsuranceJohnny Castillo SerapionОценок пока нет

- HBO Case Analysis - ABC Steel CompanyДокумент6 страницHBO Case Analysis - ABC Steel CompanyMara Lacsamana100% (1)

- May 20, 2015 Tribune Record GleanerДокумент20 страницMay 20, 2015 Tribune Record GleanercwmediaОценок пока нет

- The Wall Street Journal 2019-10-22 PDFДокумент34 страницыThe Wall Street Journal 2019-10-22 PDFParfait IshОценок пока нет

- HHS Letter To State Medicaid Directors On Hospice Care For Children in Medicaid and CHIPДокумент3 страницыHHS Letter To State Medicaid Directors On Hospice Care For Children in Medicaid and CHIPBeverly TranОценок пока нет

- Times Leader 03-10-2013Документ73 страницыTimes Leader 03-10-2013The Times LeaderОценок пока нет

- Volume 48, Issue 42, October 20, 2017Документ96 страницVolume 48, Issue 42, October 20, 2017BladeОценок пока нет

- 11-15-14 EditionДокумент32 страницы11-15-14 EditionSan Mateo Daily JournalОценок пока нет

- WI Group Insurance Board Segal ReportДокумент163 страницыWI Group Insurance Board Segal ReportMichelle FelberОценок пока нет

- ArmadaCare Announces A New Suite of Supplemental Insurance ProductsДокумент3 страницыArmadaCare Announces A New Suite of Supplemental Insurance ProductsPR.comОценок пока нет

- Times Leader 06-29-2012Документ44 страницыTimes Leader 06-29-2012The Times LeaderОценок пока нет

- April 2010 Blue & Gold Malden High SchoolДокумент24 страницыApril 2010 Blue & Gold Malden High SchoolryanseangallagherОценок пока нет

- Excerpt From "The Long Game" by Mitch McConnell.Документ10 страницExcerpt From "The Long Game" by Mitch McConnell.OnPointRadio0% (1)

- HR 2009 HR 2300: Cxvi (Obamacare - Action Plan)Документ9 страницHR 2009 HR 2300: Cxvi (Obamacare - Action Plan)Robert B. SklaroffОценок пока нет

- 340B Waste, Fraud & AbuseДокумент21 страница340B Waste, Fraud & Abuseshepard stewartОценок пока нет

- Vor Oct Issue 5Документ21 страницаVor Oct Issue 5api-204413110Оценок пока нет

- Healthcare Transformation and Changing Roles For NursingДокумент14 страницHealthcare Transformation and Changing Roles For NursingCynthia MiclatОценок пока нет

- Donald TweetsДокумент243 страницыDonald TweetsNabeel KhalidОценок пока нет

- Comments Submitted by Users To MarylandHealthConnection - GovДокумент190 страницComments Submitted by Users To MarylandHealthConnection - GovSouthern Maryland OnlineОценок пока нет

- Volume 48, Issue 11, March 17, 2017Документ45 страницVolume 48, Issue 11, March 17, 2017Blade100% (1)

- A Timeline of Maria Cino's Lobbying Work For Pfizer/ObamacareДокумент2 страницыA Timeline of Maria Cino's Lobbying Work For Pfizer/ObamacareBrooks BayneОценок пока нет

- Pharmacies The 340b Drug ProgramДокумент26 страницPharmacies The 340b Drug ProgramSnow FlewОценок пока нет

- DH 0702Документ14 страницDH 0702The Delphos HeraldОценок пока нет

- Health Law OutlineДокумент28 страницHealth Law OutlineJenna Burch83% (6)

- Claremont COURIER 10.4.13Документ40 страницClaremont COURIER 10.4.13Claremont CourierОценок пока нет

- 2018-08-20 - OR4AD Comment To Task Force - Prices Paid by Oregonians - Rev2Документ103 страницы2018-08-20 - OR4AD Comment To Task Force - Prices Paid by Oregonians - Rev2Oregonians for Affordable Drug Prices NowОценок пока нет

- Fina CC Case London Youth SymphonyДокумент10 страницFina CC Case London Youth SymphonyFrancisco MarvinОценок пока нет

- Introduction To Health Insurance PPT 8 23 13 FinalДокумент38 страницIntroduction To Health Insurance PPT 8 23 13 Finalapi-225367524100% (1)

- Gonzales Cannon October 31 Issue PDFДокумент44 страницыGonzales Cannon October 31 Issue PDFGonzales CannonОценок пока нет