Академический Документы

Профессиональный Документы

Культура Документы

What Is General Insurance

Загружено:

GaneshОригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

What Is General Insurance

Загружено:

GaneshАвторское право:

Доступные форматы

What is General Insurance?

Insurance other than Life Insurance falls under the category of General Insurance.

General Insurance comprises of insurance of property against fire, burglary etc,

personal insurance such as Accident and Health Insurance, and liability insurance

which covers legal liabilities. There are also other covers such as Errors and

Omissions insurance for professionals, credit insurance etc.

Non-life insurance companies have products that cover property against Fire and

allied perils, flood storm and inundation, earthquake and so on. There are products

that cover property against burglary, theft etc. The non-life companies also offer

policies covering machinery against breakdown,there are policies that cover the

hull of ships and so on. A Marine Cargo policy covers goods in transit including

by sea, air and road. Further, insurance of motor vehicles against damages and

theft forms a major chunk of non-life insurance business.

In respect of insurance of property, it is important that the cover is taken for the

actual value of the property to avoid being imposed a penalty should there be a

claim. Where a property is undervalued for the purposes of insurance, the insured

will have to bear a rateable proportion of the loss. For instance if the value of a

property is Rs.100 and it is insured for Rs.50/-, in the event of a loss to the extent

of say Rs.50/-, the maximum claim amount payable would be Rs.25/- ( 50% of the

loss being borne by the insured for underinsuring the property by 50% ). This

concept is quite often not understood by most insureds.

Personal insurance covers include policies for Accident, Health etc. Products

offering Personal Accident cover are benefit policies. Health insurance covers

offered by non-life insurers are mainly hospitalization covers either on

reimbursement or cashless basis. The cashless service is offered through Third

Party Administrators who have arrangements with various service providers, i.e.,

hospitals. The Third Party Administrators also provide service for reimbursement

claims. Sometimes the insurers themselves process reimbursement claims.

Accident and health insurance policies are available for individuals as well as

groups. A group could be a group of employees of an organization or holders of

credit cards or deposit holders in a bank etc. Normally when a group is covered,

insurers offer group discounts.

Liability insurance covers such as Motor Third Party Liability Insurance,

Workmens Compensation Policy etc offer cover against legal liabilities that may

arise under the respective statutes Motor Vehicles Act, The Workmens

Compensation Act etc. Some of the covers such as the foregoing (Motor Third

Party and Workmens Compensation policy ) are compulsory by statute. Liability

Insurance not compulsory by statute is also gaining popularity these days. Many

industries insure against Public liability. There are liability covers available for

Products as well.

There are general insurance products that are in the nature of package policies

offering a combination of the covers mentioned above. For instance, there are

package policies available for householders, shop keepers and also for

professionals such as doctors, chartered accountants etc. Apart from offering

standard covers, insurers also offer customized or tailor-made ones.

Suitable general Insurance covers are necessary for every family. It is important to

protect ones property, which one might have acquired from ones hard earned

income. A loss or damage to ones property can leave one shattered. Losses created

by catastrophes such as the tsunami, earthquakes, cyclones etc have left many

homeless and penniless. Such losses can be devastating but insurance could help

mitigate them. Property can be covered, so also the people against Personal

Accident. A Health Insurance policy can provide financial relief to a person

undergoing medical treatment whether due to a disease or an injury.

Industries also need to protect themselves by obtaining insurance covers to protect

their building, machinery, stocks etc. They need to cover their liabilities as well.

Financiers insist on insurance. So, most industries or businesses that are financed

by banks and other institutions do obtain covers. But are they obtaining the right

covers? And are they insuring adequately are questions that need to be given some

thought. Also organizations or industries that are self-financed should ensure that

they are protected by insurance.

Most general insurance covers are annual contracts. However, there are few

products that are long-term.

It is important for proposers to read and understand the terms and conditions of a

policy before they enter into an insurance contract. The proposal form needs to be

filled in completely and correctly by a proposer to ensure that the cover is adequate

and the right one.

Вам также может понравиться

- 9692 Saurabh Tupkar FinanceДокумент44 страницы9692 Saurabh Tupkar FinanceGanesh100% (1)

- CamScanner 08-26-2022 12.37.37Документ1 страницаCamScanner 08-26-2022 12.37.37GaneshОценок пока нет

- 9754 Pradnyesh Vitkar OSCMДокумент57 страниц9754 Pradnyesh Vitkar OSCMGaneshОценок пока нет

- Syllabus KM & MonpoДокумент2 страницыSyllabus KM & MonpoGaneshОценок пока нет

- 9668 Anuli Rode FinДокумент56 страниц9668 Anuli Rode FinGaneshОценок пока нет

- MCQ Bom 106 PDFДокумент14 страницMCQ Bom 106 PDFGaneshОценок пока нет

- HR Unit No 2Документ59 страницHR Unit No 2GaneshОценок пока нет

- HR 2Документ12 страницHR 2GaneshОценок пока нет

- SKN Sinhgad School of Business Management: Internal Marks MBA-II (Sem III) Marketing 2017-19Документ2 страницыSKN Sinhgad School of Business Management: Internal Marks MBA-II (Sem III) Marketing 2017-19GaneshОценок пока нет

- Public Health Project Planning and DevelopmentДокумент153 страницыPublic Health Project Planning and DevelopmentGaneshОценок пока нет

- Sample Rubric For Industry Analysis - Desk Research SKN Sinhgad School of Business ManagementДокумент2 страницыSample Rubric For Industry Analysis - Desk Research SKN Sinhgad School of Business ManagementGaneshОценок пока нет

- PGDMLM: Day & Date Session Time Subject Seat NoДокумент10 страницPGDMLM: Day & Date Session Time Subject Seat NoGaneshОценок пока нет

- MBS Syllabus 2013 Pattern PDFДокумент0 страницMBS Syllabus 2013 Pattern PDFFernandes RudolfОценок пока нет

- 207 RM MbaДокумент5 страниц207 RM MbaGaneshОценок пока нет

- Sample LetterДокумент1 страницаSample Lettervilaschinke123Оценок пока нет

- UNIT 3 Human RightsДокумент20 страницUNIT 3 Human RightsGaneshОценок пока нет

- Institute of Science Poona's Institute of Business Management and Research Wakad, Pune - 57Документ2 страницыInstitute of Science Poona's Institute of Business Management and Research Wakad, Pune - 57GaneshОценок пока нет

- SR No Name of Student Class: List of Students Sent For PostageДокумент1 страницаSR No Name of Student Class: List of Students Sent For PostageGaneshОценок пока нет

- SR No Name of Student Class: List of Students Sent For PostageДокумент1 страницаSR No Name of Student Class: List of Students Sent For PostageGaneshОценок пока нет

- Global LogisticsДокумент43 страницыGlobal LogisticsGaneshОценок пока нет

- Global LogisticsДокумент43 страницыGlobal LogisticsGaneshОценок пока нет

- Atharva Institute of ManagementДокумент1 страницаAtharva Institute of ManagementGaneshОценок пока нет

- Logistic Management 2Документ4 страницыLogistic Management 2Ganesh100% (1)

- Instructions To Submit Resume To The Placement Cell: Institute of Business Management and Research, Wakad, Pune-57Документ3 страницыInstructions To Submit Resume To The Placement Cell: Institute of Business Management and Research, Wakad, Pune-57GaneshОценок пока нет

- 211 GeopoliticsДокумент3 страницы211 GeopoliticsGaneshОценок пока нет

- Quarterly States That Removing Main Obstacles "Would Free India's Economy To Grow As Fast AsДокумент6 страницQuarterly States That Removing Main Obstacles "Would Free India's Economy To Grow As Fast AsGaneshОценок пока нет

- 201 Marketing ManagementДокумент3 страницы201 Marketing ManagementGaneshОценок пока нет

- 19 Hhhsemester I Credits 3Документ4 страницы19 Hhhsemester I Credits 3GaneshОценок пока нет

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (895)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5794)

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (400)

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (345)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2259)

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (121)

- Blackrock US Equity Index Segregated FundДокумент1 страницаBlackrock US Equity Index Segregated Fundarrow1714445dongxinОценок пока нет

- PNB MetLife PolicyДокумент4 страницыPNB MetLife PolicyNeelОценок пока нет

- Monthly Digest February 2023 Eng 19Документ35 страницMonthly Digest February 2023 Eng 19Ayub ArshadОценок пока нет

- KKR Co Inc Bernstein Conference Presentation June 2021Документ33 страницыKKR Co Inc Bernstein Conference Presentation June 2021gourmetviviОценок пока нет

- AEOI FormДокумент2 страницыAEOI Formgheorgheadrianonea100% (1)

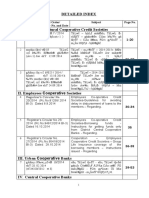

- Detailed Index: Sl. No. Government Order/ Registrar'Circular No. and Date Subject Page NoДокумент8 страницDetailed Index: Sl. No. Government Order/ Registrar'Circular No. and Date Subject Page NokalkibookОценок пока нет

- Summer Internship Project Report ON "Itr E-Filing": Subject Code:KMBN308Документ60 страницSummer Internship Project Report ON "Itr E-Filing": Subject Code:KMBN308Sumit Ranjan100% (6)

- Abbott V Abbott Abbott V AbbottДокумент9 страницAbbott V Abbott Abbott V AbbottTyler ReneeОценок пока нет

- Chapter 1 Strategic Compensation - A Component of Human Resource SystemsДокумент50 страницChapter 1 Strategic Compensation - A Component of Human Resource SystemsSandra Chan100% (1)

- Jeevan Arogya PDFДокумент47 страницJeevan Arogya PDFRizwan KhanОценок пока нет

- The Philippine American General Insurance Company, Inc., Plaintiff-AppellantДокумент2 страницыThe Philippine American General Insurance Company, Inc., Plaintiff-AppellantCZARINA ANN CASTROОценок пока нет

- Quarter 1 Lesson 1-2 ReviewerДокумент4 страницыQuarter 1 Lesson 1-2 ReviewerVenice SolverОценок пока нет

- Transport Insurance For International TradeДокумент6 страницTransport Insurance For International TradeyenleОценок пока нет

- Feasibility Assessment and Financial Projection Results For A Social Health Insurance Scheme in SwazilandДокумент96 страницFeasibility Assessment and Financial Projection Results For A Social Health Insurance Scheme in SwazilandbejarhasanОценок пока нет

- ZP Eligibility CalculatorДокумент11 страницZP Eligibility CalculatorYash SoniОценок пока нет

- Family Finance - The Essential Guide For Parents, Ann Douglas, Elizabeth Lewin - (2001)Документ265 страницFamily Finance - The Essential Guide For Parents, Ann Douglas, Elizabeth Lewin - (2001)sebastianОценок пока нет

- Statistical Compilation of Annual Statement Information For Life & Health Insurance Companies in 2018Документ216 страницStatistical Compilation of Annual Statement Information For Life & Health Insurance Companies in 2018Htet Lynn HtunОценок пока нет

- Chapter - 10 International BusinessДокумент7 страницChapter - 10 International BusinessAejaz MohamedОценок пока нет

- All India Services Cargo Movers: Dear Sir/madamДокумент2 страницыAll India Services Cargo Movers: Dear Sir/madambabukuttan818338Оценок пока нет

- Health Insurance Exchange in California: CoverageДокумент2 страницыHealth Insurance Exchange in California: CoverageNeha ChauhanОценок пока нет

- Assignment TAX (21 AIS 039)Документ18 страницAssignment TAX (21 AIS 039)Amran OviОценок пока нет

- RE Property Management Appointment 547 DenmДокумент17 страницRE Property Management Appointment 547 DenmBolboОценок пока нет

- Portfoliopython: 1 Week 1 Section 1 - Fundamentals of Risk and ReturnsДокумент23 страницыPortfoliopython: 1 Week 1 Section 1 - Fundamentals of Risk and ReturnsHoda El HALABIОценок пока нет

- AckoPolicy-BBCA00234545270 00Документ4 страницыAckoPolicy-BBCA00234545270 00Softway GoaОценок пока нет

- Essays On American CultureДокумент6 страницEssays On American Culturehoyplfnbf100% (2)

- IMMI Grant NotificationДокумент4 страницыIMMI Grant NotificationMadhu BhaiОценок пока нет

- Estate ExercisesДокумент12 страницEstate ExercisesAmira SyahiraОценок пока нет

- Application Form For Minor Policy Alterations: (Contact Details To Be Filled Mandatory)Документ2 страницыApplication Form For Minor Policy Alterations: (Contact Details To Be Filled Mandatory)Sonu SinghОценок пока нет

- Erma Bombeck EssaysДокумент5 страницErma Bombeck Essayslmfbcmaeg100% (2)

- Draft - JCO - Contract Agreement - Macopa Cold StorageДокумент14 страницDraft - JCO - Contract Agreement - Macopa Cold StorageMiguel MorenoОценок пока нет