Академический Документы

Профессиональный Документы

Культура Документы

Escorts Microsec 230514

Загружено:

Arunddhuti RayАвторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Escorts Microsec 230514

Загружено:

Arunddhuti RayАвторское право:

Доступные форматы

- 1 -

Microsec Research

21

st

May 2014

We rate Escorts (Escorts) Limited a BUY. Escorts was incorporated in the year 1944 as

Escorts Agents. It has played a pivotal role in the agricultural growth of India for over five

decades. One of the leading tractor manufacturers of the country, Escorts offers a

comprehensive range of tractors, more than 45 variants starting from 25 to 80 HP. Escort,

Farmtrac and Powertrac are the widely accepted and preferred brands of tractors from the

house of Escorts. A leading material handling and construction equipment manufacturer, the

company manufactures and markets a diverse range of equipment like cranes, loaders,

vibratory rollers and forklifts. The company today is the world's largest Pick 'n' Carry

Hydraulic Mobile Crane manufacturer.

.

Investment Highlights

Stable government-positive for the company: The focus on Agriculture and mechanization

of farm sector is on the agenda of the new government and we expect that the new

government would lead to the development of the Agriculture and construction sectors as a

whole. We expect that the higher Agri and construction activities result in the higher need

of the tractors and agri equipments in the days to come. Higher revenue and better

realizations would improve the margins of the company and boost the financials. The stable

governments focus on Agriculture and construction sectors may also benefit of the

company.

Strong Revenue growth in December, 2013 Quater: The Company has shown robust growth

in Revenue during the quarter ended December, 2013. Revenue of the company has grown

by 12.78% to INR1160 crore in comparison to INR1028 crore. EBITDA of the company

improved from INR53 crore to INR71 and PAT improved from INR28 to INR60 on back the

higher tractors sales.

Expansion plans: Escorts is doubling the capacity of its Rudrapur plant. Escorts are

expanding our Rudarpur plant and would double its production capacity. Escorts

manufacture shock absorbers and struts at Rudarpur at Udham Singh Nagar in Uttrakhand.

The installed capacity is to manufacture 1.5 lakhs shock absorbers per month and it would be

expanded up to 5,00,000 numbers per month. The Company is also scouting for new markets

globally. The company started exporting tractors to Australia. The company exports its

tractors to European markets and Latin America.

Escorts Ltd

BUY

Sector- Automobiles-Tractors

SarojSingh

EmailIDssingh2@microsec.in

Current Market Price (INR) 130

Target Price 193

Upside Potential 48%

52 Week High/Low (INR) 145/60

Market Capitalization (In INR Cr.) 1,652

Market Data

81.54

91.54

101.54

111.54

121.54

131.54

141.54

2

2

-

M

a

y

-

2

0

1

3

2

2

-

J

u

n

-

2

0

1

3

2

2

-

J

u

l

-

2

0

1

3

2

2

-

A

u

g

-

2

0

1

3

2

2

-

S

e

p

-

2

0

1

3

2

2

-

O

c

t

-

2

0

1

3

2

2

-

N

o

v

-

2

0

1

3

2

2

-

D

e

c

-

2

0

1

3

2

2

-

J

a

n

-

2

0

1

4

2

2

-

F

e

b

-

2

0

1

4

2

2

-

M

a

r

-

2

0

1

4

2

2

-

A

p

r

-

2

0

1

4

P

r

i

c

e

Period

CLOSE(Escorts Ltd) CLOSE(SENSEX)

BSE Code 500495

NSE Code ESCORTS

Bloomberg Ticker ESCO IN

Reuters Ticker ESC.BO

Face Value (INR) 10.00

Equity Share Capital (In INR Cr.) 119.27

Beta vs Sensex 1.28

STOCK SCAN

Promoter

and

Promoter

Group

41.97%

FII

6.88%

DII

2.18%

Others

48.97%

Shareholding

Notes- *Financial year ended Sep, consolidate and EPS is base on no of equity share 11.93

- 2 -

Microsec Research

21

st

May 2014

Escorts Ltd sales volume trend

Escorts segmental revenue

Escorts Ltd is organized in mainly four primary business segments, Agri Machinery

Products, Auto Ancillary Product, Construction Equipments and Railway equipments

businesses, all are focus areas of the new Government The companys most of the

revenue comes from Agri Machinery Products ~81%, Auto Ancillary Products

contribute 3% in revenue, Construction Equipments businesses revenue ~16% and

Railway equipments businesses 4% in 15M DEC2013.

Source-Ace equity and microsec research

Financial Performance

Source-Ace equity and microsec research

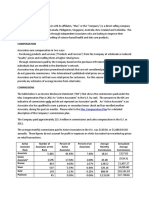

DESCRIPTION FY09A FY10A FY11A FY12A 15M Dec13 FY14E FY15 E

AgriMachineryProducts 72% 74% 71% 72% 81% 80% 82%

AutoAncillaryProducts 3% 3% 3% 3% 3% 4% 3%

ConstructionEquipments 16% 17% 19% 18% 12% 11% 11%

RailwayEquipments 7% 6% 4% 4% 4% 4% 4%

2

6

5

1

3

3

7

8

4

1

0

1

4

0

4

9

5

3

0

9

4

8

8

5

5

6

1

8

2

1

1

2

4

5

1

6

8

1

9

0

3

3

5

3

1

0

3

5

6

5

7

1

2

6

1

2

2

7

2

2

1

3

1

9

4

2

3

8

0

500

1000

1500

2000

2500

3000

3500

4000

4500

5000

5500

6000

FY09A FY10A FY11A FY12A FY13 FY14E FY15E

NetSales EBITDA PAT

4

5

6

2

7

6

0

0

8

6

6

3

,

4

2

0

6

0

,

6

7

3

8

5

2

7

7

9

2

0

9

9

1

0

3

1

5

1

0

20000

40000

60000

80000

100000

120000

FY09A FY10A FY11A FY12A 15M

Dec13

FY14E FY15E

No.Tractors sold

- 3 -

Microsec Research

21

st

May 2014

Valuation

At the CMP of INR130, the stock is trading at a P/E of 8x its FY14E EPS of INR16.28 and 6.5x

its FY15E EPS of INR19.94. The company has sound business model and ROE is expected to

pick up. We assign a P/E multiple of 9.7x to its FY15E EPS to arrive at a Target price of

INR193 for a time period of 12 months.

Key Concern

Slowdown Economic is the key risk to the company.

Lower Tractors sales may impact the companys profitability.

Insufficient monsoon

- 4 -

Microsec Research

21

st

May 2014

Theinvestmentsdiscussedorrecommendedinthisreportmaynotbesuitableforallinvestors.Investorsshouldusethisresearchasoneinputintoformulating

aninvestmentopinion.Additionalinputsshouldinclude,butarenotlimitedto,thereviewofother.Thisisnotanoffer(orsolicitationofanoffer)tobuy/sellthe

securities/instrumentsmentionedoranofficialconfirmation.MicrosecCapitalLimitedisnotresponsibleforanyerrororinaccuracyorforanylossessufferedon

account of information contained in this report. This report does not purport to be offer for purchase and sale of share/ units. We and our affiliates, officers,

directors,andemployees,includingpersonsinvolvedinthepreparationorissuanceofthismaterialmay:(a)fromtimetotime,havelongorshortpositionsin,

andbuyorsellthesecuritiesthereof,ofcompany(ies)mentionedhereinor(b)beengagedinanyothertransactioninvolvingsuchsecuritiesandearnbrokerage

orothercompensationdiscussedhereinoractasadvisororlenderIborrowertosuchcompany(ies)orhaveotherpotentialconflictofinterestwithrespectto

any recommendation and related information and opinions. The same persons may have acted upon the information contained here. No part of this material

maybeduplicatedinanyformand/orredistributedwithoutMicrosecCapitalLimitedpriorwrittenconsent.

Disclaimer

Вам также может понравиться

- Ambit Research Report Turnaround StocksДокумент76 страницAmbit Research Report Turnaround StocksArunddhuti RayОценок пока нет

- Ten Baggers Portfolio AmbitДокумент18 страницTen Baggers Portfolio AmbitPuneet367Оценок пока нет

- Auto & Ancillary Banking and Financial Services Consumer and RelatedДокумент1 страницаAuto & Ancillary Banking and Financial Services Consumer and RelatedArunddhuti RayОценок пока нет

- IndiNivesh Best Sectors Stocks Post 2014Документ49 страницIndiNivesh Best Sectors Stocks Post 2014Arunddhuti RayОценок пока нет

- How To Find Last Two DigitsДокумент3 страницыHow To Find Last Two DigitsArunddhuti Ray100% (1)

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (400)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (895)

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (266)

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (345)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (121)

- Religious Freedom Non Impairment of ContractsДокумент4 страницыReligious Freedom Non Impairment of ContractsJean Jamailah Tomugdan100% (1)

- HP Final... GRP 04Документ6 страницHP Final... GRP 04Sowjanya Reddy PalagiriОценок пока нет

- Fu-Wang Foods Ltd. AnalysisДокумент27 страницFu-Wang Foods Ltd. AnalysisAynul Bashar AmitОценок пока нет

- ACC3210Документ6 страницACC3210anba velooОценок пока нет

- BA 211 Midterm 2Документ6 страницBA 211 Midterm 2Gene'sОценок пока нет

- ch03 PDFДокумент42 страницыch03 PDFerylpaez100% (1)

- Zara CaseДокумент2 страницыZara CaseE100% (1)

- Monopoly Market StructureДокумент17 страницMonopoly Market StructureMeet PasariОценок пока нет

- EAGLE 2018 Annual Report (SEC Form 17-A) PDFДокумент208 страницEAGLE 2018 Annual Report (SEC Form 17-A) PDFRafael Obusan IIОценок пока нет

- Management AccountingДокумент40 страницManagement AccountingG Anwar100% (5)

- Common-Size Financial StatementsДокумент16 страницCommon-Size Financial StatementsApril IsidroОценок пока нет

- Overview of Financial Reporting, Financial Statement Analysis, and ValuationДокумент32 страницыOverview of Financial Reporting, Financial Statement Analysis, and ValuationVũ Việt Vân AnhОценок пока нет

- Miguel Corporation.": Financial Leverage Ratios Measures The Extent To Which The FirmДокумент5 страницMiguel Corporation.": Financial Leverage Ratios Measures The Extent To Which The FirmLedayl MaralitОценок пока нет

- 9 Cir vs. Baier-Nickel DGSTДокумент2 страницы9 Cir vs. Baier-Nickel DGSTMiguelОценок пока нет

- ECON302 Tutorial1 Answers PDFДокумент5 страницECON302 Tutorial1 Answers PDFAngel RicardoОценок пока нет

- BAOutlineДокумент91 страницаBAOutlinebillyharmonОценок пока нет

- Kotak Mahindra BankДокумент23 страницыKotak Mahindra BankSai VasudevanОценок пока нет

- Final Term Project: Report On MCB PakistanДокумент6 страницFinal Term Project: Report On MCB PakistanBHATTIОценок пока нет

- Annual Report 2017 05 PDFДокумент85 страницAnnual Report 2017 05 PDFdewiОценок пока нет

- Inditex InditexДокумент4 страницыInditex InditexMegCurtisОценок пока нет

- Customer Relation ManagementДокумент13 страницCustomer Relation ManagementSaurav SharanОценок пока нет

- Module 2. Lesson 4. Inclusions To Gross IncomeДокумент13 страницModule 2. Lesson 4. Inclusions To Gross IncomeRaniel AnidoОценок пока нет

- Britannia Industry Ltd. Manvi Bindal 22BSP0907Документ17 страницBritannia Industry Ltd. Manvi Bindal 22BSP0907ajthebestОценок пока нет

- Class 8 Chapter 15 Compound Interest Exercise 15b DownloadДокумент4 страницыClass 8 Chapter 15 Compound Interest Exercise 15b DownloadSikander KhanОценок пока нет

- Semester - 6 Bb-601 Corporate Strategy Instructions For Paper-SetterДокумент30 страницSemester - 6 Bb-601 Corporate Strategy Instructions For Paper-SetterPriyansh SrivastavaОценок пока нет

- Max International Income Disclosure Statement - enДокумент2 страницыMax International Income Disclosure Statement - enDialllОценок пока нет

- Marginal CostingДокумент31 страницаMarginal Costingdivya dharmarajan50% (4)

- Cost of Capital ExerciseДокумент2 страницыCost of Capital ExerciseLiana Monica LopezОценок пока нет

- Business Valuation: Valuation Methodologies Discounts and PremiumsДокумент43 страницыBusiness Valuation: Valuation Methodologies Discounts and PremiumsTubagus Donny SyafardanОценок пока нет

- Correction of ErrorsДокумент2 страницыCorrection of ErrorsZvioule Ma FuentesОценок пока нет