Академический Документы

Профессиональный Документы

Культура Документы

Reg Questions

Загружено:

esskae59mОригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Reg Questions

Загружено:

esskae59mАвторское право:

Доступные форматы

Johnson worked for ABC Co. and earned a salary of $100,000.

Johnson also received, as a fringe benefit, group term-life insurance at twice Johnson's salary. The

annual IRS-established uniform cost of insurance is $2.76 per $1,000. What amount must Johnson include in gross income?

a. $100,276

b. $100,414

c. $100,000

d. $100,552

Explanation

Choice "b" is correct. The first $50,000 of group term life insurance is a nontaxable fringe benefit. Amounts exceeding this are taxable based on IRS tables. The

total group term life insurance here is $200,000 (twice the salary of $100,000). The amount exceeding $50,000 is $150,000. The cost given here is $2.76 per

$1,000 of insurance. 150 $2.76 = $414. So the total amount included in gross income is $100,414 ($100,000 + $414).

Choice "c" is incorrect. $100,000 does not include any of the taxable amount of group term life insurance.

Choice "a" is incorrect. $100,276 only includes $100,000 of the group term life insurance instead of $150,000.

Choice "d" is incorrect. $100,552 includes the entire $200,000 of the group term life insurance instead of only $150,000.

Lane, a single taxpayer, received $160,000 in salary, $15,000 in income from an S Corporation in which Lane does not materially participate, and a $35,000

passive loss from a real estate rental activity in which Lane materially participated. Lane's modified adjusted gross income was $165,000. What amount of the real

estate rental activity loss was deductible?

a. $0

b. $35,000

c. $15,000

d. $25,000

Explanation

Rule: Passive activity is any activity in which the taxpayer does not materially participate. A net passive activity loss generally may not be deducted against other

types of income (e.g., wages, other ordinary or active income, portfolio income (interest and dividends), or capital gains). In other words, passive losses may

generally only offset passive income for a tax year-the remaining net loss is generally "suspended" and carried forward to a year when it may be used to offset

passive income (or when the final disposition of the property occurs). However, there is an exception (the "mom and pop exception," as we refer to it in the

textbooks) to this general rule. Taxpayers who own more than 10% of the rental activity, have modified AGI under $100,000, and have active participation

(managing the property qualifies), may deduct up to $25,000 annually of net passive losses attributable to real estate. There is a phase-out provision for modified

AGI from $100,000 $150,000, and the deduction is completely phased-out for modified AGI in excess of $150,000.

Choice "c" is correct. Per the above rule, unless an exception exists (and it does not in this case, as Lane's modified adjusted gross income is in excess of

$150,000), passive losses may only offset passive income for a tax year (i.e., no "net loss" may exist). In this case, Lane has a $20,000 net loss from passive

activity [$15,000 S Corporation income (passive, in this case because the facts state Lane does not materially participate) minus the $35,000 rental real estate

loss]. Thus, only $15,000 of the passive loss from real estate rental activity may be used to offset the $15,000 income from the S Corporation. The remaining

$20,000 passive activity loss is carried forward to be used in future years.

Choice "a" is incorrect. Per the above rule, passive losses may generally only offset passive income for a tax year. Lane has passive income of $15,000 in the

year; thus, passive loss up to $15,000 may be deducted from passive income.

Choice "d" is incorrect. This answer option is an attempt to confuse the candidate into using the "mom and pop" exception, which applies when taxpayers who

actively participate, own more than 10% of the rental activity, and have modified AGI under $100,000 are able to deduct up to $25,000 annually of net passive

losses attributable to real estate. There is a phase-out provision for modified AGI from $100,000 $150,000, and the deduction is completely phased-out for

modified AGI in excess of $150,000. In this case, the facts state that Lane's modified adjusted gross income is $165,000; thus, Lane does not qualify to use the

exception.

Choice "b" is incorrect. This answer option assumes that the full amount of the rental real estate loss is deductible against the passive income from the S

Corporation, and, thus, against Lane's other taxable income. As indicated in the rule above, unless an exception applies (it does not in this case), a net passive

activity loss may not be deducted against other types of income (e.g., wages, other ordinary or active income, portfolio income (interest and dividends), or capital

gains). Thus, the full $35,000 rental real estate loss is not deductible in the year by Lane.

During the taxable year, Blake transferred a corporate bond with a face amount and fair market value of $20,000 to a trust for the benefit of her 16-year old child.

Annual interest on this bond is $2,000, which is to be accumulated in the trust and distributed to the child on reaching the age of 21. The bond is then to be

distributed to the donor or her successor-in-interest in liquidation of the trust. Present value of the total interest to be received by the child is $8,710. The amount of

the gift that is excludable from taxable gifts is:

a. $20,000

b. $13,000

c. $8,710

d. $0

Explanation

Choice "d" is correct.

Rule: An amount will not be treated as an excluded gift or bequest if the governing instrument provides that the specific sum is payable only from the "income" of

the estate or trust.

Choices "a", "b", and "c" are incorrect, per the above rule.

Lyon, a cash basis taxpayer, died on January 15, Year 50. The estate executor made the required periodic distribution of $9,000 from estate income to Lyon's sole

heir. The following pertains to the estate's income and disbursements in Year 50:

Estate Income

$20,000 Taxable interest

10,000 Net long-term capital gains allocable to corpus

Estate Disbursements

$5,000 Administrative expenses attributable to taxable income

Lyon's executor does not intend to file an extension request for the estate fiduciary income tax return. By what date must the executor file the Form 1041, U.S.

Fiduciary Income Tax Return, for the estate's Year 50 calendar year?

a. Monday, April 15, Year 51.

b. Friday, September 15, Year 51.

c. Thursday, June 15, Year 51.

d. Wednesday, March 15, Year 51.

Explanation

Choice "a" is correct.

Rule: Form 1041 is due on the 15th day of the fourth month after the close of its taxable year.

Lyon's calendar Year 50 return would be due on April 15, Year 51.

Choices "d", "c", and "b" are incorrect, per the above rule.

Commerce Corp. elects S corporation status as of the beginning of the current year. At the time of Commerce's election, it held a machine with a basis of $20,000

and a fair market value of $30,000. In March of the current year, Commerce sells the machine for $35,000. What would be the amount subject to the built-in gains

tax?

a. $10,000

b. $5,000

c. $15,000

d. $0

Explanation

Choice "a" is correct. The built-in gain for the machine is $10,000, the difference, on the date of the election of S status, between the $20,000 adjusted basis of the

machine to the C corporation and the $30,000 fair market value. That is the amount of the gain that occurred while the corporation was a C corporation, and it is

also the amount that is subject to the built-in gains tax.

Choice "d" is incorrect. The $0 indicates that there is no built-in gain on the machine. There are a number of exceptions to the built-in gains tax, but none of them

apply in this question.

Choice "b" is incorrect. The $5,000 is the amount of the gain recognized on the sale ($35,000 - $20,000 - $10,000) that is not built-in gain. The $5,000 gain

occurred while the corporation was an S corporation and is not subject to the built-in gains tax.

Choice "c" is incorrect. The $15,000 is the total gain recognized on the sale ($35,000 - $20,000), not the amount of gain subject to the built-in gains tax.

To qualify as an exempt organization, the applicant:

a. May be organized and operated for the primary purpose of carrying on a business for profit, provided that all of the organization's net earnings are turned

over to one or more tax exempt organizations.

b. Must not be classified as a social club.

c. Must not be a private foundation organized and operated exclusively to influence legislation pertaining to protection of the environment.

d. Need not be specifically identified as one of the classes upon which exemption is conferred by the Internal Revenue Code, provided that the organization's

purposes and activities are of a non-profit nature.

Explanation

Choice "c" is correct. To qualify as an exempt organization, an applicant must not be a private foundation organized and operated exclusively to influence

legislation.

Choice "a" is incorrect. A "feeder" organization, carrying on a trade or business for profit but distributing 100% of the profits to exempt organizations, is itself not tax

exempt.

Choice "d" is incorrect. The applicant must be of a type specifically identified as one of the classes upon which exemption is conferred by the Code (e.g., organized

for religion, charitable, scientific, etc., purposes).

Choice "b" is incorrect. A social club supported solely by members' dues and service charges does qualify as an exempt organizatio

Smith, a single individual, made the following charitable contributions during the current year. Smiths adjusted gross income is $60,000.

Donation to Smiths church $5,000

Art work donated to the local art museum

(Smith purchased it for $2,000 four months ago and a local art

dealer appraised it for)

3,000

Contribution to a needy family 1,000

What amount should Smith deduct as a charitable contribution?

a. $9,000

b. $8,000

c. $5,000

d. $7,000

Explanation

Choice "d" is correct. This question is asking for the actual deduction and requires the candidate to determine which items are deductible charitable contributions.

The $5,000 donation to the church is allowable. The artwork donated to the local art museum is deductible to its basis, $2,000. Although it is appreciated property,

Smith held the property for only four months, making it short-term capital gain property. Donations of short-term capital gain property are deductible to the donor to

the extent of his/her adjusted basis. The contribution to a needy family is not a deductible contribution, as it was not made to a qualifying organization.

Choice "c" is incorrect. This choice excludes the donation of the artwork to the art museum.

Choice "b" is incorrect. This choice erroneously includes the donation of the artwork at the art's fair market value.

Choice "a" is incorrect. This choice includes all three contributions. It erroneously includes the artwork at its fair market value as well as including the donation to

the needy family, which is not a deductible donation.

Вам также может понравиться

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (121)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (266)

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (399)

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5794)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2259)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1090)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (895)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- Auditing Notes - Chapter 3Документ24 страницыAuditing Notes - Chapter 3Future CPA100% (7)

- Solutions To Problems: Pe On Estate TaxДокумент11 страницSolutions To Problems: Pe On Estate TaxErica NicolasuraОценок пока нет

- Your Payment Receipt PDFДокумент1 страницаYour Payment Receipt PDFoiciruaОценок пока нет

- Cisa NotesДокумент2 страницыCisa Notesesskae59mОценок пока нет

- Christopher Verizon BillДокумент4 страницыChristopher Verizon BillSharon Jones100% (2)

- UNIT II Tax RemediesДокумент17 страницUNIT II Tax RemediesAl BertОценок пока нет

- CIR Vs AlgueДокумент1 страницаCIR Vs AlgueJolas E. BrutasОценок пока нет

- Network Security TutorialДокумент15 страницNetwork Security TutorialArmaan Singh ChawlaОценок пока нет

- HQ03 - 6th BATCH - General Principles of Income TaxationДокумент13 страницHQ03 - 6th BATCH - General Principles of Income TaxationJimmyChaoОценок пока нет

- Domain 1Документ3 страницыDomain 1esskae59mОценок пока нет

- 478 613Документ8 страниц478 613Fahad AliОценок пока нет

- 12v1 Database BackupДокумент6 страниц12v1 Database Backupnarasi64Оценок пока нет

- Stock BasisДокумент3 страницыStock Basisesskae59mОценок пока нет

- Corp-Tax Rosenberg s05Документ32 страницыCorp-Tax Rosenberg s05stonecerberusОценок пока нет

- Excise Taxes Are Imposed Upon The Transfer of Goods and Services and Based On The ValueДокумент1 страницаExcise Taxes Are Imposed Upon The Transfer of Goods and Services and Based On The Valueesskae59mОценок пока нет

- Dividends Received Deduction: 0% - 19% 70% 20% - 79% 80% 80% or More 100%Документ2 страницыDividends Received Deduction: 0% - 19% 70% 20% - 79% 80% 80% or More 100%esskae59mОценок пока нет

- Excise Taxes Are Imposed Upon The Transfer of Goods and Services and Based On The ValueДокумент1 страницаExcise Taxes Are Imposed Upon The Transfer of Goods and Services and Based On The Valueesskae59mОценок пока нет

- ItemizedДокумент1 страницаItemizedesskae59mОценок пока нет

- AMT TaxationДокумент1 страницаAMT Taxationesskae59mОценок пока нет

- Kunezle & StreiffДокумент3 страницыKunezle & StreiffJanna Robles SantosОценок пока нет

- Tally: Chap-1:-Company Creation & Deletation Create CompanyДокумент32 страницыTally: Chap-1:-Company Creation & Deletation Create CompanysananathaniОценок пока нет

- Form MTR 6 CSTДокумент1 страницаForm MTR 6 CSTca_kamalОценок пока нет

- Authorization For Credit Card Transactions: U.S. Citizenship and Immigration ServicesДокумент1 страницаAuthorization For Credit Card Transactions: U.S. Citizenship and Immigration ServicesDIEGO BUSTOSОценок пока нет

- Plastic Money Full Project Copy ARNABДокумент41 страницаPlastic Money Full Project Copy ARNABarnab_b8767% (3)

- Accumulated Depreciation: EquipmentДокумент9 страницAccumulated Depreciation: EquipmentAndrewVazОценок пока нет

- Application For Registration: Republic of The Philippines Department of Finance Bureau of Internal Revenue BIR Form NoДокумент2 страницыApplication For Registration: Republic of The Philippines Department of Finance Bureau of Internal Revenue BIR Form NoehrgsdОценок пока нет

- SarikaДокумент55 страницSarikaStella PaulОценок пока нет

- Amerbran CompanyДокумент1 страницаAmerbran CompanyJalad Mukerjee100% (1)

- 1706Документ2 страницы1706May Chan Cuyos100% (1)

- Natural Care Service Package (NCSP) Agreement: Cuckoo International (B) SDN BHDДокумент1 страницаNatural Care Service Package (NCSP) Agreement: Cuckoo International (B) SDN BHDWesdi DОценок пока нет

- Evidence: The Detail of Source of Income Has Been Mentioned in TheДокумент2 страницыEvidence: The Detail of Source of Income Has Been Mentioned in TheDrone TewatiaОценок пока нет

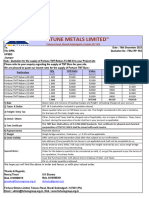

- "Fortune Metals Limited": Talwara Road, Mandi Gobindgarh, Punjab-147 301Документ1 страница"Fortune Metals Limited": Talwara Road, Mandi Gobindgarh, Punjab-147 301S K SharmaОценок пока нет

- Instructor's Manual - Vol. 1 - Solutions To Appendix E Tax Cases - 2011Документ48 страницInstructor's Manual - Vol. 1 - Solutions To Appendix E Tax Cases - 2011Heather Green100% (1)

- Ride Details Bill Details: Thanks For Travelling With Us, GautamengineeringcompanyДокумент3 страницыRide Details Bill Details: Thanks For Travelling With Us, Gautamengineeringcompanyanon_523618295Оценок пока нет

- Fee Structure 7Документ1 страницаFee Structure 7ABHISHEKОценок пока нет

- 23 UgsthbДокумент84 страницы23 UgsthbChawla DimpleОценок пока нет

- Tally TestДокумент2 страницыTally Testsathish kumarОценок пока нет

- TAX 1601 Answers Additions To TaxДокумент4 страницыTAX 1601 Answers Additions To TaxAlrahjie AnsariОценок пока нет

- Income Taxation - Regular Income Tax 2Документ5 страницIncome Taxation - Regular Income Tax 2Drew BanlutaОценок пока нет

- Balance - Sheet 1119Документ2 страницыBalance - Sheet 1119BASKOROОценок пока нет

- HBL Id (Key Fact Sheet) - Jul - Dec 2020 PDFДокумент1 страницаHBL Id (Key Fact Sheet) - Jul - Dec 2020 PDFAli ShahОценок пока нет

- In A NutshellДокумент3 страницыIn A NutshellJane TuazonОценок пока нет

- Wealth Management PPT FinalДокумент42 страницыWealth Management PPT FinalCyvita VeigasОценок пока нет