Академический Документы

Профессиональный Документы

Культура Документы

Affidavit of Heirship For A Motor Vehicle: (See Important Instructions On Reverse Side.)

Загружено:

tortdogОригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Affidavit of Heirship For A Motor Vehicle: (See Important Instructions On Reverse Side.)

Загружено:

tortdogАвторское право:

Доступные форматы

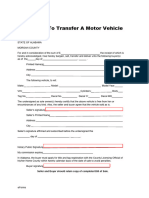

AFFIDAVIT OF HEIRSHIP FOR A MOTOR VEHICLE

Form VTR-262

(Rev. 4/2006)

DHT # 142368 (See important instructions on reverse side.)

YEAR MAKE BODY STYLE MODEL LICENSE PLATE NUMBER

VEHICLE IDENTIFICATION NUMBER TITLE/DOC. NUMBER

THE STATE OF TEXAS COUNTY OF

Before me, the undersigned authority, on this day personally appeared all the undersigned affiants, who, after having been by me

duly sworn, on oath, each for himself and herself deposes and states that ,

the recorded owner of the above described motor vehicle, died on the day of , year , at

in the county of , and the State of ;

that the deceased left (check one) either no will or a will; a court has determined that no administration is necessary or that no

application for administration or probate has been filed; that there is no necessity for an administration upon the estate nor for probate

of a will and all affiants having agreed that the will shall not be offered for probate; that affiants herein are the sole and only known

heirs at law of the deceased and, if there is a will, all beneficiaries of the will are, therefore, authorized under the law to sell, transfer

and assign the ownership to said motor vehicle described above, to wit; there are no other known heirs who have prior right to the

estate of the deceased, and it is the decision of all of the undersigned that title to the above described motor vehicle be issued to:

NAME OF PURCHASER ADDRESS CITY STATE ZIP CODE

Or, if the lienholder recorded on the title is deceased and the lien is paid, title issued free and clear of lien to:

NAME OF RECORDED OWNER ADDRESS CITY STATE ZIP CODE

* * * SIGNATURES OF AFFIANTS (HEIRS) * * *

Subscribed and sworn to before me this the day of , year .

NOTARY

SEAL , Texas

NOTARY PUBLIC COUNTY

ODOMETER DISCLOSURE STATEMENT (only for vehicles less than 10 model years old)

FEDERAL AND STATE LAW REQUIRE THAT YOU STATE THE MILEAGE IN CONNECTION WITH THE TRANSFER OF OWNERSHIP.

FAILURE TO COMPLETE OR PROVIDING A FALSE STATEMENT MAY RESULT IN FINES AND/OR IMPRISONMENT.

I certify to the best of my knowledge that the odometer reading is the actual mileage of the vehicle unless one of the following

statements is checked:

1. The mileage stated is in excess of its mechanical limits.

ODOMETER READING (NO TENTHS)

2. The odometer reading is not the actual mileage.

WARNING - ODOMETER DISCREPANCY.

SIGNATURE OF SELLER/HEIR PRINTED NAME (SAME AS SIGNATURE) DATE OF STATEMENT

SELLER/HEIR ADDRESS CITY STATE ZIP CODE

I am aware of the above odometer certification made by the seller/heir.

SIGNATURE OF PURCHASER PRINTED NAME (SAME AS SIGNATURE) DATE OF STATEMENT

HEIRSHIP PROCEDURE

1. If the estate has been probated, the executor or administrator may assign the title provided a certified copy of the probate

proceedings or Letters Testamentary or Letters of Administration is attached. Otherwise, the following procedures must be

met in order to transfer ownership.

2. If an heirship affidavit is used when a court has determined that no administration is necessary, the affiant(s) must attach the

original or certified copy of the court document indicating no administration of the will is necessary and the portions of the will which

specify that the will is in the deceased owner’s name and indicates the name(s) of the heir(s).

3. Complete the information regarding the vehicle description.

4. ALL HEIRS OF ESTATE - If there has been no administration on the estate, and no administration is necessary, the heir or heirs

should sign in the SIGNATURE OF AFFIANTS AREA. If all heirs cannot appear before one notary public on the same date,

separate acknowledgments may be taken and attached to the form. If one of the heirs is a surviving spouse, only that heir need

sign as an affiant, unless there are surviving children of the deceased with a parent who is other than the surviving spouse. If there

is no surviving spouse, or if there are surviving children of the deceased with a parent who is other than the surviving spouse, all

children of the decedent (if any) must sign as affiants. If the decedent left neither a spouse nor children, consult legal counsel as to

who are the “heirs at law.”

NOTE: 1. Children born to or legally adopted by the deceased qualify for this procedure as “children” of the deceased.

2. If there are surviving minor children of the deceased who are “heirs,” a guardian must sign for the minor children and

attach Letters of Guardianship.

3. If there is no surviving spouse, a guardian should sign for any surviving minor children of the deceased and attach

Letters of Guardianship.

Note: The foregoing is for information purposes only. If legal advice is required in any matter, the affiant(s) should make their

own arrangements for the same.

5. NOTARIZATION - All signatures must be notarized.

6. Errors - Errors that have been lined through and explained may be corrected with a statement of fact. Erasures and significant

alterations may require a new form to be completed.

7. ODOMETER DISCLOSURE STATEMENT - This section is required to be completed by the seller/heir and the purchaser on

motorized vehicles with a year model of less than 10 model years old.

NOTE: Only one seller/heir is required to execute the odometer disclosure statement.

The following additional documentation may be required in order for a title transfer to be processed by the County Tax Assessor-Collector

in the name of the title applicant(s):

a. An Application for Texas Certificate of Title (Form 130-U);

b. A Title and Registration Verification or Current License Receipt;

c. A Release of Lien (if applicable);

d. An Affidavit of Physical Inspection (Form VTR-270);

e. A secure Dealer Reassignment of Title (Form VTR-41-A); and

f. Current Proof of Liability Insurance in the Title Applicant’s Name(s).

WARNING: TRANSPORTATION CODE § 501.155, PROVIDES THAT FALSIFYING INFORMATION ON ANY

REQUIRED STATEMENT OR APPLICATION IS A THIRD-DEGREE FELONY.

Вам также может понравиться

- A Simple Guide for Drafting of Conveyances in India : Forms of Conveyances and Instruments executed in the Indian sub-continent along with Notes and TipsОт EverandA Simple Guide for Drafting of Conveyances in India : Forms of Conveyances and Instruments executed in the Indian sub-continent along with Notes and TipsОценок пока нет

- Mechanic's Lien Foreclosure: Vehicle InformationДокумент2 страницыMechanic's Lien Foreclosure: Vehicle InformationToshiba userОценок пока нет

- The Book of the Morris Minor and the Morris Eight - A Complete Guide for Owners and Prospective Purchasers of All Morris Minors and Morris EightsОт EverandThe Book of the Morris Minor and the Morris Eight - A Complete Guide for Owners and Prospective Purchasers of All Morris Minors and Morris EightsОценок пока нет

- HowДокумент1 страницаHowHazel-mae LabradaОценок пока нет

- Motor Vehicle Title Reassignment SupplementДокумент2 страницыMotor Vehicle Title Reassignment SupplementBrittney WhiteОценок пока нет

- Alberta Bill of SaleДокумент2 страницыAlberta Bill of SaleDalvinder KaurОценок пока нет

- OregonДокумент2 страницыOregonGestoría Andres Saenz100% (1)

- Bill of Sale DocumentДокумент2 страницыBill of Sale Documentclaudine BelisleОценок пока нет

- Bill of SaleДокумент2 страницыBill of SaleRebecca PenarОценок пока нет

- Alberta Bill of Sale 2014Документ2 страницыAlberta Bill of Sale 2014bigbearzukeОценок пока нет

- Vehicle Identification Number and Odometer Verification: 1FMZU77E31UB39728 2001 Ford White MichiganДокумент2 страницыVehicle Identification Number and Odometer Verification: 1FMZU77E31UB39728 2001 Ford White MichiganTjay SlackОценок пока нет

- 516 FillДокумент1 страница516 FillAlfazone360Оценок пока нет

- bmv3774 OhioДокумент1 страницаbmv3774 Ohiojamm247Оценок пока нет

- Odometer Disclosure Statement-WPS OfficeДокумент1 страницаOdometer Disclosure Statement-WPS OfficeBianca Benj ZariОценок пока нет

- Odometer Disclosure Statement-WPS OfficeДокумент1 страницаOdometer Disclosure Statement-WPS OfficeArnel AlmenarioОценок пока нет

- Nonresidence and Military Service Exemption From Specific Ownership Tax AffidavitДокумент2 страницыNonresidence and Military Service Exemption From Specific Ownership Tax AffidavitWerewolfman 186Оценок пока нет

- Title Paper PDFДокумент2 страницыTitle Paper PDFJason KennedyОценок пока нет

- BMV 3774Документ1 страницаBMV 3774LEAHОценок пока нет

- Application (S) For Certificate of Title To A Motor VehicleДокумент1 страницаApplication (S) For Certificate of Title To A Motor VehicleAnonymous L3hKyrVEpОценок пока нет

- OdometerДокумент1 страницаOdometervarsityrunnerОценок пока нет

- Affidavit of Ownership PacketДокумент8 страницAffidavit of Ownership PacketJeremy WebbОценок пока нет

- DR2395Документ2 страницыDR2395Heryanto ChandrawarmanОценок пока нет

- Notice of Sale And/or Bill of Sale For A Motor Vehicle, Mobile Home, Off-Highway Vehicle or VesselДокумент1 страницаNotice of Sale And/or Bill of Sale For A Motor Vehicle, Mobile Home, Off-Highway Vehicle or Vesselghoshtapan4321Оценок пока нет

- REG 227, Application For Duplicate or Paperless TitleДокумент2 страницыREG 227, Application For Duplicate or Paperless Titlefoufou79100% (1)

- Odometer Disclosure Statement: Year Make Model Body Vehicle Identification NoДокумент0 страницOdometer Disclosure Statement: Year Make Model Body Vehicle Identification NoNooruddin SheikОценок пока нет

- Application For Replacement or Transfer of Title: DMV Use OnlyДокумент2 страницыApplication For Replacement or Transfer of Title: DMV Use OnlyDoug LymanОценок пока нет

- Odometer Disclosure StatementДокумент1 страницаOdometer Disclosure StatementPhilip VargasОценок пока нет

- 3 Odometer DisclosureДокумент1 страница3 Odometer DisclosureJuan Carlos MartinezОценок пока нет

- Vsa 17 AДокумент2 страницыVsa 17 AJustin WilliamsОценок пока нет

- Vsa 40Документ2 страницыVsa 40Dewy WildonОценок пока нет

- VTR 270Документ1 страницаVTR 270Erick CrespoОценок пока нет

- 82042Документ2 страницы82042theevilpeterОценок пока нет

- POA VehicleДокумент1 страницаPOA VehicleAdam JaredОценок пока нет

- Affidavit of Heirship For A Motor VehicleДокумент2 страницыAffidavit of Heirship For A Motor VehicleCeberus233Оценок пока нет

- GEICO FL Total Loss PaperworkДокумент3 страницыGEICO FL Total Loss PaperworkSandeep SuryavanshiОценок пока нет

- LetterOfAuth REG0169Документ1 страницаLetterOfAuth REG0169gelin capiliОценок пока нет

- Derelict Motor Vehicle CertificateДокумент1 страницаDerelict Motor Vehicle CertificateAplus Recycling, LLCОценок пока нет

- Reg227 PDFДокумент2 страницыReg227 PDFxerxeschuaОценок пока нет

- FL DMVДокумент2 страницыFL DMVshameem_ficsОценок пока нет

- Car Bill of SaleДокумент1 страницаCar Bill of SaleRomi Roberto100% (1)

- Adobe Scan 09-Jun-2023Документ8 страницAdobe Scan 09-Jun-2023digitaladitya6564Оценок пока нет

- New Mexico Bill of Sale Form For Motor Vehicle Trailer or BoatДокумент2 страницыNew Mexico Bill of Sale Form For Motor Vehicle Trailer or BoatMocks CetОценок пока нет

- Kansas Vehicle Bill of Sale Form TR 312Документ1 страницаKansas Vehicle Bill of Sale Form TR 312Jonathan Thomas ColeОценок пока нет

- VTR 441 PDFДокумент2 страницыVTR 441 PDFAdrian BookerОценок пока нет

- Bill of Sale CarДокумент1 страницаBill of Sale CardareaperdegenesizОценок пока нет

- Vsa17a PDFДокумент2 страницыVsa17a PDFxerxeschuaОценок пока нет

- Morgan County Alabama Motor Vehicle Bill of Sale FormДокумент1 страницаMorgan County Alabama Motor Vehicle Bill of Sale Formtonyharris714Оценок пока нет

- MVD10009 PDFДокумент2 страницыMVD10009 PDFAudrey Freeman100% (1)

- Texas Certificate of TitleДокумент2 страницыTexas Certificate of TitleArq Isaac TriujequeОценок пока нет

- Title ApplicationДокумент2 страницыTitle ApplicationZaki ZahidОценок пока нет

- Future Generali Motor-Od Claim FormДокумент2 страницыFuture Generali Motor-Od Claim FormSABodyShop NagpurОценок пока нет

- Affidavit of Inheritance/Litigation: Affidavit of Loss/Release of Interest, Owner DeceasedДокумент1 страницаAffidavit of Inheritance/Litigation: Affidavit of Loss/Release of Interest, Owner DeceasedBranden FieldОценок пока нет

- Vehicle Insurance Claim Form - 15102019Документ4 страницыVehicle Insurance Claim Form - 15102019DILIP KОценок пока нет

- Reg 168 AДокумент1 страницаReg 168 AManny TileОценок пока нет

- Application For Duplicate Motor Vehicle Certificate of Title (Fillable)Документ1 страницаApplication For Duplicate Motor Vehicle Certificate of Title (Fillable)Courtney LedОценок пока нет

- Affidavit of NonliabilityДокумент3 страницыAffidavit of Nonliabilityzia_ghiasiОценок пока нет

- Authorization To Renew Motor Vehicle/Trailer License: Cash or Check in Registered Owner'S Name RequiredДокумент1 страницаAuthorization To Renew Motor Vehicle/Trailer License: Cash or Check in Registered Owner'S Name RequiredRamil ElambayoОценок пока нет

- Application For High Occupancy Vehicle (Hov) DecalДокумент1 страницаApplication For High Occupancy Vehicle (Hov) DecalsandyolkowskiОценок пока нет

- Texas Export Only English PDFДокумент1 страницаTexas Export Only English PDFWest WheelsОценок пока нет

- Example Sales AgreementДокумент1 страницаExample Sales Agreementmeopeo1003Оценок пока нет

- SL-950TR SL-750TR SL-750TRS SL-750TRFL SL-550TR SL-550TRS: Installers GuideДокумент52 страницыSL-950TR SL-750TR SL-750TRS SL-750TRFL SL-550TR SL-550TRS: Installers GuidetortdogОценок пока нет

- Trek 4 CommentsДокумент3 страницыTrek 4 CommentstortdogОценок пока нет

- SiriusXM MSLR FullCookbook 2012 PDFДокумент75 страницSiriusXM MSLR FullCookbook 2012 PDFmechaphileОценок пока нет

- Dahlquist EmailДокумент2 страницыDahlquist Emailtortdog100% (2)

- Venturing Leadership Skills CourseДокумент75 страницVenturing Leadership Skills Coursetortdog100% (2)

- Varsity Scouting Guidebook - 2000Документ240 страницVarsity Scouting Guidebook - 2000tortdog100% (1)

- Calling List For Ward ScoutsДокумент2 страницыCalling List For Ward ScoutstortdogОценок пока нет

- Elder Pace On Strengthening YMДокумент2 страницыElder Pace On Strengthening YMtortdogОценок пока нет

- Varsity Basketball Tournament Registration Form051126142418Документ5 страницVarsity Basketball Tournament Registration Form051126142418tortdog100% (1)

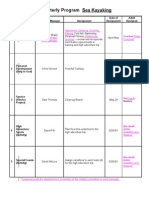

- Varsity Program HelpsДокумент23 страницыVarsity Program Helpstortdog100% (1)

- Ward VarsityДокумент99 страницWard VarsitytortdogОценок пока нет

- Preach My GospelДокумент244 страницыPreach My GospeltortdogОценок пока нет

- Registration Form For The Varsity Turkey Vulture Triathlon: Dia/park - Maps/pwd - MP - p4505 - 121 PDFДокумент2 страницыRegistration Form For The Varsity Turkey Vulture Triathlon: Dia/park - Maps/pwd - MP - p4505 - 121 PDFtortdogОценок пока нет

- Unit Commissioner WorksheetДокумент2 страницыUnit Commissioner Worksheettortdog100% (1)

- Quarterly ProgramДокумент1 страницаQuarterly ProgramtortdogОценок пока нет

- New Staff ApplicationДокумент2 страницыNew Staff ApplicationtortdogОценок пока нет

- Rising Star District CookbookДокумент99 страницRising Star District Cookbooktortdog100% (1)

- Turkey Vulture Triathlon DetailsДокумент5 страницTurkey Vulture Triathlon DetailstortdogОценок пока нет

- Schedule For High AdventureДокумент2 страницыSchedule For High AdventuretortdogОценок пока нет

- Referee RegistrationДокумент1 страницаReferee RegistrationtortdogОценок пока нет

- InvitiationДокумент1 страницаInvitiationtortdogОценок пока нет

- Microsoft Word - Turkey Shoot-1Документ1 страницаMicrosoft Word - Turkey Shoot-1tortdogОценок пока нет

- Microsoft Word - Turkey FlyerДокумент2 страницыMicrosoft Word - Turkey Flyertortdog100% (2)

- Health Officer Training 19-141Документ150 страницHealth Officer Training 19-141tortdog100% (2)

- Disappear Varsity WorkbookДокумент12 страницDisappear Varsity WorkbooktortdogОценок пока нет

- Microsoft Word - Triathlon REG FORMДокумент1 страницаMicrosoft Word - Triathlon REG FORMtortdogОценок пока нет

- Shac Varsity Basketball Tournament Evaluation FormДокумент2 страницыShac Varsity Basketball Tournament Evaluation FormtortdogОценок пока нет

- General Camp PoliciesДокумент9 страницGeneral Camp PoliciestortdogОценок пока нет

- Crew Tracking SheetДокумент17 страницCrew Tracking SheettortdogОценок пока нет

- 2006 Varsity High AdventureДокумент2 страницы2006 Varsity High AdventuretortdogОценок пока нет

- James Borwick, 5th Baron BorwickДокумент3 страницыJames Borwick, 5th Baron BorwickChun Ming IpОценок пока нет

- Trade Using Market Profile Trading Strategies PDFДокумент3 страницыTrade Using Market Profile Trading Strategies PDFJohn BestОценок пока нет

- Before: Patricia L. RichardsonДокумент5 страницBefore: Patricia L. Richardsonpuneet0303Оценок пока нет

- American Car - November 2014 UKДокумент116 страницAmerican Car - November 2014 UKenricoio100% (2)

- Policy No. 2312 1001 4634 4400 000Документ2 страницыPolicy No. 2312 1001 4634 4400 000JPC RTKОценок пока нет

- SPC 2nd EditionДокумент235 страницSPC 2nd EditionBYRONGOSОценок пока нет

- Fleet ManagementДокумент17 страницFleet Managementpl82Оценок пока нет

- Catalog NacДокумент28 страницCatalog Nacud90117Оценок пока нет

- Marvelous College of Technology, IncДокумент7 страницMarvelous College of Technology, Incthirsty liquidОценок пока нет

- Abb Price ListДокумент12 страницAbb Price ListShamim Ahsan Parvez47% (15)

- Briggs and Stratton Model 9000, Model 10000, Part GuideДокумент64 страницыBriggs and Stratton Model 9000, Model 10000, Part Guidegaryg11100% (1)

- 953CДокумент24 страницы953CVictor M. Mejia Diaz0% (1)

- TS en 15085-2-2008 Demi̇ryolu Araçlari Ve Bi̇leşenleri̇ni̇n Kaynaği-Bölüm 2 Kaynak İmalatçilarinin Kali̇te Özelli̇kleri̇ Ve Belgelendi̇ri̇lmesi̇Документ24 страницыTS en 15085-2-2008 Demi̇ryolu Araçlari Ve Bi̇leşenleri̇ni̇n Kaynaği-Bölüm 2 Kaynak İmalatçilarinin Kali̇te Özelli̇kleri̇ Ve Belgelendi̇ri̇lmesi̇c3409127100% (3)

- FinalДокумент31 страницаFinalAvinash RaiОценок пока нет

- Multi Nut Tightner at Remover (Autosaved)Документ22 страницыMulti Nut Tightner at Remover (Autosaved)Pratheep Kumar78% (9)

- Director Manager Environmental Health Safety in Nashville TN Resume Neil SchwartzДокумент2 страницыDirector Manager Environmental Health Safety in Nashville TN Resume Neil SchwartzNeilSchwartzОценок пока нет

- 17071-02 B13R D13C CHN 125761-132856 PDFДокумент120 страниц17071-02 B13R D13C CHN 125761-132856 PDFAnonymous EDNsviОценок пока нет

- Polyone (Shanghai) Co. LTD PDFДокумент14 страницPolyone (Shanghai) Co. LTD PDFchinmoyd1Оценок пока нет

- Curriculum Vitae: Sumeet Sourabh Phone-+91 9312068821 EmailДокумент3 страницыCurriculum Vitae: Sumeet Sourabh Phone-+91 9312068821 Emailsumeet sourabhОценок пока нет

- Kotler On BrandingДокумент26 страницKotler On Brandingzulejunior87Оценок пока нет

- Project ReportДокумент44 страницыProject ReportShiva SankarОценок пока нет

- DWG - NO-3: Drum Munting Frame Breake MountingДокумент1 страницаDWG - NO-3: Drum Munting Frame Breake MountingBrajnandan AryaОценок пока нет

- Lancer Evo PricelistДокумент4 страницыLancer Evo PricelistFarizudin Haji DaudОценок пока нет

- Gestamp-Experience of VANADIS 4Документ38 страницGestamp-Experience of VANADIS 4k4r0_oliveiraОценок пока нет

- Basic Equipment Wiring AGY EngineДокумент20 страницBasic Equipment Wiring AGY EnginemasterbfishОценок пока нет

- Complete Final Assembly / Sub Assembly / Rubber Parts From BIN That Are Going Into Final Assembly With SC CC Characteristics Table - 1 Issued byДокумент1 страницаComplete Final Assembly / Sub Assembly / Rubber Parts From BIN That Are Going Into Final Assembly With SC CC Characteristics Table - 1 Issued byKarthiОценок пока нет

- 2012 Q3 - McKinsey Quarterly - Leading in The 21 Century PDFДокумент136 страниц2012 Q3 - McKinsey Quarterly - Leading in The 21 Century PDFBayside BlueОценок пока нет

- Mobilkran Mobile Crane Grue Automotrice: Technische Daten Technical Data Caractéristiques TechniquesДокумент18 страницMobilkran Mobile Crane Grue Automotrice: Technische Daten Technical Data Caractéristiques TechniquesVinodh Palanichamy0% (1)

- Mobile Equipment Inspection Procedure-GuideДокумент2 страницыMobile Equipment Inspection Procedure-GuideElavarasan JayachandranОценок пока нет

- Bse 20181008Документ52 страницыBse 20181008BellwetherSataraОценок пока нет

- Essential Guide to Workplace Investigations, The: A Step-By-Step Guide to Handling Employee Complaints & ProblemsОт EverandEssential Guide to Workplace Investigations, The: A Step-By-Step Guide to Handling Employee Complaints & ProblemsРейтинг: 3 из 5 звезд3/5 (2)

- Employment Law: a Quickstudy Digital Law ReferenceОт EverandEmployment Law: a Quickstudy Digital Law ReferenceРейтинг: 1 из 5 звезд1/5 (1)

- Legal Writing in Plain English: A Text with ExercisesОт EverandLegal Writing in Plain English: A Text with ExercisesРейтинг: 3 из 5 звезд3/5 (2)

- A Student's Guide to Law School: What Counts, What Helps, and What MattersОт EverandA Student's Guide to Law School: What Counts, What Helps, and What MattersРейтинг: 5 из 5 звезд5/5 (4)

- The Power of Our Supreme Court: How Supreme Court Cases Shape DemocracyОт EverandThe Power of Our Supreme Court: How Supreme Court Cases Shape DemocracyРейтинг: 5 из 5 звезд5/5 (2)

- Flora and Vegetation of Bali Indonesia: An Illustrated Field GuideОт EverandFlora and Vegetation of Bali Indonesia: An Illustrated Field GuideРейтинг: 5 из 5 звезд5/5 (2)

- Legal Writing in Plain English, Third Edition: A Text with ExercisesОт EverandLegal Writing in Plain English, Third Edition: A Text with ExercisesОценок пока нет

- How to Make Patent Drawings: Save Thousands of Dollars and Do It With a Camera and Computer!От EverandHow to Make Patent Drawings: Save Thousands of Dollars and Do It With a Camera and Computer!Рейтинг: 5 из 5 звезд5/5 (1)

- Dictionary of Legal Terms: Definitions and Explanations for Non-LawyersОт EverandDictionary of Legal Terms: Definitions and Explanations for Non-LawyersРейтинг: 5 из 5 звезд5/5 (2)

- Legal Forms for Starting & Running a Small Business: 65 Essential Agreements, Contracts, Leases & LettersОт EverandLegal Forms for Starting & Running a Small Business: 65 Essential Agreements, Contracts, Leases & LettersОценок пока нет

- So You Want to be a Lawyer: The Ultimate Guide to Getting into and Succeeding in Law SchoolОт EverandSo You Want to be a Lawyer: The Ultimate Guide to Getting into and Succeeding in Law SchoolОценок пока нет

- Nolo's Encyclopedia of Everyday Law: Answers to Your Most Frequently Asked Legal QuestionsОт EverandNolo's Encyclopedia of Everyday Law: Answers to Your Most Frequently Asked Legal QuestionsРейтинг: 4 из 5 звезд4/5 (18)

- Nolo's Deposition Handbook: The Essential Guide for Anyone Facing or Conducting a DepositionОт EverandNolo's Deposition Handbook: The Essential Guide for Anyone Facing or Conducting a DepositionРейтинг: 5 из 5 звезд5/5 (1)