Академический Документы

Профессиональный Документы

Культура Документы

Mountain Man Brewing

Загружено:

Alfred EstacaАвторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Mountain Man Brewing

Загружено:

Alfred EstacaАвторское право:

Доступные форматы

Alfred Estaca

MKTG 489

Mountain Man Brewing Company

1

Situation Analysis

Mountain Man Beer Company is a family owned business since 1925. The company

has been passed down the Prangel family for generations, and with it the old family

brew recipe. When this case was written, Mountain Man Lager is known as Best

Beer in West Virginia and selected as Americas Championship Lager. Their

product was the best known regional beer, yielding an unaided response rate of

67% (MMBC).

However, as revenue is beginning to shrink, and there is more of an interest in light

beer, Chris Prangel is looking to diversify Mountain Man Brewing Companys

product mix. As of when this case was written, Mountain Man Brewing had one

product in its mix Mountain Man Lager.

SWOT Analysis:

Strengths: Quality and Taste, Competitive Pricing, Regional Loyalty, Generations in

business, Grass Roots Marketing

Weakness: Resources are not as strong as larger brewers, therefore if Mountain

Man spreads themselves thin, they can loose everything

Opportunity: First time drinkers not loyal to a brand. Light beer has an annual

growth rate of 4%, Cater to women market (42%), Younger demographics 25 - 44

age group constitutes 54% of light beer drinkers

Threats: cannibalization, loss of brand loyalty, R&D expensive to develop the light

beer, increase advertising costs, Other Domestic Brands take up for 9.4% market

share of domestic light beer Brands.

Problem Definition:

The issue at hand is, given cannibalization, additional fixed costs, additional variable

costs, additional production and R&D costs will initiating a new product to the mix

outweigh the 2% decline in revenue from the prior fiscal year. Additionally, will

creating a new product help battle the increase in taxes and the decrease of beer

drinking nationally (2.1%)

Options

Option 1: Keep the status quo. Do not create a new product, and keep selling

Mountain Man Lager. The pros to this course of action, is it will not require

Mountain Man Brewing to squander its resources in a new product. In addition, by

not creating a new product, Mountain Man Brewing will keep its image intact. The

Alfred Estaca

MKTG 489

Mountain Man Brewing Company

2

con however, is Mountain Man Brewing will have to figure out new ways to contend

with the 2% drop in revenue.

Option 2: Create Mountain Man Light Beer. By adding a product to the mix,

Mountain Man Brewing will be able to gain additional revenue. Diversify its market

from old blue collar working men to younger men and women. These younger men

and women which are between the ages of 21 and 27 years old have yet to establish

brand loyalty and account for 27% of total beer sales. In addition, Mountain Man

Brewing will be able to grab hold of the Light Beer Market which have sales at over

50% and growing at a compound rate of 4% annually. The con to this however are

the costs Mountain Man will incur; $1,650,000 in fixed costs, and $71.62 in variable

per unit costs. Moreover, an additional product may cannibalize the existing lager,

take up existing shelf space and hurt brand image to the established followers of

Mountain Man Lager.

Option 3: Create a light beer under a new name. By creating a light beer, which isnt

directly related to Mountain Man Lager, MMBC will be able to enjoy the fruits of

additional revenue without the cannibalization of its Lager. The con to this course of

action however is, releasing a whole new product means MMBC wont be able to

leverage its name and its market who already enjoy Mountain Man Lager.

Essentially this light beer will have to start from the ground up. This will incur more

costs for MMBC with advertising.

Decision

Create a Mountain Man Light (Option 2). By undertaking option 2, MMBC will be

able to utilize its already robust reputation. Option 2 will provide additional revenue

to outpace the 2% decline in revenue. Considering net revenues in 2005 was

$50,440,000; the 2% decline equated to $1,008,800. According to exhibit 1 the

revenue in 2006 from Light Beer alone will be $9,454,626.43 which is about 18.7%

of 2005 revenue. This profit will easily cover the fixed costs of $1,650,000 incurred

from the Light Beer. Moreover, the break-even point of 65,012 units (exhibit 2) will

easily be reached considering a market share of 97,470.38 for the year of 2006.

Additionally, the difference between the 2% from revenue decline and 18.7% from

light beer revenue gives us a 16.7% pillow to fight cannibalization. Therefore, an

ideal cannibalization would be from 2%-6%.

Alfred Estaca

MKTG 489

Mountain Man Brewing Company

3

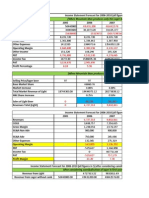

Exhibit 1

Market Size of East Central

Region with 4% CAGR

2005 18,744,303.00

2006 19,494,075.12

2007 20,273,838.12

Mountain Man Market Share

growing at .25% per year

2005 46,860.76

2006 97,470.38

2007 152,053.79

Mountain Main Revenue from

Light Beer

2005 $4,545,493.48

2006 $9,454,626.43

2007 $14,749,217.24

Exhibit 2

Break Even Analysis

Fixed Costs Variable Unit Costs

Additional Advertising

$750,000.

00 Cost Per Barrel $66.93

Annual SG&A Costs

$900,000.

00

Per barrel

additional cost $4.69

to produce Light

Beer

Unit Selling Price: $97.00

Break Even Units: 65,012

Вам также может понравиться

- Mountain Man Case Analysis by Group 2Документ2 страницыMountain Man Case Analysis by Group 2Curiosity Killer100% (2)

- Marketing 3 - Group 3 - Soren Chemicals - Case AnalysisДокумент2 страницыMarketing 3 - Group 3 - Soren Chemicals - Case Analysispuneet100% (1)

- Group Assignment 2 Crescent Pure CaseДокумент11 страницGroup Assignment 2 Crescent Pure CaseKamala MalaОценок пока нет

- Mountain Men Brewing CompanyДокумент12 страницMountain Men Brewing CompanyStephanie Lawrence Knop25% (4)

- Mountain Man Brewing Company - Group8Документ3 страницыMountain Man Brewing Company - Group8Akriti Sehgal100% (2)

- Pillsbury Cookie Challenge - IIM-KДокумент5 страницPillsbury Cookie Challenge - IIM-KDeepu SОценок пока нет

- Mountain Man Brewing Company Case Study AnalysisДокумент21 страницаMountain Man Brewing Company Case Study AnalysisRDH100% (9)

- MMBCДокумент5 страницMMBCSabyasachi Sahu100% (1)

- Mountain Man Brewing CompanyДокумент13 страницMountain Man Brewing CompanySuneetSinghBadla100% (1)

- Mountain Man Brewing Company Analysis UpdatedДокумент8 страницMountain Man Brewing Company Analysis UpdatedSandhya Rajan50% (2)

- Mountain Man Brewing Company - BE - TemplateДокумент2 страницыMountain Man Brewing Company - BE - TemplateswapniljsoniОценок пока нет

- MMBC - Case AnalysisДокумент28 страницMMBC - Case AnalysisPhong Phan Thanh100% (1)

- Mountain Man Brewing Scenario AnalyzerДокумент4 страницыMountain Man Brewing Scenario AnalyzerAnjulHans100% (1)

- Soren Chemicals CaseДокумент20 страницSoren Chemicals CaseKaushik Jana96% (24)

- This Test Method Is Not For ResaleДокумент4 страницыThis Test Method Is Not For ResaleMilagros WieczorekОценок пока нет

- Mountain Man Beer CompanyДокумент4 страницыMountain Man Beer CompanyAshwin Golapkar100% (1)

- Mountain Man Brewing CompanyДокумент2 страницыMountain Man Brewing CompanySharon Goh67% (3)

- Metabical Demand, ForecastingДокумент6 страницMetabical Demand, ForecastingAnirban KarОценок пока нет

- Crescent PureДокумент6 страницCrescent PureSHIVAM CHUGH100% (3)

- Eco7 AnalysisДокумент11 страницEco7 AnalysisDewang PalavОценок пока нет

- Case Study AnalysisДокумент8 страницCase Study AnalysisPaulo RojasОценок пока нет

- Loctite-Corporation Mid TermДокумент16 страницLoctite-Corporation Mid TermPreeti SoniОценок пока нет

- Department of Management Studies Marketing Management: Case Study ReportДокумент16 страницDepartment of Management Studies Marketing Management: Case Study ReportAakanksha Panwar100% (1)

- Worksheet 240357970 Case Analysis Soren ChemicalsДокумент8 страницWorksheet 240357970 Case Analysis Soren Chemicalsmahesh.mohandas3181Оценок пока нет

- MMBC Breakeven AnalysisДокумент11 страницMMBC Breakeven Analysismrr2012Оценок пока нет

- MMBCДокумент12 страницMMBCCaro Gomez de CaroОценок пока нет

- Mountain Man Brewing CoДокумент4 страницыMountain Man Brewing CoMaite Gorostiaga100% (1)

- Mountain Man Brewing CompanyДокумент32 страницыMountain Man Brewing CompanyFez Research Laboratory83% (12)

- MMBC Case Write-UpДокумент2 страницыMMBC Case Write-UpKundan K100% (1)

- Mountain Man Brewery Case Report UploadДокумент6 страницMountain Man Brewery Case Report Uploadherediamario100% (1)

- Mountain ManДокумент5 страницMountain ManShrey PandeyОценок пока нет

- Mountain Man Brewing CompanyДокумент6 страницMountain Man Brewing CompanyChida_m100% (3)

- Mountain Man Brewing Company - CompliedДокумент21 страницаMountain Man Brewing Company - CompliedSukriti Vijay100% (3)

- Mountain Man BeerДокумент29 страницMountain Man BeerShivam TrivediОценок пока нет

- Mountain Man Brewing Company Writing Case AnalysisДокумент6 страницMountain Man Brewing Company Writing Case AnalysisAleksandra100% (1)

- MMBC Marketing PLanДокумент12 страницMMBC Marketing PLanCuriosity KillerОценок пока нет

- PBM - Mountain Man BrewingДокумент17 страницPBM - Mountain Man Brewingpreeti jainОценок пока нет

- Individual Write Up MMBCДокумент5 страницIndividual Write Up MMBCchetankabra85Оценок пока нет

- Mountain Man Case StudyДокумент4 страницыMountain Man Case StudyZhijian Huang100% (2)

- Mountain Man Brewing Company Case StudyДокумент3 страницыMountain Man Brewing Company Case StudyPreetam Joga75% (4)

- Mountain Man Brewing CompanyДокумент1 страницаMountain Man Brewing Companynarender sОценок пока нет

- Mountain Man Brewing Company ProjectДокумент41 страницаMountain Man Brewing Company Projectmon309250% (2)

- Case Project - Mountain ManДокумент2 страницыCase Project - Mountain ManSubhrodeep Das100% (1)

- Correction Mountain Man Brewing Company - Group2 Sec H 2014Документ12 страницCorrection Mountain Man Brewing Company - Group2 Sec H 2014Tatsat Pandey100% (2)

- Mountain Man Brewing CompanyДокумент3 страницыMountain Man Brewing CompanySajal Gupta100% (1)

- Market Analysis: We Need To Perform Market Analysis For All 3 Places (California, Washington andДокумент3 страницыMarket Analysis: We Need To Perform Market Analysis For All 3 Places (California, Washington andshivam chughОценок пока нет

- Individual Write Up - MMBCДокумент5 страницIndividual Write Up - MMBCmradulraj50% (2)

- Report For CrescentPureДокумент15 страницReport For CrescentPurefiqa100% (1)

- Montreaux Chocolate USA: Are Americans Ready For Healthy Dark Chocolate?Документ8 страницMontreaux Chocolate USA: Are Americans Ready For Healthy Dark Chocolate?DHARAHAS KORAPATIОценок пока нет

- Case Write-Up The Springfield NoreastersДокумент4 страницыCase Write-Up The Springfield NoreastersSiddhant SanjeevОценок пока нет

- Crescent PureДокумент7 страницCrescent PureShubham RankaОценок пока нет

- SorenДокумент3 страницыSorenPratyush JaiswalОценок пока нет

- Crescent PositioningДокумент2 страницыCrescent Positioningpawan verma verma100% (2)

- SafeBlend FracturingДокумент3 страницыSafeBlend Fracturingcharyel020% (1)

- Recommendations & Conclusion: Execute NICHE Market Positioning StrategyДокумент5 страницRecommendations & Conclusion: Execute NICHE Market Positioning Strategysoldasters100% (1)

- BPMM6013 Marketing Management: Eco7: Launching A New Motor OilДокумент26 страницBPMM6013 Marketing Management: Eco7: Launching A New Motor OilNithin kumarОценок пока нет

- Loctite Case StatsДокумент8 страницLoctite Case StatsBharat SinghОценок пока нет

- Mountain Man Case StudyДокумент4 страницыMountain Man Case StudykarthikawarrierОценок пока нет

- Q.1) Despite Being A Strong Brand What Caused Its Decline?: AnswerДокумент2 страницыQ.1) Despite Being A Strong Brand What Caused Its Decline?: AnswerSuman ChandaОценок пока нет

- Mountain Man Brewing Company: Bringing The Brand To Light: Harvard Business School CaseДокумент28 страницMountain Man Brewing Company: Bringing The Brand To Light: Harvard Business School CaseAnkan MetyaОценок пока нет

- Mountain Man Brewing Bringing Brand To Light Marketing EssayДокумент7 страницMountain Man Brewing Bringing Brand To Light Marketing EssayRaghavendra NaduvinamaniОценок пока нет

- Catalogue Havells AppliancesДокумент57 страницCatalogue Havells AppliancesOlympiad TrainerОценок пока нет

- Accenture Last Mile POV - PDF SOMДокумент10 страницAccenture Last Mile POV - PDF SOMKaushal RaiОценок пока нет

- Zakaria Ch1Документ8 страницZakaria Ch1Zakaria HasaneenОценок пока нет

- Simple Modern Sewing: 8 Basic Patterns To Create 25 Favorite GarmentsДокумент8 страницSimple Modern Sewing: 8 Basic Patterns To Create 25 Favorite GarmentsNatalija Siladjev50% (2)

- Menu For The Hampton Beach Seafood FestivalДокумент6 страницMenu For The Hampton Beach Seafood FestivalHamptonSalemNHPatchОценок пока нет

- 2018 Fire CatalogДокумент28 страниц2018 Fire CatalogForum PompieriiОценок пока нет

- Distribution Strategy of ONNДокумент10 страницDistribution Strategy of ONNarpit agrawalОценок пока нет

- CRM at PantaloonsДокумент16 страницCRM at Pantaloonssurbhijain018100% (1)

- Uefa Kit Regulation 2012Документ67 страницUefa Kit Regulation 2012Silenzio UnoОценок пока нет

- Fashion Timeline: Martha Graciela Castillo Solís Colegio Anglo Mexicano de Coyoacán Subject: English (Reading)Документ13 страницFashion Timeline: Martha Graciela Castillo Solís Colegio Anglo Mexicano de Coyoacán Subject: English (Reading)Martha Castillo SolisОценок пока нет

- Perfume ListДокумент111 страницPerfume ListLysuan AlbaОценок пока нет

- Aerospace Selector GuideДокумент11 страницAerospace Selector GuideJonathan Wong FeiОценок пока нет

- Music Today 1Документ42 страницыMusic Today 1dian indrianiОценок пока нет

- Silliker Lab Micro EZSwabInstructions 2011 EMAILДокумент2 страницыSilliker Lab Micro EZSwabInstructions 2011 EMAILMichelle Morgan LongstrethОценок пока нет

- Unit-1 Basic Upper Preparation TechniquesДокумент7 страницUnit-1 Basic Upper Preparation TechniquesumidgrtОценок пока нет

- Edible Oils FДокумент15 страницEdible Oils FPallavi OakОценок пока нет

- Quiz - Pre A1 Starters - at The Clothes ShopДокумент2 страницыQuiz - Pre A1 Starters - at The Clothes ShopNgoc Huyen HoangОценок пока нет

- OL500 Series GuideДокумент16 страницOL500 Series GuideKirsty BОценок пока нет

- Amazon & WalmartДокумент27 страницAmazon & WalmartJesus Andrade100% (1)

- The Importance of Global Business Protocol and Etiquette in International Business NegotiationsДокумент5 страницThe Importance of Global Business Protocol and Etiquette in International Business NegotiationsBright ChenОценок пока нет

- Sketch Wallet Sewing Pattern PDFДокумент11 страницSketch Wallet Sewing Pattern PDFscason9Оценок пока нет

- TrueДокумент57 страницTrueEbisa DuressaОценок пока нет

- SAP Organization StructureДокумент19 страницSAP Organization Structuresapcust100% (2)

- UNPUBLISHED Consumer Research PaperДокумент4 страницыUNPUBLISHED Consumer Research PaperjocelynrubinОценок пока нет

- Sewing of Household LinensДокумент44 страницыSewing of Household LinensMaximino Eduardo Sibayan94% (35)

- Marketing Segmentation AMULДокумент56 страницMarketing Segmentation AMULchandu_jjvrpОценок пока нет

- Pennsville Fire Rescue 2010 SOPsДокумент89 страницPennsville Fire Rescue 2010 SOPsberoblesОценок пока нет

- A Retailer or Shop Is A Business That Presents A Selection of Goods or Services and Offers To Sell Them To Customers For Money or Other GoodsДокумент4 страницыA Retailer or Shop Is A Business That Presents A Selection of Goods or Services and Offers To Sell Them To Customers For Money or Other GoodsNaMan SeThiОценок пока нет

- Personal Best A2 - Audio ScriptsДокумент11 страницPersonal Best A2 - Audio ScriptsBrenda Carolina Orellana MaldonadoОценок пока нет