Академический Документы

Профессиональный Документы

Культура Документы

B16

Загружено:

asdjkfnasdbifbad0 оценок0% нашли этот документ полезным (0 голосов)

37 просмотров9 страниц144 B16 INCOME EXEMPT FROM TAXES - INDIVIDUALS. 1. Official emoluments of rulers and consorts of rulers. 2. Wound and disability pensions granted to persons in respect of service in various armed and defence forces in Malaysia or in a Commonwealth country. 3. Disability pensions for war injuries disability pensions granted in respect of war service injuries to members of civil defence organisations in any territory comprised in Malaysia on 1 Jan 1968. 4.

Исходное описание:

Авторское право

© © All Rights Reserved

Доступные форматы

PDF, TXT или читайте онлайн в Scribd

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документ144 B16 INCOME EXEMPT FROM TAXES - INDIVIDUALS. 1. Official emoluments of rulers and consorts of rulers. 2. Wound and disability pensions granted to persons in respect of service in various armed and defence forces in Malaysia or in a Commonwealth country. 3. Disability pensions for war injuries disability pensions granted in respect of war service injuries to members of civil defence organisations in any territory comprised in Malaysia on 1 Jan 1968. 4.

Авторское право:

© All Rights Reserved

Доступные форматы

Скачайте в формате PDF, TXT или читайте онлайн в Scribd

0 оценок0% нашли этот документ полезным (0 голосов)

37 просмотров9 страницB16

Загружено:

asdjkfnasdbifbad144 B16 INCOME EXEMPT FROM TAXES - INDIVIDUALS. 1. Official emoluments of rulers and consorts of rulers. 2. Wound and disability pensions granted to persons in respect of service in various armed and defence forces in Malaysia or in a Commonwealth country. 3. Disability pensions for war injuries disability pensions granted in respect of war service injuries to members of civil defence organisations in any territory comprised in Malaysia on 1 Jan 1968. 4.

Авторское право:

© All Rights Reserved

Доступные форматы

Скачайте в формате PDF, TXT или читайте онлайн в Scribd

Вы находитесь на странице: 1из 9

| 144 |

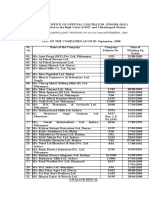

B16 INCOME EXEMPT FROM TAXES

INDIVIDUALS

1. Official emoluments of rulers and consorts of rulers and former rulers or consorts of former

rulers

Official emoluments of Rulers or Ruling Chiefs as defined in S. 76 of the Income Tax Act 1967

(ITA) and consorts of rulers and former rulers or consorts of former rulers (Sch 6 Para 1A, 1B, 2).

2. Income and official emoluments of diplomatic and consular staff

Income and official emoluments of diplomatic and consular staff by virtue of laws relating to diplomatic

and consular privileges (Sch 6 Para 3, 4).

3. Wound and disability pensions

Wound and disability pensions granted to persons in respect of service in various armed and defence

forces in Malaysia or in a Commonwealth country and pensions granted to wives or dependent

relatives of members of any of the forces (Sch 6 Para 7).

4. Disability pensions for war injuries

Disability pensions granted in respect of war service injuries to members of civil defence

organisations in any territory comprised in Malaysia on 1 Jan 1968 (Sch 6 Para 8).

5. Bounties to reserve forces

Bounties paid out of funds provided by Parliament to members of the Royal Malaysian Naval

Volunteer Reserve, Malaysian Territorial Army and Royal Malaysian Air Force Volunteer Reserve

(Sch 6 Para 9).

6. Emoluments of members of armed forces or civil servants of Commonwealth countries

Emoluments of members of armed forces or civil servants of Commonwealth countries performing

duties in Malaysia where the emoluments are payable out of the public funds of and subject to foreign

tax of that Commonwealth country (Sch 6 Para 10).

7. Dividends distributed by co-operative societies to members (Sch 6 Para 12A)

8. Death gratuities

Sums received by way of death gratuities or as consolidated compensation for death or injuries

(Sch 6 Para 14).

9. Compensation for loss of employment and payments for restrictive covenants

Compensation for loss of employment or in consideration for any covenant entered into by the

employee restricting his/her right to take up a similar employment is exempt as follows:

(a) whole sum of compensation if due to ill health; or

(b) RM10,000 for every completed year of service with the same employer or with companies in the

same group. The tax exemption of RM10,000 is applicable to the payment made in respect of an

individual who ceased employment on or after 1 July 2008 (Sch 6 Para 15).

10. Pensions to widows, widowers and children

Pensions granted or paid under any written law relating to widows, widowers and orphans pensions

or under an approved scheme to or for the benefit of the widow, widower, child or children of a

deceased contributor to the scheme (Sch 6 Para 16).

| 145 |

11. Income derived from trading in commodities through consignees by non-residents

Income derived by non-residents from trading in Malaysia through consignees in commodities

(rubber, copra, pepper, tin, tin ore, gambier, sago flour or cloves) produced outside Malaysia (Sch 6

Para 18).

12. Interest or discount on Government securities or bonds

(a) Interest or discount paid or credited to any individual in respect of Bon Simpanan Malaysia issued

by Central Bank of Malaysia or in respect of any savings certificates or security or bond issued or

guaranteed by the Government. With effect from Y/A 2006, this exemption is extended to

discount received (Sch 6 Para 19, 35).

(b) Interest accrued in respect of bonds issued under the Bon Simpanan Malaysia Siri Kedua

(BSM 2) by Bank Simpanan Nasional [PU(A) 473/97].

13. Interest or discount on debentures, Islamic Securities other than convertible loan stock

With effect from Y/A 2003, interest income earned by individuals from debentures other than

convertible loan stock approved by the Securities Commission is exempt from tax.

With effect from Y/A 2006, the exemption is extended to discount received (Sch 6 Para 35).

With effect from Y/A 2010, the exemption is extended to cover interest or discount from Islamic

Securities [Sch 6 Para 35(b)].

14. Income from employment exercised in Malaysia not exceeding 60 days

Income derived by a non-resident in exercising an employment in Malaysia:

(a) for less than 60 days in the basis year for a year of assessment; or

(b) for a continuous period not exceeding 60 days which overlaps the basis years for 2 successive

years of assessment; or

(c) for a continuous period which overlaps 2 successive basis years and which together with that

period, does not exceed 60 days (Sch 6 Para 21).

15. Education allowances

Education allowances paid to designated officers under the overseas service agreements of North

Borneo or Sarawak (Sch 6 Para 23).

16. Scholarships

Sums received by an individual in the nature of a scholarship or other similar grant or allowance

whether or not it is in connection with an employment of that individual (Sch 6 Para 24).

17. Retirement gratuities

Retirement gratuities paid due to ill health or on or after reaching the retiring age of 55 or other

compulsory age of retirement specified under any written law from an employment which had lasted

10 years with the same employer or with companies in the same group [Sch 6 Para 25(1)].

With effect from Y/A 2007, full income tax exemption is given for the retirement benefit if the

retirement takes place on reaching the compulsory age of 50 but before 55 and that person has

served not less than 10 years with the same employer. The exemption is on condition that the

compulsory retirement age is provided for in the employment contract or collective agreement

between the employer and the employee [Sch 6 Para 25(1)(c)].

18. Retirement gratuities and payments in lieu of leave of Government servants

Retirement gratuities or payment in lieu of leave paid out of public funds on retirement from an

employment under any written law or on termination of a contract of employment (Sch 6 Para 25A,

25B).

| 146 |

19. Interest paid to non-residents

(a) Interest derived from Malaysia by non-residents on any approved loan (Sch 6 Para 27).

(b) Interest derived from Malaysia by non-residents and paid or credited by any person carrying on

the business of banking or finance in Malaysia and licensed under the Banking and Financial

Institutions Act 1989 or the Islamic Banking Act 1983 or by any other institution approved by the

Minister, provided that the exemption shall not apply to interest paid or credited on funds required

for purposes of maintaining net working funds as prescribed by the Central Bank of Malaysia

(Sch 6 Para 33).

20. Remittance of foreign source income to Malaysia

Income arising from sources outside Malaysia and received in Malaysia by any person who is not

resident in Malaysia (Sch 6 Para 28). Effective Y/A 2004, exemption on foreign source income is

extended to include a resident individual, a trust body, a co-operative and a Hindu joint family [Sch 6

Para 28(1)].

21. Pensions

Pensions derived from Malaysia received by an individual who has reached the age of 55 or

compulsory age of retirement from employment specified under any written law or due to ill health.

The pension must be in respect of exercising a former employment in Malaysia and where the

pension is paid other than under any written law, it must be from an approved pension or provident

fund, scheme or society. Where a person is paid more than 1 pension, the highest pension paid will

be exempted (Sch 6 Para 30).

22. Gratuities or pensions paid to politicians

Gratuity or pension derived from Malaysia and paid to a resident person under any law applicable to

the President or Deputy President of the Senate, Speaker or Deputy Speaker of the House of

Representatives, Speaker of the State Legislative Assembly, Member of the Senate, Member of the

House of Representatives or Member of the State Legislative Assembly, provided the person has

attained the age of 55 or has ceased to hold office due to ill health. This exemption applies to the

higher or highest pension only where the person is eligible for exemption under Para 30 and Para 30A

of Sch 6 (Sch 6 Para 30A).

23. Royalties on literary and artistic work

Royalties for a year of assessment received by an individual resident in Malaysia in respect of:

Y/A 1994

onwards

RM

(a) Publication of, or the use of or the right to use, any literary work or any original

painting (Sch 6 Para 32B)

20,000

(b) Publication of, or the use of or the right to use, any artistic work (Sch 6 Para

32)

10,000

(c) Recording discs or tapes (Sch 6 Para 32) 10,000

24. Income from musical composition or translation

Income of up to RM20,000 for a year of assessment received by an individual resident in Malaysia in

respect of any musical composition (Sch 6 Para 32D).

| 147 |

25. Income from translation of books or literary works

Income of RM12,000 for a year of assessment received by an individual resident in Malaysia in

respect of any translation of books or literary works at the specific request of any agency of the

Ministry of Education or Minister of Higher Education or the Attorney Generals Chambers (Sch 6

Para 32A).

26. Income from employment on board a Malaysian ship

Income of an individual derived from exercising an employment on board a Malaysian ship as defined

in S. 54A(6) of the ITA (Sch 6 Para 34). With effect from Y/A 2007, this exemption is extended to

employment on board a foreign ship which is operated by a resident person who is the registered

owner of a Malaysian ship [Sch 6 Para 34 (1) and 34(2)].

27. Interest from financial institutions

(a) Bonus from money deposited in any savings account with the Lembaga Urusan dan Tabung Haji

[PU(A) 64/96].

(b) Interest received from moneys deposited in all approved institutions (with effect from 30 Aug

2008) [PU(A) 211/2009].

28. Gains or profits from financial institutions under Interest-Free Banking Scheme

Gains or profits from deposits placed in any investment account under the Interest-Free Banking

Scheme for a period exceeding 12 months with a bank or finance company licensed under the

Banking and Financial Institutions Act 1989 or the Islamic Banking Act 1983 [PU(A) 65] or with Bank

Simpanan Nasional [PU(A) 155/98].

29. Prize monies received by professional sportsmen and sportswomen

Prize monies received by professional sportsmen and sportswomen (individuals who are engaged in

sport for a livelihood) from participation in a sports tournament (with effect from Y/A 1990) [PU(A)

428].

30. Income derived from employment in Labuan

(a) Tax exemption up to the equivalent of 50% of gross income of a non-citizen derived from an

employment in a managerial capacity with a Labuan entity for the Y/A 1992 to 2004 [PU(A) 382

and PU(A) 100/2000] and Y/A 2005 to Y/A 2010 [PU(A) 84/2007]. This exemption has been

extended to include co-located office or marketing office in Labuan and the exemption is in effect

from Y/A 2011 to Y/A 2020 [PU(A) 420/2011]. Labuan entity has the same meaning assigned to

it in the Labuan Business Activity Tax Act 1990 (Act 445).

(b) Tax exemption up to the equivalent of 50% of gross income of a non-citizen individual derived

from exercising an employment in Labuan in a managerial capacity in a trust company from Y/A

1998 to Y/A 2001 [PU(A) 102/2000], Y/A 2002 to Y/A 2005 [PU(A) 405/2004], Y/A 2006 to Y/A

2010 [PU(A) 81/2007] and Y/A 2011 to Y/A 2020 [PU(A) 420/2011]. Trust company has the

same meaning assigned to it in the Labuan Trust Companies Act 1990 (Act 442).

(c) Tax exemption on fees received by a non-citizen individual in his/her capacity as a director of a

Labuan entity for the Y/A 2002 to 2006 [PU(A) 260/2003], Y/A 2007 to Y/A 2010 [PU(A) 80/2007]

and Y/A 2011 to Y/A 2020 [PU(A) 419/2011].

(d) Tax exemption of 50% on the gross housing and Labuan Territory allowances received by a

citizen from exercising an employment in Labuan with the Federal or State Government, a

statutory body or a Labuan entity from Y/A 1998 until Y/A 2001 [PU(A) 307/2000], Y/A 2002 to

Y/A 2005 [PU(A) 406/2004], Y/A 2006 to Y/A 2010 [PU(A) 82/2007] and Y/A 2011 to Y/A 2020

[PU(A) 421/2011].

31. Dividend income declared from tax exempt accounts

Dividends received by an individual paid out from an Exempt Account under the Promotion of

Investments Act 1986 (PIA) or under Sch 7A(5) of the ITA.

| 148 |

32. Income from Labuan entities or trusts

(a) Dividends received from a Labuan entity distributed out of income derived from an offshore

business activity or income exempt from tax.

(b) Distributions received from a Labuan trust by the beneficiaries.

(c) Royalties received from a Labuan entity by non-resident persons or another offshore company.

(d) Interest received from a Labuan entity by resident and non-resident persons (other than persons

licensed to carry on banking and insurance business).

(e) Amounts received from a Labuan entity by non-resident persons or another offshore company in

consideration of services, advice or assistance specified in S. 4A (i) and (ii) of the ITA

[Items (a) to (e) PU(A) 437/2007].

(f) Any gains or profit falling under S. 4(f) of the Act received by a non-resident from a Labuan entity

(effective 1 Jan 2009) [PU(A) 389/2009].

33. Cash awards received by scientists, writers and artists

With effect from Y/A 1993, all cash awards received from the Government, State Government or a

local authority by scientists, writers and artists by profession [PU(A) 223/93].

34. Pension or gratuity paid to a judge

Any pension or gratuity paid or payable to any person who has been appointed a judge from among

members of the public service and which payment is paid or payable in respect of his/her services in

the public service prior to his/her appointment as a judge [PU(A) 336/93].

35. Grants of remembrance allowance

A grant of remembrance allowance granted under S. 3 and a grant to next of kin of recipient under

S. 5 and 6 payable pursuant to the Seri Pahlawan Gagah Perkasa (Remembrance Allowance) Act

1990 [PU(A) 196/94].

36. Annuities

Sums received by way of annuities granted under annuity contracts issued by Malaysian life insurers

(whose ownership or membership are held in majority by Malaysian citizens) from Y/A 1995 onwards

(Sch 6 Para 36).

37. Income from a resident company engaged in sea transport business

Income received by a non-resident under an agreement or arrangement for participation in a pool

from a company resident in Malaysia engaged in the business of transporting passengers or cargoes

by sea [PU(A) 322/1995].

38. Dividends declared by closed-end funds

Dividends declared out of the exempt income of closed-end funds received by shareholders (S. 60H,

ITA).

39. Income from cultural performances

Income (other than emoluments in the exercise of his/her official duties) of an individual resident in

Malaysia derived from his/her performances in cultural performances approved by the Minister

(Sch 6 Para 32C).

40. Income from provision of qualifying professional services in Labuan

Income tax exemption of up to 65% of the statutory income for each year of assessment for Y/A 2000

to Y/A 2004 from a source consisting of provision of qualifying professional services (legal,

accounting, financial or secretarial services rendered in Labuan to a Labuan entity) [PU(A) 103/2005].

The above exemption was extended to Y/A 2010 [PU(A) 83/2007] and has been further extended to

Y/A 2011 to Y/A 2020 [PU(A) 418/2011].

| 149 |

41. Income earned by drivers from car and motorcycle racing events of international standard

Income tax exemption from Y/A 1999 on income earned by drivers from car and motorcycle racing

events of international standard [PU(A) 501/2000].

42. Dividends from domestic companies paid out of dividends from Labuan entities

Income tax exemption for dividends received by shareholders of domestic companies which are paid

out of the dividends received from Labuan entities [PU(A) 99/2000].

43. Income of Malaysian experts remitted from overseas into Malaysia

Income of Malaysian experts or their spouses approved by the special committee arising from a

source outside Malaysia and remitted into Malaysia within 2 years from the date of their return from

abroad to serve the nation [PU(A) 67/2001].

44. Income from export of qualifying services

Income tax exemption equivalent to 10% of the value of increased exports of qualifying services

provided in or from Malaysia to foreign clients but not exceeding 70% of the statutory income for a

year of assessment effective Y/A 1999 or Y/A 2001 depending on the type of qualifying services

provided [PU(A) 154/2001].

The income tax exemption will be increased to 50% of the value of increased exports with effect from

Y/A 2002 [PU(A) 57/2002]. For healthcare service providers, the income tax exemption will be

increased to 100% of the value of increased exports for Y/A 2010 to Y/A 2014.

45. Interest from bonds and securities issued by Pengurusan Danaharta Nasional Bhd

Tax exemption (including withholding tax) on interest received from such bonds and securities issued

within and outside Malaysia effective from Y/A 1999 [PU(A) 220/2001].

46. Grant or subsidy received from Federal and State Government

Statutory income of any person in relation to a source of income derived from the allocations given by

the Federal and State Government in the form of grant or subsidy is exempt effective from Y/A 2002

[PU(A) 33/2003].

47. Discount or profit received from bonds or securities issued by Pengurusan Danaharta

Nasional Bhd

Tax exemption (including withholding tax) on discount or profit received from sale of bonds or

securities issued within and outside Malaysia effective from Y/A 1999 [PU(A) 153/2003].

48. Fees or honorarium received by lecturers/experts from the National Accreditation Board (LAN)

Income tax exemption on fee or honorarium (other than emoluments in the exercise of his/her official

duties) received by an individual for services which have been verified by the National Accreditation

Board (LAN) for purposes of validation, moderation or accreditation of franchised education

programmes in higher educational institutions with effect from Y/A 2004 (Sch 6 Para 32E).

49. Income received by researchers from commercialisation of research findings

Income tax exemption of 50% of the statutory income for a period of 5 years commencing from the

date of first payment received by an individual from the commercialisation of scientific research which

has been verified by the Ministry of Science, Technology and Environment with effect from Y/A 2004

[PU(A) 94/2004].

50. Interest from Merdeka Bonds issued by the Central Bank of Malaysia.

Tax exemption on interest received from such bonds with effect from Y/A 2004 (Sch 6 Para 34A).

| 150 |

51. Employment income from Operational Headquarters, Regional Offices, International

Procurement Centres or Regional Distribution Centres

Income tax exemption on a portion of a non-citizen individuals income derived from an employment

with an operational headquarters company or a regional office, to be computed in accordance with the

formula provided in the Gazette Order [PU(A) 382/2003]. With effect from Y/A 2008, the exemption

has been extended to non-citizen individuals working with International Procurement Centres or

Regional Distribution Centres [PU(A) 101/2008].

52. Perquisite in relation to service awards

With effect from Y/A 2008, income tax exemption on perquisite in relation to service, innovation and

productivity awards of up to a maximum amount of RM2,000 for each year of assessment. The

exemption in respect of Long Service Award shall only be given to employees when they have served

the same employer for more than 10 years (Sch 6 Para 25C).

53. Payments received pursuant to a separation scheme

Income tax exemption on payments received by employees pursuant to a separation scheme where

employees are given an option for an early termination of an employment contract. The exemption is

on condition that such schemes do not expressly or impliedly provide for the employee to be

reemployed under any other scheme of employment by the same employer or any other employer

[Sch 6 Para 15(3)].

54. Interest received by non-resident depositors

A non-resident depositor is exempt from tax in respect of interest received from the following

institutions:

(a) AmIslamic Bank Berhad with effect from Y/A 2006 [PU(A) 155/2007].

(b) Hong Leong Islamic Bank Berhad with effect from Y/A 2006 [PU(A) 108/2007].

(c) Kuwait Finance House (Malaysia) Berhad with effect from Y/A 2006 [PU(A) 363/2006].

55. Income derived from a Malaysian shipping company

With effect from 2 Sep 2006, the income (from rental of a ship on voyage or time charter basis, or a

bare boat made under any agreement or arrangement for the use of that ship) of a non-resident

person derived from a Malaysian shipping company [PU(A) 58/2007].

56. Allowance derived from Malaysian Airline System Berhad

With effect from Y/A 2005, productivity allowance or incentive allowance received by the pilot and

cabin crew from exercising employment with Malaysian Airline System Berhad is exempt from tax

[PU(A) 230/2006].

Pilot means the captain and co-pilot who are under the service of Malaysian Airline System Berhad.

Cabin crew means the in-flight supervisor, chief steward or stewardess, leading steward or

stewardess and flight steward or stewardess who are under the service of Malaysian Airline System

Berhad.

57. Income received by non-resident experts in Islamic finance

Income of non-resident experts in Islamic finance for the period 8 Sep 2007 to 31 Dec 2016. The

experts have to be verified by the Malaysian Islamic Financial Centre Secretariat [PU(A) 114/2008].

58. Dividend income

Income tax exemption for dividend income received by individuals with effect from Y/A 2008 under the

single-tier tax system (Sch 6 Para 12B).

| 151 |

59. Interest income from Islamic securities

With effect from Y/A 2008, interest paid or credited to any person in respect of Islamic securities

originating from Malaysia, other than convertible loan stock:

(a) issued in any currency other than Ringgit; and

(b) approved by the Securities Commission.

With effect from Y/A 2010, the above exemption is also extended to include Islamic Securities

approved by the Labuan Financial Services Authority [Sch 6 Para 33B(b)].

60. Payment received from Malaysian Technical Co-operation Programme

Income tax exemption with effect from Y/A 2007 on payment received by a non-citizen who is also a

non-resident from participating in the Malaysian Technical Co-operation Programme [PU(A)

437/2008].

61. Perquisites and Benefits-In-Kind [PU(A) 152/2009]

An employee is exempt from tax in respect of the following:

(a) perquisites in relation to travel allowance, petrol card, petrol allowance or any of its combination

for travelling between the home and work place up to RM2,400 per year (effective from Y/A 2008

to Y/A 2010);

(b) perquisites in relation to travel allowance, petrol card, petrol allowance or toll rate or any of its

combination for travelling for official duties up to RM6,000 per year;

(c) parking rate or parking allowance;

(d) meal allowance;

(e) child care allowance of up to RM2,400 a year;

(f) gifts and monthly bills for fixed line telephone, mobile phone, pager, or broadband;

(g) the amount of subsidy on interest of housing, education or car loan shall be determined in

accordance with the following formula:

A x B

C

A difference between the amount of interest to be borne by the employee and the amount

of interest payable by the employee in a basis period for a year of assessment

B the total aggregate of balance of the principal amount of the housing, education or car

loan taken by the employee in a basis period for a year of assessment or RM300,000.00,

whichever is the lower

C the total aggregate of the principal amount of the housing, education or car loan taken by

the employee.

(h) medical benefits exempted from tax be extended to include expenses on maternity and traditional

medicines but exclude complimentary medicine and homeopathy;

(i) discounted price for consumable business products of the employer up to RM1,000 per year; and

(j) discounted price for services provided by the business of the employer and for the benefit of the

employee, spouse and child of the employee.

The above exemptions are not extended to an employee where the employee has control over his/her

employer. All the above proposals are effective from Y/A 2008 except for item (a) which is effective

from Y/A 2008 to Y/A 2010.

| 152 |

62. Income received by a non-resident expert for providing technical training services

[PU(A) 262/2009]

Withholding tax exemption is given to non-resident experts on income received for providing technical

training services in the following fields:

(a) postgraduate courses in information communications and technology (ICT), electronics and life

sciences;

(b) post basic courses in nursing and allied healthcare; and

(c) aircraft maintenance engineering courses.

The above is applicable from 30 Aug 2008 until 31 Dec 2012.

63. Income from the sukuk ijarah

Tax exemption on income from the sukuk ijarah, other than convertible loan stock, issued in any

currency by 1Malaysia Sukuk Global Bhd with effect from Y/A 2010 [PU(A) 169/2010].

Вам также может понравиться

- Irb Exchange RatesДокумент2 страницыIrb Exchange RatesyrijvszpОценок пока нет

- B17Документ14 страницB17yrijvszpОценок пока нет

- B18Документ46 страницB18asdjkfnasdbifbadОценок пока нет

- Major Tax Changes in MalaysiaДокумент9 страницMajor Tax Changes in MalaysiaasdjkfnasdbifbadОценок пока нет

- Region (Ncer) : B24 Northern Corridor EconomicДокумент3 страницыRegion (Ncer) : B24 Northern Corridor EconomicasdjkfnasdbifbadОценок пока нет

- B19Документ5 страницB19asdjkfnasdbifbadОценок пока нет

- Transitioning to Malaysia's Single Tier Dividend SystemДокумент2 страницыTransitioning to Malaysia's Single Tier Dividend SystemyrijvszpОценок пока нет

- B27Документ2 страницыB27asdjkfnasdbifbadОценок пока нет

- B20Документ4 страницыB20asdjkfnasdbifbadОценок пока нет

- Iskandar Malaysia Development IncentivesДокумент3 страницыIskandar Malaysia Development IncentivesasdjkfnasdbifbadОценок пока нет

- B25Документ6 страницB25asdjkfnasdbifbadОценок пока нет

- B21 MSC MalaysiaДокумент4 страницыB21 MSC MalaysiaasdjkfnasdbifbadОценок пока нет

- B28 Sabah Development Corridor: Sector IndustriesДокумент2 страницыB28 Sabah Development Corridor: Sector IndustriesasdjkfnasdbifbadОценок пока нет

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5784)

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (890)

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (399)

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (265)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (344)

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (119)

- Assessing Gross Efficiency and Propelling Efficiency in Swimming Paola Zamparo Department of Neurological Sciences, Faculty of Exercise and Sport Sciences, University of Verona, Verona, ItalyДокумент4 страницыAssessing Gross Efficiency and Propelling Efficiency in Swimming Paola Zamparo Department of Neurological Sciences, Faculty of Exercise and Sport Sciences, University of Verona, Verona, ItalyVijay KumarОценок пока нет

- Digital Communication Quantization OverviewДокумент5 страницDigital Communication Quantization OverviewNiharika KorukondaОценок пока нет

- Recycle Used Motor Oil With Tongrui PurifiersДокумент12 страницRecycle Used Motor Oil With Tongrui PurifiersRégis Ongollo100% (1)

- Self Team Assessment Form - Revised 5-2-20Документ6 страницSelf Team Assessment Form - Revised 5-2-20api-630312626Оценок пока нет

- National Advisory Committee For AeronauticsДокумент36 страницNational Advisory Committee For AeronauticsSamuel ChristioОценок пока нет

- Clogging in Permeable (A Review)Документ13 страницClogging in Permeable (A Review)Chong Ting ShengОценок пока нет

- Testbanks ch24Документ12 страницTestbanks ch24Hassan ArafatОценок пока нет

- Key formulas for introductory statisticsДокумент8 страницKey formulas for introductory statisticsimam awaluddinОценок пока нет

- Supreme Court rules stabilization fees not trust fundsДокумент8 страницSupreme Court rules stabilization fees not trust fundsNadzlah BandilaОценок пока нет

- Test Bank For Core Concepts of Accounting Information Systems 14th by SimkinДокумент36 страницTest Bank For Core Concepts of Accounting Information Systems 14th by Simkinpufffalcated25x9ld100% (46)

- Liber Chao (Final - Eng)Документ27 страницLiber Chao (Final - Eng)solgrae8409100% (2)

- NGPDU For BS SelectДокумент14 страницNGPDU For BS SelectMario RamosОценок пока нет

- SQL Server 2008 Failover ClusteringДокумент176 страницSQL Server 2008 Failover ClusteringbiplobusaОценок пока нет

- Brain, Behavior, and Immunity: Alok Kumar, David J. LoaneДокумент11 страницBrain, Behavior, and Immunity: Alok Kumar, David J. LoaneRinaldy TejaОценок пока нет

- Lecture 1: Newton Forward and Backward Interpolation: M R Mishra May 9, 2022Документ10 страницLecture 1: Newton Forward and Backward Interpolation: M R Mishra May 9, 2022MANAS RANJAN MISHRAОценок пока нет

- April 2017 Jacksonville ReviewДокумент40 страницApril 2017 Jacksonville ReviewThe Jacksonville ReviewОценок пока нет

- Machine Learning: Bilal KhanДокумент26 страницMachine Learning: Bilal KhanBilal KhanОценок пока нет

- Guide to Fair Value Measurement under IFRS 13Документ3 страницыGuide to Fair Value Measurement under IFRS 13Annie JuliaОценок пока нет

- Ch07 Spread Footings - Geotech Ultimate Limit StatesДокумент49 страницCh07 Spread Footings - Geotech Ultimate Limit StatesVaibhav SharmaОценок пока нет

- Cells in The Urine SedimentДокумент3 страницыCells in The Urine SedimentTaufan LutfiОценок пока нет

- Budget ControlДокумент7 страницBudget ControlArnel CopinaОценок пока нет

- WassiДокумент12 страницWassiwaseem0808Оценок пока нет

- Master of Commerce: 1 YearДокумент8 страницMaster of Commerce: 1 YearAston Rahul PintoОценок пока нет

- Statement of Compulsory Winding Up As On 30 SEPTEMBER, 2008Документ4 страницыStatement of Compulsory Winding Up As On 30 SEPTEMBER, 2008abchavhan20Оценок пока нет

- Identifying The TopicДокумент2 страницыIdentifying The TopicrioОценок пока нет

- Biomotor Development For Speed-Power Athletes: Mike Young, PHD Whitecaps FC - Vancouver, BC Athletic Lab - Cary, NCДокумент125 страницBiomotor Development For Speed-Power Athletes: Mike Young, PHD Whitecaps FC - Vancouver, BC Athletic Lab - Cary, NCAlpesh Jadhav100% (1)

- Microsoft Word 2000 IntroductionДокумент72 страницыMicrosoft Word 2000 IntroductionYsmech SalazarОценок пока нет

- Product CycleДокумент2 страницыProduct CycleoldinaОценок пока нет

- Time Table For Winter 2023 Theory ExaminationДокумент1 страницаTime Table For Winter 2023 Theory ExaminationSushant kakadeОценок пока нет

- AAU5243 DescriptionДокумент30 страницAAU5243 DescriptionWisut MorthaiОценок пока нет