Академический Документы

Профессиональный Документы

Культура Документы

Key Moving Averages Held at Monday's Lows For The Five Market Averages

Загружено:

Richard Suttmeier0 оценок0% нашли этот документ полезным (0 голосов)

12 просмотров2 страницыThe daily charts shift to negative on daily closes below 21-day simple moving averages at 17,003 Dow Industrials, 1974.22 S&P 500, 4432.54 Nasdaq and 8311.13 Dow Transports.

Dow Transports are back below my monthly pivot at 8365 and the Russell 2000 traded below its semiannual pivot at 1139.81.

Оригинальное название

Key moving averages held at Monday’s lows for the five market averages

Авторское право

© © All Rights Reserved

Доступные форматы

PDF, TXT или читайте онлайн в Scribd

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документThe daily charts shift to negative on daily closes below 21-day simple moving averages at 17,003 Dow Industrials, 1974.22 S&P 500, 4432.54 Nasdaq and 8311.13 Dow Transports.

Dow Transports are back below my monthly pivot at 8365 and the Russell 2000 traded below its semiannual pivot at 1139.81.

Авторское право:

© All Rights Reserved

Доступные форматы

Скачайте в формате PDF, TXT или читайте онлайн в Scribd

0 оценок0% нашли этот документ полезным (0 голосов)

12 просмотров2 страницыKey Moving Averages Held at Monday's Lows For The Five Market Averages

Загружено:

Richard SuttmeierThe daily charts shift to negative on daily closes below 21-day simple moving averages at 17,003 Dow Industrials, 1974.22 S&P 500, 4432.54 Nasdaq and 8311.13 Dow Transports.

Dow Transports are back below my monthly pivot at 8365 and the Russell 2000 traded below its semiannual pivot at 1139.81.

Авторское право:

© All Rights Reserved

Доступные форматы

Скачайте в формате PDF, TXT или читайте онлайн в Scribd

Вы находитесь на странице: 1из 2

Richard Suttmeier is the Chief Market Strategist at www.ValuEngine.com.

ValuEngine is a fundamentally-based quant research firm in Melbourne, FL. ValuEngine

covers over 8,000 stocks every day.

A variety of newsletters and portfolios containing Suttmeier's detailed research, stock picks,

and commentary can be found http://www.valuengine.com/nl/mainnl

To unsubscribe from this free email newsletter list, please click

http://www.valuengine.com/pub/Unsubscribe?

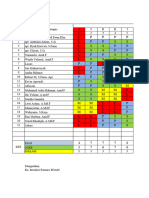

Jul y 29, 2014 Key movi ng aver ages hel d at Mondays l ow s f or t he f i ve mar ket aver ages

The daily charts shift to negative on daily closes below 21-day simple moving averages at 17,003 Dow

Industrials, 1974.22 S&P 500, 4432.54 Nasdaq and 8311.13 Dow Transports.

Dow Transports are back below my monthly pivot at 8365 and the Russell 2000 traded below its

semiannual pivot at 1139.81.

The weekly charts for Dow Industrials, S&P 500, Nasdaq and Dow Transports remain positive but

overbought with the five-week modified moving averages at 16893, 1955.9, 4374 and 8214,

respectively. The weekly chart for the Russell 2000 remains negative with its five-week MMA at

1160.18.

The Dow Utility Average has declining 12x3x3 weekly slow stochastics so its weekly chart shifts to

negative this week with a close on Friday below its five-week MMA at 554.91.

The PHLX Semiconductor Index (SOX) set a multi-year intraday high at 652.28 on J uly 16 and was up

nearly 22%. Fridays close was below its five-week MMA at 624.94 but it still has an overbought

12x3x3 weekly slow stochastic with its year-to-date gain cut to 15%.

The Housing Sector Index (HGX) ended last week with a negative weekly chart below its five-week

MMA with declining stochastic. It remains below its 61.8% Fibonacci retracement of its decline from

mid-2005 high to the March 2009 low.

The ABA Community Bank Index (ABAQ) also has also has a negative weekly chart and below its

61.8% retracement from its high in December 2006 to the March 2009 low.

This weeks risky levels are 17179 Dow Industrials, 2009.2 S&P 500, 4564 Nasdaq, 8434 Dow

Transports and 1202.15 Russell 2000.

Semiannual and annual value levels are 16301, 14835 and 13437 Dow Industrials, 1789.3, 1539.1

and 1442.1 S&P 500, 3972, 3471, 3063 Nasdaq, 7423, 6249 and 5935 Dow Transports and 1139.81,

966.72 and 879.39 Russell 2000.

Monthly, quarterly and semiannual risky levels are 17364, 17753 and 18522 Dow Industrials, 1994.2,

2052.3 and 2080.3 S&P 500, 4529, 4569 and 4642 Nasdaq, and 1215.89, 1293.11 and 1285.37 on

Russell 2000,

Dow Industrials: (16983) Semiannual and annual value levels are 16301, 14835 and 13467 with a

daily pivot at 16,937, the J uly 17 all-time intraday high at 17151.56, and weekly, monthly, quarterly and

semiannual risky levels at 17179, 17364, 17753 and 18552.

S&P 500 (1978.9) Semiannual and annual value levels are 1789.3, 1539.1 and 1442.1 with a daily

pivot at 1975.0, the J uly 24 all-time intraday high at 1991.39, and monthly, weekly, quarterly and

semiannual risky levels at 1994.2, 2009.2, 2052.3 and 2080.3.

NASDAQ (4445) Semiannual and annual value levels are 3972, 3471 and 3063 with a daily pivot at

4454, the J uly 3 multiyear intraday high at 4485.93 and weekly, monthly, quarterly and semiannual

risky levels at 4564, 4529, 4569 and 4642.

NASDAQ 100 (NDX) (3967) Quarterly, monthly, semiannual and annual value levels are 3936, 3894,

3515, 3078 and 2669 with a daily pivot at 3975, the J uly 24 multiyear intraday high at 3997.50, and

weekly and semiannual risky levels at 4022 and 4105.

Dow Transports (8333) Quarterly, semiannual and annual value levels are 8256, 6249 and 5935

with monthly, daily, weekly and semiannual pivots at 8383, 8356, 8434 and 8447, the J uly 23 all-time

intraday high at 8515.04.

Russell 2000 (1139.50) Annual value levels are 1139.81, 966.72 and 879.39 with semiannual and

daily pivots at 1139.81 and 1144.73, the J uly 1 all-time intraday high at 1213.55, and weekly, monthly,

semiannual and quarterly risky levels at 1202.15, 1215.89, 1285.37 and 1293.11.

The SOX (616.00) Daily, semiannual and annual value levels are 611.65, 608.02, 512.94, 371.58

and 337.74 with quarterly and daily pivots at 626.96 and 627.06, a monthly risky level at 642.34, the

J uly 16 multiyear intraday high 652.28 and weekly risky level at 662.77.

Dow Utilities: (563.48) Annual, quarterly, semiannual and annual value levels are 548.70, 536.44,

523.72 and 497.53, with daily and monthly pivots at 559.61 and 563.54, a weekly risky level at 569.81,

the J une 30 all-time intraday high at 576.98 and semiannual risky level at 612.49.

10-Year Note (2.491) Weekly, monthly and quarterly value levels are 2.620, 2.787 and 3.048 with

daily, annual and semiannual risky levels at 2.425, 2.263, 1.999 and 1.779.

30-Year Bond (3.260) Weekly, monthly and quarterly value levels are 3.396, 3.486 and 3.971 with

an annual pivot at 3.283 and daily, annual and semiannual risky levels at 3.190, 3.107 and 3.082.

Comex Gold ($1304.9) Quarterly and monthly value levels are $1234.6 and $1233.8 with a daily

pivot at $1315.4 and weekly, semiannual and annual risky levels at $1360.2, $1613.0, $1738.7,

$1747.4 and $1818.8.

Nymex Crude Oil ($101.62) No value levels with weekly, daily, monthly, semiannual, annual and

quarterly risky levels at $104.51, $103.86, $105.23, $107.52 and $113.12.

The Euro (1.3433) Annual and semiannual value levels are 1.3382 and 1.2203 with daily and weekly

pivots at1.3423 and 1.3483 and monthly, quarterly, semiannual and annual risky levels at 1.3819,

1.4079, 1.4617 and 1.5512.

The Dollar versus Japanese Yen (101.85) An annual value level is 93.38 with daily and weekly

pivots at 101.43 and 101.88 and monthly and quarterly risky levels at 106.47 and 112.83.

The British Pound (1.6982) Quarterly and annual value levels are 1.6874 and 1.6262 with a daily

pivot at 1.6931 and weekly, semiannual and monthly risky levels at 1.7270,1.7302 and 1.7438.

To learn more about ValuEngine check out www.ValuEngine.com. Any comments or questions contact

me at RSuttmeier@gmail.com.

Вам также может понравиться

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (119)

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (265)

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (399)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2219)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5794)

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1090)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (344)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (890)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- HG Rexroth Program Productlisting WebДокумент24 страницыHG Rexroth Program Productlisting WebLuis Panti Ek50% (2)

- Code Search Assignment 1Документ6 страницCode Search Assignment 1Jackie BeadmanОценок пока нет

- Nifty intraday levels and trading strategyДокумент8 страницNifty intraday levels and trading strategyManoj PalОценок пока нет

- Suttmeier Weekly Market BriefingДокумент4 страницыSuttmeier Weekly Market BriefingRichard SuttmeierОценок пока нет

- Suttmeier Weekly Market Briefing, March 9, 2015Документ4 страницыSuttmeier Weekly Market Briefing, March 9, 2015Richard SuttmeierОценок пока нет

- Suttmeier Weekly Markets Briefing, February 23, 2015Документ4 страницыSuttmeier Weekly Markets Briefing, February 23, 2015Richard SuttmeierОценок пока нет

- Richard Suttmeier's Weekly Market BriefingДокумент4 страницыRichard Suttmeier's Weekly Market BriefingRichard SuttmeierОценок пока нет

- Suttmeier Weekly Market BriefingДокумент1 страницаSuttmeier Weekly Market BriefingRichard SuttmeierОценок пока нет

- Suttmeier Morning Briefing, February 3, 2015Документ1 страницаSuttmeier Morning Briefing, February 3, 2015Richard SuttmeierОценок пока нет

- Suttmeier, Weekly Market BriefingДокумент4 страницыSuttmeier, Weekly Market BriefingRichard SuttmeierОценок пока нет

- Suttmeier Weekly Market BriefingДокумент1 страницаSuttmeier Weekly Market BriefingRichard SuttmeierОценок пока нет

- Suttmeier Morning Briefing, February 3, 2015Документ1 страницаSuttmeier Morning Briefing, February 3, 2015Richard SuttmeierОценок пока нет

- Suttmeier Weekly Market BriefingДокумент2 страницыSuttmeier Weekly Market BriefingRichard SuttmeierОценок пока нет

- Suttmeier Morning Briefing, February 3, 2015Документ1 страницаSuttmeier Morning Briefing, February 3, 2015Richard SuttmeierОценок пока нет

- Suttmeier Morning Briefing, February 3, 2015Документ1 страницаSuttmeier Morning Briefing, February 3, 2015Richard SuttmeierОценок пока нет

- Suttmeier Weekly Market Briefing, February 2, 2015Документ4 страницыSuttmeier Weekly Market Briefing, February 2, 2015Richard SuttmeierОценок пока нет

- Suttmeier Morning Briefing, January 27, 2015Документ1 страницаSuttmeier Morning Briefing, January 27, 2015Richard SuttmeierОценок пока нет

- 1412229SuttmeierWeeklyBriefinSuttmeier Weekly Briefing, Dec. 29, 2014Документ2 страницы1412229SuttmeierWeeklyBriefinSuttmeier Weekly Briefing, Dec. 29, 2014Richard SuttmeierОценок пока нет

- Suttmeier Morning Briefing, January 13, 2015Документ1 страницаSuttmeier Morning Briefing, January 13, 2015Richard SuttmeierОценок пока нет

- Suttmeier Morning Briefing, January 13, 2015Документ1 страницаSuttmeier Morning Briefing, January 13, 2015Richard SuttmeierОценок пока нет

- Suttmeier Morning Briefing, January 30, 2015Документ1 страницаSuttmeier Morning Briefing, January 30, 2015Richard SuttmeierОценок пока нет

- Suttmeier Morning Briefing, January 13, 2015Документ1 страницаSuttmeier Morning Briefing, January 13, 2015Richard SuttmeierОценок пока нет

- Suttmeier Morning Briefing, January 13, 2015Документ1 страницаSuttmeier Morning Briefing, January 13, 2015Richard SuttmeierОценок пока нет

- Suttmeier Weekly Market BriefingДокумент3 страницыSuttmeier Weekly Market BriefingRichard SuttmeierОценок пока нет

- Suttmeier Morning Briefing, January 13, 2015Документ1 страницаSuttmeier Morning Briefing, January 13, 2015Richard SuttmeierОценок пока нет

- Suttmeier Weekly Briefing, January 12, 2015Документ3 страницыSuttmeier Weekly Briefing, January 12, 2015Richard SuttmeierОценок пока нет

- Suttmeier Morning Briefing, January 13, 2015Документ1 страницаSuttmeier Morning Briefing, January 13, 2015Richard SuttmeierОценок пока нет

- Suttmeier Weekly Briefing, January 19, 2015Документ3 страницыSuttmeier Weekly Briefing, January 19, 2015Richard SuttmeierОценок пока нет

- Suttmeier Morning Briefing, January 13, 2015Документ1 страницаSuttmeier Morning Briefing, January 13, 2015Richard SuttmeierОценок пока нет

- Suttmeier Morning Briefing, January 13, 2015Документ1 страницаSuttmeier Morning Briefing, January 13, 2015Richard SuttmeierОценок пока нет

- Suttmeier Morning Briefing, 01/07/2015Документ1 страницаSuttmeier Morning Briefing, 01/07/2015Richard SuttmeierОценок пока нет

- Suttmeier Morning Briefing, 01/07/2015Документ1 страницаSuttmeier Morning Briefing, 01/07/2015Richard SuttmeierОценок пока нет

- Suttmeier Morning Briefing, 01/07/2015Документ1 страницаSuttmeier Morning Briefing, 01/07/2015Richard SuttmeierОценок пока нет

- Absen Lars DHP Hari Ke 2Документ63 страницыAbsen Lars DHP Hari Ke 2diklat rsudpmОценок пока нет

- Dow Jones Companies List: # Company Symbol Weight Price CHG % CHGДокумент1 страницаDow Jones Companies List: # Company Symbol Weight Price CHG % CHGFinaskoОценок пока нет

- Cisco Catalyst 9300 Series Switches Data Sheet - CiscoДокумент87 страницCisco Catalyst 9300 Series Switches Data Sheet - CiscombayeОценок пока нет

- P&G affiliate company reference listДокумент27 страницP&G affiliate company reference listhenryОценок пока нет

- Telegram Channel: T.Me/Kissvix Whatsapp Nobuhle Mfeka:0794319534 Facebook: @kissbuhleДокумент2 страницыTelegram Channel: T.Me/Kissvix Whatsapp Nobuhle Mfeka:0794319534 Facebook: @kissbuhleClari Soto100% (1)

- Absen Apel RabuДокумент69 страницAbsen Apel RabuDinaОценок пока нет

- Dow Jones 15 Companies Index PerformanceДокумент122 страницыDow Jones 15 Companies Index PerformanceAnthony CadenaОценок пока нет

- Commercial Sales Associate FY - 19: Kavyaa KДокумент12 страницCommercial Sales Associate FY - 19: Kavyaa KKavya PradeepОценок пока нет

- Ph. D., New York University : PDF Created With Pdffactory Pro Trial VersionДокумент211 страницPh. D., New York University : PDF Created With Pdffactory Pro Trial VersionRa'fat JalladОценок пока нет

- ETFs and Pairs Sheet1 1Документ2 страницыETFs and Pairs Sheet1 1Frank AbrahamОценок пока нет

- 10 Jawa Tengah CleanДокумент309 страниц10 Jawa Tengah Cleanghaitsa palupiОценок пока нет

- Resultado: Buscar Fabricante o Prefijos MACДокумент10 страницResultado: Buscar Fabricante o Prefijos MACJosé LuisОценок пока нет

- Jadwal Asesmen TambahanДокумент114 страницJadwal Asesmen TambahanAkademi Keperawatan AntariksaОценок пока нет

- Trabajo Parcial 12-10Документ145 страницTrabajo Parcial 12-10Takeshi CastroОценок пока нет

- Practice Sheet Faangm NewДокумент320 страницPractice Sheet Faangm NewNaresh KumarОценок пока нет

- Jadwal Depo Farmasi 24 Jam 2024 NewДокумент35 страницJadwal Depo Farmasi 24 Jam 2024 NewAmdonaldi aquaОценок пока нет

- Getting Started With Xilinx ISE 14.7 For EDGE Spartan 6 FPGA KitДокумент18 страницGetting Started With Xilinx ISE 14.7 For EDGE Spartan 6 FPGA KitSajid AliОценок пока нет

- Pengumuman Peserta OA DTS 2020 - COP 1966 PDFДокумент50 страницPengumuman Peserta OA DTS 2020 - COP 1966 PDFAdhitama MahaputraОценок пока нет

- Excel SheetДокумент12 страницExcel Sheetapi-299474991Оценок пока нет

- SP Sector Performance 05152009Документ2 страницыSP Sector Performance 05152009andrewblogger100% (1)

- TAMPLATE NIK (Nama Dinas)Документ161 страницаTAMPLATE NIK (Nama Dinas)Fadhil Fadhlillah0905Оценок пока нет

- Dow Jones Industrial Average Historical ComponentsДокумент19 страницDow Jones Industrial Average Historical ComponentsWafa RizviОценок пока нет

- Coba Lagi Absen CheckboxДокумент5 страницCoba Lagi Absen CheckboxUba Deo RusdinОценок пока нет

- EAFE MSCI EAFE Index SignalsДокумент12 страницEAFE MSCI EAFE Index SignalsMikeMacDonaldОценок пока нет

- Absen PKM 2023Документ15 страницAbsen PKM 2023Intan Maya SariОценок пока нет

- MLB 150 ACCSДокумент11 страницMLB 150 ACCSok na ata toОценок пока нет

- P02 18Документ248 страницP02 18priyankaОценок пока нет