Академический Документы

Профессиональный Документы

Культура Документы

INB CaseStudy - Full

Загружено:

SoniyaVijaywargi0 оценок0% нашли этот документ полезным (0 голосов)

44 просмотров9 страницCase Study Banking

Авторское право

© © All Rights Reserved

Доступные форматы

PDF, TXT или читайте онлайн в Scribd

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документCase Study Banking

Авторское право:

© All Rights Reserved

Доступные форматы

Скачайте в формате PDF, TXT или читайте онлайн в Scribd

0 оценок0% нашли этот документ полезным (0 голосов)

44 просмотров9 страницINB CaseStudy - Full

Загружено:

SoniyaVijaywargiCase Study Banking

Авторское право:

© All Rights Reserved

Доступные форматы

Скачайте в формате PDF, TXT или читайте онлайн в Scribd

Вы находитесь на странице: 1из 9

Project

Case Study Page 1 of 9

Case Study

Indian Net Bank (iNB)

XXX_CaseStudy - Full.doc

Version 1.1

Project

Case Study Page 2 of 9

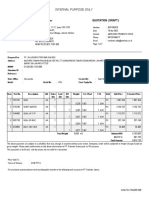

Revision History

Date Version Description

10/04/2006 1.0 Initial

13/04/2006 1.1 More functionalities added

Project

Case Study Page 3 of 9

1. Introduction .......................................................................................................................................... 4

1.1. Background..................................................................................................................................... 4

1.2. Overview......................................................................................................................................... 4

1.3. Acronyms and Abbreviations.......................................................................................................... 4

1.4. Color Coding.................................................................................................................................. 4

2. Requirements ........................................................................................................................................ 5

2.1. Business Processes ......................................................................................................................... 5

2.1.1. Accounts ................................................................................................................................. 5

2.1.2. Customers ............................................................................................................................... 6

2.1.3. Accounts Receivable .............................................................................................................. 6

2.1.4. Accounts Payable ................................................................................................................... 6

2.1.5. Bill Payments.......................................................................................................................... 7

2.1.6. Transactions............................................................................................................................ 7

2.2. Look-and-feel.................................................................................................................................. 8

2.3. Security........................................................................................................................................... 8

3. Deliverables........................................................................................................................................... 9

Project

Case Study Page 4 of 9

1. Introduction

1.1. Background

The purpose of the case study is to provide a real world application to Software Engineer

Trainees (SETs), which they can develop by going through all the stages of a Software

Development Life Cycle (SDLC).

This is to achieve a reduced time to production of SETs so that they are project ready by the

time they are put onto projects.

1.2. Overview

The case study is for an Online Banking Application for a fictitious bank named Indian Net Bank

(iNB). The proposed application must have some basic features for customers to perform their

day-to-day banking operations over the Internet.

Apart from day-to-day operations, the site must also take into consideration security, ease of use,

familiar look-and-feel across the application, easy navigation and performance.

SETs not only have to develop the application, but also come up with a proper design for the

same. They are expected to analyze the requirements and based on their understanding, create

the following artifacts:

Use Case Documents

Functional Specifications

Test Plan

Test Cases

SETs are also expected for follow some basic coding standards and adhere to best practices and

coding principles.

SETs will also have to deploy their applications at specific locations so that it can be tested. For

this purpose, they will have to create an installation pack, which will deploy their application, with

minimal manual intervention.

1.3. Acronyms and Abbreviations

CnF Clearing and Forwarding agents

iNB Indian Net Bank

SDLC Software Development Life Cycle

SET Software Engineer Trainees

1.4. Color Coding

This document contains sections that are color coded. The color coding and meaning of the color

code are mentioned in the table below:

Color Name Sample Meaning

Bright Green Open requirements. SETs are expected to clarify these

requirements.

Turquoise Minor change control to be introduced during construction/testing

phase.

Gray Major change control to be introduced after all coding/testing is over.

Project

Case Study Page 5 of 9

2. Requirements

2.1. Business Processes

2.1.1. Accounts

The application should support two types of accounts; viz; Savings and Current.

An additional account of type Fixed Deposit can also be made available.

Savings Account

Savings account, in addition to other basic information, will have a rate of interest, which

customers can earn on their monthly balances.

All savings accounts will have the same rate of interest. If the rate changes, it will be effective for

all savings accounts.

Customers should not be able to withdraw more than a configured amount on a day.

A minimum balance must be maintained at all times. This amount must be configurable.

Current Account

Current accounts will not have a rate of interest as customers cannot earn interest on a current

account.

Customers should not be able to withdraw more than a configured amount on a day.

A current account can have the facility of having a zero balance.

Customers should be able to avail of overdraft facility on their current accounts. If overdraft facility

is availed, then the bank will charge a rate of interest on the overdraft amount to the customer.

This rate of interest will be the same for all current accounts, irrespective of the amount being

withdrawn as overdraft.

Overdraft Charges Calculation

Overdraft charges will be calculated daily. So at the end of the day, if the balance is negative,

overdraft charges will be levied and added to the balance, resulting in the balance going down

further in negative territory.

Fixed Deposit

The maturity period and rate of interest for Fixed Deposits will be as follows:

Validity Rate of Interest

12 months 4.5%

24 months 5.0%

36 months 5.5%

Withdrawal and Deposit operations cannot be performed on Fixed Deposit accounts.

Project

Case Study Page 6 of 9

2.1.2. Customers

Customers are individuals who manage their accounts with the bank. A customer can have only a

single account at any given time and no more. So, a customer can either have a Savings account

or a Current account.

They can have one or more of each of the account types mentioned in section 2.1.1. So, for e.g.;

a customer can have 3 savings accounts and 2 current accounts. There will be no limit on the

number of accounts that a customer can hold with the bank.

Every customer holding a current account will have a set Credit Limit for the overdraft facility. A

credit limit of zero means no overdraft. The credit limit will not be separate for each current

account, but one credit limit on the customer, applicable to all current accounts held by him/her.

2.1.3. Accounts Receivable

The customer can be a corporate firm. The company has many clearing and forwarding (CnF)

agents who sell the companys products throughout the country.

These CnF agents are also responsible for collecting payments in the form of cheques and

depositing them in the companys account in the bank. CnF agents enter the cheques details

against invoices. All cheques will be deposited in a single account, which will be a clearing

account. This clearing account can either be a Savings or Current account. All payments are to

be logged against invoices. It is possible that an invoice has not been full paid.

Cheques are usually cleared in 3 working days. Some cheques may pass and some may bounce.

Till they are cleared or rejected, they remain un-cleared.

Clearing of Cheques

Cheques are automatically cleared on the 3

rd

day of receiving the cheques. On a particular day,

all cheques that have been received 3 days ago, will be cleared automatically and transferred to

the main account of the customer. This main account can either be a Savings or Current

account.

Only cheques that are not marked as bounced will be transferred to the main account. The

accountant will mark cheques as bounced manually.

Reconciliation

A report will be printed as on a particular date, which will list all the cheques that have been

received, and out of these received cheques, how many have been cleared, bounced and not-

cleared. The total amount of cheques received must be the sum of cleared, bounced and not-

cleared.

2.1.4. Accounts Payable

The customer, as a company, will obviously have vendors from whom it purchases various things.

Payments are to be made to the vendors on a regular basis. Every vendor has a set credit period.

Vendors will have their own credit days. Once invoices are received from the vendor, payments

are to be made to the vendor on the last day of the credit period for that vendor.

Cheques for the payments are to be generated automatically. On a given date, a list of payments

for various vendors will be generated and the accountant will select all payments that should be

Project

Case Study Page 7 of 9

made immediately. Payments not selected for immediate payment must be listed again on the

next days statement.

Payments to vendors will be made from separate accounts. The payment account for each

vendor will have to be configured and cheques for the vendors will be drawn on the payment

account only and not from any other account.

For e.g.; there are 3 accounts AC001, AC002 and AC003. Then, there are 2 vendors V0101 and

V0106. Payments to V0101 will always be made from AC001 and payments to V0106 will always

be made from AC003.

Once the accountant selects the payments to be made, the system should print the invoice

details on top and the actual cheques at the bottom on an A4 size paper for each payment.

Invoices can be partially paid. Invoices cannot be merged for payments. Cheque numbers to be

auto-generated and must continue from last payment made. Separate cheques numbers for each

account from which payments are made.

2.1.5. Bill Payments

Customers should be able to pay their bills from any of their accounts. Bills can be paid

immediately or they can be scheduled for payment at a later date. Bills can be scheduled for

payment at least 3 days before the due date. Immediate payments of bills can be made only if

there are a minimum of 2 days left for the due date. A scheduled bill payment can be cancelled

within one day of due date of the bill to be paid. Scheduled payments can be cancelled.

2.1.6. Transactions

Customers should be able to perform basic transactions on the web site on their accounts. These

activities are listed below:

View List of Accounts

View Account Details

o Last 5 transactions

View Account Details

o For a specified date range

View Customer Profile

Manage Customer Profile

Deposit Money

Withdraw Money

Transfer Money (to other customers account)

Transfer Money (between own accounts)

Add accounts to Customer

Manage Vendor details

Manage CnF Agents

Accounts Receivable

o Manage Payments Received

o Clear cheques

o Mark cheques as bounced

o Reconciliation Report

Accounts Receivable

o List Payments due to Vendors

o Select payments to be made

o Print cheques

o View list of cheques issued

Between a date range

Project

Case Study Page 8 of 9

Manage Utility Providers for Bill Payment

Pay Bills

o Pay Bills Immediately

o Schedule Bill Payments

o Cancel scheduled bill payments

o View list of all payments made for a date range

2.2. Look-and-feel

All pages must have the same look-and-feel with exactly the same header, footer and navigation

panel on the left.

Users must be able to go to any screen with minimum mouse-clicks.

2.3. Security

After three consecutive invalid logon attempts, a users login account should be locked. This login

account can only be re-activated manually.

Project

Case Study Page 9 of 9

3. Deliverables

SETs are expected to deliver the following SDLC artifacts in the form of documents:

Use Case Documents

Functional Specifications

Test Plan

Test Cases

They are also expected to deliver the following SDLC artifacts on paper:

Activity Diagrams

Use Case Diagrams

Sequence Diagrams

Вам также может понравиться

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (400)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (895)

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (266)

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1090)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (344)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (121)

- Abjamesola Tailoring Services Case StudyДокумент17 страницAbjamesola Tailoring Services Case StudyTintin Tao-onОценок пока нет

- ARTI Annual Report 2019 PDFДокумент139 страницARTI Annual Report 2019 PDFS Gevanry SagalaОценок пока нет

- Certificado Inshur SH - 2Документ1 страницаCertificado Inshur SH - 2ukmagicoОценок пока нет

- A Guide To UK Oil and Gas TaxationДокумент172 страницыA Guide To UK Oil and Gas Taxationkalite123Оценок пока нет

- MSCI Equity Indexes November 2020 Index Review: Press ReleaseДокумент4 страницыMSCI Equity Indexes November 2020 Index Review: Press ReleaseAlbert Wilson DavidОценок пока нет

- PDFДокумент19 страницPDFRam SriОценок пока нет

- MBA 662 Financial Institutions and Investment ManagementДокумент4 страницыMBA 662 Financial Institutions and Investment ManagementAli MohammedОценок пока нет

- Allux Indo 8301385679Документ2 страницыAllux Indo 8301385679Ardi dutaОценок пока нет

- The Safe Mortgage Loan Originator National Exam Study Guide Second Edition 2nd Edition Ebook PDFДокумент62 страницыThe Safe Mortgage Loan Originator National Exam Study Guide Second Edition 2nd Edition Ebook PDFalec.black13997% (33)

- Houzit Pty LTD: 1st Quarter Ended Sept - 2012 Actual Results Budget Q1 Actual Q1 $ VarianceДокумент4 страницыHouzit Pty LTD: 1st Quarter Ended Sept - 2012 Actual Results Budget Q1 Actual Q1 $ VarianceHamza Anees100% (1)

- For Use With Business Analysis and Valuation 6e by Palepu, Healy and Peek (ISBN 9781473779075) © 2022 Cengage EMEAДокумент21 страницаFor Use With Business Analysis and Valuation 6e by Palepu, Healy and Peek (ISBN 9781473779075) © 2022 Cengage EMEAFilip PopovicОценок пока нет

- PricingДокумент2 страницыPricingKishore kandurlaОценок пока нет

- 2023 06 03 14 36 00oct 22 - 560068Документ5 страниц2023 06 03 14 36 00oct 22 - 560068Piyush GoyalОценок пока нет

- (Sarvesh Dhatrak) Derivatives in Stock Market and Their Importance in HedgingДокумент79 страниц(Sarvesh Dhatrak) Derivatives in Stock Market and Their Importance in Hedgingsarvesh dhatrakОценок пока нет

- MATRIX 2-Tax-RevДокумент18 страницMATRIX 2-Tax-RevJepoy FranciscoОценок пока нет

- SDH 231Документ3 страницыSDH 231darff45Оценок пока нет

- Member Statement: Questions?Документ8 страницMember Statement: Questions?Michael CarsonОценок пока нет

- TATA MOTORS Atif PDFДокумент9 страницTATA MOTORS Atif PDFAtif Raza AkbarОценок пока нет

- Eco Sem6Документ8 страницEco Sem6smarttalksaurabhОценок пока нет

- Asset Management PlanДокумент49 страницAsset Management PlanAndar WIdya PermanaОценок пока нет

- Chapter 8Документ19 страницChapter 8Benny Khor100% (2)

- Mananquil, Julieta P. - Jeths JefrenДокумент12 страницMananquil, Julieta P. - Jeths JefrenMarissa Bucad GomezОценок пока нет

- Buying The Dip: Did Your Portfolio Holding Go On Sale?Документ16 страницBuying The Dip: Did Your Portfolio Holding Go On Sale?Rafael CampeloОценок пока нет

- NHB Vishal GoyalДокумент24 страницыNHB Vishal GoyalSky walkingОценок пока нет

- TBCH 13Документ43 страницыTBCH 13Tornike JashiОценок пока нет

- Draft AnswerДокумент5 страницDraft Answeraalawi00Оценок пока нет

- Sherry Hunt Case - Team CДокумент4 страницыSherry Hunt Case - Team CMariano BonillaОценок пока нет

- Sat YamДокумент39 страницSat YamShashank GuptaОценок пока нет

- Export 09 - 07 - 2020 00 - 39Документ59 страницExport 09 - 07 - 2020 00 - 39Kalle AhiОценок пока нет

- Provisional 2014 15Документ29 страницProvisional 2014 15maheshfbОценок пока нет