Академический Документы

Профессиональный Документы

Культура Документы

India's Growing Apparel Market

Загружено:

simonebandrawala9Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

India's Growing Apparel Market

Загружено:

simonebandrawala9Авторское право:

Доступные форматы

INDIAS FAST-GROWING APPAREL MARKET

Indias apparel market is in the throes of change. Rapid growth and rising

urbanization have spawned a new class of consumers with more money to spend,

and a growing passion for fashion. In Indias high-growth, fast-changing retail

clothing market, we see significant new growth opportunities for foreign and

domestic players.

Indian apparel sales are expected to reach an estimated $25 billion this year, having

grown in excess of 10 percent over the past 5 years, a growth rate faster than that of

the overall India retail marketand the trajectory is expected to continue. In India,

apparel is the second largest retail category (behind food and groceries),

representing approximately 10 percent of the total market. This growth is being

driven by a number of factors:

Increase in disposable income:

By 2005, 21 million of Indias 210 million households already earned more than

$4,000 a year, qualifying them for membership in what we call the consuming

class. Based on McKinsey research, by 2015 the number of consuming class

households will likely triple to 64 million.

New occasions

As the lifestyles of Indias prospering urban consumers have evolved, their

clothing needs have broadened, reflecting more varied usage occasions. For

men, clothing choices once came primarily in three basic categories: home-wear,

work clothes, and special occasion wear. Now, with more socializing

opportunities, men are buying more sophisticated combinations of outfits: party

wear, sports wear, clothes for hanging out at the mall. Not long ago, for example,

men from Indias northern regions only required a good dark suit or Sherwani, the

traditional long coat, to cover big occasions and important celebrations. But over

the past several years, men have begun to supplement those staples with

expensive Western style jackets, and collared shirtssome in funky patterns

and cut for a night on the town, others in stripes or checks for casual meetings

with important business associates. Today, Indians are more inclined than

consumers in other markets to buy apparel for a specific purpose. Indeed, 38

percent of Indian respondents to a recent McKinsey study said they were highly

likely to buy apparel for special eventsa significantly higher proportion than in

Brazil (5 percent), Russia (3 percent) or China (6 percent). Family celebrations

and weddings continue to eat up an enormous share of Indian consumers

clothing budgets.

Growth in the womens segment:

Historically, the mens apparel market in India has been significantly larger than

the womens apparel market. With only 20 percent of Indias urban women in the

workforce, womens wardrobes have traditionally been limited to home wear and

items for special occasions. Now, women are more willing to dress differently

when they venture beyond the hometo shop, for example, or visit a school or

office.

Fashion increasingly a form of self-expression:

Increasingly, Indian consumers are embracing the idea of fashion for its own

sake, as a means of self-expression, and not merely as a functional purchase.

Television, movies, advertising and the Internet bombard todays Indian consumer

with new ideas about style, even as American-style shopping malls lure them

away from traditional marketplaces. Traditional clothing remains central to the way

consumers dress, and the quality and craftsmanship of classic Indian clothing

have drawn rave reviews in recent years from some of the worlds leading

designers, style magazines, and fashion blogs. In a recent McKinsey survey of

Indian consumers, 62 percent said they thought it was important to keep up with

trends. More than ever, Indian consumers are experimenting with combining

styles, as seen in the recent Indo-fusion, boom, which mixes the silhouettes of

the East with the comfort cut of the West.

Over the next five years, one expects this growth to continue and the size of the

market to nearly double. The increase will come partly from continued gains in

disposable income, but its not just that Indians have more to spend. As they

prosper, Indian consumers will naturally continue to spend more of what they earn

on what they wear. Consumers worldwide typically spend an average of 5-6 percent

of total income on apparel, but the figure is often significantly higher in emerging

markets. Consumers in Chinas larger cities, for example, spend 10 percent of their

income on clothing, nearly double what their counterparts in Indian cities spend. That

higher propensity to spend on clothes has helped to make Chinas apparel market 4-

6 times larger than Indias. Brazils consumers similarly spend more per capita on

clothing than either Indias or Chinas.

Besides continued momentum from the trends mentioned above, we see two

additional forces that will inject further growth into Indias apparel sector:

Further urbanization and the comparative youth of Indias population.

At present, just 29 percent of Indias population resides in cities, among the

lowest urbanization rates of any nation in the world. But that has been changing.

Over the next 20 years, we expect the number of Indians living in cities to grow by

300 million, where they will don new styles and fashions to match new lifestyles. A

large percentage of these new city dwellers will be in their twenties, and making

first-time choices for whole categories of clothing items including denims, shirts,

and even shoes.

Continued rise of organized retail.

Large, branded store chains where products are systematically stocked and

displayed, will speed the transformation of consumer preferences. For now,

organized retail accounts for less than 20 percent of all Indian apparel purchases;

the rest takes place in tiny, family-run shops. But over the past five years, scores

of shopping malls have opened on the outskirts of Indias largest cities and the

trend is sure to accelerate.

But as in the fashion industry everywhere, success in India will depend on getting

many things right at once: figuring out what consumers want, developing a profitable

retail concept, and building a solid team. How, then, to compete in this promising but

fast-changing market? We see two success factors:

Focus on inventory and markdown management

Today, apparel is one of Indias most attractive business segments due to

its high margins. Looking at an index based on the cost of a basic white

shirt, we have found that Indian apparel prices have doubled over the last

decade, and tend to be 25 to 30 percent higher than in China as a result of

supply chain inefficiencies and restricted competition. We expect that

situation to change as Indias fashion industry draws new players and

capital in years to come. For one thing, apparel retail in India relies heavily

on sales promotions and special events. Tempting as it will be to bring

Western concepts like fast fashion and large assortments to India out of

the gate, innovation has its risks, including higher markdowns and lower

sell-throughs if the new offer or collection is not a hit. And uncertainty on

inventory management and ordering in the absence of historical sales data

is likely to be the norm. Winners will need to get the back-end operations

right much earlier than the scale of the market suggests: managing margin

through smarter in-season markdowns, a disciplined balance between core

fashion and high fashion, managing inventory through a proper mix of

made-to-order and later engagement rates, and keeping 50 to 60 percent

of regularly restocked items at the core have become part of a winning

retail formula. Though optimum margins on these pieces of clothing may

not be as much as the more expensive, high-impact fashion pieces, they

keep customers coming back regularly. The high fashion range should be

advertised and showcased, but kept only to 10 to 15 percent of inventory to

reduce the impact of markdowns.

Take a segmented view of the market

As in many other emerging markets, not all consumer segments or geographies

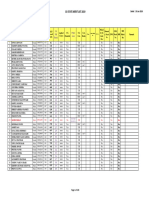

are the same. It shows that some segments of apparel shoppers spent 20 times

more than othersdriven not only by income, but also by lifestyle. For example,

consumers in the north tend to spend more than in other regions due to cooler

climates and different approaches to social occasions. Similarly, retailers cannot

ignore the smaller cities, which will drive apparel growth opportunities, even for

more expensive brands. Benetton, for example, recently hit $100 million in sales

in India, and is targeting $250 million within the next 3-4 years, largely by targeting

smaller cities, which are already contributing about 20 percent to the companys

growth and growing much more quickly than in the larger mark Winners who want

to build real scale in India will be those who understand the market in a granular

manner, and then own the customer throughout their lifecycle with a portfolio of

brands, price points, and formats.

FASHION INDUSTRY GROWTH DRIVERS

There are many factors on which the future growth of fashion industry depends:-

World GDP

The GDP growth will determine the buying capacity of people and also the

condition of other industries on which fashion industry depends.

Policies

As many countries are plunged into recession, the countries are changing the

import and export policies. These policies will have a major impact on the industry

growth as most part of fashion accessories are exported to other countries.

Development of logistics

Logistics is the backbone of fashion industry. As the better the logistics, faster the

product hits the market, cheaper the cost, better it is for the customers and so for the

companies.

Growth of retail chains

Most of the companies do not have their exclusive showroom only. They depend a

lot on multi-branded showrooms across the world to sell their products. Hence the

growth and stability of the retail chains will go on to improve the condition of fashion

industry.

Development in IT

Speed of the process, the customers order from ordering the raw material to the

final selling of the product, greatly depends on the technology used in the system.

E.g. use of RFID, clipped tags, faster printers, better communication channels etc.

Better the technology available and used the better the responsiveness of the

fashion industry towards customers demands.6.

Others

There are various skills (of people or computer) which influence a lot the fashion

industry such as forecasting etc.

Вам также может понравиться

- Why Starbucks Will Win in ChinaДокумент5 страницWhy Starbucks Will Win in Chinasimonebandrawala9Оценок пока нет

- Ratan Tata's Journey in 4 StagesДокумент6 страницRatan Tata's Journey in 4 Stagessimonebandrawala9Оценок пока нет

- Annabee's Cupcakes and Tarts Bakery Business PlanДокумент14 страницAnnabee's Cupcakes and Tarts Bakery Business Plansimonebandrawala9Оценок пока нет

- Business PlanДокумент63 страницыBusiness Plansimonebandrawala9Оценок пока нет

- Intro To PRДокумент14 страницIntro To PRsimonebandrawala9Оценок пока нет

- Zara's SCMДокумент6 страницZara's SCMsimonebandrawala9Оценок пока нет

- PR of Gauri and NainikaДокумент12 страницPR of Gauri and Nainikasimonebandrawala9Оценок пока нет

- Plan For Supply Chain Agility at Nokia: Lessons From The Mobile Infrastructure IndustryДокумент14 страницPlan For Supply Chain Agility at Nokia: Lessons From The Mobile Infrastructure Industrysimonebandrawala9Оценок пока нет

- Job Analysis Provides Insights for HR FunctionsДокумент59 страницJob Analysis Provides Insights for HR Functionssimonebandrawala9Оценок пока нет

- Cinthol Fortifies Its Presence in The Personal Care Category With All New Packaging and Launch of Shower GelДокумент3 страницыCinthol Fortifies Its Presence in The Personal Care Category With All New Packaging and Launch of Shower Gelsimonebandrawala9Оценок пока нет

- Qualities of An EntrepreneurДокумент10 страницQualities of An Entrepreneursimonebandrawala9Оценок пока нет

- Esops - FinancialДокумент6 страницEsops - Financialsimonebandrawala9Оценок пока нет

- Ratan TataДокумент13 страницRatan Tatasimonebandrawala9Оценок пока нет

- PR Strategy - Manish MalhotraДокумент12 страницPR Strategy - Manish Malhotrasimonebandrawala950% (2)

- Brand3Benetton Group1Документ23 страницыBrand3Benetton Group1simonebandrawala9Оценок пока нет

- Critical Evaluation - Role of The ImfДокумент8 страницCritical Evaluation - Role of The Imfsimonebandrawala9Оценок пока нет

- Indian Family Businesses Modernise to Remain CompetitiveДокумент3 страницыIndian Family Businesses Modernise to Remain Competitivesimonebandrawala9100% (1)

- ESOPДокумент40 страницESOPsimonebandrawala9Оценок пока нет

- Indian Family Businesses Modernise to Remain CompetitiveДокумент3 страницыIndian Family Businesses Modernise to Remain Competitivesimonebandrawala9100% (1)

- Indian Family Businesses Modernise to Remain CompetitiveДокумент3 страницыIndian Family Businesses Modernise to Remain Competitivesimonebandrawala9100% (1)

- Indian Railways ModernisationДокумент29 страницIndian Railways Modernisationsimonebandrawala9Оценок пока нет

- Compensation ManagementДокумент19 страницCompensation Managementsimonebandrawala9Оценок пока нет

- IMC Introduction to Integrated Marketing CommunicationsДокумент14 страницIMC Introduction to Integrated Marketing Communicationssimonebandrawala90% (1)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (890)

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (399)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5794)

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2219)

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (344)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (265)

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (119)

- Jayakrishnan - Kavitha / Dancing ArchitectureДокумент114 страницJayakrishnan - Kavitha / Dancing Architectureboomix100% (1)

- Demographic Features of India's PopulationДокумент24 страницыDemographic Features of India's PopulationHarsh Karia100% (1)

- InstwiseadmДокумент220 страницInstwiseadmpatupatil1135Оценок пока нет

- 06 Axis BankДокумент48 страниц06 Axis BankClint BanksОценок пока нет

- India's Economic and Social DevelopmentДокумент12 страницIndia's Economic and Social Developmentgamer guy100% (1)

- Formation of StatesДокумент15 страницFormation of Statesabpaul100% (1)

- TarsansarДокумент27 страницTarsansarsureshОценок пока нет

- Strategy Phase 1 India 2020 Rev.1Документ28 страницStrategy Phase 1 India 2020 Rev.1vikas KaleОценок пока нет

- Sarva Shiksha Abhiyan, GOI 2012-13: HighlightsДокумент8 страницSarva Shiksha Abhiyan, GOI 2012-13: HighlightsaamritaaОценок пока нет

- Schools of Hindu LawДокумент4 страницыSchools of Hindu LawMuhammad Zakir HossainОценок пока нет

- Importance of Dates in HistoryДокумент3 страницыImportance of Dates in HistoryAchilles HussainОценок пока нет

- Growth of Robotics in IndiaДокумент14 страницGrowth of Robotics in Indianitul deoriОценок пока нет

- State Board Igcse: SR - No Name of Institution Name of Board TypeДокумент8 страницState Board Igcse: SR - No Name of Institution Name of Board Typebdscreations44Оценок пока нет

- Admitted Candidates List Upto Mop Up Round MBBS BD-MCC COUNCELLING 2022 PDFДокумент3 197 страницAdmitted Candidates List Upto Mop Up Round MBBS BD-MCC COUNCELLING 2022 PDFrasdigdevОценок пока нет

- Shortlisted Competition Entry - National War Museum at New Delhi, by Collaborative Architecture - ArchitectureLive!Документ7 страницShortlisted Competition Entry - National War Museum at New Delhi, by Collaborative Architecture - ArchitectureLive!Monika MaharanaОценок пока нет

- All Parties Conference 1928 Summary of ProceedingsДокумент12 страницAll Parties Conference 1928 Summary of ProceedingsĻost ÒneОценок пока нет

- BookReview TamilBrahmans PublishedДокумент5 страницBookReview TamilBrahmans PublishedGayathri SОценок пока нет

- College Wise Fee DetailsДокумент6 страницCollege Wise Fee DetailsVasuk SharmaОценок пока нет

- MatrimonyДокумент11 страницMatrimonyagsanyamОценок пока нет

- Projet TomДокумент47 страницProjet TomTom Thomas100% (1)

- Indian Ergonomics Standards - Existing and Needs: Production and General Engineering DepartmentДокумент2 страницыIndian Ergonomics Standards - Existing and Needs: Production and General Engineering Departmentnarendar.1Оценок пока нет

- Merit List Neet Ug 2019Документ221 страницаMerit List Neet Ug 2019KashishОценок пока нет

- History of MaharashtraДокумент21 страницаHistory of MaharashtraobruxosabioОценок пока нет

- TribesДокумент2 страницыTribesAbhinav panigrahiОценок пока нет

- Genealogies AssignmentДокумент4 страницыGenealogies AssignmentNilanjana GhoshОценок пока нет

- Manifesto of Rashtriya Swayamsevak SanghДокумент3 страницыManifesto of Rashtriya Swayamsevak SanghArpita Basu100% (1)

- The Constitution (Scheduled Castes and Scheduled Tribes) Orders (Amendment) Act, 2022Документ2 страницыThe Constitution (Scheduled Castes and Scheduled Tribes) Orders (Amendment) Act, 2022ksauravfreeebookОценок пока нет

- Himachal Pradesh Ntse ResultДокумент6 страницHimachal Pradesh Ntse ResultYatish GoyalОценок пока нет

- The State Symbols of Tamil NaduДокумент5 страницThe State Symbols of Tamil NaduSushilkumar NingthouchaОценок пока нет

- Rice IndustryДокумент89 страницRice Industryraghu007nairОценок пока нет