Академический Документы

Профессиональный Документы

Культура Документы

RJR Case Study

Загружено:

Felipe Kasai MarcosАвторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

RJR Case Study

Загружено:

Felipe Kasai MarcosАвторское право:

Доступные форматы

Chapter 17 Valuation and Capital Budgeting for the Levered Firm 17A-1

The Adjusted Present Value Approach to Valuing

Leveraged Buyouts

1

Introduction

A leveraged buyout (LBO) is the acquisition by a small group of equity investors of a public

or private company nanced primarily with debt. The equityholders service the heavy inter-

est and principal payments with cash from operations and/or asset sales. The shareholders

generally hope to reverse the LBO within three to seven years by way of a public offering

or sale of the company to another rm. A buyout is therefore likely to be successful only if

the rm generates enough cash to serve the debt in the early years, and if the company is

attractive to other buyers as the buyout matures.

In a leveraged buyout, the equity investors are expected to pay off outstanding principal

according to a specic timetable. The owners know that the rms debtequity ratio will

fall and can forecast the dollar amount of debt needed to nance future operations. Under

these circumstances, the adjusted present value (APV) approach is more practical than the

weighted average cost of capital (WACC) approach because the capital structure is chang-

ing. In this appendix, we illustrate the use of this procedure in valuing the RJR Nabisco

transaction, the largest LBO in history.

The RJR Nabisco Buyout In the summer of 1988, the price of RJR stock was hovering

around $55 a share. The rm had $5 billion of debt. The rms CEO, acting in concert with

some other senior managers of the rm, announced a bid of $75 per share to take the rm

private in a management buyout. Within days of managements offer, Kohlberg, Kravis, and

Roberts (KKR) entered the fray with a $90 bid of their own. By the end of November, KKR

emerged from the ensuing bidding process with an offer of $109 a share, or $25 billion

total. We now use the APV technique to analyze KKRs winning strategy.

The APV method as described in this chapter can be used to value companies as well as

projects. Applied in this way, the maximum value of a levered rm (V

L

) is its value as an

all-equity entity (V

U

) plus the discounted value of the interest tax shields from the debt its

assets will support (PVTS).

2

This relation can be stated as:

V

L

V

U

PVTS

t =

1

UCF

t

________

(1 R

0

)

t

t =

1

t

C

R

B

B

t 1

_________

(1 R

B

)

t

In the second part of this equation, UCF

t

is the unlevered cash ow from operations for

year t. Discounting these cash ows by the required return on assets, R

0

, yields the all-

equity value of the company. B

t1

represents the debt balance remaining at the end of year

(t 1). Because interest in a given year is based on the debt balance remaining at the end

of the previous year, the interest paid in year t is R

B

B

t1

. The numerator of the second term,

Appendix 17A

w

w

w

.

m

h

h

e

.

c

o

m

/

r

w

j

1

This appendix has been adapted by Isik Inselbag and Howard Kaufold, The Wharton School, University of

Pennsylvania, from their unpublished manuscript titled Analyzing the RJR Nabisco Buyout: An Adjusted Pres-

ent Value Approach.

2

We should also deduct from this value any costs of nancial distress. However, we would expect these costs

to be small in the case of RJR for two reasons. As a rm in the tobacco and food industries, its cash ows are

relatively stable and recession resistant. Furthermore, the rms assets are divisible and attractive to a number of

potential buyers, allowing the rm to receive full value if disposition is required.

ros05902_ch17_appendiix.indd 1 10/31/06 11:36:18 AM

17A-2 Part IV Capital Structure and Dividend Policy

t

C

R

B

B

t1

, is therefore the tax shield for year t. We discount this series of annual tax shields

using the rate at which the rm borrows, R

B

.

3

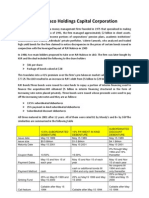

KKR planned to sell several of RJRs food divisions and operate the remaining parts of

the rm more efciently. Table 17A.1 presents KKRs projected unlevered cash ows for

RJR under the buyout, adjusting for planned asset sales and operational efciencies.

With respect to nancial strategy, KKR planned a signicant increase in leverage with

accompanying tax benets. Specically, KKR issued almost $24 billion of new debt to

complete the buyout, raising annual interest costs to more than $3 billion.

4

Table 17A.2

presents the projected interest expense and tax shields for the transaction.

We now use the data from Tables 17A.1 and 17A.2 to calculate the APV of the RJR

buyout. This valuation process is presented in Table 17A.3.

The valuation presented in Table 17A.3 involves four steps.

Step 1: Calculating the present value of unlevered cash ows for 19891993 The

unlevered cash ows for 19891993 are shown in the last line of Table 17A.1 and the rst

line of Table 17A.3. These ows are discounted by the required asset return, R

0

, which at

the time of the buyout was approximately 14 percent. The value as of the end of 1988 of

the unlevered cash ows expected from 1989 through 1993 is:

5.404

_____

1.14

4.311

_____

1.14

2

2.173

_____

1.14

3

2.336

_____

1.14

4

2.536

_____

1.14

5

$12.224 billion

Step 2: Calculating the present value of the unlevered cash ows beyond 1993 (unlevered

terminal value) We assume the unlevered cash ows grow at the modest annual rate of

w

w

w

.

m

h

h

e

.

c

o

m

/

r

w

j

3

The pretax borrowing rate, R

B

, represents the appropriate discount rate for the interest tax shields when there is

a precommitment to a specic debt repayment schedule under the terms of the LBO. If debt covenants require

that the entire free cash ow be dedicated to debt service, the amount of debt outstanding and, therefore, the

interest tax shield at any point in time are a direct function of the operating cash ows of the rm. Because

the debt balance is then as risky as the cash ows, the required return on assets should be used to discount the

interest tax shields.

4

A signicant portion of this debt was of the payment in kind (PIK) variety, which offers lenders additional

bonds instead of cash interest. This PIK debt nancing provided KKR with signicant tax shields while allow-

ing it to postpone the cash burden of debt service to future years. For simplicity of presentation, Table 17A.2

does not separately show cash versus noncash interest charges.

Table 17A.1

RJR Operating Cash

Flows (in $ millions)

1989 1990 1991 1992 1993

Operating income $2,620 $3,410 $3,645 $3,950 $4,310

Tax on operating income 891 1,142 1,222 1,326 1,448

Aftertax operating income 1,729 2,268 2,423 2,624 2,862

Add back depreciation 449 475 475 475 475

Less capital expenditures 522 512 525 538 551

Less change in working capital (203) (275) 200 225 250

Add proceeds from asset sales 3,545 1,805

Unlevered cash ow (UCF) $5,404 $4,311 $2,173 $2,336 $2,536

Table 17A.2

Projected Interest

Expenses and Tax

Shields (in $ millions)

1989 1990 1991 1992 1993

Interest expenses $3,384 $3,004 $3,111 $3,294 $3,483

Interest tax shields (t

C

34%) 1,151 1,021 1,058 1,120 1,184

ros05902_ch17_appendiix.indd 2 10/31/06 11:36:19 AM

Chapter 17 Valuation and Capital Budgeting for the Levered Firm 17A-3

3 percent after 1993. The value, as of the end of 1993, of these cash ows is equal to the

following discounted value of a growing perpetuity:

2.536(1.03)

__________

0.14 0.03

$23.746 billion

This translates to a 1988 value of:

23.746

______

1.14

5

$12.333 billion

As in Step 1, the discount rate is the required asset rate of 14 percent.

The total unlevered value of the rm is therefore $12.224 $12.333 $24.557 billion.

To calculate the total buyout value, we must add the interest tax shields expected to be

realized by debt nancing.

Step 3: Calculating the present value of interest tax shields for 19891993 Under

the prevailing U.S. tax laws in 1989, every dollar of interest reduced taxes by 34 cents.

The present value of the interest tax shield for the period from 19891993 can be calcu-

lated by discounting the annual tax savings at the pretax average cost of debt, which was

approximately 13.5 percent. Using the tax shields from Table 17A.2, the discounted value

of these tax shields is calculated as:

1.151

_____

1.135

1.021

______

1.135

2

1.058

______

1.135

3

1.120

______

1.135

4

1.184

______

1.135

5

$3.834 billion

Step 4: Calculating the present value of interest tax shields beyond 1993 Finally, we

must calculate the value of tax shields associated with debt used to finance the operations of

the company after 1993. We assume that debt will be reduced and maintained at 25 percent

w

w

w

.

m

h

h

e

.

c

o

m

/

r

w

j

Table 17A.3

RJR LBO Valuation

(in $ millions except

share data)

1989 1990 1991 1992 1993

Unlevered cash ow (UCF) $ 5,404 $4,311 $2,173 $2,336 $ 2,536

Terminal value: (3% growth after 1993)

Unlevered terminal value (UTV) 23,746

Terminal value at target debt 26,654

Tax shield in terminal value 2,908

Interest tax shields 1,151 1,021 1,058 1,120 1,184

PV of UCF 19891993 at 14% 12,224

PV of UTV at 14% 12,333

Total unlevered value $24,557

PV of tax shields 19891993 at 13.5% 3,834

PV of tax shield in TV at 13.5% 1,544

Total value of tax shields 5,378

Total value 29,935

Less value of assumed debt 5,000

Value of equity $24,935

Number of shares 229 million

Value per share $ 108.9

ros05902_ch17_appendiix.indd 3 10/31/06 11:36:21 AM

17A-4 Part IV Capital Structure and Dividend Policy

w

w

w

.

m

h

h

e

.

c

o

m

/

r

w

j

of the value of the firm from that date forward.

5

Under this assumption it is appropriate to

use the WACC method to calculate a terminal value for the firm at the target capital struc-

ture. This in turn can be decomposed into an all-equity value and a value from tax shields.

If, after 1993, RJR uses 25 percent debt in its capital structure, its WACC at this target

capital structure would be approximately 12.8 percent.

6

Then the levered terminal value as

of the end of 1993 can be estimated as:

2.536(1.03)

___________

0.128 0.03

$26.654 billion

Because the levered value of the company is the sum of the unlevered value plus the

value of interest tax shields, it is the case that:

Value of tax shields (end 1993) V

L

(end 1993) V

U

(end 1993)

$26.654 billion $23.746 billion

$2.908 billion

To calculate the value, as of the end of 1988, of these future tax shields, we again discount

by the borrowing rate of 13.5 percent to get:

7

2.908

______

1.135

5

$1.544 billion

The total value of interest tax shields therefore equals $3.834 $1.544 $5.378 billion.

Adding all of these components together, the total value of RJR under the buyout

proposal is $29.935 billion. Deducting the $5 billion market value of assumed debt yields

a value for equity of $24.935 billion, or $108.9 per share.

Concluding Comments about LBO Valuation Methods As mentioned in this

chapter, the WACC method is by far the most widely applied approach to capital budgeting.

5

This 25 percent gure is consistent with the debt utilization in industries in which RJR Nabisco is involved.

In fact, that was the debt-to-total-market-value ratio for RJR immediately before managements initial buyout

proposal. The rm can achieve this target by 1993 if a signicant portion of the convertible debt used to nance

the buyout is exchanged for equity by that time. Alternatively, KKR could issue new equity (as would occur, for

example, if the rm were taken public) and use the proceeds to retire some of the outstanding debt.

6

To calculate this rate, use the weighted average cost of capital from this chapter:

R

WACC

S

______

S B

R

S

B

______

S B

R

B

(1 t

C

)

and substitute the appropriate values for the proportions of debt and equity used, as well as their respective costs.

Specically, at the target debt-to-value ratio, B(S B) 25 percent, and S(S B) (1 B(S B))

75 percent. Given this blend:

R

S

R

0

B

__

S

(1 t

C

) (R

0

R

B

)

0.14

0.25

____

0.75

(1 0.34) (0.14 0.135)

0.141

Using these ndings plus the borrowing rate of 13.5 percent in R

WACC

, we nd:

R

WACC

0.75(0.141) 0.25(0.135)(1 0.34)

0.128

In fact, this value is an approximation to the true weighted average cost of capital when the market debt-to-value

blend is constant or when the cash ows are growing. For a detailed discussion of this issue, see Isik Inselbag

and Howard Kaufold, A Comparison of Alternative Discounted Cash Flow Approaches to Firm Valuation, The

Wharton School, University of Pennsylvania (June 1990), unpublished paper.

7

A good argument can be made that because post-1993 debt levels are proportional to rm value, the tax shields

are as risky as the rm and should be discounted at the rate R

0

.

ros05902_ch17_appendiix.indd 4 10/31/06 11:36:22 AM

Chapter 17 Valuation and Capital Budgeting for the Levered Firm 17A-5

We could analyze an LBO and generate the results of the second section of this appendix

using this technique, but it would be a much more difcult process. We have tried to show

that the APV approach is the preferred way to analyze a transaction in which the capital

structure is not stable over time.

Consider the WACC approach to valuing the KKR bid for RJR. We could discount the

operating cash ows of RJR by a set of weighted average costs of capital and arrive at the

same $30 billion total value for the company. To do this, we would need to calculate the

appropriate rate for each year because the WACC rises as the buyout proceeds. This occurs

because the value of the tax subsidy declines as debt principal is repaid. In other words, no

single return represents the cost of capital when the firms capital structure is changing.

There is also a theoretical problem with the WACC approach to valuing a buyout. To

calculate the changing WACC, we must know the market value of a rms debt and equity.

But if the debt and equity values are already known, the total market value of the company

is also known. That is, we must know the value of the company to calculate the WACC. We

must therefore resort to using book value measures for debt and equity, or make assump-

tions about the evolution of their market values, to implement the WACC method.

w

w

w

.

m

h

h

e

.

c

o

m

/

r

w

j

ros05902_ch17_appendiix.indd 5 10/31/06 11:36:23 AM

Вам также может понравиться

- 24 RJR Nabisco - A Case Study of Complex Leveraged Buyout - Financial Analyst's JournalДокумент14 страниц24 RJR Nabisco - A Case Study of Complex Leveraged Buyout - Financial Analyst's JournalJoel DiasОценок пока нет

- 24 RJR Nabisco - A Case Study of Complex Leveraged Buyout - Financial Analyst's JournalДокумент14 страниц24 RJR Nabisco - A Case Study of Complex Leveraged Buyout - Financial Analyst's JournalJoel DiasОценок пока нет

- 24 RJR Nabisco - A Case Study of Complex Leveraged Buyout - Financial Analyst's JournalДокумент14 страниц24 RJR Nabisco - A Case Study of Complex Leveraged Buyout - Financial Analyst's JournalJoel DiasОценок пока нет

- RJR Nabisco Harshavardhan 2015PGP254Документ18 страницRJR Nabisco Harshavardhan 2015PGP254Harsha Vardhan100% (1)

- BBB Case Write-UpДокумент2 страницыBBB Case Write-UpNeal Karski100% (1)

- Hill Country Snack Foods CoДокумент9 страницHill Country Snack Foods CoZjiajiajiajiaPОценок пока нет

- Questions:: 1. Is Mercury An Appropriate Target For AGI? Why or Why Not?Документ5 страницQuestions:: 1. Is Mercury An Appropriate Target For AGI? Why or Why Not?Cuong NguyenОценок пока нет

- RJR Nabisco Case - Group 4 - PPTДокумент8 страницRJR Nabisco Case - Group 4 - PPTMeghna Saluja100% (1)

- RJR Nabisco - SpreadsheetДокумент10 страницRJR Nabisco - SpreadsheetSurajОценок пока нет

- RJR Nabisco HBS Case SolutionДокумент13 страницRJR Nabisco HBS Case SolutionRattan Preet Singh25% (4)

- RJR Nabisco ValuationДокумент33 страницыRJR Nabisco ValuationShivani Bhatia100% (4)

- RJR NabiscoДокумент22 страницыRJR Nabiscokriteesinha100% (2)

- Group2 - Clarkson Lumber Company Case AnalysisДокумент3 страницыGroup2 - Clarkson Lumber Company Case AnalysisDavid WebbОценок пока нет

- Apple Stock BuybackДокумент2 страницыApple Stock BuybackalimithaОценок пока нет

- Group 2 - Marvel Bankruptcy Memo Rev3Документ3 страницыGroup 2 - Marvel Bankruptcy Memo Rev3Abiodun Ayodele Babalola100% (1)

- CongoleumДокумент16 страницCongoleumMilind Sarambale0% (1)

- Kohler CompanyДокумент3 страницыKohler CompanyDuncan BakerОценок пока нет

- RJR Nabisco ValuationДокумент40 страницRJR Nabisco ValuationEdisonCaguanaОценок пока нет

- Project Chariot IpДокумент7 страницProject Chariot Ipapi-544118373Оценок пока нет

- Bankruptcy and Restructuring at Marvel Entertainment GroupДокумент12 страницBankruptcy and Restructuring at Marvel Entertainment Groupvikaskumar_mech89200% (2)

- RJR Nabisco LBOДокумент5 страницRJR Nabisco LBOpoojaraneifm25% (4)

- Berkshire - IntroДокумент2 страницыBerkshire - IntroRohith ThatchanОценок пока нет

- Case Assignment - RJR NabiscoДокумент1 страницаCase Assignment - RJR NabiscoMuhammad Rehan NasirОценок пока нет

- 8D & 7QC ToolsДокумент117 страниц8D & 7QC ToolsAshok Kumar100% (1)

- Case StudyДокумент10 страницCase StudyEvelyn VillafrancaОценок пока нет

- RJR Nabisco ValuationДокумент7 страницRJR Nabisco ValuationAnil Kotaga0% (1)

- BerkshireДокумент30 страницBerkshireNimra Masood100% (3)

- RJRДокумент4 страницыRJRliyulongОценок пока нет

- RJRJRJJRJRJRJJR111111Документ4 страницыRJRJRJJRJRJRJJR111111John Paul Chua57% (7)

- Bidding For Hertz Leveraged Buyout, Spreadsheet SupplementДокумент12 страницBidding For Hertz Leveraged Buyout, Spreadsheet SupplementAmit AdmuneОценок пока нет

- Ethodology AND Ssumptions: B B × D EДокумент7 страницEthodology AND Ssumptions: B B × D ECami MorenoОценок пока нет

- RJR NabiscoДокумент17 страницRJR Nabiscodanielcid100% (1)

- RJR Nabisco ValuationДокумент38 страницRJR Nabisco ValuationJCОценок пока нет

- RJR Nabisco 1Документ6 страницRJR Nabisco 1gopal mundhraОценок пока нет

- Technical Note On LBO Valuation and Modeling - 150309 - 4!10!2015 - SAMPLEДокумент30 страницTechnical Note On LBO Valuation and Modeling - 150309 - 4!10!2015 - SAMPLEJayant Sharma100% (1)

- Yell PresentationДокумент27 страницYell PresentationSounak DuttaОценок пока нет

- April 8/91: All GroupsДокумент33 страницыApril 8/91: All Groupsreza mirzakhaniОценок пока нет

- RJR - NabiscoДокумент37 страницRJR - NabiscoAB100% (1)

- Transformational LeadershipДокумент75 страницTransformational LeadershipvincentpalaniОценок пока нет

- Gics-In-India Getting Ready For The Digital WaveДокумент81 страницаGics-In-India Getting Ready For The Digital Wavevasu.gaurav75% (4)

- Lex CaseДокумент8 страницLex CaseAshlesh MangrulkarОценок пока нет

- Caso 4 MarriotДокумент12 страницCaso 4 MarriotbxuffyОценок пока нет

- 5G NR Essentials Guide From IntelefyДокумент15 страниц5G NR Essentials Guide From IntelefyUzair KhanОценок пока нет

- Nabisco - Sol v0.1 PDFДокумент13 страницNabisco - Sol v0.1 PDFMohit Khandelwal100% (1)

- RJR Nabisco ValuationДокумент33 страницыRJR Nabisco ValuationKrishna Chaitanya KothapalliОценок пока нет

- Calculating The NPV of The AcquisitionДокумент23 страницыCalculating The NPV of The Acquisitionkooldude1989100% (1)

- Cases RJR Nabisco 90 & 91 - Assignment QuestionsДокумент1 страницаCases RJR Nabisco 90 & 91 - Assignment QuestionsBrunoPereiraОценок пока нет

- VIB Case Study On RJR NabiscoДокумент1 страницаVIB Case Study On RJR NabiscoSatyajeet SenapatiОценок пока нет

- In-Class Project 2: Due 4/13/2019 Your Name: Valuation of The Leveraged Buyout (LBO) of RJR Nabisco 1. Cash Flow EstimatesДокумент5 страницIn-Class Project 2: Due 4/13/2019 Your Name: Valuation of The Leveraged Buyout (LBO) of RJR Nabisco 1. Cash Flow EstimatesDinhkhanh NguyenОценок пока нет

- RJR Nabisco Holdings Capital CorporationДокумент3 страницыRJR Nabisco Holdings Capital CorporationManogana RasaОценок пока нет

- Leveraged BuyoutДокумент9 страницLeveraged Buyoutbharat100% (1)

- Case Analysis - Compania de Telefonos de ChileДокумент4 страницыCase Analysis - Compania de Telefonos de ChileSubrata BasakОценок пока нет

- The Relative Pricing of High-Yield Debt: The Case of RJR Nabisco Holdings Capital CorporationДокумент24 страницыThe Relative Pricing of High-Yield Debt: The Case of RJR Nabisco Holdings Capital CorporationAhsen Ali Siddiqui100% (1)

- Case Background: Kaustav Dey B18088Документ9 страницCase Background: Kaustav Dey B18088Kaustav DeyОценок пока нет

- Seagate Veritas Summary 021501Документ4 страницыSeagate Veritas Summary 021501satheesh21090% (1)

- Report On Marvel's Restructuring Dilemma: Financial ManagementДокумент19 страницReport On Marvel's Restructuring Dilemma: Financial Managementebi ayatОценок пока нет

- Carter LBOДокумент1 страницаCarter LBOEddie KruleОценок пока нет

- M&a Assignment - Syndicate C FINALДокумент8 страницM&a Assignment - Syndicate C FINALNikhil ReddyОценок пока нет

- COVID-19 R M&A TransactionsДокумент3 страницыCOVID-19 R M&A TransactionsrdiazeplaОценок пока нет

- Applying APV in The Real World - The RJR Nabisco BuyoutДокумент2 страницыApplying APV in The Real World - The RJR Nabisco Buyoutsulaimani keedaОценок пока нет

- Duke Finance Adjusted NPVДокумент9 страницDuke Finance Adjusted NPVbgraham421Оценок пока нет

- Lier Corporation ReportДокумент4 страницыLier Corporation ReportAmandeep AroraОценок пока нет

- App18a PDFДокумент5 страницApp18a PDFWalter CostaОценок пока нет

- ValuationДокумент3 страницыValuationRendry Da Silva SantosОценок пока нет

- Finc 610 QPДокумент15 страницFinc 610 QPSam Sep A SixtyoneОценок пока нет

- 2022.03.08 FDM Past Papers and QuestionsДокумент24 страницы2022.03.08 FDM Past Papers and QuestionsCandice WrightОценок пока нет

- SBR TutorialsДокумент11 страницSBR TutorialskityanОценок пока нет

- Worksheet in C Users Felipe - Kasai Downloads MBA591 - InstructorguideДокумент4 страницыWorksheet in C Users Felipe - Kasai Downloads MBA591 - InstructorguideFelipe Kasai MarcosОценок пока нет

- Worksheet in C Users Felipe - Kasai Downloads MBA591 - InstructorguideДокумент4 страницыWorksheet in C Users Felipe - Kasai Downloads MBA591 - InstructorguideFelipe Kasai MarcosОценок пока нет

- Capital Budgeting Decision Rules: What Real Investments Should Firms Make?Документ31 страницаCapital Budgeting Decision Rules: What Real Investments Should Firms Make?Adolfo SnyderОценок пока нет

- OMM 618 Final PaperДокумент14 страницOMM 618 Final PaperTerri Mumma100% (1)

- Characteristics of Trochoids and Their Application To Determining Gear Teeth Fillet ShapesДокумент14 страницCharacteristics of Trochoids and Their Application To Determining Gear Teeth Fillet ShapesJohn FelemegkasОценок пока нет

- Early Christian ArchitectureДокумент38 страницEarly Christian ArchitectureInspirations & ArchitectureОценок пока нет

- Weekly Lesson Plan: Pry 3 (8years) Third Term Week 1Документ12 страницWeekly Lesson Plan: Pry 3 (8years) Third Term Week 1Kunbi Santos-ArinzeОценок пока нет

- Translations Telugu To English A ClassifДокумент111 страницTranslations Telugu To English A ClassifGummadi Vijaya KumarОценок пока нет

- 6 RVFS - SWBL Ojt Evaluation FormДокумент3 страницы6 RVFS - SWBL Ojt Evaluation FormRoy SumugatОценок пока нет

- H.mohamed Ibrahim Hussain A Study On Technology Updatiing and Its Impact Towards Employee Performance in Orcade Health Care PVT LTD ErodeДокумент108 страницH.mohamed Ibrahim Hussain A Study On Technology Updatiing and Its Impact Towards Employee Performance in Orcade Health Care PVT LTD ErodeeswariОценок пока нет

- Reflective Memo 1-PracticumДокумент5 страницReflective Memo 1-Practicumapi-400515862Оценок пока нет

- Medical Equipment Quality Assurance For Healthcare FacilitiesДокумент5 страницMedical Equipment Quality Assurance For Healthcare FacilitiesJorge LopezОценок пока нет

- 353 Version 7thДокумент1 страница353 Version 7thDuc NguyenОценок пока нет

- MMB & DFT 2012 Workshop ProceedingsДокумент44 страницыMMB & DFT 2012 Workshop ProceedingsFelipe ToroОценок пока нет

- Course Outline Cbmec StratmgtДокумент2 страницыCourse Outline Cbmec StratmgtskyieОценок пока нет

- Dash8 200 300 Electrical PDFДокумент35 страницDash8 200 300 Electrical PDFCarina Ramo LakaОценок пока нет

- Jaiib QpapersДокумент250 страницJaiib Qpapersjaya htОценок пока нет

- GSE v. Dow - AppendixДокумент192 страницыGSE v. Dow - AppendixEquality Case FilesОценок пока нет

- Historical Perspective of OBДокумент67 страницHistorical Perspective of OBabdiweli mohamedОценок пока нет

- General Characteristics of Phonemes: Aspects of Speech SoundsДокумент8 страницGeneral Characteristics of Phonemes: Aspects of Speech SoundsElina EkimovaОценок пока нет

- B.e.eeeДокумент76 страницB.e.eeeGOPINATH.MОценок пока нет

- Rwamagana s5 Mathematics CoreДокумент4 страницыRwamagana s5 Mathematics Coreevariste.ndungutse1493Оценок пока нет

- IELTS Material Writing 1Документ112 страницIELTS Material Writing 1Lê hoàng anhОценок пока нет

- Papalia Welcome Asl 1 Guidelines 1 1Документ14 страницPapalia Welcome Asl 1 Guidelines 1 1api-403316973Оценок пока нет

- Ducati WiringДокумент7 страницDucati WiringRyan LeisОценок пока нет

- USTH Algorithm RecursionДокумент73 страницыUSTH Algorithm Recursionnhng2421Оценок пока нет

- SAP HCM Case StudyДокумент17 страницSAP HCM Case StudyRafidaFatimatuzzahraОценок пока нет

- Aqa Ms Ss1a W QP Jun13Документ20 страницAqa Ms Ss1a W QP Jun13prsara1975Оценок пока нет