Академический Документы

Профессиональный Документы

Культура Документы

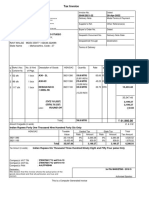

Local Sales Tax Collections 0714

Загружено:

Nick Reisman0 оценок0% нашли этот документ полезным (0 голосов)

6K просмотров3 страницыLocal sales tax collections in New York State grew by $173 million, or 2. Percent. Growth in the first quarter of 2014 was only 1. Percent higher than in first quarter of 2013. New York City's sales tax collections grew by 4. Percent, or $152 million, in first half of 2014.

Исходное описание:

Авторское право

© © All Rights Reserved

Доступные форматы

PDF, TXT или читайте онлайн в Scribd

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документLocal sales tax collections in New York State grew by $173 million, or 2. Percent. Growth in the first quarter of 2014 was only 1. Percent higher than in first quarter of 2013. New York City's sales tax collections grew by 4. Percent, or $152 million, in first half of 2014.

Авторское право:

© All Rights Reserved

Доступные форматы

Скачайте в формате PDF, TXT или читайте онлайн в Scribd

0 оценок0% нашли этот документ полезным (0 голосов)

6K просмотров3 страницыLocal Sales Tax Collections 0714

Загружено:

Nick ReismanLocal sales tax collections in New York State grew by $173 million, or 2. Percent. Growth in the first quarter of 2014 was only 1. Percent higher than in first quarter of 2013. New York City's sales tax collections grew by 4. Percent, or $152 million, in first half of 2014.

Авторское право:

© All Rights Reserved

Доступные форматы

Скачайте в формате PDF, TXT или читайте онлайн в Scribd

Вы находитесь на странице: 1из 3

Local sales tax collections in New

York State grew by $173 million, or

2.4 percent, for the first six months

of 2014 compared to collections

during the same period in 2013.

1

This is less than half of the 5.2

percent annual growth seen in

2013, but just more than half of the

15-year average annual growth rate

of 4.5 percent.

Although total local sales tax

collections have grown each quarter

since the end of the 2008-2009

recession, the rate of this growth

has shown a downward overall

trend. Growth in the first quarter of

2014 was only 1.2 percent higher

than in the first quarter of 2013,

the weakest growth since the end

of the recession. Growth in the

second quarter of 2014 was slightly

stronger (3.5 percent).

New York Citys sales tax

collections grew by 4.8 percent,

or $152 million, in the first half of

2014. This was lower than City

growth in the recent past (2013

collections grew by 6.8 percent

over 2012), but it still accounted

for nearly 90 percent of total local

sales tax growth in the State in the

first six months of 2014.

NEW YORK STATE OFFI CE OF THE STATE COMPTROLLER

Di v i s i on of L oc al Gov er nment and Sc hool Ac c ount abi l i t y

Thomas P. DiNapoli State Comptroller July 2014

Local Government Snapshot

Growth in Local Sales Tax Collections Slows to 2.4 Percent in First

Half of 2014; Long Island and Southern Tier Collections Decline

2.4%

First 6 Months

-6.0%

9.9%

5.0%

3.3%

5.2%

-8%

-6%

-4%

-2%

0%

2%

4%

6%

8%

10%

12%

Average Annual

Increase

1999 to 2013:

4.5%

Recessions

Local Sales Tax Collections Percentage Change Over Prior Year,

1999 Through First Half of 2014

Source: Department of Taxation and Finance; additional calculations by the Office of the State

Comptroller. Numbers not adjusted for tax rate or tax law changes.

13.5%

2.3%

5.8%

1.2%

3.5%

0%

2%

4%

6%

8%

10%

12%

14%

Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2

2010 2011 2012 2013 2014

Trendline

Local Sales Tax Collections Percentage Change Over Prior Year,

By Quarter, Q1 2010 to Q4 2014

Source: New York State Department of Taxation and Finance; additonal calculations by the

Office of the State Comptroller. Numbers not adjusted for tax rate or tax law changes.

The Long Island region experienced

a decline in sales tax collections of

3.8 percent, or $45 million, over the

first six months of 2014 compared

to the year before. This was in large

part due to an 8.3 percent decrease

in Nassau County. In early 2013,

sales tax revenues were boosted

by recovery effort purchases in the

many communities severely affected

by Superstorm Sandy in 2012.

However, by 2014, this temporary

spending had mostly ceased.

The strongest growth for the first

six months of 2014 was in the North

Country region (7.6 percent). This

growth was boosted by sales tax

rate increases in several counties

(see discussion below). Sales tax

collections in the Southern Tier region declined slightly (0.2 percent) in the first six months of 2014,

continuing the decline of 2.3 percent for all of 2013.

Forty-one counties had sales tax collections growth in the first half of 2014 compared to the first half

of 2013. The strongest growth was in four counties where sales tax rate increases were enacted

effective December 1, 2013. St. Lawrence County increased its county sales tax rate from 3 percent

to 4 percent, which contributed to sales tax collections growth of 31 percent in the first six months

of 2014.

2

Hamilton County also increased its rate from 3 to 4 percent, and had 24.4 percent growth.

Lewis and Essex counties both increased their rates from 3.75 percent to 4 percent, and had growth

of 15.6 percent and 9.3 percent, respectively.

Ulster County had a decline in sales tax collections of 5.7 percent in the first six months of 2014. This

decline was due to a delay of the regularly scheduled renewal of an additional 1 percent increment

in the sales tax rate, causing the Countys rate to drop from 4 to 3 percent from December 1, 2013 to

February 1, 2014 at which point the additional 1 percent rate renewal became effective.

New Yor k St at e Of f i c e of t he St at e Compt r ol l er

Local Government Snapshot

2

3.5%

1.5%

0.9%

1.4%

7.6%

-0.2%

1.7%

-3.8%

2.4%

4.8%

-6%

-4%

-2%

0%

2%

4%

6%

8%

10%

C

a

p

i

t

a

l

D

i

s

t

r

i

c

t

C

e

n

t

r

a

l

N

Y

F

i

n

g

e

r

L

a

k

e

s

M

o

h

a

w

k

V

a

l

l

e

y

N

o

r

t

h

C

o

u

n

t

r

y

S

o

u

t

h

e

r

n

T

i

e

r

W

e

s

t

e

r

n

N

Y

L

o

n

g

I

s

l

a

n

d

M

i

d

-

H

u

d

s

o

n

N

e

w

Y

o

r

k

C

i

t

y

Upstate Downstate

Local Sales Tax Collections Percentage Change Over Prior Year,

By Region, First Half 2013 to First Half 2014

Source: Department of Taxation and Finance; additional calculations by the Office of the State

Comptroller. Includes County and City collections only. Numbers not adjusted for tax rate or

tax law changes.

New Yor k St at e Of f i c e of t he St at e Compt r ol l er

Local Government Snapshot

3

New York City

Essex

Erie

Lewis

St. Lawrence

Franklin

Hamilton

Ulster

Oneida

Steuben

Herkimer

Delaware

Clinton

Otsego

Jefferson

Warren

Suffolk

Oswego

Sullivan

Allegany

Orange

Cattaraugus

Cayuga

Tioga

Saratoga

Greene

Wayne

Broome

Chautauqua

Ontario

Monroe

Chenango

Dutchess

Fulton

Madison

Onondaga

Albany

Yates

Niagara

Wyoming

Schoharie

Cortland

Genesee

Tompkins

Orleans

Chemung

Schuyler

Montgomery

Putnam

Washington

Columbia

Livingston

Rensselaer

Seneca

Westchester

Nassau

Rockland

Schenectady

Counties selection

Percentage Change Over Prior Year

Decline more than 2 percent

Decline less than 2 percent

Increase less than 4 percent

Increase between 4 and 8 percent

Increase more than 8 percent

Percentage Change in Local Sales Tax Collections, First Half 2013 to First Half 2014

Source: Department of Taxation and Finance; additional calculation by the Office of the State Comptroller. Includes county and New York City sales taxes only.

1

Sales tax collections data from the New York State Department of Taxation and Finance. Local sales taxes are those imposed for entities

other than the State. This includes: county and city sales taxes, the sales tax surcharge for the Metropolitan Commuter Transportation District,

segmented sales taxes and consumer utility taxes.

2

The local rates are combined with the State rate of 4 percent to comprise the overall sales tax rate for that jurisdiction.

Вам также может понравиться

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5794)

- OCM LawsuitДокумент29 страницOCM LawsuitNick Reisman100% (1)

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (399)

- E2022 0116cv Tim Harkenrider Et Al V Tim Harkenrider Et Al Decision After Trial 243Документ18 страницE2022 0116cv Tim Harkenrider Et Al V Tim Harkenrider Et Al Decision After Trial 243Nick ReismanОценок пока нет

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- Matter of Demetriou V New York State Department of Health 2022-00532Документ2 страницыMatter of Demetriou V New York State Department of Health 2022-00532Nick ReismanОценок пока нет

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (894)

- Letter - FL Region - Booster Healthcare Mandate 1-12-22Документ2 страницыLetter - FL Region - Booster Healthcare Mandate 1-12-22Nick ReismanОценок пока нет

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- EndorsementsДокумент4 страницыEndorsementsNick ReismanОценок пока нет

- SNY1221 CrosstabsДокумент9 страницSNY1221 CrosstabsNick ReismanОценок пока нет

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- Amy Brignall Et Al V New York State Unified Court System Et Al - Filed PETITIONДокумент56 страницAmy Brignall Et Al V New York State Unified Court System Et Al - Filed PETITIONNick ReismanОценок пока нет

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- Amy Brignall Et Al V New York State Unified Court System Et Al - Filed PETITIONДокумент56 страницAmy Brignall Et Al V New York State Unified Court System Et Al - Filed PETITIONNick ReismanОценок пока нет

- Economic Benefits of Coverage For AllДокумент2 страницыEconomic Benefits of Coverage For AllNick ReismanОценок пока нет

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (265)

- As Filed PetitionДокумент67 страницAs Filed PetitionNick ReismanОценок пока нет

- SNY0122 Crosstabs011822Документ8 страницSNY0122 Crosstabs011822Nick ReismanОценок пока нет

- Notice of Appeal Nassau County Mask RulingДокумент8 страницNotice of Appeal Nassau County Mask RulingNick ReismanОценок пока нет

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- Covid 19 Executive Order To Limit Non Essential Elective Procedures 12-3-21Документ3 страницыCovid 19 Executive Order To Limit Non Essential Elective Procedures 12-3-21News10NBCОценок пока нет

- Lottery Commission Increase Letter To Governor HochulДокумент3 страницыLottery Commission Increase Letter To Governor HochulNick ReismanОценок пока нет

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (344)

- Hochul Housing Coalition Letter PrsДокумент4 страницыHochul Housing Coalition Letter PrsNick ReismanОценок пока нет

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- Cuomo ReportДокумент63 страницыCuomo ReportCasey Seiler100% (2)

- ICS0921 CVCrosstabsДокумент4 страницыICS0921 CVCrosstabsNick ReismanОценок пока нет

- Contract c000271Документ21 страницаContract c000271Nick ReismanОценок пока нет

- SNY1021 CrosstabsДокумент8 страницSNY1021 CrosstabsNick ReismanОценок пока нет

- Letter To Gov Hochul 8.31Документ2 страницыLetter To Gov Hochul 8.31Nick Reisman100% (1)

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- Ics 0621 CV Cross TabsДокумент7 страницIcs 0621 CV Cross TabsNick ReismanОценок пока нет

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2219)

- SNY0921 CrosstabsДокумент9 страницSNY0921 CrosstabsNick ReismanОценок пока нет

- NY Gig Labor Clergy LetterДокумент3 страницыNY Gig Labor Clergy LetterNick ReismanОценок пока нет

- NY State Groups Sign-On Letter Supporting Biden's Tax & Investment Plans 8-9-21Документ4 страницыNY State Groups Sign-On Letter Supporting Biden's Tax & Investment Plans 8-9-21Nick ReismanОценок пока нет

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1090)

- S Ny 0621 Cross TabsДокумент8 страницS Ny 0621 Cross TabsNick ReismanОценок пока нет

- Cuomo Nyiva 050321 PMДокумент3 страницыCuomo Nyiva 050321 PMNick ReismanОценок пока нет

- News Release Redistricting August 2021 FinalДокумент2 страницыNews Release Redistricting August 2021 FinalNick ReismanОценок пока нет

- Accountability Waiver Announcement Memo 062221Документ5 страницAccountability Waiver Announcement Memo 062221Nick ReismanОценок пока нет

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (119)

- New York Right To Bargain Bill LetterДокумент2 страницыNew York Right To Bargain Bill LetterNick ReismanОценок пока нет

- SNY0521 CrosstabsДокумент7 страницSNY0521 CrosstabsNick ReismanОценок пока нет

- s5 PDFДокумент5 страницs5 PDFKeshav KumarОценок пока нет

- Group Assignment Accounting Cycle - ADДокумент4 страницыGroup Assignment Accounting Cycle - ADShewatatek MelakuОценок пока нет

- MariGolds Cost PH 2Документ2 страницыMariGolds Cost PH 2BHARAT SОценок пока нет

- Withholding Tax PPT PresentationДокумент16 страницWithholding Tax PPT PresentationClyde Louis Oliver-Linag100% (1)

- AH100-3000 CatalogueДокумент229 страницAH100-3000 CatalogueoldtimerstudioОценок пока нет

- The Following Information Has Been Reported by Laporte Inc On PDFДокумент1 страницаThe Following Information Has Been Reported by Laporte Inc On PDFLet's Talk With HassanОценок пока нет

- Return 2019 PDFДокумент3 страницыReturn 2019 PDFIkramОценок пока нет

- SUYOG2604Документ1 страницаSUYOG2604vishalОценок пока нет

- Procurement Oracle R12 Invoice AP AdjustmentДокумент42 страницыProcurement Oracle R12 Invoice AP Adjustmentyasserlion100% (1)

- CIR Vs de PrietoДокумент3 страницыCIR Vs de PrietoJoseph Artfel II LAZOОценок пока нет

- 1511256898711park Cubix Price Sheet 2 9 17 PDFДокумент1 страница1511256898711park Cubix Price Sheet 2 9 17 PDFManjunathОценок пока нет

- Important Information About Form 1099-G: D D Flaumenbaum 2481 Haff Ave North Bellmore Ny 11710-2735Документ1 страницаImportant Information About Form 1099-G: D D Flaumenbaum 2481 Haff Ave North Bellmore Ny 11710-2735ddouglasf2357Оценок пока нет

- SRPL 2300255Документ2 страницыSRPL 2300255radhe panelОценок пока нет

- Delos Reyes Quiz 1Документ2 страницыDelos Reyes Quiz 1zavriaОценок пока нет

- Leed's Invoice # V10122828Документ2 страницыLeed's Invoice # V10122828Anil KumarОценок пока нет

- Quotation.782 Juniper v2.5 HardwareДокумент1 страницаQuotation.782 Juniper v2.5 HardwareFAVE ONEОценок пока нет

- Exempted Supplies Under GSTДокумент127 страницExempted Supplies Under GSTmonikaОценок пока нет

- Cir Vs Central Luzon Drug CorporationДокумент2 страницыCir Vs Central Luzon Drug CorporationVincent Quiña Piga71% (7)

- Wells Fargo Everyday CheckingДокумент4 страницыWells Fargo Everyday Checkingpeter.pucciОценок пока нет

- Tax Invoice: 36AADCM3491M1Z2 30AAACC6253G1Z6Документ1 страницаTax Invoice: 36AADCM3491M1Z2 30AAACC6253G1Z6VIDHI JAINENDRASINH RANAОценок пока нет

- IndusInd Bank Legend Credit Card - Dec 2017Документ15 страницIndusInd Bank Legend Credit Card - Dec 2017rithbaan basuОценок пока нет

- Korea tax rates and calculations for individuals and companiesДокумент4 страницыKorea tax rates and calculations for individuals and companiesQuynh NguyenОценок пока нет

- Confirmation For Booking ID # 849524949Документ1 страницаConfirmation For Booking ID # 849524949Saibal SenОценок пока нет

- The Inherent Powers of Government and TaxationДокумент5 страницThe Inherent Powers of Government and TaxationElaiza LozanoОценок пока нет

- Emergent Payments India Private Limited Tax InvoiceДокумент1 страницаEmergent Payments India Private Limited Tax InvoiceSuganthan SundharamОценок пока нет

- Assesment Procedure: By: Smriti KhannaДокумент25 страницAssesment Procedure: By: Smriti KhannaSmriti KhannaОценок пока нет

- Calculate Completing A 1040Документ2 страницыCalculate Completing A 1040api-4921774500% (1)

- GSTR-1 07AUYPS5769G2ZJ March 2018-19Документ41 страницаGSTR-1 07AUYPS5769G2ZJ March 2018-19Sachin SharmaОценок пока нет

- Collector v. UstДокумент2 страницыCollector v. UstEynab PerezОценок пока нет

- CPA Review Problems on Operating Segment and Interim ReportingДокумент3 страницыCPA Review Problems on Operating Segment and Interim ReportingLui100% (2)

- Financial Words You Should Know: Over 1,000 Essential Investment, Accounting, Real Estate, and Tax WordsОт EverandFinancial Words You Should Know: Over 1,000 Essential Investment, Accounting, Real Estate, and Tax WordsРейтинг: 4 из 5 звезд4/5 (11)

- Government’s Achilles Heel or How to Win Any Court Case (we the people & common sense). Constitutional LegalitiesОт EverandGovernment’s Achilles Heel or How to Win Any Court Case (we the people & common sense). Constitutional LegalitiesРейтинг: 4.5 из 5 звезд4.5/5 (5)

- Math for Grownups: Re-Learn the Arithmetic you Forgot from School so you can calculate how much that raise will really amount to, Figure out if that new fridge will actually fit, help a third grader with his fraction homework, and convert calories into cardio timeОт EverandMath for Grownups: Re-Learn the Arithmetic you Forgot from School so you can calculate how much that raise will really amount to, Figure out if that new fridge will actually fit, help a third grader with his fraction homework, and convert calories into cardio timeРейтинг: 1 из 5 звезд1/5 (1)

- Living Trusts for Everyone: Why a Will Is Not the Way to Avoid Probate, Protect Heirs, and Settle Estates (Second Edition)От EverandLiving Trusts for Everyone: Why a Will Is Not the Way to Avoid Probate, Protect Heirs, and Settle Estates (Second Edition)Рейтинг: 5 из 5 звезд5/5 (3)

- Taxpayer's Comprehensive Guide to Llcs and S Corps: 2016 EditionОт EverandTaxpayer's Comprehensive Guide to Llcs and S Corps: 2016 EditionРейтинг: 5 из 5 звезд5/5 (1)

- What Everyone Needs to Know about Tax: An Introduction to the UK Tax SystemОт EverandWhat Everyone Needs to Know about Tax: An Introduction to the UK Tax SystemОценок пока нет

- What Your CPA Isn't Telling You: Life-Changing Tax StrategiesОт EverandWhat Your CPA Isn't Telling You: Life-Changing Tax StrategiesРейтинг: 4 из 5 звезд4/5 (9)