Академический Документы

Профессиональный Документы

Культура Документы

Compilation of Responses To Questions Raised During The Wto Committee On Agriculture Meeting On 21 March 2014

Загружено:

bi2458Оригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Compilation of Responses To Questions Raised During The Wto Committee On Agriculture Meeting On 21 March 2014

Загружено:

bi2458Авторское право:

Доступные форматы

G/AG/W/126

16 May 2014

(14-3007) Page: 1/49

Committee on Agriculture

RESPONSES TO POINTS RAISED BY MEMBERS UNDER THE REVIEW PROCESS

COMPILATION OF RESPONSES TO QUESTIONS RAISED DURING THE COMMITTEE

ON AGRICULTURE MEETING ON 21 MARCH 2014

1

The present document compiles responses received in writing by the Secretariat to the questions

raised in document G/AG/W/119 as well as follow-up comments made during the Review Process.

Outstanding responses will be circulated in addenda to this document as soon as they are provided

by Members. A comprehensive version of the present compilation will be issued thereafter.

_______________

1

This document has been prepared under the Secretariat's own responsibility and is without prejudice

to the positions of Members or to their rights or obligations under the WTO.

G/AG/W/126

- 2 -

TABLE OF CONTENTS

1 MATTERS RELEVANT TO THE IMPLEMENTATION OF COMMITMENTS: ARTICLE

18.6 ................................................................................................................................. 4

1.1 Article 18.4 of the Agreement on Agriculture ................................................................. 4

1.1.1 Statement by Canada (AG-IMS ID 73069) .................................................................. 4

1.2 Brazil's domestic support programmes .......................................................................... 5

1.2.1 Question by United States of America (AG-IMS ID 73026) ............................................ 5

1.3 Canada's proposed changes to tariff schedule ................................................................ 6

1.3.1 Question by United States of America (AG-IMS ID 73027) ............................................ 6

1.4 Canada's dairy policies ............................................................................................... 8

1.4.1 Question by New Zealand (AG-IMS ID 73001) ............................................................. 8

1.4.2 Question by United States of America (AG-IMS ID 73034) ............................................ 8

1.5 China's Cotton Domestic Support ................................................................................. 9

1.5.1 Question by United States of America (AG-IMS ID 73035) ............................................ 9

1.6 Costa Rica's compliance with AMS commitments ........................................................... 10

1.6.1 Question by Canada (AG-IMS ID 73002) ................................................................... 10

1.6.2 Question by United States of America (AG-IMS ID 73037) ........................................... 11

1.7 Ecuador's domestic purchase requirements .................................................................. 12

1.7.1 Question by United States of America (AG-IMS ID 73038) ........................................... 12

1.8 India's market support price for rice ............................................................................ 12

1.8.1 Question by Pakistan (AG-IMS ID 73053) .................................................................. 12

1.9 India's national food security bill ................................................................................. 13

1.9.1 Question by United States of America (AG-IMS ID 73066) ........................................... 13

1.10 India's sugar export subsidies ................................................................................... 14

1.10.1 Question by Australia and Colombia (AG-IMS ID 73036 and AG-IMS ID 73067) ............. 14

1.10.2 Question by Brazil (AG-IMS ID 73068) .................................................................... 16

1.10.3 Question by European Union (AG-IMS ID 73055) ...................................................... 16

1.11 India's wheat stocks and exports .............................................................................. 17

1.11.1 Question by Canada (AG-IMS ID 73003).................................................................. 17

1.11.2 Question by United States of America (AG-IMS ID 73039) .......................................... 17

1.12 Saint Lucia's domestic purchase requirements for poultry and pork ................................ 18

1.12.1 Question by United States of America (AG-IMS ID 73040) .......................................... 18

1.13 Thailand's paddy pledging scheme ............................................................................. 19

1.13.1 Question by Canada (AG-IMS ID 73004).................................................................. 19

1.13.2 Question by United States of America (AG-IMS ID 73041) .......................................... 19

1.14 Turkey's domestic support and export subsidies .......................................................... 21

1.14.1 Question by European Union (AG-IMS ID 73056) ...................................................... 21

1.15 Turkey's destination of wheat flour sale ...................................................................... 21

1.15.1 Question by United States of America (AG-IMS ID 73042) .......................................... 21

1.16 U.S. Farm Bill ......................................................................................................... 22

G/AG/W/126

- 3 -

1.16.1 Question by Indonesia (AG-IMS ID 73043) .............................................................. 22

2 POINTS RAISED IN CONNECTION WITH INDIVIDUAL NOTIFICATIONS .................... 26

2.1 ADMINISTRATION OF TARIFF AND OTHER QUOTA COMMITMENTS (TABLE MA:1) ............... 26

2.1.1 Russian Federation (G/AG/N/RUS/2) ......................................................................... 26

2.2 IMPORTS UNDER TARIFF AND OTHER QUOTA COMMITMENTS (TABLE MA:2) ..................... 27

2.2.1 Ecuador (G/AG/N/ECU/38) ...................................................................................... 27

2.2.2 Norway (G/AG/N/NOR/74) ...................................................................................... 27

2.2.3 Tunisia (G/AG/N/TUN/44) ....................................................................................... 28

2.3 DOMESTIC SUPPORT COMMITMENTS (TABLE DS:1) ....................................................... 28

2.3.1 Botswana (G/AG/N/BWA/19) ................................................................................... 28

2.3.2 Brazil (G/AG/N/BRA/32) ......................................................................................... 28

2.3.3 European Union (G/AG/N/EU/10/REV.1, G/AG/N/EU/17) ............................................. 32

2.3.4 Guatemala (G/AG/N/GTM/45) .................................................................................. 36

2.3.5 India (G/AG/N/IND/7) ............................................................................................ 37

2.3.6 Indonesia (G/AG/N/IDN/30, G/AG/N/IDN/34) ............................................................ 38

2.3.7 Jordan (G/AG/N/JOR/16) ........................................................................................ 39

2.3.8 Norway (G/AG/N/NOR/73) ...................................................................................... 40

2.3.9 Ukraine (G/AG/N/UKR/18) ...................................................................................... 40

2.3.10 United States of America (G/AG/N/USA/80/REV.1, G/AG/N/USA/89/REV.1,

G/AG/N/USA/93) ............................................................................................................. 42

2.4 EXPORT SUBSIDY COMMITMENTS (TABLES ES:1, ES:2 AND ES:3) .................................. 44

2.4.1 Brazil (G/AG/N/BRA/33) ......................................................................................... 44

2.4.2 European Union (G/AG/N/EU/18) ............................................................................. 44

ANNEX 1 ........................................................................................................................ 46

ANNEX 2 ........................................................................................................................ 47

ANNEX 3 ........................................................................................................................ 48

G/AG/W/126

- 4 -

1 MATTERS RELEVANT TO THE IMPLEMENTATION OF COMMITMENTS: ARTICLE 18.6

1.1 Article 18.4 of the Agreement on Agriculture

1.1.1 Statement by Canada (AG-IMS ID 73069)

The paper G/AG/W/122, which presents best practices in notification relating to Article 18.4, is

intended as a practical contribution to help strengthen the review process by promoting greater

transparency in notifications and more effective and consistent questions and answers from

Members.

Canada's interest in Article 18.4 stems from an observation that Members' notification practices

and the resulting questions and answers relating to this issue have been rather inconsistent. At

times, this has resulted in less transparency in the review process. A history of notifications and

related questions and answers pertaining to Article 18.4 can be found in RD/AG/18/Add.1/Rev.1.

Since last June, Canada has organized four plurilateral meetings on this issue. Members have also

discussed the issue during three informal meetings of the Committee on Agriculture.

Each time Canada invited all interested Members to contact Canada and share their views. This

resulted in several bilateral exchanges and in an expansion of participation in the plurilateral

meetings. Canada is very pleased with the level of engagement from Members.

In particular, Canada would like to thank the co-sponsors, as well as all Members who participated

very constructively in consultations on this issue.

Before summarizing some key points, it should be underlined at the outset that the paper is

without prejudice to Members' rights and obligations under Article 18.4 and the review process

more broadly, including notification obligations. This is not a legal exercise. This point is made very

explicitly in paragraph 1.2 of the paper.

Paragraphs 2.1 and 2.2 of the paper attempt to spell out very clearly what Article 18.4 says and

does not say.

Article 18.4 does not create a right for Members to violate domestic support commitments, to

modify such commitments or to unilaterally adjust notifications to account for the influence of

excessive rates inflation.

Rather, Article 18.4 creates space in the Committee to discuss the effects of excessive inflation on

the ability of any Member to abide by its commitments and creates an obligation for Members to

give "due consideration" to these effects in the review process.

However, the article is entirely silent on the procedural aspects of how this process should work.

This lack of specific guidance reinforces the value of improving Members' notifications through the

identification of best practices.

Regarding best practices, the co-sponsors offer the following suggestions to Members seeking

consideration as provided for in Article 18.4, which are reflected in paragraph 3.2 and 3.3 of the

paper:

submit a domestic support notification with data that has not been adjusted for inflation;

and,

submit supporting documentation, which can include domestic support data that has been

adjusted for inflation, as well as other information pertaining to the nature and magnitude of

inflation and demonstrating its impacts on the ability of the Member in question to abide by

its domestic support commitments.

Canada would encourage Members to keep these points in mind, and hope that the communication

can serve as a useful reference document for the future work of the Committee.

Follow-up: Several Members including Chile, Costa Rica, the European Union, New Zealand,

Paraguay and Uruguay welcomed the paper noting that it had been useful in enhancing

transparency in the Committee's work. Some Members such as Argentina, China, the European

Union, Pakistan, Norway, and the United States of America stressed that Members should not see

this exercise as an incentive to avoid fulfilling current obligations and implementing agriculture

reforms. Argentina, Colombia, the European Union, Pakistan, and the Republic of Korea supported

G/AG/W/126

- 5 -

Canada's view that Article 18.4 did not provide for Members to unilaterally adjust domestic support

notifications. Argentina and the United States of America underlined "excessive rates of inflation"

as the precondition for Members seeking recourse to Article 18.4. Considering Article 18.4 did not

specifically define the word "excessive", the United States of America suggested Members to agree

on some criteria. New Zealand, Norway, and the United States of America pointed out that the

Committee could only consider the effects of excessive inflation on a Member's ability to abide by

its AMS commitment if sufficient information was provided in its domestic support notification.

Indonesia, supported by India, stated that inflation is unavoidable especially in developing

countries where according to data from the World Bank or IMF the rates of inflation are higher

than in developed ones. In Indonesia's view, excessive rate of inflation had undermined the

implementation of government policies including those addressing food security issues. Like some

previous speakers, Indonesia recognized that Members had yet reached consensus on issues such

as the meaning of "excessive rate of inflation" and "due consideration" and how "due

consideration" should be reflected in Members' notifications to help Members comply with AMS

commitments. In its view, that Article 18.4 did not provide for Members to self-adjust the

notification, as stated by some Members, was only one interpretation of the Article, and there

might be other interpretations on which further discussions were needed. As a developing Member

who faced negative impact of inflation when complying with AMS commitment, Indonesia was

committed to find permanent solutions for those issues. Indonesia further drew Members'

attention to the non-paper proposed by G-33 on 3 October 2013 in this regard and suggested

discussions be taken place in the special session of the Committee on Agriculture. Norway

reminded Members not to read more into the paper as it was merely a reference document for the

Committee's future work. The paper did not contain guidelines for future work and Norway

believed that discussions should continue in this respect. The Republic of Korea proposed a more

comprehensive and fundamental approach for discussions. It highlighted the twelve notifications

that were previously submitted that applied Article 18.4 and suggested the Committee to base its

discussions on those notifications. Like Indonesia, India made reference to the G-33 proposal and

stated that this exercise should by no means prejudge the final decision on this issue. China

echoed India's statement and suggested the Committee not to adopt any formal decision on this

matter. In its view, the issue of excessive rate of inflation was related to the permanent solution in

implementing the ministerial decision on food security.

1.2 Brazil's domestic support programmes

1.2.1 Question by United States of America (AG-IMS ID 73026)

The United States of America appreciates Brazil's response to the question on Prmio

para Escoamento do Produto (PEP) and Prmio de Equalizao pago ao Produtor

(PEPRO) from the January 2014 Committee on Agriculture meeting, including data on

PEPRO (AG-IMS ID 72051).

a. The United States of America has repeatedly requested information on the

quantities of product shipped to specific destinations, including both domestic

and export destinations. The United States of America is disappointed that

Brazil has not been able to compile this data to date. When specifically might

the United States of America expect to receive this data?

b. The United States of America notes that much of the PEPRO data only notes

where product may not be shipped. The United States of America requests the

PEPRO data on a similar basis as the requested PEP data given the similarity of

the two programmes. In particular, please provide data on the quantities of

product shipped to specific destinations, including domestic and export

destinations. The United States of America notes Brazil's response to the

question on PEP from the September 2013 Committee on Agriculture

meeting (AG-IMS ID 71028). In that response, Brazil noted that the PEP

programme has been suspended and is under reassessment by the government.

c. What was the basis for the reassessment?

d. Has the government completed its reassessment? If so, what did it conclude?

G/AG/W/126

- 6 -

e. Given the similarity between PEP and PEPRO, was PEPRO also reassessed? If

so, what was concluded? If not, why was this programme not reassessed?

Answer by Brazil

a. Brazil cannot estimate when the requested data will be available.

b. At this moment, the requested information is unavailable.

c. The programme was reassessed to address concerns regarding its control mechanism, in

order to prevent irregularities.

d. The reassessment is still in progress, and the programme remains suspended.

e. No, because under the PEPRO the subsidy is paid directly to the producers (requiring a

simpler control mechanism), and not indirectly to processors/traders as is the case

under the PEP.

Follow-up: The United States of America expressed disappointment with Brazil's continued failure

to provide the requested data. As PEP was suspended, PEPRO remained of interest to the United

States of America. The United States of America was also interested in the trade trends of some

agriculture products such as feed grains. The European Union flagged interest and supported the

question.

1.3 Canada's proposed changes to tariff schedule

1.3.1 Question by United States of America (AG-IMS ID 73027)

The United States of America appreciates Canada's response to question

AG-IMS ID 72049 regarding an amendment to Canada's Customs Tariff Schedule

affecting pizza food preparation products. Recognizing that Canada did not have enough

time to prepare a complete response to U.S. questions, the United States of America

repeats the following questions from January:

a. Please provide information on historical imports of the product(s) affected by

Supplementary Note 2 to Chapter 16 (referenced in AG-IMS 72049), and what

the impact of the Parliamentary motion has been on imports of these products.

b. By using an effective date that is retroactive, the measure appears to have

already impacted trade negatively without any stakeholders' input. What is the

purpose, if any, for using a retroactive date? What is the intended effect of

retroactive implementation?

c. Is Canada currently enforcing Supplementary Note 2 to Chapter 16? If yes,

please describe how it is being enforced, i.e., how is Canada verifying the

separate classification of the components of a food preparation in instances

where the components are comingled or mixed together? If it is not yet

enforcing the measure, please describe whether and how it intends to enforce

Supplementary Note 2.

d. In 2013, the Canada Border Services Agency revoked Tariff Classification

Advance Ruling No. 218973 (an advanced ruling on a certain pizza topping

product) citing Supplementary Note 2 to Chapter 16. The United States of

America understands that Supplementary Note 2 was not effective at the time

of the revocation of Advance Ruling No. 218973. Please explain the legal basis

and provide a list of all relevant measures regarding the revocation of this

advance ruling. Please also explain the legal basis for revoking the advance

ruling prior to the effective date of the Supplementary Note.

e. Are importers now subject to increased tariffs as a result of Supplementary

Note 2 to Chapter 16? Has any importer appealed or sought further review

G/AG/W/126

- 7 -

within Canada of the classification determination that resulted in the higher

tariffs? Please provide details on the application of the higher tariff rate on

affected products, including the products covered and volume of trade

concerned.

f. Are there any further proposals to amend Canada's tariff schedule in a similar

manner in the area of food preparations or other goods? If the answer is yes,

please identify and describe in detail those proposals. Are there any proposals

to amend the supplementary notes of any other chapter of Canada's tariff

schedule to target cheese and/or dairy products in a similar fashion? If the

answer is yes, please identify and describe in detail those proposals.

g. U.S. traders have raised concerns with the timing of the application of the

measure. Would Canada consider revoking or delaying application of

Supplementary Note 2?

Additionally, the United States of America requests a response to the following

questions.

h. The House of Commons Budget 2014 dated 11 February 2014 confirms the

Canadian Government's intention to proceed with the Ways and Means motion

to amend Canada's Customs Tariff Schedule to add a supplementary note to

Chapter 16. What are the specific legislative steps required to give the motion

measure legal effect and when does Canada anticipate initiating those steps?

i. Canada Border Services Agency issued Customs Notice 13-021 as of

29 November 2013, stating "the Canada Border Services Agency (CBSA) wishes

to advise of an amendment to the Departmental Consolidation of the Customs

Tariff effective November 29, 2013". The Notice contains the same language as

the Ways and Means motion to add the supplementary note. The Notice further

directs traders to "an amended version of the Departmental Consolidation of

the Customs Tariff, reflecting this change" on the CBSA Web site. What legal

effect does CBSA Customs Notice 13-021 have? What legal effect does the

amended Customs Tariff schedule of Canada have?

Answer by Canada

It is impossible to single out specific products in Canada's trade statistics for any given tariff

item and, in any case, it is too early to determine how the measure in question will impact

trade in affected products. Changes to trade patterns in the future could be influenced by

various factors. As such, it is impossible to assess the impact of the measure. This measure

was not implemented on a retroactive basis.

The measure was introduced through the tabling of a Notice of Ways and Means Motion on

22 November 2013 with an effective date of 29 November 2013. The tabling of a Notice of

Ways and Means Motion is a standard parliamentary procedure to give effect to domestic

taxation changes prior to such time that formal legislation can be brought forward.

Parliamentary convention dictates that taxation proposals are effective as soon as the

government tables a Notice of a Ways and Means Motion, even though the government's

taxation plans have not yet been officially adopted by way of legislation. In this regard, it is

the long-standing practice of Canadian governments to put tax measures into effect as soon

as the Notice of the Ways and Means Motions on which they are based are tabled in the

House of Commons, with the result that taxes are collected as of the date of this notice (or

an alternate date specified therein). In this particular case, there was a limited gap between

the tabling of the Notice of Ways and Means and its effective date, in order to discourage

further circumvention of the law (whereby certain goods were packaged in a specific,

deliberate manner solely to circumvent Canada's tariff structure), but also to ensure that

goods in transit were not impacted.

The government's 2014 federal budget, tabled in the House of Commons on

11 February 2014, reiterated the government's intention to modify the Customs Tariff

G/AG/W/126

- 8 -

through the addition of a new Supplementary Note to Chapter 16, to formally codify the

Notice of Ways and Means Motion tabled on 22 November 2013. Generally, legislative

amendments are made through legislation, which must be adopted by Parliament. The

legislation is introduced and then debated by both the House of Commons and the Senate.

Once the legislation has been passed by both chambers, it is presented for Royal Assent,

after which it becomes law. The specific legislative vehicle for implementing this amendment

has yet to be confirmed. Canada can provide more details as they become available.

Supplementary Note 2 to Chapter 16 of Canada's Customs Tariff clarifies that the individual

components of certain food preparations that include cheese are to be classified separately,

regardless of their packaging, in order to ensure consistent application of the law.

Specifically, this clarification addresses a gap whereby certain imported goods were

packaged in a specific, deliberate manner solely to circumvent Canada's tariff structure

(e.g. significant imports of a "pizza toppings" product containing 79% shredded mozzarella

cheese and 21% sliced pepperoni, packaged together in a single plastic bag and separated

by a sheet of wax paper to qualify as a "food preparation" in Chapter 16). All rates of duty in

Canada's Customs Tariff remain unchanged. No other such proposals are being considered

at this time.

Follow-up: Supported by New Zealand, the United States of America questioned Canadas

statement that the measure was not implemented on a retroactive basis. The United States was

concerned that stakeholders input was not taken into account. The United States of America

disagreed with Canada's assertion that some packaging practices circumvented Canada's the tariff

structure and considered these practices reflected the incentives created by Canada's TRQs. New

Zealand flagged the concern that the move to amend Canada's customs tariff schedule to add a

supplementary note affecting certain commercial "food preparations" would impose a new

prohibitively high tariff on what was previously zero duty rate.

1.4 Canada's dairy policies

1.4.1 Question by New Zealand (AG-IMS ID 73001)

In February, the Canadian Dairy Commission released programme guidelines for the

Planned Export Program for Cheese (PEPC). The purpose of the programme is described

as a mechanism to "encourage and support Canadian cheese manufacturers and

exporters in developing long term export markets for Canadian cheese". Given that

Canada uses nearly its entire export subsidy revenue outlays for "incorporated

products" and "other milk products" each year, could Canada please indicate whether

this will have an effect on other existing export programmes that use special milk

Class 5(d) permits?

Answer by Canada

The use of export subsidies for dairy products in terms of budgetary outlays and quantity is

consistent with Canada's WTO rights and obligations. In 2010-2011, Canada used 100% of

its annual outlay commitment levels for skim milk powder, other milk products and

incorporated products, while it was not fully utilized for cheese and butter. Canada remains

committed to its WTO rights and obligations and as such will operate the Planned Export

Program for cheese in a way to ensure these commitments are met.

1.4.2 Question by United States of America (AG-IMS ID 73034)

The United States of America is concerned at the proliferation of Canada's special milk

pricing classes, which now include 39 different classes. Domestic food and industry

processors appear to receive a special milk class permit to purchase dairy inputs at a

subsidized price, predicated on a declaration that a competitive like-product has been

imported into Canada. These special milk prices range from whey used in animal feed to

cheese used in the manufacturing of further processed products, such as frozen pizzas.

These products are produced using the heavily discounted dairy inputs and are then sold

in domestic and foreign markets. The United States of America has noticed increasing

discrepancies between the export numbers published by the Canadian Dairy Commission

and the export numbers supplied by Statistics Canada in Canada's export subsidy

G/AG/W/126

- 9 -

notifications to the WTO Committee on Agriculture, in particular with regard to exports

of cheese. Please explain these discrepancies and how the dairy export subsidies in

Canada's notifications are calculated.

Answer by Canada

The use of export subsidies for dairy products in terms of budgetary outlays and quantity is

consistent with Canada's WTO rights and obligations. In 2010-2011, Canada used 100% of

its annual outlay commitment levels for skim milk powder, other milk products and

incorporated products, while it was not fully utilized for cheese and butter. Discrepancies

between Canada's export subsidy notifications and trade statistics can be explained by the

use of different data sources. Volumes of subsidized exports are reported by the Canadian

Dairy Commission, whereas total exports are reported by Statistics Canada. Statistics

Canada may revise its data up to four years after they were initially reported. Canada's total

exports also include exports of dairy products made from milk and/or other dairy ingredients

imported under re-export programmes, such as the Import for Re-Export Program (IREP),

and other exports that do not benefit from export subsidies.

Follow-up: New Zealand welcomed the assurance that Canada would continue to remain within its

export subsidy commitments, particularly since the new planned export programme for cheese

appeared to apply to products for which Canada used nearly its entire export subsidy revenue

outlays. New Zealand therefore continued to take an interest in this programme and whether it

would have an effect on other existing export programmes that used special milk class 5(d)

permits. New Zealand was also interested in the increasing discrepancies between the export

numbers of the Canadian Dairy Commission and the export numbers supplied by Statistics Canada

in the export notifications, which was noted by the United States of America in its question. The

United States of America flagged interest. The European Union continued to be concerned in the

operation of Canadian milk classes in general.

1.5 China's Cotton Domestic Support

1.5.1 Question by United States of America (AG-IMS ID 73035)

Is China in a position to respond to the questions asked by the United States of America

in AG-IMS ID 72052 regarding China's cotton support programme?

a. China noted in its last response that it would be notifying domestic support

shortly. Please provide an update on the intended timeframe for China to notify

domestic support notifications for recent years, in particular for years when

cotton price support was applied.

b. Please provide the Committee with specific information from its official

website(s) on various subsidy measures associated with price support,

including the legal mechanisms by which they are implemented, as well as

updated data on the accumulation, maintenance, and distribution of cotton

stocks since the program's inception?

c. The United States of America requests that China provide the Committee with a

brief summary of China's analysis on the economic impact and effects of

China's management of its sizable domestic cotton stocks on the world cotton

market, taking into account the large role China plays in both global supply and

demand of cotton.

Answer by China

a. Chinese government is preparing the notification for the years of 2009 and 2010. China

is finalizing the notification by asking various agencies to review and confirm the numbers.

Due to the huge amount of data and the involvement of over 10 departments and agencies,

China needs some time to guarantee the accuracy of the notification. When the notification

is ready, China will send it to the Committee without further delay.

G/AG/W/126

- 10 -

b. All information regarding cotton reserve can be found on the website of National

Development and Reform Commission. The legal documents for the mechanism are Notice

No.5 issued in 2011, No. 3 in 2012 and No. 20 in 2013. In 2011, the purchase price of

cotton reserve was 19,800 RMB per tonne. In 2012 and 2013, due to the increase of market

price, the purchase price increased to 20,400 RMB. The purchase, maintenance and

distribution of the reserve are carried out by China National Cotton Reserves Corporation.

The company buys and sells cotton through open trade in the national cotton exchange.

Profits or losses are possible depending on the fluctuating market prices.

c. China's cotton reserve has limited impacts on the world cotton market. The government

manages the reserve to safeguard farmers' interests. China purchases a certain amount of

cotton and sells some old reserve every year. The purchase begins after the harvest. The

government avoids bulk purchase within a short period of time, in order to prevent

interrupting the market by avoiding supply shortage. Neither does the government dump

large quantities of reserves on the market which would lead to price decreases.

Since China initiated the cotton reserve mechanism, China's cotton imports have been

steadily increasing while at the same time China has almost no exports. In 2011, China's

cotton import was 3.4 million tonnes, which increased to 5.1 million in 2012. In 2013, China

imported 4.1 million tonnes of cotton. The import price stayed around US$2 to US$3 per kilo

for all those years. China's trade is not interrupted by the reserve mechanism and China

does not export cotton to distort international supply.

From a world outlook, China also does not see any major impacts caused by China's cotton

reserve. According to the cotton report issued by USTR in March 2014, the world cotton

production remains at around 26 million tonnes while the world consumption maintains at

around 23 million tonnes in the recent years. Chinese national consumption stayed at

around 8 million tonnes. The world price slowly increased without much fluctuation. China is

not convinced that China's reserve polices have major and direct economic impacts on the

world cotton production, consumption, or prices and therefore does not consider that these

is an impact on the world market.

Annex 1 contains a monthly chart of average cotton prices in two years.

Follow-up: The European Union looked forward to receiving Chinas upcoming notification.

1.6 Costa Rica's compliance with AMS commitments

1.6.1 Question by Canada (AG-IMS ID 73002)

At the last meeting of the Committee on Agriculture, Costa Rica indicated that the date

of the elimination of the price support mechanism for rice is postponed to 1 March 2015,

as the rice sector needs more time to finalize its definition of the alternative mechanism

that is to replace the current price support mechanism. Canada takes this opportunity to

again thank Costa Rica for its commitment to transparency and willingness to engage

openly with Members.

a. Could Costa Rica provide an update on the progress made so far in developing

and defining an alternative mechanism that would bring Costa Rica in

compliance with its domestic support commitments?

b. Could Costa Rica inform this Committee of the options currently under

consideration?

Answer by Costa Rica

Costa Rica will be able to provide details regarding the alternative mechanism once it has

been defined. Costa Rica will notify the Committee in due course, as it has always done in

the WTO.

G/AG/W/126

- 11 -

1.6.2 Question by United States of America (AG-IMS ID 73037)

The United States of America thanks Costa Rica for regularly updating this Committee on

its rice policies over the past several years during which time Costa Rica has notified an

Aggregate Measurement of Support (AMS) in excess of its bound commitments. The

United States of America appreciates the transparency provided in Costa Rica's

notification G/AG/GEN/116, but is disappointed to learn that the elimination of Costa

Rica's price support mechanism for rice has been postponed until 1 March 2015. It is the

U.S. understanding that Costa Rica's Law 8285, which established the National Rice

Corporation (CONARROZ), allows the Minister of Agriculture and Livestock (MAG) and

the Minister of Economy, Industry and Commerce (MEIC) representation on

CONARROZ's General Assembly and Board of Directors. The United States of America

also notes the leading role the General Assembly and Board of Directors takes in

CONARROZ's policy creation, approval, and implementation. Article 7 of Law 8285 and

its Regulations states that CONARROZ "shall suggest the price of rough rice and its

byproducts to the MEIC with the financial value the agro-industrialist must pay to

producers, as well as the prices consumers must pay for milled rice". The United States

of America also understands from Article 20, paragraph o that a responsibility of the

Board of Directors is to "approve, the recommendation for chaff and milled price prices

through technical studies, which shall be notified to the MEIC".

a. Please describe in more detail the role of the CONARROZ's General Assembly

and Board of Directors in price determination.

b. Will these policies continue after the adoption of Executive Decree

No. 38093-MEIC in March 1, 2015? With respect to the alternative mechanism

that the United States of America understands is to be introduced, the United

States of America repeats two questions asked in September 2013

(AG-IMS ID 71030) and in January 2014 (AG-IMS ID 72050):

i. Will producers be able to sell outside of the new system?

ii. What is Costa Rica's timeline for publishing these new policies and for

notifying them to the WTO?

Answer by Costa Rica

The role played by the Governing Board of the National Rice Growers Corporation

(CONARROZ) in setting the price of rice is limited to making a non-binding recommendation

to the Ministry of the Economy, Industry and Trade. The General Assembly of CONARROZ,

which brings together all producers and industrialists in the sector, does not take part as

such in the recommendation formulation process.

Pursuant to Law No. 7472 on the Promotion of Competition and Effective Consumer

Protection and its implementing regulations, the authority to set the price of rice lies solely

with the Executive, and specifically the Ministry of the Economy, Industry and Trade, which

is under no obligation to endorse the recommendation made by CONARROZ.

Executive Decree No. 38093-MEIC stipulates that the current rice pricing scheme will be

abolished as of 1 March 2015, which is the date set for completion of the definition of the

alternative mechanism. This will not involve any changes to the application of Laws

Nos. 8285 (creation of CONARROZ) and 7472 (Promotion of Competition and Effective

Consumer Protection).

i. and ii. See answer to AG-IMS ID 73002.

Follow-up: Canada, the United States of America and Uruguay thanked Costa Rica for the

transparency provided. The United States of America stressed the importance of this issue in which

a Member had been breaching its commitments over a number of years. Pakistan registered its

concern.

G/AG/W/126

- 12 -

1.7 Ecuador's domestic purchase requirements

1.7.1 Question by United States of America (AG-IMS ID 73038)

Industry reports that the government of Ecuador is requiring importers to source a

specified percentage of products domestically, based on agreements signed between

Ecuador's Ministry of Agriculture, Ministry of Industries, and importers.

a. Please explain the legal basis for these new domestic purchase requirements

and how they are consistent with Ecuador's WTO obligations.

b. Does Ecuador intend to submit notifications to the WTO related to market

arrangements for agricultural products that include procurement of a domestic

product as a requisite for importing?

Answer by Ecuador

As regards the first question of the United States of America, Ecuador does not request

importers specifically to source a percentage of products domestically. What Ecuador is

driving and promoting is a change to its production matrix based for the most part on the

development of human knowledge and talent.

There is no law, regulation or stipulation requiring importers or domestic traders to purchase

a percentage of products domestically. The signed agreements to which the United States of

America refers are technical cooperation agreements drawn up at the wish and request of

the import/production sectors themselves that have a vested interest in the national

production promotion policy and are seeking activities to improve the production chain.

In order to be implemented, these production promotion agreements, which are fully

consistent with the WTO provisions, require - given Ecuador's production structure - the

import of capital goods and inputs. The conditions of competition for imports are thus not in

any way affected.

Moreover, these agreements are open to any interested production sector, which means that

there is no discrimination regarding their approval, and they are not contingent upon

meeting performance or absorption of domestic production requirements.

Follow-up: Canada flagged its interest.

1.8 India's market support price for rice

1.8.1 Question by Pakistan (AG-IMS ID 73053)

Pakistan appreciates the response provided by India regarding exports of rice in the last

two years (AG-IMS ID 72059). It appears that Indian rice exports increased 41% from

year 2011-2012 to 2012-2013. The exports of non-Basmati increased by 67%.

Based on the information available on the website of Food Corporation of India (FCI)

regarding support price (US$338 per tonne, 1 US dollar equals to 47.91 Indian rupees

for 2011-2012 and US$344.3 per tonne, 1 US dollar equals 54.45 Indian rupees for

2012-2013) for paddy common rice, it appears that during the same period there was an

increase of 24% in the rice MPS (Market price support) on the basis of procured quantity

as eligible production. However there was an increase of 7.3% on the basis of total

production as eligible production. Since Grade A rice procurement quantity was not

available therefore MPS for paddy common rice is used for this calculation. Price of

Grade A rice is Rs 30 per quintal higher than common rice.

G/AG/W/126

- 13 -

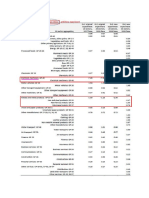

Table 1. RICE AMS (only market price support, other product specific rice AMS is not

included) (billion US$)

Commodity 2011-12 2012-13

Calculated on the basis of procured quantity as eligible production 2.64 3.28

Calculated on the basis of total production as eligible production 7.99 8.54

Source: Indian Economic Survey 2012-13, Directorate of Economics and Statistics, Department of Agriculture

and Cooperation, Ministry of Agriculture India. State Bank of India.

Answer by India

India appreciates Pakistan's keen interest and efforts to help India work out its market price

support for rice. Pakistan may like to compare the figures with India's notifications for the

relevant years, which are under preparation.

Follow-up: Noting that Indias last domestic support notification was submitted for 2003 and only

6 months of 2004, Pakistan requested India to provide a timeline as regards when India would

provide its next notification. India replied that they were working on the notification but there were

constraints in the work.

1.9 India's national food security bill

1.9.1 Question by United States of America (AG-IMS ID 73066)

According to India's Finance Minister, the estimate for India's food subsidy bill in

2014-2015 is Rs 115,000 crore (US$18.8 billion; note crore = 10 million) in the interim

budget. According to India's National Sample Survey Office the poverty gap per its latest

Consumption Expenditure Survey is Rs 55,744 crore (US$9.1 billion) in 2011-2012. In

other words, the cost of India's food subsidy bill is approximately twice the amount it

would cost to provide all below poverty households with enough cash to cross the

poverty line. The significant cost of the food subsidy bill compared to the poverty gap in

India highlights the large costs the government incurs in procuring, storing, and

distributing food grains that could otherwise be more effectively used to alleviate

poverty in India. The United States of America understands that the Finance Minister has

also capped the Food Corporation of India's reimbursements for costs incurred in

operating the food subsidy programme at the aforementioned Rs 115,000 crore

(US$18.8 billion).

a. Besides limiting expenditures, what steps is the government of India taking to

more efficiently implement its current policies? Further, does the

recently-passed National Food Security Act 2013 include any specific language

to address these concerns?

b. Given that the National Food Security Act 2013 directly impacts measures

reported under Annex 2 of the Agreement on Agriculture, when does India plan

to submit a DS:2 notification?

Answer by India

The inferences drawn by the United States of America in the chapeau of the question are

unwarranted.

The National Food Security Act, 2013 (NFSA) gives legal entitlement to distribution of

subsidized food grains under the Targeted Public Distribution System (TPDS). The TPDS is

already operational across all the states/union territories.

G/AG/W/126

- 14 -

The Act also provides for measures for reforms in TPDS. These include the following:

doorstep delivery of food grains to TPDS outlets;

application of information and communication technology tools including end-to-end

computerisation in order to ensure transparent recording of transactions at all levels,

and to prevent diversion;

leveraging ''aadhaar'' for unique identification, with biometric information of entitled

beneficiaries for proper targeting of benefits under this Act;

full transparency of records;

preference to public institutions or public bodies such as Panchayats, self-help groups,

co-operatives, in licensing of fair price shops and management of fair price shops by

women or their collectives;

diversification of commodities distributed under the Public Distribution System over a

period of time;

support to local public distribution models and grain banks;

introducing schemes, such as cash transfer and food coupons to the targeted

beneficiaries in order to ensure their food grain entitlements.

The amount mentioned in the Budget for 2014-15 are budget estimates and no cap as such

on food subsidy has been imposed.

Follow-up: Canada, the European Union and the United States of America requested India to

provide a Table DS:2 notification. India responded that the notification was still under preparation.

Pakistan was of the view that the bill provided a very big production incentive to farmers because

all procurements were achieved at administered prices that were set by the government. Pakistan

would like India to notify the programme properly according to Indias WTO commitments under

the Agreement on Agriculture. India considered Pakistans concern unwarranted at this stage as

the government had not published any information regarding how the public procurement would

be carried out.

1.10 India's sugar export subsidies

1.10.1 Question by Australia and Colombia (AG-IMS ID 73036 and AG-IMS ID 73067)

Australia understands that the Indian government decided to provide incentive

payments to Indian sugar exporters upon the export of sugar, as per The Gazette of

India, dated 28 February.

a. Can India explain the legal basis for this export subsidy, given that India has

no scheduled export subsidy commitments under the Agreement on

Agriculture?

b. With regard to the elements of this incentive payment, can India confirm that

the level of the payment is Indian Rupees 3300 per metric tonne of raw sugar?

c. When did the incentive payments referenced in the Gazette commence, and

when will they end?

d. What is the total value of all incentive payments made to date on the export of

sugar since 12 February 2014?

e. What is the total volume of raw sugar and refined sugar exports made since

12 February 2014 that have been subject to incentive payments?

G/AG/W/126

- 15 -

f. Can India provide the latest available average cost of production figures (on a

per metric tonne basis) for those Indian raw sugar producers that have

received incentive payments for the export of like product?

g. For the same like product, can India provide the average domestic price (on a

per metric tonne basis)?

h. Part (4) of paragraph 2 of the Sugar Development Fund (Amendment) Rules,

2014 states that the incentive payment will be recalculated every two months

after March 2014 taking into account the average exchange rate of the Indian

rupee vis--vis U.S. dollars. Under this bi-monthly review, is it possible for

India to terminate the incentive payment for reasons other than movement in

the average exchange rate?

i. Can India provide the anticipated total value of the incentive payments over

the expected duration of the scheme?

j. Under the scheme, is there a maximum cap applicable to the per metric tonne

incentive payment?

k. In accordance with the Bali 2013 Ministerial Declaration, can India explain

what, if any, steps it took to exercise utmost restraint with regard to its

decision to implement the incentive payments?

l. Can India indicate when an export subsidy notification covering this scheme

will be issued?

Answer by India

As one of the numerous steps contemplated/undertaken by the central government as well

as various state governments in the country to tackle arrears payments by sugar mills to

Indian sugarcane farmers, it was decided to promote product diversification in the Indian

sugar industry by incentivizing raw sugar production, since the industry traditionally

produces white sugar.

The model of the Indian sugar industry is quite different from the models in many other

countries. The sugar mills in the country neither own the sugarcane fields nor undertake

contractual cultivation. The raw material for the sugar industry, sugarcane, is cultivated by

estimated 5 million farmer families on individual land holdings which are extremely small

and scattered and in general range from 0.5 to 2 hectares.

The interventions by the government aim to infuse additional liquidity in the severely

stretched sector and are linked to cane payments to farmers by the sugar mills.

c. The intervention is effective from 28 February 2014. The current incentive levels are

expected to be reviewed before the commencement of 2014-15 sugar season or even

earlier.

d. No payment has been made under this scheme since 28 February 2014.

e. To date no payment has been made.

f. So far no incentive payments have been made for the exports of raw sugar.

g. No other domestic product is comparable with this new product, raw sugar.

h. Yes, the central government may amend or modify or discontinue the scheme at any

time as indicated in the notification.

i-k. The incentive budget will be reviewed from time to time.

G/AG/W/126

- 16 -

l. The scheme will be covered in the notification for the relevant year, which is under

preparation.

1.10.2 Question by Brazil (AG-IMS ID 73068)

Brazil is concerned with the impact in the world market and with the potential adverse

effects to the interests of other Members caused by subsidized sugar exports from India.

According to India's Official Gazette, dated 28th February 2014, raw sugar exporters

from India are entitled to export subsidies amounting to 3,300 Rupees per metric ton for

February and March, 2014. These subsidies will be subject to recalculation every two

months taking into account the average exchange rate of the Rupee vis--vis the

US Dollar.

In this regard, Brazil would like to raise the following questions:

a. Could India confirm whether these export subsidies for sugar have been

approved?

b. Could India indicate the amount of export subsidies it will grant in budgetary

outlays and subsidized quantities?

c. Given that there has been to date no legally-binding decision by the WTO to

extend the application of Article 9.4 of the Agreement of Agriculture, what

would be the legal basis for the provision of these export subsidies?

d. Could India confirm whether these subsidies are intended to reduce marketing

and/or transportation costs? If yes, how the actual costs incurred in the

marketing and/or transportation of exported sugar impact the provision of the

subsidy?

e. Could India explain:

i. the rationale for increasing so significantly the provision of export subsidies

for sugar; and

ii. the steps it took to ensure compliance with the Ministerial Declaration

adopted in MC-9 according to which Members shall exercise utmost restraint

with regard to any recourse to all forms of export subsidies?

Answer by India

See above.

1.10.3 Question by European Union (AG-IMS ID 73055)

According to media reports, Indian Cabinet of Ministers approved on 12 February 2014

an export subsidy of Rs 3,333 per tonne for export of four million tonnes of raw sugar.

Could India please confirm that such export subsidies have indeed been approved and if

so confirm the budget and the quantities concerned?

Answer by India

See above.

Follow-up: Converting the sugar export subsidy of Indian Rupees 3,300 per metric tonne into

US$0.054 per kilogramme or US$0.024 per pound based on the current exchange rate, Australia

pointed out that this export subsidy was significant, as it equated to roughly 16% to 14% of the

current world price based on the ICE NO.11 futures market for raw sugar which had been at

around US$0.16 - 0.17 per pound over the last month. Australia was concerned about the

possibility that domestic stocks of sugar in India were being exported into the world market with

export subsides. In Australias view, as India was the world 3

rd

largest exporter of sugar, this

G/AG/W/126

- 17 -

policy had the potential to seriously disrupt the world price for sugar, which had been already very

low. Australia was strongly concerned that such measure would not be consistent with the recent

Bali ministerial declaration to exercise the utmost restraint with regard to any forms of export

subsidies and all export measures with equivalent effect, and also constituted a breach of India's

WTO obligations. Australia was particularly interested in a response from India to one question

that had not been answered - the legal basis of this export subsidy. As producers and exporters of

sugar, Colombia, El Salvador and Paraguay shared Australias concern. Colombia stated that this

subsidy not only had given rise to concern to some of Colombias sugar producers but also could

have a negative impact on the world sugar market. Brazil noted that points c, d and e of their

questions to India remained unanswered. Canada, the European Union, New Zealand, Pakistan,

Thailand and the United States of America registered concern. Pakistan joined Australia and Brazil

in demanding India to respond to unanswered questions.

1.11 India's wheat stocks and exports

1.11.1 Question by Canada (AG-IMS ID 73003)

Canada thanks India for its responses and would like to follow-up on questions posed at

the January meeting of the Committee on Agriculture. India confirmed that 2 million

metric tonnes of wheat were indeed approved for exports in August 2013 at US$300 per

tonne and that, in keeping with market trends, the base price was lowered to US$260

per tonne. India also indicated that lowering the base price does not necessarily imply

that product will be sold at that price, and that so far, export prices were between

FOB US$279.52 and US$289.90 per tonne. Canada understands that the Food

Corporation of India, which according to India is holding stocks of 28 million metric

tonnes as of January 2014, purchases its wheat from producers at administered prices

through a minimum support price mechanism.

a. Could India elaborate on the specific elements considered under the ambit of

market trends when determining base price for wheat exports?

b. Could India elaborate on the process whereby its government determines what

volume of wheat stocks will be approved for export and what factors are

considered when determining timing of the export tenders?

c. Could India indicate what costs in addition to those related to market trends

are taken into consideration in determining an export price for wheat, for

example, transportation costs, storage costs?

d. Could India indicate if there is any intention to approve more exports of wheat

at the base price of US$260 per tonne once the 2 million metric tonnes have

been exported?

Answer by India

a and c. See answer to AG-IMS ID 73039.

b. During the current year a total quantity of 2 million tonnes has been approved for export

from the Central Pool stocks, to be completed by 30 June 2014 and accordingly

individual tenders are being floated.

d. Presently there is no new proposal for export of wheat on government account.

1.11.2 Question by United States of America (AG-IMS ID 73039)

Expanding the background on the question submitted during the January Committee on

Agriculture meeting, the United States of America notes that export tenders published

by the state Trading Corporation of India Limited (STC), Minerals and Metals Trading

Company (MMTC), and Project and Equipment Corporation of India (PEC) between

15 November 2013 and 23 January 2014, report the government of India tendered more

than 1 million tonnes of wheat at prices ranging from US$278.20 - 289.90 per tonne.

G/AG/W/126

- 18 -

Further, the Food Corporation of India has published that the total economic cost of the

acquisition and distribution of wheat in 2013/2014 was US$316.79 per tonne, well

above the noted tender prices.

The United States of America resubmits its January 2014 Committee on Agriculture

question to India:

The United States of America is concerned that India is exporting wheat at prices well

below acquisition costs. For example, India's Commission on Agricultural Costs and

Prices in its discussion paper no 2 estimated that the cost of storing, handling, and

distributing wheat purchased by the government's Food Corporation of India equals

40% of the acquisition cost. For example, if India procured wheat in 2013/2014 at

13,500 rupees per tonne or US$221 per tonne (US$1 = 61 rupees), the United States of

America calculates a cost to port of US$310 per tonne. An export price of US$260 per

tonne is well below this cost to the India government.

a. Please provide figures on the cost to the Indian government of wheat at export

ports named in export tender documents published by the State Trading

Corporation of India Limited (STC), Minerals and Metals Trading Company

(MMTC), Project and Equipment Corporation of India (PEC), and any other such

entity; broken down by acquisition cost, storage cost, transport cost, other

cost.

b. Please also provide the winning bids on wheat export tenders for MMTC, STC

and PEC via this port.

Answer by India

The inferences drawn by the United States of America in the chapeau to the resubmitted

question are unwarranted.

a. The acquisition cost and incidental charges for 2 million tonnes of wheat exports from

the Central Pool stocks of FCI during 2013-2014 (December 2013 February 2014

period) include pooled cost of grains to FCI, handling charges, gunny cost,

administrative charges, statutory taxes and storage charges for a period of six months.

b. Details of the bids cannot be provided because of commercial considerations.

Follow-up: Australia, Pakistan and Ukraine shared Canada's and U.S. interest in India's export

policies on wheat. In view of the large number of questions raised to India, the United States of

America considered a plurilateral meeting as suggested by India useful to address some of the

issues. With respect to India's notifications, the United States of America sought clarification

regarding the timeline for submission. Pakistan and Ukraine supported the U.S. request. India

clarified that it had not proposed a plurilateral meeting but would consider it based on Members'

suggestions. India reiterated the challenges involved in the process of preparing notifications for

developing countries.

1.12 Saint Lucia's domestic purchase requirements for poultry and pork

1.12.1 Question by United States of America (AG-IMS ID 73040)

The United States of America welcomes Saint Lucia's notification of its import licensing

procedures and the copies of the law and order that implement such requirements to the

WTO Import Licensing Committee (G/LIC/N/1/LCA/4 and G/LIC/N/1/LCA/4/Corr.1).

The United States of America notes that the External Trade Act at Section 3 (1) states

that "The Minister may by order published in the Gazette and in a newspaper circulating

in the island (b) prohibit absolutely or limit the importation of any goods if in his or

her opinion such action is in the interest of the island and may for the same reason

make by order any such imports subject to such conditions as he or she may think fit".

Based on the External Trade Act, Section 3(1), it appears that the domestic purchase

requirements for chicken and pork would constitute "conditions" that should be

published as an order.

G/AG/W/126

- 19 -

a. Please state whether an order establishing that an importer must purchase

domestic product in order to receive an import license for chicken or pork was

published, and if so, where.

b. Additionally, please explain how Saint Lucia's domestic purchase requirements

for poultry and pork are consistent with Saint Lucia's WTO obligations,

including Article 4.2 of the Agreement on Agriculture and Article III:4 of

the GATT 1994.

c. When will Saint Lucia respond fully to the questions asked by the United States

of America during COA meetings in September 2013 (AG-IMS 71032) and

January 2014 (AG-IMS 72055)?

Answer by Saint Lucia

Saint Lucia undertook to provide a response at a later stage.

1.13 Thailand's paddy pledging scheme

1.13.1 Question by Canada (AG-IMS ID 73004)

Canada appreciates Thailand's participation in informal consultations on this issue.

However, Canada regrets that its questions to Thailand on its Paddy Pledging Scheme

since the November 2012 meeting remain unanswered.

a. Could Thailand indicate whether it intends to answer these questions in the

near future? If so, could Thailand provide information on the timelines for

providing the requested information?

b. While the Committee is still expecting Thailand's domestic support notifications

for 2007 and subsequent years, could Thailand please provide an estimate of

government expenditures related to the purchase of rice under the Paddy

Pledging Scheme?

Preliminary Answer by Thailand

b. Under the current paddy pledging scheme, the government operates the scheme mainly

with revolving funds in the procurement. The government expenditures accordingly will

cover the payment of different rates of interests, administrative cost, and other fixed cost in

operation. Because of the nature of the programme, Thailand will not be able to know the

exact expenditure until the closing of account for each year.

1.13.2 Question by United States of America (AG-IMS ID 73041)

There have been a number of press reports regarding Thailand's rice policy recently.

These reports have indicated that Thailand may suspend or end its current rice policy.

a. Please provide an update on the status of Thailand's Paddy Pledging Scheme.

Please provide specific details with regards to if and how the programme will

be continued going forward.

b. If the policy is being permanently eliminated, what steps, if any, is the

government considering in order to replace it with a new policy scheme?

The United States of America notes press reports indicating that in February Thailand

tendered 600,000 tonnes of rice from government stocks to exporters at an estimated

10,000-11,000 baht (US$307-338) per tonne. In January, Thailand reportedly tendered

150,000 tonnes of rice at prices 7-19% below market prices. The United States of

America also understands from press reports that Thailand will be seeking to sell 1

million tonnes of rice per month.

G/AG/W/126

- 20 -

c. Please provide data to confirm the volume and price of these and other

tenders.

d. What steps will Thailand take to ensure export prices remain in line with its

WTO commitments?

The United States of America also resubmits its question from the January Committee

meeting:

e. The United States of America notes that Thai rice prices have declined

dramatically in 2013. Further, Thailand has gone from the highest-priced

supplier to one of the lowest over the past two years. In AG-IMS ID 71033,

Thailand indicated that it was taking measures to minimize the impact on

markets of its release of government rice stocks. Press reports in Thailand have

also indicated that Thailand has sold rice at below market prices.

i. What factors have contributed to this dramatic decline in Thailand's export

prices?

ii. Has Thailand evaluated whether it needs to take any additional steps to

minimize the impact of its stock releases on markets, including displacing

exports of other countries due to its low prices?

f. Press reports in Thailand note that even at these low prices, Thailand is finding

it difficult to find buyers for its rice and is simultaneously under pressure to sell

stocks in order to fund its rice subsidy programme, which is currently late in

making payments to its producers. Given the current situation, what, if any,

changes does Thailand plan to make to its rice pledging scheme to address

these concerns?

g. Please provide an update on the following aspects of Thailand's rice pledging

scheme.

i. How much rice has been procured by the government in the current crop

year?

ii. How much rice does Thailand currently have in government stocks?

iii. What is the current support price for rice in Thailand?

iv. What is the support price for the upcoming rice crop year?

h. Thailand last made a domestic support notification for the year 2007.

Thailand's rice domestic support has undergone several reforms since that time

and is much different today than it was seven years ago. The United States of

America notes this significant delay in notifications and requests an update on

when Members can expect Thailand to come into compliance with its

notifications requirements.

Preliminary Answer by Thailand

On the information that the Unite States of America requested on many aspects of the

pledging scheme, Thailand will make the best effort to gather the information. Thailand

would also like to note that some of the information is commercially confidential under the

law.

a. The existing pledging scheme began on 1 October 2013 and ended on

28 February 2014 except for the rice planted in the south for which the programme

will end on 31 July 2014. Since the dissolution of parliament in December 2013,

the government agencies are currently functioning under the caretaker

government. Any new programme will only be subject to the new administration.

G/AG/W/126

- 21 -

As for the current pledging scheme, as explained previously, Thailand is gathering

information and data from the provinces and the final expenditures will be notified

when Thailand closes the account for the scheme.

e.

i. In 2013 world prices of rice fell overall due to the increasing volume of rice in the

world market, and Thai rice price was no exception. In any case, according to

different statistics, Thailand's rice export volume has decreased for the past few

years and so has Thailand's export share in the world market. When compared with

other countries rice prices at the equivalent quality, Thai rice prices are still

relatively high.

Follow-up: The United States of America raised concern on press reports about Thailand selling

730,000 tonnes of rice stocks at US$380 per tonne, which implied huge losses given the value of

the stock per tonne was considerably higher than the sale price. The European Union and Pakistan

shared the concern. Canada and the European Union welcomed Thailand's upcoming domestic

support notification for 2008. Uruguay indicated interest in the issue.

1.14 Turkey's domestic support and export subsidies

1.14.1 Question by European Union (AG-IMS ID 73056)

a. Given that Turkey has not submitted domestic support (DS:1) and export subsidies

(ES:1) notifications to the Committee on Agriculture since 2001 and 2000

respectively, could Turkey please indicate when it intends to submit these overdue

notifications to the WTO?

b. In the meantime, could Turkey please confirm that since 2001 its budgetary outlays

and eligible quantities of subsidized exports, including for citrus fruits, have

remained within its commitments?

c. Could Turkey please confirm that its AMS has remained since 2002 below its de

minimis level?

Answer by Turkey

The Relevant Turkish institutions, mainly the Ministry of Economy and the Ministry of Food,

Agriculture and Livestock have been working on Turkey's overdue notifications. However,

the process is still ongoing and has not been completed yet. Therefore, Turkey will be able

to submit the notifications only after the work is finalized.

Follow-up: The European Union reiterated its request for Turkey to update its notifications, and

sought Turkey' specific reply to the question on citrus fruits. The Philippines registered continued

interest in this issue.

1.15 Turkey's destination of wheat flour sale

1.15.1 Question by United States of America (AG-IMS ID 73042)

The United States of America appreciates Turkey's response to AG-IMS ID 72057

regarding sales of Turkish wheat flour made from the Turkish Grain Board (TMO) wheat

sales.

In Turkey's response, it states that "As a legal entity truly autonomous in its activities,

TMO determines purchase and sale prices of products within its area of activity through

decisions taken by the Board of Directors".

a. Does the Board of Directors have the authority to operate TMO at a profit loss

resulting from procurement prices set above world prices and sales prices set

at world prices? If so, how is the profit loss covered?

G/AG/W/126

- 22 -

Turkey also states that "TMO currently does not make wheat purchases as part

of inward processing schemes".

b. Does TMO sell wheat to domestic mills specifically for the export of flour? If so,

please provide the volume of TMO wheat sold to millers specifically for export

for the past three years. Please also include data listing the quantity of bran

exported and nationalized against the inward processing system for wheat

flour exports.

c. Please share data for the last three years listing the quantity and quality of

wheat imported and quantity and quality of flour exported under Turkey's

inward processing system.

Answer by Turkey

a. TMO is a fully autonomous entity in its commercial activities and the same applies to the

responsibility of TMO's Board of Directors in its management activities. Responsibility for

the management of TMO is in line with the principles specified in related legislation. As

an autonomous entity, TMO operates both its commercial and management activities

according to the requirements of the economy.

b. TMO carries out both purchasing of grain directly from producers and selling of grain to

domestic users by only taking stock adequacy, climate, production, world prices,

domestic market conditions, profitability and efficiency into account.

c. See Annex 2.

Follow-up: Taking note of Turkey's response to the previous question that it was preparing

outstanding notifications, the United State of America believed that those notifications might

provide answers to some of the U.S. questions. The Russian Federation as an exporter of wheat

and wheat flour and the Philippines expressed interest in the issue. The European Union flagged its

continued concern.

1.16 U.S. Farm Bill

1.16.1 Question by Indonesia (AG-IMS ID 73043)

On 7 February 2014, a new Farm Bill (the Agriculture Act of 2014) was signed into law.

The cost of the Act is estimated at US$956 billion. The Bill is issued in an environment of

high farm income. As one of the biggest agriculture spenders in absolute and per capita

terms, any policy related to subsidy in the United States of America always has an

outsized impact on global food security prospect.

United States of America is one of Indonesia's main trading partners especially on

agriculture. Any policy change in the United States of America will have direct influence

on the agriculture market and on the fate of large portion of vulnerable farmers in

Indonesia. In this regard, Indonesia would like to ask some preliminary questions to the

United States of America:

a. The Bill is estimated to cut US$8 billion from the Supplemental Nutrition

Assistance Program or SNAP (food stamp) by changing eligibility rules. Can the

United States of America explain further the new eligibility requirements to

receive food stamps?

b. The Bill will end income transfer programme to price support to producers.

What are the reasons for this shifting?

c. For eligible crops, the Bill requires U.S. farmers to make an irrevocable choice

between two programmes for countercyclical price protection: Price Loss

Coverage (PLC) and Agricultural Risk Coverage (ARC). The choice will be in

effect for the 2014 to 2018 crop years.

G/AG/W/126

- 23 -

i. Could the United States of America explain the eligibility criteria for the

producers to enrol in the two schemes?

ii. How does the Price Loss Coverage operate?

iii. How does Agricultural Risk Coverage operate?